Edition 765 - February 22, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Spreads

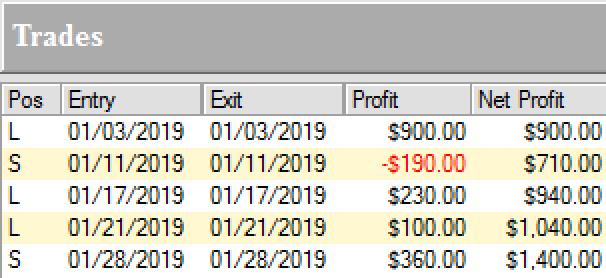

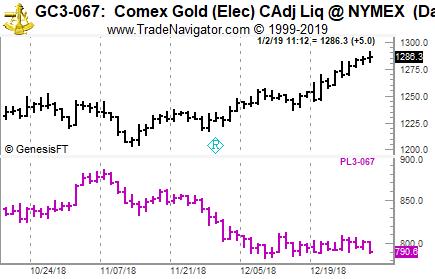

Every time I produce a series of Chart Scans, I always like to provide at least one spread chart, because so many of our readers ignore spreads. I’m not saying that spreads are the only way to trade. However, if you are not watching spreads, you are missing out on a lot. They can be done with futures, ETFs, and stocks. Below is a spread chart long Gold, and short Platinum. Take a look. No magic is needed to trade spreads. All you have to do is be observant. This spread could easily have been entered by reading the news or watching something as idiotic as CNBC.

Here is the same spread seen as two bar charts. Obviously, gold is rising, while platinum is sideways. Back in November, gold was rising while platinum was falling.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Quick Thinking

Have you ever watched the last minute of a close football match and felt excited? When you are anticipating what will happen next, you often feel a little high, especially if you expect a desirable outcome. Humans like excitement. Whether it is a traffic accident on the way to work or the last scene of a murder mystery on television, we like suspense. Trading is naturally exciting, but if you are a winning trader, you do not put on trades for sheer excitement. Losing traders seek out thrills. Winning traders assess the market action rationally, make a sound trading plan, and calmly trade the plan. It may seem boring at times. But it doesn't always need to be. If you "think fast," you can spice things up.

Have you ever experienced racing thoughts, and felt a sense of eagerness, urgency, and wild exhilaration? Perhaps you were trying to meet a deadline, and felt at the top of your game, as if you were not only going to meet the deadline but also do a great job. You've probably also felt this sense of eagerness, urgency and exhilaration when you were about to close a big winning trade. When you are about to take home huge profits, feeling excited is understandable. If only we could bring this sense of excitement to the more mundane tasks of trading, such as when we are scouring charts for the next high probability setup. Increasing the speed of your thinking may offer a solution.

How can you think faster as a trader and sharpen your mental edge? Thinking fast is not the same thing as acting impulsively. Trading with the proper mental edge demands that you feel calm and rational, but rather than allow your mind to wander unenthusiastically, you want to push yourself to think with more attention. Rather than let your thoughts drift, focus on your trading. Try to block out distracting thoughts, and intensely focus on your immediate experience. Try to search for new setups more rapidly. Run through possible scenarios more rapidly. Plan more rapidly. If you can increase the speed of your thinking processes, you will feel more creative and optimistic and this state of mind can help you discover new insights. That said, it is essential to avoid trading impulsively. Think fast while you are planning the trade, but make sure you have a clear head before you execute the trade. Again, the idea is to "think fast" when you are in the planning stages of a trade.

Trading is a demanding profession. To make profits day after day, it is necessary to find new high probability setups. It can be a intimidating task, and if you are not careful, you can feel beaten down. But when you feel a little down, think fast. Your mood will pick up. You will see new possibilities, and trade at your best.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

SQ Trade

On 21st January 2019 we gave our Instant Income Guaranteed subscribers the following trade on Square Inc. (SQ) right after earnings. Price insurance could be sold as follows:

- On 29th January 2019, on a GTC order, we sold to open SQ Jun 21 2019 45P @ 1.50, with 142 days until expiration with our short strike about 35% below price action.

- On 13th February 2019, we bought to close SQ Jun 21 2019 45P @ 0.75, after 15 days in the trade for quick premium compounding even if our option had 142 days to go until expiration initially.

Profit: 75$ per option

Margin: 900$

Return on Margin annualized: 202.78%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Stop Management

Richard Wyckoff wrote: “My stop was moved down so there couldn't be a loss, and soon a slight rally and another break gave me a new stop, which insured a profit, come what might…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders start the year with a big bang in the currency markets!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including many currency markets like the Dollar Index Future (DX), the Australian Dollar Future (6A) and the New Zealand Dollar Future (6N), where Ambush Traders had an amazing start into 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Here’s the result of all of these trades, trading one contract, including $10 commissions/slippage per trade:

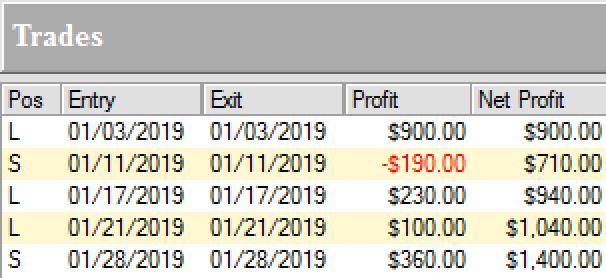

New Zealand Dollar Future (6N):

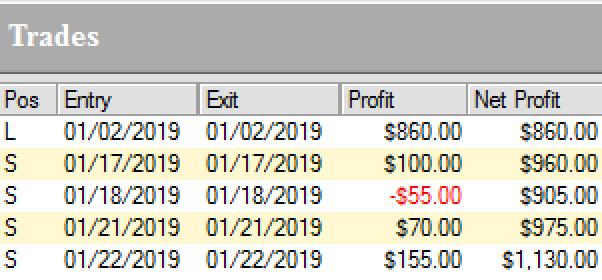

Australian Dollar Future (6A):

Dollar Index (DX):

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.