Displaying items by tag: markets

Instant Income Guaranteed by Joe Ross

Start on the right path to Wealth Building!

Instant Income Guaranteed - A new way to look at trading

Hit and Run Trading

“Hit and run?” Sounds like maybe I did something wrong? But don’t think for one second that I’m admitting to some kind of wrongdoing, because everything I did was 100% within the law.

And on this web page I'm going to show how easily I picked up and got away with $67,500... from some of the most fearful, and often greediest, speculators and investors who participate in the stock market.

Now I know it sounds suspicious. But as you'll soon see, it’s not.

What I did has been legally possible for more than 39 years. And for ordinary people like you and me, it's the easiest way to pocket a few hundred, or even a few thousand dollars, without working very hard.

In fact, I've shown this to other people, and they have joined me in this extremely unusual activity.

Like research chemist S. Ruof, who grabbed $2,100 and told me, "This was my first time, and it was very easy!"

Or retired dentist Norma C., who says, "I had no problems learning it. I have made over $10,000."

One of the folks who joined us made over $50,000 since finding out about this. He said, "I have been using this for almost a year, and now I’m living on it."

These are everyday people like you and me, who have come from all walks of life. None of them have any specialized skills or training in this field. Yet each has learned how to do this simple action to supplement, or even replace, their monthly income.

In only 5 months, I picked up over $67,500 this way. Whenever I do this, it takes me only 2 to 3 minutes. I do it from my laptop, sitting comfortably in my home office. I have the use of the money right away. It’s mine to use any way I choose: to pay my bills - to take vacations - or buy a new car.

My name is Joe Ross. I’ve been trading in the markets for almost 6 decades. And I'm going to show you exactly how I pull off what I like to call "Hit and Run Trading."

My name is Joe Ross. I’ve been trading in the markets for almost 6 decades. And I'm going to show you exactly how I pull off what I like to call "Hit and Run Trading."

Now I understand that you may have moral reservations about doing this yourself. So let me put your mind at ease and show you exactly what it is - why it's been lawful for more than 35 years - and how you can use it to grab cash month after month in just a few minutes of your time. How you can use it to pay your bills... buy gifts, travel... supplement your income... or whatever you wish.

Then you can decide if it's something you could feel comfortable doing. And if so, you'll see how easily you, too, could pocket a bunch of money almost immediately after reading what I have to say...

Hit and Run Trading exploits people’s fear of losing money

The first thing you should know about this way to pocket money is that it's lawfully being done by huge investment banks and hedge funds every day.

Of course, the fact that they do it doesn't make it legal. But what they do was passed into law by Congress, signed by the President, and endorsed by the SEC and the U.S. Federal government - most likely at the urging of Wall Street's large hedge funds and investment banks, who make billions of dollars with it every year.

Now I'm not talking about any kind of regular investing, day trading, or anything like that. And when I say "pocketing money," I'm not describing any form of stealing or robbery.

As you probably know, Wall Street has many ways of making money which have nothing to do with buying or selling stocks. In fact, what I will show you if you join me is how to not buy stocks, unless for some reason you want to own them.

The actions of the big money traders make money for them in seconds, time and time again. In most cases with little risk, because they create situations in which they almost always make money.

Perhaps you've heard of some of them, like high-frequency trading or arbitrage, a tactic that lets Wall Street pros buy up investments at one exchange at a lower price, and immediately sell them at another exchange at a profit.

They can do this over and over again, with little chance of losing money. With high-frequency trading, they can do a thousand trades in a second or two.

Tactics like these are not available to people like us. But they generate piles of cash for the professionals who use them.

Maybe you've heard of the specialized investments Wall Street creates, which let the pros exploit existing market situations at huge profits, but with little or no risk.

These Wall Street insiders use strange-sounding names like “credit default swaps,” and “collateralized debt obligations” to snatch billions of dollars from the markets.

These tactics may be lawful, but in my opinion they are unethical.

Yes, there are many tactics used on Wall Street which, in reality, add up to legalized theft - unfair tactics that allow them get away with a fortune, but aren't available to individuals like you and me.

I don't agree with these tactics, no matter how lucrative they are, because I don't believe in making money by hurting or exploiting someone else financially. I have always made my money by performing a service or producing a product. It’s no different with Hit and Run Trading, I want to create new value.

Yes, there is one type of “clever” trading which is both ethical and within the law. I use that kind of trading all the time, and have no reservations in using it (and neither should you) because by using it I perform a service that others want.

A similar service is heavily used on Wall Street by their taking advantage of their mountains of cash. But in the case of what I do, it isn't complicated and doesn't require large sums of money. It’s a form of price insurance - and it's available to regular folks like you and me.

I've adapted the service for my own use, making it possible to use with almost anyone’s limited resources.

In fact, what I do often lets me jump ahead of the big Wall Street firms and get away with a cut of their profits before they even know what happened. And that's why I call it Hit and Run Trading.

It's easy to do, and you don't need any specialized training or skill to do it.

But it wasn't always like this...

Computer technology gives us access to this Wall Street secret

Years ago, when this way of trading was made lawful, it wasn't available to ordinary investors. Only Wall Street professionals could take advantage of it.

But all that changed in the 1990's when the combination of the personal computer and the Internet made the markets accessible to all. That's when regular folks like you and me gained access to the markets through online discount brokers. And for the first time, we were able to directly get at the same pools of money as the pros. And for the first time also, we could use Hit and Run Trading to pull in money just as the pros do.

"I was able to pay off my car almost 2 years early!" says Lori B. in Austin, TX, after grabbing $13,250.

“I’m taking my family on a long hoped-for vacation, says Michael Ems of Cape Town, South Africa.

These folks are grabbing the easiest and safest income possible.

As John Vacani, an investment analyst said; "It's really doing a service for those who need to protect the value of their investments. It’s truly a win-win situation for those who provide the service and those who need it."

And once you try it for yourself, you'll see exactly why. Because with Hit and Run Trading, you can pocket money every day the markets are open, while at the same time providing a real service to those who need it.

So how do you do it?

It works through your online brokerage account by accessing money lying around in the financial markets.

Now I realize you may not think the markets have money lying around for you to simply grab.

But that is how Wall Street does it. Let me show you...

Providing insurance against fear

Many stock market investors, as well as many stock market advisers, live in fear of falling stock prices. Investors, especially, fear losing money on their stock investments through a stock market crash or falling prices in what they call “a bear market.”

Stock market psychology erroneously equates rising prices with being “good” and falling prices with being “bad.” Therefore the markets are heavily biased towards rising prices. But nothing, not even stock prices, goes up forever, so stock prices are said to “climb a wall of worry.”

Most investors can withstand the normal ups and downs of the stock market, but they are terrified of suddenly falling (crash) or steadily falling (bear market) stock prices. To protect against falling prices, investors are advised to purchase a form of price insurance. That insurance protects them against falling prices.

Said another way, an investor can purchase insurance against falling stock prices by purchasing an insurance contract that will grow in value at the same time the value of shares of stock is lost due to falling prices.

Insurance is no doubt one of, if not the best, business in the world. Insurers receive money up front for perceived risks that may never take place. That upfront money is what they call “the float,” and they use it to invest for profits. But unlike other businesses that have to pay interest on money they borrow, insurers get their investment capital for free via the premiums people pay for insurance. What a racket, huh?

