Edition 716 - March 2, 2018

Chart Scan with Commentary - Ledge Trade

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

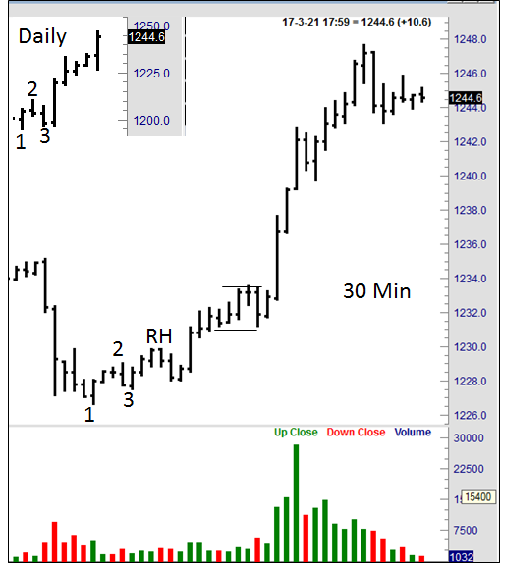

This issue of Chart Scan is about "ledges." Ledges are a formation described in the Law of Charts. A Ledge must occur in a trend. It must consist of not more than 10 bars from beginning to end. A ledge must have two matching highs or very close to matching highs, and two matching or very close to matching lows.

You trade a breakout of the ledge only in the direction of the major trend or swing. The 30-minute Gold chart below contains an almost perfect ledge, with two exact matching lows at 1231.20 and two almost matching highs at 1233.50 and 1233.40. In this case a sell stop was placed at 1233.50. The question is: "What was the direction of the former trend or swing?" We can see that prices had already made a 1-2-3 low, followed by a Ross Hook (RH).

We can confirm that uptrend by going to the daily chart, which I have inset into the graph of the 30-minute chart (upper left corner). What we see is that the direction of the current swing is up. Therefore we trade the breakout of the ledge to the upside.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Staying with Winners

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

When you are riding a winner, avoid looking at it all the time. Search out new trades in other markets. Absorb yourself with looking for opportunities elsewhere, if you are the type that must have market action. Diversification is the key word here. But remember, you can afford to take only the very, very best trades elsewhere when you are riding a winner. Don’t blow away the profits you are making on your winner by maniacal trading in other markets.

The best and perhaps the only way to make money in the markets is to cherish and succor your winning positions. Stand back and admire them, appreciate them. Let them develop, unfold, and make you money.

Please don’t confuse staying with winning trades with long term trading. They are not the same. In my own case, most of my long held winners start with a short term daytrade held overnight because I am trading towards the breakout of a major entry signal, such as a Ross hook, or a 1-2-3 high or low.

For most traders, because they don’t have the deep pockets, the patience, or both, to be long term traders, shorter term trading is best. It is in shorter term that the trader with the smaller account can profit.

Here’s a good way to handle your money management: Divide your risk capital into 8 percent segments of declining equity balance. (For example, $10,000 account, risk maximum $800 total on your first trade. If you lose $500, then risk a maximum of 8% of $9,500 on the next trade.)

Such a strategy will allow you to successfully take more than a dozen hits in a row. The odds of such NOT happening are greatly in your favor. With mediocre trade selection or worse, such as the flip of a coin, you should get at least one winner. If you ride that winner, you should come out ahead.

Practice not trading as often as you have been. The brokers are rich enough, you don’t need to trade to make them happy. When you have a winner, reset your stops often, keep them moving.

There’s a saying in poker that you should think about from time to time. It goes something like this: “If you’ve been in the game for twenty minutes, and haven’t yet figured out who the patsy is, then it’s YOU!” Think about that when you run your business of trading. Take your time, be patient, let the markets show you what to do. Let the markets come to you, fill your positions, and then take you for the supreme joyride of making a year’s pay on a single trade. The ride is worth the wait.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Example: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

TRADE WITH NO LOSSES

Here's our latest example!

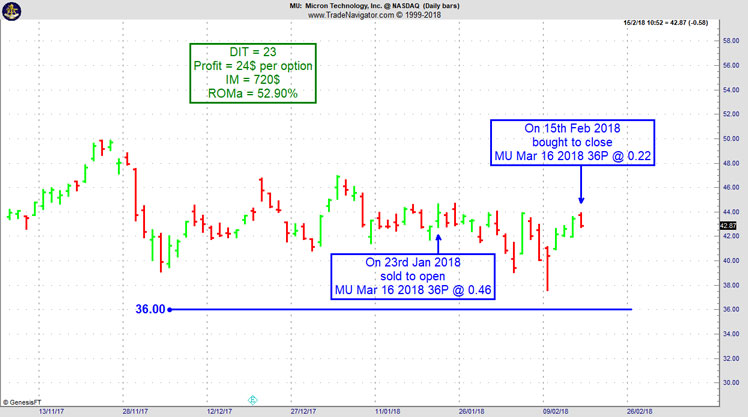

MU Trade

When the put short strike is carefully chosen, we can withstand a sharp downside correction without any trouble. On 22d January 2018 we gave our Instant Income Guaranteed subscribers the following trade on Micron Technology Inc (MU). Price insurance could be sold as follows:

- On 23rd January 2018, we sold to open MU Mar 16 2018 36P @ 0.46$, with 53 days until expiration and our short strike about 16% below price action,

- On 15th February 2048, we bought to close MU Mar 16 2018 36P @ 0.22$, after 23 days in the trade; our short strike was never challenged during the sharp market correction, we only had to stay a little longer in the trade to close it.

Profit: 24$ per option

Margin: 720$

Return on Margin annualized: 52.90%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Example - GFJ18 – GFK18

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

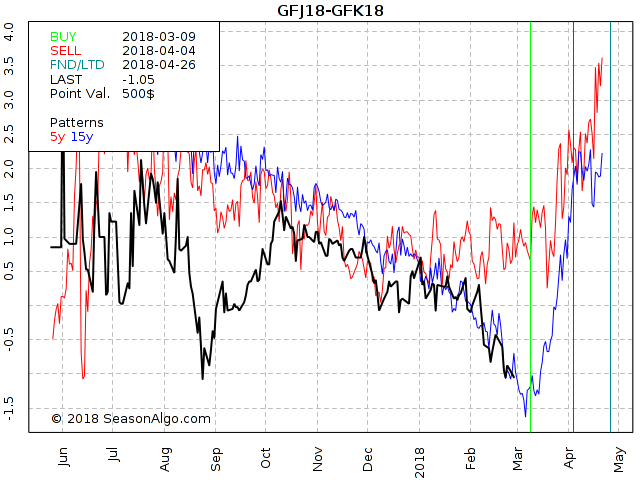

This week, we're looking at long GFJ18 – GFK18: long April 2018 and short May 2018 Feeder Cattle (CME on Globex).

Today we consider a Feeder Cattle calender spread: long April 2018 and short May 2018 Feeder Cattle (CME on Globex). As we can see on the seasonal chart above, the spread usually turns around at the beginning of March and starts to move to the up-side. In addition, the spread reached the August low after moving strongly lower during the last few weeks. Will the August 2017 low hold and will the spread follow it’s 15 year seasonal pattern to the up-side during the next few weeks? Of course, we don’t know yet and I would not want to jump into this spread only because the seasonal pattern looks attractive. But if we get an entry signal from the chart I might jump into this trade using a close stop just below the February low.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - Who's Next in Line

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

"Buy low, sell high" is one of the most popular memes in the investment and trading world. And obviously, it does make sense...read more.

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.