Newsletters (208)

Children categories

Edition 684 - July 21, 2017

Chart Scan with Commentary - Mutual Funds

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

We received a question asking whether or not the Law of Charts works with Mutual funds. The answer is yes it does but the concept is more easily seen on a weekly chart because daily charts show only the Closing price for mutual funds.

The chart shown is Oppenheimer Gold and Special Minerals Class Y mutual fund, which rises when the with the price of gold and other minerals, and falls and falls when the price of gold and other minerals fall. Please note: Some mutual funds are inverse funds where shares in the fund rise when prices fall, and fall when prices rise. The chart shows the entry on a breakout from a Trading Range on exactly the 29th weekly bar. The breakout is that long bar you see as prices break through the Trading Range. The Law of Charts states that breakouts from consolidations are most likely to occur on bars 21-29.

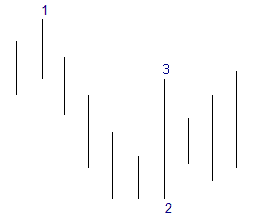

The arrow shows a potential entry one tick above the high of the range. Notice that share prices have recently formed a 1-2-3 low.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - The Nature of the Trading Business

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Consider the following: As a trader you are in a business. Your strongest opponent has plenty of capital. He follows a program and he does it without emotion. He is totally aware of the fact that no one knows where the next tick will fall. Whereas he usually has good insights regarding the major forces that drive the market, he does not fool himself into thinking he can explain the vagrancies of price movement intraday or even from day to day. He knows that no one truly can. The successful trader has learned his lessons by actually trading. This is a business driven by fear, greed, and selfishness, and very few worthwhile pointers are given out by the industry, other traders, or the myriad of so-called trading gurus who plague the pages of trading magazines and pages of their websites. The most valuable information is closely guarded and not often put in books or on web pages. Learning about trading is a ‘forever’ experience. As the markets change and as we adjust to them, we learn. The learning is ongoing. It stops only when you no longer trade. During the time we trade we can always improve. Trading is a great business for those who master it, and those who master it are traders who have mastered themselves.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - FITB Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 20th June 2017 we gave our IIG subscribers the following trade on Fifth Third Bancorp (FITB). We sold price insurance as follows:

- On 21st June 2017, we sold to open FITB Jul 21 2017 23P @ $0.15, with 30 days until expiration and our short strike 10% below price action.

- On 10th July 2017, we bought to close FITB Jul 21 2017 23P @ $0.05, after 19 days in the trade.

Profit: $10 per option

Margin: $460

Return on Margin Annualized: 41.76%

With implied volatility extremely low, we still managed to sell price insurance 10% below price action and below a major support level.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea - Soybean Oil (CBOT on Globex)

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

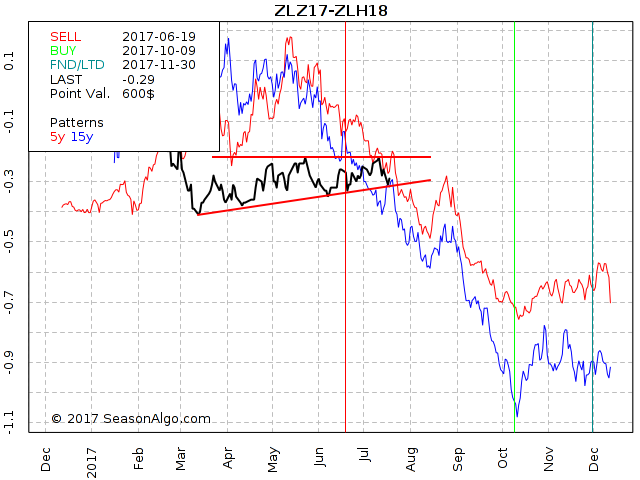

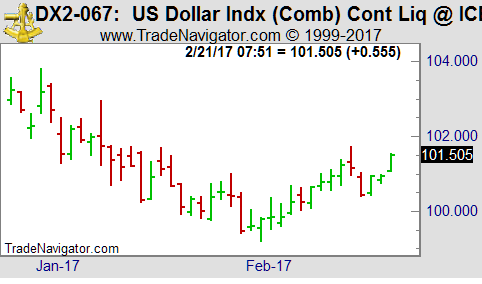

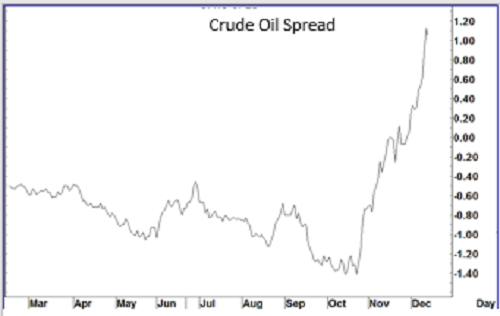

This week, we're looking at short ZLZ17 – ZLH18: short December 2017 and long March 2018 Soybean Oil (CBOT on Globex).

Today we consider a Soybean Oil calendar spread: short December 2017 and long March 2018 Soybean Oil (chart above). The spread has been trading sideways for a long time making slightly higher lows with highs around -0.2. For an entry it either needs to break to the down-side or move back up to the upper side of the range.

Also the seasonal statistic looks promissing with 14 winners during the last 15 years and a max. daily drawdown of only $192 in 2011.

Do you want to see how we manage this trade and how to get detailed trading instructions every day?

Traders Notebook Complete

Please visit the following link:

Yes, I would like additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading Related Questions

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

I would like to share a video that provides answers to trading related questions. Feel free to This email address is being protected from spambots. You need JavaScript enabled to view it. with any questions or whatever is on your mind about trading.

Happy Trading,

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 683 - July 14, 2017

Chart Scan with Commentary - TTE Rule

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

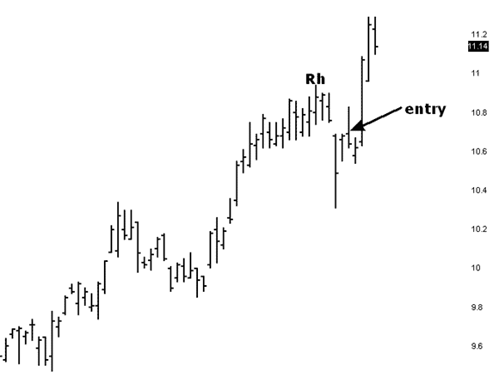

The chart below shows something I feel we need to learn about the Traders Trick (TTE). Prices reached a high of 10.94 and then retraced for two days. Those two days made identical highs [at 10.90]. Prices then dropped again, and again we had two identical highs [at 10.69]. The TTE rules say that after 4 bars of correction you are no longer to enter a trade based on the TTE. However, the rules also state that when expecting a continuation towards the upside, equal highs count as only one bar of correction (retracement). So, although we have 4 bars in the correction, because of the equal highs we count this as only two bars of correction. Now you can see why we made an entry 1 tick above 10.69. What happened afterwards is of no consequence to the rule I am showing you here. In accordance with your money and trade management, you made a little, took a loss, or made a lot on this trade. I will tell you only that we made a little.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Information Overload

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Do you do an awful lot of research into a market before you attempt to take a trade in it? Do you look at fundamentals and try to glean as much information as you can about the underlying? Do you feel that you are doing a more than adequate job of information seeking, but are still not as much as a breakeven trader? Are you beginning to feel that you are doing something wrong?

