Joe Ross

Day Trading

A Complete Day Trading Course in One Book

"Joe and I have been friends for some time. We have collaborated on trading techniques, so I know of his dedication to the market. But in this book we see the other side of Joe -- the instructor of the grand style. He is teaching us "How to Fish." ~W. E. Dalton, MD

This book is a must-read for every serious day trader. It's the essence of Joe Ross' experience of well over five decades of trading the international markets. Although the focus is on day trading, it teaches you methods and concepts that are applicable in position trading as well.

Many traders fail because of a wrong mindset and the fact that they don't know where to start or what to expect as an outcome. This could be the most important book you’ll ever read. Joe has organized it in a clear, step-by-step manner. Instead of being overwhelmed, you'll have a clear trading plan. You'll know exactly where to start, what to do next, and where you can realistically expect to end up.

Day Trading Highlights

Chart Reading

This covers what you need to know about the "Law of Charts" and the simple tricks of how to use it in your trading. "A chart is a chart is a chart." The immediate psychology of a market is reflected in the price action. You don’t really need any indicators. We'll show you how a bar chart can reveal very powerful price patterns when you understand the proper interpretation and implementation.

Identifying Congestions and Trend Finding

In trading, it is equally important to be able to recognize congestion at the earliest possible time, and to identify a trend before everybody else sees that it is happening. We call it "identifying a trend while it is still in the birth canal," and shows you several methods of doing just that.

Markets are in congestion areas much longer than they are in trends. The early parts of the book center almost entirely around congestion areas, which may be seen on any chart in any time frame. Later in the book, the concepts and the techniques taught center around trending formations.

Let us show you how to spot the very beginning of a trend, and how to successfully enter existing and established trends. You will see and learn very simple and basic ways to trade. The main features of our methods show you early in the game what might happen next, and thus gets you on board a trend while it is "still in the birth canal."

Your own Trading Plan

You will find out if day trading is or is not suitable for you. It takes certain character traits and certain trading techniques to be a successful day trader. We'll described these, and also how you should combine them so that you write and follow your own trading plan. You will understand why you must want it your way, and why you should take only trades that "have your name on them."

The trading plan includes all the preparation and the actions you will take, such as: establishing entries, all potential orders, setting alerts, accommodating for gap openings, and, if you are filled, what you do until the exit of all your contract sets.

Trading Mindset

In Joe's unique way, he shows you how your own mind can help you become a successful trader or can break you apart. Trading is mainly a psychological endeavor, and the way you perceive the markets, coupled with your emotional reactions, actually determine your success or failure as a trader. It's simple advice to anyone who wants to trade: work to learn how to understand price movement.

By using powerful real life examples, we can demonstrate why trading has to be simple, despite the example of most traders who are in a never-ending search for complicated methods. Also, demystifying several relevant, but confusing concepts, such as those of "support and resistance," "oversold and overbought," and some of the overly used indicators that are not needed in order to trade profitably.

Entry Signals

We reveal major, minor, and intermediate intraday trading signals showing you exactly what they are, and explain why they are important. When you day trade, you want explosive moves after your entry. It is therefore crucial to scale down entry signals based on different time frames so that you get the greatest magnitude of movement once in the trade. This is a unique approach that has been developed and refined over decades of trading.

Searching Out the Best, and Trade Filtering

One of the most important things that any trader can learn to do is to identify the best trades. These can differ from one person to another because we see trades differently, and not everyone trades in the same way. But everyone can learn to recognize what happens in the markets that result in successful trades. Then the trick is to stick to it like glue - until it stops working.

We'll show you exactly what to be comfortable with, while keeping your trading as your own. Examples going into full details of how you should see the whole trade setup, how to think, and select the trades, so that you can adapt that knowledge to your own comfort level.

Let us explain how a trading filter serves several purposes. You will learn how to use a trading filter to calibrate your stop, and to avoid false breakouts as well. You will be able to anticipate breakouts, and thus get into the trade earlier than you might otherwise have done.

Risk and Money Management

We will show you one of the finest points of Joe Ross' trading: his philosophy of money and risk management. These two concepts overlap, and yet they are different. Risk management says "I can afford to risk only so much," while money management asks "What can I expect to make for the risk I have taken?" You will understand why he says that trading is a business and why, the sooner one treats it that way, the sooner one will become a winner.

Placing Stops

The most frequent question we have been asked at Trading Educators is "Where do I put my stop?" Stop placement is a function of a number of variables. There are three kinds of stops: protective, objective, and time stops. It is vital to understand the role of each of these stops and to use them accordingly within your own trading plan.

Unfortunately, most traders place stops where they don’t make any sense, such as at a certain percentage away from the entry. We'll teach you how to place your stops in a practical manner that takes into consideration both technical factors and your own comfort level.

Brokers and Commissions

There is nothing more important in day trading than to have a responsive, accurate, reliable broker handling your account. Offering you several real-life examples of our experiences with brokers that will really make you think. He helps you consider all the vital factors such as commissions, margins, speed of execution, and reliable customer service when you desperately need it.

You will understand why brokers are in this business. You really need to know how to take advantage of your broker’s strengths, and how to avoid losing money because of their weaknesses. You will learn how to choose a reliable broker and build a solid relationship with him or her, one that works well for you.

E-Mini S&P 500 Trading

We dedicate a section to traders who like to day trade the E-Mini S&P 500, but starts it with a word of caution: we have seen too many otherwise good traders destroyed by trading the five-minute chart in the S&P E-Mini. Getting into the E-Mini is like stepping into the ring with a rattlesnake: you can be bitten quickly, and when you least expect it.

