Joe Ross

Day Trading Forex

Master Trader Joe Ross shows you how he does it!

"I hate to see so many aspiring Forex traders losing their money. Why do they have to make everything so complicated when, in fact, it’s not at all hard to win? In this eBook I show you trips and traps of Forex day trading. You need to know them in order to avoid the fate of so many other traders." ~ Joe Ross

Message from Joe Ross

I’ve been trading Forex for many years, even before there was such a thing as retail Forex, and before more and more people decided to become Forex traders. Trading Forex is heavily marketed and popular, but it is also deadly. The correspondence I receive attest to the fact that most people who attempt to day trade Forex are losing their money. The turnover rate is atrocious. Because of the pain I’ve seen, I decided that I will show you how I day trade the currency pairs.

Learn where to find more safety in your trading, and where the greatest Forex profits are made. The Day Trading Forex eBook gives you detailed answers to vital questions, such as knowing which currency pairs to trade, which time frame to use, and where to set your profit-taking objectives and your protective stop.

Day Trading Forex Highlights and What You Can Learn:

Chart Reading – The Law of Charts

You will learn to identify the basic formations of The Law of Charts: what they are, what they mean, and how to trade them in the Forex market. You will see how I trade the Ross Hooks and consolidations. I reveal a fantastic way to implement The Law of Charts (TLOC), namely the Traders Trick Entry (TTE), together with simple ways of using it in your trading.

I always like to remind traders that "a chart, is a chart", and Forex charts are no different from any other kind of chart. Forex charts show you human emotional reaction to the movement of prices. It’s the same as with stocks or futures charts. As they say, "a picture is worth a thousand words." On that basis, you are going to find many thousands of words in this eBook. It will truly help you to understand and implement The Law of Charts in your trading.

Identifying Consolidations and Finding Trends

Are you aware that currencies trade sideways 85% of the time? Do you know how to make money when they are doing just that? Please take a look at the chart below: do you know what it means when prices have formed as between the two red lines below?

You will find the answer to that question, and many more. It is vital to recognize congestions at the earliest possible time. In fact, you'll see how to identify sideways markets before anyone else realizes they are beginning to consolidate. In order to do that, the book has been "loaded" with graphic examples.

Your Own Trading Plan

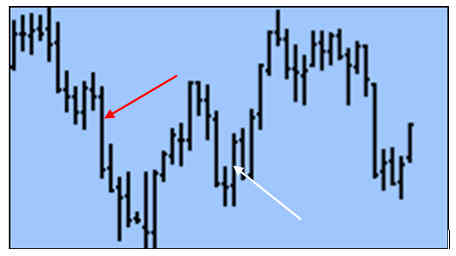

Please look at the chart below: do you know why someone sold at the red arrow and someone bought at the white arrow? You will find out why in a fascinating way, through the help of a single graphic representation. You will discover precisely where to have your entry order, what your initial objective should be, and where to best place your protective stop.

You will learn to set up your own trading plan simply by using price charts, and with almost no indicators. The ones used will greatly help you in filtering and managing your trades, but your main focus will be on the price action as seen on the chart. Charts will also help you figure out which pair to trade, and which time frame best fits your comfort zone.

Trade Management and the Costs of Running your Trading Business

It is not only risk management that you need to know about in order to successfully day trade Forex. You will learn other aspects of management, things that most traders ignorantly ignore. For example, you will learn how business management, risk management, trade management, and personal management are all part of the picture, not just money management. This information alone will save you thousands of dollars. You need to know the concepts and the realities of how a "bucket shop" operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills". It’s all true, as will be explained to you. You will also see that Forex trading is not without heavy overhead in the form of the spread you pay to trade. You will discover the most important things you need to know about Forex regulation and brokers.

Commonly Asked Question

What's the difference between the Day Trading Hardback Book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? The Day Trading book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

"Joe's Day Trading Forex book has been an invaluable source of information about the most traded market in the world. I got not only the proper way to trade this market with plenty of example and clear explanations but also how to create good habits to become a profitable trader. Truth is together with this book and Daytrading Joe's book I have been trading smarting and my account has benn growing since then slowly but surely." ~ Johnny A., USA

"I have been following the Joe Ross method for years. At one time I owned my own day trading firm and taught his method to my traders. Many used it successfully, others used their own method. The EBbook is very detailed and when followed gives you a direct, set of plans that you can write down and consistantly use." ~ Michael H., USA

"EXCELLENT practical outline of trading forex using the raw mechanics of the market (price action, order / flow, participant overview) coupled with proactive analysis, trade management, entry and exit techniques). Most notably, it works!" ~ George P., Australia

"I feel confident with the material because of Joe's age and experience in the market. I also feel his material is very simple to remember and apply in my daily reading of the market." ~ Steen N., Denmark

"As usual, another great work about markets, in this case Forex. Joe discovers new ways to trade Forex market, to manage risk and stablish profits." ~ Carlos L., Spain

"Joe as usual has great insights about the trading process. They're different from other run of the mill trading products or services." ~ Eugene T., Singapore

$127.00

Day Trading Forex

eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Day Trading Strategy with E-Mini S&P 500 eBook

"Day trading the E-Mini can be a full-time career for any trader; if you are going to day trade, you may need nothing more than the E-Mini. In this eBook, Joe Ross shows you a better, most sensible approach to day trading the E-Mini, based on my own trading experience." ~ Joe Ross

The E-Mini has become the premier market for day trading by retail traders and can be a full-time career for any trader. Day Trading the E-Mini S&P 500™ eBook introduces techniques and methods for day trading the E-Mini S&P 500 futures developed by Joe Ross. After you absorb these lessons additional trading education is available via books, webinars and private tutoring to become a profitable E-Mini day trader!

