Newsletters (208)

Children categories

Edition 670 - April 14, 2017

Can you ever be sure that you have an edge in trading?

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Thank you for your feedback on my last article "Having an edge in the markets". Some of you have been brave enough to take that article to the next logical step and ask the question most traders hardly dare to ask.

Here's an email I got: "I have experienced all the things you described. The thing that I always wonder about is how do you know if you have a real trading edge? Every time I have a winning period and then move into a period of drawdown I start asking myself, "Do I really have an edge or am I now just giving everything back because I don't?". Is there a way to have an assurance that your methodology has an edge? Is it possible to have that confidence?"

Definitely, one of the hard questions when it comes to trading. And one that makes most traders feel very uncomfortable for a reason. I myself kind of blanked out each time it came to my mind for years. Why? Probably because I already knew that I wouldn't like the answer too much. And it's much easier to just move on with some magical thinking and decide to "trust in your guru" or "believe what you've read in a book".

But one day every honest trader has to face this, so let's not lose time and dive right into it.

First, let's redefine the question. I'll assume you have read the last article and if you didn't, now is a good time to do so. In the article, we discussed that a casino has an edge at the roulette table, a real edge that is indisputable and 100% real. You can explain it in a few sentences, it has been there 10 years ago and will still be there in 10 years as long as the rules of the game don't change. The house has an advantage, and the owners of the casino can be 100% confident about this.

How's the situation in trading? Are there edges equal to the house advantage of a casino? And the answer is actually yes, here are a couple of examples:

- When most trading still happened in the pits, traders who had a seat at the exchange and were trading directly from the pit had an edge. They could see the big players placing their orders, immediately see/hear/feel when the market started to move and jump on the move early. By the time the retail traders called in their orders to join the trend they could already cash in. Notice that almost all of these successful pit traders failed to make money when they were forced to trade in front of a computer screen without that locational advantage. Many of them are now trading gurus...

- Market makers who were front-running orders. These are almost gone these days in electronic trading, but HFT trading algorithms have actually taken their place. They usually have a very small speed advantage, being a bit closer to the exchanges than everyone else. And a huge part of their game is running the same strategies as the human market makers did back in the days. With smaller amounts but a lot faster and at much higher frequency.

- Arbitrage opportunities, trading the same stock but on different exchanges for example to exploit price differences. This was a really nice edge but the margins got smaller and smaller over the years as the markets became more efficient. Nowadays there still are some opportunities in markets like cryptocurrencies or developing markets in countries that are just opening up to the global world. But they're not easy to find and the profit margins usually are very small.

There's more, but the truth is that all of that kind of sure thing edges I know of are gone or too expensive to exploit for a private trader. One example of this is HFT trading where you need a serious amount of money to get a fast enough connection to the exchanges and super cheap trading costs to make this really work. Unless you have that, HFT trading is a sure way to ruin due to the trading costs you have to pay and getting beaten constantly by faster HFT trading algorithms.

Now let's move on to the kind of edges most of us are looking for on a daily basis. These aren't sure thing edges like the one the casino has. Let's call them speculative edges. One might be that during a certain time of the month's stocks tend to move higher. Or a chart pattern that increases the odds of prices to move in a certain direction. Or a trader who believes he has exceptional gut instincts about where the markets will move. It could also be a specific system/method like the well-known turtle system.

What differentiates all of these speculative edges from the ones we discussed before is that they're always uncertain. A trading method like the turtle system might work for a decade and then stop working. The reason for this might be that too many people are doing the same thing or because the markets change. The same can be said of a chart pattern. Markets, market participants and market relationships change all the time. Some markets even completely disappear. And so do market inefficiencies.

Because of that, truth is you can never be sure if what you believe to be an edge actually still is an edge.

But there are things you can do to increase the odds of an edge being valid and to make this a bit less of an issue.

First of all, don't just blindly believe and bet your money on a chart pattern/method/idea because it's on some website, a trading guru tells you about it or you find it in a magazine/book. I can honestly say that I've looked at most of what's out there in the trading world (for free and expensive/premium products). Truth is that even when you ignore the obvious bullshit it’s very hard to find any real edges in what's on offer out there.

Also just because something sounds logical and reasonable doesn't mean it will actually give you an edge. This is a very common scheme in the trading education world. We all love these little stories and explanations as for other areas of life, this actually works quite well. But not in trading.

