Edition 770 - March 29, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Possible Spread Trade

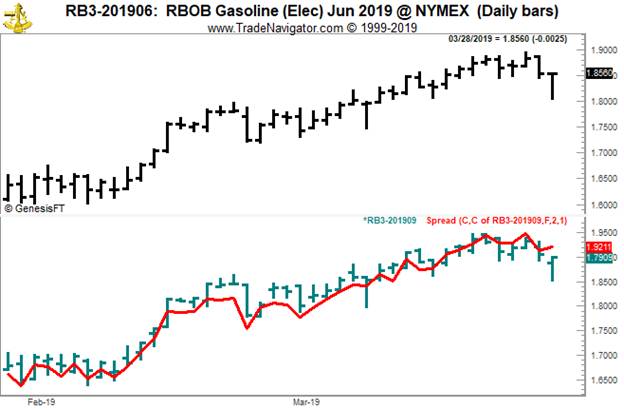

I received a complaint saying that whenever I give a spread trade in Chart Scan, I always show one that is already working. So, let’s look at a spread that is coming up soon, one you might look for. The trade is an intra-market spread in the gasoline futures.

Here’s what makes this spread work: Consumption of gasoline is lowest in winter, when driving conditions are worst, and highest in summer, when school is out, people are on vacation, and driving conditions are best.

During February, gasoline refineries retool --- shutting down for maintenance and preparing to maximize gasoline production. From that point in time, demand for gasoline begins to grow as the industry rebuilds depleted inventories in time for the traditional opening of the US vacation and driving season (Memorial Day, the last Monday in May). That growth is further accelerated by a need to actually replace inventories along the Eastern Seaboard with gasoline reformulated to meet seasonally more stringent environmental standards. (For example, gasoline deliverable against March futures is unacceptable for delivery against April-September contracts). In this situation, price precedes consumption.

Intensifying pressure to meet accelerating demand during the transition from low inventory/low consumption to high consumption drives futures prices and bull spreads.

In fact, the Long June/Short September Gasoline spread typically closes higher in the June contract around May 3 than around April 9, about 93% of the time. You’ll want to enter this trade from 1-10 days prior to April 9.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

GLUU Trade

On 5th March 2019 we gave our Instant Income Guaranteed subscribers the following trade on Glu Mobile Inc. (GLUU). Price insurance could be sold as follows:

- On 8th March 2019, on a GTC order, we sold to open GLUU Jun 21 2019 6P @ 0.15, with 102 days until expiration with our short strike about 35% below price action.

- On 26th March 2019, we bought to close GLUU Jun 21 2019 6P @ 0.05, after 18 days in the trade as GLUU shot up about 30% after our entry.

Profit: 10$ per option

Margin: 120$

Return on Margin annualized: 168.98%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Manage the Trade

Once you get into a trade, you must eventually get out. Some argue that this is more important than where you get into a trade. My experience has been…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

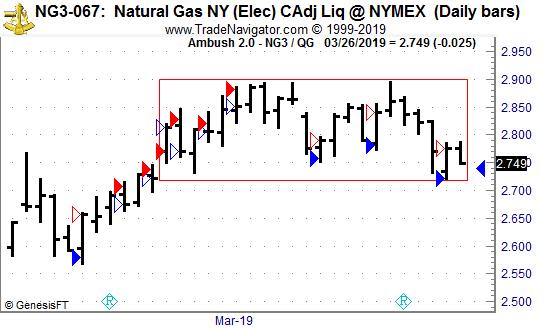

Is Natural Gas back to normal?! Ambush traders have one of their cash cows back!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Natural Gas Future (NG) traded at the CME, where Ambush Traders are cashing in again lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Towards the end of 2018, fundamental news caused prices in Natural Gas to go crazy with volatility levels almost 10 times above normal. This didn’t just put various funds out of business but also caused most Ambush traders to stay away from NatGas for a while.

Right now NG is trading pretty much where it traded before the hype and looks much more like the NatGas market we are used to again.

As you can see on the chart below it moves in boxes and has a lot of false intraday breakouts, perfect conditions again for Ambush:

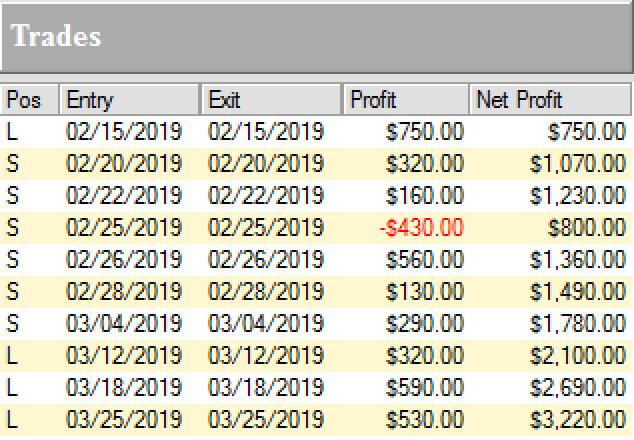

With NatGas behaving normal again, Ambush results look great again too.

Here’s the result of all of these trades, trading one Natural Gas (NG) contract, including $10 commissions/slippage per trade:

Now if you’ve been the one making money on the crazy up-move just ask yourself how often that actually happens and if you wouldn’t rather be making money the other 95% of the time ;)

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.