What do you need to get started with E-Mini trading? For the most part, all you need is a set of charts. No technical studies for trading this market are needed. By the third or fourth bar inclusive of and following the opening, you can sit back to enjoy the fantastic trading patterns made by the E-Mini as it marches towards its session close. Find these secrets in the Day Trading the E-Mini S&P 500™ eBook.

The Day Trading the E-Mini S&P 500™ eBook will teach you:

- Preparation – plan for success

- Steps to prepare each day for when the market opens.

- What considerations to look for early.

- How to think like a “market mover” and see through the charts.

- Set healthy expectations and use sound trade management.

- Expectations – the right mindset is crucial

- Learn to understand market situations.

- Learn to form healthy expectations from each day and situation.

- Learn when to trade and when to stay away.

- Tools of the trade – execute trades successfully

- Chart reading – learn how to read charts and understand reasons prices are moving.

- Trade selection – review the trading session and entry signals. Successful day trading strategy relies largely on trade selection.

- Trade management - learn how to set objectives and how to set protective stops, including how to know when to exit immediately.

- Timing – is everything

- Morning – learn when to leverage E-Mini trading in the morning.

- Afternoon – learn when to leverage E-Mini trading in the afternoon.

- Slow Times – learn what to do when markets become slow.

- Trading without indicators – is entirely possible

- Learn to trade with or without indicators on charts.

Take a Sneak Peek at topics included in Day Trading the E-Mini S&P 500™ eBook with the Table of Contents.

"Joe, I'm very glad that you spent the time to write a new actualized book on how to day trade the E-Mini. It reveals new insights on how to analyze that market and especially important on how to manage the trade properly. In my opinion it's a very helpful supplement to your hardbound Day Trading Book you wrote some years ago. I read all your books you wrote in the past regarding trading futures and I never regretted it. In fact, I learned so much from it I'd never had learned anywhere else. So, your eBook is no exception - great insights and extremely useful for becoming a successful trader. That eBook isn't for the shelve but really for the daily use on my trading desk!" ~ Stefan N., Germany

"Joe's approach is simple, straightforward and, most of all, it works. I've taken the same approach and applied it to forex and it works! I've purchased all of Joe's trading books and have never regretted a single purchase." ~ Chris H., Japan

"It’s good solid information...just as you would expect from Joe." ~ Alan B., France

"Just fabulous! Thank you so much Joe. After 3 years of trading, I'm finally coming out of the wilderness. I now understand exactly where I was going wrong. SO simple, but yet so difficult to see without Joe's help." ~ Eloise G., Australia

$127.00

Day Trading the E-Mini S&P 500™ eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

eBooks

We Offer a Wide Variety for All Levels of Traders and Markets.

Day Trading E-Mini S&P can be a full-time career for any trader; if you are going to day trade, you may need nothing more than the E-Mini. In this eBook we'll show you a better, more sensible approach to day trading the E-Mini, based on Joe's own trading experience.

Time: Short Term Trading Market: Futures

Day Trading Forex gives you detailed answers to vital questions, such as knowing which currency pairs to trade, which time frame to use, and where to set your profit-taking objectives and your protective stop.

Time: Short Term Trading Market: Forex

Stopped Out! The stop placement that makes sense. The question we are most consistently asked is "Where do I put the stop?" Therefore, this eBook is about stop placement. Most trading books and articles you read concentrate on entry. This book concentrates on exit. Knowing when to get out of a trade is vastly more important than is getting into a trade.

Time: Short Term Trading, Long Term Trading Market: Futures, Forex, ETFs/Stock

Money Master will show you how to retire with considerable wealth. This eBook presents a progression of thought and techniques in using the stock market that causes your money to work for you. If the content of this book were taught in schools, there could be an end to poverty for millions of people.

Time: Long Term Trading Market: ETFs/Stock

Money Making Options offers you two profitable ways to trade options.

Time: Long Term Trading Market: Futures, ETFs/Stock

Futures - From The Beginning arms you with vital information and insights - it will help you to get to the next level of understanding towards a more rewarding trading life.

Time: Short Term Trading, Long Term Trading Market: Futures, Forex

Testimonial

Read comments from a wide array of students and customers

who achieved success through Trading Educators

Trading Educators has three seasoned expert traders who are here to assist, manage, and simplify your trading. They understand their fellow traders and the obstacles they face in their trading growth. Let them show you powerful ways to maximize your trading potential.

Trading Educators has received thousands of grateful comments from satisfied students and customers in more than 25 countries. They have an unsurpassed track record of success in trading and in teaching all levels (beginner, intermediate, and advanced) of traders.

"I had the very good fortune to stumble across Joe Ross' works back in the mid 1990's and am therefor, one of the early "Ross Hookers." I have every hardcover book that Joe has written, a few I even had to reorder over the years as my continual page turning, writing on the borders and highlighting various things he mentioned, eventually became almost unreadable. So, when I would replace one, it would arrive and I would dive back into it for even more reads. While how many times one reads a book is not the objective, it's the successful application of what's between the covers, I have read each one an average of 2 dozen times over the past 35 years and still do today. Joe Ross has been my mentor ever since and I do want to come over for one of his seminars. I will look into the when and where of upcoming teaching seminars. I am no spring chicken myself at 79 years of age and I know Joe recently turned, I think, 86 or so. It's never too late to learn more. The more I learn the more I know that I don't know. This is why I stay joined at the trading hip of Joe Ross. He is a very great man to have shared all of his trading knowledge over the years. Without him I would have been just another casualty in the world of futures trading. Regards, John M., Texas"

"Joe Ross' seasonal spreads book is awesome! I finished half of it so far and knew the value there. His book had very simple concepts and loved it. My goal is to learn all Joe Ross has to offer! Old traders (saying it in a good way) stood the test of time and love to learn from them. Once I finished the next 2 books, plan to take some more courses he is offering."

