Edition 722 - April 13, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - How to Spot a Bottom Coming in the Currency Markets

The following article was sent to me by a student. It is so good that I really want to pass it on.

"When I'm out doing business in Dallas, people always ask me what I do for a living. When I tell them I work in the currency market as an instructor and financial writer, they always want to know if a bottom is coming in the markets.

"Well, let's talk about that for a moment.

"Financial analysts like to say there are no fundamentals or support levels during a bear market. But what they really mean is no one really cares about a company's nuts and bolts when markets start to head south.

"It's the same in the currency markets. When markets head south, no one tends to care about a country's (or its currency's) fundamentals.

"What Matters Most When Markets Fall Apart

"In addition to fundamentals, Forex traders also track a currency's technical performance to gauge how a particular currency will perform.

"During normal markets, there are key areas where a currency pair will stop on the charts. Sometimes it's a "round number" like 1.36 or 1.40, but other times it's just a place on the chart where the pair has resisted falling many times. These are called "support levels."

"Unfortunately, technical analysis isn't the best gauge of a currency during a bear market either. Most of the usual technical analysis becomes obsolete during a bear market because investors simply aren't paying attention to it. At those times the market is almost purely driven by sentiment (i.e. how the majority of traders feel about the market). In a bear market, investors tend to let fear rule their trades.

"So what puts a bottom in the currency market? A change in sentiment.

"Here's the problem: Only drastic measures force a sentiment change. So this is what you sit back and watch for.

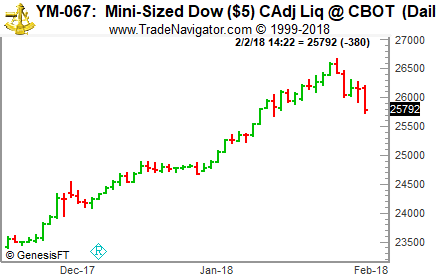

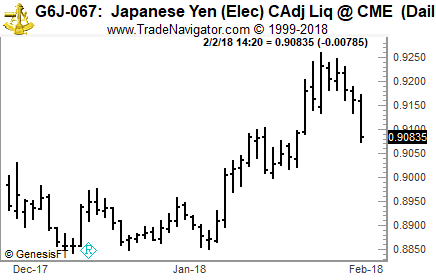

"I watch stocks a lot as a clue as to when certain key carry trades will turn around. (Remember: Carry trades happen when investors borrow low-yielding assets to buy higher-yielding assets and then pocket the difference.) You'll see from the charts below that the Dow Jones Industrial Average and the EUR/JPY (euro vs. the Japanese yen) look almost identical. They feed off of one another.

"When the Dow Turns, Inevitably the EUR/JPY Pair Also Turns!

"Why else do I watch stocks to see where currencies may go? Because I know that the Fed practically worships the stock market."

"VIX - Let the 'Fear Gauge' Be Your Guide

"The Fed officials don't sleep well at night when stocks are falling. So many Americans either work for or invest in publicly traded companies, so if these companies are failing, it's also going to hurt the rest of the economy.

"Hence, the Fed-Heads think they have to do something so they can get these stock prices headed in the right direction.

"So during these times, I switch gears and mainly look at market indicators that judge sentiment such as the VIX (found at stockcharts.com using symbol $VIX), mutual fund redemptions, and unusual government activity.

"Let me explain in a bit more detail. If you've been reading my articles, you know that I'm a big proponent of judging the 'risk' appetite out there in the market. When markets are calm, the VIX has a low reading. However, when times get shaky, the VIX has a very high reading as investors become what Forex traders call 'risk averse.'

"You see, the VIX judges fear in the market. When the VIX heads to historic highs, fears are also at historic highs too. When fear reaches its peak, it generally predicts that a sentiment shift is coming. And a sentiment shift means a bottom is coming in the markets.

"Mutual Fund Redemptions Are Your Next Clue for Finding a Bottom

"Mutual fund redemptions are yet another. You can just listen to CNBC or Bloomberg TV during bear markets and they'll tell you about mutual fund redemptions. When mutual fund redemptions hit new highs it tells me that the retail investors have been shaken to the core and are running for cover.

