Newsletters (208)

Children categories

Edition 739 - August 10, 2018

Over the last two weeks, over $7,500 in profitable trades! Scroll down to

Marco Mayer' s Ambush Trading Method, this deal you won't want to miss!.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Spreads

Recently, during our Italian spread seminar, May 24-25 I gave two examples of observation spreads. With an observation spread you truly trade what you see—one market going up while the other goes down; or, one market going up while the other is moving sideways; or both markets going up or down, but one is moving much faster than the other.

In the Live Cattle-lean hogs trade shown below, cattle prices are rising, but hog prices remain in a sideways trading range.

In the soymeal-soybean trade above, prices in each leg of the spread are falling, but soybean prices are falling faster, and more steeply than soymeal prices.

In any event, if you stop staring at a day trading screen and look around you’ll see plenty of opportunities like the spreads above.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Perspective: Winners VS. Losers

We all want to feel like winners. Winning makes us feel on top of the world, as if we can do anything. But in the trading business, the bottom line is how much money you make in the end. As I’ve mentioned in past issues of Chart Scan, best way to monitor your performance is to use a win-loss ratio, but there are many different ways to calculate this statistic, and each have advantages and disadvantages.

The first issue to consider when calculating a win-loss ratio is to decide on a reference point to use for your calculation. It's up to you, and it depends on how many trades you make. If you only make 10 trades a year, it makes sense to use a year as your reference point. If you make 10 trades a day, in contrast, you may want to use a day as a reference point. Most people would probably use a week or a month. Specifically, the win-loss ratio would be based on all trades made in the reference point. For example, if you decided to use a month as your reference point, you would calculate the win-loss ratio based on all the trades you made in a month.

The second issue is to decide which formula to use to calculate the win-loss ratio. There are at least three ways. In the first way, traders compare the number of winning trades to the number of losing trades. The dollar amounts are ignored. For example, if you made 10 trades in a week, and 6 trades were winners and 4 trades were losers, you would divide winners (6 trades) by losers (4 trades), and end up with a value of 1.5. Values greater than 1 indicate that you are winning overall (based on a reference point of a week), whereas values less than 1 indicate that you are losing overall. Some trading experts criticize this approach because it is easy to distort this statistic. If you know, for example, that you have made 5 losers and 5 winners, you can make a few small winning trades that produced relatively little profits and make yourself come out as a winner. It is argued that because the dollar amount is not built into the ratio. it provides a biased picture.

A more formal approach, which is often used in the money management strategy developed by John Kelly, uses the average dollars won and lost across a series of trades in a reference point, such as a month. For example, if you made 20 winning trades and 80 losing trades in a month, you would calculate the mean dollars won across the 20 winning trades and the mean dollars lost across the 80 losing trades. Once you have the two averages, you would simply divide the average dollars won by the average dollars lost. Again, values greater than 1 indicate that you are winning overall, whereas values less than 1 indicate that you are losing overall (across the reference point). The advantage of this approach is that the actual dollars won or lost are taken into account. The disadvantage is that an average, or mean, may not provide an accurate view of how much money is won or lost.

The disadvantages of these two approaches have led us at Trading Educators to suggest using a modified version of the win-loss ratio. We suggest taking the total amount of money you won across a series of trades and divide it by the total amount you lost. For example, if you made 20 winning trades and won a total of $5000, and made 15 losing trades and lost a total of $4000, you would divide your wins by losses and end up with a value of 1.25. (It may also be useful to multiply this value by 100 to remove the decimal).

There is no one right way to trade, and there is no single correct way to calculate the win-loss ratio, but whatever you decide, it is useful to monitor your performance. By calculating a win-loss ratio, you remove some of the mystery and uncertainty in trading. You know where you stand, and you will be more aware of where you have been and can think more clearly about where you are going.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Example: Instant Income Guaranteed

KEY Trade

On 19th Jul 2018 we gave our Instant Income Guaranteed subscribers the following trade on KeyCorp (KEY). Price insurance could be sold as follows:

- On 23rd Jul 2018, on a GTC order, we sold to open KEY Aug 31 2018 18.5P @ 0.15 , with 37 days until expiration and our short strike about 10% below price action.

- On 30th July 2018, we bought to close KEY Aug 31 2018 18.5P @ 0.05, after 7 days in the trade for quick premium compounding.

Profit: 10$ per option

Margin: 370$

Return on Margin annualized: 140.93%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Example: Traders Notebook

This week, we're looking at -ZLZ18+2xZLN19-ZLZ19 Butterfly Spread: short 1 December 2018, long 2 July 2019, short 1 December 2019 Soybean Oil (CBOT on Globex).

Today we consider a Soybean Oil Butterfly spread: short 1 December 2018, long 2 July 2019, short 1 December 2019 Soybean Oil. The spread looks a bit wild with many ups and downs but has found support around 0.6 several times and has been following nicely its seasonal pattern. As long as this level holds, the spread has a good chance to move higher. Traders have to “leg-in” into the spread by selling and buying each leg separately or by selling and buying the spreads involved (December 2018 – July 2019 and July 2019 – December 2019).

Do you want to see how we manage this trade and do you want to get detailed trading instructions every day?

Click here for additional information!

Did you miss our 50% off Summer Sale?

Use Coupon Code During Checkout

tn35

To Receive 35% off!

Hurry Sale Ends on the 24th!

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

In two weeks, Ambush Trading Method made over $7,500 in PROFITS!

Ambush Trading Method has a proven track record. The last few Chart Scan Newsletters have given you examples of winning trades and you can be in on them:

A SPECIAL DEAL IS COMING YOUR WAY!!