~ K.R. Ohio, USA

(Testimonial for Joe Ross' trading book: Trading Spreads and Seasonals)

"Joe has provided everything imaginable to be a successful trader. Some area I need to apply myself with kindness and commitment. I will re-read Trading is a Business and utilize my Life Index. I am experiencing a courage problem." Kind regards, J.Z., Connecticut, USA

"Really like the Newsletter. Joe's Chart Scan is the only subscription I actually read in depth on a regular basis. Others are very quickly skimmed."

~ Bob C., USA

(Testimonial for Joe Ross-Trading Educators Chart Scan Newsletter)

"Dear Joe Ross, Please accept our heartfelt greetings and gratitude on this auspicious occasion of Guru Purnima. In our Indian culture, The word Guru literally translates to Teacher and the Teacher is one and the same with God.

Rightly so, You have imparted such life changing education so generously to students like my husband and you need to know how much of a positive impact you have had in our lives. My husband holds great reverence and respect for you sir, that not a single day goes by at our home without the mention of your name.

He was able to change his profession from being a chief engineer on a cargo carrying ship to a full time trader and he is now making a living out of trading which is all because of you sir!

When I hear stories from the other wives of these ship crew that their husbands are caught on board the ship for more than 6 months and sometimes 1 year away from their homes and families owing to this pandemic and restrictions regarding sign on and sign off, I feel thankful for having my beloved husband and the father of my 12 year old daughter at home all safe, well and all for ourselves.

Thanks to you sir, we are able to make a living out of trading and live comfortably in spite of this raging pandemic. I am sure a lot of families across the world are thankful to you, this is just a small gesture to express my heartfelt gratitude and love for such a magnanimous teacher such as yourself.

I am not sure if you have ever visited India, but if you ever plan to make a trip to India, please visit our home and we will consider it as a great blessing to host you and your family at our home. On this occasion, my sincere and heartfelt prayer to the almighty for a long, healthy and happy life for you and your dearest family and friends. God bless you sir and may He always protect you." Kind regards, M & V.G. Rajaram

"TN gives Ideas for new overall approaches to trade entries & trade management as well as ideas for individual trades. I like the way Andy explains his reasoning behind the trades he selects, gives me food for thought. The bite-size news stories are a handy heads-up for the fundamentals behind some of the market moves and Joes tips are always read and absorbed. Good to be able to chat with others in the same boat. To be able to direct any questions I have to Andy in real-time is a big benefit."~ R. F.

(Testimonial for Andy Jordan’s Traders Notebook)

"Joe, wow! This such good advice. My dad (recently departed) introduced me to TE many years ago, now I am 62 and trading full time and no more jobs available. So i have to make my trading functionally viable for survival. Without discipline, it will never work. Thanks for making great educational material and lessons available." Keith C., USA

"Hi Marco, I'm so impressed with AMBUSH, that I wanted to volunteer a testimonial that I hope will help others: I purchased Marco Mayer's Ambush System years ago before he offered Ambush Signals. AMBUSH is amazing. It's very simple and clear cut. No guesswork. Then Marco came along with AMBUSH signals. WOW! The signals have made it so simple and dummy-proof. I just wait for the email in the evening, log on, and presto. I just put in the numbers it shows and go watch TV! It takes me about 10 minutes and I'm done. I would HIGHLY recommend Ambush signals. I use them daily. I also wanted to include "stats" from my first month (January 2020) of Real Money TRADING. I started Jan 6th and did NOT trade on Monday Martin Luther King Day in the USA. I think you traded on that day. So that might be the only difference. I am trading the $100,000 portfolio as you set out with the exception of substituting the 6E (2) and removing the US Dollar as my broker won't let me trade it.

Total Trades = 60; Wins = 33 (55%); Losses = 27 (45%); TOTAL Net (after all commissions) = $5,085.84 profit; Keep up the GREAT work....."

Sincerely, DR

(Testimonial from Marco Mayer's Ambush Signals)

"Hey Joe, after now 12 Years until I first read your Books “Futures-Trading “, “Trading is a Business” and “Day-Trading” and many Years of Studying the Markets Day in and Day out and read your Books Time and Time again, (There is allways something New to find!) i want to thank you in this E-Mail that you shown me how the Markets really work! After so many Years I´m now Consistent Profitable! And you and your Books are one of the Reasons! Time and Time again you give your “EDGE” to all the Traders out there. THANK YOU Joe… God bless you."

