Newsletters (208)

Children categories

Edition 622 - May 13, 2016

Stay tuned while Mayer Marco puts on the finishing touches to: AlgoStrats.com.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading Concept

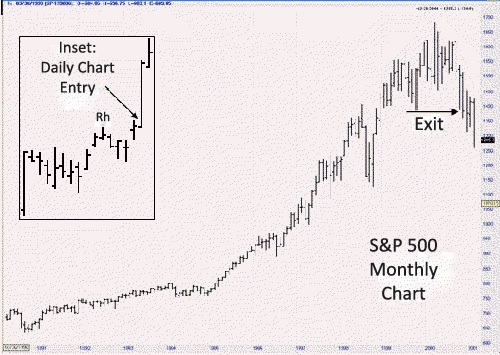

One of the concepts we teach at Trading Educators is that at times, it is worth taking entry signals from the larger time frame chart and then, once in the trade, managing from a lesser time frame. For example: taking an entry signal from a 60-minute chart, then managing on a 30-minute chart once you get a fill. Or taking entry from a weekly chart, and managing on the daily chart. The reason for doing this is to enable you to micro-manage the trade.

However, in the case of the greatest trade I have ever personally seen, the management was done in just the opposite manner. It was done by a long-term trader, and the trade lasted from 1991 to 2000.

The trader entered the S&P 500 in early December, 1991, and exited in 2000, by first entering from a daily chart, using a trailing stop for protection. When he felt he had accumulated sufficient profits, he began trailing his stop on the weekly chart, and then finally on the monthly chart, where he kept his stop two support levels (below two retracements) back. The trade ended up making $16 million.

Going from "micro" managing to "macro" managing is a perfectly logical way in which to stay longer in a trade. There was a Ross hook on the daily chart following a breakout from congestion. However, because of the gap opening on the bar prior to the one where I showed the entry, he chose to enter the following day. This is not exactly how I would have preferred to enter, but who am I to argue with $16 million?

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Lottery Mindset

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Do you ever dream about winning the lottery? There are actually people who have such good luck that they repeatedly enter contests and win. They win so often that if they wanted, they could count on winning, even though they are essentially trying to capitalize on chance. They develop a "lottery mindset" in that they approach life by counting on rare chance events. The rest of us aren't so lucky, and we don't live our lives counting on a fluke like winning the lottery. We work hard, master a profession, and work steadily to make a living. In many ways, top-notch traders approach their profession in the same diligent way. They don't view trading as recreational gambling, counting on a fluke to make a profit.

That said, many people do experience key life-changing events. We have all heard of people who needed a lucky break and got it. You often hear of actors who, with their last 50 bucks went for an audition, landed a job, and ended up as a star of a hit sit-com.

You probably know of friends who were desperately searching for a job for months, and needed a job fast! With only a week's worth of resources left, they found a job. It can also happen in sports. Olympic athletes may practice their entire life for "one moment in time" when they can perform at their best. But there is some luck involved. A family member may pass away, or they may become ill, and it may throw them off their game. Sure, they have rare talents, but the Gold Medal winners are also lucky enough to have everything go their way. There are times when life can come down to a few key moments. It's a little like playing Lotto, and hoping that you'll win.

Even though profitable traders don't approach trading as if they were playing the lottery, they almost all have at least one big winning trade in their careers. In a series of exclusive interviews, we asked traders to describe their biggest winning trades. Jesse described how he invested in Juno Online: "I bought about 3000 shares, and the stock went up 20 points in two days. It went up fast, and there was really no reason for it. I had a feeling it was just hype and euphoria, so I sold out and made $60,000." Andy described how he used to trade currencies: "One day I was trading Yen, and made around $18,000 in just that day." Don's biggest trade was in the heyday of the dot-com boom. "A European auction company was upgraded one morning. It was touted as the next eBay. CNBC was playing it up. The stock had just split, and they got the price target a little bit wrong. They quoted an ungodly high amount. This was merely a single digit stock. That morning it had traded up over 100. I shorted it as it fell.”

Do people make huge profits capitalizing on a once-in-a-lifetime trade? Sure they do, but the question you need to ask yourself is, "Do I want to trade hoping to make all my profits on a fluke?" Do you want to approach trading with a lottery mindset? If you do, you'll always be on edge, and you will have difficulty trading with discipline. You'll tend to take big chances, and you may end up losing big. It's better to trade more prudently. That doesn't mean never taking a risk or pushing yourself to invest a little more capital when you hit upon a winning streak. What it does mean, though, is controlling over-confidence. Don't seek out those one or two trades a year that will make up for all you've lost. There's an advantage to using a more methodical approach: continue to search for solid, high probability trade setups, outline detailed trading plans, and trade prudently with unwavering discipline.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog - Thoughts about being an option buyer

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Read Andy's blog about why we sell options instead of buying them in Traders Notebook along with a TN special offer.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Position Sizing Part II

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In the first part of the Position Sizing series, Marco explains the basic indicators that are useful for position sizing. In Part II, Marco gives you a simple approach to determine your position size based on market volatility.

If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 621 - May 5, 2016

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

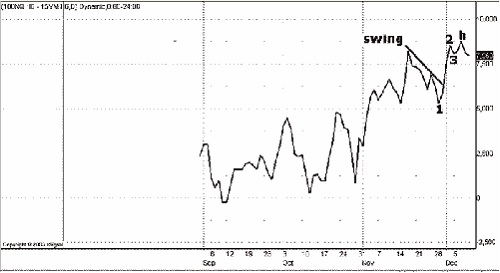

Long Term Trading

Some years ago I was tutoring a trader who would be trading a $1 billion managed money account, moving up from trading a $15 million account. He had been trading in a single market, but found that the amount of money being managed was simply too big for a single market, which he traded in his own country. The need to diversify brought him to the U.S. to learn about the U.S. markets.

