Displaying items by tag: income

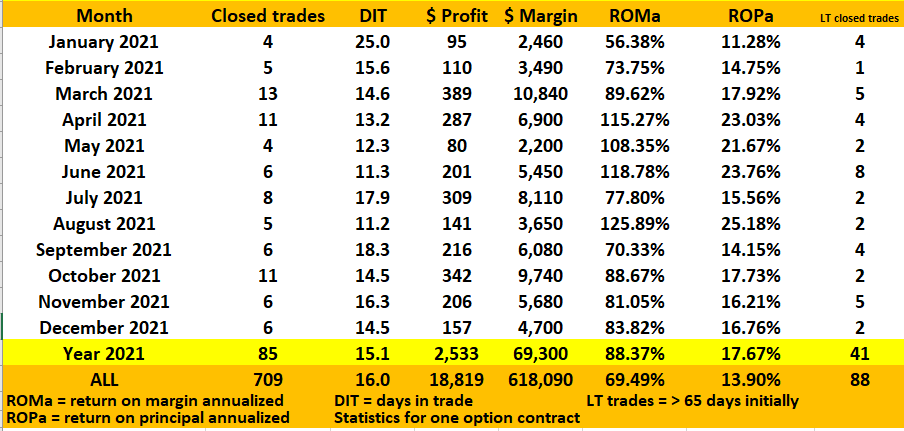

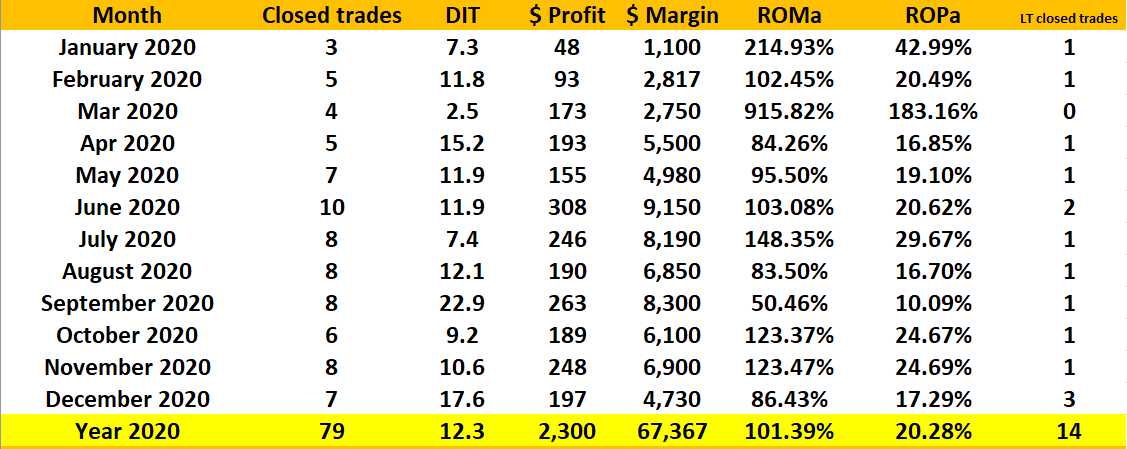

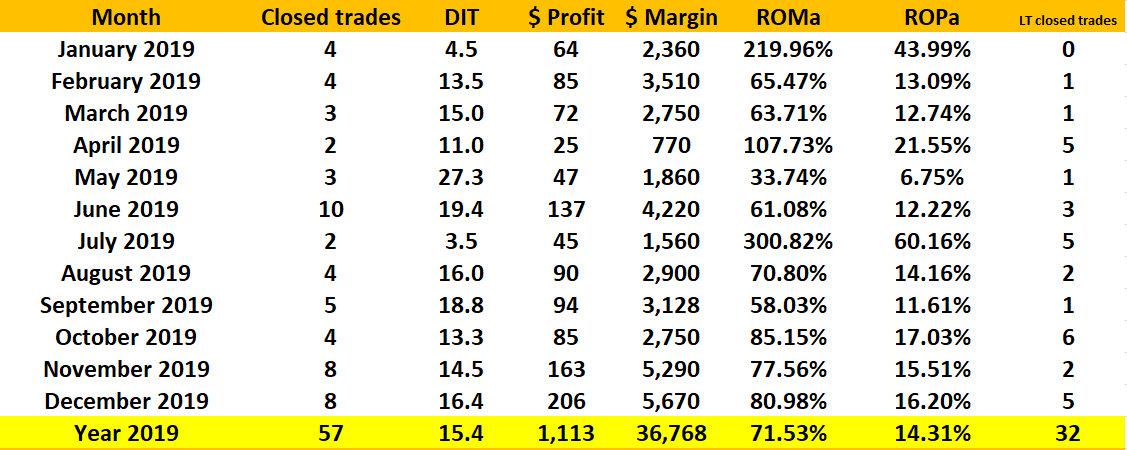

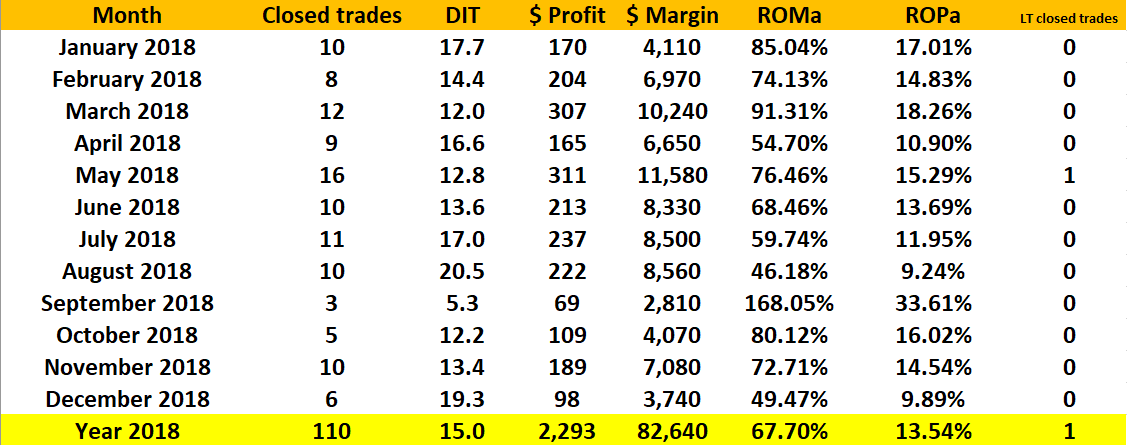

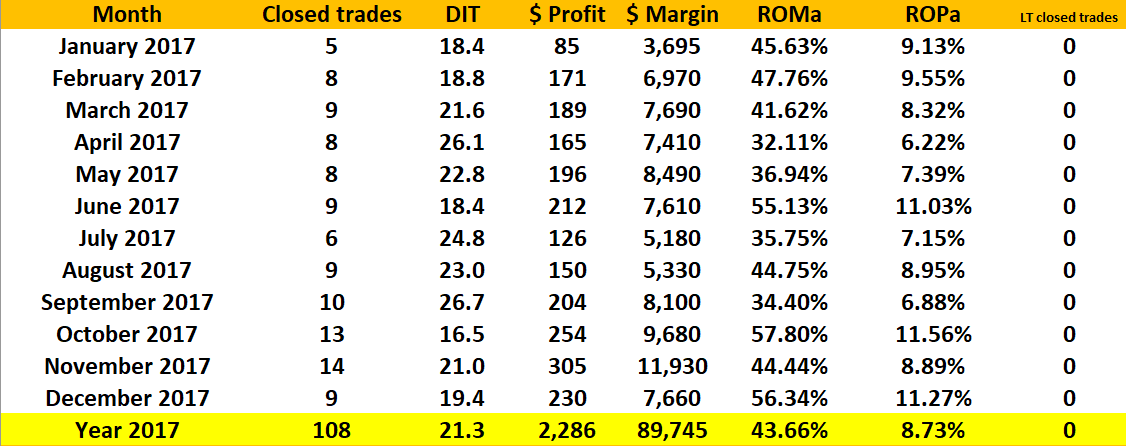

