Edition 710 - January 19, 2018

Blog Post - Keeping a Trading Journal

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

I keep one of sorts, it is part of my monthly homework. The journal is very basic and includes...read more.

Receive daily guidance from Andy Jordan! Traders Notebook Complete shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook Complete

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Enter a Position in Gold or Silver

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

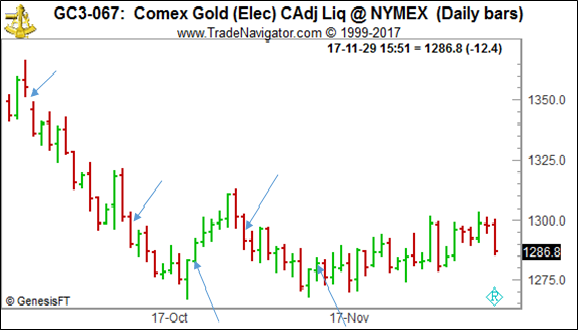

When economic times become volatile times, investors run to hard assets. Gold is a favorite hard asset in which to run, but keep in mind that gold loves to swing, even when it is trending. Recently, we've seen perfect setups for attempting to enter positions in gold based on the setups we teach at Trading Educators. The chart below shows exactly what I mean. The Law of Charts made it clear. I have shown where there were entry opportunities in gold. Three were short setups and two were long setups for short-term scalps. Trading gold, or silver should be obvious in times where people are looking for safe havens.

There are essentially two ways to "play" gold. One: Trade the swings in gold. Two: Buy and hold. Gold is most likely on its way to at least $5,000, and if we get the much anticipated “global currency reset,” we could easily see $10,000.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Mastering Yourself

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

If we had a crystal ball, trading would just be a matter of buying at a bottom, holding the stock as the price continued to rise, and selling near a top, right before the public sells in a state of panic. But we don't have a crystal ball, and there is no foolproof way to forecast the markets. Sure, if you have enough capital, are willing to wait long enough for a stock price to increase, and will be satisfied with a small profit, you can identify a few key stocks that will pay off handsomely with a buy-and-hold strategy. But that isn't what you're looking for. If you are like most traders, you are trying to capitalize on short-term moves to make big gains over and over again, and in the long run, mount a series of impressive wins. To accomplish this goal, you need to control your impulses and emotions. You need to cultivate enough energy to study the markets and search for profitable setups. But the work doesn't end there. You also need to execute your trading plan with smoothness and agility.

A cursory review of history reveals a host of people who have fallen victim to self-sabotage. They range from presidents Ulysses S. Grant to Bill Clinton, from Charles M. Schwab of U.S. Steel to Dennis Kozlowski of Tyco International. These individuals rose from humble beginnings to accumulate wealth, fame, and power. Yet in the end, they took extreme risks and paid a steep price. Upon hearing their stories, it's tempting to think they had a motive for self-sabotage, a hidden demon ready to undermine all that they had accomplished.

Most of the articles in Chart Scan are about gaining a mental edge, and when you trade with a mental edge, you increase your odds of winning. This sentiment is expressed by the many trading experts. By understanding your motives and setting goals, as well as consciously controlling your state of mind, you can manage anxieties, focus concentration, and enhance our confidence as traders. In addition, by using specific psychological skills you can greatly improve your performance. These skills will increase your level of personal enjoyment and fulfillment.

At Trading Educators, we try to bring you knowledge from our own journey through life as a trader. We would like this opportunity to thank you for reading, and allowing us to help you master the markets and be the best trader that you can be. If you set realistic goals, work hard to gain market experience, and manage your mental state, you will be one of the few who become a winning trader.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Example: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

SSYS TRADE

On 10th January 2018 we gave our Instant Income Guaranteed subscribers the following trade on Stratasys Inc (SSYS). Price insurance could be sold as follows:

- On 11th January 2018, we sold to open SSYS Feb 23 2018 18.5P @ 0.30$, with 42 days until expiration and our short strike about 14% below price action.

- On 12th January 2018, we bought to close SSYS Feb 23 2018 18.5P @ 0.15$, after 1 day in the trade for very quick premium compounding.

Profit: 15$ per option

Margin: 370$

Return on Margin annualized: 1479.73%

Philippe

Receive daily trade recommendations - we do the research for you.

TRADE WITH NO LOSSES!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Why having a view on a market isn't enough.

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco Mayer talks about why having a view on the direction of a market isn't enough. The reason is that just having a directional view doesn't make a trade...find out why!

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.