Edition 763 - February 8, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Comparison of the traits of winning traders vs. losing trader

|

TRAITS OF CONSISTENT WINNERS |

TRAITS OF CONSISTENT LOSERS |

|

Tell virtually no one their activities in the marketplace. |

Tell anyone who will listen the details of their market activities, to the point of campaigning for their particular point of view. |

|

View other’s opinions about the markets as other’s opinions. |

Very disturbed by someone else’s contrary opinions. Such opinions make them worry they themselves will be wrong. |

|

Approach speculation for what it is, a form of educated guessing. There are no sure things and they realize that. A commitment will be maintained only if it continues to act profitably. If a loss is taken, it is not taken as a personal failure, simply a bet that did not work. |

Cannot face the possibility of being wrong. This is taken as a personal failure. Their self-inflicted emotional punishment seems far worse than the monetary loss involved. For these reasons, closing out a position that has not worked out is seen as a great sign of failure. A losing position originally entered as a short-term trade is extended and rationalized as a long-term position (assuming such a position can be adequately financed.) Often the position is sold out only because of a failure to meet margin calls; i.e., it is an involuntary rather than a voluntary liquidation. |

|

Tend to make no pinpoint forecasts. Obviously, if all their own research points to higher prices, this is in a sense a forecast, but since no one can consistently predict how high a price will be realized, the forecast merely consists of an upward bias. Even this is only adhered to as long as the price movement confirms the research bias. They realize they must be eternally vigilant for a sign of change. |

Tend to work with very detailed forecasts of price behavior. Any fundamental research worked with is usually not original and is believed rather blindly. While such forecasts may be verbalized repeatedly, they are not truly believed in only because so many past forecasts have not worked out. Their own forecasts are for unusually large price movements. Such phrases as “This one’s the retirement trade,” are often used. |

|

Have an attitude that one attempts to capitalize on a portion of a particular price movement rather than on the entire move. Do not attempt to either pick bottoms or tops ahead of actual evidence of a change in direction. They do not allow greed to tempt them back into a market they have exited if their research says they are late in the movement or that the market has become overextended. |

Tend to either take many small profits, because they are so seldom experienced, or overstay a commitment because they dream of much larger profits. Often their dreams of all things the profits will buy prevent them from selling at a lower price than already achieved in the current trend. Once the trend does reverse, higher prices are waited for in the hope their dreams can still come true. |

|

Tends to handle capital very carefully. Initial commitments to a position are taken in small increments and are added to only if these early commitments become profitable. They have a plan which is closely followed. They tend to make money over months only because they seldom realized success in short-term operations. Capital is gradually withdrawn even from a successful trade, mainly because there is a strong aversion to having capital at risk. Good money management is seen as the key to mental equilibrium and therefore, good decision making. Mental equilibrium is seen as very fragile, and is guarded very carefully. |

Tends to plunge into the market with most or all of his trading capital. If the early stages of the trade are successful, any available margin produced through paper profits is immediately committed to making the position larger. No capital is withdrawn from the market due to success. Instead, the losing trader dreams not only of the money that will be made, he begins daydreaming of all the fantastic things the paper profits will buy. The Mercedes, a yacht with own crew, an apartment in London, ad infinitum. The trade, if it lasts this far, has become a mental trip. The loser has lost touch with reality. The paper profits are purely numbers, no longer currency. The trader has now become very emotional about the whole situation. He will overstay the position until the price trend truly turns against him. First, the paper profits are given up, then the actual trading capital, and then come the margin calls. At this point, it is purely a miracle if the loser escapes without owing the broker money after he has been forced by his broker to finally close out all positions. Emotional depression now sets in. And the next trade made is even a larger disaster. |

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

CDAY Trade

On 26th November 2018 we gave our Instant Income Guaranteed subscribers the following trade on Ceridian HCM Holding Inc. (CDAY). Price insurance could be sold as follows:

- On 6th December 2018, on a GTC order, we sold to open CDAY Dec 21 2018 30P @ 0.25, with 15 days until expiration with our short strike about 22% below price action.

- On 28th January 2019, we bought to close CDAY Dec 21 2018 30P @ 0.10, after 12 days in the trade (we could have let the option expire worthless for a greater annualized return, but we played safe and bought it back a few days before expiration as we usually do in these cases).

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 76.04%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: The Best Trader in the World

If you had to describe the best trader in the world, who would that person be? What qualities would he have? Take a moment ...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders start the year with a big bang in the currency markets!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including many currency markets like the Dollar Index Future (DX), the Australian Dollar Future (6A) and the New Zealand Dollar Future (6N), where Ambush Traders had an amazing start into 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Here’s the result of all of these trades, trading one contract, including $10 commissions/slippage per trade:

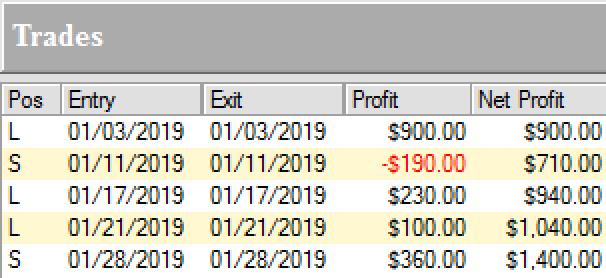

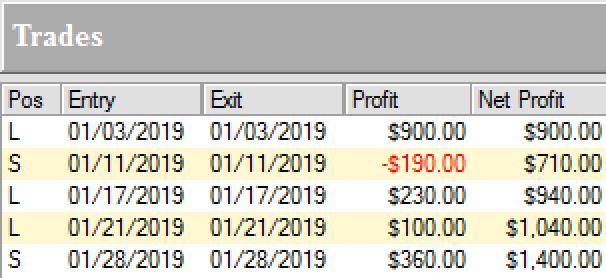

New Zealand Dollar Future (6N):

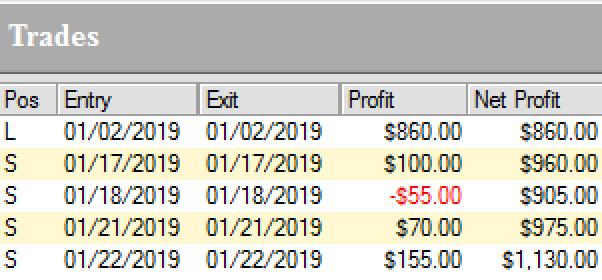

Australian Dollar Future (6A):

Dollar Index (DX):

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.