Here's an example: "this price pattern shows you clearly that the big players in this market bought at price X, after which prices moved higher very strongly. So the bulls clearly won and the traders who are short have to cover their position once price Y is hit." Sounds logical, makes some sense, could be true right? But all of this is just an interpretation of what everyone can see on a price chart. It doesn't mean that bla-bla actually has any predictive value. The opposite could be as true!

So what to do? I suggest to always backtest and validate any trading idea. Yes, you'll still just look at the past and backtesting has its flaws but it surely puts you ahead of a trader who doesn't backtest at all. If you don't believe in backtesting, simply ask yourself if you would still trade a chart pattern if you'd know that it lost money every year for the last 10 years in the market and timeframe you plan to trade it. I wouldn't and that's why I want to know at least that much before betting my money on an idea.

Backtesting the right way is not easy. You need to learn how to do it as well as possible, knowing it's limitations and flaws. Do your best to avoid over optimizing, make sure your backtest is statistically sound and you have enough trade samples (no, 30 is not enough). Evaluate trading costs correctly and use high-quality historical data. Depending on the strategy, use out of sample validation, walk-forward optimization, cross validations and monte carlo simulations.

If you're doing proper backtesting, you'll be way ahead of all the traders out there who just blindly trade some signal. You'll know a lot more about the possibly good signals and you'll have filtered out tons of strategies that you now know for sure have no edge whatsoever.

Even now though you'll still not know for sure if your strategy really has an edge or not. You've done all you can to strongly improve the odds but it still is a speculative edge and should be treated as such.

That’s why I see trading systems as investments. After having done my research, I might decide to invest in a trading system. And like investing in stocks, I'll diversify as good as possible by investing in multiple systems. This way if some of my systems are actually just "data accidents" that somehow still made it through my strict system development process, it's not going to be a disaster as long as the other systems perform as expected.

I believe that's as close as you can come to a sure thing edge as a speculative trader. Of course, that's not what traders want to hear but it's always much better to know and be aware of what’s true rather than to ignore it.

Happy Trading!

Marco

PS: If you know of any sure thing trading edges out there, please email me, This email address is being protected from spambots. You need JavaScript enabled to view it.!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

When it comes to trading...more-less-confused.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

When it comes to trading it seems that the more you know, the less you know, and the more you become confused.

People have the tendency to believe that the accuracy of their forecasts increases with more information. This is the illusion of knowledge - that more information increases your knowledge about something and improves your decisions. However, this is not always the case - increased levels of information do not necessarily lead to greater knowledge. There are three reasons for this. First, some information does not help us make predictions and can even mislead us. Second, many people may not have the training, experience, or skills to interpret the information. And, finally, people tend to interpret new information as confirmation of their prior beliefs.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