Andreas

(Sorry that my English is not that good) A German Dax-Trader

(Testimonial from Joe Ross' trading books: Trading is a Business, and Day Trading)

“Thanks for all the years of education and encouragement!” Thanks again, Melvin A., North Carolina, USA

"Dear Joe, My name is Eric, and I am a student of you. I want to say thanks to you, Joe, because you taught me how to make money in the markets, without you, I can’t imagine it." Best wishes, Eric, China

"The Stopped out e-book is a Masterpiece, a book of great TECHNIQUES. My favorite topics - CCI, Volatility stop and ATR are great with in-depth explanation. Joe Ross is always my best author/tutor and his books are encyclopedia for my trading futures. Thank you for providing this book at this great age. Best wishes for a long life. JR trading books contains Great Wealth of knowledge with clear simple explanation, to the very point for trading. I am going to buy his "MONEY MASTER" and TRADING ORDER POWER STRATEGIES" next, why because the techniques shows are really happening in my trade. So, why do I purchase his books, they all contain real Trading Technics for trader's like me !!!!"

~ Perumal R., Malaysia

(Testimonial for Joe Ross' eBook Stopped Out!)

"Thank you for all your teaching over the years as it has helped me make a lot of money in a safe, organized and foundational way."

~ Brett Q., USA

"The method looks like it is a great one! Is the first time during my 4 years trading experience that I actually made some money!! The only important issue is that it needs to be done everyday in my experience, or to put it better, the order needs to be there everyday, because missing an important big money trade in the month can make the difference with the Ambush; this is what happened to me, when i started putting the orders daily, my account began growing slowly!"

~ Alberto, Italy

(Testimonial for Marco Mayer’s Ambush Method)

“Prof. Ross, can't imagine a world without your insight and wisdom.” Steve (USA)

"If I could turn the clock back to when I first started trading, I would begin private tutoring with Joe right from the start. His wisdom, knowledge of the markets and years of experience would have saved me from many years of struggle not to mention costly bad trades. I can already see the enormous benefits, not only financially but psychologically, by implementing his methods."

~ Anthony A., USA

(Testimonial for Private Mentoring with Joe Ross)

"Andy cuts through the jargon and makes it simple to understand, straight to the points that matter and that will produce results. The whole program was done at a suitable pace and with no pressure. I have come out with a good knowledge of how to find and select trades. I feel far more confident in myself, and look forward to a potentially profitable future. Highly recommended."

~ James M.

(Testimonial for Andy Jordan's Spread Trading Mentoring Program)

"Dear Joe, thank you for all your generous and wonderful contributions to the world!" Love and blessings, Linda, Colorado, USA

"Joe and Andy, Just wanted to let you know I really appreciate the trading tidbits in Traders Notebook. I look forward to reading every day... very relevant and helpful ...and yes spreads are my good trading friend now! Please keep it up! Thanks, Frank M., U.S.A."

“Dear Joe, I am glad that you teach people like me and we have a chance to learn it. All the best, much of health. Keep up what you do. Thanks.” J. Veselovský, Czech Republic

"Hi Joe, I can't say enough thanks. I just finished reading your whole book "Trading Is a Business" including the appendices. I'm so glad you included them too. What a gift you given us and challenge. Your book is doing such a wonderful job of challenging and encouraging me to be the best I can be. Do the work and love the process. Truly for me, trading is the best business in the whole world for me now. All my best, Richard"

(Testimonial for Joe Ross' trading book Trading Is a Business)

“Dear Joe, I am glad that you teach people like me and we have a chance to learn it. All the best, much of health. Keep up what you do. Thanks.” J. Veselovský, Czech Republic

"About the Trading with MORE Special Setups webinar: Very well-framed conceptual introduction. The recommended approaches are generally effective in my experience (I had previously arrived at my own variation on Gimme).

The real-world trading examples where JR presents scenarios and asks what you would do are OUTSTANDING. JR's presentation conveys authority, and is often quite amusing."

~ Charles S., USA

(Testimonial for Joe Ross' webinar Trading with MORE Special Set-ups)

"I really appreciate your service and the good information that I have received from you over the last year." Linda R., USA, Traders Notebook

"As an option seller, I've found this book to be very informative and essential for the way I prefer to trade. From personal experience, this book compliments Trading Optures and Futions. That said I think it's essential that Trading by the book and Trading Optures and Futions should be purchased together." ~ WG, USA

(Testimonial for Joe Ross' trading book Trading by the Book)

"Joe - First let me thank you, you have been a great teacher and I have learned soooooo much from your books and emails. I have been trading the YM (100 tick) and the ES (200 tick) off Ninja Trader and making good $$$$ using 1-2-3 formations. 1-2-3 formations work with daily, monthly, 5 minute and tick charts…. Again thank you, the small investment I made in your books have yielded me great returns.

~ Greg, USA

“Joe, the wisdom you teach us is the only source of my success in the markets . I am privileged to write you this short note. All the best! Roman R., Switzerland

“Joe's "Trading the Ross Hook" is by far the most important book for anyone in the trading business to read. It opened my eyes and has allowed me to understand the price mechanics of the markets. Literally, if you master the material in Trading the Ross Hook, you need look no further for information that will provide you with the ability to be a full-time, profitable trader. In my opinion as a successful, profitable trader, it is one of the most important works in the history of trading. Simple and applicable, what more could one ask?”

~ T. C., Canada/Manitoba

(Testimonial for Joe Ross' trading book Trading the Ross Hook)

“Dear Joe, I travelled to Texas to attend one of your lectures many years ago. I also have many of your books. Thank you for your trading wisdom. All the best, Peter B., Toronto, Canada

"The Traders Trick webinar is brilliant. Extremely helpful and immediately applicable. All was extremely clear. Previous webinars and Joe's experience and presentation style have convinced me to attend this one as well."

George P.

