Edition 723 - April 20, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Ratio Spread vs. Differential Spreads

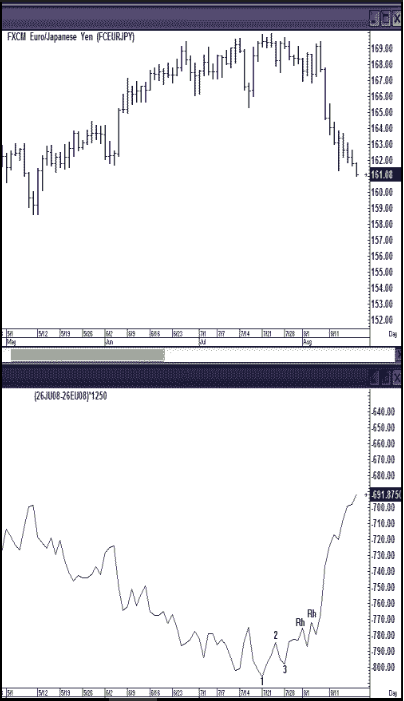

Is it possible for a differential spread to move more than a ratio spread? You might not think so when you look at a forex chart with open, high, low, close bars that look very much like moves in the outrights. However, differential spreads often move more than the ratio spreads, and in 2008 such a situation occurred in euro vs. the yen. Let's take a look.

All forex pairs are nothing more than ratio spreads. In the case of the EUR/JPY, we see the euro divided by the yen.

In the upper half of the chart above, we see a ratio spread between the euro and the yen. From the highest recent high (169.95) to the current low (161.08), there is a movement of $8.87 in the forex pair.

In the lower chart we see a differential spread displayed in dollars, and the move there is from the lowest low (-806.125) to the recent high (-691.875), a move of (114.25) Hopefully, you realize that for a differential spread to be making money, the spread line must rise. So although we are dealing with negative numbers, the spread has been moving to a less negative number. In other words, the yen has been gaining on the euro by $114.25. So what has really been happening, comparing the two spreads, is that the differential spread has moved 12.88 times more than the ratio spread.

If you're going to trade this pair, would it not have been more profitable to trade the differential between the euro and the yen than to trade the ratio between the euro and the yen?

If you are going to trade currencies in the majors, you should always consider whether to trade them in the futures or the Forex. Although I used a chart from 2008 because it was handy, the situation above happens frequently. Currencies are often better traded in the futures market than in the Forex market.

Interestingly, the differential spread chart also gave a much clearer signal vis-a-vis the Law of Charts.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Being Flexible

How flexible are you in your everyday life? When you are in a new city, do you worry about getting lost or do you just go your own way and assume that somehow and someway you'll eventually get back to your hotel? Do you get upset when you are told you are wrong, or do you welcome criticism or an opposing opinion? The ability to be open and flexible often makes the difference between winning and losing in the trading business.

Trading is a scary business. When your money is on the line, you naturally feel defensive. The more uncertain you are, the more rigid and defensive you become. It's a natural, biological response. When humans are threatened, it is often in their best interests to choose a specific course of action and stick with it. Imagine that you are changing lanes in rush hour traffic. If you commit to a lane change, it's essential to stick with your course of action. If you waver, you'll confuse other drivers and may end up causing an accident. When we are in potential danger, our mind focuses on executing a specific course of action; other alternatives are completely ignored. At times, this can be a good strategy when trading the markets. If you are executing a scalp trade, for example, you must commit to a specific course of action, get in and get out, and make a profit. It would do you little good to waver at a critical moment when you should take decisive action.

When making long term trades, market conditions can change, and you may need to make midcourse corrections. You have to look at a trade from different angles and willingly explore every possibility. Many traders are stubborn, however. They have their money on the line, and they are afraid their trading strategy may not pan out. Unfortunately, their stubbornness restricts them from freely examining their options. Eventually, they end up losing money when they miss a critical market change.

How can you increase the odds of becoming flexible? First, don't impregnate a trading plan with extreme psychological significance. A trade is just a trade. It reveals nothing about your intelligence, talent, or true inner-worth. It's merely a business transaction, so treat it as nothing more. Second, minimize risk. Again, when you feel that your well-being is at risk, you feel threatened and defend your ego by acting inflexibly. If you limit the amount you risk on a trade, you will feel naturally relaxed, and thus, more open and flexible to possibilities. If you feel extreme stress, you might even want to close out a position and reevaluate it. If it is a longer term trade, you have the luxury of exiting and reevaluating your trading plan while feeling safe, and thus, relaxed. Third, you can ask a trusted friend or coach to play devil's advocate and help you see alternative perspectives.

Don't be afraid to admit that you may be wrong. The willingness to admit you are wrong gives you power and freedom. When you are willing to admit you are wrong, you won't be defensive, but you'll feel so free that you will trade creatively and profitably.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

TRADE WITH NO LOSSES

Here's our latest example!

MU Trade

On 10th April 2018 we gave our Instant Income Guaranteed subscribers the following trade on Micron Technology Inc (MU). Price insurance could be sold as follows:

- On 11th April 2018, we sold to open MU May 18 2018 40P @ 0.40, with 37 days until expiration and our short strike about 21% below price action,

- On 12th April 2018, we bought to close MU May 18 2018 40P @ 0.20, after only 1 day in the trade for quick premium compounding

Profit: 20$ per option

Margin: 800$

Return on Margin annualized: 912.50%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - It's the Decision of the Market

The market will tell you on any given trade how much money you are going to win (or lose, or break even). It will tell you this quite simply, by how well it is moving or not moving in your direction. If you think, contrary to this, that you have any influence on the outcome of the trade, or that you “deserve” to win more, you will probably overreach yourself. The market will let you know the range you are going to be in; your job is to maximize it.

This maximizing of your trade may mean winning $1,100 instead of $1,000, but it also might mean losing only $500 instead of $600.

The market and circumstances, good or bad, will tell you the baseline range you are going to be in. Your job as a trader is to get to the top of that range, and to make the most out of each trade.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Blog Post - Drawdown is the norm, not the exception

When I started out trading I had the illusion that being a successful trader meant to no longer have drawdowns or at least on very rare occasions. And I think most traders start out with that idea in their mind even though they don’t understand what it actually means. Read more.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.