Edition 809 - January 3, 2020

Happy New Year, everyone! Joe Ross will have a special message in next week's newsletter. Be sure to tune in!

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Options and Moving Averages Part 2

Last week we looked at entering and exiting trades based on where prices are relative to a 50 bar moving average. In this issue of Chart Scan, we are going to examine entering or exiting trades based on a Moving Average Crossover.

There are a variety of proponents for this kind of trade and they vary as to the number of bars to use in each MA to be used. Some insist on exponential Mas, and some are content with a simple MA. Personally, I don’t see that it matters at all, so long as you are consistent in the way you trade the crossover.

One magic combination I received calls for a 20-bar EMA, along with a 5-bar EMA. Another, uses a combination of 13-bars and 30-bars. The idea is to buy or sell when the lesser MA crosses the greater MA.

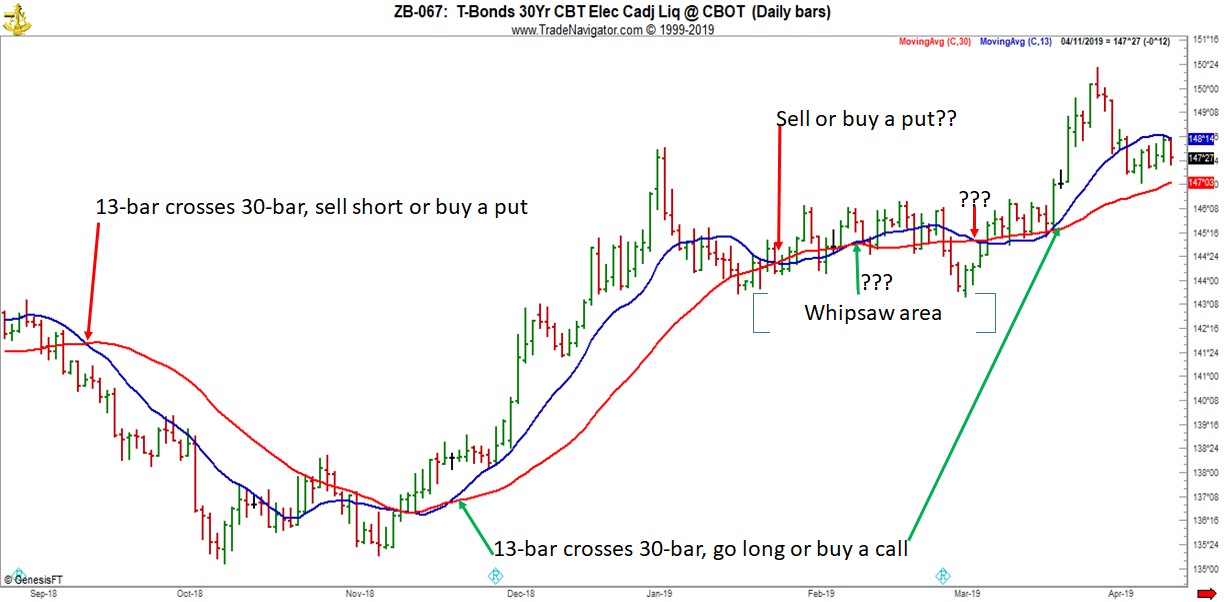

The example I will use is seen below using a 13-30 crossover. It’s the same bond chart I used in Part 1, so you can have something to compare. Notice that with this technique the trader must have considerable finesse in choosing entries and exits. As you can see, when prices are moving sideways in a trading range, moving average crossovers can chop you into little pieces. This method definitely must be accompanied with more rules and astute observation than a simple crossing of a single MA.