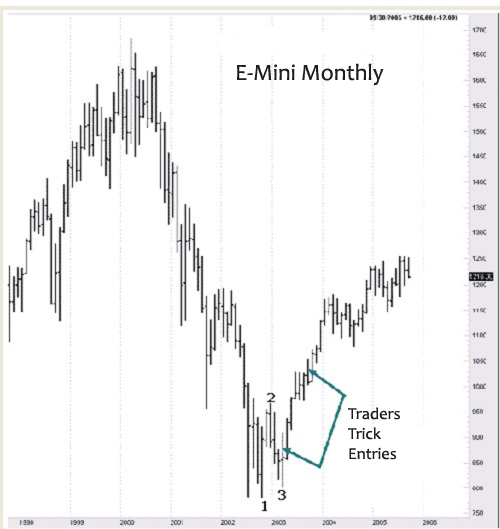

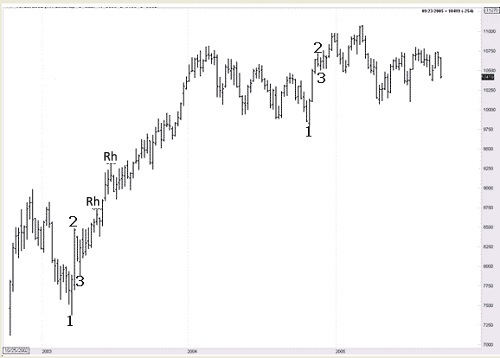

With a trading account of that size, he feels there is no way to engage in short-term day trading, and I agree. It's pretty hard to diversify when your entire focus is on a 5-minute E-mini chart. So this week, I want to show you something about the long-lost art of position trading long-term charts using monthly and weekly charts in markets with which most of you are already familiar - the E-mini S&P 500 and the Mini Dow.

It seems that these days few traders are interested in trading long-term. The monthly and weekly charts remain relatively unnoticed. Traders are so busy looking at anything and everything from 60 minutes down to 1 minute, that they let beautiful trades slip right by them in the very markets where they are trying so desperately to make a buck. Since monthly and weekly charts of the E-mini S&P and Mini DJ show only a few bars, I am going to have to use a continuous chart to show you what I mean. The prices may not be correct historically, but the relationship between bars will be exactly as they happened, so don't despair about the fact of continuity. Please keep in mind that the moves you will be seeing are huge on the monthly and weekly charts; and if they last for only a few bars, that is many times better than the moves you are getting on intraday charts.

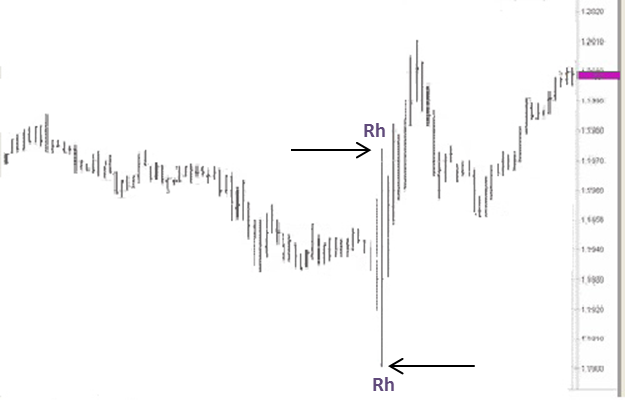

The weekly chart of the Mini Dow below is loaded with Ross Hooks (Rh), too many for me to mark them all. Each one has a Traders Trick. Please examine these charts on your own, and remember the moves are big. A Ross hook is the first and subsequent failures of prices to continue in the direction they were moving after the breakout of a 1-2-3 formation, a ledge, or any form of consolidation. If you need more help, please study "The Law of Charts" which was a free EBook sent to you via email. If you need another copy, please This email address is being protected from spambots. You need JavaScript enabled to view it. to request it.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Maintaining Discipline

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Traders and investors have difficulty "letting their profits run." When you see your position increase in value, it's hard to avoid selling early to lock in profits. But not every trade goes your way, so when you come upon a trade that does produce a profit, it's vital for your long-term success to maximize the profits for that particular trade. You must make more profits on your winning trades than you lose on your losing trades, but this is difficult to do if you consistently sell prematurely. Waiting for your price objective takes self-control. You must fight the urge to sell early if it fits in with your testing and trading experience.

A thinking strategy that may help you increase your ability to maintain self-control when you need to consists of viewing trading decisions as "linked" in that the decisions you make on earlier trading choices influence the decisions you make on later trading choices.

How do you approach discipline when you trade? Do you think, "I'll sell early on this trade, but on future trades, I'll let my profits run. What's the harm?" It may set a bad precedent. What you do early on may influence what you do later: If you sell early on some trades, you may tend to sell early on other trades. The truth is that initial choices are good predictors of future choices. The choices you make deciding on a smaller reward upfront, or waiting for a larger reward later, are important. For example, a person might decide between one piece of pizza now and two pieces of pizza in a week. It's quite similar to taking a smaller profit early rather than patiently waiting to take a larger profit later. Nevertheless, you must make such decisions based on experience and testing. If you are more comfortable taking smaller profits at both ends of the trade, then doing so becomes your trading style. If that is how you trade profitably, then stick with it.

If you want to trade with discipline, it is essential that you maintain discipline at all times. Don't sell early, and think, "I'll hold on next time." The mind doesn't seem to work that way. You must show self-control early, and on all decisions. So when you are about to sell early, stop! Remind yourself that the long term consequence of taking profits prematurely is that it might set a bad precedent. You won't be able to show self-control and restraint when you really need to. And in the long run, it will severely cut into your overall profits.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Today I'm looking into Silver and will explain a trading idea using options.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Method

I'll explain how to read the equity chart of a trading method or system to better understand the characteristic of a trading method.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In my new Q&A Episode, I'll answer questions about the usefulness of demo-trading, trading 123 formations, and why I developed my own python-based backtesting platform.. If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 620 - April 29, 2016

As we spring into May, for many of you, this time of the year is when you start to make plans for the summer, declutter areas in your house, and enjoy the recent plush growth and blooms from your garden. For traders, this is also a great time to re-evaluate your trading plan, straighten up your office, and add one healthy habit to your trading routine. You are encouraged to use the upcoming month for reflection and to make positive improvements to your trading.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

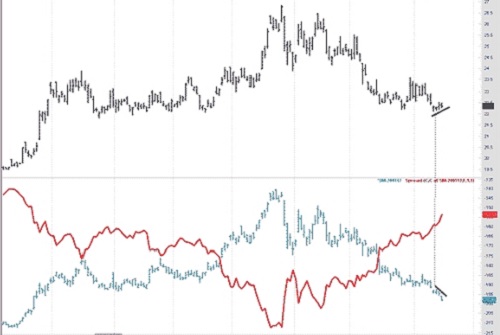

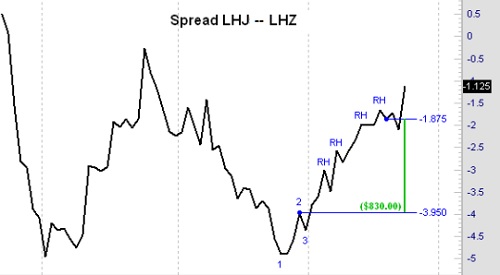

Spread Trading

I can't help but show you one of the easiest trades I ever made. I was browsing through my charts using Genesis Trade Navigator, and what I call an "observation trade" leaped off the screen.