Be on the look out for next week's Chart Scan Newsletter, just for our subscribers!

Here is a recap of last week!

Ambush Traders keep on dominating the Natural Gas market

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Natural Gas Future (NG) traded at the NYMEX, where Ambush Traders are having an amazing run for months now.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

As you might know, Natural Gas is one of the all time favorite markets for Ambush. And looking at the following chart it becomes clear why. It’s one of the least trendy markets out there. Like all markets it goes sideways most of the time but even when it trends it’s doing so in a slow manner. Just have a look on the chart and ask yourself what kind of trader you want to be. The one making money on the rare occasion of NG trending (blue arrows) or during the remaining 90% of the time (red boxes).

Here’s the result of all of the trades you can see on the chart, trading one NG contract, including $10 commissions per trade. Yes, that’s over $4620 trading just one contract with a winning rate of over 75% and a profit factor of over 4!

Don’t miss the next trade and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to generate signals on your own and want to know the exact trading rules of Ambush, purchase the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 738 - August 3, 2018

Last week a $3,775 profit and this week a $4,620 profit, what?!?

Scroll down to Marco Mayer's trading article about Ambush Trading Method.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Law of Charts in Depth

I would like to share answers to several questions from my students about the The Law of Charts free material and The Law of Charts In-Depth Webinar, and how to handle short term trading at daily bars when I am not a scalper.

Student #1. When is first tradeable opportunity to trade solo 123 High or Low? The pivot point, then 4 times / or 5 times / HH and HL? / or LH and LL / then two correction bars and TTE is possible? Two correction bars and TTE is possible? I am not sure what this student is asking. No matter that this is in congestion or trading range? Never trade TTE in congestion. However, if you have a TTE followed by a RH within the congestion, you can use TTE to get in early before the point of the RH is violated.

How long must be previous swing in order to allow to trade solo 123 formations in the direction of this swing ? / or opposite direction /? 1-2-3 must occur at the end of a trend or swing. There is no way to tell you “how long,” it is a matter of judgment based on what you see. In general, a trend is a series of higher highs and higher lows (opposite for a downtrend). A swing must be a leg that takes you beyond any consolidation.

Student #2. Where should you take profit from trading daily Reverse bar which goes in opposite direction to swing or trend ? When is no present RH

or 2 point? Should that be closest next Daily paper if there is room available/? Or at trading Reverse Bars is this not important? I would not take any reversal bar unless it is at the end of a trend or swing. If prices are in congestion, then the reversal bar must have its extreme point outside of the congestion. Be very careful about this.

Student #3. If I don't want be a scalper at daily bars. What is essential for taking profit? By scalping to take a quick profit after 7-10 pips, and then move Stop Loss to Break Even. This is a good plan. You have to experiment about which works best for you.

In the case of an hourly chart – If prices are in a 10 hour cluster would you take 30 pips /or more/ and time stop. Time frame has nothing to do with it. You want to be paid to trade. Take money as soon as you can—all of it or part of it.

But at daily bars when I am not a scalper ? Take some money off the table, and then set a trailing stop as you prefer. The main thing is to get paid to trade no matter what the time frame.

Is it most effective to let profits grow at least 30- 40 pips and then move SL at BE ? I cannot answer this. You must decide on what works best for you. There are no rules for how many pips you should try to take. Just stay within your account size and don’t overtrade. I don’t know of any effective number of pips. Deciding what works, is a combination of your money management, your trade management, and your experience.

Student #4. Is the best trading time - morning 8:00- 10:30 – Is it also important even if I don't want make a scalp trade? Always the U.S. morning is best. The first 90 minutes of trading are the most important time of the day. You must look at the volume to see when the most traders are usually in the market. I use a 30-minute chart to see the first 90 minutes. Usually, they will be at the essentially the same time every day, plus or minus 30 minutes.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Your Money or Your Ego?

Which would you be willing to part with first, your money or your self-esteem? If you are like most traders, you are likely to let your money go before your self-esteem.

Trading stories are full of traders who gladly fed losing trades to avoid admitting the fact that they made a mistake. They hoped against hope that a losing trade would turn around if they could merely wait long enough. In the end, it's better to cut your losses and to move on, but few traders do so. They lose more and more money. Why? The biggest reason is ego. They don't want to admit they were wrong. They don't want to feel like a loser.

A 2006 study showed how people are willing to lose money in order to protect their self-esteem. Participants played a game of chance that was similar to continuing to invest in a losing trade: they were told they could win a jackpot of $10 if they patiently played long enough by feeding the investment in 25-cent increments. Each participant was given $5 in quarters to play the investment game. They had the choice of continuing to put in quarter after quarter to keep an investment going or cutting their losses. In the experimental group, participants were threatened by being told that most people choke under pressure when playing the game and that if they were prone to crack under strain, they would have difficulty. A control group was not given this "ego threat." These researchers also looked at people's self-esteem to see if it would impact the amount of money participants lost. What did they find?

You might think that people with high self-esteem would handle a warning that they might choke under pressure better than people with low self-esteem, but they did not. One might also expect people with high self-esteem to perform better on the investment task than people with low self-esteem, but people with high self-esteem lost more money than people with low self-esteem. Why? People with high self-esteem tend to want to defend their ego. They want to preserve their self-esteem even if it means continuing to lose money on a game they can't win.