Well, it could be that you are suffering from information overload. It could also be that you are gathering information about the wrong things. People have a tendency to believe that the accuracy of their trading increases with more information. This is one of the illusions of knowledge—that more is somehow better—that more information increases your knowledge about something and improves your decision- making ability. But that is not necessarily true—increased levels of information do not always lead to greater knowledge. There are three reasons for this. First, people tend to interpret new information as confirmation of what they previously believed. You believe what you want to believe—you are biased, even if you are not conscious of the fact. Second, some information doesn't help us at all in making predictions, and can even mislead us. Finally, we often do not have the training, experience, or skills to interpret the information correctly.

You have to closely examine the kind of information you are looking at and determine its real value to the markets you are trying to trade. I have seen traders keeping elaborate records of everything they are doing as they trade. They keep files full of articles and reference materials which they pore over prior to making a trade. But is all this really necessary? I doubt it. It is much better to trade what you see without having to find justification for every trade through research.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - EWW Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 14th June 2017 we gave our IIG subscribers the following trade on iShares MSCI Mexico Investable ETF (EWW). We sold price insurance as follows:

- On 15th June 2017, we sold to open EWW Jul 28, 2017 49.5P @ $0.38, with 43 days until expiration and our short strike 9% below price action.

- On 7th July 2017, we bought to close EWW Jul 28, 2017 49.5P @ $0.10, after 22 days in the trade.

Profit: $28 per option

Margin: $990

Return on Margin Annualized: 46.92%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Latest Blog Post - Overtrading

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

My latest blog post points out 5 mistakes when it comes to overtrading. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - What you should know about winning percentage

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

The winning rate or percentage of winning trades are very common statistics. And while it can be a useful metric, it can also be misleading, so let's have a look!

The winning rate or winning percentage tells you how much percent of the trades in a backtest (or real past trades) have been winning trades. So if you have 100 trades in total, and 75 of those trades closed with a profit, you have a winning rate of 75%. Now the first thing to notice here is how those winning trades are defined. Are breakeven-trades included? What about commissions? If you have 100 winning trades in the E-Mini Dow Future and each of those trades was closed at 1 tick profit ($5) and you pay $7.50 per round turn, you actually lost money even if you hit your profit target 100% of the time.

Which leads us to the next question. What was your profit to loss ratio? Without knowing how much money was made on the winning trades and how much was lost on the losing trades, the winning rate is completely useless. Here’s an extreme example. Let’s say you have 90 out of 100 winning trades, a winning rate of 90%. Sounds great right? But what if on average you had an average profit of $100 per winning trade ($100 x 90 = $9000) but an average loss of 1000$ per losing trade ($1000 x 10 = $10000)? Right, you'd have lost $1000 even with a winning rate of 90%. Of course, this also works the other way around, if you only have 10% winners, but those are 10 times the size of your 90% losing trades, you’ll come out ahead!

Don't forget to always have a look at the profit/loss ratio and don't get all excited right away if you see a very high winning rate.

Happy Trading,

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 682 - July 7, 2017

Chart Scan with Commentary - Strategy

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

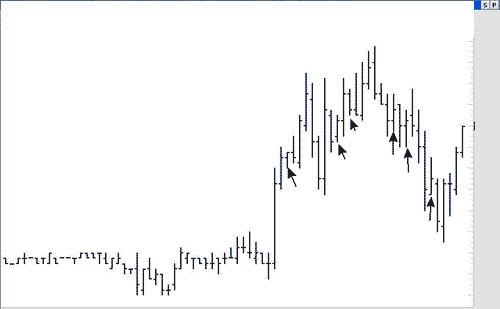

I had a bit of fun scalping the eMini S&P 15-minute chart. I figured out that the best time to do it was between 07:30 AM U.S. and 14:45 PM (Central Time). Sometimes the best trades are made simply by just looking around for stuff to do, and what I saw in the eMini S&P from past days gave me a chance to test a strategy I was thinking about using.

Caution: When using a strategy such as the one I will show you, don't expect it to work all the time, or for a very long time. No doubt, shortly after this issue of Chart Scan comes out, it will stop working. Do you want to know why? It's because if a lot of people jump onto it, the market will adjust, and the strategy will stop working.

There is a wise saying which came into being primarily since the advent of mechanical trading systems, and it goes something like this: "Your system will stop working when someone else builds his system based on your system." Can you see the truth in that? It is because of that reality that it is best to scout around for what may be working recently, and why it is a waste of time to backtest a system or method to see if it has worked for the last 10 years. You can't trade history you are forced to trade the present in an attempt to take advantage of the future.

When scalping, it is vital to understand the mind set needed for this kind of activity. You must not allow yourself to look for the big trade. You must not allow yourself to look for how much you can make by riding a winner. The discipline calls for seeking a set number of ticks, pips, or points, and then taking your money. You must have absolutely no regrets about missing out on what happens after you have taken your money--you must exit at your money objective. This is not to say that you cannot come up with a management scheme that allows for only part of your money to be taken at an objective, and then developing a scheme for trailing a stop in case the move continues. You might even have two objectives for a trade, maybe more.

The idea behind a scalp trade is to find a very high percentage trade and then use a lot of shares or contracts, so that you make a pile of money on only a very small move. You have to be fast, so I suggest you do this kind of scalping only in fully electronic markets like the eMini S&P. Also, be sure there is sufficient volume to enable your scalp. You will be badly hammered by the market if you go long with a lot of size in a market that is not trading sufficient volume to handle that size in the time interval you are trading.

Example: A market is trading a volume of only 70 contracts in a 15-minute period, and you enter with a 50 lot. You will definitely move the market, and there will be only 35 potential fills to take the other side of your trade. You would be overtrading.

Example: A stock is trading a volume of 9,000 shares in a 15-minute period, and you decide to enter a trade for 5,000 shares. Do you see what will happen to you? There are only 4,500 potential fills for your position. You would be overtrading.

With those things in mind, and probably a few I've forgotten, let's look at how I traded the eMini S&P.

I have placed arrows pointing to the available trades. My objective was to get .75 per trade on a lot of contracts. There were 6 trades in all, and 100% winners. One of the trades made only .50 and one made only .25. The remaining 4 trades made .75. Total made was 3.75 points. On the surface, that is not a lot for a day's work. But I did a lot of contracts. I'm not telling how many, but you can figure out for yourself how many you need to do. If you wanted to make $1,875 you would have had to trade a 10 lot. Of course, that would have been the gross amount. Commissions and fees would have reduced your take-home pay.

What was the magic method? Here it comes, but it is not the Holy Grail of trading. The five trades were all breakouts of inside bars, bought or sold at the high or low of the inside bar. Take a look:

What does all this have to do with the Law of Charts? The Law of Charts states that the breakout of the high or low of any bar is an entry signal. In my book Day Trading, I describe major, intermediate and minor entry signals. Every book or article I've written, every seminar or webinar I've given, is and has been, in one way or another, based on the Law of Charts. If you haven't studied it, get it. There is no charge for it.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Pulling the Trigger

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Dear Joe, Sometimes I absolutely dread sitting down to trade. I have had so many bad experiences that I’m not sure I can pull the trigger. Is there anything I can do about it?

What happens to us as we trade colors the way we see things in the market and influences the way we approach them. We take a big hit in a particular market, and we decide never to trade there again. Or, when we have a great trade in a market, it produces pleasure, so we try to trade there again as soon as we can.