Sometimes when you are looking at charts, something hits you as a "can't lose" trade. Such was the long Bean Oil, and short Soy Meal trade shown in this article. Bean Oil had virtually no direction, and Soy Meal, along with Soybeans, were heading down. This is a natural trade. There is no need for seasonality, correlation, backwardation, or chart pattern. Simple observation is all that is needed for this kind of easy money. Let’s look - Upper Graph (Bean Oil) and Lower Graph (Soy Meal):

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Right Timing

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Over the three-day weekend, trader Bill received a call from his friend Jack. "Hi Bill, did you take a look at the market last week?" Bill replied, "It was a rough week for my short positions. I didn't anticipate the buying surge and it hurt me a little. No, I didn't look closely at the market. I was caught up trading my own positions." Excitedly, Jack says, "Well, on Monday I bought at 345 and sold at 370 on Friday. I made almost $4,000 on that one trade alone."

Have you ever received a call from a friend in the trading business bragging about a great trade that he or she made? If you aren't doing as well, and cannot also bask in the glory of success, it's hard to avoid feeling a little resentful, envious, and somewhat disappointed in yourself. You may think, "It's just a matter of being at the right place at the right time, and unfortunately, I was at the wrong place at the wrong time."

Trading can indeed be a matter of luck. When events aren't going your way, you can get thrown off and become overly consumed with how poorly you are doing to the point that you can't think clearly. Trading the markets skillfully requires a clear, focused mindset. You can't get thrown off. But when your money is on the line, it's hard to think clearly.

There's a powerful human need to trade with perfection. You want to be at the right place at the right time, and make a huge win. One of the worst fears of many traders is missing out on a significant trading opportunity. It's natural to want to search for a once-in-a-lifetime trade, and make a year's worth of profits in a day. But constantly searching for such trades can be distracting. You spend the majority of your time searching for the ultimate trade setup, and when you do that, you start placing demands on yourself that you just can't reach. You think illogically. You lose focus, and you can no longer think clearly and wisely.

Ironically, if you become overly consumed with being at the right place at the right time, you will probably be at the wrong place at the wrong time. You won't think freely and creatively, and you will miss the potentially profitable opportunities right in front of you. From a bird's eye view, they may not be the absolute best opportunities out there, but they may be good enough to profit from. If you devote all your effort to trading them, you will make profits. Remind yourself that you don't have to be perfect. You don't have to trade the best opportunities at all times. You just need to trade the best way you know how with the resources and opportunities you have available to you. You need to trade freely, rather than stagnating under the pressure of trading to perfection.

Trading can be a matter of probabilities. Sometimes you'll be at the right place at the right time; at other times you won't. That's all right. If you are consumed with perfection and finding the ultimate trading opportunity, you will often miss the trades that are right in front of your nose.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Read Andy's latest blog post which addresses a tough question, "Can I really make it as a trader?"

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy's Trading Plan Series - Part 2

This is the second part of the Trading Plan series that provides answers for the following questions: "Who needs a trading plan?" and "What will a trading plan do for you?"

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In this Trading Basics video, Marco shares his knowledge to get into position sizing. Topics include the Range, Avg. Range, True Range, and Average True Range (ATR) indicator, as well as the concept of Initial Risk (R). If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

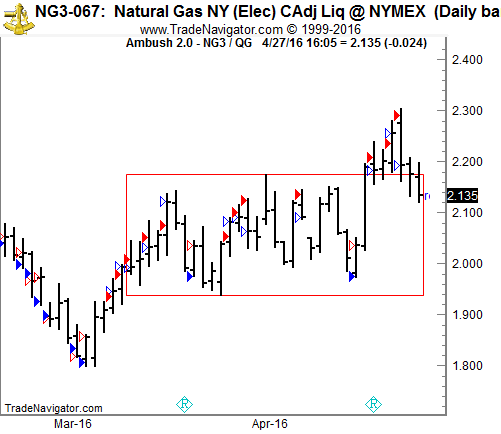

Ambush Method Trade and Performance Report

by Master Trader Marco Mayer

Specialist in Forex, Futures, Systematic Trading, and Creator of Ambush Trading Method

Ambush had a really good run during the last couple of months! This week is an excellent example with the Henry Hub Natural Gas Futures (NG) traded at the NYMEX.

The market has been moving in a small range between 1.95 and 2.20 (red box) for weeks and finally last week, it broke out of the range and managed to move up to 2.30. As you can see on the chart below, that’s where Ambush traders sold NG and ambushed all the breakout-traders who still wanted to get in after the break out. Today it’s moving within the range again, and I wouldn’t be surprised to see NG moving back down towards 2.00.

On the chart above are four different kinds of arrows:

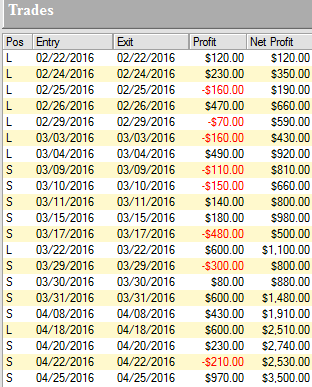

Let's examine the results of those trades (including $10 for commissions and slippage round-turn) trading one Henry Hub Natural Gas Futures (NG) contract:

As you can see, Ambush managed to make a total of $3,500.00 profit (including $10 for commissions and slippage round-turn) trading just one contract without keeping any positions overnight!

Click on the link below to see the long-term performance of the Henry Hub Natural Gas Futures (NG) and all other markets supported by Ambush:

View The Reports Now

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 619 - April 22, 2016

Sometimes you just need a little extra encouragement, a gentle push in the right direction, or someone to hit you upside the head and tell you to, "snap out of it!" Trading Educators has the trading experience to provide you with the type of support needed, don't hesitate. Email us today!