What is the lesson? Don't link your net worth to your self-worth. If you think you have value as a person because you make money on winning trades, you will believe that an outcome of a trade determines your self-worth. It does not, however. No matter how much you win or lose, you still have value as a person. If you remember this fact, you will be able to trade more rationally and objectively. But on the other hand, if you let your self-worth be defined by how well you do as a trader, you will be putting your self-esteem on the line with your money, and you will be likely to do anything to maintain your high self-esteem, even if it means losing money. So whatever you do, forget about making it personal. Trading is not personal. It is just business. If you keep your self-esteem out of the picture, you will trade more objectively, rationally, and profitably.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Example: Instant Income Guaranteed

RDFN Trade

On 13th Jul 2018 we gave our Instant Income Guaranteed subscribers the following trade on Redfin Corporation (RDFN). Price insurance could be sold as follows:

- On 17th Jul 2018, we sold to open RDFN Aug 17 2018 20P @ 0.30 , with 30 days until expiration and our short strike about 15% below price action.

- On 23rd July 2018, we bought to close RDFN Aug 17 2018 20P @ 0.15, after 6 days in the trade for quick premium compounding.

Profit: 15$ per option

Margin: 400$

Return on Margin annualized: 228.13%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Overall Balance

Trading in itself is a thrilling activity, and many non-traders never have a chance to experience that level of excitement. However, as thrilling as it may be, it's not the only thing there is in life. In many ways trading is still quite one-dimensional. It doesn't have the richness and nuance of the larger life outside of trading.

In this regard, it's necessary to achieve an overall balance in our lives. There is little gained if we become expert traders, yet leave the rest of our lives in shambles. Eventually, something will begin to disintegrate in our trading as well.

It is always necessary to remember that there is another world out there beyond trading!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

$4,620 PROFIT!

Ambush Traders keep on dominating the Natural Gas market

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Natural Gas Future (NG) traded at the NYMEX, where Ambush Traders are having an amazing run for months now.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

As you might know, Natural Gas is one of the all time favorite markets for Ambush. And looking at the following chart it becomes clear why. It’s one of the least trendy markets out there. Like all markets it goes sideways most of the time but even when it trends it’s doing so in a slow manner. Just have a look on the chart and ask yourself what kind of trader you want to be. The one making money on the rare occasion of NG trending (blue arrows) or during the remaining 90% of the time (red boxes).

Here’s the result of all of the trades you can see on the chart, trading one NG contract, including $10 commissions per trade. Yes, that’s over $4620 trading just one contract with a winning rate of over 75% and a profit factor of over 4!

Don’t miss the next trade and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to generate signals on your own and want to know the exact trading rules of Ambush, purchase the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 737 - July 27, 2018

Be sure to scroll down to Marco Mayer's article, $3,775 profit!

DON'T MISS OUT!

50% off Traders Notebook Subscription!

Use Coupon Code: andy50

OFFER EXPIRES JULY 31, 2018

Read what a current Traders Notebook subscriber has to say!

”The Traders Notebook authored by Andy Jordan based upon his experience and Joe Ross’s techniques is a premier daily advisory, with the what why and when of carefully selected futures trades and more.

I look forward to receiving the notice every night that a new Notebook is available with Outrights, Spreads and Options recommendations and some tidbits as well.

The presentation, reasoning and basis of each trade is explained in such a concise articulate way that you eagerly spend more time looking at the charts rather than trying to put together a drawn-out explanation. That is a most efficient teaching technique.

Additionally, Andy is not only a commensurate trader and teacher but also available for you, helping you with your questions and observations. He teaches you not to just place orders, but how to become a “trader”. I believe this is the genuine mission of Trading Educators and it is exemplified by TN.”

Frank M., July 16, 2018

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Traders Notebook - Summer Special - OFFER ENDS SOON!

Hi Traders,

Don't miss out on my summer special with Traders Notebook that offers you 50% off our regular subscription price! Take advantage of half the price with a 6-Month or 1-Year subscription with Traders Notebook, but the offer expires on July 31, 2018. Learn while you trade using Traders Notebook, benefit from the trading experiences that are provided to you with a personal touch that no other plan offers. Use coupon code andy50 during checkout and start receiving my trading notifications with guidance. Feel free to email me with questions, This email address is being protected from spambots. You need JavaScript enabled to view it., or check out the Traders Notebook Complete product page for more testimonials and product overview.

I look forward to trading alongside with you,

Andy Jordan

Coupon Code: andy50

Good through July 31st!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

TRADING EDUCATORS' TEASER!!

Andy Jordan's Live Trading Room is currently closed to the public, but will open just for YOU starting September of 2018! More updates will follow.

Listen up Traders Notebook subscribers, in August via email, you will receive special pricing, that's right! It is our way of thanking you for being a preferred Trading Educators' customer.

Check this out, traders!

Trading sample from the Live Trading Room on 07/19.

Long at 67.12 with an initial stop at 66.99 trading 2 contracts with an risk of $260 for both contracts.

Selling the first contract at 67.27 for a profit of $150 and the second contract at the target at 67.82 for a profit of $700.

Total profit of $850 or 3.3 times the risk.

Details on how to sign up will follow in upcoming Chart Scan Newsletter Editions!

Email Andy Jordan with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it.!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Swiss Franc

Will the Swiss National Bank allow the franc to reach parity with the U.S. dollar?

In the past, every time the franc tried to equal the buck, the Swiss National Bank (SNB) intervened and bought or sold francs. Recently, I looked at the daily chart of the franc, and decided that we will probably see the franc reach parity against the dollar in spite of any actions by the SNB.

As long as the euro keeps rising, there is no problem for the Swiss if their currency rises. The Swiss are inextricably tied to the value of the euro. In general, the euro is the anti-dollar. When the dollar falls, the euro rises. The falling dollar rightfully scares the bejeebers out of a lot of investors, and they run to the franc for some sort of feeling of safety.