We will show you several examples, so that you realize that trading with the short term charts requires making decisions quickly. You have plenty of examples of preparation for the trading session, entry signals, and trade management. You learn why you don’t have to trade too often and too much, especially when trading the E-Mini. We'll also show you why trade selection is in large part responsible for trading it successfully.

g>Forex Trading

You will learn what Forex is, why it exists, and the main terms that characterize a forex trading account. We then tell you the most important things you need to know about forex regulation and brokers. You need to know the concepts and the realities of how a bucket shop operates, about the leaning and skewing of prices, as well as the myths of "free streaming data" and the "guaranteed fills".

There is a full chapter dedicated to a forex method that Joe Ross uses. You will learn in detail the 19 rules of the method, and be guided through preparation, entry, risk management, and profit management. There are several chart examples and detailed instructions accompanying each rule.

Day Trading and Position Trading

At the beginning of the book, Joe takes you through the definition of day trading, and compares it with position trading. We'll show you the similarities and the differences between the two. You learn the advantages and the disadvantages of each of them. You discover the benefits of one over the other. But most importantly, you learn that "a chart is a chart is a chart," and that's why the techniques and the concepts shown in this book work in both day trading and position trading.

Day Trading is a complete revision of Joe's classic Trading by the Minute, one of the most popular books on intraday trading ever written. It has become a classic in its time. This revised book is a day trading course that is a "must read" for online day trading.

If you are an online electronic day trader, you will refer to this book time and time again. Joe has taught thousands of people how to day trade.

Commonly Asked Question

What's the difference between the Day Trading book, the Day Trading E-Mini S&P 500 eBook, and the Day Trading Forex eBook?

The Day Trading hardback book is a full-sized textbook that is loaded with lessons, examples taken from real trades, and reveals many concepts to succeed at trading. The Day Trading E-Mini S&P 500 eBook teaches you how to day trade in almost any market, along with some concepts that go beyond what is in the Day Trading book, and focuses specifically on the E-Mini S&P 500. The Day Trading Forex eBook teaches concepts that are not in the other two products; it can be used in a variety of markets, but focuses on Forex.

Learn Master Trader Joe Ross' Tricks and Inside Information from this Book

"I would recommend Joe's book on day trading to anyone interested in learning about this subject and wants to hear about it from someone who practices what he preaches. It is apparent from the book that Joe knows the reality of trading markets rather than the theory. I have recently assessed my trading for the last 3 months and am beginning to (at last!) turn in a profit. This is due partly to the help given in this book. Thanks Joe!" ~Jon Martin

"This is a WONDERFUL exposition of what it takes to be successful in the trading profession. Rich in its descriptions of proper ATTITUDE, THOUGHT PATTERNS, and SELF-KNOWLEDGE --- all of them the keys to profit. Just as valuable is Joe's placing indicators, high-powered math, statistics, and complex theory in their proper perspective, namely that they are typically DISTRACTIONS rather than aids, in comparison to learning THE DETAILS of price action. In the same vein, Joe emphasizes the value of DISCRETIONARY trading compared to MECHANICAL trading, making the point that since all markets change over time, sooner or later a rigid, inflexible system not being able to adapt, will fail." ~Bill Schenker

$150.00

Dimensions: H 11 1/4" x W 8 5/8"

327 pages

30-Day Money Back Guarantee*

Hardcover Only

*If you aren't thrilled with Day Trading, just send it back within 30 days and we'll refund 100% of your purchase price (less s&h).

- markets

- income

- options trading education

- stock market

- day trading

- trading techniques

- position trading

- bar chart

- congestions

- trend finding

- identify trends

- trading plan

- setting alerts

- price movement

- intraday trading signals

- identify best trades

- risk management

- money management

- placing stops

- stop placement

- emini s&p 500 trading

- trade management

- forex

- forex trading

- trading logic

- traders trick entry

- entry signals

Trading Webinars and Books

RECORDED WEBINARS AND HARDCOVER BOOKS

Our wide range of trader topics are covered within each of these recorded webinars. Scroll down for HARDBACK BOOKS.

Time: Short Term Trading, Long Term Trading

Market: Futures, Forex, ETFs/Stock

The Law of Charts In-Depth we will show YOU how to win consistently in any market and in any time frame. What it takes to create charts that fit your trading style and level of comfort. The content of this intensive, in-depth recorded webinar takes the "The Law of Charts" to the next step after reading what is available as a free eBook if you sign up to recieve our free trading material.

Time: Short Term Trading, Long Term Trading

Market: Futures, Forex, ETFs/Stock

Trading All Markets is a combination of the unique concepts of The Law of Charts™ and of Market Dynamics™ will give you incredible confidence to act, which is even more important than the trading technique itself. These two concepts are changing the paradigms about relative terms such as "failures," "retracements," "support," or "resistance".

Time: Short Term Trading, Long Term Trading

Market: Futures, Forex, ETFs/Stock

Trading with MORE Special Set-ups reveals a complete strategy for making money in the markets. You will be able to use it in any market and in any time frame that provides enough price movement for you to come out a winner.

Time: Short Term Trading, Long Term Trading

Market: Futures, Forex, ETFs/Stock

Traders Trick Advanced Concepts provides a deeper learning experience going over the finer points of the Trick. Over the years, and with extensive feedback from successfully trading students, the Traders Trick has evolved far beyond what is available as an EBook if you sign up for our free trading material.

These hardcover books will make a great addition to your library, start your collection today.

Time: Short Term Trading, Long Term Trading

Market: Futures, Forex, ETFs/Stock

Day Trading - Many traders fail because of a wrong mindset and the fact that they don't know where to start or what to expect as an outcome. This could be the most important book you’ll ever read. Joe has organized it in a clear, step-by-step manner. Instead of being overwhelmed, you'll have a clear trading plan. You'll know exactly where to start, what to do next, and where you can realistically expect to end up.

eBOOK VERSION COMING SOON!

Time: Short Term Trading, Long Term Trading

Market: Futures, Forex, ETFs/Stock

Trading is a Business - Eighty percent of traders are on the right side of the market when they enter a trade, yet overall, ninety percent of them lose money in the markets. Why? Because no one shows them how to properly manage what takes place after they get in, either in the markets or within themselves!

