Edition 764 - February 15, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Trend from Congestion

In mid-April, share prices of the McDonald's Corp broke from an area of congestion to form once again another area of congestion. Although not rocket science, the Law of Charts calls for prices to break out from a trading range a high percentage of the time on the 21st to 29th bar of congestion. The low of the 20th bar took out the bottom of the congestion area, but Closed above that area. The 21st bar firmly violated the congestion area both Closing and making a new low below the area of congestion. The very next price bar was an inside bar, thus creating a Ross hook. Prices corrected for two days and then gapped lower once again. The violation of a Ross hook establishes a trend, so we were now looking at an established trend. The second bar labeled Rh became a Ross hook when prices once again failed to move lower. The resulting two bars of correction away from Rh #2 presented traders with a Traders Trick entry. A very nice sell short trade resulted when prices violated the low of the Traders Trick. Prices moved down once again, and as we see the chart at last look, we have a third Ross hook, and a Traders Trick entry to sell short on a violation of the low of the correcting bar.

Does it matter what caused prices to move lower? Only if you are interested in the fundamentals, knowledge of which came too late to take advantage of the long bar move down seen as the next-to-last price bar. In this case, news about terrorist bombs being planted entered the picture, causing a severe sell-off. But using the Law of Charts and the Traders Trick would have automatically seen you with a sell stop just below the low of the second from last price bar.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

IR Trade

On 30th January 2019 we gave our Instant Income Guaranteed subscribers the following trade on Ingersoll-Rand plc (IR) right after earnings. Price insurance could be sold as follows:

- On 31st January 2019, we sold to open IR Mar 15 2019 87.5P @ 0.50, with 45 days until expiration and our short strike about 13% below price action.

- On 11th February 2019, we bought to close IR Mar 15 2019 87.5P @ 0.15, after 11 days in the trade as IR went on upwards after our entry.

Profit: 35$ per option

Margin: 1750$

Return on Margin annualized: 66.36%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Disappointment and Regret

Every trader makes bad trades and faces regret, it is inevitable. And we all have the human tendency to be overtaken by emotions. When we screw up we have a feeling of...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders start the year with a big bang in the currency markets!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including many currency markets like the Dollar Index Future (DX), the Australian Dollar Future (6A) and the New Zealand Dollar Future (6N), where Ambush Traders had an amazing start into 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

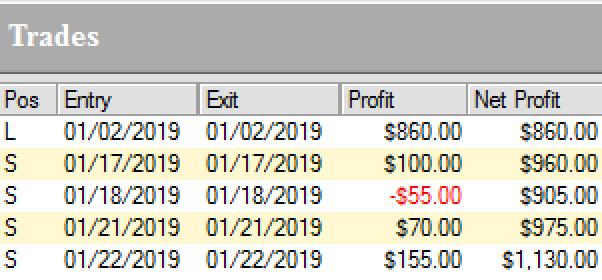

Here’s the result of all of these trades, trading one contract, including $10 commissions/slippage per trade:

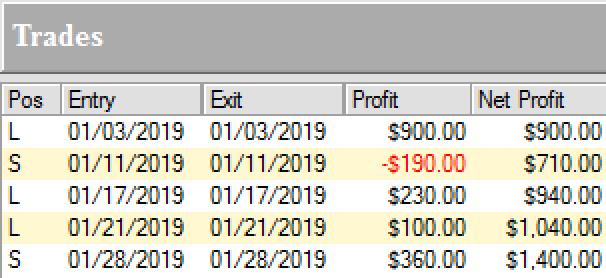

New Zealand Dollar Future (6N):

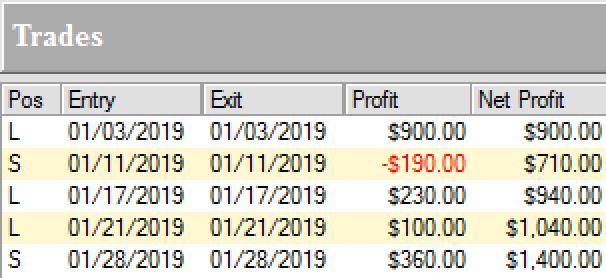

Australian Dollar Future (6A):

Dollar Index (DX):

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.