How do you envision the markets overall? More importantly, how do you conceive of your role in the market? Do you see the markets as potentially hazardous arenas in which you must be very, very careful? Do you see them as though everyone in them is out to take your money? Or do you view them as a place in which there is dynamic profit opportunity?

Each time you sit down to your trader workspace, do you feel uncomfortable and wish you were somewhere else? Or are you really eager to jump into your work, look over your charts, and get down to trading? Does plowing through new material feel like a lot of hard work, or does it excite you to learn new information that will add to your ability as a trader?

The way you envision the markets will have a powerful influence on your actions! So it's absolutely necessary for you to be very much aware of just what your perception is and what past experiences colored your perception. You need to honestly assess your vision of - and feelings towards - the markets and your role in them. It will surely be time well spent.

Here's something to think about: the longer you sit in front of your screen, the more bad experiences you are going to have. The thing that defeats most day traders is that of overtrading. As you continue to sit in front of your trading screen, your focus and your sensibilities become increasingly numb. The longer you sit there, the more the probabilities increase in favor of your making bad decisions and wrong trades.

Let me ask you a question that may put the entire situation into perspective for you. Have you ever seen old people in a nursing home sitting hour upon hour staring at the TV screen? If you haven't, can you picture what it would be like? Almost everyone has seen people who either by choice or circumstance, sit all day watching TV. They sit and watch the "boob tube" hour after hour. What do you suppose this is doing for their minds? Do you think they are becoming increasingly sharp? Is sitting there all day helping them to grow? What would you say is happening to their minds? Are they not going to suffer from an increasing amount of atrophy as they fail to think - as they fail to use their minds?

When I see a trader sitting in front of his trading screen all day long, it generates the same kind of picture for me as when I see someone watching TV all day. They are destroying their minds. At least with TV you might learn something. But what are you learning watching a cursor tick up and down hour after hour?

Trading is a terrible occupation if all you do is trade. Taking signals from a mechanical trading system is one of the most mind numbing, emotionally crippling things anyone can do. The shorter the time frame being watched, the worse it is. Is it any wonder that 90% or more of wannabe day traders last only 3-6 months in the market?

A successful trader has two major things going for him/her: 1. Plenty of money to have an excellent life-style. 2. Plenty of time to do some good in this world. But if you sit and trade all day, what do you have to show for it in the end? What have you produced that is of benefit to anyone but yourself?

I'll let you answer that. But my suggestion to you is that you strive to trade less, not more. Learn what the good trades look like, and then trade them only when they occur. And when they do occur, focus your money - trade as many contracts on the good trades as you can. Don't trade more of the time on lots of trades, trade lots of contracts less of the time on the good trades.

Use your time and money to help those less fortunate than you. After all is said and done, it is more blessed to give than to receive. Do you know what the word "bless" means? It is a verb meaning to "make happy." Paraphrased, that old saying translates to "you will be a happier person if you 'give,' than if all you do is strive to 'get.'" But if you are busy spending all your time on a 1-minute chart trying all day long to get, you're not going to be able to get much of the happiness that is available from giving.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - TXT Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 15th May 2017 we gave our IIG subscribers the following trade on Textron Inc. (TXT). We sold price insurance as follows:

- On 16th May 2017, we sold to open TXT Jun 16, 2017 44P @ $0.37, with 30 days until expiration and our short strike 8% below price action.

- On 1st June 2017, we bought to close TXT Jun 16, 2017 44P @ $0.10, after only 16 days in the trade, for quick premium compounding.

Profit: $27 per option

Margin: $880

Return on Margin Annualized: 69.99%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan Trading Idea - Cocoa trading at the ICE

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

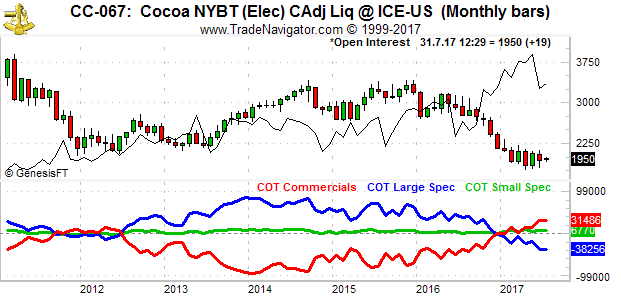

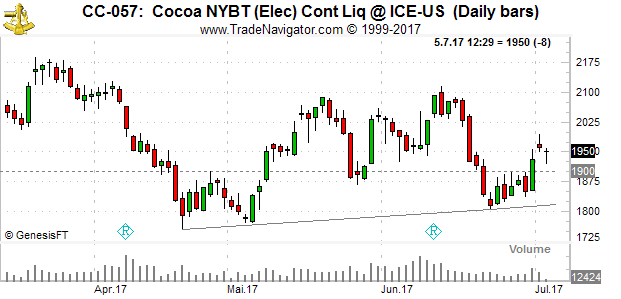

This week, we're looking at Cocoa trading at the ICE. What caught my first attention was the net long position of the Commercials. As you can see on the chart below it is at an all time high with the Large Specs at an all time low.

On the second chart below you can see that we are (slightly) in an up-trend since April with making (slightly) higher lows. The break above 1900 might be another sign for Cocoa to move higher.

Because of above reasons you might want to look into selling Cocoa puts using a far out of the money strike price. I’d prefer the December puts with a delta of about 10.

Do you want to see how we manage this trade and how to get detailed trading instructions every day?

Please visit the following link:

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video Marco reviews an "Outside Bars" pattern as an entry signal. He shows you how if it works as an entry signal in the Russell 2000 Mini Future and how to evaluate entry signals in general by using a systematic approach.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 681 - June 30, 2017

Chart Scan Trading Idea - Long GFQ17-GFU17 Feeder Cattle Spread

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

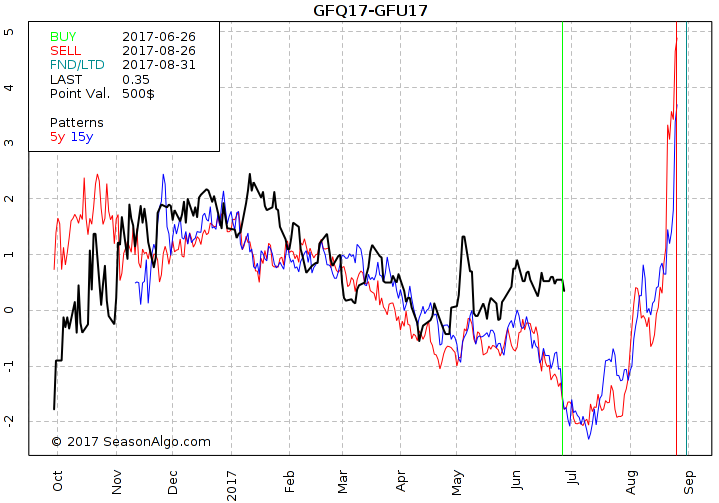

Today I am looking at a market that I don’t like to trade using outrights, but trade regularly with spreads. We are looking at the spread long August and short September Feeder Cattle with a seasonal time window between 06/26 and 08/26. Seasonality looks strong during that time and also the seasonal statistic looks promising. Because the time difference between both legs is very short (only 1 month) the spread is usually not very volatile and therefore the risk per spread contract at the lower range.

Do you want to see how we manage this trade and how to get detailed trading instructions every day? Please visit the following link: Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy Jordan's Blog Post - Some things that keep traders from "making it".