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Thrust Reversals

Last week we looked at a "Spike Reversal." This week we are going to look at a different kind of reversal, which I call a "Thrust Reversal."

Quite often "Thrust" is the first step in what turns out to be at the very least a short-term move. By that, I mean you can usually count on some sort of follow-through in the short-term.

The stock chart I'm going to show you is one that has been previously shown, Watts Water Technologies (WWT). But what you see occurs in all markets and in all time frames. I had expressed that the chart showing was a sudden and rapid "melt-down" of prices that was nothing more than stop running, and that you see such stop running quite often in the stock market. My point then was that what we were seeing was not a downtrend. It was simply a collapse brought about by one or more market movers powerful enough to put the squeeze on investors who were long the shares of the company. Such moves often accompany disappointing financial reports by a company, but not always. Sometimes a melt-down is initiated by news affecting an entire industry, or even by news affecting the whole economy.

In the case of the up-thrust bar in the share price of WWT, I feel certain that what we are seeing is directly related to the recent hurricane that hit the gulf coast of the U.S.A. Is this the beginning of an uptrend? That is possible, yes. But more likely it is the beginning of a short-term move that could quite possibly last only a day or two. When I see a thrust reversal, I get ready for some quick short-term profits. In essence, this is a scalping situation. Take some money and run. Possibly move any remaining portion of your position to breakeven, and count your blessings if the thrust bar results in a real move.

It looks as follows:

The up-thrust bar we are seeing with this chart is defined in the Law of Charts as a breakout from congestion.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Low Probability Setups

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

How many times do you tell yourself “I'll worry about it later”?

When trying to deal with the fact that we must eventually cope with an onerous, unpleasant event, such statements help us to get through life. We often put off things we don't want to do, hoping that we will muster enough energy and enthusiasm to deal with them in the future. We prefer to put off facing an unpleasant reality until the very last minute. The same thing seems to happen when we make trading or investment decisions. Traders may be willing to enter low probability setups as long as they don't have to deal with the consequences of the trade.

Research participants were asked to imagine making various economic decisions, and to indicate which economic decision they would prefer, and under what conditions. In the first hypothetical economic decision, the payoff was high, but the chance of receiving the payoff was low. In the second economic decision, the payoff was low, but the chance of receiving the payoff was high. People’s preferences depended on whether the payoff was to be received immediately or in the distant future. People indicated that they would be willing to accept a low probability of success if the potential payoff was high, and they didn't need to find out what happened until the distant future. People did not prefer an economic decision that had a low probability of success if they had to deal with the outcome of the decision in the near future. Indeed, if they had to make an economic decision that had consequences for the near future, they would take the option of receiving a low payoff as long as it had a high probability of success.

These research findings may explain how decisions about long-term investments are made. When it comes to long-term investments, people are willing to risk money on a low probability setup as long as they believe the potential profit is high. This is somewhat irrational, however. The probability of success is an important element when deciding whether or not to risk capital. It doesn't matter whether it is a long-term investment or a short-term trade, a trade setup should have a high probability of success. But people have a natural human tendency to accept a low probability setup as long as they don't have to face the outcome until the distant future, and they believe that the potential payoff is high.

If we believe that the potential profits from an investment are high, we tend to irrationally risk capital even when the odds of success are low. In the end, however, it's more beneficial to look for setups that have a high probability of success, even if it means standing aside until we find them.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Today, Andy is looking into Natural Gas and provides the details for an options trade.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy's Trading Plan Series

Stay tuned for the next several weeks as Andy starts his trading plan series which explains what every trader needs in order to make a successful plan.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In this episode, Marco answers a follow up question on disciplined trading, and talks about the limited life on trading-systems and how to deal with that. If you have a question, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 618 - April 15, 2016

We love feedback from our traders! Proven success from one of Joe's books is highlighted in our Forum and goes into detail. Our top priority is educating our traders, and staying true to our philosophy, "Teach our students the truth in trading - teach them how to trade!"

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

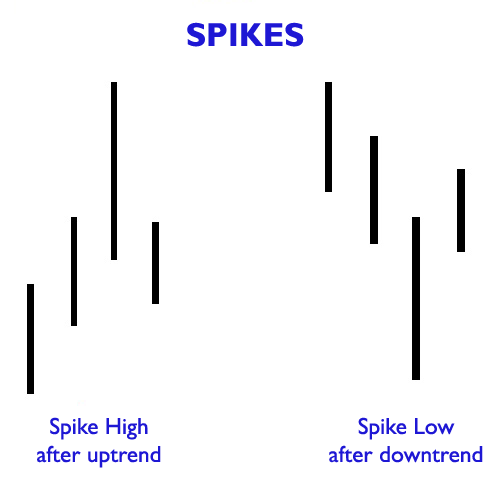

Spike Reversals

Let’s look at a 1-2-3 formation in combination with a Spike Reversal. The Spike Reversal is often a price bar that becomes the #1 point of a 1-2-3 formation. It looks as follows:

Spike Reversal

A Spike Low has:

- a low sharply below those of the days on either side,

- a close near the day’s high,

- and must be preceded by a strong decline.

Keeping in mind that every #1 point is also a Ross Hook for the continuation of a trend, nevertheless probabilities dictate that the Spike Reversal is more often than not the beginning of a move in the opposite direction to the previous trend or swing. It may turn out to be nothing more than a retracement correction of a few bars, but there are two things I prefer to do when I see one:

- Bring my trailing stop within 1-tick of the extreme of the reversal bar.

- Take my money and run - standing aside until either the trend continues or the Spike Reversal does indeed result in the formation of a 1-2-3 high or low.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Action Plan

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

In our everyday lives we are used to doing things reflexively, on the spur of the moment. That is because throughout our lives we have acquired certain skills. For example, we don't consciously think about stepping on the brakes or the accelerator as we drive, we just do it automatically.

Despite their experience learning various skills throughout their lives, wannabe traders often think they can trade on the spur of the moment. They don't carefully plan a trade or follow a trading plan when it is time to execute it. But detailed trading plans are an essential ingredient for success.

When you first start out trading, it is difficult to trade on the spur of the moment. There are too many issues to attend to, and without a wealth of experience, you are bound to make mistakes. Making a specific action plan while trading has clear benefits. Knowing when, where, and how helps you to perform effortlessly and gracefully. Specific plans help us respond quickly and automatically when it is necessary. When we make a plan beforehand, we can follow it, acting swiftly and efficiently.

