Edition 766 - March 1, 2019

TRADERS NOTEBOOK

"SPRING IS JUST AROUND THE CORNER"

SPECIAL!

50% OFF

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Classical Chart Projection

Hey Joe! I’ve asked everyone I know, but no one seems to know, “what is a ‘hedge wrapper.’”

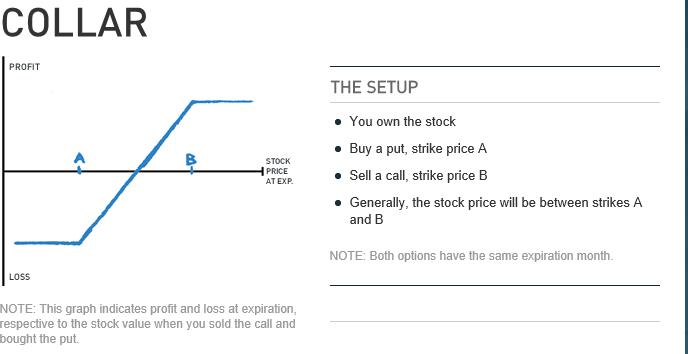

A hedge wrapper is also known as a “Collar.” Based on the rest of what you wrote about complete protection against a drop in price, what you probably want is called a “Zero Cost Collar.”

A zero cost collar is a form of options collar strategy where the outlay of money on one half of the strategy offsets the cost incurred by the other half. It is a protective options strategy that is implemented after a long position in a stock that has experienced substantial gains. You buy a protective put and sell a covered call. Other names for this strategy include zero cost options, equity risk reversals, and hedge wrappers.

For example, if the underlying stock trades at $120 per share, the investor can buy a put option with a $115 strike price at $0.95 and sell a call with a $124 strike price for $0.95. In terms of dollars, the put will cost $0.95 x 100 shares per contract = $95.00. The call will create a credit of $0.95 x 100 shares per contract - the same $95.00. Therefore, the net cost of this trade is zero.

It is not always possible to execute this strategy as the premiums, or prices, of the puts and calls do not always match exactly. Therefore, investors can decide how close to a net cost of zero they want to get. Choosing puts and calls that are out of the money by different amounts can result in a net credit or net debit to the account. The further out of the money the option, the lower its premium. Therefore, to create a collar with only a minimal cost, the investor can choose a call option that is farther out of the money than the respective put option is. In the above example, that could be a strike price of $125.

To create a collar with a small credit to the account, investors do the opposite—choose a put option that is farther out of the money than the respective call. In the example, that could be a strike price of $114.

At the expiration of the options, the maximum loss would be the value of the stock at the lower strike price, even if the underlying stock price fell sharply. The maximum gain would be the value of the stock at the higher strike, even if the underlying stock moved up sharply. If the stock closed within the strike prices then there would be no effect on its value.

If the collar did result in a net cost, or debit, then the profit would be reduced by that outlay. If the collar resulted in a net credit then that amount is added to the total profit.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: What’s Next?

It is Tuesday, and you’ve been watching the markets closely for the past two weeks. It appears to be the fulfillment of your dreams: prices are making new market highs. You wonder, "What is the smart thing to do?" On the one hand, you can go long, but will this optimism last? Oil prices are still high, but they are lower and a little more stable compared to last summer. Everyone is hoping that companies will show strong earnings this quarter, but will they? Are the record highs just temporary? On Wednesday, the masses were worried about interest rates and the markets across the board closed down. Perhaps, cautious optimism may be warranted. Many traders and investors prefer a bullish market, but smart traders are cautiously optimistic these days. When trading the markets, you can't count on a sure thing. It can be up for several days and down the next. No one knows with 100% certainty what will happen next.

There is no replacement for doing your homework. The more you know about the markets and the companies you trade, the greater your odds of winning. Which companies will have earnings that match analysts' forecasts, and more important, will it matter? As any astute market observer knows, a stock may rise before an earnings announcement, if the masses are optimistic, but should the earnings report fail to match expectations, the price will decline even though the company may have done rather well. It's all a matter of the opinion of the buyers and sellers.

What will the masses do? That's the big question. Right now, there is international turmoil and a belief that we may not experience the economic growth to which we have been accustomed. And when that happens, the masses may turn to pessimism. What can you do to profit?

