Edition 776 - May 17, 2019

It seems a recent update has affected any customer that purchased an eBook(s), we are sorry for any inconveniences. Please email us at This email address is being protected from spambots. You need JavaScript enabled to view it. if there are other concerns to address.

THANK YOU FOR YOUR PATIENCE WHILE ACTIVELY WORK ON THIS MATTER

WE APPRECIATE YOUR BUSINESS!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Should I Buy Gold?

Chart Scan is not an advisory. I intend it to be a teaching letter. However, in this issue of Chart Scan I want to answer the question above. It’s a question I hear on a regular basis. Following are some things you should consider when thinking about buying gold.

“Monster Gold-Mining Deals Pile Pressure on Those Left Behind.”

The January 14 Bloomberg headline above might not seem like much, but it is really something to think about. Here’s why.

When an industry consolidates, investors can make a lot of money. Consolidation means buyouts—which usually come at a premium… And premiums boost stock prices higher. But that’s not the only reason the above is worthy of your attention. Mergers among mining companies are signaling a shift in the gold market, as well.

Those who know me know that I recommend holding a small percentage (5–10%) of chaos hedges like gold in of your portfolio. These assets provide insurance in times of crisis. But under the right conditions, they can also boost your wealth.

In today’s article, I’ll tell you why 2019 is shaping up to be a year in which holding gold will start to pay off.

Over the past six months, the gold mining industry has seen two megamergers.

In September 2018, A major gold miner bought a competitor for $6 billion. The merger made the major miner the largest gold mining company in the world… But that title won’t last long.

Recently, another major miner announced it would buy a rival miner for $10 billion. If the deal goes through, this latter miner will unseat the former as the world’s biggest gold miner. This wave of consolidation will probably continue.

The two major miners still represent only six or seven percent of global mine supply, so it’s still a very fragmented industry and I think investors are rightfully demanding that there’s a bit more consolidation.

And miners aren’t just merging because the industry is fragmented. They’re merging because it’s also necessary for their survival. That’s why the pressure is on for them to join forces.

I’ve heard the following dozens of times, “Gold Supply is Drying Up!” I decided to look more deeply into that statement to see if this time it might be believable. Here’s what I found:

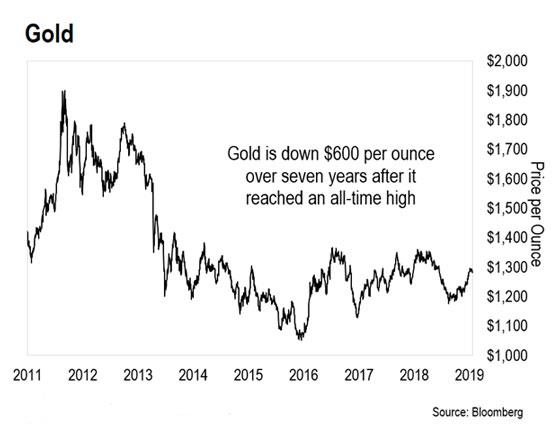

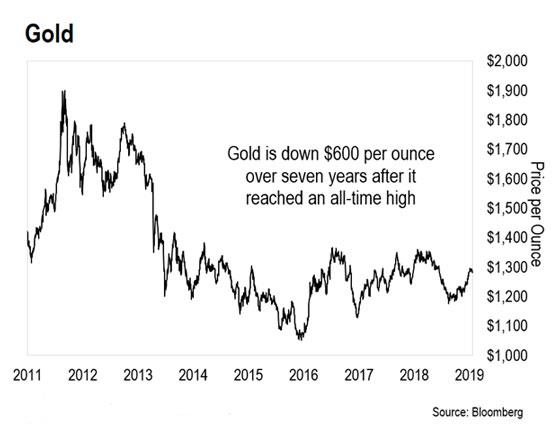

Over the past seven years, we’ve seen a massive bear market in gold. As you can see in the chart below, gold is down $600 from its peak in September 2011…

Due to lower prices, miners have had to tighten their budgets. And in tough times, one of the first budget items to go is exploration. After all, if gold isn’t profitable, why look for it?

It hasn’t just been gold miners cutting back, either. Metals miners across the board have done so as well.

Capital spending is projected to be less than half of what it was at its peak in 2012. And smaller exploration budgets mean miners are finding fewer new deposits. On top of that, the new deposits aren’t as good as old ones.

