Edition 713 - February 9, 2018

Chart Scan with Commentary - The Law of Charts (again)

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

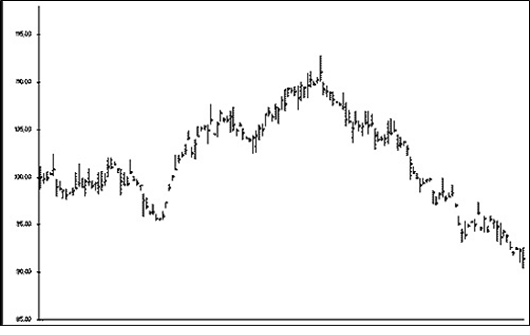

I won't bore you with this subject any more after this next chart. But 2 weeks ago I wrote "I am often challenged with regard to the Law of Charts. 'How do you know it's a law?' The answer is that TLOC can be seen on any chart that makes highs and lows."

Now I will add to that the fact that, if you chart a series so as to get a sequence of recurring events, you can add that series of events to represent a trend. After all, doesn't a series of higher highs and higher lows constitute a trend?

As I have often stated, the impetus for TLOC is the human action and reaction to the movement of prices. However, it is possible to see TLOC in action due to a variety of causes. The chart below shows a series of coin flips.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Contagious Behavior

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

People have a natural affinity to follow others. It can be very adaptive at times. If you see someone slip on an icy sidewalk, for example, it would be wise of you to start walking slowly and carefully to protect yourself from getting hurt. People are so attuned to others that they mimic their behaviors without knowing it. Psychologists call this phenomenon contagious behavior. Contagious behavior is the unconscious transmission of actions or emotions from one person to another. When trading the markets, we often fall prey to contagious behavior when we react to opinion—opinion of anyone, including our own.

There are both social and biological bases for contagious behavior. It's a pervasive phenomenon. From a social standpoint, researchers have shown that people react automatically to well learned scripts. When we see a set of behaviors happen over and over, we react to this pattern without thinking. Consider a common example while trading the markets: An analyst talks up a stock spurring a few online traders to buy. Next, a few other traders see the initial buying spree, and decide to follow. Soon many people are following the crowd. Research has shown that people can follow the crowd without knowing it. Negative emotions, such as fear and panic, are especially contagious. When people are studied in groups in a laboratory setting, they tend to "catch" unpleasant emotions from others more than pleasant emotions. When you see the masses sell, for example, you are naturally bound to become afraid yourself and start selling. Your natural human affinity to follow others can work against you.

There are also biological reasons that we follow each other. Humans are built to follow others. Research studies have shown that neurons in the brain fire merely by watching someone perform an action. We laugh when others laugh, and we run from a threat when we see others reacting in a panic. Humans are biological, social beings and these social and biological bases of contagious behavior may difficult to beat at times.

Contagious behavior may be difficult to fight, but you must find a way to break away from the crowd. Winning traders often need to go their own way. It is often useful to be a rebel, when necessary. The winning trader steps back from the crowd and tries to identify the optimal point to buy and sell. It is necessary to build up immunity to contagious market behavior. How can you do it? First, anticipate the strong tendency to follow the crowd. If you are aware of the powerful influence of the crowd, you can go against them when you need to. Second, know your personality. Some people are more prone to "catch" contagious behavior than others. Emotions are especially catchy. If you are easily discouraged, you may be prone to catch other people's panic and fear. Third, try not to pay attention to the crowd. Obviously, you can't follow the crowd if you are oblivious to what they are doing. If you make a conscious attempt to try to look at circumstances from an objective view, you will develop the habit of seeing things that way.

It may be difficult to build up immunity to contagious market behavior, but if you increase your awareness of the potential problem, you learn to look inward and go your own way. The more you can think independently, the more you will be inoculated from the contagious opinions and emotions of the crowd.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Example: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

TRADE WITH NO LOSSES

Here's our latest example!

CNDT Trade

On 5th January 2018 we gave our Instant Income Guaranteed subscribers the following trade on Conduent Incorporated (CNDT). Price insurance could be sold as follows:

- On 10th January 2018, we sold to open CNDT Feb 16 2018 15P @ 0.15$ (on a GTC order), with 36 days until expiration and our short strike about 8% below price action

- On 18th January 2018, we bought to close CNDT Feb 16 2018 15P @ 0.05$, after 8 days in the trade for quick premium compounding

Profit: 10$ per option

Margin: 300$

Return on Margin annualized: 152.08%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Ambush Trading Method - PAYDAY!