When you purchase accident insurance, you immediately cough up the money to protect against an accident, but hope you never have one. The insurer has the exact same hope. Your protection is from month to month, quarter to quarter, semi-annually, or year to year, depending on how you pay for it.

When you buy health insurance, you come up with the money, “the premium”, to pay for an insurance you hope you will never have to use. Again, you pay for it each month, each quarter, semi-annually, or perhaps on a yearly basis.

If a person buys a one-year term life insurance policy, the insurance expires at the end of one year, and has to be renewed for another year, usually at a higher price. If not renewed at the end of one year, the insurance policy expires worthless. Strange! The only way to collect on that kind of insurance is to die. Still, it serves an economic purpose for those who survive the person insured.

Buyers of price insurance are insuring against something they hope they will never have to use. Sellers of price insurance share the same hope. Price insurance against falling prices is sold for one week, one month, one quarter, several months, or even one year and beyond. The longer the insurance period covered, the higher the price for protection, since the insurer will be at risk for a long period of time.

The buyer of price insurance wants the insurer to take the risk of falling stock prices by agreeing to buy the insured’s stock when prices have fallen to the point of loss. For that insurance, the buyer pays a premium.

The seller of price insurance receives immediate income in the form of the premium paid by the insured. The seller agrees to buy devalued shares of stock from the buyer of the price insurance, and statistics show that at the end of the insurance period 8 out of 10 insurance contracts have no value whatsoever. They expire worthless, without the insured’s collecting anything. Price insurance is the cost paid for protection against a fall in the price of the underlying shares of stock.

The seller of price insurance pockets the contract premium and gets to keep it on average 80% of the time, but what about the other 20% of the time? Does the insurer, the person selling the insurance, have to pay up? Does the seller of price insurance actually have to pay up, and purchase the devalued shares of stock as set out in the insurance contract? Not with Hit and Run Trading.

With Hit and Run Trading, you will find out how to pocket guaranteed option premium, i.e., guaranteed income, without ever having to buy a single share of stock. A Hit and Run trader never has to fear falling stock prices, because a Hit and Run trader will never have to own shares of any stock. If you never own shares, you will never fear a falling stock market, and never lose money by owning shares.

Just click "submit" and access unlimited cash

The most money made by the professionals in the stock market is not made by buying and selling stocks. The real money, the big money, is made by dealing in derivatives. Price insurance is a derivative. And derivatives comprise the largest financial market in the world.

The word derivative means that the financial instrument, (in this case the price insurance contract) is derived from an intangible — the intangible in this case is fear of losing money on the price of shares of stock. Every derivative must have an underlying asset. In the case of price insurance, the underlying assets are the shares of stock.

Derivatives have many different names such as:

Forward rate agreements...

Money market instruments...

Stock options...

Swap options...

Interest rate caps...

Property index notes...

Futures...

and many additional names, most of which we’ve never even heard.

Their names might sound confusing, but basically these are all just various types of bets. Insurance, too, is a bet.

Derivatives are bets on anything to do with money. Like bets on what interest rates will be next month - bets on fuel prices – or, as in the case of price insurance for stocks, bets on share prices. If you buy insurance of any kind, you are placing a bet.

If you buy life insurance, you bet the company that you might die tomorrow, and the insurance company says, “Yes! You will die, but not yet.” When you buy health insurance, you bet you will get sick, but the insurance company says, “We don’t think so.” With accident insurance, you bet you will have an accident, but the insurance company says, “We don’t think you will.”

Hit and Run Trading has nothing to do with your making any of these bets. With Hit and Run Trading, you take the insurance company’s side of the argument. You don’t make a bet, you take a bet, but it’s a bet you cannot lose if you are careful in underwriting the risk.

I got the Hit and Run Trading idea by finding out how Wall Street makes its money, which led me to the secret I want to share. I learned how to underwrite risk, so that I never have to buy the devalued shares of stock. Wall Street makes money by unfairly collecting the money being lost on bets. I learned to make money by performing a much-wanted service.

Let me show you what I mean...

Investors lose money betting that prices will fall

The money they lose is yours for the taking. Many of the bets placed in the stock market are highly speculative. For instance, I recently saw bets being made that Microsoft's stock price would drop. People who simply don’t understand Microsoft’s business, were buying price insurance to hedge against expected falling prices. Wow! Were they ever wrong! Within a week, Microsoft’s prices soared 2 ½% in a single day.

In other words, some people were using the stock market to bet that Microsoft's stock price would collapse in the next few weeks. To me, that's just ridiculous. But what's even crazier is that these people had put up $2,320 betting this would happen.

To show you how unlikely this bet is, just consider that Microsoft has been around for decades and is the world's number 1 software company. They make multiple billions a year from their software business. Microsoft actually has 16 businesses that make over a billion dollars a year each. And their money from this has been going up every year without any signs of stopping. Even during the last financial crisis, Microsoft's stock didn't drop by as much as these people were betting on.

So short of an unprecedented global disaster, I don't see how its share price could possibly drop an anticipated 60% in a few weeks.

But for whatever reason, there were some people out there who've placed bets on this happening.

Who are these people?

They are speculators, and fear-driven investors. In fact, they may be some of the insiders... or Wall Street's wealthy clients. Often they are people with perhaps more money than common sense.

To them, the stock market is just a huge casino where they can place bets in the off chance of hitting a large jackpot. These people just love taking risks, and would feel equally at home in a casino. Losing on speculative bets like this is normal in their pursuit of that one lucky bet that may pay off. It comes with the territory, similar to losing your bet on a spin of the roulette wheel.

Lots of people gamble in the stock market. They do it for the adrenaline rush, and the euphoria that comes with it. Others, who are fearful investors, are often just plain ignorant of the realities of the markets.

And that's why they're placing bets on things like Microsoft's stock dropping so far in such a short time. It's trying to attain the thrill of getting rich quick, or to protect against unlikely losses.

Of course, Microsoft's stock price will go up and down over the next few weeks as it always does. But it's virtually impossible for it to drop as much as those speculators were betting on. Too bad for them, because they'll lose the $2,320 per contract they've put on this wager. And in most cases, some Wall Street firm will pick up this money like a casino collecting bets from its gambling table.

And this is where the Hit and Run Trading comes in. Because with Hit and Run Trading, you can grab this money before Wall Street does.

"I couldn't believe how easy it was. Last year I made $78,000," says Denise H. in Albany, NY.

And Bahamas retiree, Don W., is collecting $1,300 EACH WEEK.

Let me show you how you could do it...

How to "steal" from Wall Street's income

What Hit and Run Trading enables you to do is spot these ridiculous bets, and collect the money being lost by those impulsive speculators and fearful investors.

As I mentioned, I don't believe in taking money from people without their consent. And I certainly don't believe in hurting someone else financially while my own wealth is growing.

When you use this tactic, you are simply collecting the money lost by impulsive (and often wealthy) gamblers who make wildly speculative bets in the derivatives market. They are willing to pay for price insurance, which will result in limiting their losses. They are placing a bet, and I’m willing to take that bet knowing I will win.

That's what the Hit and Run Trading allows you to do. It helps you to run ahead of Wall Street and pick up the money being lost before they do, while at the same time performing a needed service.

That's why I call it a "hit and run". Because when you do this, you're "snatching" some of Wall Street's profit.