Planning allows traders to more easily remember specifically what to do. They don't waste time trying to recall what it is they are going to do. They have decided what to do and when, beforehand, and have little trouble doing what they have planned. Second, research has shown that traders respond quickly when they have a plan to follow. If you have a clearly defined plan, you are ready to respond more efficiently when optimal market conditions arise. Third, when traders have a plan, they can more easily ignore interruptions and distractions. They are able to more easily focus on the task at hand, maintaining self-control. Action plans are especially useful when trying to respond during high stress situations, such as during a day when the market action is hard to pin down. Trading the markets on an especially chaotic day can be stressful. A series of necessary decisions are best made from a detailed trading plan.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

What!? No trading idea this week? Don't worry, it'll be back in next week's edition.

Visit Andy's Blog for his latest post

This week's blog post in his enhancement trading series addresses some very important tools and without these, it will be difficult to make it in the market.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

This is the first episode of a new series where Marco will answer any of your trading related questions. So whatever is on your mind that you want to ask a professional trader, go ahead and send an This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 617 - April 8, 2016

Yesterday, was a very special day for someone with Trading Educators who has dedicated most of their life to learning all the "ins and outs" of trading, and sharing that knowledge with thousands of followers. That someone special is Joe Ross! Joe, we hope you had a very "Happy Birthday" and wishing you good health, happiness, and many more birthdays to come. Traders, feel free to send This email address is being protected from spambots. You need JavaScript enabled to view it. your birthday well-wishes - we know he'd love to hear from you.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Euro FX

This week we are looking at an unusual chart sent to us by one of our subscribers. It is a chart of the Euro FX. I know you cannot see much detail, but for the sake of this explanation the main point is that the very long bar contains two Ross hooks.

You would think this pattern would show up more often, but it is rather rare. After a trading range is established, there is a bar that breaks out of both sides of the trading range.

The bar with the two Ross Hooks is the first bar to break out above the trading range, but it is the second bar to break out below the trading range.

The next bar is an inside bar, the first failure to go higher and lower after the breakout. So the breakout bar has two Ross Hooks.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Conquering Regret

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

One of the most powerful emotions that influences decisions of investors and traders is regret. People probably wouldn't mind making a bad trading decision if they knew there was absolutely no possibility of regretting it later. Of course, people differ in terms of how often and intensely they experience regret. If you have an obsessive-compulsive disorder, you might never make a trading decision without over-thinking it or becoming overwhelmed as you incessantly worry about what might go wrong. That being said, many normal people put off making trading decisions just to avoid later feeling regret and self-reproach.

Regret is common among many traders and investors. They can't stop thinking of how they wished they had taken a different course of action. They repeatedly mull over the consequences of the regretted decision. They can't seem to get it out of their mind. It can be so debilitating that they put off making a future trading decision for fear that again they may have to face extreme regret. How can you conquer regret and trade more freely and creatively? Psychologist Dr. Van K. Tharp offers some simple steps towards a solution:

First, acknowledge your feelings of regret. Dr. Tharp suggests metaphorically stepping out of your body and looking at yourself more objectively. Look at yourself while feeling regret, and imagine feeling differently. Examine how you feel out of control due to your debilitating feelings of regret.

Secondly, remember the times when you made a good decision, felt no regret, and were in complete control. When you remember how you took control in the past, you will immediately feel empowered rather than stuck in feelings of past regrets.

Third, look at the adaptive nature of regret. People feel regret when they make a mistake. Regret protects them from making the same mistake again. By realizing that your feelings of regret have an adaptive function, you'll start to feel better.

Fourth, feel resourceful and powerful. Think about how you can avoid making regrettable mistakes in the future. Make a specific plan of action for avoiding the same mistake twice.

Fifth, remember the times when you made successful trades.

Conquering regret takes practice, so these steps should be repeated as needed to help you feel more secure in your future trading decisions.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

A 3-leg spread combining meats and grains - it might be a spread you have never seen before.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Visit Andy's Blog for his latest post

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

This week's blog post in Andy's enhancement trading series discusses stop management.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Greetings from Port de Soller, Mallorca

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Hi traders, I'm on vacation this week and wanted to share a picture from one of my hiking excursions. Have a good weekend.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 616 - April 1, 2016

Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Ledges

This week we are looking at a ledge. Prices have made a 1-2-3 low, followed by a Ross Hook. The hook is also the high point of a ledge formation.

A breakout of the #2 point of a 1-2-3 low defines a trend. A breakout of a Ross Hook establishes a trend. Ledges, by definition, always occur in a trending market. So if a breakout comes at the top of the ledge, we can assume the trend will continue.

Notice also that there was a potential Traders Trick Entry based on the high of the day following the point of the hook. However, because of the gap opening, the entry was not taken.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Pressured Trading

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Many traders these days feel pressured to perform. They don't believe that they have the luxury of taking time to patiently learn the trading profession. Instead, they feel they must do things quickly. Novice traders, for example, hold themselves up to the impossible ideal of thinking that just overnight they can develop astute intuition to read the markets. They approach trading like recreational gambling. They believe that trading is simply a matter of placing a bet, throwing the dice, and seeing if they can win. Approaching trading in this manner, however, will usually produce the same results as recreational gambling; the recreational trader loses to the house, which in this instance, are the professional traders. If the desire is to trade like a winner, it is important to take things slowly. Take things a step at a time, and approach trading methodically.

Trading methodically means making clearly defined trading plans. This process takes time. Rather than think of a trading plan on the spur of the moment, it is useful to carefully write down a trading plan. Study the markets and identify trades that are likely to increase in price (if going long). Write down the reasons you think the price will increase, along with factors that may thwart your plan. What adverse events may influence the price? You could try to do all this thinking in your head, but the human mind has limits. It can process only a limited amount of information. If you write it down to see it in black-and-white, you will transform the abstract into specific ideas and plans. When you make things concrete, you will find it relieves stress and frees up creative psychological energy. When you write things down, you can examine your plan thoughtfully and see the potential flaws with a third eye, objective perspective. It may take a little time to write it all down, but it is worthwhile.