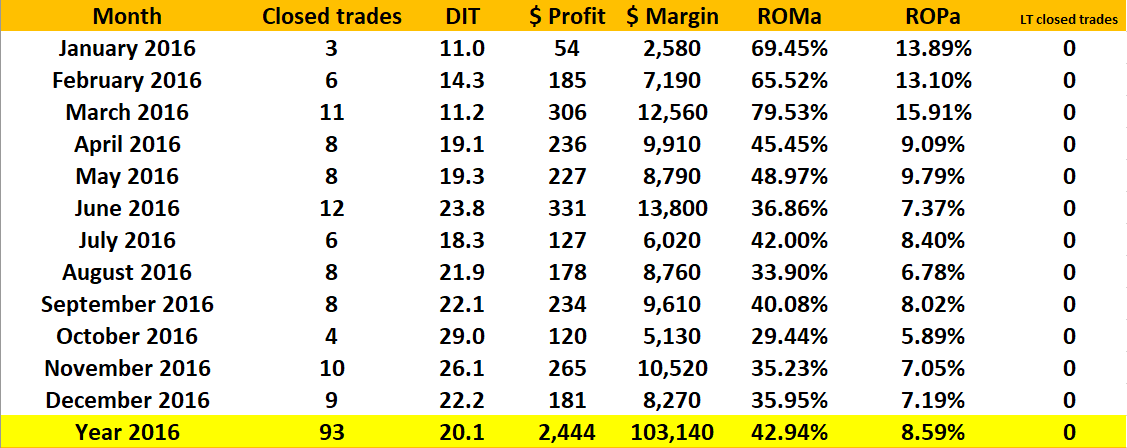

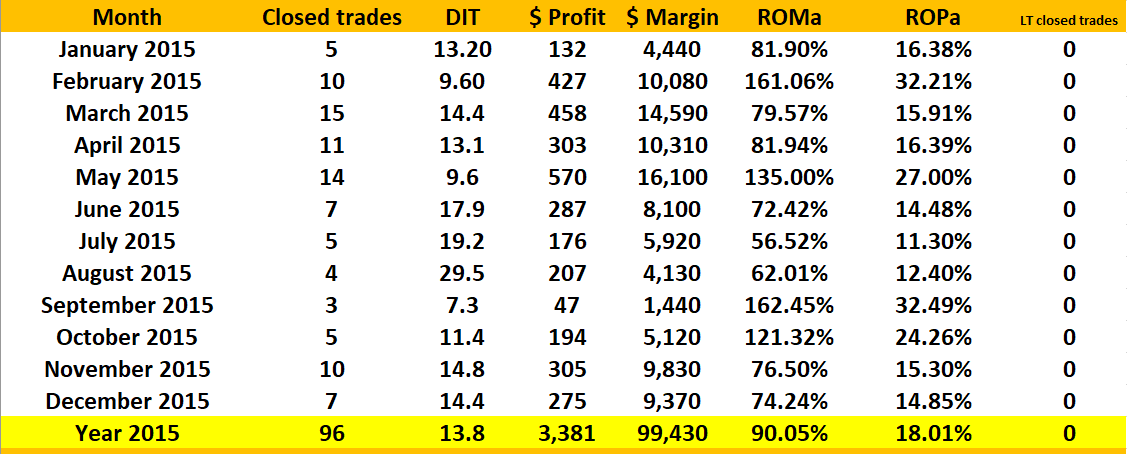

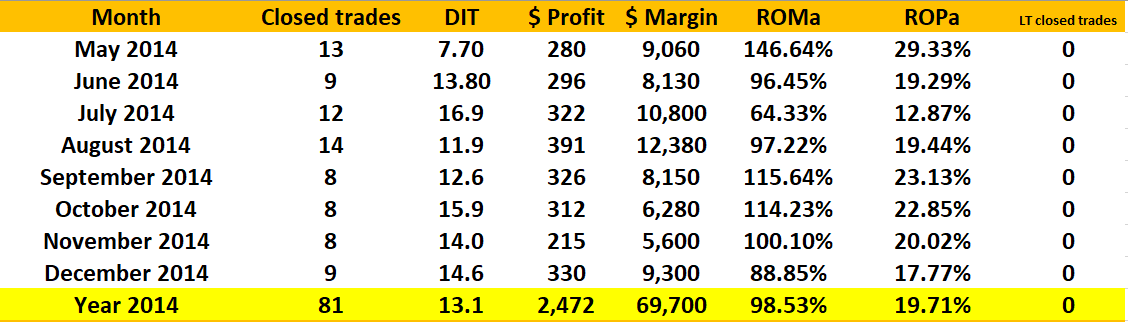

Option Performance Track Record Instant Income Guaranteed

Market: Stock Options

Check out our track record!

