Edition 805 - December 6, 2019

What? You missed our Trading Educators Black Friday and Trader Tuesday deals?! It's not too late, contact us!

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

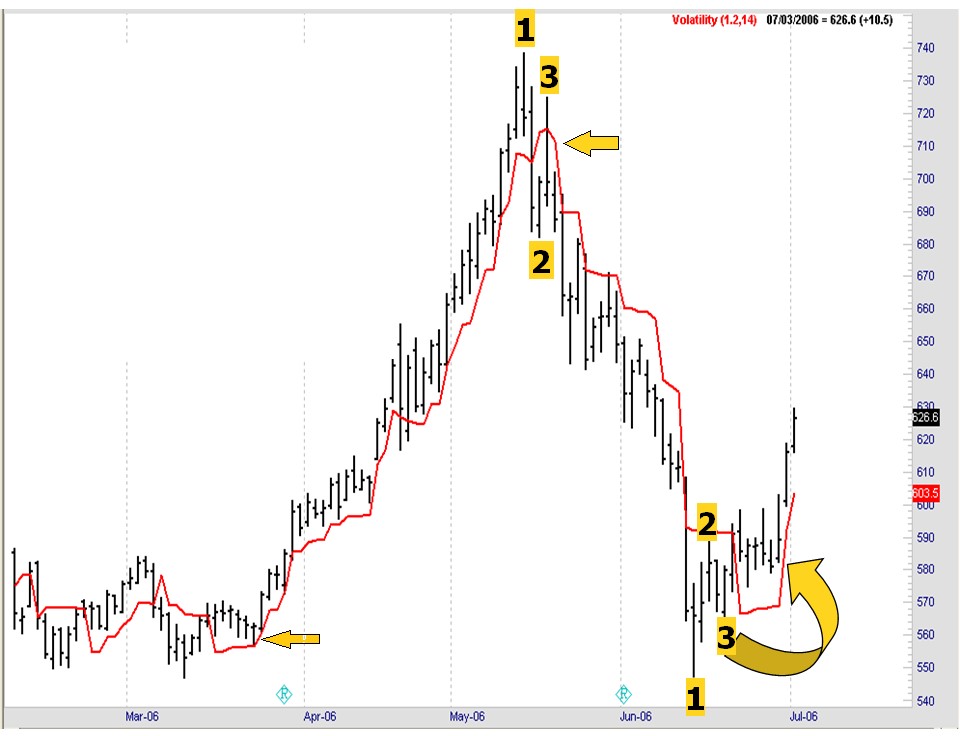

Chart Scan with Commentary: Volatility Stop

Lately, I’ve been teaching a student in China via SKYPE. One of the questions that has come up and also via seminars and emails is, “Where do you put the Stop?” That has to be the most loaded question I ever receive, because there is no definitive answer. However, in getting as close as I possibly could, I wrote an e-Book called “Stopped Out,” in which I did my best to answer that question. In it I showed the weaknesses in some stop placement schemes and the strength in others.

I received a question in via email about the “Volatility Stop indicator.” Joe, have you ever heard of Welles Wilder’s Volatility Stop? Do you know how to use it? I would appreciate any comments you care to make about it!

I have used VS in the past, and it’s a very good way to trail a stop when a market is trending. It is virtually worthless in a sideways market, unless that market is swinging wildly, with huge swings from high to low.

The trick I always used was what I call containment of the trend. As prices come out of congestion, typically with a 1-2-3 formation, possibly followed by a Ross hook, I begin looking for VS to curve around #3 point and begin tracking below the prices in an uptrend or above the prices in a downtrend.

We’ll look at that now.

VS has 3 possible parameters. A moving average, a multiplier, and an offset feature (not all software have the offset). You have to fool around with the parameter settings until you find a best fit situation. By changing the parameters, we can curve fit VS to give us containment.

Once you are in the trade, you stay in until you get a close at or below the VS line. Interestingly, if you want to know where to put tomorrow ‘s stop, you can offset (displace) VS by one (or more) bars.

The next chart shows how by manipulating the settings, I was able to contain prices at 3 different turning points.