Time: Short Term Trading, Long Term Trading

Market: Futures, Forex, ETFs/Stock

Trading the Ross Hook uses the discovery of the Ross Hook as the nucleus for Joe's trading approach. The book goes beyond chart-reading abilities to include the pivotal, sine qua non of any successful business endeavor, money and trade management.

Time: Long Term Trading

Market: Futures, ETFs/Stock

Trading Spreads and Seasonals shows you why spread trading is a quietly kept secret. Why? Because spread trading completely eliminates stop running. Do you think the insiders want you to know that? What would they do if they didn't have your stops to run?

Time: Long Term Trading

Market: Futures, ETFs/Stock

Trading Options and Futures shows you over time, successful traders change strategies as the nature of the markets change. By learning about options and how you can use them, you will be finding it easier to trade and win.

eBooks Espanol

TRADING EDUCATORS E-BOOKS AVAILABLE IN SPANISH LANGUAGE

OPCIONES QUE HACEN DINERO

(Money Making Options e-book)

¡¡STOPPED OUT!!

(Stopped Out e-book)

Life Index for Traders

Stay on course for greater profits with the

Life Index for Traders™

"I developed this product many years ago to help myself build the right kind of character for trading, as well as my personal fortune. Even though I am a successful trader, I'm not a perfect trader. I have never stopped growing and learning, and with the Life Index, I have greatly cut my losses." ~ Joe Ross

Message from Joe Ross

I use the Life Index to chart my trading life, and doing it boosts my profitability. Any or all aspects of my life that impact my trading can be charted. You should do it, too! You can use the Life Index to monitor your daily life, to chart your progress, and to stay on course with your trading plan.

A great tool for charting your life, your trading business, and for building the kind of character necessary for making money through trading. The Life Index™ is a simple concept that, when applied diligently, will guide you into becoming a more successful trader as well as a more successful person who succeeds in making money through trading.

$147

Life Index and Equity Evaluator

eBook

Use the Life Index to help form winning habits

The Life Index helps you put together a plan that captures your thoughts and brings your actions under control. Joe can tell you this: the more you think you don’t need to keep a life index, the more you are apt to be the person who really needs to be keeping it.

You can chart any aspect of your life that you feel is important to your trading. The Life Index also helps you build the right character and have the correct mindset to be a successful trader.

You need character to trade profitably

Without strong character you are heading for disaster in your trading business. Without strong character, the markets will rip you apart before you know it.

Character pertains to your very makeup, the essential fiber of your being. It includes your attitudes, your integrity, your honesty, your self-discipline, and your self-control. Without it, it's almost impossible to be consistently profitable in the markets. Character has everything to do with your success as a trader.

You need to be persistent and diligent when you trade

That takes character. There is no room for compromise. You need to examine your own level of maturity as a trader and as an individual if you want to succeed.

Where and how do you learn all about the Life Index?

I explained the concept in detail in my book Trading Is a Business, but the book does not provide you with an easy, practical way to quickly implement the practices into your trading life. Because we live in an extremely fast-paced world, with little spare time, I asked William Vanecek to create a tool, the Life Index for Traders (LIFT), that would enable anyone to immediately be able to start charting and using his/her own life index. It's fantastic! I really wish I had this unique tool years ago. The Life Index changed my life, but this practical tool takes it to another level! The "Life Index For Traders™" simplifies the process of tracking, charting, and evaluating Your Life, saving you valuable time

Some of the concepts from my books are so important that they can stand alone as a subject of study. Some are so central to my trading that it is essential to get them right. The Life Index™ is one of these concepts, and the computer evaluation tool, "LIFT™," was designed to make “getting it right” easier. LIFT makes it easier for you to gain the self-control and self-discipline you need for trading success. It includes multiple graphs that enable you to evaluate your progress from several vantage points. You can view your overall Life Index by week or by day, and you can also view your progress by category. Using these multiple vantage points can help you pinpoint problem areas in your character that require the most attention, and therefore will save you from wasting time in the areas that don’t need your attention. This, too, will make you more effective, efficient and profitable. If you are serious about improving as a trader, you need to add the Life Index for Traders™ to your trading repertoire.

Equity Evaluator

There's an additional tool I asked William to digitalize for me: it's a simple but extremely effective tool I created for charting my progress as a trader. We call it the "Equity Evaluator™" This tool fits perfectly with the Life Index for Traders™ (LIFT). The Equity Evaluator™ lets you see exactly how well you are doing in the markets. But it does even more than that. The Equity Evaluator tells when you need to stop trading long enough to take a serious look at your Life Index. It tells you when you need to paper trade, and it tells you when it's okay to trade with real money. The Life Index for Traders (LIFT) and the Equity Evaluator™ work hand-in-hand to ensure your trading success. The Equity Evaluator is included with LIFT as a bonus.

Stay on course with your trading goals -

chart your life and make money doing it!

"There are some people who do not know that they must have a hold over themselves and their life. Out of those who know this, almost all fail to consistently keep their lives/career on track. Through the LIFT, a person can constantly keep his life organized and whenever he strays, the LIFT will indicate where he's going astray. It's a Great tool to realize who you are, where you are and what you can achieve. Thanks to Mr. Joe Ross and the people associated with the LIFT!"

~ Amit Jain, India

"I truly believe Life index for Traders is an excellent and very helpful tool in becoming better. I am a better, smarter trader but also a better, more fulfilled person. I first found out about it in Joe Ross' book "Trading is a Business" which to me is certainly the most valuable book about trading. Life Index for Traders e-book is so nicely done that I soon noticed that I have become “addicted” to it. It has rapidly become a pleasant and easy to follow habit. It is not only about constant self-evaluation. I think one of the most important things about the Life index is that it shows you on a daily basis what is important for you to do as a trader. And sooner or later you do it. You implement new good habits in your life, one by one. Excellent tool! Extremely efficient! Thank you Joe!!!"