And as I said, I'm completely comfortable with a legal strategy that earns me money while I perform a service others are willing to pay for.

To give you an idea of how easily you can pick up this kind of money, just look at the vast number of bets and the money in the market right now...

Millions of bets losing money means millions of dollars for the taking

Today, as I write this, TransCanada Pipeline Company is selling for $45.52. In the last 4 days the price has risen $0.85, and rose more than $2 in the past 3 weeks. Yet there are 1,402 crazies and fear-driven holders of TransCanada who are willing to bet that prices will fall back 87% in the next 6 weeks.

Johnson & Johnson, a global dominating blue chip company, just hit $98.23 per share, up from $85.47 per share in less than 2 months. There are 2,824 owners of Johnson & Johnson who are willing to pay someone to take their shares off their hands if prices fall back to $85 in the next 19 days!

Earlier I showed you some of the ridiculous bets people have placed on Microsoft’s stock. Now, I’ve shown you two more insane bets. But the truth is, it's like that with nearly every large stock on the New York, AMEX, and NASDAQ stock exchanges - on everything from stock symbols AAPL to ZZZ.

Your online brokerage account holds the key to collecting money in less than 5 minutes

Doing these "hit and run trades" is very easy. In fact, it involves steps that are not unlike placing a regular order to buy or sell shares of stock, except that in this case you don't use the stock order section of your account.

Instead, you access another account feature of which most people simply aren't aware. It gives you direct access to the money you'll be extracting with the Hit and Run Trading.

If you deal with any of the large online brokerages like Fidelity... E*Trade... Charles Schwab... TD Ameritrade... or Scottrade, you most likely have this feature in your account. Personally, I use Interactive Brokers to do the job.

The key to access the money is easier to find on some brokerage websites than others. And some accounts have the feature locked out or disabled by default. But don't worry. With a few clicks or a phone call, you can usually unlock this feature in your existing brokerage account. I'll show you exactly how.

Once you've enabled this account feature, you simply enter a specific code into the account. I'll show you how to generate the code. This code is used to place the "transfer request" that extracts a given amount of money out of the market.

And then, you just click "submit" to watch the money get transferred into your account.

How much you collect varies each time. But most people I've shown this to can withdraw a few hundred to a few thousand dollars at a time.

So where do you get these "transfer request" codes?

That's easy - I'll teach you how they are constructed. Putting them together is child’s play. I’ll also give you simple step-by-step instructions on how to use them. All you have to do is follow the directions I give you in my online seminar, workshop, and two months of daily guidance.

Start profiting by joining my next group of insurers...

During the period of daily guidance I’ll give you details on how much you can expect to grab, and how to go about collecting the money.

If you're interested, I'll add you to the list for my next course immediately.

You see, I've been a trader for almost six decades, and an educator for more than half that time. I love to show people how they can make money. In the early 1990s I formed Trading Educators. Trading Educators has grown to have representation in numerous countries around the world. We have students on every continent.

I’ll show you how to find the bets most likely to lose, so you can then collect them.

And once you've taken my online seminar and workshop, I'll not leave your side for two full months — and beyond that if you wish. I'll guide you every day with all the information you could possibly need.

I am so confident that you will not lose money selling price insurance that I guarantee to give back your seminar and guidance fee if you incur even one loss during the two-month guidance period. What I will show you is not for novices who are happy with mediocre gains...

Collecting a steady income this way is not for everyone. And I find that the people who benefit most from my program usually meet two specific qualifications:

First, I recommend you have at least $2,000 in investing capital set aside. $2,000 will severely limit what you can do, but it will enable you to learn the technique and rather quickly build your capital so that you can snatch more and more money away from Wall Street, and help those who need your service.

Of course, whether or not you choose to follow my advice, and how much money you commit to any single bet, is entirely up to you. But it's a good idea to have at least this much capital at your disposal so you get the maximum benefit of the techniques I'll be showing you.

And second, you must be open to embracing a new way of seeing things. I will be showing you a highly profitable way to make money.

In my experience as a trader and educator, I’ve seen that most people are afraid to try anything that looks in any way "unusual." Especially when it comes to the financial markets.

If that sounds like you, I regret wasting your time.

I have no interest in showing you a conventional way of making money. If all you want to do is buy stocks and collect a few dividends, there’s no point in continuing because my technique relies completely on money to be made from the highly lucrative derivatives market.

In other words, you'll be using tactics that might be entirely new to you, unlike anything you imagined would be legal or even possible. Let’s be honest. Have you really ever heard of price insurance? Where would you go to buy such a service?

As a result, you must be willing to use the investments found in the derivatives market, including stock options. They are the best way to collect the money being lost in this market.

That's why with Hit and Run Trading, we'll be using stock options to collect other people's wild bets. Those stock options are the financial vehicle the government provided to the market insiders over 35 years ago.

To reiterate, we're NOT making any bets ourselves. We're only going after the money being lost on those crazy gambles and fear-driven hedges.

So, if you're comfortable with mutual fund gains or a typical buy-and-hold approach, Hit and Run Trading most likely isn't suited for you.

On the other hand, if you're still interested and ready to collect a safe, consistent guaranteed income, then I think you'll love Hit and Run Trading.

And don't worry, you don't need any special skill or prior experience. Just a willingness to try something you may have never done before.

If you're excited by the idea of making an extra $1,000 or more each and every month, I think you're going to love this!

California insurer, Jose M., says, "I am averaging about $4,000 per month."

And listen to this one: Lukas Z. was so excited with his results, he sent me an email saying, “I'm buying a new BMW since everything else is paid off.”

So how much does it cost to join me on my Wall Street "raids?" How much is it worth to know you have guaranteed income for life, with a money-back guarantee that you will not lose any money if you do as I say?

Would $100,000 be too high? What about $50,000? Would you give a year’s pay to know you are set for life?

Well, I don’t charge anywhere near that kind of money. I will reserve a seat for you at my online seminar. Before the seminar you will receive a PDF copy of the seminar content so that you can look it over and prepare yourself for what I will show you.

I will also reserve a seat for you at the online workshop. You will receive a PDF copy of the workshop material as well. Two-days later, you will be ready to start hauling in the money. From that point on, I will hold your hand and guide you for 2 months, during which time I guarantee you will have had no losses. Two months of guidance is more than enough for most to completely master my strategy and technique. The price for all that is $2,900, no ups, no extras, no discounts. It’s more than a fair price for knowledge that can make you financially independent.

Here's how you can start collecting income now:

How to get started...The money from your 1st "insurance premium" could cover your cost

The fact is, you could easily collect 2 to 3 times that amount in the next few days if you have sufficient starting capital.

The bottom-line is that I believe that what I show you will change your life for the better as soon as you start using it. And it could easily help you make a retirement fortune, as it is already doing for so many other people who are selling price insurance.

IMPORTANT: If you intend to sell price insurance from an IRA or other controlled pension plan, you may need to obtain permission from the broker to do so.

You can sign up right here. This will take you to a secure order page, where you'll be able to review everything before submitting your order.

