Edition 800 - November 1, 2019

This is our 800th Edition Newsletter!

Master Trader Joe Ross won't extend this offer to just any trader!

Our 800th Anniversay Edition will be a special one!

OUR FIRST 8 TRADERS WILL RECEIVE

30% OFF JOE ROSS' PRIVATE MENTORING!!

SIGN UP TODAY!

Yes, I want 30% Off Joe Ross' Private Mentoring Services!

Use Coupon Code after we send you the payment link: 30=800

BUT FIRST!

Click below and complete Joe Ross' Private Mentoring submission form:

https://tradingeducators.com/contact-form-joe

LEARN MORE ABOUT MASTER TRADER JOE ROSS' PRIVATE MENTORING SERVICES, CLICK HERE:

https://tradingeducators.com/private-mentoring/joe-ross

OUR 80% OFF COUPON HAS EXPIRED : (

BUT!

YOU CAN STILL ENJOY A NICE DISCOUNT

40% OFF Recorded Webinars and eBooks!

Use coupon code during checkout: thanks40

HURRY! THIS DISCOUNT WILL EXPIRE SOON!

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Price Insurance

There is more than one way to think about selling put options. If you are strictly an option trader, you look at selling puts as a way to make money if prices remain sideways, or move up. You are a speculator. As a speculator, you might look at put selling as part of an overall option strategy involving one or more other options.

A person buying a put option can be either an investor or a speculator. As an investor, you want insurance against falling prices of the underlying you own. As a speculator you are hoping to profit from the premium earned if the put fails to reach the strike price of the put by the time the option expires.

At Trading Educators, we view selling puts as being in the insurance business. Insurance companies succeed to the extent that they are good underwriters of risk. With our Instant Income Guaranteed program (IIG), we strive to be excellent underwriters. We view the person buying the put as he/she getting what they want—either insurance, or as a way to speculate on falling prices. By selling puts, we give them what they want. So it is a win-win situation. Both buyer and seller are getting what they want.

Following is a recent IIG trade. We were in the trade 18 days. Our annualized return on margin of $120 was 168.98%. If you’re tired of the losses you take trading with other methods, give IIG a try.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: False Consensus Part 1

Traders and investors try to understand their world. They make hypotheses and test them. Rather than conducting formal...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

CF Trade

- On 19th and 20th August 2019, we sold to open CF Nov 15 2019 40P @ 0.825, with 86 days until expiration and our short strike about 17% below price action.

- On 11th October 2019, we bought to close CF Nov 15 2019 40P @ 0.15, after 53 days in the trade.