~Michal Abel, Poland

"Discipline is very important for successful trading! I want to be a successful trader so I use the Life Index for Traders to log my progress on a daily basis. That way I can show it to my coach and be held accountable for my actions. This will encourage to improve all areas of my life. That, in turn, will help my trading!"

~Andrew Danik, USA

$147

Life Index and Equity Evaluator

eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received your download information by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.

Stealth Trader™

Learn How To Profit from Trading Volatility Breakouts!

Stealth Trader is a complete trend-trading method which holds on to the trend as long as it is productive.

Professional Trader Andy Jordan, creator, uses this method in many U.S. futures markets, and it also works in Forex and some ETFs. You will love the simplicity of this method. When you purchase our Stealth Trader eBook, you'll be entitled to receive personal attention directly from Andy.

History

As we study charts, we see that a typical behavior of many markets is to go from "action" into "flat," and then, after some time, back into “action” again, as shown on the chart below. A market can, of course, trend for a long time or go sideways for a couple of weeks, but more often we will see the typical "action – sideways – action – sideways" behavior.

The questions that came to mind were: "Are there any indicators that can show us 'action' and 'flat' in the markets?" and "How good are they at showing us when to enter or when to leave the trade alone?"

As you will discover in the eBook, there are indicators resolving the problems explained above, and they work very well.

The next question was, "Is there any entry technique we can combine with our indicator?" After running a few tests, it ended up with a surprisingly simple entry strategy that you will find in the eBook.

Because testing the methods by hand in various markets is very time-consuming, we started to program the method using a simple stop strategy (you will learn several stop strategies in the eBook). We were amazed to see that the method worked in so many different markets. Please click on "Stealth Performance" on the right menu (Stealth Menu) to see some statistics for over 24 U.S. Futures Markets tested over the last six years.

Important Facts

Total Net Profit: $1,483,803 (Average Yearly Profit in USD $134,615) with a Profit Factor of 1.39. A $5 round turn commissions & 1/2 tick slippage for each stop-markt or market on close order included. No compounding used, trading same number of contracts all the time.

The way the method is programmed is very basic. It simply uses the low (when long) or the high (when short) of the previous bar as the stop loss, no adjustments during the trading day, simply using End of Day charts. Important: You do not need any specific software you can program. Stealth Trader is using a few standard indicators you can find in any other software as well! You will be able to influence the trading results dramatically by using various exit strategies. In the eBook you will find more detail about several ways of managing the trades.

Another important fact is that it stays VERY stable in regard to the variables implemented in the method. We have seen many other methods that require continual adjustment of the variables. When programmed into our software, we had a good idea about the values we wanted to use for the variables. When tested the method with different values, the results stayed very stable. That's an important fact! You do not want to see a method performing very differently only because you changed a few variables. What you want to see is that the performance stays stable even if you slightly change the numbers of your parameters.

$947.00

Stealth Trader™

eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received instructions via email by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.

CROSS PRODUCT PROMOTION

Combine Stealth Trader™ with the Ambush Trading Method™ and receive 20% off your purchase of Ambush-Stealth-Combo!

Ambush Trading Method™

"AMBUSH" A MARKET OF YOUR CHOICE

Ambush many stock index futures, commodity futures, currency futures, forex pairs, or CFDs markets

Systematic Trader Marco Mayer, our in-house quant-trader has come up with a safer and easier way to trade a large variety of markets, with the potential of locking in a steady stream of profits.

The Ambush Trading Method™ was launched in 2009. It's proven itself in many different market conditions since then, not only in backtests, but also in forward-testing.

Ambush supports a variety of markets, including:

- Futures: Stock Index, Commodity, Currency, and Interest Rates

- Spot Forex Markets

- CFDs on any of the supported markets (results may vary, depending on your broker's quotes)

Ambush is based on Daily charts, so there is no need to sit in front of a screen to watch all day. When the market you want to trade opens, you place your limit entry order and your protective stop, and you go on about your business. You will always close your position on the same day you entered the market. This means there's no overnight risk, and depending on your broker, this can make a huge difference in relation to margin requirements.

"Of the many ways to trade I’ve seen over the years, I have never seen a more stable way to take profitable gains from the market."

Master Trader Joe Ross

Understanding the Ambush Method

The idea of Ambush is actually quite simple. As markets became more and more difficult to trade on a breakout-basis using a daily chart, Marco started to look for a way to exploit that reality. The problem was how to get into a market when many traders are "trapped" in their trades, and how to profit when they lose. This sounds tough, but these are often some of the best trades you can get into.

In other words, you'll "ambush" those traders who're buying or selling when it's statistically a very bad idea to do so, at least on a short-term basis. Odds are their trade will fail, and when it does they'll have to quickly get out, or even reverse their trades, which will drive prices strongly into our direction.

This means Ambush is a counter-trend method on a short-term basis. It doesn't necessarily go against the long-term trend of a market that has been trending for weeks, but it does go against trying to get into the market during short-term trends when the odds favor an intraday-reversal. Still it's based on daily charts and you don't need to watch the markets during the day, which makes it a quite unique method. It actually allows you to profit from significant short-term intraday-moves without being tied to the screen!

Simple Rules

Ambush is not a black-box system. Instead, we give you the complete trading rules which allow you to become really comfortable with the method.

- This method uses simple, clear rules. They tell you exactly:

- At what price to place your limit entry order.

- At what price to place your protective stop-loss.

- When to get out of a trade.

- The exit-rules used by Ambush are very simple. There's no profit target involved, and the stop-loss is only a catastrophic stop-loss. This means that one of the biggest issues of method-development, which is overoptimizing the exits, doesn't apply for Ambush.

- You will become a member of a private section where we post the latest set of market suggestions and specific parameters for fine-tuning the method to each market. The fine-tuning is done in a way that avoids over-optimizing the method, and targets robustness instead of performance. This gives us an additional edge in each of very different markets, while applying the same basic method.

