Edition 711 - January 26, 2018

Chart Scan with Commentary - The Law of Charts

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I am often challenged with regard to the Law of Charts. "How do you know it's a law?" The answer is that TLOC can be seen on any chart that has a range of values.

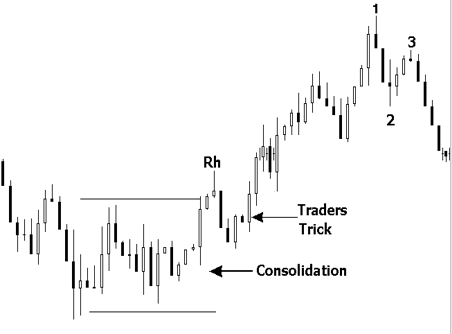

As I have often stated, the impetus for TLOC is the human action and reaction to the movement of prices. However, it is possible to see TLOC in action due to a variety of causes. The chart below shows what I mean.

This chart was produced by a random number generator using MS Excel. It really would have been nice for trading. In the future I want to show you another chart that proves TLOC is real. However, for now, please realize that TLOC is not a method or a system; it is a law. As with any law or precept, it is up to you as the trader to come up with a way to make money from the fact that TLOC will make patterns of consolidation, 1-2-3s, and Ross hooks.

Joe Ross knows trading!

Click on the links below to learn about his trading method!

Trading the Ross Hook

The Law of Charts

Traders Trick Entry

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Stress and Vulnerability

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Many traders underestimate the influence of stress. Stress is not only a psychological reaction, but a biological response as well. When you are stressed, your body reacts instinctively. You are agitated, on edge, and ready to lash out. Your attention is restricted. Your mind is closed and inflexible. The stress response has a specific biological, adaptive function: Your energy is channeled into making the simple response of fighting an opponent or running away. Not only is your energy channeled, but your perceptions are limited. Trading requires a more complicated skill set, though, and when you feel stressed out, you are bound to make a trading error.

It's surprising how stress can impact your ability to trade effectively. What's there to impact? Trading isn't that complicated, is it? Actually, there's a great deal that can happen. You can have a very complete trading plan, where every aspect is spelled out clearly, and you may have a wealth of experience executing such plans, but when you are stressed out, even the simplest task can be difficult to complete. You may not see an obvious signal to take action. And even when you see the signal, you can make a small mistake when you're stressed. Again, you are agitated and your psychological perceptions and intuition are restricted and closed off. You miss little things and have a tendency to respond quickly without thinking. While trading, we often do things automatically, without thinking, but stress can cause us to act so quickly that we miss something. We may forget to place an order according to plan or we may misread a signal and close out a position too early. These little errors can add up to disaster.

How can you beat stress? The most effective stress control strategies prevent stress before it happens. It is useful to minimize potential stressors. Getting into an argument with your spouse, for example, can put you in a bad mood that can escalate into an intense, distracting mood later in the day. Minor hassles can build up. For example, you may get cut off on the way to work, or the police may wrongly give you a traffic ticket. It can all add up, and set the stage for an incapacitating stress response. It’s important to acknowledge the power of these stressors, and when you feel agitated by them, you may want to stand aside until you feel better. Your trading environment can also impact your ability to handle stress. In many ways, trading is an art. You wouldn't try to create art in a noisy, chaotic environment, and you may not want to trade in such an environment either.

Trading requires an optimal mindset. When you are upset, tired, and emotionally distracted, you will have trouble following your trading plan. You must return to a calm, focused mindset, a mindset where you are attentive and alert, and can trade like a winner.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Performance Track Record: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

TRADE WITH NO LOSSES

HERE'S THE PROOF!

Check out our Performance Track Record page!

Check out our Performance Track Record page!

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

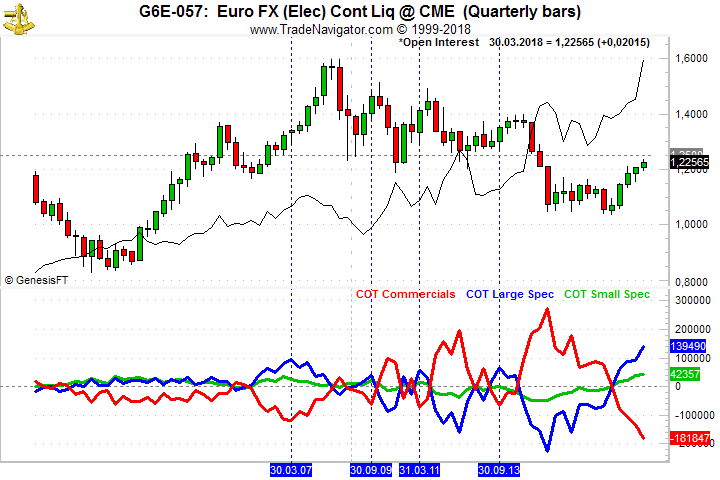

Trading Idea - Short Euro FX (or long on a strong break above 1.2500)

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Today, I want to have a closer look at the Euro FX, especially at the all time net short position of the Commercials. While the COT report can give a trader some kind of “road map”, it is not meant to be a timing tool, as you can see on the chart below. The market did NOT turn around at the low levels of the COT Commercials chart (red line on the chart below), it took the market more time until it finally turned to the down-side. But not only the COT chart with the extreme levels look interesting, also the 1.2500 level is an interesting level because very often old support levels turn into resistance and vise versa. As I said before, I would not time my trades using COT (or seasonal) charts, but with possible resistance at 1.2500 we might see a lower Euro FX soon. On the other hand, if we move strongly above 1.2500 and the Commercials get caught on the wrong foot, we might easily see 1.4000.

Receive daily guidance from Andy Jordan! Traders Notebook Complete shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook Complete

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading Bitcoin and other Cryptocurrencies

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

After I mentioned that I’ve been doing trading the crypto currencies last year there’s been quite some feedback from you with questions about these new markets.

So I thought I’d share my thoughts about the crypto markets, my experiences regarding trading these and hopefully give you some useful tips on how to get started.

First of all, these crypto currency markets are still quite in the early stages of development. Volatility is often crazy, exchanges and brokers are still not fully established in terms of stability and features and every now and then there’s still something crazy happening like bitcoins getting stolen, exchanges going bust and so forth. It kind of reminds of the early days of retail forex trading even though the actual markets are completely different of course.

There’s Bitcoin Futures trading at the CME now but the liquidity isn’t really there yet. After having tried different crypto exchanges, I’m now using gdax.com which is quite well regulated and so far I’m having no issues at all trading there. Liquidity usually is very good and even when the markets go a bit crazy the platform works just fine. Another one that I didn’t try personally as it’s for US citizens only but that I’ve heard is good too is gemini.com.

Personally I still avoid having large sums of money at any of the crypto exchanges. To invest in a coin I do the trade at the exchange and then sent the actual coins to my electronic wallet instead of leaving them at the exchange. If I want to get out I sent the coins to the exchange, do the trade and withdraw the money back to my bank account. This way the risk of losing money when an exchange goes under is minimized.

New markets also have many advantages though, especially for us private traders. The biggest is that there’s less competition as the professionals aren’t in there yet. Even though there’s bitcoin futures trading at the CME now, hardly any of the very tough competitors you have in the currency or stock future markets are there yet.

This makes is quite easy to trade these markets if you’re used to trading much more difficult markets. They’re mostly driven by private investors and many well known strategies that stopped working in most markets long ago work very well in the crypto currency markets. One example are simple breakout and momentum strategies. When these markets start moving, they often do so in a very nice and "clean" way.

Happy Crypto-Trading!

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.