Edition 772 - April 12, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Where’s the #2 Point?

Hey Joe, what do they mean when they talk about “picks and shovels” companies?

"Picks and shovels" companies can make great low-risk investments. That's because these businesses provide the tools and services that support entire sectors.

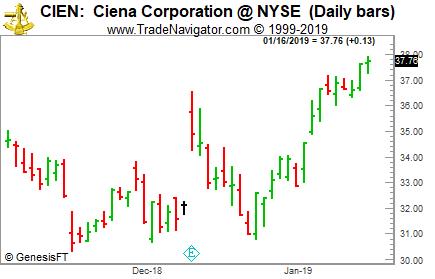

I can best answer your question with an example: Ciena (CIEN) is a $6 billion telecommunications supplier. It provides the hardware and software that runs broadband Internet, cable, and telecom networks. Although you may not have heard of Ciena, its partners include telecom giants like AT&T (T), Comcast (CMCSA), and Verizon (VZ). And as those giants compete for market share, Ciena keeps making sales... Ciena recently reported sales of more than $3 billion for the fiscal year 2018, a 10% increase from 2017.

As you can see on the chart at the time of this writing CIEN shares are up, too. The stock soared more than 60% over the past year, and it recently hit a new multiyear high. It's more proof that investing in picks-and-shovels companies is a solid strategy.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Strategic Trading

Successful trading is part reliable method and part mental edge. Without a sound set of methods and financial resources, it is impossible to trade profitably. Your method should also have a good track record, and it is essential to have enough capital to allow your method to work in terms of realistic position sizes and the number of losing trades you can afford to take before you hit upon a winning streak. But method is only part of the equation. You also need to approach trading with the proper mindset.

Trading can be a matter of probabilities. Even when you have accounted for all possibilities, there are times when the circumstances don't match up with your trading plan and you end up with a losing trade. For example, a company may miss earnings expectations, and from studying the products of the competition, you can arrive at the astute conclusion that the company's stock price is destined to decline. You buy to cover. But what you didn't account for was a popular media analyst talking up the stock and claiming that it was bound to hit new highs in the next quarter. The masses act on the report and the price goes up. What can you do? Rather than kick yourself for being wrong, it is prudent to take it in stride and move on. Trading the markets with assurance can be a matter of probabilities. You have to go where the markets take you and accept what happens. You cannot impose your will onto the markets, and when things don't go your way, you cannot take it personally.

Why do we take setbacks personally? Many times, it is how we look at the situation that dictates how we will feel about it. When we believe a setback happens because it was our fault, and circumstances cannot be changed, we will take the setback personally. A trader might think, for example, "I don't have the natural ability to make it as a trader. It's not the markets, it is me, and I will never master the markets." Psychologists call this kind of thinking "helpless prone." When we make a failure a big deal, we cannot help but feel pessimistic and helpless. Instead of falling prey to a sense of hopelessness, you need to develop an action-based, realistic plan for overcoming obstacles. You must work under the assumption that you can achieve your goals if you put in enough time and effort. What is wonderful about the trading profession is that it is only about the markets and you. There is no supervisors or customers to please. It's not about overcoming interpersonal or institutional factors.

Accept personal responsibility when appropriate. The method you use to trade the markets is your responsibility. You must decide to use a sound method. You must decide to carefully manage risk to ensure your long-term survival. You must decide to put in the necessary effort to find high probability setups. But you can't control the market action. You can't control how much public interest there will be in the market you are trading. You can't control the extent that unexpected news or unexpected world events may influence prices. Assuming you can control everything will make you "helpless prone." Once you have taken every precaution and trade with a sound method, you can limit the amount of risk on each trade and make a profit across a series of trades. Rather than mull over the outcome of a single trade, you can coolly move on to the next trade. And when you take losses and setbacks in stride, you will be more likely to trade freely, creatively, and profitably.

READ MORE OF JOE ROSS' BLOG POSTS!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

RGLD Trade

On 1st October 2018 we gave our Instant Income Guaranteed subscribers the following trade on Royal Gold Inc. (RGLD). Commercials had just become net long gold futures for the first time since 2001. Price insurance could be sold as follows:

- On 1st October 2018, we sold to open RGLD Jan 17 2020 65P @ 4.50, with 466 days until expiration with our short strike about 15% below price action.

- On 4th April 2019, we bought to close RGLD Jan 17 2020 65P @ 0.65, after 185 days in the trade for a nice profit of 385$ per option

This trade went comfortably through the sharp correction in December 2018.

Profit: 385$ per option

Margin: 1300$

Return on Margin annualized: 58.43%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Trading In One Market Than In Many

Develop a relationship with that market, as though it was one of your best friends. Know the market's personality and feel its…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Is Natural Gas back to normal?! Ambush traders have one of their cash cows back!

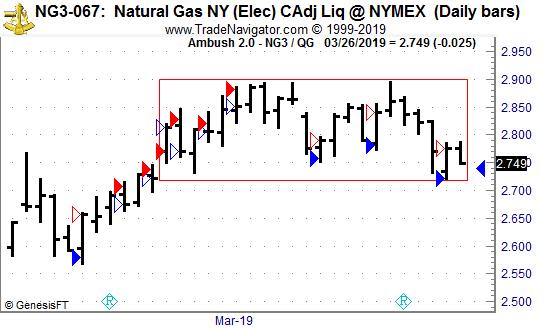

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Natural Gas Future (NG) traded at the CME, where Ambush Traders are cashing in again lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Towards the end of 2018, fundamental news caused prices in Natural Gas to go crazy with volatility levels almost 10 times above normal. This didn’t just put various funds out of business but also caused most Ambush traders to stay away from NatGas for a while.

Right now NG is trading pretty much where it traded before the hype and looks much more like the NatGas market we are used to again.

As you can see on the chart below it moves in boxes and has a lot of false intraday breakouts, perfect conditions again for Ambush:

With NatGas behaving normal again, Ambush results look great again too.

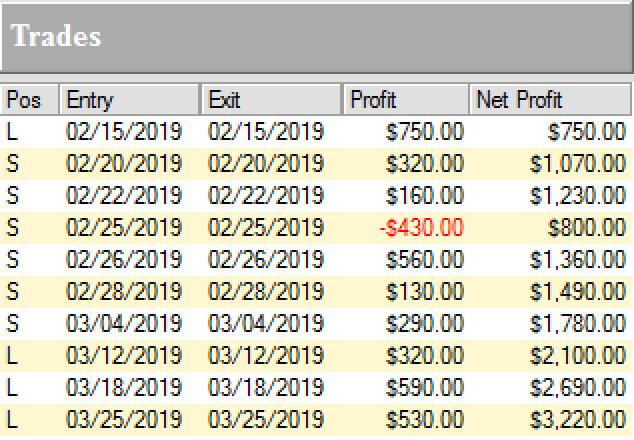

Here’s the result of all of these trades, trading one Natural Gas (NG) contract, including $10 commissions/slippage per trade:

Now if you’ve been the one making money on the crazy up-move just ask yourself how often that actually happens and if you wouldn’t rather be making money the other 95% of the time ;)

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.