Of course, the franc is no longer backed by gold, so flight to the franc is a bit silly. The franc is not safer than the euro in many respects, and currently franc bank deposits are paying negative interest. The SNB cannot allow the franc to rise much against the euro because the economies of their major trading partners are all based on the euro, with Germany being the main importer of Swiss products.

What could stop the franc from reaching parity would be a dollar rally—a rally that many think is long overdue. A dollar rally will move the euro down, and the franc will almost surely have to follow.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Trading Preparations

Are you ready to tackle the markets at any time? Bring it on, right? It would be ideal if we were ready to trade at any given moment, but the human mind has its limits. You don't have an endless supply of energy. After a marathon stretch of trading, for example, you may not be able to tackle the markets in earnest. You may not be able to concentrate fully. You may be easily distracted, and while you are in a state of confusion, you are likely to make trading errors. It is necessary to prepare to trade. It is vital to get your mind ready to trade the markets.

Trading when you’re at your best, and at the right time requires the proper amount of challenge on the one hand, but a good match with your skills on the other. If a trading task is too hard, you will choke. But on the other hand, if you spend your entire trading life blandly fighting boredom, you'll never feel motivated to trade. If trading is a challenge for you, you can get psyched up and be ready to trade at your peak.

Don't make the mistake of thinking that trading doesn't require some preparation. Some seasoned traders actually rate their mental state before they trade. If they are in a bad mood, or feel dazed and confused, they stand aside for the day. It makes little sense to trade in the wrong state of mind. You will end up making trading errors that you'll regret later.

How can you prepare yourself to trade in the proper mental state? The first step is to make sure that you are rested. Many people think they can get away with the minimal amount of sleep or skip nutritious meals. But proper nutrition and adequate sleep are necessary to cultivate an optimal mindset. Trading saps up psychological energy, and psychological energy is limited, so it is vital that you take steps to maximize your energy through proper sleep and nutrition.

Trading in a peak performance mindset requires intense concentration and focus, but it's difficult to maintain this stance when the pressure is on you to perform. Thus, a second step that you can take is to reduce any psychological pressure that may potentially sap up limited psychological energy. The most obvious way to relieve such pressure is to think in terms of probabilities and carefully manage risk. It's useful to remember that you may not win on any single trade, but after a series of trades, you will have enough winners to make a profit in the long run. It's also important to manage your risk. Determine your risk up front and risk only a small amount of trading capital on a single trade. Doing so will ease a lot of the pressure, allowing you to be more open to see the opportunities that the market offers.

It is also important to anticipate any obstacles that may interfere with your ability to trade. For example, if a stressful event is about to happen, such as a move to a new home or a visit from an overbearing relative, it is important to account for such events. You will have trouble trading when you are stressed out. If you anticipate an upcoming stressful event, you should plan to stand aside until the stressful event passes.

Don't think that you can trade the markets without being mentally and physically prepared. Unless you are at your peak, you will make mistakes. Give yourself a break. You can't trade under all possible conditions. If you are rested, relaxed, and ready to trade at your peak, you will increase your chances of taking home huge profits.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

LEN Trade

On 5th Jul 2018 we gave our Instant Income Guaranteed subscribers the following trade on Lennar Corporation (LEN). Price insurance could be sold as follows:

- On 6th Jul 2018, we sold to open LEN Aug 17 2018 47.5P @ 0.46 , with 41 days until expiration and our short strike about 11% below price action.

- On 16th July 2018, we bought to close LEN Aug 17 2018 47.5P @ 0.22, after 10 days in the trade for quick premium compounding.

Profit: 24$ per option

Margin: 950$

Return on Margin annualized: 92.21%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

$3,775 PROFIT!

While everyone is confused about the Dollar, Ambush Traders continue to cash in!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Dollar Index Future (DX) traded at the ICE, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

As you might remember we talked about the Dollar Index a couple of weeks ago and I’d like to give you an update! Back in early July a trading range formed (see chart) and Ambush traders cashed in by following Ambush Signals: selling at the top and buying at the bottom of the range. Guess what, everyone is still confused about the USD as no one knows how that trade war is going to end:

Luckily Ambush has no trouble at all in such markets and so Ambush Traders continued having a really good time trading DX!

Where’s the Dollar Index going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

Here’s the result of these trades, trading one Dollar Index (DX) contract, including $10 commissions per trade. Yes that’s a win rate of 80% and a profit factor of almost 9!

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 736 - July 20, 2018

Summer Special!

50% off Traders Notebook Subscription!

Use Coupon Code: andy50

”The Traders Notebook authored by Andy Jordan based upon his experience and Joe Ross’s techniques is a premier daily advisory, with the what why and when of carefully selected futures trades and more.

I look forward to receiving the notice every night that a new Notebook is available with Outrights, Spreads and Options recommendations and some tidbits as well.

The presentation, reasoning and basis of each trade is explained in such a concise articulate way that you eagerly spend more time looking at the charts rather than trying to put together a drawn-out explanation. That is a most efficient teaching technique.

Additionally, Andy is not only a commensurate trader and teacher but also available for you, helping you with your questions and observations. He teaches you not to just place orders, but how to become a “trader”. I believe this is the genuine mission of Trading Educators and it is exemplified by TN.”

Frank M., July 16, 2018

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Traders Notebook - Summer Special

Hi Traders,

I am running a summer special with Traders Notebook that offers you 50% off our regular subscription price! Enjoy half the price with a 6-Month or 1-Year subscription and my discount is good until the end of July. I assure you that this offer will not only save and earn you a few dollars, but will benefit your trading experiences while providing you a personal touch that no other plan offers. Use coupon code andy50 during checkout and start receiving my trading notifications with guidance. Feel free to email me with questions, This email address is being protected from spambots. You need JavaScript enabled to view it., or check out the Traders Notebook Complete product page for more testimonials and product overview.