(Testimonial for Joe Ross' webinar Traders Trick - Advanced Concept)

Frequently Asked Questions

These FAQs are listed questions and answers from various e-mail correspondence between our trading students/customers, all supposed to be frequently asked in some context, and pertaining to a particular topic.

Links throughout the answers will guide you to further information on our website or from other sources. Should you have any further questions, please consult our Contact Us page.

Q: Can I make a living trading? Is it really possible to trade for a living?

A: Yes, it is possible. Our trading team is hard proof that it can happen and they have worked very hard to get where they are today. That is why, Trading Educators takes pride in developing educated traders who are independent thinkers. We want you to succeed as a trader. It is imperative that you first evaluate your financial situation and emotional state, as there has probably been a lot of marketing thrown at you to purposely get you off track. Stay away from "get rich quick" schemes, they don't work and only offer empty promises.

Next, take the appropriate steps to educate yourself, learn patience, which will then lead you to developing a trading plan, and most important is to test your trading plan by using a simulated trading program before going live with real money. Aligning your trading plan with a simulated trading program will put you and your plan to the true test. The overall average among professional traders is that they make 6%/month on the amount of money they have in their trading account. When you compound 6%/month the result is 100%/year, which is an excellent return. For example, if you have a margin account of $10,000, you should be able to double it in a year.

If you're new to trading, click here to start with Level, Time, Market, and Goal. For our intermediate to advanced traders, you should already have a trading plan in place, so take advantage of our One-on-One Private Sessions with one of our three Master Traders to evaluate and strengthen your trading plan. Joe Ross, Andy Jordan or Marco Mayer.

—

Q: Where do I put my stop?

A: There are many variables involved in stop placement and at Trading Educators, we believe it makes no sense whatsoever to use a fixed dollar amount, a fixed percentage of your account, or a fixed number of ticks or pips for stop placement. The markets change from one day to the next. Due to variations in volatility, no fixed method of stop placement is going to be any good in all situations. If you are asking "Where to place your protective stop loss at the time you initiate a trade" or "How much risk should I take when I enter a trade?", then you've got to start educating yourself further and deeper into trading materials. Those answers can only come from you.

Trading Educators webinars and private turtoring are your best options to help you with your trading plan. Our three master traders will guide you through your end result questions on the amounts for your stop placement in forex, futures, stocks, spreads, and options. We also show you how to figure out objectives, position size, determine which markets, and time frames you could trade in. There is no way for us to tell you how much risk that you can afford to take. Ask yourself the following questions, keeping in mind that these are tough and direct, so be very honest with yourself:

- What is my risk tolerance (level of comfort), emotionally, mentally, physically, or financially?

- How much money do I have or it’s intended use?

- What is my initial reaction under pressure?

- How will I behave during a winning or losing streak?

- Trading isn't predictable, so how will it impact my family situation?

- How will greed affect my trading?

- Fear plays a big role when it comes to trading, put yourself in these situations:

- Fear of missing a move.

- Fear of being wrong.

- Fear of losing money.

- Other moral and emotional fears.

- How will pride affect your trading?

These are just a few of the things that only you know about yourself. So when the question arises, "Where do I put my stop?" Remember, the answer solely depends on you and the steps you should take to educate yourself as a trader. It takes the will to learn, patience, and an understanding that this process won't happen overnight. But, if you've gotten this far into your quest as a trader, then you've come to the right place. Trading Educators has over eighty-seven years of combined trading experience, giving you the luxury of having all the necessary resources right at your finger tips. Through our products and services, we encourage independent thinkers and want you to succeed! Take the time to read through our website, and let us help you answer your own question of "Where do I put my stop?" Our recommendation to you is starting with Joe Ross' eBook "Stopped Out!" and One-on-One Tutoring with one of our three Master Traders.

—

Q: Is a Ross Hook that is also a doji bar valid?

A: A Ross Hook (Rh) is formed when there is a failure of prices to move higher (rising prices) or lower (falling prices), following the breakout of the #2 point of a 1-2-3 formation, or the breakout from any kind of consolidation. The Rh has nothing to do with location of the Open or Close of a bar, so a doji bar that becomes the point of a Rh, is as valid as any other bar that becomes the point of a Rh. Read more about Trading the Ross Hook.

—

Q: How long should a time stop be?

A: There is no definitive answer to how long a time stop should be. A time stop is completely subjective, and must be determined by the trader based on testing and experience within the chosen market and time frame. Some traders are content to wait longer than other traders. You simply cannot say a time stop should always be a certain number of minutes or hours.

—

Q: What is the difference between these three products: Day Trading Hardback Book, Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook? I already have the Day Trading book, will the Day Trading E-Mini and the Day Trading Forex give me more information?

A: The Day Trading Hardback Book is a full-size text book that is loaded with lessons, and examples taken from real trades. It reveals to you the many concepts you need to know to succeed at trading. It is really the first step in the process of learning to day trade.

The Day Trading E-Mini eBook can be used to learn how to day trade almost anything you would like to day trade. It teaches some concepts that go beyond what is taught in the Day Trading book. However, the focus of the book is specifically the E-Mini S&P 500. This eBook can be a second step in the learning process, or you can choose to jump ahead to the full 2-day Day Trading Webinar or Private Tutoring by Master Traders' Andy Jordan and Joe Ross.

The Day Trading Forex eBook teaches concepts not taught in either of the other day trading books. Although it, too, can be used to day trade a variety of markets, the focus is on currency trading in Forex, or currency futures. The Day Trading Forex eBook can be used as a second step in learning to day trade. Our students tell us that the 2-day webinar, or even better 3 days of tutoring with Joe Ross is a marvelous experience that will change your life and take you to the pinnacle of trading. You will never again see the markets the way you have in the past. You will know and understand how markets work, and how to make money in them.

