Edition 715 - February 23, 2018

Trading Article - Is trading futures gambling?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Trading futures is gambling only when you trade them without full knowledge of what you are doing. There is a good measure of self-knowledge required to choose the proper course to follow if you want to become a trader. It has even been postulated that many small traders in the futures markets, without knowing it, secretly want to lose. They jump in with high hopes—but feeling vaguely guilty. Guilty over 'gambling' with the family's money, guilty over trying to get 'something for nothing,' or guilty over plunging in without really having done much research or analysis. Then they punish themselves, for these or other sins, by selling out, demoralized, at a loss.

A trader is gambling when he/she trades from ignorance. The gambler makes his trading decisions on gut feelings, hopes, dreams of getting rich quick, tips from the broker, “inside information” from friends, and from the improper understanding and use of indicators, oscillators, moving averages, and mechanical trading systems. In general, he is looking for a way to shortcut having to truly learn what is going on. Unfortunately, most people who attempt to trade fall into this category.

However, true trading is actually speculation (managed risk). The speculator is willing to accept the risk of price fluctuation in return for the greater leverage that comes with that risk in the hopes of earning a greater profit. The true speculator makes his trading decisions based on knowledge gathered from Information about the behavior of the underlying, seasonality, historical and current trends, chart analysis, fundamentals, the market dynamics, and knowledge of those who trade it.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Risk

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

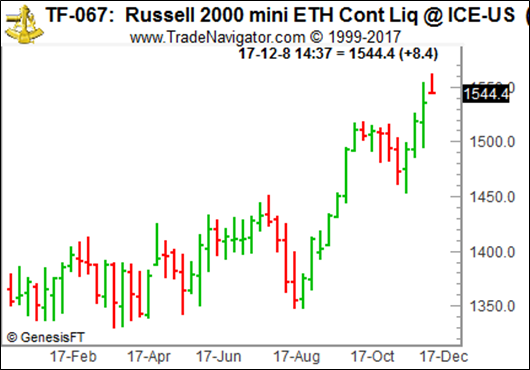

I suppose you want to tell me that there is no point in your watching the weekly charts because the risk is too great. But the truth is that the risk on the weekly chart is no greater than the risk on a 1-minute chart — at least not if you handle it correctly. Let's say you decide you can afford to risk $300 on a trade. You may have decided that amount in a number of different ways. It could be a flat amount you are willing to risk on any trade. It could be an amount that is a certain percentage of your account, or it could be that you are willing to risk a certain amount of ticks, pips, cents, or points. Whichever way you have arrived at the $300, the amount still is $300. My point is a risk of $300 is a risk of $300, no more, no less.

Think about this: the move on a weekly chart as it violates last week's high or low is going to have a lot more momentum behind it than a move on a 5-minute chart as it violates the previous 5 minutes' high or low. It takes a lot more momentum energy to overcome a weekly high or low than it does to overcome the high or low of a lesser time frame, wouldn't you agree?

Every trade ever made begins intraday. Day traders enter and get out by the end of the day. Anything else is a position trade, but every position trade begins intraday, regardless of the time frame you are using for your entry signal. I have many times used a weekly chart signal to enter a day trade, simply because the moves are much stronger on the weekly chart than they are on an intraday chart.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Example: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

TRADE WITH NO LOSSES

Here's our latest example!