"Investors are so scared that they can't take it anymore. So they cash out their 401ks and IRAs and taxable accounts. Inevitably, this is when the markets are near their bottom and the change comes.

"You see, the Fed sees investors scampering all around and they know they have to step in and do something.

"So when the Fed and/or the Treasury make unusual moves, I know a bottom is here or near. Either way, I know it's time to start tip-toeing back into the waters by buying the euro vs. Japanese yen pair (EUR/JPY).

"Here's why: When I see a bottom coming in the stock markets, I know that EUR/JPY is about to bottom as well. For starters, the EUR/JPY largely follows the stock market. So when the stock bottoms, so will the EUR/JPY.

"Also, the EUR/JPY is a riskier trade because it gives a higher yield. If the stock market is bottoming, risk-taking will become popular in the markets again. Stock investors will plow back into stocks, while currency investors plow back into the riskier trades. That means the EUR/JPY will rise.

"Unusual Government Actions' Signal It's Time to Leap Back In

"Well, so what have we had recently? We've had the Fed and Treasury dumping tons of dollars into the financial markets lately in an attempt to fix the credit crisis.

"Not only has that been an unusual move but the U.S. Fed coordinated a "group interest rate cut." The Fed, European Central Bank (ECB), Bank of England (BOE) and three other central banks all cut interest rates at the same time on the very same day.

"Then the government started buying positions in banks to support the financial system. Some are even nationalizing some of their banks to rescue them.

"Not only is the U.S. committing money to their financial system, but Germany, France and the U.K. all do the same. Collectively they pumped TRILLIONS of dollars into the market.

"When you see drastic measures like this, you know the central banks of the world are trying to "re-inflate" their economies from the deflationary spiral they've gotten into.

"And they will be successful, at least for now. As they work their magic, stocks will eventually heal. When they do, high-yielding carry trades like the EUR/JPY will also profit.

"Governments are opening up the floodgates and they won't stop until they feel the markets have reversed and a sentiment change has taken place.

"So in times like these (where the market is looking for the turning point), make sure to focus on sentiment type indicators like the VIX and mutual fund redemptions. Most importantly, keep an eye out for any government interventions.

"Take it from someone who practices these techniques with real money every single day. I'm not just teaching in theory here...this stuff really works out there in the real markets."

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Risk Management

Many traders view risk management as critical to long-term success. Consider what a couple seasoned traders told me about risk management. Mark said, "You can have a crummy trading strategy, but if you have good risk management, you can make money. If you have poor risk management, it doesn't matter how good the trading strategy is. You're going to lose in the end." Similarly, he observes, "You must have a survivability element so that if you literally wished to select stocks by throwing darts at a board, you would continue to survive market to market."

Risk management is viewed by many as important, but what's the best way to manage risk? Some traders use very specific rules for managing risk, such as risking a small percentage of capital on each trade. Other traders don't seem to have any specific rules, but may look at past performance as a key. (What is the volatility? What was the previous day's low?)

As important as risk management is, not all successful traders always manage risk. Some successful traders put on big positions when they believe they see a chance to make a huge, substantial win. When they believe they are right, they just take a chance. Doing so may lead to big losses when they are wrong, but they do it when they need to.

Is taking big risks a good idea? When it comes to trading, there is no one "right" way to trade. All you can do is consider the advantages and disadvantages of each approach and decide which approach you want to take. Whether you want to take big risks may depend on your experience and trading skills. If you are a novice trader, you have not yet learned how to use a set of methods consistently to make a profit in the long term. For novice traders, it is often vital that they control their risk (for example, risking a small percentage on each trade) so that they could survive long enough to gain mastery as a trader. One reason trading coaches preach the virtues of careful risk management is that a common mistake among novice traders is wanting to "get rich quick" and putting on big trades to make big wins. The methods and skills of a novice trader, however, do not warrant taking such huge risks. What often happens is that they lose all of their capital on a few big trades and need to stop trading.