Those who know Joe Ross' Trading Educators and the success

we bring from Joe's products is highlighted which

shows our track record below:

Joe Ross shows you how trading

for instant income is indeed attainable!

Option Strategies with Instant Income Guaranteed

Earn While You Learn to Trade!

Can you imagine discovering a way to trade that promises instant income? If you think such a method is impossible, think again. Instant Income Guaranteed trading education it is definitely achievable, and everything you need to know is available online for one low price in a special three-part online recorded webinars.

Instant Income Guaranteed provides stock trading courses for beginners and experienced traders alike. Developer and Master Trader Joe Ross along with Expert Instant Income Trader Philippe Gautier have spent the last several years perfecting a way to earn instant guaranteed income.

- Special Three-Part Webinars

-

Detailed Q&A

- Wealth building over time (requires patience)

- Opportunity to create current income

- Utilize other peoples money to finance your growth

- The highest level of safety we have ever seen

- Three-part webinar - In Part I, Joe Ross outlines the strategy. Beginning and experienced traders will discover new information! In Part II, Joe Ross walks you through various trades and scenarios. In Part III, Philippe Gautier explains updates and improvements to the strategy. In just a few hours, you will be prepared for actual trading, which can begin as soon as you feel ready. As an added bonus, these webinars are available to access anytime you want to view again.

- How to select the right stocks for the strategy.

- How to manage the trade.

- How to compute returns on both margin and principal, and how to annualize your returns.

- Trades offered for your consideration will range from around $20 to around $100, sometimes a bit more per share. Trades available at each price vary; however, it is possible to create one or more positions daily, provided you have sufficient funds.

- Most brokers require a margin of 20% of the cost needed to buy shares per option sold. It can vary. For example, one known broker requires margin of only 15% on accounts over $100,000.

- The length of trades varies. Trades average 17 days, but some trades may last longer during the two months of guidance, you will see why certain strategies are used, and you will realize that, if handled properly, you will be trading profitably.

- You should be able to follow the strategy using any stockbroker. If you need a broker referral, Trading Educators can recommend one.

- You can always “paper trade” what does not fit you account size: we recommend not to take positions exceeding 50% of your available cash in terms of underlying value. For instance, if you sell 1 XYZ 10P, with an underlying value of 10*100 = 1000$, do not sell more than 5 puts (or 50% of 10 000$ = 5000$) initially.

- You can probably take all debit spreads trades we give from time to time

- There are ways to limit margin requirements for the trades you take by buying cheap protection (i.e. buying a further out of the money put that will limit your margin requirements/total risk in the trade)

- You may be required to put up full margin on some of the strategies. However, don't worry about that, because even with putting up full margin, the strategies make much more money than you can get from your bank, a money-market mutual fund, or from government bonds and notes.

- You may have to receive permission from your broker to make the transactions from an IRA account. Some have told us they are able to trade the strategie from their IRA account.

Option trades vary.

Learn strategies to manage them.

What if I only have $10,000 to trade?

YES, you can do it, but you will be limited in the number of positions you will be able to take initially, the time for you account to grow. However:

IMPORTANT! If you intend to participate in the program using an IRA or any controlled pension plan, there are two things you need to know:

- You may be required to put up full margin on some of the strategies. However, don't worry about that, because even with putting up full margin, the strategies make much more money than you can get from your bank, a money-market mutual fund, or from government bonds and notes.

- You may have to receive permission from your broker to make the transactions from an IRA account. Some have told us they are able to trade the strategies from their IRA account.

Joe Ross and Philippe Gautier bring you proven trading expertise!

"About a year ago, I traveled down to Uruguay and spent a week with Joe doing his Instant Income Guaranteed seminar. Since that time, I was able to quit my regular job and now I trade full time. I couldn't have asked for a more amazing experience and I am thankful for the kind of lifestyle I can have without a 9 to 5." ~ Paula T., U.S.A.

"Hi Joe, Instant Income Guaranteed training has been, by far, the best investment in trading I have made (and believe me there has been some earlier investments...). I can strongly recommend this training to people who are not looking for unnecessary excitement but rather want to make money steadily by trading the way Joe teaches. My warmest thanks to you, Joe!" ~ Juha Y., Finland

"The strategy was nicely explained and demonstrated on daily guidance podcast every working day. Joe explained some other important issues (psychology, when and why to take profit, how to deal with the deal when you under fire - roll out and down). During the 2 months daily guidance I had no loss. I find it very useful." ~ Petr Oliva, CZ

"It's been around a year since I enrolled in the Instant Income Guaranteed program. Probably the best trading decision I have ever made. It is amazing the annualized return you can produce if you keep flipping your money. I have taken shares on a couple of stocks because I chose to do so, I don't consider that a loss." ~ Thanks, Randy C.

$1,500.00 - Instant Income Guaranteed

Day Trading

A Complete Day Trading Course in One Book

"Joe and I have been friends for some time. We have collaborated on trading techniques, so I know of his dedication to the market. But in this book we see the other side of Joe -- the instructor of the grand style. He is teaching us "How to Fish." ~W. E. Dalton, MD

This book is a must-read for every serious day trader. It's the essence of Joe Ross' experience of well over five decades of trading the international markets. Although the focus is on day trading, it teaches you methods and concepts that are applicable in position trading as well.