Wishing you all the best,

Joe Ross

DISCLAIMER: Trading Educators, Inc. is a publisher of Educational material, and NOT a securities broker/dealer or an investment advisor. You are responsible for your own investment decisions. All information contained in our publications or on our web site(s) should be independently verified with the companies mentioned, and readers should always conduct their own research and due diligence and consider obtaining professional advice before making any investment decision. As a condition to accessing Trading Educator’s materials and websites, you agree to our Terms and Conditions of Use, including without limitation all disclaimers of warranties and limitations on liability contained therein. Owners, employees, and writers may hold positions in the securities that are discussed in our newsletters or on our website.

These have to be changed -àDisclaimer | Privacy Policy

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Please read below for access information

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

The Law of Charts In-Depth - Recorded Webinar

Go Deeper into "The Law of Charts™"

Master Trader Joe Ross explains the way he stacks up profits with tips and tricks that make it easy for you to apply "The Law" to YOUR trading!

Through this recorded webinar The Law of Charts, we will show how YOU how to win consistently in any market and in any time frame. What it takes to create charts that exactly fit your trading style and level of comfort. The content of this intensive, in-depth recorded webinar takes the "The Law of Charts" to the next step. You will feel like you are attending a private seminar with Joe Ross himself. Many traders have expressed that this is the next best thing to Joe private tutoring when it comes to The Law of Charts. Learn from the BEST!

PURE SIMPLICITY

This recorded webinar on The Law of Charts brings you the pure simplicity of what the markets are all about. Trading does not have to be complicated. Everything you need to know in order to make money in the markets is right there in front of you when you look at a price chart. It's much easier than you've been led to believe.

Why is it so important to have a trading concept?

Because of a known fact that is pretty scary: The majority of traders lose money in the markets, or barely make it.

But what about those who are successful?

Imagine the following situation: 10 people are sitting around a table and everybody puts $100 in the middle. After a few minutes, one person stands up, takes most of the money, and leaves. 9 people remain sitting at the table fighting over what's left.

Which of these people do you want to be?

If you decide to be the one who takes it all away, we have good news for you:

- You don't have to wait for a miracle - trading skills can be learned, but you have to let Master Trader Joe Ross show you how it is done!

Find out why you already have an edge over everyone else, and learn more about an easy way to enhance the advantage.

Believe it or not, you already have an edge over the other people at the table who are still fighting for the leftovers. Why? Because you have decided to trade with a concept that can lead you through the markets and guide you along to consistent success in your trading!

You have no idea how many emails we receive every day in which traders ask for help because they have lost in the markets, and have to deal with yet another loss.

Our answer to each and every one of these emails is the same:

If you do not want to experience loss after loss, and if you really want to become a successful trader, then you definitely should start trading with a defined concept.

We have seen a lot of trading systems come and go. Often they are called "Killer" or "Monster" or even "Hyper" trading systems that say they will "make you rich in just three months." You know exactly what we are talking about.

Joe Ross’ original trading concept "The Law of Charts," which is the first eBook you can or already recieved when signing up for the Free Trading Materials that does not need any kind of hype. It has helped many to trade successfully and profitably for years. It doesn´t need any power words like "monster" or "killer" because it has proved its worth.

You may have read about this simple concept on our website, and you have seen it "in action" in our free weekly newsletter, so you know that The Law of Charts can be used in any market and in any time frame, and it doesn´t matter where you apply it to produce consistent profits.

HOW DOES THE TLOC WEBINAR DIFFER FROM THE LAW OF CHARTS EBOOK?

The free Law of Charts eBook presents details of the formations that make up The Law of Charts. That's it! The content of the free material goes no further than that.

The recorded webinar, presented by Master Trader Joe Ross himself, will give you a very brief presentation of the Law of Charts formations and a very detailed explanation of how to implement the Law of Charts for making profits. Joe Ross wants to teach you to understand and show how to take advantage of the markets. It also reveals one of the most essential factors in trading called "Market Dynamics".

The Law of Charts™ In-Depth

Recorded Webinar - $947.00

Market Dynamics answers the questions:

- Where are prices most likely to move next?

- Why do prices move to where they move?

- How far are prices likely to move when they do move?

PLUS: Let us show you some of the best ways to follow market momentum and thrust: the source of market momentum, the cause of market momentum, and how to take advantage of it, to put profits into your pocket. It takes you through some very interesting uses of indicators that will assist you in filtering Law of Charts formations. Typically, we're not users of indicators the way they were created to be used, but using indicators in unconventional ways to determine when to use Law of Charts formations, and to filter out the best of the best prior to entry.

In addition, we give you the rationale behind the Traders Trick Entry™. You will learn what causes Ross Hooks™, and how to trade them. You will see how and when to use the Law of Charts when prices are in consolidation.

There is more, much, much more in this webinar with slides showing you information that you haven't read even in our free Law of Charts material, nor in any of his other books.

We want you to fully experience the dynamic POWER of the The Law of Charts™

As mentioned, Trading Educators offers the concept at no cost when you subscribe to get our Free Trading Materials and, as you may have recognized, it is easy to understand; and once understood, it is also easy to apply in the markets. But sometimes it takes just a little bit "more" to completely experience the full power of The Law of Charts - the power that helps you trade with such incredible insight.

Every time you view a price chart, the truth you need for making money is staring you in the face. It is looking right back at you.

Our students have verified that once you understand the markets, all you’ll ever need to trade them profitably is an understanding of the Law of Charts along with the dynamics of the market.

We present some indicators, but they are used in an unorthodox manner. People think that the more complicated something is, the better it is, but the truth of the matter is just the opposite.

Look at the truth of the markets in virtually every scene. There is truth in every price bar you see, and in every group of price bars there is additional truth. It doesn’t matter whether you use traditional or candlestick price bars. You can see the truth with line or point and figure graphs. The truth is the truth, and you will find it on the charts. You will come to see the truth as we guide you with additional valuable comments and which are not found in an indicator, a mathematical formula, Fibonacci ratios, Elliott Waves, or Gann theory.

We don’t mean that people cannot make money using those things. What we do mean is that if you are able to throw off all the complications of theories, indicators, and mathematical ratios, you can come to see what is really there on the chart when you look at it. The truth is simple, and the charts follow a law which Joe named a long time ago "The Law of Charts."

Explore the depths of "The Law of Charts™" created by Master Trader Joe Ross

Learn how to apply the law to your trading so that you can start trading more deliberately and more successfully the next time you trade.

Master Trader Joe Ross will answer the important and essential questions of every trader:

- Where will prices move next?

- Why will they go there?

- How far will they go?

Learn how to identify a trend before everyone else sees it, and how to enter the market ahead of most other traders.

You will see exactly how a master trader conquers the market.

This recorded webinar is his most requested recorded webinar, The Law of Charts will completely change the way you look at the markets. You will never see the charts as you did before - you will be able to read them like an open book. Many former seminar attendees / viewers told us that what they learned in the first hour was worth the price of the entire webinar. Master Trader Joe Ross created Trading Educators to teach those who want to learn trading, even though he has passed on, his writings will stand the test of time. Let Joe teach you how to trade.

The Law of Charts™ In-Depth

Recorded Webinar - $947.00

5 Hours and 30 Minutes (5 Part Series)

Orders Filled Within 24-Hours*

All Sales Final

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Day Trading

A Complete Day Trading Course in One Book

"Joe and I have been friends for some time. We have collaborated on trading techniques, so I know of his dedication to the market. But in this book we see the other side of Joe -- the instructor of the grand style. He is teaching us "How to Fish." ~W. E. Dalton, MD

This book is a must-read for every serious day trader. It's the essence of Joe Ross' experience of well over five decades of trading the international markets. Although the focus is on day trading, it teaches you methods and concepts that are applicable in position trading as well.