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Find out the three psychological traits that prevent traders from becoming consistently successful. Read more.

Chart Scan with Commentary - Strategy

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I was going through my portfolio of past Chart Scans when I came across a chart with a question from one of our students. The chart and my answer to his question are below.

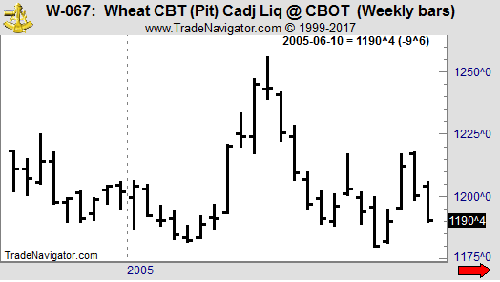

Hey Joe! Wheat seems set to go lower. It has formed a 1-2 with a potential #3 high formation at the end of a swing. If prices end up with a lower high and a lower low next week, the 1-2-3 formation will be complete. Friday’s Close ended the week near the low of the week after having spiked higher earlier in the week. In an odd sort of way, we have a “spike reversal.”

I agree. You could call that a sort of spike reversal, but it seems to me you have already miss the best chance to go short. I took the liberty of marking the chart you sent with the appropriate entry point.

In my opinion, entering 1 tick below of the “spike reversal” would have given you a more certain entry. Entering that way would have you already short based on a Traders Trick Entry.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Rationalizing

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

One of the most important things to learn in this life is how we ourselves behave, not only when we are acting on our own, but when we are part of the crowd. And what few of us understand is how many of our important daily actions are not thought out in advance. We are all attempting to survive in what is basically a hostile environment. Many of our actions are in response to some sort of stimulus, whether someone else’s words, or actions, or something physical like our computer going down while in the midst of a trade. It may be painful to admit, but in much of human behavior we act first and then rationalize what we did later. While we all try to be logical, in most instances the rationalization comes after the fact, if it comes at all, and in general it is not at all close to explaining why we acted in the way we did. It is tough to be honest with ourselves, but honesty with self holds one of the secrets to success. This is nowhere more true than in trading.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - WY Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

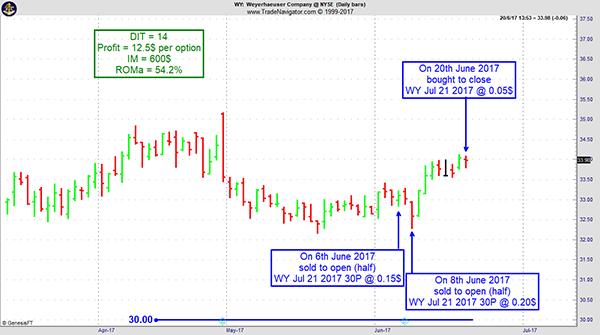

On 6th June 2017 we gave our IIG subscribers the following trade on Weyerhauser Company (WY), the stock being close to weekly and daily support zones. We decided to sell price insurance as follows:

- On 6th June 2017, we sold to open WY Jul 21 2017 30P @ $0.15, with 45 days until expiration and our short strike 10% below price action for half of our position.

- On a GTC order, on 8th jun 2017, we sold to open WY JuL 21, 2017 30p @ $0.20.

- On 20th June 2017, we bought to close WY Jul 21, 2017 30P @ $0.05, after only 14 days in the trade, for quick premium compounding.

Profit: $12.5 per option

Margin: $600

Return on Margin Annualized: 54.32%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

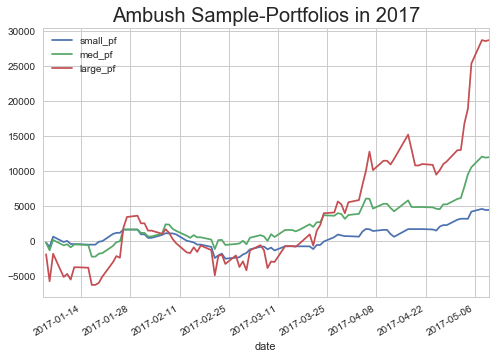

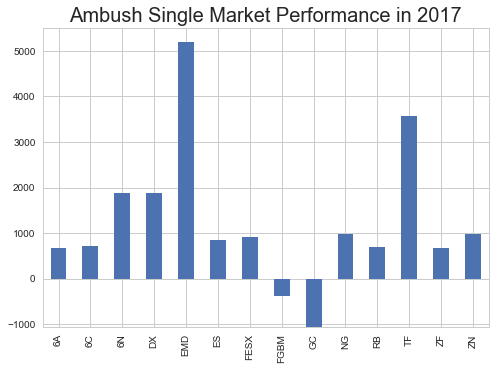

Ambush Traders dominate the E-Mini S&P 500 again in June!

Ambush Traders dominate the E-Mini S&P 500 again in June!

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

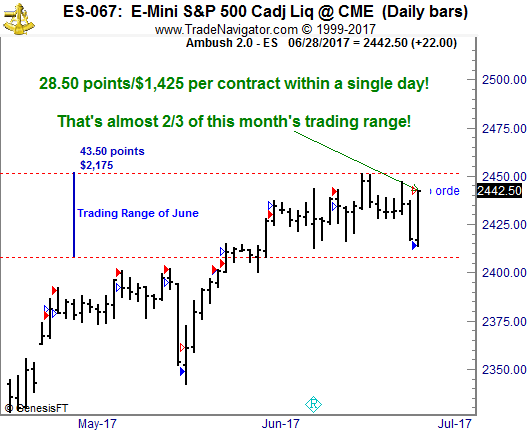

Ambush just won’t stop making new equity highs in many markets, including the E-Mini S&P 500 this year.

And so it just happened again yesterday when Ambush Traders totally dominated the E-Mini S&P 500. You have to see THIS trade for yourself:

Let’s put this into perspective. June’s trading range (Difference between the highest high and the lowest low of the whole month so far) in the ES was about 43 1/2 points.

The Ambush trade you can see on the chart is 28 1/2 points. Yesterday, within just one day Ambush traders made almost 2/3 of the whole months trading range! That’s $1,425 with a single day trade!

That’s insane and honestly makes most day/swing/position traders who sit in front of their charts all day long getting in and out of the market look like fools.

Just think of most day traders sitting there all day long trying to scalp a point or two out of the E-Mini. Want to know what the result of their efforts is at the end of the trading day? Red eyes and hardly any trading profits due to the trading costs, a happy broker thankful for the commissions and if the high-frequency trading robots could laugh, they would!

Now compare that to the Ambush traders who just placed their orders at the market open and went to the beach! Relaxed eyes, hardly any commissions and about $1400 profits at the end of the day…

Want to become an Ambush Trader too?

Then simply sign up to Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 PM NY Time (yes, it's ready much earlier now than before) the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the markets close! Can you imagine a more comfortable way to day trade?

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 680 - June 23, 2017

Hesitating Before a Trade

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

There are any number of reasons why a trader hesitates before a trade. The main one is lack of planning. Without a plan, there is no degree of confidence a trade will be successful, it’s all wishful thinking. Unless they are outright gamblers, traders usually have a strong need to protect their assets and avoid risk. This is especially true for beginning traders. It can take a long time to build up sufficient capital for serious trading. By that I mean sufficient capital to be able to trade for a living. It is quite understandable to fear losing all or part of your initial capital. Beginners tend to seek absolute certainty before taking a risk, and gaining true confidence in you ability to trade successfully can take time.