Many traders fail because of a wrong mindset and the fact that they don't know where to start or what to expect as an outcome. This could be the most important book you’ll ever read. Joe has organized it in a clear, step-by-step manner. Instead of being overwhelmed, you'll have a clear trading plan. You'll know exactly where to start, what to do next, and where you can realistically expect to end up.

Day Trading Highlights

Chart Reading

This covers what you need to know about the "Law of Charts" and the simple tricks of how to use it in your trading. "A chart is a chart is a chart." The immediate psychology of a market is reflected in the price action. You don’t really need any indicators. We'll show you how a bar chart can reveal very powerful price patterns when you understand the proper interpretation and implementation.

Identifying Congestions and Trend Finding

In trading, it is equally important to be able to recognize congestion at the earliest possible time, and to identify a trend before everybody else sees that it is happening. We call it "identifying a trend while it is still in the birth canal," and shows you several methods of doing just that.

Markets are in congestion areas much longer than they are in trends. The early parts of the book center almost entirely around congestion areas, which may be seen on any chart in any time frame. Later in the book, the concepts and the techniques taught center around trending formations.

Let us show you how to spot the very beginning of a trend, and how to successfully enter existing and established trends. You will see and learn very simple and basic ways to trade. The main features of our methods show you early in the game what might happen next, and thus gets you on board a trend while it is "still in the birth canal."

Your own Trading Plan

You will find out if day trading is or is not suitable for you. It takes certain character traits and certain trading techniques to be a successful day trader. We'll described these, and also how you should combine them so that you write and follow your own trading plan. You will understand why you must want it your way, and why you should take only trades that "have your name on them."

The trading plan includes all the preparation and the actions you will take, such as: establishing entries, all potential orders, setting alerts, accommodating for gap openings, and, if you are filled, what you do until the exit of all your contract sets.

Trading Mindset

In Joe's unique way, he shows you how your own mind can help you become a successful trader or can break you apart. Trading is mainly a psychological endeavor, and the way you perceive the markets, coupled with your emotional reactions, actually determine your success or failure as a trader. It's simple advice to anyone who wants to trade: work to learn how to understand price movement.

By using powerful real life examples, we can demonstrate why trading has to be simple, despite the example of most traders who are in a never-ending search for complicated methods. Also, demystifying several relevant, but confusing concepts, such as those of "support and resistance," "oversold and overbought," and some of the overly used indicators that are not needed in order to trade profitably.

Entry Signals

We reveal major, minor, and intermediate intraday trading signals showing you exactly what they are, and explain why they are important. When you day trade, you want explosive moves after your entry. It is therefore crucial to scale down entry signals based on different time frames so that you get the greatest magnitude of movement once in the trade. This is a unique approach that has been developed and refined over decades of trading.

Searching Out the Best, and Trade Filtering

One of the most important things that any trader can learn to do is to identify the best trades. These can differ from one person to another because we see trades differently, and not everyone trades in the same way. But everyone can learn to recognize what happens in the markets that result in successful trades. Then the trick is to stick to it like glue - until it stops working.

We'll show you exactly what to be comfortable with, while keeping your trading as your own. Examples going into full details of how you should see the whole trade setup, how to think, and select the trades, so that you can adapt that knowledge to your own comfort level.

Let us explain how a trading filter serves several purposes. You will learn how to use a trading filter to calibrate your stop, and to avoid false breakouts as well. You will be able to anticipate breakouts, and thus get into the trade earlier than you might otherwise have done.

Risk and Money Management

We will show you one of the finest points of Joe Ross' trading: his philosophy of money and risk management. These two concepts overlap, and yet they are different. Risk management says "I can afford to risk only so much," while money management asks "What can I expect to make for the risk I have taken?" You will understand why he says that trading is a business and why, the sooner one treats it that way, the sooner one will become a winner.

Placing Stops

The most frequent question we have been asked at Trading Educators is "Where do I put my stop?" Stop placement is a function of a number of variables. There are three kinds of stops: protective, objective, and time stops. It is vital to understand the role of each of these stops and to use them accordingly within your own trading plan.

Unfortunately, most traders place stops where they don’t make any sense, such as at a certain percentage away from the entry. We'll teach you how to place your stops in a practical manner that takes into consideration both technical factors and your own comfort level.

Brokers and Commissions

There is nothing more important in day trading than to have a responsive, accurate, reliable broker handling your account. Offering you several real-life examples of our experiences with brokers that will really make you think. He helps you consider all the vital factors such as commissions, margins, speed of execution, and reliable customer service when you desperately need it.

You will understand why brokers are in this business. You really need to know how to take advantage of your broker’s strengths, and how to avoid losing money because of their weaknesses. You will learn how to choose a reliable broker and build a solid relationship with him or her, one that works well for you.

E-Mini S&P 500 Trading

We dedicate a section to traders who like to day trade the E-Mini S&P 500, but starts it with a word of caution: we have seen too many otherwise good traders destroyed by trading the five-minute chart in the S&P E-Mini. Getting into the E-Mini is like stepping into the ring with a rattlesnake: you can be bitten quickly, and when you least expect it.

We will show you several examples, so that you realize that trading with the short term charts requires making decisions quickly. You have plenty of examples of preparation for the trading session, entry signals, and trade management. You learn why you don’t have to trade too often and too much, especially when trading the E-Mini. We'll also show you why trade selection is in large part responsible for trading it successfully.

g>Forex Trading

You will learn what Forex is, why it exists, and the main terms that characterize a forex trading account. We then tell you the most important things you need to know about forex regulation and brokers. You need to know the concepts and the realities of how a bucket shop operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills".

There is a full chapter dedicated to a forex method that Joe Ross uses. You will learn in detail the 19 rules of the method, and be guided through preparation, entry, risk management, and profit management. There are several chart examples and detailed instructions accompanying each rule.