Q: I have Analysis Paralysis. Can you help?

A: There are two reasons you have Analysis Paralysis. You can be the victim of one or both of the following:

- You don’t believe in yourself and what you are doing.

- You don’t believe that what you are doing truly works.

Trading Educators can't emphasize enough that you must regularly evaluate your trading plan to work through or shorten length of time while in analysis paralysis. You are on the right track, if 1) you acknowledge analysis paralysis, and 2) you are ready to break away from it. If you think that our Master Traders don't ever get analysis paralysis, then it's time to clue you in. Our Master Traders are constantly reading up on the latest market materials, and seeking out new resources which helps them evaluate their trading plans. This only pushes them further along into becoming better traders. Sometimes it good to start from the beginning, remind yourself as to why you started trading and celebrate the months, quarters or years where you showed a profit. Revisit a book or article that helped in your education or got you excited about becoming a trader. Try a fresh and new prespective, sort through the many products and services that fits your trading need. Learn with the best, you have the skill set, and we are here to help break you out of this temporary state of mind.

Q: What information do I need to trade?

A: This is a great question and Trading Educators is excited to walk right along side of you while you gain confidence in getting your answer. We have purposely set up our website to guide you through and answer questions along the way. We can help you determine which market(s) and style of trading that best suits your trading goals. Visit our home page and read through the four sections: Level, Time, Market, and Goals. We offer a wide range of products and services to help get your started such as books, eBooks, Webinars, Private Tutoring, and Daily Trading Advisory Programs. If you still have questions after visiting our site, feel free to Contact Us, so we may assist you.

—

Q: I have trouble Pulling the Trigger on a trade. Can you help?

A: There are two reasons you can't pull the trigger on a trade. You can be the victim of one or both of the following:

- You don’t believe in yourself and what you are doing.

- You don’t believe that what you are doing truly works.

We can help. It can be done in a number of ways:

- Read one or more of our eBooks or Hardback Books.

- Private tutoring with Master Traders Joe Ross, Andy Jordan, or Marco Mayer.

—

Q: Does "The Law of Charts" work in any market, any time frame or under all conditions: for example: a panic market or irregular price action?

A: A "Law" is not something that "works." A "Law"” is something that is always true. The question asking whether or not The Law of Charts works implies that The Law of Charts is some kind of system or method, and you want to know if it "works."

The Law of Charts as applied to prices describes in graphic form the emotional action and reaction of human beings to the movement of prices. Therefore, it ALWAYS "works" because as long as people trade markets, you will see the same basic patterns over and over again.

The Law of Charts "works" with any chart graphic that describes an underlying movement that has a range of values.

You can see the Law of Charts working on gas meter readings, water levels of a river or random coin flips, anything that has a range of values.

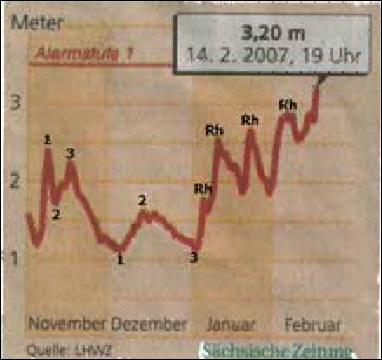

The chart below shows water level readings for the Elbe river in Germany.

In the case of gas meter readings, the impetus for what you see on the chart is consumption of natural gas, which will have a range of values because usage will vary seasonally. In the case of water levels in a river, the impetus will be the range of values that will vary due to water usage, and the amount of rainfall, snow-melt, or both.

In the case of coin flips the impetus is the pure statistical probability of a series of heads or tails.

Below is a chart of coin flips. In the case of price charts the impetus is human emotion as seen in the action and reaction of traders and investors to the movement of prices. If something is true, it is always true. The Law of Charts is always true—there is no way to get around it.

The purpose of studying The Law of Charts is to gain an understanding of how and why prices move to create 3 basic chart formations: The 1-2-3, the Ross Hook, or various types of consolidation. Whether or not you make money from this knowledge will be in direct accordance with how you implement that knowledge.

Electricity follows the laws of physics. But unless you implement the laws that govern electricity the best you can hope for is a shocking experience. With proper implementation you can turn a motor, generate heat, or create light.

The Traders Trick Entry (TTE) that we teach at Trading Educators is one way to implement the Law. There are probably dozens, maybe even hundreds of ways to implement The Law of Charts (TLOC). To learn more about the "Law," check out The Law of Charts In-Depth Webinar and during private tutoring we will reveal numerous ways to implement The Law of Charts.

—

Q: How much money do I need to trade full-size contracts in forex, futures, or anything else?

A: The amount of money you need is entirely determined by your broker. Follow this link for a broker referral.

—

Q: Ross Hook: How far can a RH be from point 2?

A: It’s kind of a judgment call, but you can read what Joe has done on page 300 of Trading the Ross Hook, where it states that the #3 point should be between 1/3rd and 2/3rds of a point 1 to 2 retracement. It is all going to depend on what works for you in the time frame and market you are trading.

—

Q: Trend Lines: Do you use 1-2-3 highs and lows; and Ross Hooks with trend lines to help buy or sell in better places?