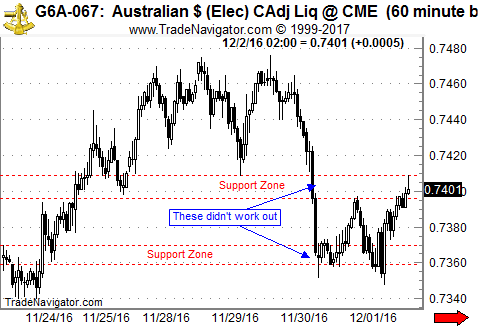

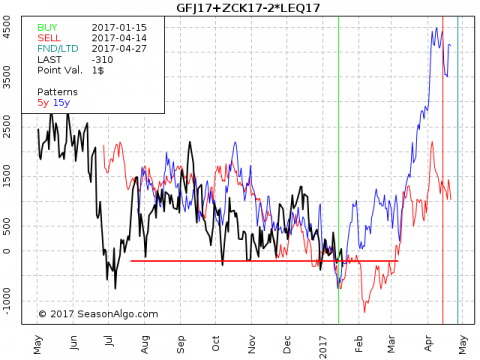

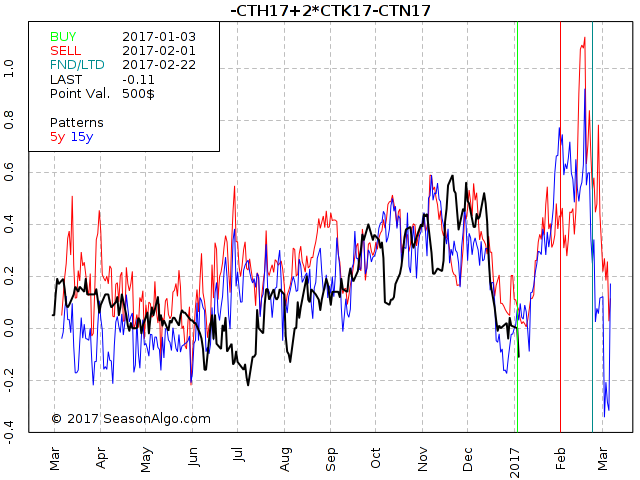

Chart Scan with Commentary - Why don’t more people know about spreads?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Could it be that those who are in the know don’t want YOU to know?

Spreads are kind of a strange thing to be writing about in a trading newsletter the goes out mostly to traders who are probably trading everything and anything except spreads. You see, trading spreads on futures contracts is mostly for people "in the know," but there are few who know much about spread trading.

Since spreads can be traded strictly using spread orders shortly after the Open or during the Close, it really doesn’t matter where you live on this planet should you care to take advantage of spread trading. But why would you want to do that? I suppose I’d better answer my own question: It’s because of the many, many advantages spread trading has over every other kind of trading I’ve seen in my decades of trading experience.

It’s truly amazing that people don’t know much about spread trading, and please don’t confuse it with "spread betting", they are not at all the same thing. What’s startling about it is that there is more refined information about trade selection when it comes to spreads than you can find in any other trading venue. With so much great information available about which spreads to enter, you have to wonder why so few people know about spreads.

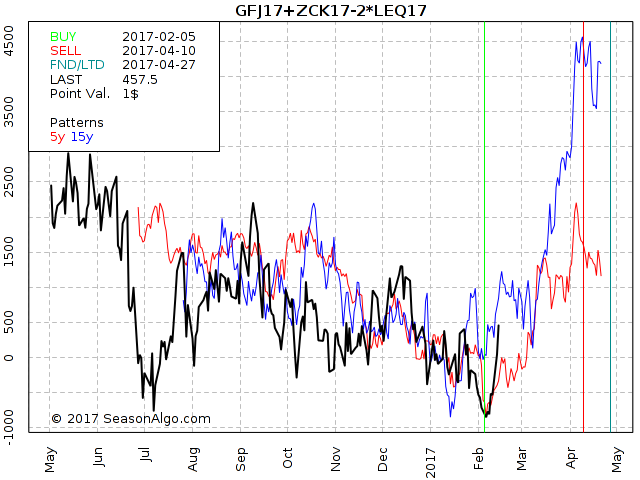

A spread is the arithmetic difference between the prices of two outright contracts. You simply subtract the one you want to sell short from the one you want to buy long. Technically, you can spread any two contracts you care to, but normally a spread is done between two futures contracts that are in some way related to one another. The reason for using futures to do spreads is that the US exchanges offer substantially reduced margins for trading them.

Trading futures spreads brings you a whole new trading experience. Is there anyone out there who would not want to trade free of any costs for data? It is possible when trading spreads.

Can you imagine situations where even though prices in the underlying are moving sideways, you will be trading a chart that is trending? For the most part, isn’t it the trend where you make the most money? The fact is that spreads trend more steeply, more often, and for longer periods of time than the trends in the outrights. You see when a spread trends, it trends based on reality and not on market manipulation by those able to move prices.

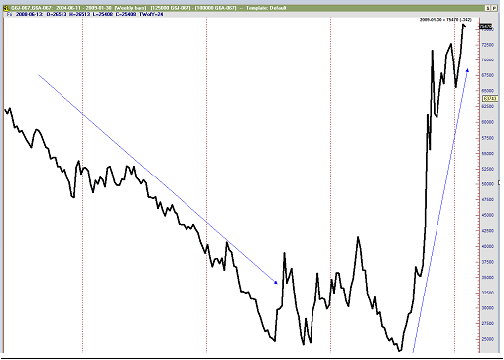

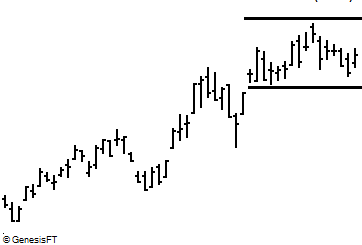

As an example of how long spreads can trend, let’s look at a weekly chart of being long the Japanese yen futures contract for March, 2009 spread against being short an Australian dollar contract for March, 2009. These currencies are traded in Chicago at the CME Exchange. Of course, prior to the March, 2009 contract, you would have been in the December, 2008 contract, and before that in the September, 2008 contract. The uptrend began in August, 2008 and at the time I wrote this it was still going. The scale on the right shows actual dollars earned by the spread. It moved from approximately US$25,000 to US$75,000 (US$50,000+) profits at the time of this writing.

