Edition 724 - April 27, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Trending or Not Trending?

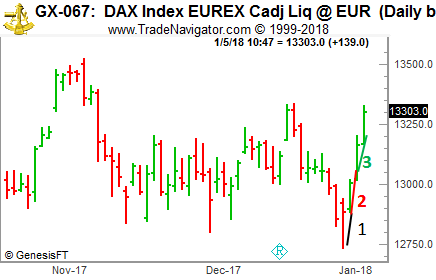

Viewing the chart above, are prices trending or are they consolidating? This kind of question has come up a couple of times in the past few weeks. According to The Law of Charts, there is a defined trend showing on the chart. But which kind of trend? Is it an uptrend or a downtrend, and how can you tell which it is?

The Law of Charts states that trend supersedes any form of consolidation. That means if you find a trend within an area of consolidation, you must assume prices are trending. At Trading Educators, we call consolidations of 11 to 20 bars "congestion," and consolidations of 21 or more bars "trading ranges" However, in the chart above, if I count from the segment marked "1," to the segment marked "3" we have defined the beginning of a trend. Segment counting is explained in my book “Trading the Ross Hook.” Segment counting is part of the Law of Charts.

The Law of Charts states that if prices make 3 consecutive higher lows, the probabilities are for a trend to form, probably after a small retracement. It further states that if prices were to violate the high of the third segment bar, we would surely have a defined trend.

So based on Segment Counting, we are looking at the start of an uptrend.

What I like best is that in any language, a chart is a chart. For those who might not know, the DAX (GX) is traded at the Eurex Exchange.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Ready to Lose

Imagine what you would do in the following scenario. You have been looking at a position for a week. You had a clear and simple trading plan: Just wait for an announcement at the end of the week, watch prices jump, and then sell. As might be expected, things aren’t working as you had planned. First, no clear trend has emerged; prices are moving chaotically up and down. Second, it’s been two days since the announcement and the price has barely moved. You decide to wait for two days to see if your original plan will come to fruition, but a small voice inside you is telling you to sell. You’ve been stressed out and you’re tired. It’s been a tough week. Part of you wants to listen to the little voice, and just close out the position, but the logical part of your mind is telling you to wait patiently and see what happens. Although you know what you want to do, you have a powerful urge to sabotage your efforts, and just walk away. What can you do to combat this feeling?

Trading often comes down to maintaining a peak performance state at a few critical moments of trading. To take advantage of these key moments, you must be relaxed, full of energy, and ready to take decisive action. But your mind can grow weary, just like how a muscle can become weak and ready to fail at the slightest strain. When you go on a long run, for example, you soon run out of energy. You can't go any farther. Your muscles begin to ache and you need to take a rest and recuperate before you start moving again. It's the same when it comes to trying to maintain your mental edge. It's vital that you consider that the mind has limited energy, and that after putting in a hard and tedious effort, you must take a rest and rejuvenate, so you can face the market action with a renewed sense of vigor. If you have strained your mental "muscles," you'll have trouble maintaining control. Your mind will be elsewhere or you'll be too tired to act decisively. When you're tired, you may want to give up.

Don’t underestimate your need for psychological energy. When you are tired, you will have a strong urge to give up at a critical point during a trade when you should enthusiastically watch the market action and be ready to face a challenge with a peak mental state. The winning trader is always ready and willing to take action. To be a winning trader, you must be rested and ready, so get plenty of rest, make sure you are well nourished and physically up to the stresses and strains of trading. By taking these precautions, you’ll trade the markets with a winning mental edge and easily fight the urge to sabotage your efforts.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

TRADE WITH NO LOSSES

Here's our latest example!

ANDE Trade

On 27th March 2018 we gave our Instant Income Guaranteed subscribers the following trade on The Andersons Inc (ANDE). Price insurance could be sold as follows:

- On 4th April 2018, on a GTC order, we sold to open ANDE Apr 20 2018 30P @ 0.30, with 16 days until expiration and our short strike about 8% below price action,

- On 12th April 2018, we bought to close ANDE Apr 20 2018 30P @ 0.15, after only 8 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 114.06%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - How to Handle Fear

The best way to handle fear comes in two steps:

1. A detailed trading plan

2. Risk control

Let’s look at risk control first. You have no doubt, read it many times: "Trade with money you can afford to lose." Here’s another one: "Trade positions that are so small that you may think, "what's the point of even putting on the trade?"" One more: "Do not over-trade!"

All of the above carry essentially the same message: They minimize the personal significance of a trade. If the trade seems basically insignificant, you will be able to do a better job of controlling your emotions. Be sure to limit your risk as much as you can. You cannot afford to let yourself lose a lot on a single trade, it is demoralizing and it will take many more trades to regain your losses.

It's essential for survival as a trader to limit the amount of capital you risk on any one trade. It's also mandatory to learn to cut your losses short. Don't get stuck in a losing trade. Don't hope that it will turn around; just sell the loser quickly, get out fast. Controlling risk will not only make you feel safe and secure, it will ensure your longevity as well.

Now to the second part: Having a detailed trading plan. Before you execute a trade, specify how and when you will enter. Make sure you set out the signals that indicate the market may be going against your trade, and how and when you will exit. Most wannabe traders fail to carefully plan their trades. They first execute a trade and then once they are in the trade they try to develop a plan as they go along. What usually happens is that they easily become alarmed because they don't know what to do or when to do it. It's hard to think on your feet, especially when you are first learning to trade. What you need is the safety of a detailed trading plan: specific guideline to follow. Making a plan follows the wisdom of any job being 80% preparation and only 20% execution. The more clearly the plan is laid out, the easier it is to follow. And when the plan is easy to follow, it's likely that you'll stick with it. You'll be disciplined and in control of your emotions and thought processes.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

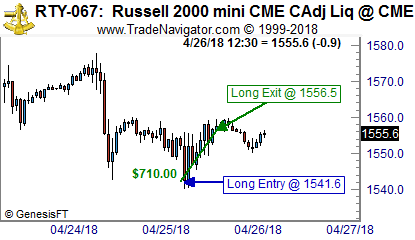

Trading Example - Buying the Low of the Day in the E-mini Russell 2000

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-mini Russell 2000 (RTY) traded at the CME, where Ambush Traders had a really nice trade this week.

Ambush trades on an end-of-day basis so there’s no need to even look at an intraday chart but to show you all the details of the trade, here’s a 60-minute chart of RTY.

As you can see we had an Ambush Signal to buy at 1541.6 which turned out to be almost the low of the day. A classic Ambush Trade where we ambushed the novice traders who sold below the previous days low. As these traders realized they were wrong buying panic kicked in and we could get out with a very nice profit of $710 per contract about 8 hours later!

Of course, a single trade doesn’t tell you too much about a trading method. If you want to learn more about Ambush and see long-term reports of all supported markets, check out the Ambush Signals Page.

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.