A: The best thing we can recommend is to do what works for you. Joe Ross does not use trend lines nor does he use support resistance lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. He also does not use Fibonacci retracements and is aware of them, and uses them in an unconventional way. But, he doesn't trade based on them. The most important and only truth available for trading is the price bar directly in front of you. You can't trade the past and you don't know the future. Therefore, you must trade what you see.

—

Q: Support and Resistance: Do you use support and resistance to help you to buy or sell in better places?

A: Joe Ross does not use support and resistance. Nor does he use trend lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. Joe also doesn't use Fibonacci retracements and is aware of them, and uses them in an unconventional way. But he doesn't trade based on them.

—

Q: Fibonacci: Do you use Fibonacci ratios to get better entries for buying and selling?

A: Joe Ross does not use Fibonacci retracements, ratios, or confluence in his trading. He is aware of them, and uses them in an unconventional way. But he doesn't trade based on them. Nor do he use trend lines or support and resistance lines. He trades using a plain vanilla chart with no indicators or studies of any kind on the chart. That doesn’t mean that’s best for you. It’s best for Joe. You must do what works for you. Joe is aware of them, and uses them in an unconventional way. But he doesn't trade based on them. Fibonacci ratios, Gann ratios, the "Golden Ratio," and Elliott waves are all attempts to mathematically (scientifically?) trade markets that are both emotional and psychological. You cannot successfully or consistently apply mathematics to human emotional and psychological actions and reactions, which is why the field of psychology is a pseudo-science. The mathematical approach to markets is a vain attempt to put price action into a predictable box with known dimensions and parameters. However, markets do not behave in accordance with mathematics. Markets go wherever human emotion takes them.

—

Q: I’m concerned that my data supplier does not provide all the trades through their feed. I’ve heard that they are aggregating the trades and making an average of “X” number of trades. Can you explain?

A: There is one caveat with all data feeds. In order to make them appear faster, providers will typically aggregate trades. Joe Ross doesn't know of a single data provider that will, or even could show you every single trade, and even if they did, he seriously doubts that your computer would be able to receive every trade that was made. What you see on your screen is at best an approximation of the actual trading. Think about it for a moment. Let's put everything that is happening into slow motion so we can see what is really going on. As the prices come into your computer, they are cached for distribution. At some point your computer must distribute what it has saved in its cache. During a distribution phase, the computer is not receiving prices it is posting them to the screen. Although the entire process is taking place in fractions of a second, there is no way you could possibly receive all of the ticks. To add insult to injury, your computer is probably also doing other things. The operating system does things; if you have any kind of spam filter, firewall, antivirus, or program running in the background your computer is monitoring those other things as well. In the fractions of a second it takes your computer to pay attention to its other tasks, you are not receiving ticks sent out by the data vendor. Your computer is like a one arm wallpaper hanger. It can do only one thing at a time. Your concerns are without real foundation. Any data supplier has similar problems with their computer receiving prices from the exchange, and the exchange's computer has the same kind of problem distributing the data as your computer has receiving it.

—

Q: Which order type would be the best for let’s say Crude Oil or the EuroFX on a 5 or 3-minute chart?

A: There is no best order type for any market or time frame. The best order type depends on your strategy.

The type of order you use is one of the tactics you use to carry out your strategy.

- Do you absolutely want to be filled? If yes, use a market order.

- Do you absolutely want to be filled if prices reach a certain level or go through that level? If yes, use a stop market order.

- Do you want to be filled if prices reach a certain level, but not be filled at a price past that level? If yes, use a limit order.

- Do you want to be filled if prices reach a certain level, but are happy if prices are filled within a range you specify, but not be filled at a price past the specified range? If yes, you a stop limit order.

Keep in mind that limit orders and stop limit orders have no requirement to be filled. They can be passed right over and leave you behind with no fill.

—

Q: What does it mean when #2 point is very close to Ross Hook?

A: Most of the time it means you should expect sideway action to follow. Unless prices break through the Rh with force, you are probably going to see a consolidation area, with the #1 point of the 1-2-3 as the low of the area and the Rh as the high of the area.

However, the areas of so-called accumulation at the low and distribution at the high are not as long as in years past. This is due to people trading with indicators, which also causes markets to mostly swing instead of trend.

—

Q: Will your stuff work with tick charts?

A: Our "stuff" works with any kind of chart that depicts a range of values. Therefore, we have students who trade tick charts, range charts, volume charts, line charts, even point, and figure charts. One of the greatest traders we know uses our "stuff" to trade point and figure charts.

—

Q: I haven't been trading long and want to learn more about trading. Will I be able to understand your products?

A: If you are a beginner trader, the terminology may seem overwhelming at first, but as you start educating yourself, it will come easier. Click here to get a clearer path as to which market(s) and trading style that will best suit you. For intermediate and advanced traders, your biggest challenge will be retraining yourself from old habits. We are here to assist and help you learn the art of trading, email us with any questions, at any time.

—

Q: If I buy a product, will I need to continue to buy more products to learn to trade?

A: Learning to trade is a lifetime experience. Joe Ross has been in the markets for fifty years and says he is still learning. There are certain products you should want to buy to give you a proper foundation for building a trading career. How many you will need is something only you can know. It is highly doubtful that you will be able to read a single book and then become a successful trader. Trading is a serious business, one in which you cannot afford to make many mistakes. The more time and money you spend on building a firm foundation, the greater will be your chances for success.

With proper preparation, trading can make you wealthy. Without adequate preparation, it can make you poor. Whether you succeed at trading, depends in great part on how much you are willing invest in your education. If you’re not willing to invest in yourself, you are probably better off putting your money in a mutual fund and hoping for the best.