- Since markets change, we continue to look 2-3 times each year for new markets to add to our list of suggested markets.

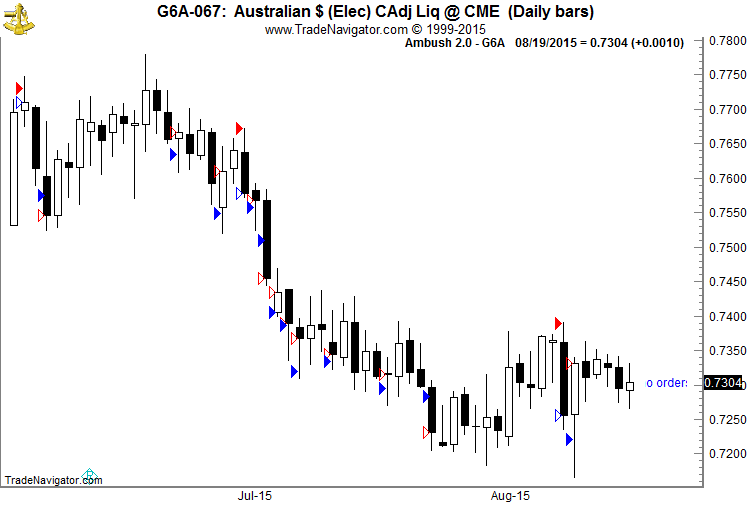

Ambush Trading Example

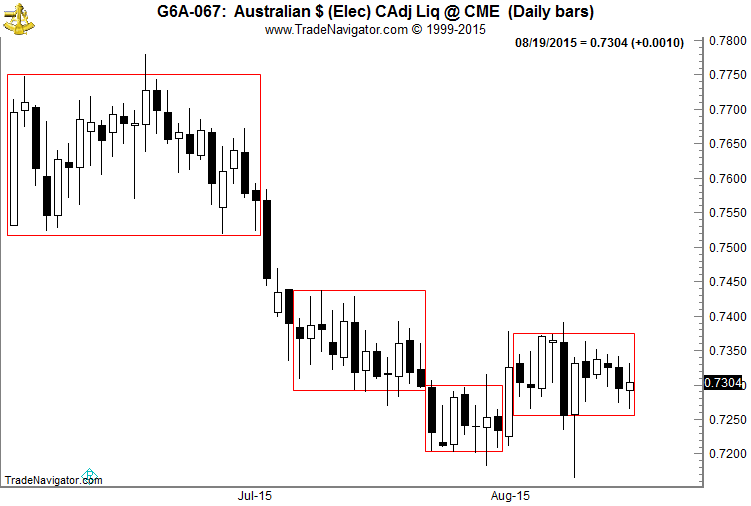

Below is an idea of what an Ambush trade actually looks like.

In looking at the chart below, ask yourself

"Is it possible to successfully trade in such choppy market conditions?"

Daily chart of the Australian Dollar Future (6A, traded at the CME):

The answer is YES, Ambush can.

This example clearly shows how well the concept of Ambush works in a real market. Notice on how many trades we get in around the high/low of the day, and how strongly prices reverse from there.

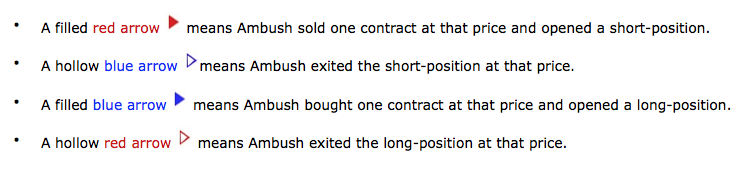

Check out the results of those trades (without commissions):

As you can see, Ambush managed to make a total of $3,200 profits.

Don't sit and watch prices intraday all day long in order to make these trades.

Simply place your orders at the beginning of each new trading day,

place your stop, and walk away.

$1,799.00

Ambush Trading Method™ eBook

Performance Reports for the Ambush Trading Method™

The above Australian Dollar Futures example shown represents just a small sample of trades in only one market. It was a very good period for Ambush in that market, and as you know, it is not always like that. While this gives you an idea of what Ambush trades looks like plotted on a chart, it doesn't tell you anything about the actual long-term performance of the method overall.

And while you can trade Ambush in just one market, it's actually better to trade it in multiple markets at the same time. This way your trading will diversify nicely, and give you more robust results and smaller drawdowns long-term.

Look at our detailed reports for each of the markets. Whether you're interested in Futures or Forex.

What you need

All you need to use with Ambush is daily-charting software of the market you want to trade.

Ambush also uses two indicators which can be found in most charting software programs:

- ATR (Average True Range)

- RSI (Relative Strength Index)

Contact us with quetions regarding Ambush, don't hesitate to get in touch with us!

"I have been trading using the Ambush method since August 2014. I have mainly been trading the 3 currencies - 6A Australian Dollar, 6C Canadian Dollar and 6E the Euro. For the last 5 months of 2014 I was making consistent profits on a monthly basis. Trading only 1 lot I averaged a profit of about $2500 a month! In 2015 due to the euro-crisis and other events Ambush so far has been in a drawdown in two of the three currencies I'm trading but I'm confident that once the markets calm down again, Ambush will perform like it did last year. But being the conservative trader that I am, and knowing that drawdowns are normal trading any method, I decided to stay on the sidelines for now to protect my capital...still overall for me the profits so far by far exceed the losses I experienced during the drawdown!" ~ Clive, South Africa

"I like the ambush trading method, it controls the draw downs which I have experienced with it, while also regaining the loses and making money." ~ R.A., U.S.

