Edition 807 - December 20, 2019

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

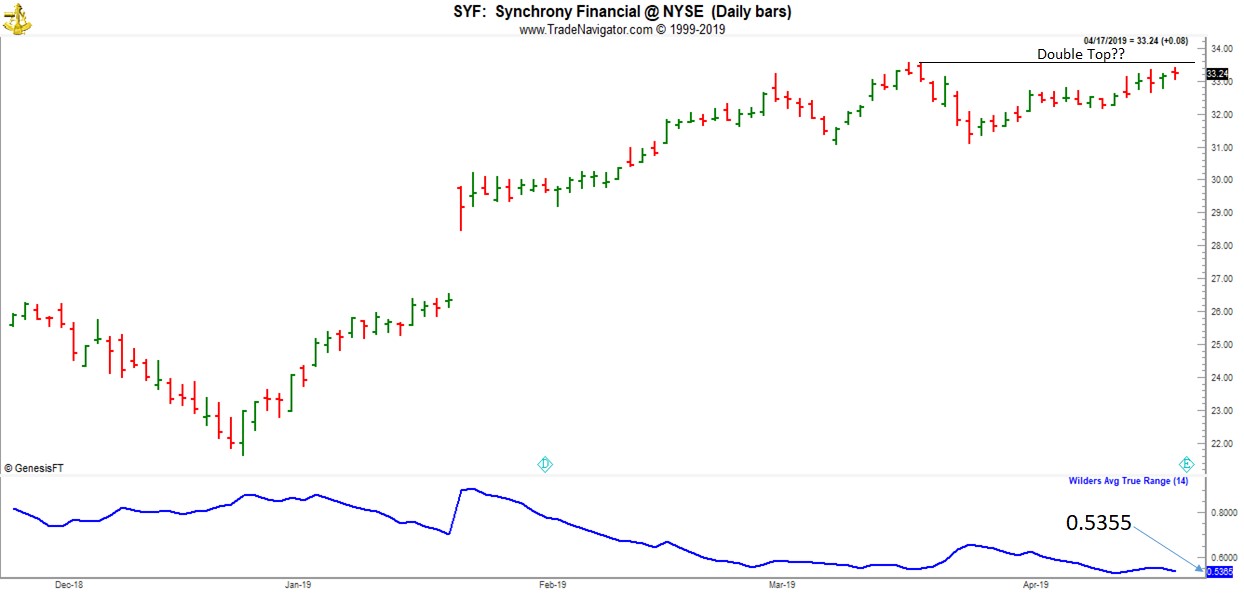

Chart Scan with Commentary: ATR

Hey Joe, you said to the effect that, “ATR is good for many important things a trader needs to know.” You said, “ATR has the ability to solve many problems that traders encounter. With ATR:

- We know our risk so we know where to place the stop.

- Because ATR is based on volatility, we know what our objective should be.

- ATR is able to fit the time frame into our comfort level.

- ATR shows us which markets to trade.

- ATR shows us the time of day to trade. What is the ATR when the volume is the best?

- ATR shows us how many contracts to trade.

Is there anything else you can use it for?”

Yes, there is. I can think of a couple more uses at the moment, and it’s best used in the stock market with stocks in the same sector. First let’s define what ATR is:

The Average True Range (ATR) is a technical analysis indicator that measures real volatility (not Implied Volatility) by decomposing the entire range of an asset price for that period. Simply put, a stock experiencing a high level of volatility has a higher ATR, and a low volatility stock has a lower ATR. The ATR may be used by traders to enter and exit trades, and it is a useful tool to add to a trading system. It was created to allow traders to more accurately measure the daily volatility of an asset by using simple calculations. The indicator does not indicate the price direction; rather it is used primarily to measure volatility.

A great way to use ATR is to compare stocks in a sector in order to trade together. You might buy a call for the more volatile stock and buy a put for the less volatile stock, in conjunction with their individual price direction.

The charts above show two stocks trading in the financial sector. Both stocks have been moving up, but Synchrony Financial is considerably more volatile than Regions Financing. Think about how you might take advantage of that volatility. Options for Synchrony Financials are going to have higher option premium than options for Regions Financing.

If you wanted to use options to short Synchrony, instead of trading based on price, think about trading based on volatility—high volatility vs low volatility. Think about selling high volatility and buying low volatility. In that case, if you thought that prices are about to top out for Synchrony, you might sell a call on Synchrony and buy a put for Regions, creating a synthetic short position.