To a great extent, it depends on your personality. If you are a risk taker, you can capitalize on the times. You can trade on the likely probability that the masses will sell markets that fail to meet analyst expectations, feel seller's regret, and buy back what they sold out of impulsive fear. You can buy at the low point and sell it back to them when seller's regret sets in. One warning, however, it sounds easier than it is. But as a strategy, it works. Whether you try it depends on your personal psychology. If you don't mind the risk and uncertainty, it will work for you. If you are a cautious, however, then this may be a time to stand aside. Cautious stock and option traders stay away from trading right before earnings reports. You never know what will happen until it happens. The cautious trader may not want to risk money when analyst forecasts and earnings reports have the most power to dictate how the masses will behave. The masses react to news, reports, and speeches, and unless you have a crystal ball, you cannot know how the market will react. They can rise or fall on good news, and vice-versa on bad news.

In the end, even during times of optimism, it is wise to stick to the basics. Manage risk by risking only a small amount of capital on a single trade. Think in terms of the big picture and realize that what matters most is your performance across a series of trades. And work hard. Study the markets. Make an educated guess as to what the masses will do, and outline detailed trading plans. And most important, trade your plan. Sticking to the basics may not allow you to make huge profits on a few key winning positions, but on the other hand, it will keep you in the game should the markets turn against you. And in all likelihood, when you stick to the basics, you will end up taking home huge profits overall.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

LITE Trade

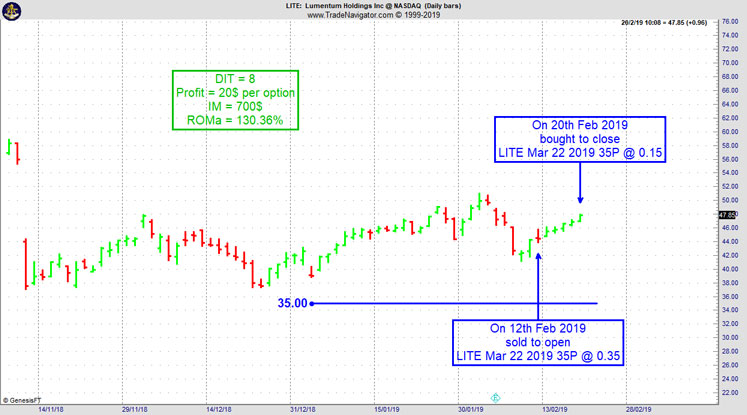

On 11th February 2019 we gave our Instant Income Guaranteed subscribers the following trade on Lumentum Holdings Inc. (LITE). Price insurance could be sold as follows:

- On 12th February 2019, we sold to open LITE Mar 22 2019 35P @ 0.35, with 40 days until expiration with our short strike about 21% below price action.

- On 20th February 2019, we bought to close LITE Mar 22 2019 35P @ 0.15, after 8 days for quick premium compounding.

Profit: 20$ per option

Margin: 700$

Return on Margin annualized: 130.36%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

TRADERS NOTEBOOK

"SPRING IS JUST AROUND THE CORNER"

SPECIAL!

50% OFF

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Why we use a 15-year seasonal pattern for trading spreads

Much seasonally based information conforms to random probability generated data. Avoid trading seasonally …read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

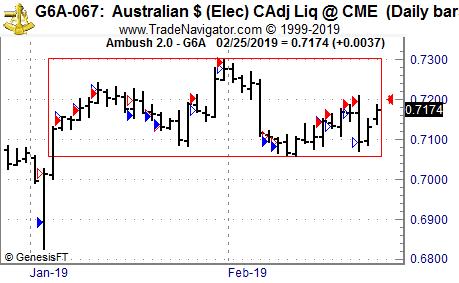

Ambush starts off with big profits into the year in the Australian Dollar!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Australian Dollar Future (6A) traded at the CME, where Ambush Traders are having an amazing time so far in 2019.

Ambush day trades on an end-of-day basis so there is no need to even check the markets during the day.

So let’s have a look at what happened in the Australian Dollar so far this year. Early January the market tried to break out to the downside and Ambush got in at a very low price level at around 0.6900, exiting above 0.7000. Since this false breakout as you can see not too much happened. The 6A just kept on moving in tight ranges and has been trading between about 0.71 and 0.73 for two months now.

Good news is that Ambush still was able to capture some nice profits, often getting in at the top/bottom of a day’s range!

Once you realize that this isn’t that uncommon but that it’s exactly what the markets do most of the time don’t you want a strategy that works well under such conditions?

Where is the Australian Dollar going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

Here’s the result of all of these trades, trading one Australian Dollar Index (6A) contract, including $10 commissions/slippage per trade:

If you’ve been on the other sides of these trades trying to buy the breakouts, you really should consider switching sides!

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

TRADERS NOTEBOOK

"SPRING IS JUST AROUND THE CORNER"

SPECIAL!

50% OFF

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.