Many traders fail because of a wrong mindset and the fact that they don't know where to start or what to expect as an outcome. This could be the most important book you’ll ever read. Joe has organized it in a clear, step-by-step manner. Instead of being overwhelmed, you'll have a clear trading plan. You'll know exactly where to start, what to do next, and where you can realistically expect to end up.

Day Trading Highlights

Chart Reading

This covers what you need to know about the "Law of Charts" and the simple tricks of how to use it in your trading. "A chart is a chart is a chart." The immediate psychology of a market is reflected in the price action. You don’t really need any indicators. We'll show you how a bar chart can reveal very powerful price patterns when you understand the proper interpretation and implementation.

Identifying Congestions and Trend Finding

In trading, it is equally important to be able to recognize congestion at the earliest possible time, and to identify a trend before everybody else sees that it is happening. We call it "identifying a trend while it is still in the birth canal," and shows you several methods of doing just that.

Markets are in congestion areas much longer than they are in trends. The early parts of the book center almost entirely around congestion areas, which may be seen on any chart in any time frame. Later in the book, the concepts and the techniques taught center around trending formations.

Let us show you how to spot the very beginning of a trend, and how to successfully enter existing and established trends. You will see and learn very simple and basic ways to trade. The main features of our methods show you early in the game what might happen next, and thus gets you on board a trend while it is "still in the birth canal."

Your own Trading Plan

You will find out if day trading is or is not suitable for you. It takes certain character traits and certain trading techniques to be a successful day trader. We'll described these, and also how you should combine them so that you write and follow your own trading plan. You will understand why you must want it your way, and why you should take only trades that "have your name on them."

The trading plan includes all the preparation and the actions you will take, such as: establishing entries, all potential orders, setting alerts, accommodating for gap openings, and, if you are filled, what you do until the exit of all your contract sets.

Trading Mindset

In Joe's unique way, he shows you how your own mind can help you become a successful trader or can break you apart. Trading is mainly a psychological endeavor, and the way you perceive the markets, coupled with your emotional reactions, actually determine your success or failure as a trader. It's simple advice to anyone who wants to trade: work to learn how to understand price movement.

By using powerful real life examples, we can demonstrate why trading has to be simple, despite the example of most traders who are in a never-ending search for complicated methods. Also, demystifying several relevant, but confusing concepts, such as those of "support and resistance," "oversold and overbought," and some of the overly used indicators that are not needed in order to trade profitably.

Entry Signals

We reveal major, minor, and intermediate intraday trading signals showing you exactly what they are, and explain why they are important. When you day trade, you want explosive moves after your entry. It is therefore crucial to scale down entry signals based on different time frames so that you get the greatest magnitude of movement once in the trade. This is a unique approach that has been developed and refined over decades of trading.

Searching Out the Best, and Trade Filtering

One of the most important things that any trader can learn to do is to identify the best trades. These can differ from one person to another because we see trades differently, and not everyone trades in the same way. But everyone can learn to recognize what happens in the markets that result in successful trades. Then the trick is to stick to it like glue - until it stops working.

We'll show you exactly what to be comfortable with, while keeping your trading as your own. Examples going into full details of how you should see the whole trade setup, how to think, and select the trades, so that you can adapt that knowledge to your own comfort level.

Let us explain how a trading filter serves several purposes. You will learn how to use a trading filter to calibrate your stop, and to avoid false breakouts as well. You will be able to anticipate breakouts, and thus get into the trade earlier than you might otherwise have done.

Risk and Money Management

We will show you one of the finest points of Joe Ross' trading: his philosophy of money and risk management. These two concepts overlap, and yet they are different. Risk management says "I can afford to risk only so much," while money management asks "What can I expect to make for the risk I have taken?" You will understand why he says that trading is a business and why, the sooner one treats it that way, the sooner one will become a winner.

Placing Stops

The most frequent question we have been asked at Trading Educators is "Where do I put my stop?" Stop placement is a function of a number of variables. There are three kinds of stops: protective, objective, and time stops. It is vital to understand the role of each of these stops and to use them accordingly within your own trading plan.

Unfortunately, most traders place stops where they don’t make any sense, such as at a certain percentage away from the entry. We'll teach you how to place your stops in a practical manner that takes into consideration both technical factors and your own comfort level.

Brokers and Commissions

There is nothing more important in day trading than to have a responsive, accurate, reliable broker handling your account. Offering you several real-life examples of our experiences with brokers that will really make you think. He helps you consider all the vital factors such as commissions, margins, speed of execution, and reliable customer service when you desperately need it.

You will understand why brokers are in this business. You really need to know how to take advantage of your broker’s strengths, and how to avoid losing money because of their weaknesses. You will learn how to choose a reliable broker and build a solid relationship with him or her, one that works well for you.

E-Mini S&P 500 Trading

We dedicate a section to traders who like to day trade the E-Mini S&P 500, but starts it with a word of caution: we have seen too many otherwise good traders destroyed by trading the five-minute chart in the S&P E-Mini. Getting into the E-Mini is like stepping into the ring with a rattlesnake: you can be bitten quickly, and when you least expect it.

We will show you several examples, so that you realize that trading with the short term charts requires making decisions quickly. You have plenty of examples of preparation for the trading session, entry signals, and trade management. You learn why you don’t have to trade too often and too much, especially when trading the E-Mini. We'll also show you why trade selection is in large part responsible for trading it successfully.

g>Forex Trading

You will learn what Forex is, why it exists, and the main terms that characterize a forex trading account. We then tell you the most important things you need to know about forex regulation and brokers. You need to know the concepts and the realities of how a bucket shop operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills".

There is a full chapter dedicated to a forex method that Joe Ross uses. You will learn in detail the 19 rules of the method, and be guided through preparation, entry, risk management, and profit management. There are several chart examples and detailed instructions accompanying each rule.

Day Trading and Position Trading

At the beginning of the book, Joe takes you through the definition of day trading, and compares it with position trading. We'll show you the similarities and the differences between the two. You learn the advantages and the disadvantages of each of them. You discover the benefits of one over the other. But most importantly, you learn that "a chart is a chart is a chart," and that's why the techniques and the concepts shown in this book work in both day trading and position trading.

Day Trading is a complete revision of Joe's classic Trading by the Minute, one of the most popular books on intraday trading ever written. It has become a classic in its time. This revised book is a day trading course that is a "must read" for online day trading.

If you are an online electronic day trader, you will refer to this book time and time again. Joe has taught thousands of people how to day trade.

Commonly Asked Question

What's the difference between the Day Trading book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook?