Or, you might sell the high volatility of Synchrony and use the money to help pay for a position in Regions, for example, sell a put on Synchrony and use the premium to buy a call on Regions.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Discipline and Temptation

Looking at your screen can be much like looking at a slot machine, and stopping yourself from dropping a dollar in the slot and pulling the handle. You must restrain yourself from making an impulsive trade, but there's a very human tendency to seek out excitement and receive a quick reward. You must fight temptation and maintain...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

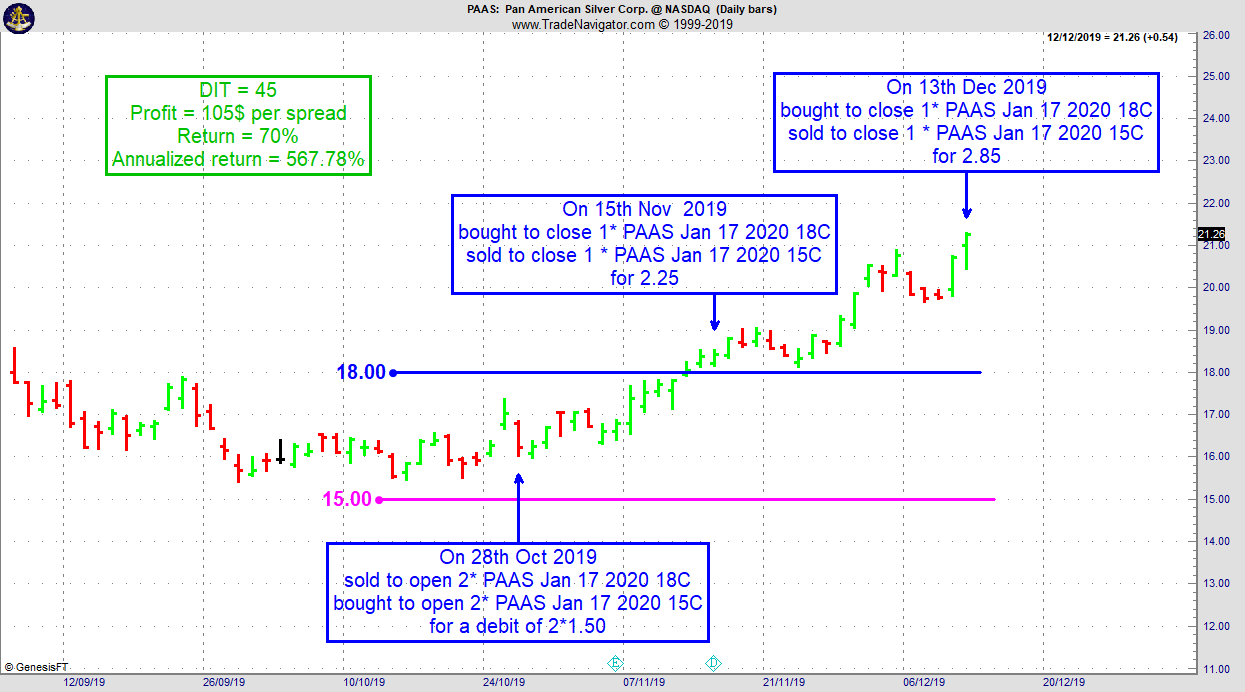

Trading Idea: Instant Income Guaranteed

PAAS Trade

- On 28th October 2019, we sold to open PAAS Jan 17 2020 2019 18C and bought to open PAAS Jan 17 2020 15C for a debit of 1.50 (or 3.00 for 2 positions).

- On 15th November 2019, we bought to close PAAS Jan 17 2020 18C and sold to close PAAS Jan 17 2020 15C for 2.25.

- On 13th December 2019, we bought to close PAAS Jan 17 2020 18C and sold to close PAAS Jan 17 2020 15C for 2.85.

Philippe

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Who are you?

A thorough understanding of who you are and what makes you tick is essential in trading. How and what you think, what you believe, and how you...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Marco Mayer's Ambush Signals

I wanted to give you all a a quick update on Ambush Signals. It's been a great service for many years now that a lot of you already enjoy, as it makes following the Ambush System so simple and easy.

But I decided it was time to make Ambush Signals even better for you. So we re-designed many parts of the website, made the Dashboard simpler and most importantly added support for spot Forex markets and now offer three different subscription models:

- Ambush Signals Pro is the Ambush Signals you already know, it includes all Futures markets and now of course also the new spot Forex markets.

- Ambush Signals Forex is a new subscription for those of you who're only interested in trading spot Forex, not the Futures markets. And it's just 1/2 the price of the Pro subscription!

- Ambush Signals Mini is somewhere in between, made for those of you who're trading only the smaller Future contracts like the Micro Index Futures. It also includes all of the spot Forex markets!

With the new subscriptions it's now possible to follow Ambush even with a small account!

For a full overview of the new subscriptions have a look at the new Ambush Signals website ambush-signals.com.

Happy Trading!

Marco

Marco Mayer is an Educator for Forex, Futures and a Systematic Trader, so if you have questions, he wants to hear from you! Contact Marco with questions!

Check out Ambush Signals

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.