Edition 806 - December 13, 2019

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Double Bottoms

Sometimes I receive questions that make me chuckle. Here’s one that came in recently?

Hey Joe! Do you believe in double bottoms?

What’s not to believe. They occur fairly often. Its’ what you do with them that’s important.

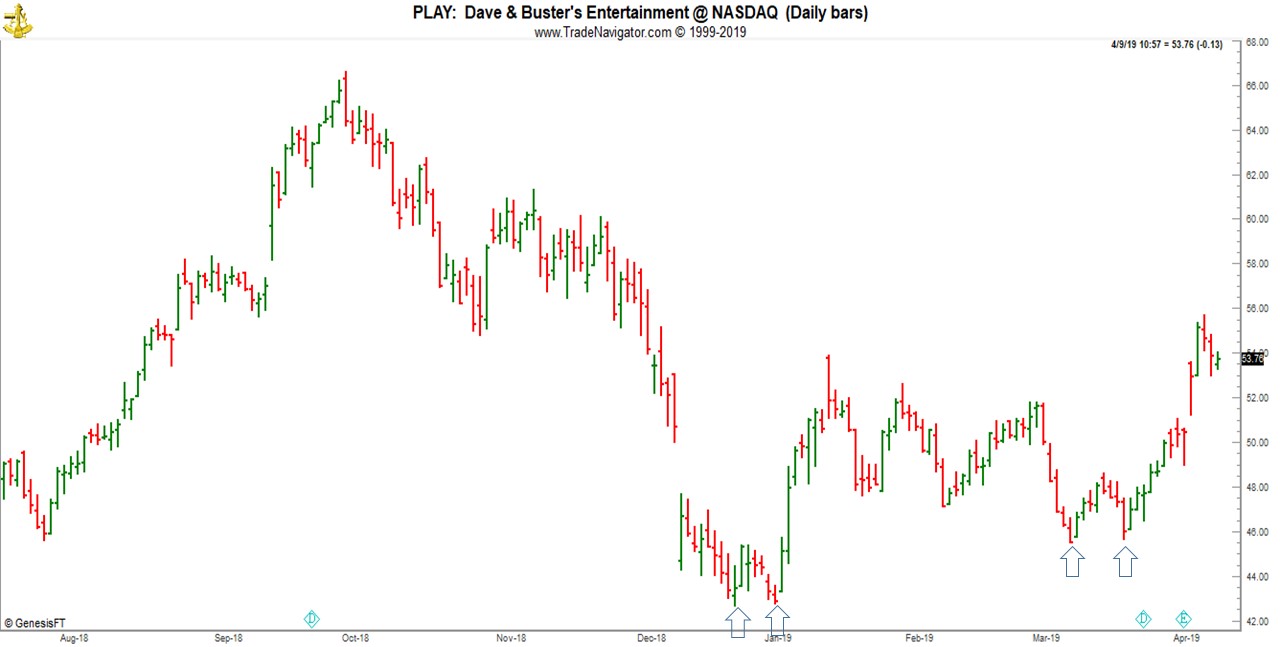

A Double Bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. It describes the drop of a stock or index, a rebound, another move to the same or similar level as the original drop, and finally another rebound. The double bottom looks like the letter "W". The twice-touched low is considered a support level.

Double bottoms are essentially 1-2-3 lows. You can see them as support and go long, or you can enter with a traders trick ahead of the #2 point.

This is totally unlike any other trading concept we have ever encountered. Most traders, if they have something that works, do everything possible to keep it a secret. Dive further into Traders Trick Advanced Concepts - Recorded Webinar.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: The News

What are the latest headlines? Do they impact the markets? Well, it depends. On Monday, October 17, 2005, here were some of the headlines that may have impacted you. GM reached a tentative agreement with the union. What's the impact? It seemed to satisfy long term investors. Company profits are bound to improve with lower...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

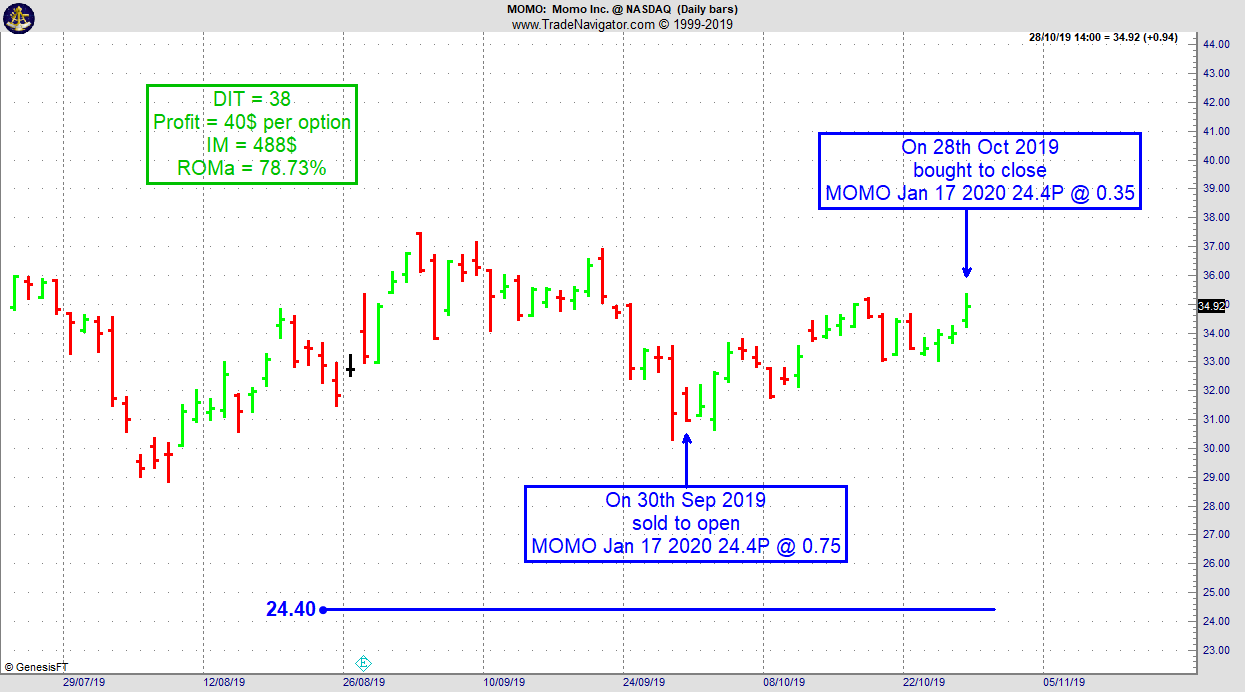

MOMO Trade

- On 30th September 2019, on a GTC order, we sold to open MOMO Jan 17 2020 24.4P @ 0.75, with 117 days until expiration and our short strike about 33% below price action, making the trade very safe.

- On 28th October 2019, we bought to close MOMO Jan 17 2020 24.4P @ 0.35, after 38 days in the trade.

Philippe

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Trading is a Business

Learning the business of trading is basically no different from learning any other business. The important thing is that you realize...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Manual Backtesting Pitfalls

If you don’t want to learn how to backtest automatically right now but still want to profit from backtesting, you got to do it manually. That’s how I started too many years ago. I still remember sitting there with printed charts and writing down trade results on a separate sheet of paper.

Now there are some pitfalls you better...read more.

Marco Mayer is an Educator for Forex, Futures and a Systematic Trader, so if you have questions, he wants to hear from you! Contact Marco with questions!

Check out Ambush Signals

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.