Day Trading and Position Trading

At the beginning of the book, Joe takes you through the definition of day trading, and compares it with position trading. We'll show you the similarities and the differences between the two. You learn the advantages and the disadvantages of each of them. You discover the benefits of one over the other. But most importantly, you learn that "a chart is a chart is a chart," and that's why the techniques and the concepts shown in this book work in both day trading and position trading.

Day Trading is a complete revision of Joe's classic Trading by the Minute, one of the most popular books on intraday trading ever written. It has become a classic in its time. This revised book is a day trading course that is a "must read" for online day trading.

If you are an online electronic day trader, you will refer to this book time and time again. Joe has taught thousands of people how to day trade.

Commonly Asked Question

What's the difference between the Day Trading book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook?

The Day Trading hardback book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

Learn Master Trader Joe Ross' Tricks and Inside Information from this Book

"I would recommend Joe's book on day trading to anyone interested in learning about this subject and wants to hear about it from someone who practices what he preaches. It is apparent from the book that Joe knows the reality of trading markets rather than the theory. I have recently assessed my trading for the last 3 months and am beginning to (at last!) turn in a profit. This is due partly to the help given in this book. Thanks Joe!" ~Jon Martin

"This is a WONDERFUL exposition of what it takes to be successful in the trading profession. Rich in its descriptions of proper ATTITUDE, THOUGHT PATTERNS, and SELF-KNOWLEDGE --- all of them the keys to profit. Just as valuable is Joe's placing indicators, high-powered math, statistics, and complex theory in their proper perspective, namely that they are typically DISTRACTIONS rather than aids, in comparison to learning THE DETAILS of price action. In the same vein, Joe emphasizes the value of DISCRETIONARY trading compared to MECHANICAL trading, making the point that since all markets change over time, sooner or later a rigid, inflexible system not being able to adapt, will fail." ~Bill Schenker

$150.00

Dimensions: H 11 1/4" x W 8 5/8"

327 pages

30-Day Money Back Guarantee*

Hardcover Only

*If you aren't thrilled with Day Trading, just send it back within 30 days and we'll refund 100% of your purchase price (less s&h).

- markets

- income

- options trading education

- stock market

- day trading

- trading techniques

- position trading

- bar chart

- congestions

- trend finding

- identify trends

- trading plan

- setting alerts

- price movement

- intraday trading signals

- identify best trades

- risk management

- money management

- placing stops

- stop placement

- emini s&p 500 trading

- trade management

- forex

- forex trading

- trading logic

- traders trick entry

- entry signals

Day Trading Forex

Master Trader Joe Ross shows you how he does it!

"I hate to see so many aspiring Forex traders losing their money. Why do they have to make everything so complicated when, in fact, it’s not at all hard to win? In this eBook I show you trips and traps of Forex day trading. You need to know them in order to avoid the fate of so many other traders." ~ Joe Ross

Message from Joe Ross

I’ve been trading Forex for many years, even before there was such a thing as retail Forex, and before more and more people decided to become Forex traders. Trading Forex is heavily marketed and popular, but it is also deadly. The correspondence I receive attest to the fact that most people who attempt to day trade Forex are losing their money. The turnover rate is atrocious. Because of the pain I’ve seen, I decided that I will show you how I day trade the currency pairs.

Learn where to find more safety in your trading, and where the greatest Forex profits are made. The Day Trading Forex eBook gives you detailed answers to vital questions, such as knowing which currency pairs to trade, which time frame to use, and where to set your profit-taking objectives and your protective stop.

Day Trading Forex Highlights and What You Can Learn:

Chart Reading – The Law of Charts

You will learn to identify the basic formations of The Law of Charts: what they are, what they mean, and how to trade them in the Forex market. You will see how I trade the Ross Hooks and consolidations. I reveal a fantastic way to implement The Law of Charts (TLOC), namely the Traders Trick Entry (TTE), together with simple ways of using it in your trading.

I always like to remind traders that "a chart, is a chart", and Forex charts are no different from any other kind of chart. Forex charts show you human emotional reaction to the movement of prices. It’s the same as with stocks or futures charts. As they say, "a picture is worth a thousand words." On that basis, you are going to find many thousands of words in this eBook. It will truly help you to understand and implement The Law of Charts in your trading.

Identifying Consolidations and Finding Trends

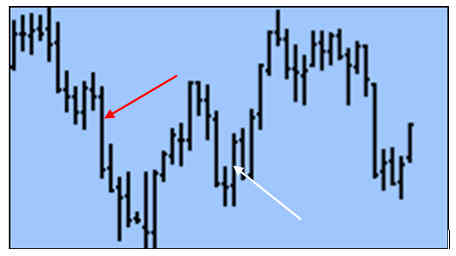

Are you aware that currencies trade sideways 85% of the time? Do you know how to make money when they are doing just that? Please take a look at the chart below: do you know what it means when prices have formed as between the two red lines below?

You will find the answer to that question, and many more. It is vital to recognize congestions at the earliest possible time. In fact, you'll see how to identify sideways markets before anyone else realizes they are beginning to consolidate. In order to do that, the book has been "loaded" with graphic examples.

Your Own Trading Plan

Please look at the chart below: do you know why someone sold at the red arrow and someone bought at the white arrow? You will find out why in a fascinating way, through the help of a single graphic representation. You will discover precisely where to have your entry order, what your initial objective should be, and where to best place your protective stop.

You will learn to set up your own trading plan simply by using price charts, and with almost no indicators. The ones used will greatly help you in filtering and managing your trades, but your main focus will be on the price action as seen on the chart. Charts will also help you figure out which pair to trade, and which time frame best fits your comfort zone.

Trade Management and the Costs of Running your Trading Business

It is not only risk management that you need to know about in order to successfully day trade Forex. You will learn other aspects of management, things that most traders ignorantly ignore. For example, you will learn how business management, risk management, trade management, and personal management are all part of the picture, not just money management. This information alone will save you thousands of dollars. You need to know the concepts and the realities of how a "bucket shop" operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills". It’s all true, as will be explained to you. You will also see that Forex trading is not without heavy overhead in the form of the spread you pay to trade. You will discover the most important things you need to know about Forex regulation and brokers.