The Day Trading hardback book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

Learn Master Trader Joe Ross' Tricks and Inside Information from this Book

"I would recommend Joe's book on day trading to anyone interested in learning about this subject and wants to hear about it from someone who practices what he preaches. It is apparent from the book that Joe knows the reality of trading markets rather than the theory. I have recently assessed my trading for the last 3 months and am beginning to (at last!) turn in a profit. This is due partly to the help given in this book. Thanks Joe!" ~Jon Martin

"This is a WONDERFUL exposition of what it takes to be successful in the trading profession. Rich in its descriptions of proper ATTITUDE, THOUGHT PATTERNS, and SELF-KNOWLEDGE --- all of them the keys to profit. Just as valuable is Joe's placing indicators, high-powered math, statistics, and complex theory in their proper perspective, namely that they are typically DISTRACTIONS rather than aids, in comparison to learning THE DETAILS of price action. In the same vein, Joe emphasizes the value of DISCRETIONARY trading compared to MECHANICAL trading, making the point that since all markets change over time, sooner or later a rigid, inflexible system not being able to adapt, will fail." ~Bill Schenker

$150.00

Dimensions: H 11 1/4" x W 8 5/8"

327 pages

30-Day Money Back Guarantee*

Hardcover Only

*If you aren't thrilled with Day Trading, just send it back within 30 days and we'll refund 100% of your purchase price (less s&h).

- markets

- income

- options trading education

- stock market

- day trading

- trading techniques

- position trading

- bar chart

- congestions

- trend finding

- identify trends

- trading plan

- setting alerts

- price movement

- intraday trading signals

- identify best trades

- risk management

- money management

- placing stops

- stop placement

- emini s&p 500 trading

- trade management

- forex

- forex trading

- trading logic

- traders trick entry

- entry signals

Day Trading Forex

Master Trader Joe Ross shows you how he does it!

"I hate to see so many aspiring Forex traders losing their money. Why do they have to make everything so complicated when, in fact, it’s not at all hard to win? In this eBook I show you trips and traps of Forex day trading. You need to know them in order to avoid the fate of so many other traders." ~ Joe Ross

Message from Joe Ross

I’ve been trading Forex for many years, even before there was such a thing as retail Forex, and before more and more people decided to become Forex traders. Trading Forex is heavily marketed and popular, but it is also deadly. The correspondence I receive attest to the fact that most people who attempt to day trade Forex are losing their money. The turnover rate is atrocious. Because of the pain I’ve seen, I decided that I will show you how I day trade the currency pairs.

Learn where to find more safety in your trading, and where the greatest Forex profits are made. The Day Trading Forex eBook gives you detailed answers to vital questions, such as knowing which currency pairs to trade, which time frame to use, and where to set your profit-taking objectives and your protective stop.

Day Trading Forex Highlights and What You Can Learn:

Chart Reading – The Law of Charts

You will learn to identify the basic formations of The Law of Charts: what they are, what they mean, and how to trade them in the Forex market. You will see how I trade the Ross Hooks and consolidations. I reveal a fantastic way to implement The Law of Charts (TLOC), namely the Traders Trick Entry (TTE), together with simple ways of using it in your trading.

I always like to remind traders that "a chart, is a chart", and Forex charts are no different from any other kind of chart. Forex charts show you human emotional reaction to the movement of prices. It’s the same as with stocks or futures charts. As they say, "a picture is worth a thousand words." On that basis, you are going to find many thousands of words in this eBook. It will truly help you to understand and implement The Law of Charts in your trading.

Identifying Consolidations and Finding Trends

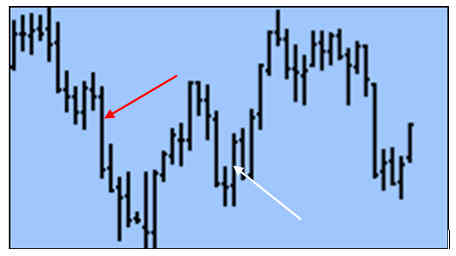

Are you aware that currencies trade sideways 85% of the time? Do you know how to make money when they are doing just that? Please take a look at the chart below: do you know what it means when prices have formed as between the two red lines below?

You will find the answer to that question, and many more. It is vital to recognize congestions at the earliest possible time. In fact, you'll see how to identify sideways markets before anyone else realizes they are beginning to consolidate. In order to do that, the book has been "loaded" with graphic examples.

Your Own Trading Plan

Please look at the chart below: do you know why someone sold at the red arrow and someone bought at the white arrow? You will find out why in a fascinating way, through the help of a single graphic representation. You will discover precisely where to have your entry order, what your initial objective should be, and where to best place your protective stop.

You will learn to set up your own trading plan simply by using price charts, and with almost no indicators. The ones used will greatly help you in filtering and managing your trades, but your main focus will be on the price action as seen on the chart. Charts will also help you figure out which pair to trade, and which time frame best fits your comfort zone.

Trade Management and the Costs of Running your Trading Business

It is not only risk management that you need to know about in order to successfully day trade Forex. You will learn other aspects of management, things that most traders ignorantly ignore. For example, you will learn how business management, risk management, trade management, and personal management are all part of the picture, not just money management. This information alone will save you thousands of dollars. You need to know the concepts and the realities of how a "bucket shop" operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills". It’s all true, as will be explained to you. You will also see that Forex trading is not without heavy overhead in the form of the spread you pay to trade. You will discover the most important things you need to know about Forex regulation and brokers.

Commonly Asked Question

What's the difference between the Day Trading Hardback Book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? The Day Trading book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

"Joe's Day Trading Forex book has been an invaluable source of information about the most traded market in the world. I got not only the proper way to trade this market with plenty of example and clear explanations but also how to create good habits to become a profitable trader. Truth is together with this book and Daytrading Joe's book I have been trading smarting and my account has benn growing since then slowly but surely." ~ Johnny A., USA

"I have been following the Joe Ross method for years. At one time I owned my own day trading firm and taught his method to my traders. Many used it successfully, others used their own method. The EBbook is very detailed and when followed gives you a direct, set of plans that you can write down and consistantly use." ~ Michael H., USA

"EXCELLENT practical outline of trading forex using the raw mechanics of the market (price action, order / flow, participant overview) coupled with proactive analysis, trade management, entry and exit techniques). Most notably, it works!" ~ George P., Australia

"I feel confident with the material because of Joe's age and experience in the market. I also feel his material is very simple to remember and apply in my daily reading of the market." ~ Steen N., Denmark

"As usual, another great work about markets, in this case Forex. Joe discovers new ways to trade Forex market, to manage risk and stablish profits." ~ Carlos L., Spain

"Joe as usual has great insights about the trading process. They're different from other run of the mill trading products or services." ~ Eugene T., Singapore

$127.00

Day Trading Forex

eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Frequently Asked Questions

These FAQs are listed questions and answers from various e-mail correspondence between our trading students/customers, all supposed to be frequently asked in some context, and pertaining to a particular topic.

Links throughout the answers will guide you to further information on our website or from other sources. Should you have any further questions, please consult our Contact Us page.

Q: Can I make a living trading? Is it really possible to trade for a living?

A: Yes, it is possible. Our trading team is hard proof that it can happen and they have worked very hard to get where they are today. That is why, Trading Educators takes pride in developing educated traders who are independent thinkers. We want you to succeed as a trader. It is imperative that you first evaluate your financial situation and emotional state, as there has probably been a lot of marketing thrown at you to purposely get you off track. Stay away from "get rich quick" schemes, they don't work and only offer empty promises.

Next, take the appropriate steps to educate yourself, learn patience, which will then lead you to developing a trading plan, and most important is to test your trading plan by using a simulated trading program before going live with real money. Aligning your trading plan with a simulated trading program will put you and your plan to the true test. The overall average among professional traders is that they make 6%/month on the amount of money they have in their trading account. When you compound 6%/month the result is 100%/year, which is an excellent return. For example, if you have a margin account of $10,000, you should be able to double it in a year.