"The method looks like it is a great one! Is the first time during my 4 years trading experience that I actually made some money!! The only important issue is that it needs to be done everyday in my experience, or to put it better, the order needs to be there everyday, because missing an important big money trade in the month can make the difference with the Ambush; this is what happened to me, when i started putting the orders daily, my account began growing slowly!" ~ Alberto, Italy

$1,799.00

Ambush Trading Method™ eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received instructions via email by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.

With Ambush Signals, you can now easily follow the Ambush System on a subscription basis for educational purposes.

CROSS PRODUCT PROMOTION

Combine the Ambush Trading Method™ with Stealth Trader™ and receive 20% off your purchase of Ambush-Stealth-Combo!

Train for the Future

An Essential Ingredient for a Profitable Trading Life!

Recommended for traders at all levels, beginners all the way through to advanced.

Can you believe it? Over the years, Joe Ross has come to realize that many traders, perhaps most traders, are unable to give a correct answer to the questions listed below:

-

What is the "settlement price?"

-

Is there a buyer and seller of last resort when trading futures?

-

What is backwardation?

-

How are feeder cattle contracts settled? How are live cattle contracts settled?

-

What does the study called "Stochastics" measure?

-

Name two indicators that can be used to give true confirmation of one another as well as of the price action?

-

Define the two kinds of FCMs?

-

Define the two kinds of IBs?

-

Is anyone required to make a market in futures, and if so, when?

-

What is a clearing firm?

-

Why is your money safer with a futures broker than with a forex broker?

How did you do? Did you know the answers? Are you sure?

Asking you this series of questions was the best way to help you determine if you need our guidance. "Futures - From The Beginning" don't let the name fool you. This eBook has information for traders at all levels, from beginners all the way through to advanced. Whether you've been trading for years or are just a beginner, there is detailed information about this business that most traders do not know, and are unaware that they need to know. If you're lucky, you might find this information on the web, but you might have to read through thousands of pages to get it. However, in "Futures - From The Beginning," you will find the answers all in one place.

Example 1: You are trading a Eurodollar spread. You give the broker your order: "Buy one December 2006 Eurodollar and sell one December 2007 Eurodollar at a spread of 52, premium to the buy side. After awhile the spread comes back and it is filled. You look at the individual legs of the spread and realize that the fill you received for the December 2006 contract was at a price beyond the limits of the prices traded throughout the entire day. What recourse do you have? Do you need recourse? Was the fill legitimate?

If you trade spreads, regardless of which markets, you need to know the answer. The answers are available in this course.

Example 2: You enter a euro fx trade from your electronic trading platform. Prices move into a trading range and continue to move sideways for awhile. Suddenly you realize that the prices on your screen have stopped ticking. You check your computer and it seems to be working. To be sure, you reboot. Nothing changes, still no ticking. You call your broker and he tells you the exchange computer is down. After about an hour the exchange computer comes back up, and you are facing a substantial loss. Do you have to eat that loss? Do you have recourse?

"Futures - From The Beginning" gives you the answers - all in one place.

Example 3: You bought an in-the-money Put option and prices have moved up. The Put is now out of the money, and your option is within a few days of expiration. The broker issues you a margin call. Can he do that?

Example 4: You are long a soybean contract. Somehow first notice day slipped past your attention and you discover that you have been assigned to take delivery. What are your options?

Example 5: You are short a Call option. The option finishes in the money and the option is called away from you. What does that mean? What is your position? What do you have to do?

Example 6: You are trading forex and are long. The trade has you with a very small gain, so you decide to hold overnight. What impact does that have on your account?

Example 7: You decide to trade Crude Oil futures at the NYMEX. You enter with a market order. You do not receive a fill for 45 minutes. Is that allowable for a market order?

If you are not sure of the solution to every one of the seven examples, then you will some day find yourself facing serious difficulties.

Did you know that there is a better way than a moving average to follow a trend? You will discover that way in this eBook, along with a method for staying with a longer term trend. That doesn't mean that you have to trade the daily, weekly, or monthly charts to realize the benefits from what we will show you.

We've seen a market trend for 400 price bars on a one-minute chart in the British Pound. That's the equivalent of two years of trading on a daily chart. You can trade a trend like that.

You can increase your chances for trading success when you know and understand the business of trading.

The more you know, the better off you will be. You need to know the rules and the players; you need to know what can hurt you and what can help you.

For instance, so many traders seek to acquire confirmation from two or more indicators that are all measuring the same thing. You can chase your tail round and round like a dog with an itch, but you will gain nothing from your pursuit when all the indicators are duplicating each other. What we're saying here is that many traders will use more than one momentum indicator, or more than one volatility indicator, to confirm not the price action, but to confirm a different indicator of the same type, measuring the same thing. But that's not the way to do it. The correct way is revealed.

There is more, much more, contained in the 21 Lessons. We feel this is information every trader should know, but that all too many do not know. The course will give you the facts you need to make important decisions.

You've waited long enough. Every day that you trade without this vital information puts you at greater risk.

$239.00

Futures - From The Beginning

eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

Money Making Options

Pure Simplicity in Trading Options

"You owe it to yourself to know the truth about trading options. There is nothing complicated about it. You don’t need an option model to succeed, and you don’t need to be an expert in Greek terminology." ~ Joe Ross

Message from Joe Ross

"In Money Making Options you’ll find two of the best option trading strategies I’ve encountered in all the years I’ve been an investor and a trader. You’ll also discover the "options secret", so that you trade with the odds stacked in your favor, and never again have to fear the negative talk that brokers and exchanges keep telling you about options trading."

Money Making Options Highlights

Trading Option Boxes in Sideways Markets

Learn what Option Boxes are, and how to use them in sideways markets. You will immediately discover one of the concepts every trader must master: how to know when prices are moving sideways. It is said that prices trend only 15% of the time. You need to know how to trade in sideways markets because prices present themselves that way 85% of the time.

You will find out how to build an Option Box. It all starts with creating one side of the box when prices are close to the top or bottom of a consolidation area, and it ends up with "closing" the box when prices are at the opposite side of the consolidation. The beauty of the Option Box is that once you’ve closed the box, there is no way you can lose unless you open it before the options are set to expire.