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

While we all love trading, we also know that trading can be really tough. Let's face it. Often you just keep on doing your "job" as a trader every day without getting anything but blows from the market.

You don’t get paid even though you're doing a great job. That’s tough and because it’s tough most traders have a difficult time dealing with this. It very quickly can lead you into questioning your whole strategy or worse your ability as a trader. I’ve been trading for almost 20 years now and guess what these periods are still tough times for me. I always thought that one day I'd be able to just trade though these without any negative emotions etc but now I'm quite sure that’s simply a fantasy! As long as money means anything to you, you’ll feel bad when you lose it. And that's actually not really a bad thing. Best you can do is learn how to deal with this and that’s where I happily got quite good in.

Anyway if you have an edge in the market and you keep on going despite taking hits your payday is gonna come. And oh boy, yesterday it did show up for Ambush traders!

Here’s the result for each of the markets for one contract (without commissions and slippage). Not bad for a day trade I’d say!

Looking at the biggest single day gains of the Ambush All Stars Portfolio for Large Accounts which includes many of the ambush markets we can see that it’s been one of the best days ever, actually there have only be 4 other days with even higher results.

Of course this is an outlier and also related to the jump in volatility we’ve seen in many of the markets. But it was also a much needed performance boost as Ambush gave back some of 2017th profits during the last quarter of the year and also didn’t have a great start into 2018. Things finally look much better again now with Ambush being in positive territory for 2018 and having recovered almost 2/3 of the drawdown.

To sum it up: For Ambush Traders, Payday arrived!

Want to become an Ambush Trader too?

Then simply sign up to Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 PM NY Time (yes, it's ready much earlier now than before) the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the markets close! Can you imagine a more comfortable way to day trade?

Now if you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want to get the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Don't forget to VOTE for Marco Mayer!

Marco Mayer has been nominated at FxStreet for the "Forex Best Awards 2018" in the category "Best Educational Article" for his article "5 Tips to improve your day trading" (link to http://www.tradingeducators.com/blog-page/5-tips-to-improve-your-day-trading). If you also liked the article which of course was published on Chart Scan first and have a minute, help Marco win the Award by voting for his article at https://goo.gl/forms/Z3K8LIjtr6RYz0z62. You'll find Marco's article in the category "Best Educational Article" and can simply select "Don't know" on all of the other categories.

Trading Example - Coffee trading at the ICE Exchange

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

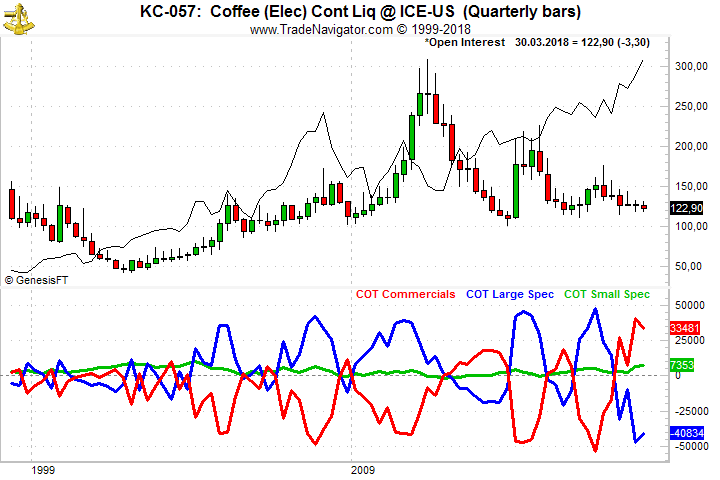

This week, we are looking at Coffee trading at the ICE Exchange.

The main motivation for this trade is the very low Implied Volatility and the extreme net long position of the Commercials. Unfortunately, the position of the Commercials cannot be used to time a trade short term. Most of the time, the Commercials can be found on the right side of the market long term. How can you approach such a market and what strategy can be used? I am usually an option seller, but under these conditions, I would look into buying an options spread using May options. Look for a spread that gives you at least 2:1 profit/loss ratio and use strikes close to the market.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.