If you're new to trading, click here to start with Level, Time, Market, and Goal. For our intermediate to advanced traders, you should already have a trading plan in place, so take advantage of our One-on-One Private Sessions with one of our three Master Traders to evaluate and strengthen your trading plan. Joe Ross, Andy Jordan or Marco Mayer.

—

Q: Where do I put my stop?

A: There are many variables involved in stop placement and at Trading Educators, we believe it makes no sense whatsoever to use a fixed dollar amount, a fixed percentage of your account, or a fixed number of ticks or pips for stop placement. The markets change from one day to the next. Due to variations in volatility, no fixed method of stop placement is going to be any good in all situations. If you are asking "Where to place your protective stop loss at the time you initiate a trade" or "How much risk should I take when I enter a trade?", then you've got to start educating yourself further and deeper into trading materials. Those answers can only come from you.

Trading Educators webinars and private turtoring are your best options to help you with your trading plan. Our three master traders will guide you through your end result questions on the amounts for your stop placement in forex, futures, stocks, spreads, and options. We also show you how to figure out objectives, position size, determine which markets, and time frames you could trade in. There is no way for us to tell you how much risk that you can afford to take. Ask yourself the following questions, keeping in mind that these are tough and direct, so be very honest with yourself:

- What is my risk tolerance (level of comfort), emotionally, mentally, physically, or financially?

- How much money do I have or it’s intended use?

- What is my initial reaction under pressure?

- How will I behave during a winning or losing streak?

- Trading isn't predictable, so how will it impact my family situation?

- How will greed affect my trading?

- Fear plays a big role when it comes to trading, put yourself in these situations:

- Fear of missing a move.

- Fear of being wrong.

- Fear of losing money.

- Other moral and emotional fears.

- How will pride affect your trading?

These are just a few of the things that only you know about yourself. So when the question arises, "Where do I put my stop?" Remember, the answer solely depends on you and the steps you should take to educate yourself as a trader. It takes the will to learn, patience, and an understanding that this process won't happen overnight. But, if you've gotten this far into your quest as a trader, then you've come to the right place. Trading Educators has over eighty-seven years of combined trading experience, giving you the luxury of having all the necessary resources right at your finger tips. Through our products and services, we encourage independent thinkers and want you to succeed! Take the time to read through our website, and let us help you answer your own question of "Where do I put my stop?" Our recommendation to you is starting with Joe Ross' eBook "Stopped Out!" and One-on-One Tutoring with one of our three Master Traders.

—

Q: Is a Ross Hook that is also a doji bar valid?

A: A Ross Hook (Rh) is formed when there is a failure of prices to move higher (rising prices) or lower (falling prices), following the breakout of the #2 point of a 1-2-3 formation, or the breakout from any kind of consolidation. The Rh has nothing to do with location of the Open or Close of a bar, so a doji bar that becomes the point of a Rh, is as valid as any other bar that becomes the point of a Rh. Read more about Trading the Ross Hook.

—

Q: How long should a time stop be?

A: There is no definitive answer to how long a time stop should be. A time stop is completely subjective, and must be determined by the trader based on testing and experience within the chosen market and time frame. Some traders are content to wait longer than other traders. You simply cannot say a time stop should always be a certain number of minutes or hours.

—

Q: What is the difference between these three products: Day Trading Hardback Book, Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? I already have the Day Trading book, will the Day Trading E-Mini and the Day Trading Forex give me more information?

A: The Day Trading Hardback Book is a full-size text book that is loaded with lessons, and examples taken from real trades. It reveals to you the many concepts you need to know to succeed at trading. It is really the first step in the process of learning to day trade.

The Day Trading E-Mini eBook can be used to learn how to day trade almost anything you would like to day trade. It teaches some concepts that go beyond what is taught in the Day Trading book. However, the focus of the book is specifically the E-Mini S&P 500. This eBook can be a second step in the learning process, or you can choose to jump ahead to the full 2-day Day Trading Webinar or Private Tutoring by Master Traders' Andy Jordan and Joe Ross.

The Day Trading Forex eBook teaches concepts not taught in either of the other day trading books. Although it, too, can be used to day trade a variety of markets, the focus is on currency trading in Forex, or currency futures. The Day Trading Forex eBook can be used as a second step in learning to day trade. Our students tell us that the 2-day webinar, or even better 3 days of tutoring with Joe Ross is a marvelous experience that will change your life and take you to the pinnacle of trading. You will never again see the markets the way you have in the past. You will know and understand how markets work, and how to make money in them.

Q: I have Analysis Paralysis. Can you help?

A: There are two reasons you have Analysis Paralysis. You can be the victim of one or both of the following:

- You don’t believe in yourself and what you are doing.

- You don’t believe that what you are doing truly works.

Trading Educators can't emphasize enough that you must regularly evaluate your trading plan to work through or shorten length of time while in analysis paralysis. You are on the right track, if 1) you acknowledge analysis paralysis, and 2) you are ready to break away from it. If you think that our Master Traders don't ever get analysis paralysis, then it's time to clue you in. Our Master Traders are constantly reading up on the latest market materials, and seeking out new resources which helps them evaluate their trading plans. This only pushes them further along into becoming better traders. Sometimes it good to start from the beginning, remind yourself as to why you started trading and celebrate the months, quarters or years where you showed a profit. Revisit a book or article that helped in your education or got you excited about becoming a trader. Try a fresh and new prespective, sort through the many products and services that fits your trading need. Learn with the best, you have the skill set, and we are here to help break you out of this temporary state of mind.

Q: What information do I need to trade?

A: This is a great question and Trading Educators is excited to walk right along side of you while you gain confidence in getting your answer. We have purposely set up our website to guide you through and answer questions along the way. We can help you determine which market(s) and style of trading that best suits your trading goals. Visit our home page and read through the four sections: Level, Time, Market, and Goals. We offer a wide range of products and services to help get your started such as books, eBooks, Webinars, Private Tutoring, and Daily Trading Advisory Programs. If you still have questions after visiting our site, feel free to Contact Us, so we may assist you.

—

Q: I have trouble Pulling the Trigger on a trade. Can you help?

A: There are two reasons you can't pull the trigger on a trade. You can be the victim of one or both of the following:

- You don’t believe in yourself and what you are doing.

- You don’t believe that what you are doing truly works.

We can help. It can be done in a number of ways:

- Read one or more of our eBooks or Hardback Books.

- Private tutoring with Master Traders Joe Ross, Andy Jordan, or Marco Mayer.

—

Q: Does "The Law of Charts" work in any market, any time frame or under all conditions: for example: a panic market or irregular price action?

A: A "Law" is not something that "works." A "Law"” is something that is always true. The question asking whether or not The Law of Charts works implies that The Law of Charts is some kind of system or method, and you want to know if it "works."

The Law of Charts as applied to prices describes in graphic form the emotional action and reaction of human beings to the movement of prices. Therefore, it ALWAYS "works" because as long as people trade markets, you will see the same basic patterns over and over again.

The Law of Charts "works" with any chart graphic that describes an underlying movement that has a range of values.