Prior to that uptrend, it would have been best to have been long the Australian dollar and short the Japanese yen (that trade lasted from some time prior to June 2004 until July of 2007, a period of more than 3 years.

Here’s another advantage of trading spreads: Market manipulation has no effect on spreads. Neither does stop running. Whether it be shares, forex, futures, or options, stop running is the major enemy of most traders in the outright futures of any market you care to trade!

You read that right, spreads are immune to stop running. In fact, there are no stop orders in spread trading. There are only entry and exit points. When you trade spreads you become invisible to the market manipulators.

I want to tell you about some of the many additional benefits of spread trading but first we need to identify the various kinds of spreads, because they go from very low risk to somewhat riskier. Reduced margins are available among the following:

- Intramarket Spreads

- Intermarket Spreads

- Inter-exchange Spreads

Intramarket spread are generally the least risky. They involve two contracts having different months, but of the same underlying. June Crude Oil – August Crude Oil would be such a spread. A slightly more risky intramarket spread would be an old-crop year – new-crop year Soybean spread, i.e., October 2006 Soybeans – March 2007 Soybeans. The Soybean crop year runs from November of one year to September of the following year.

Increasing just slightly in risk would be an Intermarket spread between Chicago Wheat and Kansas City Wheat. Note that this is also an Inter-exchange spread, as the two are traded on different exchanges. But the one variety of wheat is in a sense closely related to the other variety of wheat, and so margins to trade the spread, which in turn reflect risk, are extremely low.

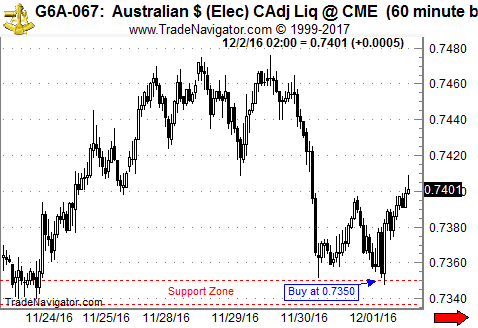

While all reduced margin spreads carry lower risk than the risk for any outright futures contract, I need to tell you about the spreads that carry the most risk. These would be some spreads in the currencies. Even though they are Intermarket spreads, currencies are not necessarily sufficiently related to offer extremely low risk. The risk on some currency spreads comes close to that of the outrights. Yet for others, which are related by virtue of seasonal economic factors, the risk is considerably less. For example, the Canadian dollar – Australian dollar spread does not see excessive adverse movements. These two nations are both what some traders call "commodity countries". The spreads between their currencies is seasonally related. When it is summer in Canada, it is winter in Australia and vice-versa. Trade between the two nations is also a factor in the spread. Swiss franc – euro spreads are also good, as the two are closely related. The Swiss, because their major trading partners are the other Europeans, cannot afford to allow their currency to become too expensive.

Risk, in spreads is a product of how closely related are the two legs of the spread.

Low margins are one of the greatest advantages of trading spreads, which in turn means you are getting more efficient use of your trading capital.

Margins on spreads carry as much as a 95% reduction as compared with margins for trading the outright futures. There are only a handful of spreads that have reductions in margin that are less than 50% of those for trading in the outrights.

When it comes to planning, spreads have no equal. Are you aware that you can plan spread trades days, weeks, and months in advance? You will know when they should be entered, and what the chart should look like when it is time to enter.

You can trade spreads without ever having to use an indicator, point and figure, or candlesticks. A simple line chart is all you’ll ever need and to make things even easier, if the spread line isn’t rising you are not making any money. You never trade a spread if the line on the chart isn’t going up.

