Edition 785 - July 19, 2019

Futures Spread Trading is the best kept secret in trading!

CLICK HERE! Traders Notebook Complete

Coupon Code: tn50

6-Month and 1-Year Subscriptions - SPECIAL 50% OFFER

Offer ends July 30, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Volatility

Hey Joe! Implied Volatility(IV) still makes me confused.

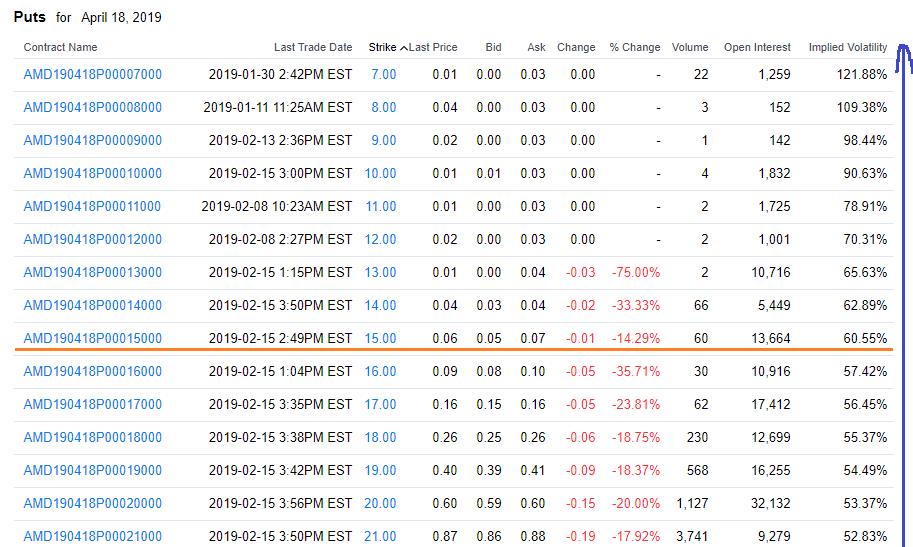

There is an example, AMD April 18 contract, 15 put option. The value of Implied Volatility(IV) is 60.55%.

I would like to know what 60.55% really is, whose 60.55%, how to compute IV?

Implied Volatility is what you get when you run historical volatility through an option model, applying the parameters of time to expiration; interest rates; dividends; and distance from actual price to the strike price.

If you learn how to make an option model, or study one of the existing models, you will understand what IV is.

Historical volatility is also a bit complicated. Normally, it is the distance between the high and the low of the time period being used. But then, how do you account for gaps? Is volatility the distance from yesterday’s low to today’s high? Is it from yesterday’s close to today’s open? Is it some other combination of high, low, open, close?

There is no agreement on this, but an average of historical volatility is what is input to an option model, spun around with the other factors I named above, in order to come up with Implied Volatility.

Please realize that HV and IV are not rocket science. Your guess is as good as anyone’s.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Stereotypes

Marvin has been following a company stock for the past year. It's a great company with solid management, high sales growth, and consistently high earnings. It is in a booming industry sector and a favorite of the media. After a year's...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

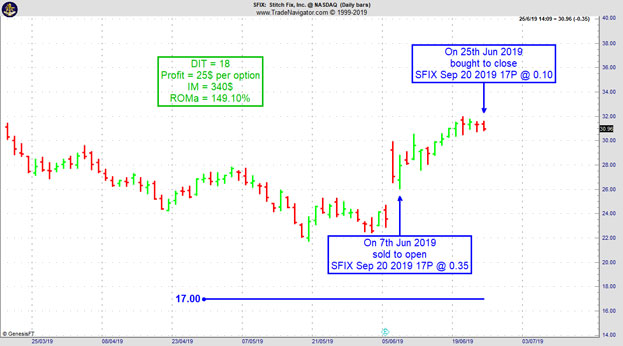

SFIX Trade

- On 7th June 2019, we sold to open SFIX Sep 20 2019 17P @ 0.35, with 42 days until expiration and our short strike about 37% below price action, making the trade very safe.

- On 25th June 2019, we bought to close SFIX Sep 20 2019 17P @ 0.10, after 18 days in the trade.

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

Futures Spread Trading is the best kept secret in trading!

CLICK HERE! Traders Notebook Complete

Coupon Code: tn50

6-Month and 1-Year Subscriptions - SPECIAL 50% OFFER

Offer ends July 30, 2019

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Admit when you are wrong

Recently I heard another tale of woe involving the failure to admit being wrong. This man followed a familiar path.

As a day trader in the E-mini S&P 500, he first contacted me…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Futures Spread Trading is the best kept secret in trading!

CLICK HERE! Traders Notebook Complete

Coupon Code: tn50

6-Month and 1-Year Subscriptions - SPECIAL 50% OFFER

Offer ends July 30, 2019

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Futures Spread Trading is the best kept secret in trading!

CLICK HERE! Traders Notebook Complete

Coupon Code: tn50

6-Month and 1-Year Subscriptions - SPECIAL 50% OFFER

Offer ends July 30, 2019

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.