Writing down a trading plan and sticking to it is the winning trader's secret weapon. If you create detailed trading plans and manage risk, you will increase your chances of success. Don't think you need to trade by the seat of your pants. Take things slowly. Map out your trading plan, and follow it. You will trade more calmly, creatively, and profitably.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Lean Hog "Butterfly" is this week's topic of discussion.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Visit Andy's Blog for his latest post

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Andy is starting a series of articles in which he will help you enhance your trading.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trend Following Is Not Yet Dead - Part II

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In this video, Marco gives you more details on his findings on traditional trend following. He goes through a very basic strategy with you, the markets used for the backtest, and the detailed results. This is Part 2 of a 2-Part series. May we suggest you watch the Part I video before viewing Part 2.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 615 - March 25, 2016

Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

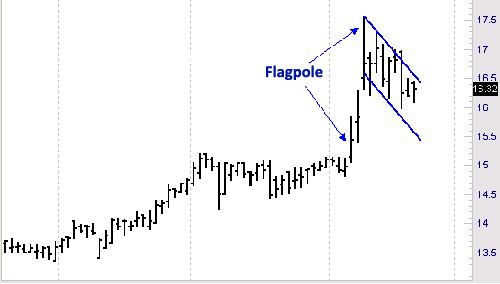

Old Style Chart Reading Still Works

The Law of Charts is to a large extent about chart reading, and chart reading incorporates some of the observations made by traders over 100 years ago. While these kinds of observations do not follow the strict rules of the Law of Charts (TLOC), they are interesting, and it is exciting to see them work. Of course we know that nothing works all the time, but it might be interesting to learn from the chart below.

The "wisdom of the ages" states that following a breakout from consolidation, if prices shoot up creating what looks like a "flagpole," and are then followed by a flag or pennant formation such as you see on the chart, when prices resume rising, they will rise again by the height of the flagpole. The flagpole begins its ascent at 15.20, which is a violation of the high of the consolidation. Prices then rise to a high of 17.56, so the total height of the flagpole is 2.36.

The low of the pennant formation is 15.98. Therefore, the projection is that prices will rise to at least 18.34.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Confirmation Bias

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Whether you are a long-term investor or a short-term trader, you might be looking through reams of information, such as charts, analyst commentaries, and financial statements, to arrive at a wise decision. You may have to sift through it all, weigh it appropriately, and use your intuition to make the most informed decision possible.

In the end, it's usually an educated guess. Traders are hardly objective, logical processors of information. They suffer from what decision-making theorists call confirmation bias. When devising a trading plan, there is strong pressure to reach a decision and implement a plan. The consequences of a wrong decision can be financially disastrous. The added pressure can get to us. Rather than look at each piece of information objectively, we tend to pay closer attention to information that confirms our initial decision, while ignoring contrary information.

If you want to make sound trading decisions, you must fight the urge to seek out information that supports your initial expectations. As a basic rule of thumb, when trying to arrive at a sound decision, you should spend more of your time looking for information that goes against your initial hunches than information that confirms them.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading From the Beach

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Because of the short week ahead of us, I've decided to head for the beach for a few days (until Sunday). Of course, I will take my "trading stuff" with me (Laptop, Smartphone) to watch and manage my open trading positions. Visit Andy's blog post to read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trend Following Is Not Yet Dead - Part I

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In his latest video, Marco gives you some insights on his journey into the world of traditional trend following. He talks about how trend following works, what to consider, and if it's a trading style for the average trader to consider. This is Part 1 of a 2-Part series. In his next video, Marco will go into the details of his backtests.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 614 - March 18, 2016

Here's some trading humor: A few days ago I booked a lot of money on a trade with a water development company. Today a man knocked on my door and asked for a small donation towards the local swimming pool. I gave him a glass of water. Now, I’m wondering if I did the right thing.

Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trade What You See

Trading Educators teaches traders to trade what they see, not what they think. But as a trader, you will never see anything if you fail to first look!

Fairly often a trade comes along that is extremely obvious. I'm wondering right now how many traders missed the absolutely easy-money Intermarket spread. The spread calls for going long the E-mini Nasdaq 100 and short the Mini Dow.

Simple observation was all that was needed to make the trading decision. The CBOT gives a 90% margin credit if you will trade the spread as a ratio spread. To obtain the credit, the CBOT called for entering 3 Mini Dow contracts vs 5 E-mini Nasdaq contracts (Note: The ratio can change).

As you can see below, The Law of Charts is at work in spreads as well as in outright futures or stocks. In fact, The Law of Charts works with any kind of chart you want to use. It works with bar charts, line charts, point and figure charts, and candlestick charts. As long as a chart has a horizontal axis and a variable vertical axis, you can see The Law of Charts in action. The Law of Charts™ states that a 1-2-3 low occurs only at the end of a trend or swing. Since the low of the swing on the chart moved lower than the low of the previous retracement, the line I have drawn indicates a downswing. If you will take a look at your own charting software, you will see that the Nasdaq futures are moving sideways, while at the same time the Dow futures are moving down. This gives the reason for the spread to work.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Realistic Optimism

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Jack and John have just started a small trading business. Jack says, "I can feel it. We're going to make a fortune. By this time next year, we'll be rolling in money."

John counters, "I doubt it. That would take a miracle."

Jack says, "You're such a pessimist. Why are you so bleak?"

John argues, "I think we'll be successful. But I don't think it's going to happen overnight. It's going to take some time, and a lot of hard work!"

John is a realist. He knows they will make huge profits eventually, but he does not falsely believe that a miracle will happen. Becoming a winning trader will require that you overcome endless setbacks. It's important to be optimistic, but it is more important to be realistic. If you are overly optimistic, like Jack, you are setting yourself up for failure. You may take unnecessary risks, or be especially disappointed when you encounter the endless setbacks that are commonplace in trading.

If you want to beat the odds and become a winning trader, then you must doggedly make trade after trade, even when you face endless setbacks. It takes a rare person to be able to pick oneself up after a fall and be ready to face each setback with enthusiasm.

Optimists do better in school, win more elections, and succeed more at work than pessimists. A study of several occupational groups from top notch winning athletes to traders on the floor of the exchange, found that optimists do better. What's their secret? It is in how they explain setbacks or failures. They don't blame themselves. They don't believe that success or failure is a matter of enduring personality traits. Instead, they explain setbacks as the result of minor, controllable situations that have nothing to do with them personally. They believe that, with enough persistence, they will have a good outcome.