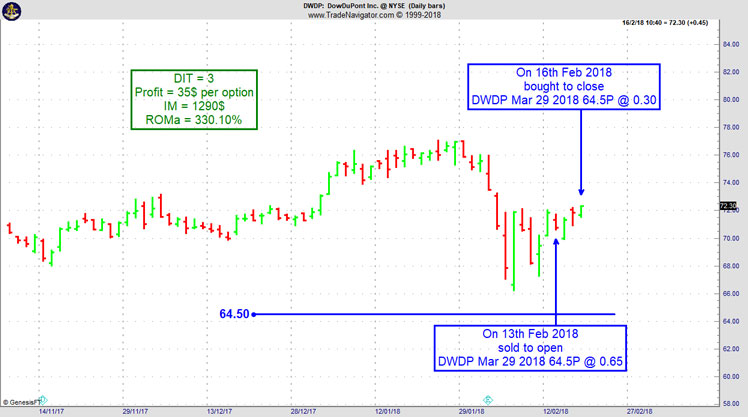

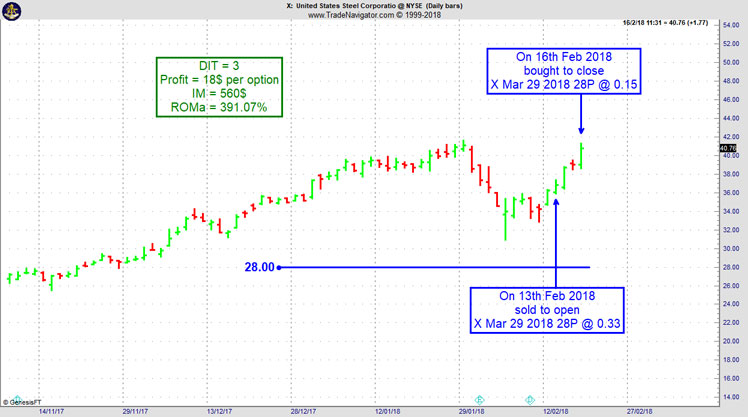

QRVO-DWDP-X

Last week we closed 3 trades within 3 days for annualized returns on margin between 327 and 391%, using spikes in implied volatility (QRVO) or entering at the very beginning of an emerging uptrend (X, DWDP) to maximize the premium sold. All our short put strikes were at a very safe distance from market action.

This is the kind of safe and quick premium compounding we are looking for.

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - 5 Tips on how to deal with drawdowns

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

After the recent harsh correction in the stock markets and cryptocurrencies, many traders and especially investors currently find their accounts in a not so nice drawdown. So I thought this might be a good time to give some advice on how to deal with such drawdowns.

What’s a drawdown? Here’s a quick explanation: You buy one stock of a company at $100 and after a month it’s trading at $120. You’re now having profits of $20 or 20% on your account. Now the stock drops from 120 to 110, that’s $10 off the highs and therefore a $10 or 8.3% drawdown from the so-called high-water mark.

You don’t like these drawdowns at all? Neither do I but the fact is that drawdowns are the norm in trading, not the exception. Most of the time you’re simply not making new all-time highs in your equity curve. Meaning that usually, you’re in some kind of drawdown so if you want to completely avoid drawdowns, stop trading. Or learn how to deal with them.

Here are some tips on how to make it thru these unavoidable trading valleys…

1) Zoom out: You’re long the S&P 500 and woke up to a 10% drawdown recently? That’s bad but hey it more than tripled over the last 10 years and is up more than 65% since early 2016. Heck, it moved up about 20% just within the last year! So yes a 10% drawdown is not nice but seeing it in the right perspective helps a lot to see things actually aren’t that bad. Zoom out and get some distance to see the drawdown in it’s larger context.

2) Switch perspective: You’re in a drawdown and therefore lost money. That’s tough but how does this actually affect your daily life? Is there something you can’t do today you’d have been able to do otherwise? Any real changes in the quality of your lifestyle? Did your wife and kids leave you? If so you surely overtraded! But if not, the only thing that actually changed is your trading account balance. That’s not nice as it’s still real money you could do real things with but being aware that your daily life isn’t actually affected is a healthy thing to remember. It helps to reduce the emotional stress and to get back into the right mindset for trading. Stop the mental drawdown and get back up!

3) Think Long-term: Remind yourself of your long-term goals regarding trading. Why you are you in this business at all. If your plan is practical the current drawdown won’t change it. You can still reach the long-term goal and succeed. See this drawdown for what it is and what happens in every business out there. You’re having a bad month/quarter/year. No reason to close your business right? Same with trading and in a couple of years you won’t even remember that little setback.

4) Look at the past: Have a look at previous similar drawdowns. The S&P had 10% drawdowns in the past, Bitcoin had 50% corrections and the system you’re trading might have had similar drawdowns in the past. This helps to notice that the drawdown you’re in might not be as unusual as you first thought. But what helps most is to notice what happened after these previous drawdowns. That’s what you want to focus on.

5) Move on: Finally you got to accept the drawdown and move on. Everyone has these if you don’t believe me look at other professional traders/funds equity curves. Even the best out there have drawdowns especially if they’re in the game for many years. Not really accepting the drawdown makes you likely to do real mistakes. Or you might end up being paralyzed, unable to put on the next trades and miss exactly what would take you out of the drawdown. So in the end, you have to forget about it and move on!

Happy Trading!

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.