Money Making Options Highlights

Premium Accumulation

The second strategy you will learn is called "premium accumulation." You can earn money in options by selling them to people who need them. Usually they need them because they are afraid - afraid of a loss, or afraid they might miss "the big move." To get those options, they will buy them from you. What they pay you for the option is called "premium."

We like to collect premium, and you will learn how to do so, as well. You will learn when to collect, how to collect, what your risk is at any given moment in time, and how to protect yourself in the markets. Premium collection works well when a market is trending, so you will learn how to recognize when prices come out of consolidation and begin to trend.

Combine the Best of Two Worlds - Be in the Markets as Often as You Like

Very few option traders know that they can take much of the risk out of trading by combining options with the underlying asset. Learn how to do this to make much safer, and often more profitable, trades.

The need for complicated option structures is eliminated, and you can be in the markets as often as you like. By combining boxes with premium accumulation, you have ways to trade both sideways markets and trending markets. You can have the best of both worlds.

Money Making Options offers you two profitable ways to trade options.

"The tactics used in Money Making Options eBook are great! Too often we open an options book and there are no tactics whatsoever in establishing a trade. It has really opened a neglected aspect of options trading - tactics." ~ E. Tan, Singapore

"Joe's Money Making Options e-book is filled with time-relative strategies that work. Considering the current volatile markets, Money Making Options e-book outlines clearly, simple methods of consistently taking money out of the markets and is helping me to survive for the long-term. I encourage any serious trader to not only purchase this e-book but master how to employ these strategies. You would not regret it. Thank you Joe Ross for what I consider to be a superb addendum to your excellent book on options trading -- "Trading Optures & Futions." ~ Kunle O., Canada

"Practical, Very Clear, Concise and can be applied immediately. Most importantly - the applied learnings produce profits." ~ George P., Australia

"Good simple practical strategies, without the complexities of traditional Option strategies." ~ K. Paul, India

"Straight forward, simple but loaded with powerful information." ~ Bonifas A., Singapore

$127.00

Money Making Options

eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received your download information by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.

Money Master™

How to Retire with Considerable Wealth

Market: Stocks

"This eBook presents a progression of thought and techniques in using the stock market that causes your money to work for you. If the content of this book were taught in schools, there could be an end to poverty for millions of people." ~ Joe Ross

Message from Joe Ross

The knowledge contained in Money Master, belongs in every home. It should be taught in schools around the world. It belongs to both the worlds of trading and of investing. Anybody can easily find the way to consistent profits by applying the strategies revealed in this eBook.

The beauty of these strategies is that your money will work for you, as the best worldwide businesses make your money grow and compound. There is also little risk in using the strategies in this eBook - so little, in fact, that you will often not even think about risk. The strategies allow you to be as passive or as aggressive as you wish. After the eBook, continue to expand your learning with the Money Master Advanced Strategies™ Recorded Webinar.

Highlights of What You Will Learn

Building the Foundation

Joe Ross wants you to think about this statement, "When I decide I want to own something, I try to buy the best quality for my money." This should also be true for you.

In Money Master, you will discover how to identify the best companies in the world, what their characteristics are, and how to apply the strategies using these great companies to make your money grow and compound.

A Different Mindset

To employ and enjoy the strategies explained in Money Master, you might have to do a complete mental turnaround. Why? Having been a day trader for many years, he used to quickly respond to the movements seen on price charts. However, with the methods you’ll see here, you’ll have lots of time to think, and to plan, as well as to act.

Joe Ross says it best. "When I bought anything as a trader, my profits were based on my expectation that prices would move higher. If prices fell, my heart, along with my hopes, fell with it. Conversely, if I sold something my anticipation was for falling prices. If prices rose, I would suffer a loss. My hope of selling high and buying back at a lower price was shattered, as was a piece of my ego."

However, with the strategies in this eBook, instead of a market meltdown causing you to panic, you won’t mind it at all. Huge market swings will no longer be a problem. You’ll be in for the longer term, and enjoy the situation both when prices rise and when they fall. You’ll have the best of both worlds while your money will be growing and compounding.

Three-Way Collecting

You will learn an amazing way to collect money from different "sources" with little effort. Have you ever collected rent from a house that you owned, even though the house was not occupied? How about a situation in which you could collect rent from a house that you didn't own? You will learn how to do the equivalent of that in the world of investing, and how to put your money to work for you.

The Options Secret

You will learn the options secret, an easy way to trade options so that you profit, by understanding the single most important and surest thing that always works in your favor. It is the opposite of what you hear from brokers and exchanges, and that should not surprise you at all!

By applying what you find in Money Master, you will profit if the market is flat, moves away, or even if it moves slightly against you. Because of that, you will not have to be precise in determining market direction. You will learn to do the opposite of what the public usually does, and you will be profitable.

Being Part of the Best Opportunities Worldwide

If someone comes along and says, "I have a business that makes billions, and I'm willing to let you in on it," shouldn’t you want to get in on it? You’ll see, through several case studies, how you can passively own great businesses, or how you can be a bit more aggressive in doing so. Either way, your money will earn money for you. By applying what you learn, you'll be able to use the strategies to develop your own personal trading and investing style, and your money will compound and grow. All you have to do is to take action now!

Continue Building Trading Knowledge with Money Master Advanced Strategies™ Recorded Webinar

Let Money Master Help You Retire with Considerable Wealth!