I look forward to working with you,

Andy Jordan

Coupon Code: andy50

Good through the month of July!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Sucker’s Rally?

Are we looking at a sucker’s rally? Is the sucker's rally about to top out? No one can say for certain. But sometimes it pays to look at the big picture.

The move from 2678.25 to 2796.00 in the June ES chart chewed through 117.75 points. Can we expect a lot of buying by Fibonacci traders at 2737.00, a 50% retracement, with prices having reached 2796.00?

It would not be out of the question to see a pile of buying enter the market at that point. I'm sure the insiders will be waiting to see if the Fib traders go long in mass at that level, if indeed the ES reaches that level. The current rally could stall out at any time, which is why I'm keeping a close watch on the VIX.

The VIX is an index of implied volatility. The higher the VIX reading, the greater that fear of losing is what drives the market. At the low in March 2009, the VIX exceeded a reading of 50, and it exceeded 80 in November of 2008. But when traders are complacent, as they are now, the VIX reading is very low, at around 13. In fact, the VIX reading is lower than it has been since May of 2018.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Be Humble

Seasoned traders observed long ago that after a series of wins, a trader is vulnerable to over-confidence and trading errors. It's quite understandable. Trading is a competitive business, and when you win, someone else loses. Market participants trade because they are greedy for profits, but often sell out of a fear of losing. How do many traders deal with the inevitable feelings of uncertainty and fear? They become ecstatically happy when they win and ready to brag about their good fortune. Out of a sense of relief, many traders can't wait to brag about their accomplishments. It's important to reward yourself for a job well done, but we have to be careful to avoid getting carried away. Winning traders are humble. They know they can be on top in one market and down in the next. The markets are fickle. A strategy that works in one set of market conditions can fail completely in another set of market conditions.

What's wrong with feeling proud after making a big win? A little pride doesn't hurt. Trading is difficult. Few people master it, so when you are doing well, it's natural to feel a sense of accomplishment and pride. That said, it is important that you rein in your pride and stay humble, especially when you are on a huge winning streak. When you feel overly proud during a winning streak, you may be prone to making a mistake. You may feel so overly confident that you take risks you should not take. The more humble you are the more open you are to your flaws, and the more astute your perceptions of the markets.

Too much pride often leads to disaster. Those who are especially proud have a burning desire to brag about their accomplishments. But bragging can go too far. When people speak of their successes too often, others often resent them, and can't wait for them to fail. The overly proud trader is likely to cave in to strong social pressure to continue making large financial gains to save face. There's also a risk of becoming stubbornly proud. Stubborn pride often happens when people have spent so much of their life feeling proud of their accomplishments, and trying to feel superior to others, that they have difficulty admitting when they have made mistakes. At an extreme, the overly proud trader becomes afraid to face mistakes and may even deny that they have faults.

Extreme pride has been the downfall of many traders. Trading is hard enough without introducing additional psychological pressures to feel superior to others, maintain social status, or save face. When pride drives trading decisions, a trader is likely to take unnecessary risks in order to make big wins to keep up appearances.

Controlling pride is crucial. It is important to develop internal standards of self-worth. It is useful to trade as if you are running a race with yourself rather than running a race against other traders. Develop your own rules and standards related to your skill as a trader. When you reach your standard, you can feel a little pride, but don't feel the need to tell others about it. If you can feel proud of your accomplishments, without feeling the need to brag about how well you have done, or exaggerate how well you are doing, then you will have learned to feel a true sense of self-worth.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

FN Trade

On 29th Jun 2018 we gave our Instant Income Guaranteed subscribers the following trade on Fabrinet (FN). Price insurance could be sold as follows:

- On 2nd Jul 2018, we sold to open FN Aug 17 2018 30P @ 0.30 , with 45 days until expiration and our short strike about 19% below price action, making the trade very safe.

- On 12th July 2018, we bought to close FN Aug 17 2018 30P @ 0.15, after 10 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 91.25%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

$2,790 PROFIT!

Ambush Traders catch stock traders with a bull trap twice for big profits!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 mini Future (RTY) traded at the CME, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Like many other stock indices, the Russell 2000 approached the June highs again this week, very close to the price level where Ambush traders sold the RTY for a $1k profit per contract. And guess what happened this time? Ambush had another sell signal very close to the last one at 1712 points which turned out to be very close to the high of the day. And like last time it turned out to be another bull trap handing us almost another $1k profit, closing the trade at 1693.5!

Is it always like that? Of course not, but if you’ve been on the other sides of these trades you maybe should think about switching sides!

Here’s the result of all of the trades shown on the chart, trading one Russell 2000 mini (RTY) contract, including $10 commissions per trade.

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? With Ambush you’re day trading without even having to be there during the day!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 735 - July 13, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Commodity Characteristics

Could Crude Oil hit $86/bbl?

If you look at a daily chart, it seems pretty far away. But....

If you look at a weekly chart of Crude Oil futures, you realize it's no big thing for prices to hit that high – especially if the economy continues in an inflationary mode.

The strange thing about commodities is that commodity prices are determined by commodity prices.

When commodity prices are high, it drives producers and users to find alternatives. Demand drops, and eventually, commodity prices drop. High prices bring in more supply, and before you know it you have too few dollars chasing too much supply.

The opposite is true as well. When commodity prices are low, supply drops off, eventually resulting in short supply. Demand increases as producers and users drop alternative sources in favor of less expensive sources. At some point, you have too many dollars chasing too little supply.