In a recent private correspondence, I was told, “Mine grades and life are dwindling.” Since the source of this statement is from a company that does the drilling for exploration teams, I have a strong reason to believe it.

Adding to the supply crunch are production costs. Over the past 15 years, they’ve skyrocketed about 300% for major gold companies.

For example, one of the major miners had an average production cost of $300 per ounce in 2004. Ten years later, it rose to $800. Another major miner’s production costs jumped from $278 per ounce in 2004 to $922 last year.

Lower gold prices combined with higher productions costs mean one thing: dwindling supply. That’s good for gold prices—and gold investors…

An old saying goes like this: “The Cure for Low Prices Is Low Prices.” It’s a common saying amongst commodity investors.

When prices are low, miners aren’t making money. So they stop exploring new mines. The lack of supply creates scarcity. But scarcity eventually pushes prices back up.

That’s why miners are merging. They’re desperate for profits and hoping they can make up for lower profitability by increasing scale. But that’s a short-term solution.

Still, the long-term outlook for gold is positive. As gold becomes scarcer, prices will eventually rebound.

Now, it could take a couple years for this trend to play out. But when it finally does, we’ll see gold rise over 50% and reach new all-time highs.

The key thing, if you are going to use gold as a hedge to protect your assets is to get positioned now, before the move higher.

So, should you buy gold? I can tell you only that it’s what I have done.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Is it Really All About Image?

Preconceived images have a powerful influence on our decisions. If we believe that a company has a hot new product, we can't help but think its stock price is bound to go up. Trading the...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

NTR Trade

- On 9th May 2019, on a GTC order, we sold to open NTR Jun 21 2019 45P @ 0.45, right ahead of earnings, as NTR retested the March swing low in the 50.50$ area as anticipated.

- On 10th May 2019, we bought to close NTR Jun 21 2019 45P @ 0.20 on earnings day, after only one day in the trade, for quick premium compounding

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

The next big thing in equities trading is here!

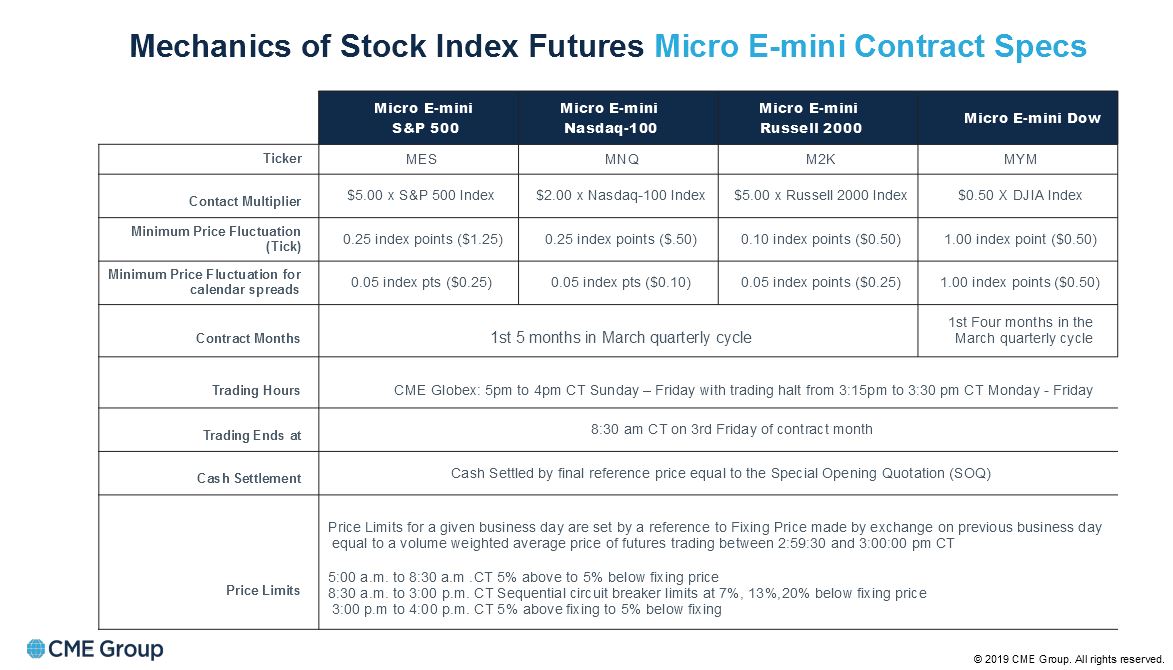

This is what the CME says about their new product the Micro E-mini futures for the 4 major US indexes. The S&P 500, the Dow, the Nasdaq and the Russell 2000.

https://www.cmegroup.com/cme-group-futures-exchange/micro-futures.html

From what I can tell, this new products are really great especially with all the high volatility we see right now in the US indexes.

