Edition 712 - February 2, 2018

Exciting News - Forex Best Awards 2018

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Marco has been nominated at FxStreet for the "Forex Best Awards 2018" in the category "Best Educational Article" for his article "5 Tips to improve your day trading" (link to http://www.tradingeducators.com/blog-page/5-tips-to-improve-your-day-trading). If you also liked the article which of course was published on Chart Scan first and have a minute, help Marco win the Award by voting for his article at https://goo.gl/forms/Z3K8LIjtr6RYz0z62. You'll find Marco's article in the category "Best Educational Article" and can simply select "Don't know" on all of the other categories.

Kind regards

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Blog - What should I do after closing out a trade?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

You must be disciplined in following the plan of your trade religiously. Once you have closed your position, you should...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Trading Sugar off the COT Report

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

If you want to see how to make a contrarian long-term trade, you might consider looking at the positions on the COT report.

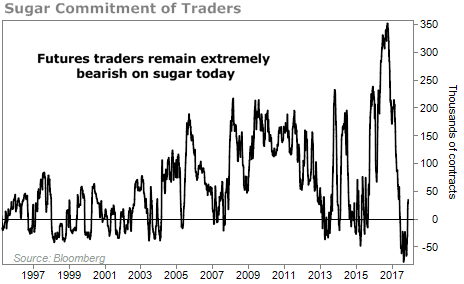

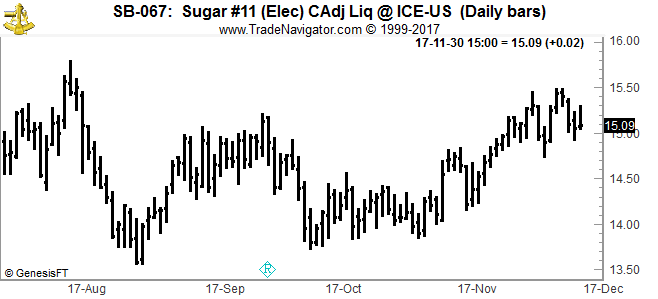

As of November 2017, sugar was really down, and way oversold, but had begun to rally. Sugar prices were down nearly 60% from 2010 and 29% from the previous year. The Commitment of Traders (COT) report revealed that traders were more negative on sugar than ever before.

COT details the real-money bets of futures traders. It tells us whether traders are excited about or disinterested in a commodity market.

That means it's a useful contrarian tool... When traders all agree on an outcome, it's a good idea to bet against them.

And futures traders have become extremely bearish on sugar in recent months. Take a look...

The COT report hit its most negative level ever in August, -77,495. It has rebounded slightly to 34,270 since then.

The negativity is a good thing for traders looking for big opportunity, based on history.

You want to be in sugar when the COT is this negative. Historically, sugar prices have soared when the COT fell below and then rose back above -35,000. Being in sugar when it is this negative has led to dramatically high returns. As I write this, sugar prices have rebounded recently. There are a number of ways you can trade this, here are a few suggestions.

Via the stock market:

- Long the iPath Sugar Subindex Total Return ETN (SGG)

- Buy a CALL LEAP option (long-dated option)

- Buy SGG and sell a CALL LEAP option

- Sell a PUT LEAP option to gain a lot of premium

Via the futures market:

- Go long July, or October 2018 futures

- Buy a CALL LEAP option

- Sell a PUT LEAP option to gain a lot of premium

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Seeing what you want to See

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Some people live in a world of delusion and fantasy. They see what they want to see and ignore what they don't want to see. Traders are especially prone to this ailment. When your money is on the line, you are consumed with avoiding loss. Trading is a competitive business where few make it in the long term. This fact always lurks in the back of your mind, putting added pressure on you. In the back of your mind, you wonder, "How am I going to make it?" Sure, you know that you must make it and that allowing pessimism to take hold will do nothing more than throw you off track, but the possibility of failure is always there, working behind the scenes to thwart your efforts. With all this psychological pressure it's hard to stay objective. There's a powerful need to see what you want to see.

staying objective is difficult It's important to distinguish between the data and your interpretations of the data. View as neutral both the events and your inclination to impose your interpretations on them. Enter the market without expectations, surrendering to it rather than struggling with it for personal gain.

How can you stay objective? The first thing you must do is trade with money you can afford to lose and manage your risk. If your entire financial future is on the line on a single trade, you will be consumed with anxiety, self-doubt, and frustration. But if you risk relatively little on a single trade, you'll know deep down that you can live with the negative consequences should the trade be a loser. It's useful to follow the old trading adage, "Risk so little capital on a trade that you ask yourself, 'Why am I even bothering to put on this trade?”

The second thing you must do to stay objective is to take your ego out of the trade. You cannot control the markets, so why put your ego on the line with your money? Don't make winning or losing a personal issue? Why put your ego on the line with each trade? Why gloat when you are lucky enough to have the odds work in your favor and sulk when the odds go against you? It's not personal in the end. There's little you can do but stay calm, try your best, and accept where the markets take you. Ironically, if you can identify and control what you can (such as risk management and a sound trading strategy), and accept what you cannot (the outcome of a trade), you will feel calm and be able to trade in a peak performance mindset. And the calmer you feel, the more open you will be to seeing the markets as they are, rather than what you want them to be.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Example: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

TRADE WITH NO LOSSES

Here's our latest example!

GDX Trade

On 9th January 2018 we gave our Instant Income Guaranteed subscribers the following trade on Market Vectors Gold Miners ETF (GDX). Price insurance could be sold as follows:

- On 10th January 2018, we sold to open GDX Mar 16 2018 21.5P @ 0.265$ (average price), with 66 days until expiration and our short strike about 7% below price action.

- On 16th January 2018, we bought to close GDX Mar 16 2018 21.5P @ 0.12$, after 6 days in the trade for quick premium compounding.

Profit: 14.50$ per option

Margin: 430$

Return on Margin annualized: 205.14%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.