Philippe

30% Savings using coupon code: iig30

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

30% Savings using coupon code: iig30

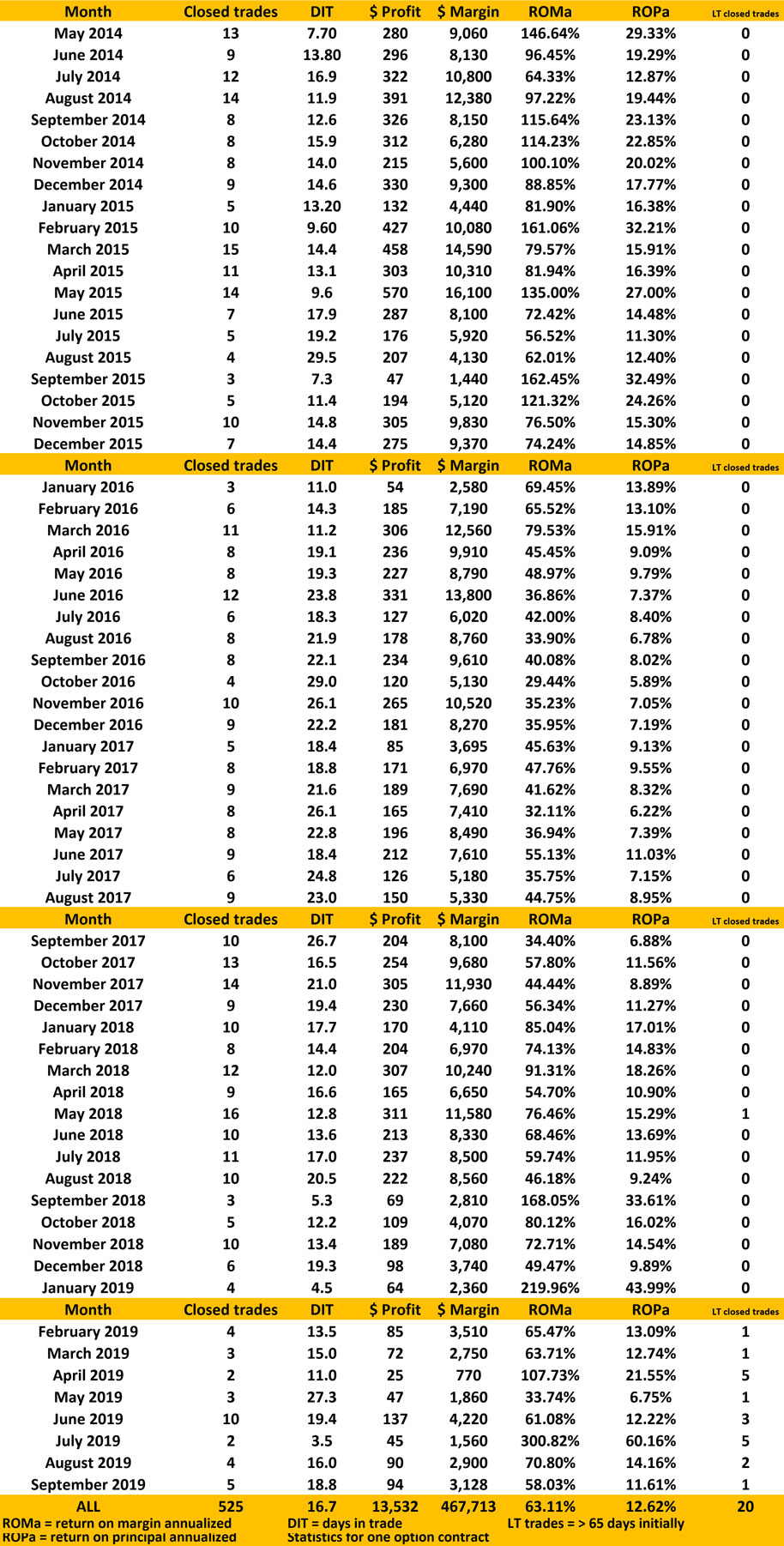

PERFORMANCE RECORD

SEPTEMBER 2019 TO MAY 2014

INSTANT INCOME GUARANTEED

Need more information? We want to hear from you.

Email questions to This email address is being protected from spambots. You need JavaScript enabled to view it.

30% Savings using coupon code: iig30

30% Savings using coupon code: iig30

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Self Control

To become a truly successful trader you must become a truly committed trader. How do you get yourself to be in control?

Statistics and society may predict, but you alone....read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

6-Months FREE when you purchase a 6-Month Subscription!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

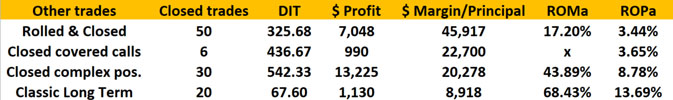

CHECK OUT PERFORMANCE SPREADS FOR TRADERS NOTEBOOK!

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Traders Notebook: How to Read a P&L Chart

Let's look at the P&L chart of all spread trade recommendations in Traders Notebook since January 2019. I would like to discuss a few things a trader should always check to see if a trading method or a specific way of trading makes sense. As we can see on the (hypothetical) P&L chart from below, the profit reached almost $15k:

- What does “$15k” mean?

- What was the risk?

- What about the draw-downs?

- Were there enough trades to see the results are statistically significant?

Let’s go through it, step-by-step:

A result of about $15k is kind of meaningless, as long as we don’t know how much money we need so we can get to this result. This is usually the point, where a good marketing specialist will look up how much margin was used to cover the trades and then he will probably tell you the following: “You could have reached that result with an account size of about $15k, Andy. As you can see, this means a return of about 100%! Isn’t that awesome?” But wait a minute. After the trades are done, it is always easy to calculate the optimized values to present huge profits. But what would have happened if there were more losing trades in a row? Well, easy answer: You would have been out of business! So, let’s have a look at the chart by ourselves and forget about the marketing guy. As we can see, the largest draw-down happened around trade 31 of about $5k. Is there a way we can have a few of these draw-downs in a row? Yes, of course. To be on the save side, we better look at the largest draw-down and we multiply this value a couple of times so we can resist even larger draw-down periods. How often we multiply the draw-down is of course up to each trader, but I would use at least 3 to 4 times the largest draw-down ($15k - $20k). Therefore, an account size of about $30k to $40k or even better $50k make much more sense to reach these results. And if we use for example an account size of $50k for our calculation, our profit is down to about 30%, which is by the way still pretty good in the world of “real trading” and not “marketing trading”.

Of course, you can take the trades also with a smaller account, let’s say with only $25k, but then you should also reduce your profit expectation, just to be not too disappointed after one year of trading. Especially beginning traders get disappointed when they make “only” 20% or 30% a year because they have statements like “I made 1 million out of $10,000 in just one year” in mind. But I can tell you, using good risk and money management parameters, these statements are all bogus.

If you still think the results shown on the chart above are pretty good and you would like to join me with Traders Notebook, I want to make you a special offer today.

Pay for a 6-month subscription and get a 12-month subscription from us! That's right, 12-month subscription for only the 6-month subscription price!

Click here to purchase Traders Notebook 6-month subscription.

I think that’s a pretty good deal, isn’t it?

Wishing you all the best with your trading,

Andy Jordan

Editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Manual Backtesting Pitfalls

If you don’t want to learn how to backtest automatically right now but still want to profit from backtesting, you got to do it manually. That’s how I started too many years ago. I still remember sitting there with printed charts and writing down trade results on a separate sheet of paper.

Now there are some pitfalls you better...read more.

Marco Mayer is an Educator for Forex, Futures and a Systematic Trader, so if you have questions, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Check out Ambush Signals

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

CHECK OUT PERFORMANCE SPREADS FOR TRADERS NOTEBOOK!

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.