You can see the Law of Charts working on gas meter readings, water levels of a river or random coin flips, anything that has a range of values.

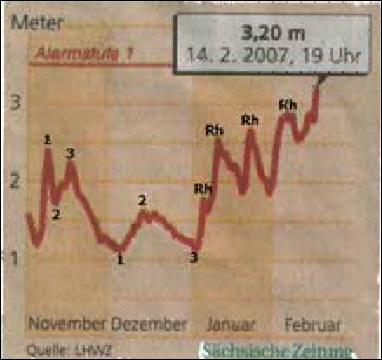

The chart below shows water level readings for the Elbe river in Germany.

In the case of gas meter readings, the impetus for what you see on the chart is consumption of natural gas, which will have a range of values because usage will vary seasonally. In the case of water levels in a river, the impetus will be the range of values that will vary due to water usage, and the amount of rainfall, snow-melt, or both.

In the case of coin flips the impetus is the pure statistical probability of a series of heads or tails.

Below is a chart of coin flips. In the case of price charts the impetus is human emotion as seen in the action and reaction of traders and investors to the movement of prices. If something is true, it is always true. The Law of Charts is always true—there is no way to get around it.

The purpose of studying The Law of Charts is to gain an understanding of how and why prices move to create 3 basic chart formations: The 1-2-3, the Ross Hook, or various types of consolidation. Whether or not you make money from this knowledge will be in direct accordance with how you implement that knowledge.

Electricity follows the laws of physics. But unless you implement the laws that govern electricity the best you can hope for is a shocking experience. With proper implementation you can turn a motor, generate heat, or create light.

The Traders Trick Entry (TTE) that we teach at Trading Educators is one way to implement the Law. There are probably dozens, maybe even hundreds of ways to implement The Law of Charts (TLOC). To learn more about the "Law," check out The Law of Charts In-Depth Webinar and during private tutoring we will reveal numerous ways to implement The Law of Charts.

—

Q: How much money do I need to trade full-size contracts in forex, futures, or anything else?

A: The amount of money you need is entirely determined by your broker. Follow this link for a broker referral.

—

Q: Ross Hook: How far can a RH be from point 2?

A: It’s kind of a judgment call, but you can read what Joe has done on page 300 of Trading the Ross Hook, where it states that the #3 point should be between 1/3rd and 2/3rds of a point 1 to 2 retracement. It is all going to depend on what works for you in the time frame and market you are trading.

—

Q: Trend Lines: Do you use 1-2-3 highs and lows; and Ross Hooks with trend lines to help buy or sell in better places?

A: The best thing we can recommend is to do what works for you. Joe Ross does not use trend lines nor does he use support resistance lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. He also does not use Fibonacci retracements and is aware of them, and uses them in an unconventional way. But, he doesn't trade based on them. The most important and only truth available for trading is the price bar directly in front of you. You can't trade the past and you don't know the future. Therefore, you must trade what you see.

—

Q: Support and Resistance: Do you use support and resistance to help you to buy or sell in better places?

A: Joe Ross does not use support and resistance. Nor does he use trend lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. Joe also doesn't use Fibonacci retracements and is aware of them, and uses them in an unconventional way. But he doesn't trade based on them.

—

Q: Fibonacci: Do you use Fibonacci ratios to get better entries for buying and selling?

A: Joe Ross does not use Fibonacci retracements, ratios, or confluence in his trading. He is aware of them, and uses them in an unconventional way. But he doesn't trade based on them. Nor do he use trend lines or support and resistance lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. Joe is aware of them, and uses them in an unconventional way. But he doesn't trade based on them. Fibonacci ratios, Gann ratios, the "Golden Ratio," and Elliott waves are all attempts to mathematically (scientifically?) trade markets that are both emotional and psychological. You cannot successfully or consistently apply mathematics to human emotional and psychological actions and reactions, which is why the field of psychology is a pseudo-science. The mathematical approach to markets is a vain attempt to put price action into a predictable box with known dimensions and parameters. However, markets do not behave in accordance with mathematics. Markets go wherever human emotion takes them.

—

Q: I’m concerned that my data supplier does not provide all the trades through their feed. I’ve heard that they are aggregating the trades and making an average of “X” number of trades. Can you explain?

A: There is one caveat with all data feeds. In order to make them appear faster, providers will typically aggregate trades. Joe Ross doesn't know of a single data provider that will, or even could show you every single trade, and even if they did, he seriously doubts that your computer would be able to receive every trade that was made. What you see on your screen is at best an approximation of the actual trading. Think about it for a moment. Let's put everything that is happening into slow motion so we can see what is really going on. As the prices come into your computer, they are cached for distribution. At some point your computer must distribute what it has saved in its cache. During a distribution phase, the computer is not receiving prices it is posting them to the screen. Although the entire process is taking place in fractions of a second, there is no way you could possibly receive all of the ticks. To add insult to injury, your computer is probably also doing other things. The operating system does things; if you have any kind of spam filter, firewall, antivirus, or program running in the background your computer is monitoring those other things as well. In the fractions of a second it takes your computer to pay attention to its other tasks, you are not receiving ticks sent out by the data vendor. Your computer is like a one arm wallpaper hanger. It can do only one thing at a time. Your concerns are without real foundation. Any data supplier has similar problems with their computer receiving prices from the exchange, and the exchange's computer has the same kind of problem distributing the data as your computer has receiving it.

—

Q: Which order type would be the best for let’s say Crude Oil or the EuroFX on a 5 or 3-minute chart?

A: There is no best order type for any market or time frame. The best order type depends on your strategy.

The type of order you use is one of the tactics you use to carry out your strategy.

- Do you absolutely want to be filled? If yes, use a market order.

- Do you absolutely want to be filled if prices reach a certain level or go through that level? If yes, use a stop market order.

- Do you want to be filled if prices reach a certain level, but not be filled at a price past that level? If yes, use a limit order.

- Do you want to be filled if prices reach a certain level, but are happy if prices are filled within a range you specify, but not be filled at a price past the specified range? If yes, you a stop limit order.

Keep in mind that limit orders and stop limit orders have no requirement to be filled. They can be passed right over and leave you behind with no fill.

—

Q: What does it mean when #2 point is very close to Ross Hook?

A: Most of the time it means you should expect sideway action to follow. Unless prices break through the Rh with force, you are probably going to see a consolidation area, with the #1 point of the 1-2-3 as the low of the area and the Rh as the high of the area.

However, the areas of so-called accumulation at the low and distribution at the high are not as long as in years past. This is due to people trading with indicators, which also causes markets to mostly swing instead of trend.

—

Q: Will your stuff work with tick charts?

A: Our "stuff" works with any kind of chart that depicts a range of values. Therefore, we have students who trade tick charts, range charts, volume charts, line charts, even point, and figure charts. One of the greatest traders we know uses our "stuff" to trade point and figure charts.

—

Q: I haven't been trading long and want to learn more about trading. Will I be able to understand your products?

A: If you are a beginner trader, the terminology may seem overwhelming at first, but as you start educating yourself, it will come easier. Click here to get a clearer path as to which market(s) and trading style that will best suit you. For intermediate and advanced traders, your biggest challenge will be retraining yourself from old habits. We are here to assist and help you learn the art of trading, email us with any questions, at any time.

—

Q: If I buy a product, will I need to continue to buy more products to learn to trade?