When it comes to short term trading, there isn't very much time for long deliberations. Market conditions are in continuous flux. Decisions need to be made relatively quickly, and if one waits too long to execute a trade, he or she may miss a significant opportunity. The reasons for hesitation are everywhere, and traders must be aware of them, and create a plan to prevent them.

Do you hesitate before a trade?

If so, Traders Notebook might help to overcome your fear to pull the trigger. With Traders Notebook you receive detailed trading recommendations for futures spreads, options, and outright trades on a daily basis with an excellent performance over many, many years.

We just made new equity highs with our spreads and options trading in Traders Notebook and we are on the best way to reach even higher levels this year.

And the best thing of all: you can start futures trading even with a small account of only $10k to $15k and build up your trading account slowly.

Click here to take advantage of our 30% off promotion!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Measuring Bar

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I have shown you how it was that a #1 and a #2 point could both occur on the same bar. This week I am revisiting that chart with some additional information.

In my book Trading Optures and Futions I wrote that one of the ways to know when prices are in consolidation is through the observation of a measuring bar.

One of my students, who lives in Brazil, was kind enough to send this chart. The doji bar labeled 1-2 is a measuring bar. What it demonstrates is that we have consolidation when: following the measuring bar we have at least four opens, four closes, or both, all falling within the range of the measuring bar. On the chart above we see that as of the time I received the chart, prices were in consolidation for 8 days.

Another characteristic of consolidation is found when prices have formed both a 1-2-3 high formation followed by a 1-2-3 (I, II, III on the chart) low. The Law of Charts dictates that when prices are in consolidation, the trader should AVOID taking Traders Tricks ahead of the breakout of a #2 point. The reason is that the expectation from a 1-2-3 formation is some sort of consolidation.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Developing a Trading Style

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Master Traders develop a style that is a reflection of their education and character. Most individual trading styles are either positional or combinational and, rarely, a synthesis of both. However, there are other styles.

Positional traders take x amount of positions within a specific price area where the market is thought to be favorable to their trading strategy. This may occur on short term weakness when the longer trends are bullish. A known risk is assumed for a specific profit taking area. Positions remain until the losses or profits are taken or the price action analysis negates the trading strategy.

Combinational traders do not have the patience of positional traders, and want immediate profitable results or will exit the market quickly. These traders add additional orders as the market moves their way, building up large positions for fast two- to six-day price moves, then take profits and exit the market.

A third type of trader is a system trader, who adheres to a trading system discipline.

A fourth type of trader is the method trader. Methods differ from systems in that a method can be traded either as a system with no discretion, or traded with discretionary intervention. A method allows for a trader to be able to change parameters. A method gives full-disclosure of all its parameters and the logic behind the method. It should be realized that both systems and methods are based not so much upon a rationale as they are upon pure statistics, i.e., when a certain setup or pattern occurs, and you behave in a certain way, the result is statistically in accordance with the probable outcome.

The complete trader is able to combine all or parts of the above approaches with his own style. Trading mastery combines observation, scientific knowledge, good judgment, intuition, and creative instincts with decisive action.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - KNX Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 31st May 2017 we gave our IIG subscribers the following trade on Host Marriott Trust (KNX). We decided to sell price insurance as follows:

- On 1st June 2017, we sold to open KNX Jul 21 2017 30P @ $0.45, with 50 days until expiration and our short strike 10% below price action.

- On 12th June 2017, we bought to close KNX Jul 21 2017 30P @ $0.20, after only 11 days in the trade, for quick premium compounding.

Profit: $25 per option

Margin: $600

Return on Margin Annualized: 138.26%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Video - Manual Backtesting Pitfalls

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco talks about some of the most common pitfalls when doing manual backtesting. So if you ever wondered why your actual trading results don't match with the manual backtest you did, this is for you!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 679 - June 16, 2017

Chart Scan with Commentary - Lesson from the Past

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

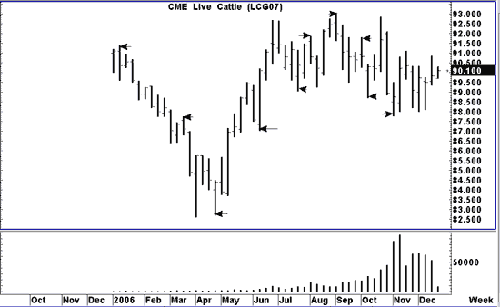

It is extremely important to pay attention to what you see. In the past I’ve written about anticipatory trading, and in this issue of Chart Scan I want to show you more about what I mean. The Law of Charts indicates that there will be many orders grouped above or below a weekly high. Since it is the job of the market to fill orders, you can anticipate that either the high or the low will be violated with considerable momentum in order to break through what, on a lesser time frame, will appear to be so-called "support" or "resistance."

Take a close look at the Weekly Live Cattle chart below. The chart is a continuous chart. I rarely bother to adjust my continuous charts, so when the contract month changes you will often see a gap like the one just prior to the last four bars on the chart.

For what I want to show you here, those gaps will not be important. They were important in 2007 and they are important even today.

I’ve drawn an arrow next to each bar that is of interest. What do you see that is "special" about the price bars I’ve pointed out?

I may have missed a few, but be aware that most of the time when one of these special bars occurred, prices moved strongly the following week in a direction opposite of the way they had been previously going. What is most interesting about these bars is what happens on the following bar, the one representing the next week’s price action.

The bars I have pointed out can occur whenever a new local high or low has been made. By local, I mean recent, not necessarily an all-time high or low, or even a contract high or low. Now, have I revealed to you the holy grail of turning points in the market?

No! I have merely pointed out "reversal bars." These are bars that make a new high, and close lower than they opened when a market has been moving up, or make a new low, and close higher than they opened when a market has been moving down. Such bars create an immediate or even longer term pivot point in the market.

Interestingly, when these occur on a weekly chart in Live Cattle, the following week sees a continuation of the price action in the direction of the reversal. Better yet is to see one of these reversals take place in conjunction with a seasonal entry signal.

Now go back and check that chart again. If you can’t see a way to make money on reversal bar anticipation, you should close out your account and use your margin money to purchase a seeing eye dog. When the reversal fails to follow through the next week, there is seldom anything to worry about. You simply are not able to get into the market, or you sustain a small loss if you are not able to watch.

Here’s another way to use the simple fact of a reversal bar, and a way that I regularly do use them.

Whenever I am holding a position in a trade, I tighten my profit protecting stops as soon as a reversal bar occurs or is in the making. I either protect a portion of my profits, or I move my stop to within one tick of the extreme of the reversal bar.

If you want to do something profitable right now, pick up your charts and see what would have happened to you in any market, in any time frame, simply using the concept of the reversal bar to get into a trade and to get out of a trade. However, there is a serious caution in the lesser time frames. In a trading range, you will find that the price bars will reverse every other bar or every two bars. In most cases you will not be able to obtain a trade using the technique as an entry signal, because prices will not continue in the direction of the reversal.

The best results will be found when prices begin to trend. How will you know when prices are beginning to trend? You will cease getting alternating reversal bars.

You might also want to look at previous issues of the Monthly Report to see if any of the reversal bars took place in conjunction with a seasonal entry signal. I looked a little way back and found that the Live Cattle contract reversed during the week of 3-27-96. The report called for a seasonal short trade entry on that date. The report also called for a seasonal short trade on 4-11-96 in the June Live Cattle contract, and sure enough, that week there was a reversal.