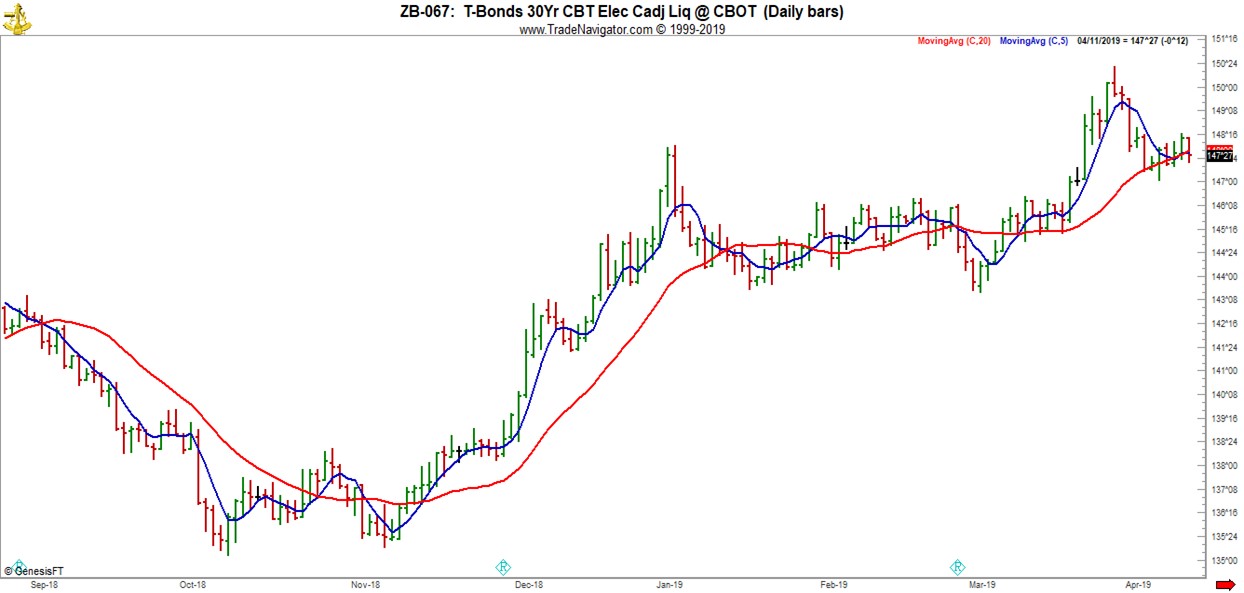

I’ll let you play with a chart using a 5-20 crossover.

In the next issue of Chart Scan, I’ll show you a bit about the way I trade options in the stock market.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Look at the Facts

Have you ever made a small losing trade and thought, "It's alright. I'll win on the next one." The next trade comes along, and you lose. And then the next one is a loser...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