After many years of hearing about peak oil, it may come as a shock that all sort of new supply is coming into play. Some huge new discoveries have been made, and technology will soon bring even more oil online. We are far, far away from running out of oil.

So, while $85/bbl is entirely possible, so, too, is $45/bbl for Crude Oil.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: It Takes Guts

Short-term winning traders have guts. They have to. No one has a crystal ball. You can guess what the markets will do, but you can never know what will happen with complete certainty. Only the traders who risk enough money, and make enough winning trades can hope to achieve glory. And living under these conditions takes guts.

Trading can be about 90% market psychology. Do fundamentals play a role? Sure they do, but mass psychology can play a bigger role at times. Consider a current news headline: ZZZ Company recently announced that it was doubling its second-quarter loss to $254 million. What can you do with this information? It's hard to know. On the one hand, you might anticipate the stock price to fall as sales continue to decline and pension costs plague an already vulnerable company. On the other hand, the stock price may be at a bottom, and ready to rise at the slightest news of prosperity. In the end, no one (besides insiders) will know for sure what will happen in the next few weeks or months.

What can a trader do? You have to take a risk and think optimistically. Rather than mull over how much money you may lose on a trade, it's useful to put the trade in perspective. It's merely one trade among many. Think of the bigger picture. You may lose on a single trade, but across a series of trades you will come out ahead overall. By risking only a small percentage of your capital on a single trade, you can allow yourself to feel at ease, and calmly assess where any given trade is going. You can nonchalantly close the trade when it isn't going well, or let it ride when it is winning. Successful traders plan on executing many trades and know that not all trades need to be winners in order to increase the equity in their accounts. It's your success overall that counts. Keeping this in mind takes some of the pressure off, and allows you to go from trade to trade in order to allow the law of averages to work in your favor.

Although thoughtful and astute analysis of a company and its stock performance is vital, trading can also be a matter of chance. It may be impossible to anticipate the outcome of any single trade. However, with a large enough number of trades and a trading approach that has a high chance of producing wins, you can expect to come out ahead if you make enough trades.

Although trading involves chance and risk taking, you should not draw the conclusion that winning traders are reckless. They aren't. They approach trading systematically. They develop clearly defined trading plans and they trade them. They wait for market conditions that increase their odds of success. But most of all, they have a positive attitude. They know that if they do their homework and make enough trades, they will take home a profit. There are no guarantees, but if you work hard, and have the guts to take a risk, you will experience the glory of trading like a winner.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

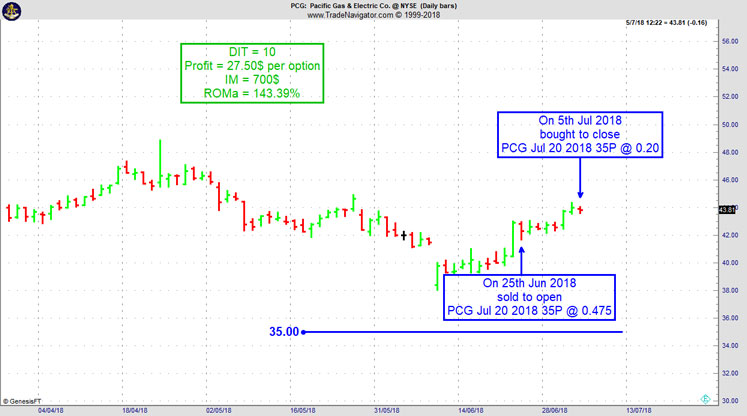

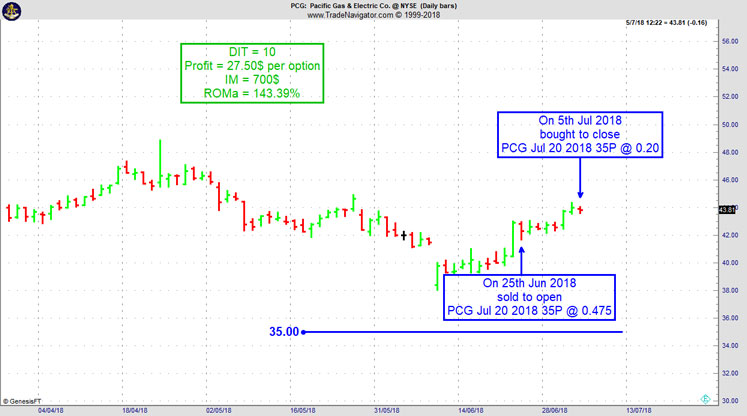

PCG Trade

On 24th Jun 2018 we gave our Instant Income Guaranteed subscribers the following trade on Pacific Gas & Electric Co (PCG), after the breakout of the point 2 of a 123 Low. Price insurance could be sold as follows:

-

On 25th Jun 2018, we sold to open PCG Jul 20 2018 35P @ 0.475 (average price), with 25 days until expiration and our short strike about 18% below price action.

-

On 5th July 2018, we bought to close PCG Jul 20 2018 35P @ 0.20, after 10 days in the trade for quick premium compounding.

Profit: 27.50$ per option

Margin: 700$

Return on Margin annualized: 143.39%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Fear in Trading

For some traders it is imperative that they run scared. For those traders it is the emotion of fear that can generate the concentration necessary to survive.

Trading is a stressful business. In other fields we see constant demonstrations of performing under stress. It is the ability to thrive under stress that sets athletic superstars apart. It is the ability to go on stage when your stomach is full of butterflies that can make a stage performer into a star.

