Edition 823

April 3, 2020

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: How to Trade an Earnings Gap

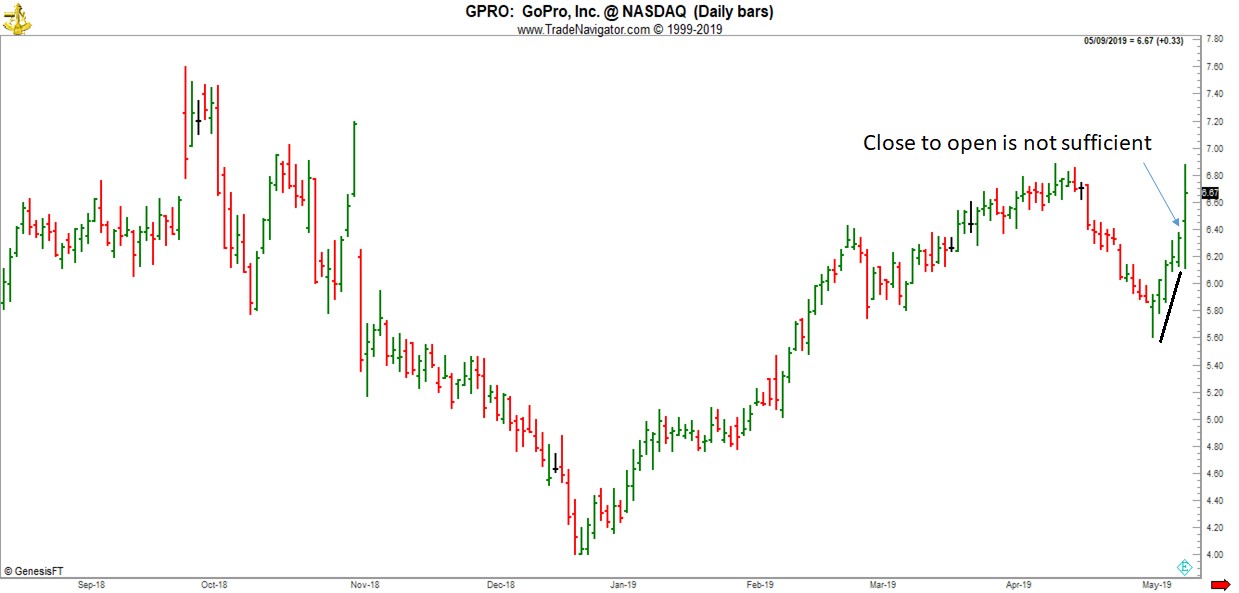

You can do very well trading gaps on earnings days. But it takes patience and great care in choosing the gaps to trade. Below is an example. Following that I will give you the necessary filters. You cannot be greedy and you cannot be in a hurry. If you miss a trade, relax. Tomorrow will be another one.

Trade action steps on earnings day:

- You enter the trade a few seconds or minutes after you see the gap open.

- You measure the distance from yesterday’s close to today’s gap open (0.55 above)

- Your stop loss will be set at ½ the measured distance (8.23 above)

- You exit this trade at the close (MOC order if available)

Filters:

- There must be a clean break on earnings day from the previous day. Inside gaps don’t count. There can be no overlap at the time of the open.

- You must take gap openings only in the direction of the most recent swing. (black line above)

- If there is no clear direction, skip the trade.

- ½ the distance from close to open must be sufficient for a stop loss. See example below.

In the example above, prices closed at 6.34 and gapped open to 6.46. ½ the distance would have placed a stop loss at 0.06 away from the open at 6.40, much too close to be traded!

You can day trade this technique once the market is open. In fact, being out by the close makes this a day trade, even if you are not a day trader. To get the maximum from the trade you may have to watch during the day. Otherwise stay in until the close.

I try to have 8 to 10 charts open and in view, so I can choose one that seems the best. You never know which way prices will move on an earnings day, and believe me, it has nothing to do with whether or not earnings were good or bad. If I’m monitoring intraday, I use a 10-minute chart.

I have a list of all the previous day’s closing prices so I can quickly calculate where to place the stop loss.

You need to practice this technique before using it with real money. Many earnings gaps will produce small wins. If you do it right, your losses will also be very small. The rest of the trades will result in sizable wins. Remember, this is a one-day trade. Be out by the close.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Ego or No Ego

When you get an easy winner do you feel guilty? Do you ask yourself, “Do I deserve to win?” Do I?

The world's most successful traders believe in themselves and their ability to win. In fact, many of them feel that they “own” the...read more.© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Learn More!

Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Need more information? We want to hear from you.

Contact us with questions!

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Your Worst Enemy

In general, we are our own worst enemy when it comes to trading. There are many ways to sabotage yourself as a trader.

Not creating a trading plan, or creating one and then not following it are two of the most common.

Some ways to self-defeat are deep seated; they lurk at the back of your mind and work behind the scenes. These are often self-image problems that can rise from as far back as...read more.

Let Andy Jordan show you how to manage trades!

Visit Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Don't wait too long for "Confirmation"!

A popular concept in the world of trading, especially among technical traders and chartists is to

wait for confirmation before entering a trade.

This means you have a Signal, for example, a price action pattern and now you wait for the markets to confirm that pattern before you enter. The idea, of course, is to filter out...read more.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.