Commonly Asked Question

What's the difference between the Day Trading Hardback Book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? The Day Trading book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

"Joe's Day Trading Forex book has been an invaluable source of information about the most traded market in the world. I got not only the proper way to trade this market with plenty of example and clear explanations but also how to create good habits to become a profitable trader. Truth is together with this book and Daytrading Joe's book I have been trading smarting and my account has benn growing since then slowly but surely." ~ Johnny A., USA

"I have been following the Joe Ross method for years. At one time I owned my own day trading firm and taught his method to my traders. Many used it successfully, others used their own method. The EBbook is very detailed and when followed gives you a direct, set of plans that you can write down and consistantly use." ~ Michael H., USA

"EXCELLENT practical outline of trading forex using the raw mechanics of the market (price action, order / flow, participant overview) coupled with proactive analysis, trade management, entry and exit techniques). Most notably, it works!" ~ George P., Australia

"I feel confident with the material because of Joe's age and experience in the market. I also feel his material is very simple to remember and apply in my daily reading of the market." ~ Steen N., Denmark

"As usual, another great work about markets, in this case Forex. Joe discovers new ways to trade Forex market, to manage risk and stablish profits." ~ Carlos L., Spain

"Joe as usual has great insights about the trading process. They're different from other run of the mill trading products or services." ~ Eugene T., Singapore

$127.00

Day Trading Forex

eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Frequently Asked Questions

These FAQs are listed questions and answers from various e-mail correspondence between our trading students/customers, all supposed to be frequently asked in some context, and pertaining to a particular topic.

Links throughout the answers will guide you to further information on our website or from other sources. Should you have any further questions, please consult our Contact Us page.

Q: Can I make a living trading? Is it really possible to trade for a living?

A: Yes, it is possible. Our trading team is hard proof that it can happen and they have worked very hard to get where they are today. That is why, Trading Educators takes pride in developing educated traders who are independent thinkers. We want you to succeed as a trader. It is imperative that you first evaluate your financial situation and emotional state, as there has probably been a lot of marketing thrown at you to purposely get you off track. Stay away from "get rich quick" schemes, they don't work and only offer empty promises.

Next, take the appropriate steps to educate yourself, learn patience, which will then lead you to developing a trading plan, and most important is to test your trading plan by using a simulated trading program before going live with real money. Aligning your trading plan with a simulated trading program will put you and your plan to the true test. The overall average among professional traders is that they make 6%/month on the amount of money they have in their trading account. When you compound 6%/month the result is 100%/year, which is an excellent return. For example, if you have a margin account of $10,000, you should be able to double it in a year.

If you're new to trading, click here to start with Level, Time, Market, and Goal. For our intermediate to advanced traders, you should already have a trading plan in place, so take advantage of our One-on-One Private Sessions with one of our three Master Traders to evaluate and strengthen your trading plan. Joe Ross, Andy Jordan or Marco Mayer.

—

Q: Where do I put my stop?

A: There are many variables involved in stop placement and at Trading Educators, we believe it makes no sense whatsoever to use a fixed dollar amount, a fixed percentage of your account, or a fixed number of ticks or pips for stop placement. The markets change from one day to the next. Due to variations in volatility, no fixed method of stop placement is going to be any good in all situations. If you are asking "Where to place your protective stop loss at the time you initiate a trade" or "How much risk should I take when I enter a trade?", then you've got to start educating yourself further and deeper into trading materials. Those answers can only come from you.

Trading Educators webinars and private turtoring are your best options to help you with your trading plan. Our three master traders will guide you through your end result questions on the amounts for your stop placement in forex, futures, stocks, spreads, and options. We also show you how to figure out objectives, position size, determine which markets, and time frames you could trade in. There is no way for us to tell you how much risk that you can afford to take. Ask yourself the following questions, keeping in mind that these are tough and direct, so be very honest with yourself:

- What is my risk tolerance (level of comfort), emotionally, mentally, physically, or financially?

- How much money do I have or it’s intended use?

- What is my initial reaction under pressure?

- How will I behave during a winning or losing streak?

- Trading isn't predictable, so how will it impact my family situation?

- How will greed affect my trading?

- Fear plays a big role when it comes to trading, put yourself in these situations:

- Fear of missing a move.

- Fear of being wrong.

- Fear of losing money.

- Other moral and emotional fears.

- How will pride affect your trading?

These are just a few of the things that only you know about yourself. So when the question arises, "Where do I put my stop?" Remember, the answer solely depends on you and the steps you should take to educate yourself as a trader. It takes the will to learn, patience, and an understanding that this process won't happen overnight. But, if you've gotten this far into your quest as a trader, then you've come to the right place. Trading Educators has over eighty-seven years of combined trading experience, giving you the luxury of having all the necessary resources right at your finger tips. Through our products and services, we encourage independent thinkers and want you to succeed! Take the time to read through our website, and let us help you answer your own question of "Where do I put my stop?" Our recommendation to you is starting with Joe Ross' eBook "Stopped Out!" and One-on-One Tutoring with one of our three Master Traders.

—

Q: Is a Ross Hook that is also a doji bar valid?

A: A Ross Hook (Rh) is formed when there is a failure of prices to move higher (rising prices) or lower (falling prices), following the breakout of the #2 point of a 1-2-3 formation, or the breakout from any kind of consolidation. The Rh has nothing to do with location of the Open or Close of a bar, so a doji bar that becomes the point of a Rh, is as valid as any other bar that becomes the point of a Rh. Read more about Trading the Ross Hook.

—

Q: How long should a time stop be?

A: There is no definitive answer to how long a time stop should be. A time stop is completely subjective, and must be determined by the trader based on testing and experience within the chosen market and time frame. Some traders are content to wait longer than other traders. You simply cannot say a time stop should always be a certain number of minutes or hours.