On the other hand, pessimism has its virtues. Pessimists may feel badly most of the time, but research studies have shown that they more accurately judge how much control they have over situational circumstances. Pessimists are more realistic in their judgments, and thus it may be beneficial to think pessimistically on occasion. Optimism may make you feel good, but pessimism helps you evaluate the feasibility of your plans, goals, or ideas. Traders, especially novices, are notoriously overly confident. Novice traders tend to over-trade, and are unrealistically optimistic. It's vital for survival to have realistic expectations when it comes to trading. Optimism helps you persist in the face of a setback, but a healthy sense of skepticism will keep you based in reality.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Implied Volatility vs Historical Volatility

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

In the video below, Andy reveals the the difference between Implied Volatility and Historical Volatility. Which volatility is important to an options trader (seller), and does one affect the other?

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Do I Deserve to Win?

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

The world's most successful traders believe in themselves and their ability to win. In fact, many of them feel that they “own” the market. They are not necessarily being arrogant, but they are sure of themselves and that they are able to take profits out of the market. Most importantly, they believe that they deserve to win. They have a mindset that is conducive to winning as a trader. It's essential that you make sure you, too, have such a mindset.

Do you find yourself acting as if you don't deserve to win? Do you waiver between two opinions, declaring that you know how to take big gains out of the market one day, and doubting whether you can really do the same the next day?

Do you often make gains, and then give them back, plus a little more sometimes? How about a lot more?

Deep down inside, you may be suffering from the work ethic. You may not believe making money easily is honest work. Is it possible that these beliefs interfere with your making easy money without a lot of guilt?

There is a powerful human need to hang onto tradition. Everyone in your family worked hard, so you must work hard. Have you considered that working smart might be a better way to go? When we stray from certain social mores and traditions, we feel confused and uneasy. Therefore, it's essential that we learn who we really are, and identify which beliefs we hold that prevent us from working smart and not hard. We need a mindset that is conducive to trading.

Money is a means of exchange that provides us with circumstances and experiences we could not otherwise have. There is plenty for everyone. Let’s face it, the government can always print more money. When we acquire wealth, we are able to support our loved ones, others, and ourselves more fully. We can be an asset to family and society.

For a few minutes, think about how you feel about the profits you make. Do you believe you deserve wealth? Do you believe you are justified in accumulating more capital than you currently have? Do you believe that by winning you are taking money away from others? Such negative beliefs are not consistent with trading success, so if you hold such beliefs, you are going to have to get rid of them if you want to “win” as a trader.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Why Having a View on a Market Isn't Enough

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Marco provides a video on YouTube. He talks about why having a view on the direction of a market isn't enough. The reason is that just having a directional view doesn't make a trade...find out why!!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 613 - March 11, 2016

We have added a new feature to our site. Please take a few minutes to check out our blog. The "blog button" is located on the top right hand corner of this page.

Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

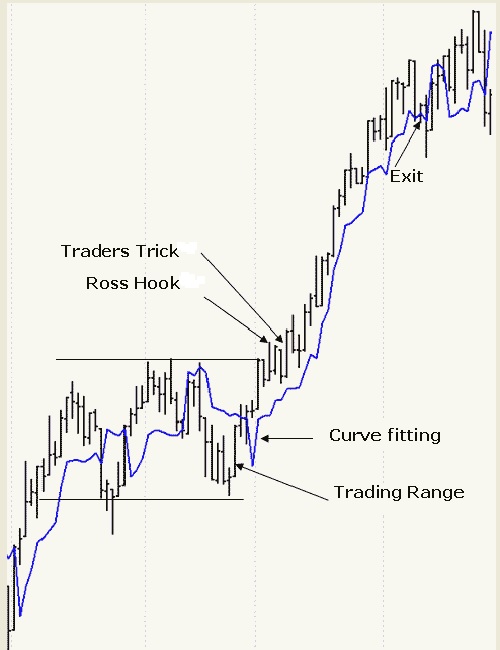

Exchange Volatility Stop

This week we are studying a 1-2-3 formation in combination with a Volatility Stop (VS). Volatility Stop can be used to track or contain a trend or a swing better than can a moving average. Since Genesis Trade Navigator has this study already programmed into it, I will use it to demonstrate how to go about setting it up.

When you see a trading range formation followed by a breakout from the consolidation area, and then a Ross Hook, you should immediately think "defined trend," and begin to also think "Volatility Stop."

What you want to do is to attempt to curve fit the Volatility Stop line around the formation including the breakout bar, so that you see containment of the formation. Then stay with the trade until prices move below the VS, or Stop Close Only below the VS, it’s your choice.

The VS has 3 parameters: a moving average, a multiplier, and an offset value. You can manipulate these three until you get containment.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Start Out Strong

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading is a challenging business. Not only is it tough to repeatedly pick one winning trade after another, it is also hard to control our emotions. Our emotions often get the better of us. Our expectations tend to influence how we feel as we trade, and when we doubt our abilities, we may have difficulty maintaining a winning attitude. One good approach to staying optimistic as we battle with the markets is to build up psychological momentum: start off ahead of the game, and build on that success. However, many traders set themselves up for failure. They start off making trading errors, and then dig themselves into an emotional hole from which they have trouble climbing out.

The expectations you have regarding a trade can dictate how you approach it. If you feel you are about to make a mistake, then you probably will make a trading error. As an example, you might have a perfectly good idea for a trade, but you may feel so on edge that you have trouble taking advantage of it. It often starts out innocently enough. You have a good trading plan, but you make a few little errors. Perhaps you trade under less than ideal market conditions, or you set your stop too close to your exit point and get stopped out. Maybe you don't put up enough capital to make your trading plan work.

Whatever it is, you may make a few poor decisions, end up with a losing trade, and feel disappointed. Making one bad trade isn't a big deal, but what happens when you make another losing trade, and then another losing trade, and so on? At that point, you may feel that it is hard to get out of the minor slump you are in.

How can you set yourself up to win? First, realize that trading can be much like a self-fulfilling prophecy: you secretly believe that your trading plan won't produce a profit, and then you subtly self-sabotage your plan by feeling uptight, overly exacting, and constrained. It is vital to feel relaxed and carefree when you start out the trading day. Think optimistically. Second, why not cheat a little? When you start the trading day, wait for an ideal trade, a trade you can afford to make, and which has a high probability of winning. If the first thing you do is to make a profitable trade, even a small one, you'll feel good on your first trade, and then you can start building on your solid start.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Click on the video below for Andy's detailed explanation of how he would handle this multi-leg Soybean spread.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Stop-Running or What?