Once a trader becomes mature, he or she may want to "reach the next level" and make a lot more profit. Experienced traders often reach a level of comfort, at which point a self-imposed barrier limits their profits. It's hard to break through this barrier, and no one really seems to know why. Very experienced traders who want to make greater profits need to start bending or breaking the rules a little to see if they can make greater profits and break through the barrier. This is risky, but some experienced traders are willing to take the risk in order to make huge yearly profits. That said, they also can afford to take more risks. As seasoned traders, they have the methods and experience to take risks, but a novice trader does not. So even though there is no right or wrong way to trade, if you are new to the trading business, risk management has the advantage of allowing you to "survive the learning curve" until you find the once-in-a-lifetime opportunities to make you wealthy beyond your wildest dreams.

by Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

TRADE WITH NO LOSSES

Here's our latest example!

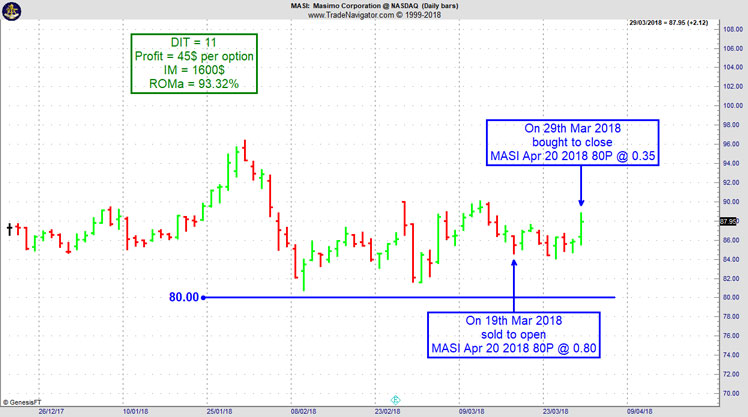

MASI Trade

On 16th March 2018 we gave our Instant Income Guaranteed subscribers the following trade on Masimo Corporation (MASI). Price insurance could be sold as follows:

- On 19th March 2018, we sold to open MASI Apr 20 2018 80P @ 0.80, with 31 days until expiration and our short strike about 8% below price action,

- On 29th March 2018, we bought to close MASI Apr 20 2018 80P @ 0.35, after 11 days in the trade for quick premium compounding

Profit: 45$ per option

Margin: 1600$

Return on Margin annualized: 93.32%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Idea

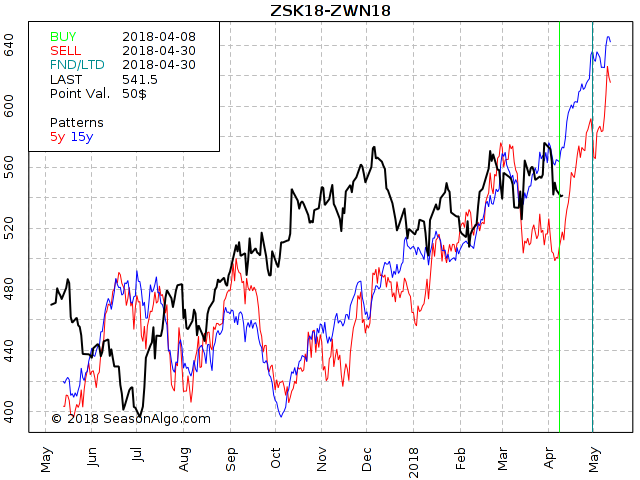

This week, we're looking at ZSK18 – ZWN18: long May 2018 Soybeans and short July 2018 Wheat (CME on Globex).

Today we consider an inter-market spread: long May 2018 Soybeans and short July 2018 Wheat (CME on Globex). The spread has been in a long term up-trend but with huge swings. With a strong seasonal pattern in both, the 15 year and the 5 year, right in front of us, there is a good chance we will see more movement to the up-side for the next few weeks. Because we are trading in 2 different markets, the spread can move fast, also against us and therefore requires a high risk of about $1,500 per spread.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Blog Post - Why Pips Don’t Matter!

Read why you should run as fast as you can when someone starts talking about Forex trading results in Pips. It’s a red flag! Read more...

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.