But I don't want to have all the fun, so I'll leave a few for you to do as research. Don't tell me you just sit in front of your screen all day and watch the markets. Heavens! You really ought to do some research, shouldn’t you???

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - A Great Lesson

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

From a longtime friend and student:

"I thought that I’d pass on something that you might want to share with your trading community. I spent way too long thinking that range bars and/or tick bars were my way to the holy grail and I would like to tell you what I realized and why I think I was wrong."

"First some background: I got started down that path, because wasn’t seeing formations on the x minute charts with what I thought was adequate frequency. This all got started a few years ago and I haven’t gone back to look at those charts. Maybe it was just a slow period or maybe I misinterpreted what I needed to see. Regardless, in my attempt to find a solution, I looked at range and tick charts. You’ll probably remember that I came to Austin and showed the range charts to you and you agreed that they showed trades clearly. Tick charts showed different things, but they make beautiful TLOC formations."

"The fatal flaw is time coupled with charting inaccuracies. The time aspect is that the TLOC formations that one sees on those charts are fantastic, but they are impossible to manage in live trading. The challenge is that the beautiful formation that you see on a historical chart can take 30 minutes or 30 seconds to form. Therefore, you either fall asleep before the formation completes itself or you don’t have time to get the order placed. In addition, the tick change shape completely sometimes when Trade Navigator corrects or recalculates the data. It doesn’t happen often, but enough to cause a problem: a formation would look one way during live trading and then after the nightly update, it would look similar, but different enough to change how I would have traded it."

"Another aspect is that when trading those charts, you must be "on" 100% of the time that you are trading, because you never know how long it will be before a tradeable formation happens. With time charts, you know that you have a few minutes while the bar completes, so you can unplug from time to time."

"I don’t know why I didn’t figure this out sooner."

"I went back to minutes and there’s plenty of action, so I’m back in business. The tick charts seem like they might be useful to see inside a reversal bar, but not on their own. You might have already put this somewhere in a blog post, but I wanted to pass on my experience."

Limit Offer!

Further your education with "The Law of Charts In-Depth" Recorded Webinar and use coupon code during checkout, Take50 to receive 50% off your purchase (offer is good until 6/19/2017).

Through this recorded webinar The Law of Charts, we will show how YOU how to win consistently in any market and in any time frame. What it takes to create charts that exactly fit your trading style and level of comfort. The content of this intensive, in-depth recorded webinar takes the "The Law of Charts" to the next step. You'll feel like your attending a private seminar with Joe Ross himself. Don't miss out, use coupon code during checkout, Take50 to receive 50% off!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - TSO Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 4th June 2017 we gave our IIG subscribers the following trade on Tesoro Petroleum Corporation (TSO). We decided to sell price insurance as follows:

- On 5th June 2017, we sold to open TSO Jul 21, 2017 75P @ $0.43, with 46 days until expiration and our short strike 11% below price action

- On 9th June 2017, we bought to close TSO Jul 21, 2017 75P @ $0.10, after only 4 days in the trade, for quick premium compounding.

Profit: $33 per option

Margin: $1,500

Return on Margin Annualized: 200.75%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - The Crush Spread

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Find out what it means when trading a crush spread. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this Q&A series, Marco answers a follow-up question related to Pinbars, gives recommendations on Forex brokers and talks about why it's so hard to trade successfully on a 5-minute chart. Enjoy!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Weekend Special for Father's Day!

Coupon Code: specialoffer

30% off when you purchase one or more:

Trading is a Business

Day Trading S&P 500

Stealth Trader

Life Index for Traders

Offer ends 6/19/2017

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 678 - June 9, 2017

Chart Scan with Commentary - Classic Another Chart Revelation

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

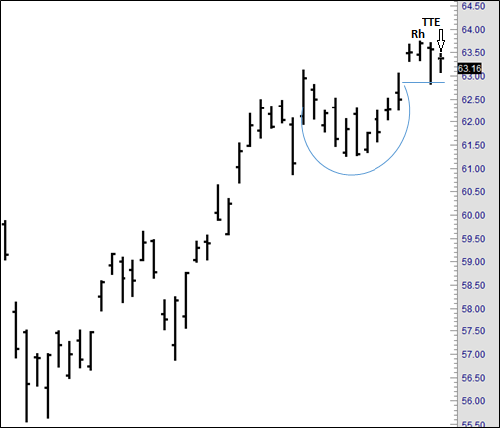

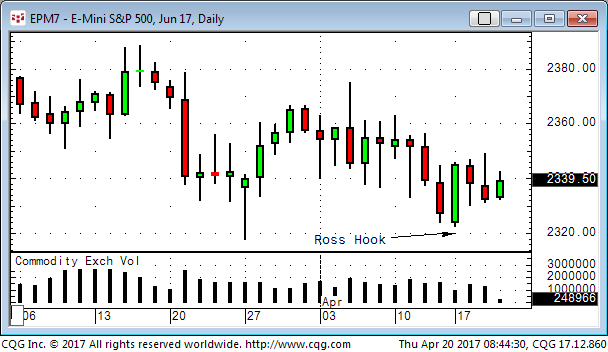

In one of my books I discuss the formation called "Cup with Handle." It is a formation that has been known about for a long time, and was first mentioned by that name by the publisher of "Investor's Business Daily." Actually the cup with handle is often nothing more than a head with a right shoulder. Lots of times the left shoulder is missing or, as in the case of the daily chart below, the left shoulder is there but very small and shallow. Notice this is an upside down head with a right shoulder to go long.

If you look closely you will see that the high of the cup "handle" is also a Ross Hook. Two days after the Ross Hook there was a Traders Trick Entry to go long at 63.40.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Protecting Profits

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Over the years, I've had the most profitable results by always making an attempt to receive pay for the risk I am taking. I want to be paid to trade. Being "paid to trade" has become a slogan at Trading Educators. The moment you can realize some profit from a trade, the sooner the pressure is off. You sleep well during nights where you have taken some money out of the trade during the day. You make fewer mistakes. Your growth in your confidence and faith in what you are doing, and seeing that what you are doing is succeeding, do wonders for your feeling of well-being.

If a trade gives you $1000 from a risk you have assumed in the market, never give them back more than $500. If someone gives you $2000, keep $1200; $3000, keep $2100; $4000, keep $3200; $5000, keep $4500. Remember the Point of Diminishing Returns as applied to trading. Never allow a $1000 per contract open equity profit to become a loss. As the market moves further beyond the Point of Diminishing Returns, the probability of a short-term trend reversal increases exponentially. The best market moves make the majority of their initial profits in 2 to 6 days. Therefore, a higher percentage of profits needs to be protected as the market moves higher and you approach at least a temporary end to the current move. Traders feel good about themselves to the degree they control trade profits and losses. This is the psychological Law of Control applied to the trade decision-making process.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