—

Q: What is the difference between these three products: Day Trading Hardback Book, Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? I already have the Day Trading book, will the Day Trading E-Mini and the Day Trading Forex give me more information?

A: The Day Trading Hardback Book is a full-size text book that is loaded with lessons, and examples taken from real trades. It reveals to you the many concepts you need to know to succeed at trading. It is really the first step in the process of learning to day trade.

The Day Trading E-Mini eBook can be used to learn how to day trade almost anything you would like to day trade. It teaches some concepts that go beyond what is taught in the Day Trading book. However, the focus of the book is specifically the E-Mini S&P 500. This eBook can be a second step in the learning process, or you can choose to jump ahead to the full 2-day Day Trading Webinar or Private Tutoring by Master Traders' Andy Jordan and Joe Ross.

The Day Trading Forex eBook teaches concepts not taught in either of the other day trading books. Although it, too, can be used to day trade a variety of markets, the focus is on currency trading in Forex, or currency futures. The Day Trading Forex eBook can be used as a second step in learning to day trade. Our students tell us that the 2-day webinar, or even better 3 days of tutoring with Joe Ross is a marvelous experience that will change your life and take you to the pinnacle of trading. You will never again see the markets the way you have in the past. You will know and understand how markets work, and how to make money in them.

Q: I have Analysis Paralysis. Can you help?

A: There are two reasons you have Analysis Paralysis. You can be the victim of one or both of the following:

- You don’t believe in yourself and what you are doing.

- You don’t believe that what you are doing truly works.

Trading Educators can't emphasize enough that you must regularly evaluate your trading plan to work through or shorten length of time while in analysis paralysis. You are on the right track, if 1) you acknowledge analysis paralysis, and 2) you are ready to break away from it. If you think that our Master Traders don't ever get analysis paralysis, then it's time to clue you in. Our Master Traders are constantly reading up on the latest market materials, and seeking out new resources which helps them evaluate their trading plans. This only pushes them further along into becoming better traders. Sometimes it good to start from the beginning, remind yourself as to why you started trading and celebrate the months, quarters or years where you showed a profit. Revisit a book or article that helped in your education or got you excited about becoming a trader. Try a fresh and new prespective, sort through the many products and services that fits your trading need. Learn with the best, you have the skill set, and we are here to help break you out of this temporary state of mind.

Q: What information do I need to trade?

A: This is a great question and Trading Educators is excited to walk right along side of you while you gain confidence in getting your answer. We have purposely set up our website to guide you through and answer questions along the way. We can help you determine which market(s) and style of trading that best suits your trading goals. Visit our home page and read through the four sections: Level, Time, Market, and Goals. We offer a wide range of products and services to help get your started such as books, eBooks, Webinars, Private Tutoring, and Daily Trading Advisory Programs. If you still have questions after visiting our site, feel free to Contact Us, so we may assist you.

—

Q: I have trouble Pulling the Trigger on a trade. Can you help?

A: There are two reasons you can't pull the trigger on a trade. You can be the victim of one or both of the following:

- You don’t believe in yourself and what you are doing.

- You don’t believe that what you are doing truly works.

We can help. It can be done in a number of ways:

- Read one or more of our eBooks or Hardback Books.

- Private tutoring with Master Traders Joe Ross, Andy Jordan, or Marco Mayer.

—

Q: Does "The Law of Charts" work in any market, any time frame or under all conditions: for example: a panic market or irregular price action?

A: A "Law" is not something that "works." A "Law"” is something that is always true. The question asking whether or not The Law of Charts works implies that The Law of Charts is some kind of system or method, and you want to know if it "works."

The Law of Charts as applied to prices describes in graphic form the emotional action and reaction of human beings to the movement of prices. Therefore, it ALWAYS "works" because as long as people trade markets, you will see the same basic patterns over and over again.

The Law of Charts "works" with any chart graphic that describes an underlying movement that has a range of values.

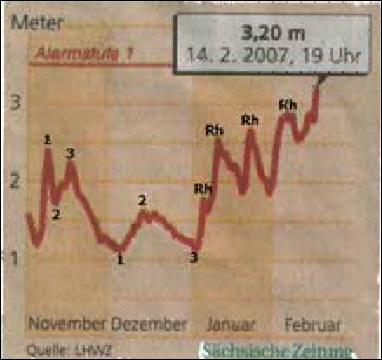

You can see the Law of Charts working on gas meter readings, water levels of a river or random coin flips, anything that has a range of values.

The chart below shows water level readings for the Elbe river in Germany.

In the case of gas meter readings, the impetus for what you see on the chart is consumption of natural gas, which will have a range of values because usage will vary seasonally. In the case of water levels in a river, the impetus will be the range of values that will vary due to water usage, and the amount of rainfall, snow-melt, or both.

In the case of coin flips the impetus is the pure statistical probability of a series of heads or tails.

Below is a chart of coin flips. In the case of price charts the impetus is human emotion as seen in the action and reaction of traders and investors to the movement of prices. If something is true, it is always true. The Law of Charts is always true—there is no way to get around it.

The purpose of studying The Law of Charts is to gain an understanding of how and why prices move to create 3 basic chart formations: The 1-2-3, the Ross Hook, or various types of consolidation. Whether or not you make money from this knowledge will be in direct accordance with how you implement that knowledge.

Electricity follows the laws of physics. But unless you implement the laws that govern electricity the best you can hope for is a shocking experience. With proper implementation you can turn a motor, generate heat, or create light.

The Traders Trick Entry (TTE) that we teach at Trading Educators is one way to implement the Law. There are probably dozens, maybe even hundreds of ways to implement The Law of Charts (TLOC). To learn more about the "Law," check out The Law of Charts In-Depth Webinar and during private tutoring we will reveal numerous ways to implement The Law of Charts.

—

Q: How much money do I need to trade full-size contracts in forex, futures, or anything else?

A: The amount of money you need is entirely determined by your broker. Follow this link for a broker referral.

—

Q: Ross Hook: How far can a RH be from point 2?

