Edition 725 - May 4, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Pork Bellies

The pork bellies market is often characterized as thinly traded, loaded with stop running, containing many sudden and suspicious moves, full of unexpected twists and turns, and notorious for gaps. But the pork bellies I want to write about today are the Treasury Bond futures. "Bonds" have been called the pork bellies of the financial markets, and with good reason.

The bond market is definitely not an illiquid market. Even during the few years in which the 30-year T-Bond was no longer sold by the Treasury Department, the bond futures maintained a decent level of liquidity and traded much the same as when the Treasury Department was actively selling the bonds at auction.

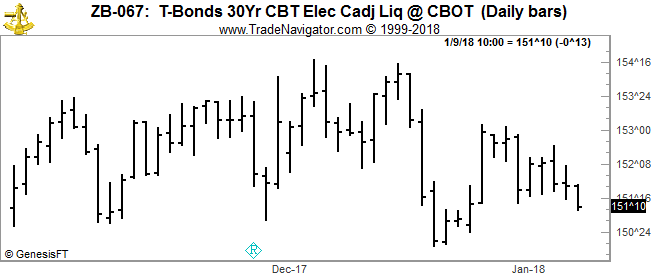

So, why are the bonds considered to be the bellies of the financial markets? The picture becomes clear via the daily chart in the electronic bond futures market.

As you view the chart below, notice that overall prices are in a trading range. They are really going nowhere. However, this is exactly the kind of market insiders love.

They know where the ceiling is and they know where the floor is. They dip down and run the stops below them and lunge up and run the stops below them. Those short move up and down are there because the pigs who run rampant in the bond futures love to run stops.

Of course, they call it "filling orders." And that is true. If you had an order below the market, they made sure it got filled and vice-versa for orders above the market. That is part and parcel with the Law of Charts. Remember, TLOC reflects the actions and reactions of humans to the movement of prices. In the case of the bond futures, the humans happen to be particularly piggish, and they love to eat stops. So, in the name of providing you with an efficient market, they go out of their way to fill all orders, even those trailing orders from a few days back, in order to give you a fill — even when you don't really want one.

"Well," they say, "if you don't want us to run your stop, don't put one in the market," knowing that this flies in the face of the rule that says, "always have a stop loss in the market to protect yourself."

If this sounds bitter, please realize that I'm not bitter. I've lived with the truth of stop running all of my trading life. My intent is to be a bit sarcastic in order to drive home a truth, which is: you're damned if you do and you're damned if you don't, insofar as protective stops are concerned. But even though your stop is likely to be run by the bond pigs, it's better to always have one. Oh, and by the way, using a mental stop is not going to do you any good. The pigs have an incredible sense of smell. They can smell your stop no matter how carefully you hide it, or how deeply you bury it in your mind!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - If you doubt, you may be out

It's almost impossible to have rock solid confidence as a trader. Sure, some traders can't be thrown off track very easily, but it's natural to feel a little afraid occasionally. Let's look at some of the reasons that you might feel shaken. What the markets will do tomorrow or next week is far from certain, and you don't have a crystal ball. Your information is fallible. And without perfect information, you are bound to feel a little uneasy when your money is on the line. In addition, there's always a possibility that something may go wrong. A media analyst may hype a stock you are shorting. And what about trading strategies? You can perfect a trading strategy only to see it fail when market conditions change without warning. If you lose your confidence occasionally, it's understandable.

Even a seasoned hedge fund manager can lose confidence. Consider what one hedge fund manager told us when we asked him about what underlies his self-doubt. "Fear of losing money and fear about the lack of validity of my research. It's perfectly natural. Just like in sports, the difference between the physical abilities of the top pros is virtually nil. But the mental difference is huge. The guys at the top in tennis, for example, are mentally consistent throughout the whole match. It's the same thing in trading. The psychology of professional traders allows them to stick to their strategies. They don't stress out as much as rookie traders. I still make mistakes once in a while, but not as often as I used to. It's impossible to eliminate all doubt. I still fall victim to doubt and other psychological pitfalls. I still have major doubts, but now I know how to control them better."

How did this hedge fund manager conquer his feelings of doubt? Gaining a wealth of knowledge is key. "It requires a combination of research and experience. After a while, making or losing a lot just did not seem to bother me. It became second nature. The other thing is learning to handle profits and the losses. With experience, you don't get as excited over them. After a while, you expect to experience the natural ups and downs."

When you experience self-doubt, don't make matters worse by feeling bad about feeling bad. Everybody experiences doubt at times. It's natural when trading something as chaotic as the markets. If you are a novice trader, feel solace in the fact that your self-doubt will subside after you sharpen your trading skills and gain a wealth of experience. And if you are a seasoned trader, it may be useful to remind yourself that everyone gets in a slump occasionally. Don't worry. You'll regain your momentum if you keep trading. The key to success is to remember that self-doubt usually leads to stagnation. When in doubt, don't panic, calm down, and think rationally. You'll eventually work through your self-doubt and return to profitability.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

TRADE WITH NO LOSSES

Here's our latest example!

WGO Trade

On 5th April 2018 we gave our Instant Income Guaranteed subscribers the following trade on Winnebago Industries Inc. (WGO). Price insurance could be sold as follows:

- On 6th April 2018, we sold to open WGO May 18 2018 30P @ 0.35, with 42 days until expiration and our short strike about 22% below price action, making the trade very safe

- On 26th April 2018, we bought to close WGO May 18 2018 30P @ 0.15, after 20 days in the trade

WGO went sideways after our entry. Our exit was possible thanks to time decay and a drop in implied volatility.

Profit: 20$ per option

Margin: 600$

Return on Margin annualized: 60.83%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - Don't give in to the death wish

The death wish is resignation, fatalism, dejection, despair — in the face of "luck" repeatedly turning against us. The death wish is admitting defeat and shrugging our shoulders and throwing up our hands (generally after a string of losses) and not caring from then on whether we win or lose. The death wish is throwing money into the pot fatalistically, to punish ourselves. It is saying, “I might as well keep throwing my money away at this point, because it doesn't matter anymore.”

The problem with the death wish is that it removes the brain's analytical, decision-making function from the equation. It also tends to magnify disasters. It takes a bad situation and kicks it up to the next level. It also misses opportunities, because its attention is so focused on the great sadness of its plight.

It may even miss the turn-around point — when things start changing and going the other way and getting better — so intent is it on making an airtight case concerning the sadness of its plight.

Try not to give in to the death wish. If a disaster starts to unfold, try as much as possible to keep it under control, not exaggerate it further. Try to salvage something from the trade. Scale back your involvement, or simply get out of the trade. Go for a walk. Go watch something on TV. Go do anything that helps clear your mind.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article - (Good) Trading happens outside your comfort zone.

After writing about why good trading usually is quite boring last week, I’ll continue down that road today and write about another similar topic.

And again it’s more of a rant that many of you maybe don’t want to read about. But I believe it really can be an eye-opener to those of you who’re really serious about trading and these are the traders that I care for the most. Actually I wish I had read this myself years ago, I had to pay a lot of money to the markets to finally really get this. Read more!

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.