Edition 771 - April 5, 2019

LAST CHANCE!

LAST CHANCE!

Feel free to email Andy Jordan, This email address is being protected from spambots. You need JavaScript enabled to view it., with any questions about Traders Notebook

Sign up today to start receiving Andy's daily advisory newsletter

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: How is Gold Doing?

I’ve been asked many times whether or not someone should buy gold. This is especially true of people who are using a currency that is not the US dollar. What you need to look at is whether or not gold is rising or falling in terms of the currency you use for everyday living. You can easily determine which way gold is moving by looking at the ratio between your local currency compared with gold.

If it’s costing more and more of your local currency to buy an ounce of gold, then gold is in an uptrend for you, and you should consider buying it. For example, if I take the price of gold and divide it by the price of the euro, I can see that in terms of the euro gold is in an uptrend.

It is taking more and more euros to buy an ounce of gold.

Please realize that what we are showing is gold in terms of a currency. However, gold can be measured in terms of just about anything. What if we looked at gold vs the S&P 500 over a period of 20 years? Until just a short time ago, gold was in a downtrend relative to the S&P 500.

What if we look at gold compared with other commodities? How is gold doing from that view point.

I suppose we can say that how gold is doing, is relative to the context in which you are looking.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

SSYS Trade

On 19th March 2019 we gave our Instant Income Guaranteed subscribers the following trade on Stratasys Inc. (SSYS). Price insurance could be sold as follows:

- On 25th March 2019, on a GTC order, we sold to open SSYS May 17 2019 6P @ 0.20, with 52 days until expiration with our short strike about 27% below price action.

- On 2nd April 2019, we bought to close SSYS May 17 2019 6P @ 0.10, after 8 days in the trade for quick premium compounding.

Profit: 10$ per option

Margin: 350$

Return on Margin annualized: 130.36%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

LAST CHANCE!

LAST CHANCE!

Feel free to email Andy Jordan, This email address is being protected from spambots. You need JavaScript enabled to view it., with any questions about Traders Notebook

Sign up today to start receiving Andy's daily advisory newsletter

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: It All Comes Together

It is critical to develop a well thought out and organized trading plan. It is then important to have…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Is Natural Gas back to normal?! Ambush traders have one of their cash cows back!

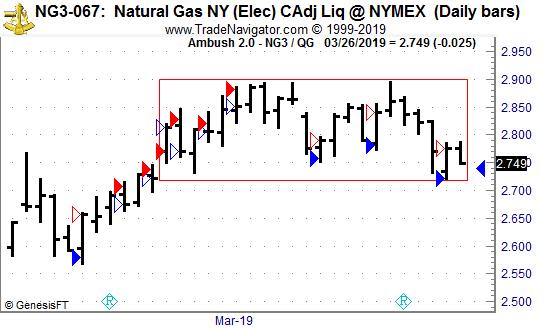

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Natural Gas Future (NG) traded at the CME, where Ambush Traders are cashing in again lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Towards the end of 2018, fundamental news caused prices in Natural Gas to go crazy with volatility levels almost 10 times above normal. This didn’t just put various funds out of business but also caused most Ambush traders to stay away from NatGas for a while.

Right now NG is trading pretty much where it traded before the hype and looks much more like the NatGas market we are used to again.

As you can see on the chart below it moves in boxes and has a lot of false intraday breakouts, perfect conditions again for Ambush:

With NatGas behaving normal again, Ambush results look great again too.

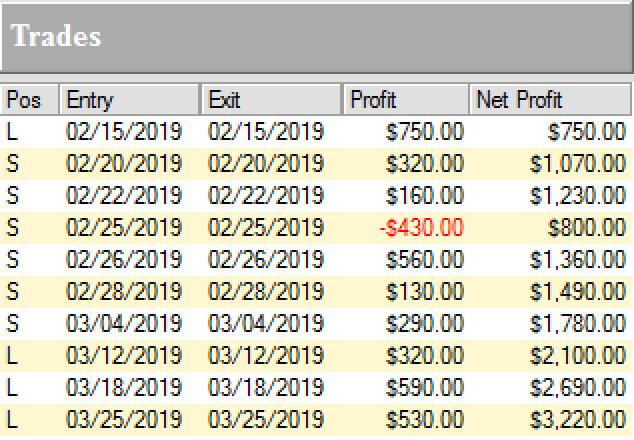

Here’s the result of all of these trades, trading one Natural Gas (NG) contract, including $10 commissions/slippage per trade:

Now if you’ve been the one making money on the crazy up-move just ask yourself how often that actually happens and if you wouldn’t rather be making money the other 95% of the time ;)

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

LAST CHANCE!

LAST CHANCE!

Feel free to email Andy Jordan, This email address is being protected from spambots. You need JavaScript enabled to view it., with any questions about Traders Notebook

Sign up today to start receiving Andy's daily advisory newsletter

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.