An effective trader learns to handle stress. His natural instinct of self-preservation is what makes him effective when challenged.

There are other forms of stress besides fear. Selfishness can cause a trader to fight in greedily for what he thinks he must have. Such a trader will trade without any consideration for personal honesty. His attitude is get what you want. Win somehow.

As a trader you must find out who you are and learn to accept yourself that way.

Regardless of the source of your stress, if you are going to trade effectively, you must face the cause of it and learn to deal with it.

Many successes in your trading,

Andy Jordan

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Example: Ambush Traders catch stock traders with a bull trap twice for big profits!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 mini Future (RTY) traded at the CME, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Like many other stock indices, the Russell 2000 approached the June highs again this week, very close to the price level where Ambush traders sold the RTY for a $1k profit per contract. And guess what happened this time? Ambush had another sell signal very close to the last one at 1712 points which turned out to be very close to the high of the day. And like last time it turned out to be another bull trap handing us almost another $1k profit, closing the trade at 1693.5!

Is it always like that? Of course not, but if you’ve been on the other sides of these trades you maybe should think about switching sides!

Here’s the result of all of the trades shown on the chart, trading one Russell 2000 mini (RTY) contract, including $10 commissions per trade.

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? With Ambush you’re day trading without even having to be there during the day!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 734 - July 6, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Trade What You See

If you are a student of The Law of Charts, you understand that what drives prices in any market are the actions and reactions of traders to the movement of price. Last week, when I began writing Chart Scan, I saw reversing action in the Canadian dollar.

What was causing that reverse action? Part of it was due to profit-taking by traders who were long and benefitted from the recent run-up in the C$. Part of what I saw was the result of selling action by the Central Bank of Canada. The Canadians have become concerned about the rising C$, which makes their exports less competitive. One other possibility is in the picture, and hints that possibly I was seeing the end of to the carry trade.

With possibilities abounding, what is a trader to do? My solution to the problem never changes — trade what you see.

As I looked at a daily chart of the C$, I could see some significant things taking place. There was no need to guess. The first clue was when C$ futures soared to 0.8168, but gave back much of what it had gained by Closing at 0.81255. That kind of giving back is strongly suggestive of an impending reversal. Sure enough, two days later, more evidence of reversal appeared as an outside, long bar (OB) down with a Close much lower than the Open.

When I see that kind of situation, I am ready to sell short. In my private tutoring sessions, I teach traders to do exactly that, because there are no fewer than two strong signals to go short staring them right in the face. However, even if you don't recognize those signals, a simple reading of the chart is all you need to recognize that the upward momentum has, at least temporarily, been lost.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Self-Control

You're in the midst of a perfect trade. You entered where you had planned, and you know when to exit. All you have to do now is wait for the price to reach 53 and sell. But it's not moving fast enough. It seems to be hovering around 51 and 50. You're starting to wonder whether or not it will ever move up. Panic sets in and you sell. About an hour later, the price hits 53 and it now seems obvious that you should have waited. Why didn't you wait? Why did you impulsively sell? If you have trouble maintaining self-control, you're not alone. It's a common ailment.

It's quite possible to have a trading plan all worked out, but fail to follow it. When you plan out the trade in a logical state of mind, you have every intention of following it. You know exactly what you will do and when. At a critical moment of trading, however, something in your inner self goes awry. When you should be especially focused on sticking with your plan, you abandon it. Why did you make such an impulsive decision that you may regret later? Some traders feel that everything happens so quickly that there is very little they can do. To some extent they are right. Your mind and body tend to react so instinctively that you can't slow things down and stop yourself from making an impulsive decision. However, you can practice slowing down the processes that precede an impulsive move. You may not realize it, but every action you take is preceded by thoughts. You have an internal dialog with yourself as you trade; it's sort of like having a conversation with yourself.

What you say in this dialog dictates how you feel and how you act. For example, if you tell yourself, "The price isn't moving the way I want. It never does, and I'm a fool for believing that it will," you will obviously feel uncertain, frustrated, and ready to close out your position. In contrast, if you think, "The price isn't where I would like it to be, but it's too soon to tell what will happen in the end. I need to relax, trust my trading plan and see if it comes to fruition," you will be more likely to stay disciplined and stick with your plan. It may seem obvious that what you say to yourself will dictate how you feel and act, but many people underestimate the power of the internal dialog. They don't realize that thoughts can pop into their head at the wrong moment and seriously impact what they do. If you are not keenly aware of what you are thinking as you trade, you are prone to fall victim to your unproductive thoughts. It is vital to monitor your thoughts, and when you enter a trade, maintain your self-control.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

PE Trade

On 12th Jun 2018 we gave our Instant Income Guaranteed subscribers the following trade on Parsley Energy Inc. (PE). Price insurance could be sold as follows:

- On 13th & 14th Jun 2018, we sold to open PE Jul 20 2018 25P @ 0.275 (average price), with 38 days until expiration and our short strike about 13% below price action.

- On 26th June 2018, we bought to close PE Jul 20 2018 25P @ 0.10, after 13 days in the trade for quick premium compounding.

Profit: 17.50$ per option

Margin: 200$

Return on Margin annualized: 98.27%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Part 2 - What's my real reason for trading?

Last week we talked about the real reasons for trading and what our hidden goals are. I've received a couple of emails asking me if I can name a few of these hidden goals.

There are numerous motives, but here are just a few to help you get the idea:

- There are those with a deep-rooted belief that things always go wrong and good things never happen to them. They have a wish to confirm this fact to themselves (trading works wonderful for this).

- There is the individual who feels deeply insecure and is looking for something to raise his self-esteem and self-worth.