Complete details of how to set up and use the VS indicator are contained in the eBook stopped out, available on our website.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Getting Help

If you’re like most modern traders, you try to do it all. You study charts and historical data for trading opportunities. You struggle to devise a thorough, well-designed trading plan. You enter trades on your own electronic trading platform, and you monitor your trades to make midcourse corrections when necessary. Depending on your personality, available resources...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

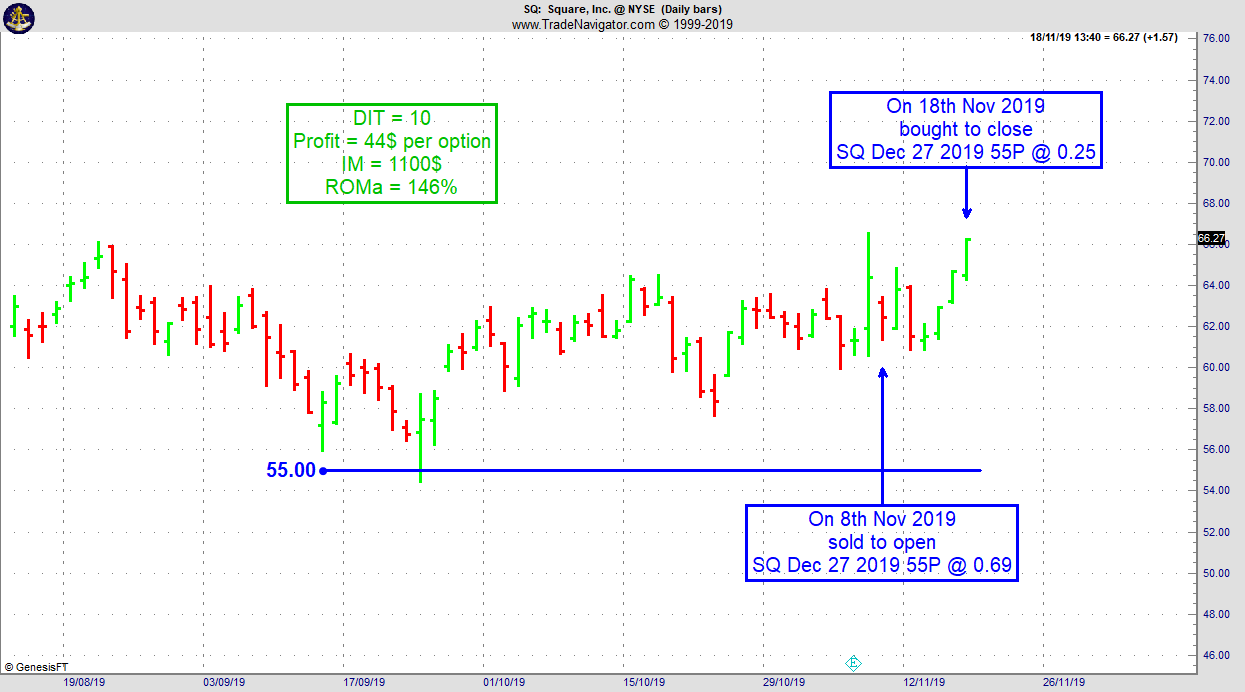

SQ Trade

- On 8th November 2019, we sold to open SQ Dec 27 2019 55P @ 0.69, with 49 days until expiration and our short strike about 15% below price action.

- On 18th November 2019, we bought to close SQ Dec 27 2019 55P @ 0.25, after 10 days in the trade

Philippe

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Self Control

To become a truly successful trader you must become a truly committed trader. How do you get yourself to be in control?

Statistics and society may predict, but you alone...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Manual Backtesting Pitfalls

If you don’t want to learn how to backtest automatically right now but still want to profit from backtesting, you got to do it manually. That’s how I started too many years ago. I still remember sitting there with printed charts and writing down trade results on a separate sheet of paper.

Now there are some pitfalls you better...read more.

Marco Mayer is an Educator for Forex, Futures and a Systematic Trader, so if you have questions, he wants to hear from you! Contact Marco with questions!

Check out Ambush Signals

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.