—

Wishing you all the best and happy trading!

From the Trading Educators Team

Contact Us

If you have any questions or comments, please feel free to contact us. We are here to assist you.

Office hours: Monday through Friday 9 A.M. to 5 P.M., U.S. Central Time. We will respond to all emails as soon as possible, and usually within one business day.

Behind the Scenes

Trading Educators

Li Quanzhong

Manager of Trading Educators in all Chinese speaking Countries

Li,Quanzhong is our manager of Trading Educators in all Chinese speaking countries: China (Hong Kong, Macao, and Taiwan), Singapore, and Malaysia.

When Mr. Li first read Joe Ross’ books, he valued the truth and quality of the trading lessons in them, something he had not found elsewhere. Although he was already a successful trader, he came to America to be individually tutored by Joe. He then developed a profitable way to adapt Joe’s methods to the Chinese markets.

In 2007 he began to translate Joe’s books and seminars into Mandarin, the first person to introduce them to non-English-speaking Chinese traders.

From his studies and his own successful experiences, Mr. Li also teaches seminars and privately tutors traders on how to trade according to Joe’s methods. What he tries to teach students is not only how to make money, but also how to become a successful trader.

Loretta R.

Editor-in-Chief

Loretta is known as “SC” in Joe’s book, "Trading Is a Business." She is Joe’s wife of over 60 years, and will always be our honorary Editor-in-Chief. Loretta has stopped proofing everything for us, but Trading Educators would not be where it is today without her.

Martha R-E

Owner

Martha, the daughter of Founders, Joe and Loretta Ross, is currently the Owner of Trading Educators, Inc. and ensures that the company continues to be relevant in today's market place while maintaining the integrity on which the company was built.

Trading Educators Team

Quanzhong Li

Manager of Trading Educators in all Chinese speaking Countries

Quanzhong Li is our manager of Trading Educators in all Chinese speaking countries: China (Hong Kong, Macao, and Taiwan), Singapore, and Malaysia. When Mr. Li first read Joe Ross’ books, he valued the truth and quality of the trading lessons in them, something he had not found elsewhere. Although he was already a successful trader, he came to America to be individually tutored by Joe. He then developed a profitable way to adapt Joe’s methods to the Chinese markets.

In 2007 he began to translate Joe’s books and seminars into Mandarin, the first person to introduce them to non-English-speaking Chinese traders. From his studies and his own successful experiences, Mr. Li also teaches seminars and privately tutors traders on how to trade according to Joe’s methods. What he tries to teach students is not only how to make money, but also how to become a successful trader.

Loretta R.

Editor-in-Chief

Loretta is known as “SC” in Joe’s book, "Trading Is a Business." She is Joe’s wife of over 50 years, and is editor-in-chief of everything that comes across her desk. Trading Educators wouldn't be where it is today without her.

Denise R.

Director of Sales & Customer Service

Denise is Joe's and Loretta's daughter-in-law, and owns Ross Trading Inc. and is Co-Owner of Trading Educators, Inc. Denise is often the first point of contact for service, problem resolution, and orders. When you need great service, Denise is your go to person.

Martha R-E

Director of Marketing

Martha is Joe's and Loretta's daughter, and is Co-Owner of Trading Educators, Inc. She handles the website, marketing, social media, and provides support for our franchise partners. Martha ensures that Trading Educators continues to be relevant in today's market place while maintaining the integrity on which the company was built.

Professional Trader Andy Jordan

Andy Jordan

Educator for Futures Trading Strategies in

Spreads, Options, Swing and Day Trading.

Andy Jordan made his first Options trade at the age of eighteen. Since then, he has been fascinated by the world of trading. In 2002, he met Joe Ross, and became interested in Spread trading. Andy was then intensively tutored by Joe Ross and other personnel at Trading Educators.

Over the years, his trading knowledge became more broadened by adding Options and Swing/Day Trading to his repertoire. He successfully administered a daily Spread Trading newsletter called Traders Notebook.

Andy's trading philosophy is something he learned within his first year from Joe Ross and that was discipline makes all the difference in trading. A trader must be able to follow their trading plan 100% and therefore the trading plan, and all of its components, has to fit the trader's mentality.

“Simplicity” is the word that Andy feels it describes best for what you need to look for in trading. A simple trading approach doesn't give much room for mistakes or doubts and allows execution with trades following a very disciplined trading plan.

Too many traders believe that the “holy grail of trading” can be found with some magic indicators or some unbelievable reliable chart formations. They completely overlook the main factor in trading: themselves!

Learning how to trade takes time. It takes time to learn the basics, but it also takes time to find out who you really are and what kind of trading best fits your personality.

Trading Educators and Joe Ross is the place where Andy's successful trading career started a long time ago. Start your trading career right here; you are in the right place!

In addition to his trading, Andy has developed several trading systems with exceptional track records. The most recent one, Stealth Trader, is a very robust breakout system which works in numerous markets without the need of adjusting any parameters.

For those interested in one-on-one personal coaching, Andy has developed and instructs a one-month online mentoring in "Trade with a Pro," program in which he demonstrates all aspects of trading from choosing the trades, learning how and when to enter the trades, manage, and exit the trades. In this one-month mentoring, he also thoroughly covers the psychological side of trading, which plays a major role in trading.

Andy Jordan was born in Germany in 1965, and currently lives in the Caribbean. He majored in mathematics and business administration in Regensburg and Hagen, and holds a PhD in mathematics.

Invest in yourself and visit Andy's private mentoring page!