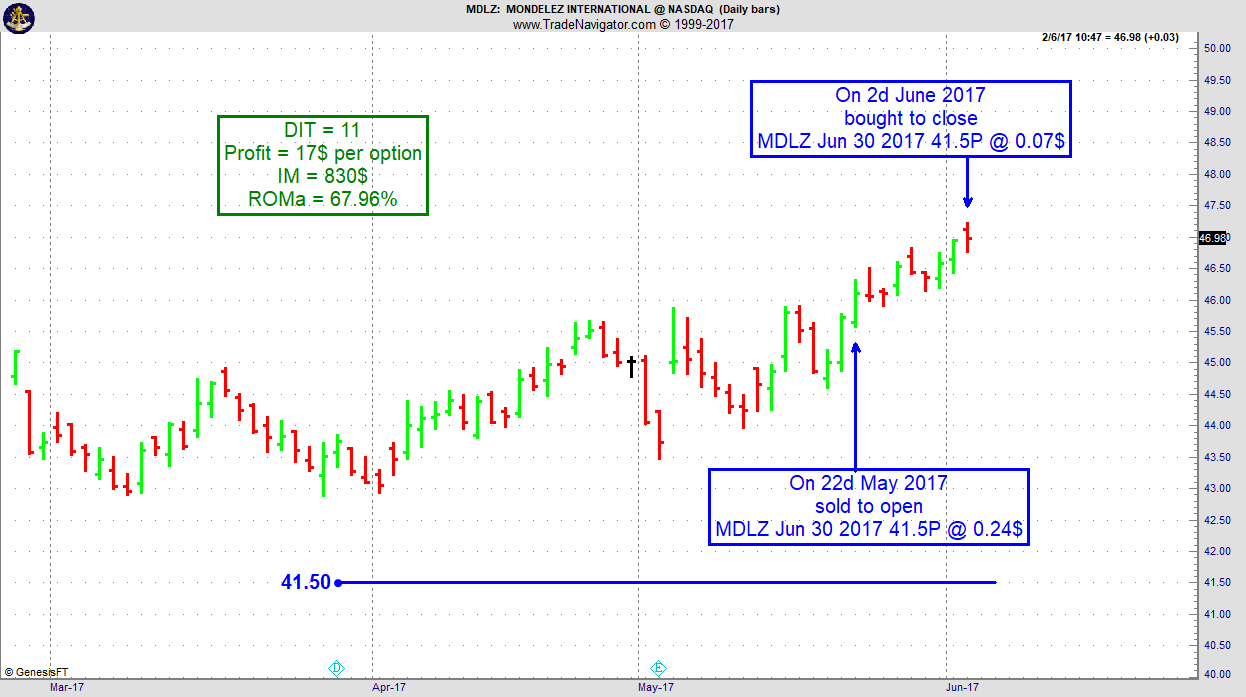

Instant Income Guaranteed - MDLZ Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 21st May 2017 we gave our IIG subscribers the following trade on Mondelez International (MDLZ). We decided to sell price insurance as follows:

- On 22d May 2017, we sold to open MDLZ Jun 30 2017 41.5P @ $0.24, with 38 days until expiration and our short strike 9% below price action.

- On 2nd June 2017, we bought to close MDLZ Jun 30, 2017 41.5P @ $0.07, after 11 days in the trade, for quick premium compounding..

Profit: $17 per option

Margin: $830

Return on Margin Annualized: 67.96%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

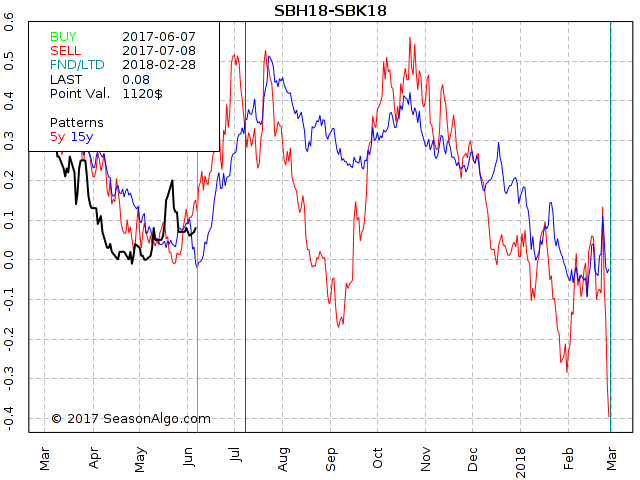

Trading Idea - Sugar spread long March and short May 2018

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Sugar is one of the markets I use mainly for spreads. In general, the Soft markets are not easy to trade and, because of exchange data fee costs of about $110, expensive. The calendar spread catches my interest because we are right at the beginning of the seasonal time window (06/07-07/08), the statistic regarding seasonality looks promising with very small draw-downs in the past and also the chart looks like the spread might turn to the up-side soon.

Do you want to know how we trade this spread in Traders Notebook?

Did you know Traders Notebook Complete had its most profitable year in 2016?

Learn how to manage this trade by getting daily detailed trading instructions, learn more!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - 5 Tips to Improve your Day Trading

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Day trading has always been a tough game, requiring a very strong psyche, discipline and a high level of trading skills to succeed in.

Nowadays though it's even harder due to the stronger competition, not only by humans but especially by computers trading at a speed a human trader simply can not match up to. High-Frequency Trading is happening in literally all of the popular markets out there and like Chess, scalping has become a game where humans cannot win against the AIs anymore. Add to that the speed/location advantage of the HFT shops and the odds of success decrease even more.

My advice is to forget about scalping. Even without the trading bots, odds of success to make money scalping are very low as the trading costs involved are incredibly hard to overcome. To not get completely killed by trading costs you need to trade in very liquid markets. But that's exactly where the robots are.

But not everything is lost, maybe all you have to do is to slightly adapt as a day trader. Here are some of the things you can do:

- The longer your trades last, the higher your profits (and losses) will be on average. It's a simple fact, if your trades last 4 hours on average, you'll be much more likely to catch a big move than if you average trade lasts 5 minutes. This way the HFTs can't hurt you as much anymore and also trading costs will have much less of an impact.

- You don't have to do 20 trades per day to be a successful day trader, quite the opposite! The more you trade, the higher your trading costs and believe me these trading costs will kill you in the long run.

- Don't get married to a specific market, instead, diversify your day trading over different, uncorrelated markets. This will strongly increase your chances of success as you'll stop seeing opportunities in a market where there aren't any.

- Day trade only markets that provide a good bang for the buck. I do this by looking at the average daily range of a market in relation to the average trading costs.

- Trade the news. I know you often hear the opposite advice but if you learn how to do this right, trading the news is one of the best ways to day trade. Just look at the markets, especially currencies. Isn't it true that most big moves happen right when some economic report is coming out? Sure, volatility explodes and liquidity often isn't that great. But hey, isn't high volatility exactly what you're looking for as a day trader? Now first you need to do your homework of course and have a plan ready on how to trade each of the specific news events.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 677 - June 2, 2017

Chart Scan with Commentary - Decisions, Decisions

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

The day the arrow is pointing to was a Friday and it created a very nice Traders Trick Entry to go long on Monday, one tick above Friday’s high. During the Sunday/Monday night prices traded as you see them above. Should you leave the TTE in place, or should you get out? I opted to leave my order in place at 1252.90. My reasons: 1) I anticipated a follow-through of the momentum begun on Friday. 2) The TTE in this instance offers a very low risk trade. I use a tight protective stop in the event I’m wrong.

The chart below shows what happened on Monday. Prices reached 1255.90, or $300 per contract, more than enough for a profitable scalp trade. Since I was scalping, I was all in and all out at 1255.90. Will gold prices move higher? Should I have stayed in the trade to see? Not if I was scalping. When I’m scalping I take what I can get and leave the rest for someone else. There are plenty of trades to be had, you simply have to look for them.