- There is the trader who believes in creating memorable, flourishing triumphs to be remembered by everyone.

- There is the person who uses trading in the same way people use punching bags – to get rid of the day's frustration. And there is the person who uses himself as a punching bag, employing trading to do the damage.

- There are those who are simply hooked on the adrenaline of the action.

It ought to be stressed that none of these hidden motives are illegal, evil, or bad. They may be exactly what someone wants out of trading. But the problem is, not very many of these motives have any relation to the task at hand ─ trading with the discipline necessary to win consistently.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Many successes in your trading,

Andy Jordan

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Example: Profitably trading the Dollar Index in uncertain Times!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Dollar Index Future (DX) traded at the ICE, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Due to the uncertainty in the US moving towards a potential trade war, the Dollar Index has been tough to trade lately. While it has been somewhat moving higher it did so in a very unsteady way with a lot of sideways action in between, see this daily chart of the DX:

Luckily, Ambush has no trouble at all in such markets and so Ambush Traders had a really good time trading DX during the last two months! As you can see we had a lot of trades at the tops and bottoms of these trading ranges, whether they’re small or a bit more expanding.

Where’s the Dollar Index going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

Here’s the result of these trades, trading one Dollar Index (DX) contract, including $10 commissions per trade. Yes that’s a win rate of over 83% and a profit factor of 9!

Is it always like that? Of course not, but if you’ve been on the other sides of these trades you maybe should think about switching sides!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 733 - June 29, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Traders Trick

Question: Would entry 1 tick below the low of the bar labeled as TTE be valid?

The answer is "perhaps!" The definition of a valid Traders Trick Entry is that there be enough room between the point of entry and the point of the Ross hook for the trader to be able to cover costs and take a profit. But does the Traders Trick on the chart below meet that condition? Most assuredly yes, if we are looking at a weekly or monthly chart. Possibly, if we are looking at a daily chart. But would it be a valid TTE on a 1-, 3-, or even a 5-minute chart? Hardly likely at all.

My point here is that a chart is a chart, is a chart. The Law of Charts states that all price charts reflecting markets make certain formations as humans emotionally respond to the movement of prices.

So what's the difference? The difference is in the magnitude of move that can be expected. For the TTE to work, there must be sufficient room for you to be able to cover costs and take a profit.

A TTE 1 tick below the low of the #3 bar might have worked on one of the lesser time frames. I happen to know a person who lost $45,000 because he could not see what I just explained to you!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Timely Exit

What is your tolerance for pain? Consider the following scenario. You have 10% of your account balance on the line. For the past two days, prices have been going in the direction you had anticipated, but today, an announcement was made that caused a market move that caused all your profits to be wiped out in an hour. What will you do? See if prices will move back to where you are okay again? At times like these, it is useful to have a clearly defined trading plan with a specific exit strategy.

Trading is inherently uncertain. You never know exactly what will happen next. That’s what makes the business exciting to some traders but nerve wracking to others. How you handle adverse events that make prices move against you depends on your personality. The best way to protect your capital is to use protective stops. When formulating your trading plan, you must decide how much pain you can tolerate. How much money can you lose before you have to exit the trade? You can set this exit point as a formal stop loss, you can use the automatic settings on your trading platform to set a stop, or you can use a mental stop (not recommended).

The problem with a formal stop loss procedure, whether it is a formal order or an automatic setting on your trading platform, is that a transitory change in price can ‘stop you out.’ if the placement of your stop loss does not adequately account for volatility. It’s hard to know how far a stock may move and a temporary drop can ruin your trading plan when a protective stop is not set properly. Mental stops may be more useful, but you run the risk of not being able to exercise your mental stop (think heart attack, nervous breakdown, stroke, personal emergency, computer failure, etc.). You can decide how far a stock price must move against you before you will liquidate the position. When prices reach the exit point, you can decide whether the low price is transitory or represents a significant change in trend. You can then exit the trade.

This all sounds good in theory, but depending on your personality, you may not be able to carry out this strategy. If you have trouble controlling your emotions and you use a mental stop, for example, you may have trouble closing the trade when it reaches your exit point. Some people panic and out of fear don’t close their position when their mental stop is reached. These people may need to impose the proper amount of discipline on their trading actions by using an electronic stop or a formal stop-loss order.

Minimizing trading losses is the hallmark of successful trading, but not all traders are equal when it comes to their ability to trade decisively under strain. If you want to trade profitably, you have to work around your personality. If you are cool headed, disciplined, and are willing to take the risk even under the most stressful conditions, you can use mental stops to protect your capital. But if you are easily shaken by choppy market action, you might want to use electronic, automatic stops to protect yourself. Whatever you do, however, minimize losses as much as possible. It’s the only way to trade profitably in the long run.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

FCX Trade

On 23rd May 2018 we gave our Instant Income Guaranteed subscribers the following trade on Freeport-McMoran Copper & Gold (FCX). Price insurance could be sold as follows:

- On 29th May 2018, on a GTC order , we sold to open FCX Jul 20 2018 14P @ 0.14, with 51 days until expiration and our short strike about 16% below price action.

- On 6th June 2018, we bought to close FCX Jul 20 2018 14P @ 0.07, after only 8 days in the trade for quick premium compounding.

Profit: 7$ per option

Margin: 280$

Return on Margin annualized: 114.06%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Idea

This week, we're looking at 500*GFU18 – 400* LEG19: long September 2018 Feeder Cattle and short February 2018 Live Cattle (CME on Globex).

Do you want to see how we manage this trade and do you want to get detailed trading instructions every day? Click here for additional information!

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Blog - Don’t get married to a market!