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Read more on Andy's blog.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Smaller Stop = Less Risk = Better Risk: Reward?

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Marco provides a follow-up video about stops in which he presents the concept of using smaller stops to risk less, and to achieve a better risk-reward ratio. While this is a popular concept, it unfortunately has its flaws if used in the wrong way. See for yourselves!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Draghi Day - EUR/USD: To Trade or Not to Trade?

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Read more on Marco's Blog.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

More...

Edition 612 - March 4, 2016

We hope your January through February proves to be profitable. After one more month, March, you can evaluate your quarterly trades to make adjustments. If adjustments are necessary, make sure that they align with your trading plans.

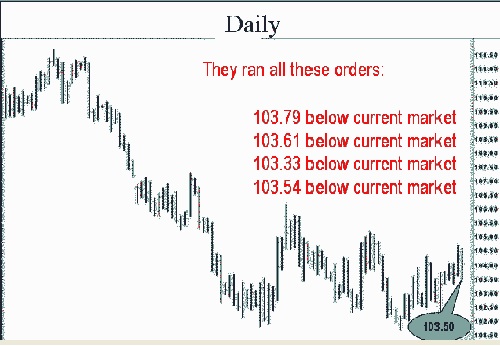

Stop-Running

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Recently I showed a student how stop-running takes place in forex trading. Most forex traders are falling for the lie that, because liquidity is so great in forex, there is very little, if any, stop-running taking place. The truth is that that there is more stop-running taking place in forex than in futures.

The chart below shows an example of stop-running in forex. Stops were located at the following levels the day before the last day you see on the chart. Our “Trading All Markets”, and “The Law of Charts In-Depth” recorded webinars will further explain this by teaching you how and where to place stops.

104.72 above current market

103.79 below current market

103.61 below current market

103.33 below current market

103.54 below current market

102.97 below current market

102.33 below current market

The last bar on the chart below shows The Law of Charts in action. One aspect of The Law of Charts is based on the fact that if there are stops in the market, the market movers will move prices to get as many of the stops as they possibly can.

In the case below, they were able to follow the line of least resistance, and took out the stops at the following levels:

103.79 below current market

103.61 below current market

103.33 below current market

103.54 below current market

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Waiting Patiently

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

If you are like most people, you want to make a fortune, and you want to make it now. It is a reasonable wish. Who wouldn't want to make enough money to make all their dreams come true? But such a future-oriented focus is often the undoing of many traders. Making money in the markets takes time. You have to wait for ideal market conditions, and you have to build up the requisite trading skills to take home huge profits. And if you are like many traders, it will also take time to save up enough capital to trade on a scale that can make you wealthy. If you are serious about making it in the trading business, you will have to learn to be patient.

Many people can't wait to be rewarded. Depending on your style of trading, being unable to wait patiently can be a problem. For a long-term investor, for example, it is necessary to buy-and-hold long enough for a long-term strategy to play out. There may be minor fluctuations during the waiting period, but seasoned investors have learned to wait it out. Most novice investors, in contrast, impulsively sell as the masses panic, and buy the stock back at a top, which usually results in a losing trade. If you are a long-term investor, it is necessary to be able to control your impulse to take a profit and allow the price to rise over time. Even shorter-term traders, such as swing traders, must fight the urge to sell early. Although trades are held for much shorter windows, a swing trader must know how to wait patiently for the optimal time to sell.

Impatient traders tend to show a future-oriented focus. They dream of the profits they will make in the future, but at the same time, they desperately need them right now. Getting rid of impatience requires the trader to curb this future-oriented perspective, and focus on the near future. Traders can become more patient by following a set of specific steps.

First, it's necessary to admit that you are impatient. This can be difficult to do. It's hard to admit our limitations. One of the best ways is to make it impersonal. Pretend you are watching a television show about yourself. Pretend the character on television isn't you. Watch how impatient you are. See yourself as an objective observer would see you, and then think about how you might change. Second, imagine you have two "tuning" knobs in front of you. Pretend that one of the knobs controls your focus on the future. If you turn the knob to the right, you will focus years into the future.

Don't let impatience thwart your long-term economic plans. Impatience can dash traders' hopes for economic success. Without the proper discipline, you will make losing trades that will eat away at your account balance. By trading with patience, you can build up your account balance slowly and surely, and eventually reach your economic goals.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SPECIAL PROMOTION!

20% off "Trading Is a Business"

20% off "Life Index and Equity Evaluator"

March 4-9, 2016 only!

Enter Coupon Code Upon Checkout: tiblife20 (all lower case)

Trading Idea with Commentary

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Click on the video below to learn about a seasonal spread with a very good historical P&L statistic. Long October Sugar and short July Sugar is showing a nice seasonal up-move during the next few weeks.

Profitable trades are attainable! To find out how to manage this and other trades, and also to receive our daily detailed trading newsletter, subscribe to Traders Notebook.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading System

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

In order to succeed in trading, you will need a system or a plan. The usual way of attaining such a system is through many days of trading, hard-earned personal experience, not repeating mistakes you’ve made while analysing trades, knowledge of probability, observing other traders, trade simulation, book learning, seminars and mentoring, or any number of similar factors. Such a system will give you a correct mathematical and intuitive grasp, and once this hard-won system is in place, you should deviate from it only on rare occasions and for good reasons. Once you attain this system, it can operate almost by itself – you just do it, quite simply – almost naturally – without thought of opponents or outcome. If you don’t have a system yet, or feel unsure about the one you have, my mentoring program can help you to find the right system so that you can trade without hesitation or fear.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Where and How (Not) to Place a Stop-Loss

by Master Trader Marco Mayer

Educator for Forex and Futures, System Trader, and Creator of Ambush Trading Method

Marco talks about stop-losses in general, ways to decide on your stops that don't make much sense, and other pitfalls like using breakeven stops. Finally, he gives you some insights on his own systematic approach regarding exits, and how he likes to decide where to put a stop-loss.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SPECIAL PROMOTION!

20% off "Trading Is a Business"

20% off "Life Index and Equity Evaluator"

March 4-9, 2016 only!

Enter Coupon Code Upon Checkout: tiblife20 (all lower case)