30% Off Webinars

Use Coupon Code During Checkout: summer30

Offer Ends June 6, 2017

The Law of Charts In-Depth

Trading All Markets

Traders Trick Advanced Concepts

Traders with More Special Set-Ups

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - More About Losses

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

How should you feel about losses? I once read somewhere that you are supposed to love losses. Does that make sense to you? It doesn't to me.

The worst aspect of losing is that it tends to create pessimism. Traders should feel bad when they lose money only if they fought the market trend, or violated their own trading strategies. The best traders have a healthy "so what, big deal!" attitude that maintains a sense of humor about losses. There is no reason to feel bad about losses if the trading discipline was correctly used. On the other hand, there is no reason to learn to love them either.

Analyze losses, learn from them, and then let them go; move on, that's the best thing to do.

Understanding man's relationship to time is one of life's most important challenges. When man becomes free of time's constraints, he lives life to the fullest and achieves goals on his own terms. Pessimism traps traders in the past, destroys their present, and robs them of the future. Imagine a world without time where the thought of death is not a finality of existence. If money were not the reason for your work-related behavior, then who are you? Where are you and what are you doing? Who shares this existence with you? In the philosophical sense, man creates himself and his existence when he takes responsibility for his actions and his time. Think how any individuals create order, structure, and discipline in their lives. How will you allow a trading loss today affect your life five years from today?

Thinking the wrong way can become self-fulfilling. The trouble with self-fulfillment is that many people have a self-destructive streak. Accident-prone drivers keep destroying their cars, and self-destructive traders keep destroying their accounts. Markets offer unlimited opportunities for self-sabotage, as well as for self-fulfillment. Acting out your internal conflicts in the marketplace is a very expensive proposition.

Traders who are not at peace with themselves often try to fulfill their contradictory wishes in the market. If you do not know where you are going, you will wind up somewhere you never wanted to be.

Every business has losses. I cannot think of any that don't. Shoplifting, embezzlement, internal pilferage, lawsuits, bad debts, spoilage, etc., I'm sure you can think of even more. You name it and businesses have one or more of the many ways to experience losses. Most businesses expect and accept such losses as part of doing business. Why, then, is it such a big deal when you have a loss in trading? If you know the answer to that, please let me know.

The way I handle a loss is this: I examine it, make every attempt to learn from it, and ascertain whether I had the loss by straying from my trading plan. If I have strayed, I reinforce my resolve to stick with my plan. If I have not strayed, then I learn from it what I can, and shrug it off as a cost of business. It is not an expense, it is a cost, and if you don't know the difference you need to take a course or read a book on the basics of accounting.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

30% Off Books and eBooks

Use Coupon Code During Checkout: summer30

Offer Ends June 6, 2017

Instant Income Guaranteed - GRMN Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 8th May 2017, we gave our IIG subscribers the following trade on Garmin Ltd (GRMN). We decided to sell price insurance as follows:

- On 9th May 2017, we tried to sell to open GRMN Jun 16 2017 47.5P @ $0.24-$0.26; some subscribers were filled but I decided not to accept less than $0.26 and was not filled on that day.

- On 18th May 2017, I sold to open GRMN Jun 16, 2017 47.5P @ $0.32 or $32 per option sold on a Good Till Cancelled order.

- On 26th May 2017, we bought to close GRMN Jun 16, 2017 47.5P @ $0.07, after 8 days in the trade (or longer for those who entered on 18th May 2017), for quick premium compounding.

Profit: $25 per option

Margin: $950

Return on Margin Annualized: 120.07%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade..

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Receive 30% Off

Instant Income Guaranteed

Use Coupon Code During Checkout:

summer30

Offer Ends June 6, 2017

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - Emotions with Winning and Losing

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

What kinds of emotions go with winning and losing? Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

30% Off Stealth Trader and Combo

Use Coupon Code During Checkout: summer30

Offer Ends June 6, 2017

Stealth Trader

Stealth/Ambush Combo

Trading Error: Averaging into a Losing Position

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco talks about one of the most common, and also one of the most deadly mistakes traders can make, and that's averaging into a losing position. He also gives you some insights as to why this is so tempting, and shows you why you should avoid it at all costs.

If you should you have any questions, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

30% Off Books

Use Coupon Code During Checkout: summer30

Offer Ends June 6, 2017

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 676 - May 26, 2017

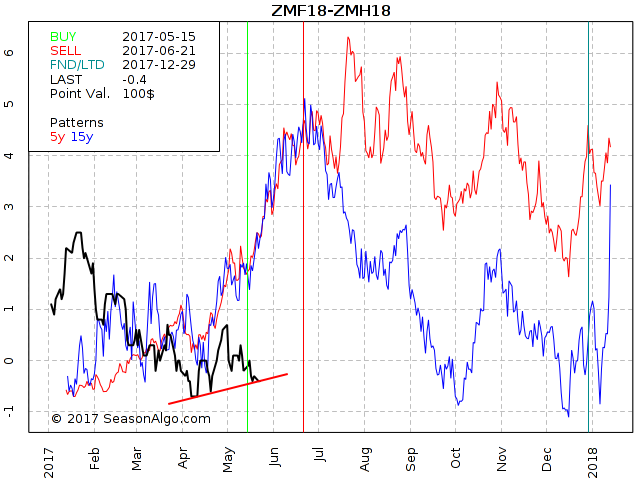

Spread Trading Idea: ZMF18-ZMH18

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Chart Scan Trading Idea: ZMF18-ZMH18, long January and short March 2018 Soybean Meal

Today I want to have a closer look at a Soybean Meal spread using 2018 contracts. While the spread doesn’t show much volume, you can easily trade 10 or 20 contracts without any problem and bid/ask with only 1-tick away (nevertheless, I recommend the use of limit orders).

So far, the spread has not made its strong seasonal move to the up-side but at least it is showing higher lows for the last few weeks. We are in an up-trend since April as shown by the red line even if the up-trend is not very strong. Personally, I would wait what happens next before entering the trade but keep in mind the seasonal time window will already close in about 4 weeks and this doesn’t give the spread much time to develop. The spread seems promising with 15 winning years out of 15 (seasonally speaking) and because volatility is low, it may also work for the once with small trading accounts.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - Money Management

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Don't confuse money management with trade management. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Error: Trading Your P&L

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco talks about another very common trading mistake, and that's trading your P&L instead of the actual market. If you're struggling to become a winning trader, this might be an eye-opener, especially if you're a breakeven trader right now.

If you should you have any questions, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Second Look

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Taking a second look at potential trades at times results in “why didn’t I see this before?”

For instance, what if you are looking at a market as it approaches a support area? Isn’t it reasonable to ask yourself, “If this market breaks through and I am long, what will I do?” Ask yourself how such an event would change the picture. If you have a position, will you still want to hold it? If you have no position, will this cause you to take a position opposite what was the trend? If it will, then why not place an order entry just the other side of that support area? Very often, when prices approach support from what has been a trading range, they are already in a counter trend within the confines of the trading range. That means a breakout of the trading range would be a continuation of a newly formed minor trend.

After a second look, I will put my work aside before looking at my charts again. Then I make a plan for the orders I want to place.

I make sure my trading platform is working. To do this, I issue an order I know will come back as “unable.” I also check to see if my phone line is working by making a call to my cell phone. In the event of an emergency, I want to be able to call my broker.