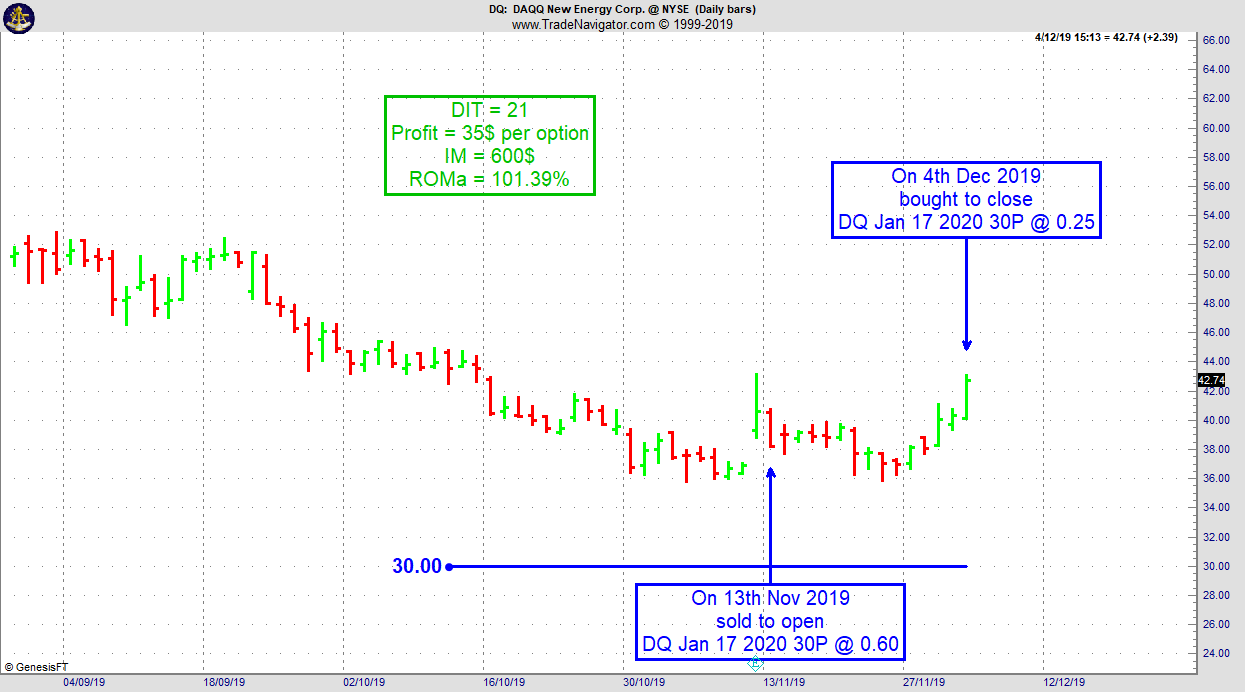

DQ Trade

- On 13th November 2019, we sold to open DQ Jan 17 2020 30P @ 0.60, with 64 days until expiration and our short strike about 26% below price action.

- On 4th December 2019, we bought to close DQ Jan 17 2020 30P @ 0.25, after 21 days in the trade

Philippe

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Record your Trading

You must be disciplined in following the plan of your trade religiously. Once you have closed your position, you should record...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

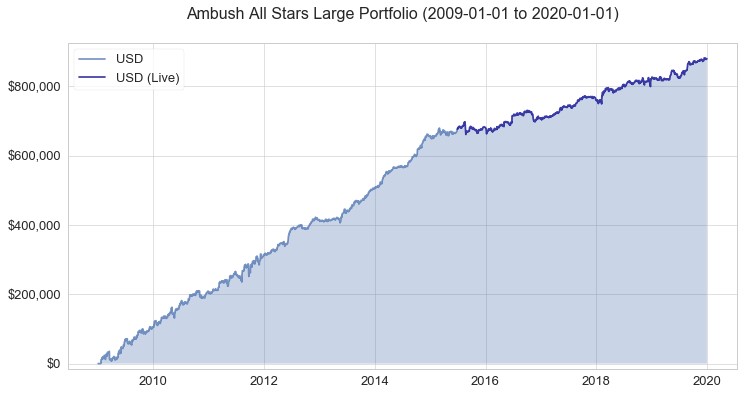

Marco Mayer's Ambush Signals: Ambush closes 2019 making new all-time-highs!

Ambush Traders had another great year with this Ambush performance finishing the year 2019 at new all-time highs! That's a really nice way to start into a new year giving ambush traders the confidence they need to look forward to the new year.

And I have to say, it is really amazing to witness this year after year for over a decade now. And every year I get the same kind of questions which are all versions of "will Ambush keep on performing well in the next year?!". And obviously I don't know for sure, because like everyone else I also can't look into the future.

But I can make some guesses and one of them is that unless a lot of markets start to behave very irregular and go all crazy, odds are that the very robust idea that makes Ambush work will continue to do so also in 2020.

Here's the long-term performance of the Ambush All-Stars large Portfolio featuring 10 markets from stocks over currencies to commodities:

Ready for you to get started with Ambush in 2020 is the new version of Ambush Signals, now featuring three different subscription models. You can find out more about Ambush and Ambush-Signals on https://ambush-signals.com and sign up for the upcoming Free Trial already!

Also, Ambush System itself is still for sale at a bargain price for a system that keeps on performing for so many years now: Have a look.

Happy New Year and Happy Trading in 2020!

Marco

Marco Mayer is an Educator for Forex, Futures and a Systematic Trader, so if you have questions, he wants to hear from you! Contact Marco with questions!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.