A: It’s kind of a judgment call, but you can read what Joe has done on page 300 of Trading the Ross Hook, where it states that the #3 point should be between 1/3rd and 2/3rds of a point 1 to 2 retracement. It is all going to depend on what works for you in the time frame and market you are trading.

—

Q: Trend Lines: Do you use 1-2-3 highs and lows; and Ross Hooks with trend lines to help buy or sell in better places?

A: The best thing we can recommend is to do what works for you. Joe Ross does not use trend lines nor does he use support resistance lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. He also does not use Fibonacci retracements and is aware of them, and uses them in an unconventional way. But, he doesn't trade based on them. The most important and only truth available for trading is the price bar directly in front of you. You can't trade the past and you don't know the future. Therefore, you must trade what you see.

—

Q: Support and Resistance: Do you use support and resistance to help you to buy or sell in better places?

A: Joe Ross does not use support and resistance. Nor does he use trend lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. Joe also doesn't use Fibonacci retracements and is aware of them, and uses them in an unconventional way. But he doesn't trade based on them.

—

Q: Fibonacci: Do you use Fibonacci ratios to get better entries for buying and selling?

A: Joe Ross does not use Fibonacci retracements, ratios, or confluence in his trading. He is aware of them, and uses them in an unconventional way. But he doesn't trade based on them. Nor do he use trend lines or support and resistance lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. Joe is aware of them, and uses them in an unconventional way. But he doesn't trade based on them. Fibonacci ratios, Gann ratios, the "Golden Ratio," and Elliott waves are all attempts to mathematically (scientifically?) trade markets that are both emotional and psychological. You cannot successfully or consistently apply mathematics to human emotional and psychological actions and reactions, which is why the field of psychology is a pseudo-science. The mathematical approach to markets is a vain attempt to put price action into a predictable box with known dimensions and parameters. However, markets do not behave in accordance with mathematics. Markets go wherever human emotion takes them.

—

Q: I’m concerned that my data supplier does not provide all the trades through their feed. I’ve heard that they are aggregating the trades and making an average of “X” number of trades. Can you explain?

A: There is one caveat with all data feeds. In order to make them appear faster, providers will typically aggregate trades. Joe Ross doesn't know of a single data provider that will, or even could show you every single trade, and even if they did, he seriously doubts that your computer would be able to receive every trade that was made. What you see on your screen is at best an approximation of the actual trading. Think about it for a moment. Let's put everything that is happening into slow motion so we can see what is really going on. As the prices come into your computer, they are cached for distribution. At some point your computer must distribute what it has saved in its cache. During a distribution phase, the computer is not receiving prices it is posting them to the screen. Although the entire process is taking place in fractions of a second, there is no way you could possibly receive all of the ticks. To add insult to injury, your computer is probably also doing other things. The operating system does things; if you have any kind of spam filter, firewall, antivirus, or program running in the background your computer is monitoring those other things as well. In the fractions of a second it takes your computer to pay attention to its other tasks, you are not receiving ticks sent out by the data vendor. Your computer is like a one arm wallpaper hanger. It can do only one thing at a time. Your concerns are without real foundation. Any data supplier has similar problems with their computer receiving prices from the exchange, and the exchange's computer has the same kind of problem distributing the data as your computer has receiving it.

—

Q: Which order type would be the best for let’s say Crude Oil or the EuroFX on a 5 or 3-minute chart?

A: There is no best order type for any market or time frame. The best order type depends on your strategy.

The type of order you use is one of the tactics you use to carry out your strategy.

- Do you absolutely want to be filled? If yes, use a market order.

- Do you absolutely want to be filled if prices reach a certain level or go through that level? If yes, use a stop market order.

- Do you want to be filled if prices reach a certain level, but not be filled at a price past that level? If yes, use a limit order.

- Do you want to be filled if prices reach a certain level, but are happy if prices are filled within a range you specify, but not be filled at a price past the specified range? If yes, you a stop limit order.

Keep in mind that limit orders and stop limit orders have no requirement to be filled. They can be passed right over and leave you behind with no fill.

—

Q: What does it mean when #2 point is very close to Ross Hook?

A: Most of the time it means you should expect sideway action to follow. Unless prices break through the Rh with force, you are probably going to see a consolidation area, with the #1 point of the 1-2-3 as the low of the area and the Rh as the high of the area.

However, the areas of so-called accumulation at the low and distribution at the high are not as long as in years past. This is due to people trading with indicators, which also causes markets to mostly swing instead of trend.

—

Q: Will your stuff work with tick charts?

A: Our "stuff" works with any kind of chart that depicts a range of values. Therefore, we have students who trade tick charts, range charts, volume charts, line charts, even point, and figure charts. One of the greatest traders we know uses our "stuff" to trade point and figure charts.

—

Q: I haven't been trading long and want to learn more about trading. Will I be able to understand your products?

A: If you are a beginner trader, the terminology may seem overwhelming at first, but as you start educating yourself, it will come easier. Click here to get a clearer path as to which market(s) and trading style that will best suit you. For intermediate and advanced traders, your biggest challenge will be retraining yourself from old habits. We are here to assist and help you learn the art of trading, email us with any questions, at any time.

—

Q: If I buy a product, will I need to continue to buy more products to learn to trade?

A: Learning to trade is a lifetime experience. Joe Ross has been in the markets for fifty years and says he is still learning. There are certain products you should want to buy to give you a proper foundation for building a trading career. How many you will need is something only you can know. It is highly doubtful that you will be able to read a single book and then become a successful trader. Trading is a serious business, one in which you cannot afford to make many mistakes. The more time and money you spend on building a firm foundation, the greater will be your chances for success.

With proper preparation, trading can make you wealthy. Without adequate preparation, it can make you poor. Whether you succeed at trading, depends in great part on how much you are willing invest in your education. If you’re not willing to invest in yourself, you are probably better off putting your money in a mutual fund and hoping for the best.

—

Wishing you all the best and happy trading!

From the Trading Educators Team

.PNG)

.PNG)