Edition 769 - March 22, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Golden Cross

Hey Joe! What is a golden cross? Can you give me an example?

A Golden Cross occurs when the 50-day moving average rises to meet and cross the 200-day moving average. I suggest that we may soon see a Golden Cross take place in the gold market. I think that the bearish gold cycle that took the most significant part of 2018 may have ended in mid-October 2018. The outlook is much more bullish, and we are entering now an upbeat gold environment and so, a possible bright future for gold in 2019. I am supporting my thoughts on the final crossing of the $1,250 per Oz resistance experienced last year, which is an essential technical bullish confirmation.

This crossing led me to predict that gold is about to form a "golden cross" during the first quarter of 2019 as shown in the chart below:

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Don’t be Frustrated

How well have you been doing in the markets these days? There have been many opportunities in the past few weeks, but an abundance of market opportunities, don't always guarantee success. Setbacks can be the rule rather than the exception when it comes to trading. Discovering reliable trading strategies is a challenge, and frequently, a promising strategy produces a series of losses, especially under new market conditions. Losses and other setbacks can be frustrating and anxiety provoking. If you are expecting to win because the markets have been showing new highs, you can feel especially frustrated when you don't meet your expectations. As much as you don't want to be fazed by these setbacks, it can be difficult. When you face setback after setback, it can be hard to pick yourself up. It's tempting to give into the frustration and feel beaten by the pressure. The only way to make it, however, is to pick yourself up and keep trading the markets with a fighting spirit.

In order to keep up a fighting spirit, it is vital to have high frustration tolerance: No matter how many setbacks you face, you must keep going. Maintaining a fighting spirit is largely a matter of having the proper mindset. People with low frustration tolerance tend to believe that they should never experience a setback and that if they experience a setback, it is impossible to overcome it. But this mindset will get you stuck rather than moving ahead. It is essential to constantly remind yourself that setbacks are a natural part of life. Indeed, if you are trying to succeed at trading, you should expect setbacks. Instead of dreaded events, challenges and setbacks can be viewed as part of the excitement and stimulation of living. When you face a setback while trading, you should view it as an opportunity to learn and develop your trading skills rather than a discouraging obstacle. Merely changing your viewpoint regarding potentially frustrating events can significantly change the outcome of your trades.

A proper attitude is one of the best ways to prevent feelings of frustration, but it is also important to build up physiological defenses. Every time you face a setback, it can take a great deal of energy to cope with it. Each setback uses up physical and mental energy, and if you are not careful, a series of setbacks can wear you out. By getting plenty of rest, and especially sound night's sleep, we can cope with frustration more easily. Regular exercise and proper nutrition can help your body create a natural defense against frustration. It is also important to set realistic expectations. You will feel especially frustrated when you set unrealistic expectations and fail to meet them. By realizing that no matter how optimal the market conditions, profits are never guaranteed, you'll feel more at ease when you encounter setbacks. You won't be caught off guard, and you will be ready to deal with them. It may be discouraging at times to continually face setbacks, but it is necessary to learn to deal with them.

READ MORE OF JOE ROSS' BLOG POSTS!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

CBOE Trade

On 24th February 2019 we gave our Instant Income Guaranteed subscribers the following trade on CBOE Holdings Inc. (CBOE). Price insurance could be sold as follows:

- On 25th February 2019, we sold to open CBOE Apr 18 2019 87.5P @ 0.90, with 53 days until expiration with our short strike about 9% below price action.

- On 15th March 2019, we bought to close CBOE Apr 18 2019 87.5P @ 0.45, after 18 days in the trade even if CBOE was mostly going sideways during the life of the trade

Profit: 45$ per option

Margin: 1750$

Return on Margin annualized: 52.14%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Diversification

Diversification is one of the crucial factors in the success of some, but not all trading plans, and may in fact make the difference between…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

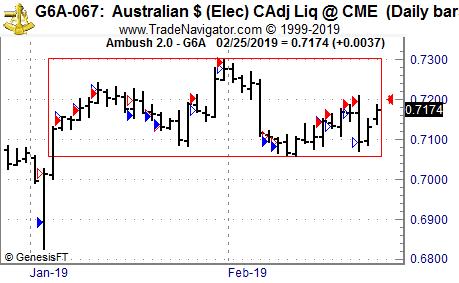

Ambush starts off with big profits into the year in the Australian Dollar!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Australian Dollar Future (6A) traded at the CME, where Ambush Traders are having an amazing time so far in 2019.

Ambush day trades on an end-of-day basis so there is no need to even check the markets during the day.

So let’s have a look at what happened in the Australian Dollar so far this year. Early January the market tried to break out to the downside and Ambush got in at a very low price level at around 0.6900, exiting above 0.7000. Since this false breakout as you can see not too much happened. The 6A just kept on moving in tight ranges and has been trading between about 0.71 and 0.73 for two months now.

Good news is that Ambush still was able to capture some nice profits, often getting in at the top/bottom of a day’s range!

Once you realize that this isn’t that uncommon but that it’s exactly what the markets do most of the time don’t you want a strategy that works well under such conditions?

Where is the Australian Dollar going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

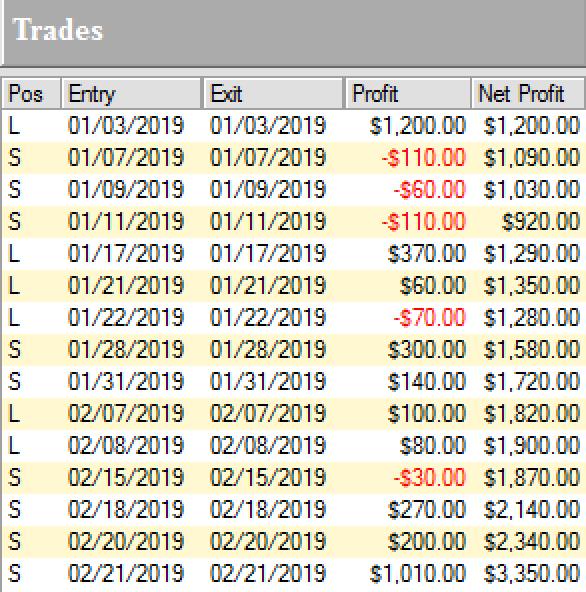

Here’s the result of all of these trades, trading one Australian Dollar Index (6A) contract, including $10 commissions/slippage per trade:

If you’ve been on the other sides of these trades trying to buy the breakouts, you really should consider switching sides!

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.