While it was easy to trade in the indexes with a small account and little risk, it got almost impossible during the last few years. The average amount on a 15 minute bar in the Nasdaq is about $400 to $500 these days which makes it almost impossible to trade these markets with small accounts.

That’s where I see a lot of potential with the Micros which are only 1/10 of the E-minis and a commission of about ½ of what we pay on the E-minis.

Finally you can open a futures account with only $2k and trade the indexes and you do not have to move into the stock market. No! You can trade real futures now with very little money.

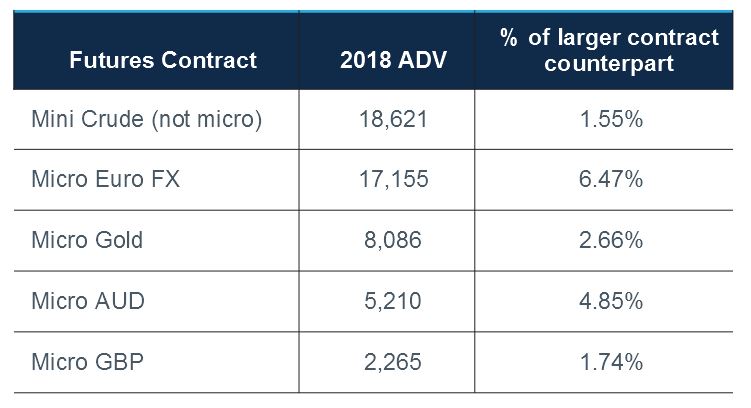

By the way, there are not only micros or minis in the indexes now, you can also find them in the Currencies or Gold or trade Mini-Sized products in Crude or even Wheat, Corn or Soybeans.

In my opinion all the Micros and Mini-Sized products in the futures market are a big step forward for the retail trader, especially at the beginning of his or her trading career.

Good trading,

Andy Jordan

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

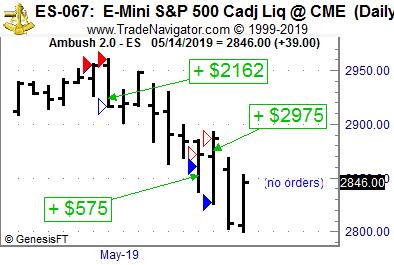

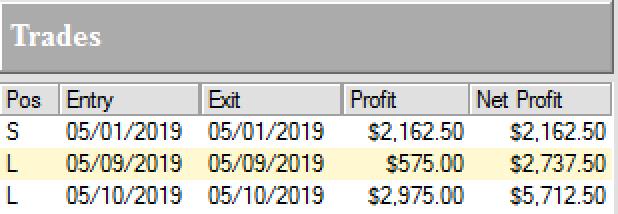

Ambush Traders lock in $5700 of profits in the E-Mini S&P 500!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-Mini S&P 500 Future (ES) traded at the CME, where Ambush Traders cashed in big time again over the last couple of days!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The E-Mini S&P 500 is the most popular market out there. Everyone follows it and most of you guys probably trade it or at least own some ETFs based on the S&P 500 index. Ambush has always been doing well in this market and so it’s no surprise it has actually just made new all time equity highs.

But this month so far has been really crazy. While a lot of traders lost their shirts on the huge reversal we’ve seen related to the news around the trade war with china, Ambush took the other side of these trades and made over $5700 within a couple of days!

Yes, looking at that chart you’re right, Ambush went short pretty much exactly at the all time high of the S&P 500...

You have to ask yourself if you really can afford to miss out on these trades or at least be aware of the signals.

Now with the new Micro E-mini S&P 500 Index Futures (MES) that just started trading at the CME you can also follow these Ambush trades now with a small account:

Yes it’s just 1/10 the size of the regular E-Mini and this allows you to nicely position size into these trades. This is great news as the E-Mini S&P 500 hasn’t been that “mini” any more lately trading at such high prices.

Whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.