"Excellent. I have read the book, and I must say, it is a real eye opener as to the many ways to be successful in the market, and make your money work for you. Methods that I would never have thought of on my own. Looking forward to implementing some of them soon. Joe is down to earth, no hype, the products I have received from you are excellent, and I am a much better trader for them. Thanks Joe, for sharing your knowledge." ~ G.M Travers, USA

"Very interesting and useful to build wealth using income generating strategies combined with the power of "compounding on compounding." ~ M. Dietsch, Germany

"A very concise book about building wealth through the purchase of dividend paying stocks." ~ Joel B., USA

"The contents provided a new perspective with which to put one's money to work. This has been a life changing knowledge and experience for me as I carefully implement the strategies outlined along with the results that I'm seeing. Please keep enlightening us and thank you for sharing Mr. Joe Ross. All of Joe Ross's books that i have purchased in the past have guided me in my quest to become a more successful trader and I was convinced this new e-book will be filled execellent insights into one can master money in order to be wealthy. Thx Joe Ross!!" ~ O. Kunle, Canada

"I enjoyed to read a hands on information. No doubt has been one of the best information about investing, I look forward putting into practice what I´ve leand and look forward learning more about this aproach as well." ~ Edgar C., Mexico

$229.00

Money Master™

eBook

Orders Filled Within 24 Hours*

All Sales Final on Digital Products

*IMPORTANT: After your order has been verified, an email will be sent within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.

The Stop Placement that Makes Sense

"The question I am most consistently asked is "Where do I put the stop?" Therefore, this eBook is about stop placement. Most trading books and articles you read concentrate on entry. This book concentrates on exit. Knowing when to get out of a trade is vastly more important than is getting into a trade." ~ Joe Ross

If you place your stop a certain number of ticks or pips distant from your entry point, or a certain distance from your entry using a percentage basis, you probably are placing your stop in the wrong place. If you place your stop a certain dollar amount from your entry, below "support," above "resistance," or based on a chart pattern, we know you are upside-down in stop placement. Please believe us, there are much better ways! Joe Ross wrote this eBook "Stopped Out" in order to show you four specialized ways for stop placement. Every single one of them is based on reality. Your stops will rarely be where everyone else puts theirs. Your stops will be unique to you, based on your personal risk tolerance, in conjunction with the risk in the market.

One very important thing: the techniques contained in this eBook apply to all markets — stocks, futures, forex, bonds, contracts for difference, spread-betting, and derivatives, regardless of where they are traded, or by which means they are traded. Like everything else we offer, this material is top quality and is profusely illustrated with charts in order to save thousands of words.

Highlights

Exit Stops that Make No Sense

You don’t need to become angry if you have used a kind of stop placement method that makes no sense, just avoid using it in the future! We demonstrate with charts why nonsensical stops will only get you into trouble.

Famous trading advisories tell traders to use a 25% stop loss. Others tell traders to use a 15% stop loss. Why? We‘ve heard traders say something like the following: "I always place my stop 15 units away from my entry." But why? Other traders say "I will risk $300 on a trade." But really, why $300? Yet other traders place their stops above resistance, or beneath support. Have you ever seen prices drop through support like a steel ball in a vacuum? Haven‘t you ever seen prices shoot up through resistance like a rocket on its way to the moon?

Stop placement must take into consideration the realities of the markets. It also has to take into consideration your financial tolerance for loss. In this book, discover ways to allow the market itself to tell you where to place the stop. More than that, the market itself can give you an amount that fits your financial tolerance for loss.

Sensible Exit Stops

You will learn about three specialized exit stops which can be used for your initial stop loss as well as for trailing stops. They all take into consideration the dynamics of the markets. You will also be introduced to a stop technique that enables you to stay in a long-term trend much longer than most traders dare stay in.

We'll show you a wonderful and accurate method for stop placement that can be used from as little as a one-minute chart to a monthly chart, and every conceivable time frame in between. You will learn a stop technique that enables you to successfully stay in medium-term trends and swings. It is a truly powerful stop placement method which is fully adjustable to your personal risk tolerance.

A Method for Staying with a Long-Term Trend

This chapter goes into a method for staying with a long-term trend even during the time of a major retracement. How long? It can be 1 month, 6 months, or up to ten years. How many traders do you know who have ridden a trend for 10 years?

One of the great lessons of trading is that you "can‘t have your cake and eat it, too". If you want to be a long-term trader using this tool, you accept the trade-off that, by keeping you in a trade for a longer time than most traders would normally endure, you give up being able to exit closer to the extreme level of the move that prices make. You learn the lesson of giving up the first and last 10% of a major move, and being happy with the rest of the 80%.

A Unique Method to Optimize Taking the Available Profits

The idea of exiting a winning trade in a timely manner is basic to success. After all, if you can't take the money off the table while it is there, you cannot succeed at trading. However, not all traders have the mental and emotional discipline to exit a trade on time, so this method offers a technically based method for stop placement.

A Method that Uses Volatility to Your Greatest Advantage

There will be no more guessing with this tool, because you will know exactly which time frame to be in. It will even tell when you shouldn’t trade at all. It keeps you out of markets and time frames you should avoid.

You’ll discover the settings Joe uses for this pure volatility indicator, but you are free to choose your own. With this stop placement technique, you will be able to personalize both your risk and your objective for every trade. That’s true! Imagine yourself being able to not only fine-tune your stops, but being able to fine-tune your objectives as well.

A Comprehensive Stop Placement / Trade Management Device - "The proof is in the pudding"

You will discover the most comprehensive stop placement/trade management device you have ever seen. It was created for our own use. Before trading, wouldn't you like to know exactly what your chances of winning?

You learn how to create your very own worksheet with which you can see how your own trading implementations are working. Once you get the feel of the work done to produce the worksheet, your understanding of how to manage risk, stop placement, and objectives will skyrocket.

We give you full exposure to how we use this trade management worksheet to trade 46 real trades in the euro. You will see how he sets up and organizes the necessary data, and then we'll show you what you should include in yours.

$167.00

Stopped Out!

eBook

Orders Filled Within 24-Hours*

All Sales Final on Digital Products

*IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours containing your access information. Please contact us if you did not receive our email. Be sure to check your junk/spam folder before contacting us. All sales are final.