In the area of trade selection, you will find that you never have to enter a spread trade with less than 80% probability of winning based on how the spread traded seasonally in the past. In fact, there are spreads that have been winners in 15 out of the last 15 years. You can also trade spreads that offer an 80% or greater chance of winning based on regression analysis.

I wish I were able to tell you the many other benefits of spread trading, but I cannot because of space limitations. I must use the words I have left to explain the chart and recap some of what I’ve written.

As concerns the chart, (March 2009 yen) minus (March 2009 Australian dollars) the spread must be adjusted for the difference in point value of the two currencies. Yen move $12.50/tick, or $1250 dollar/point, while Australian dollars move $10/tick, or $1000/point. What I want you to notice is that I multiplied each leg of the spread by its point value.

Using the multipliers of 1250 and 1000 allows me to see the spread in terms of US dollars. Currency spreads can be very profitable and I have traded them frequently. Currency futures are highly liquid as well.

In the early 1970s, there were only a few markets available for trading. They were all commodities; There was no such thing as financial futures, or stock index futures. There was one year in particular when all 8 markets that were available for trading were flat. In those days almost everyone was a trend trader. But there were no trends. Most traders found themselves churning their own accounts because there was no way to get on the right side of the market. Many of those who survived did so because, even though the markets were flat, the spreads between the various months or related commodities were trending.

I encourage you to at least look into futures spread trading. You can do them no matter where you live and work. In times of flat markets especially, or wildly swinging markets, spread trading can be a mainstay of your trading career.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

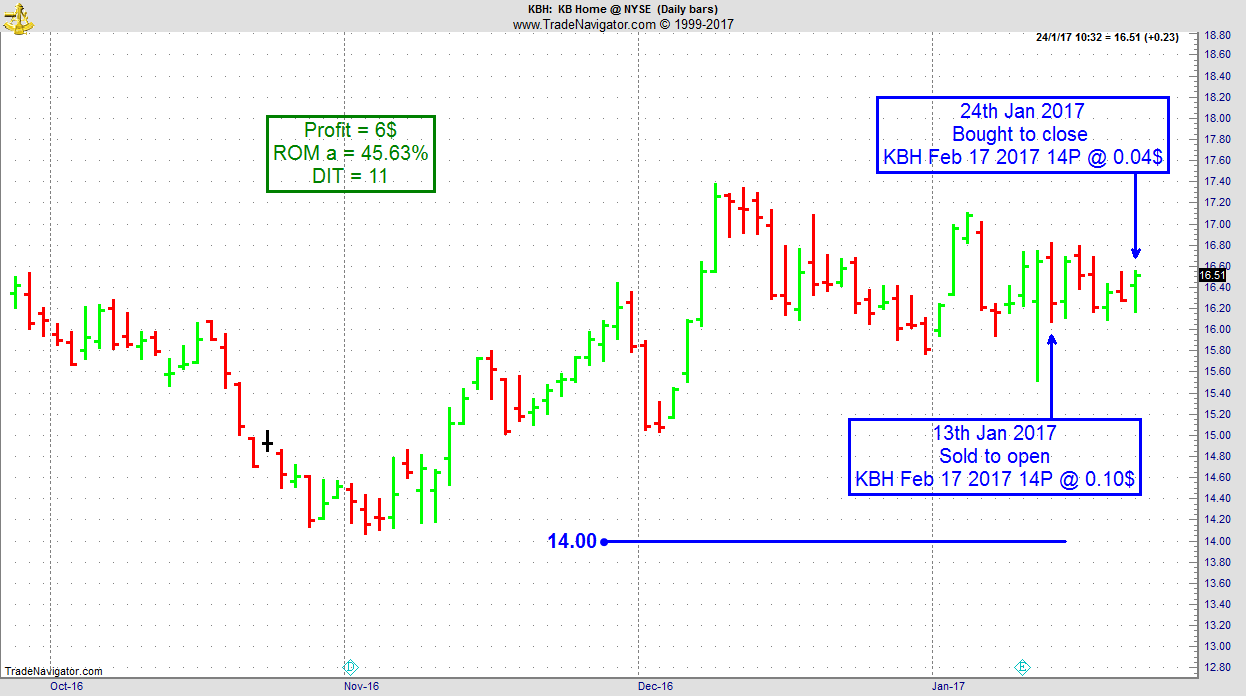

Instant Income Guaranteed - X Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

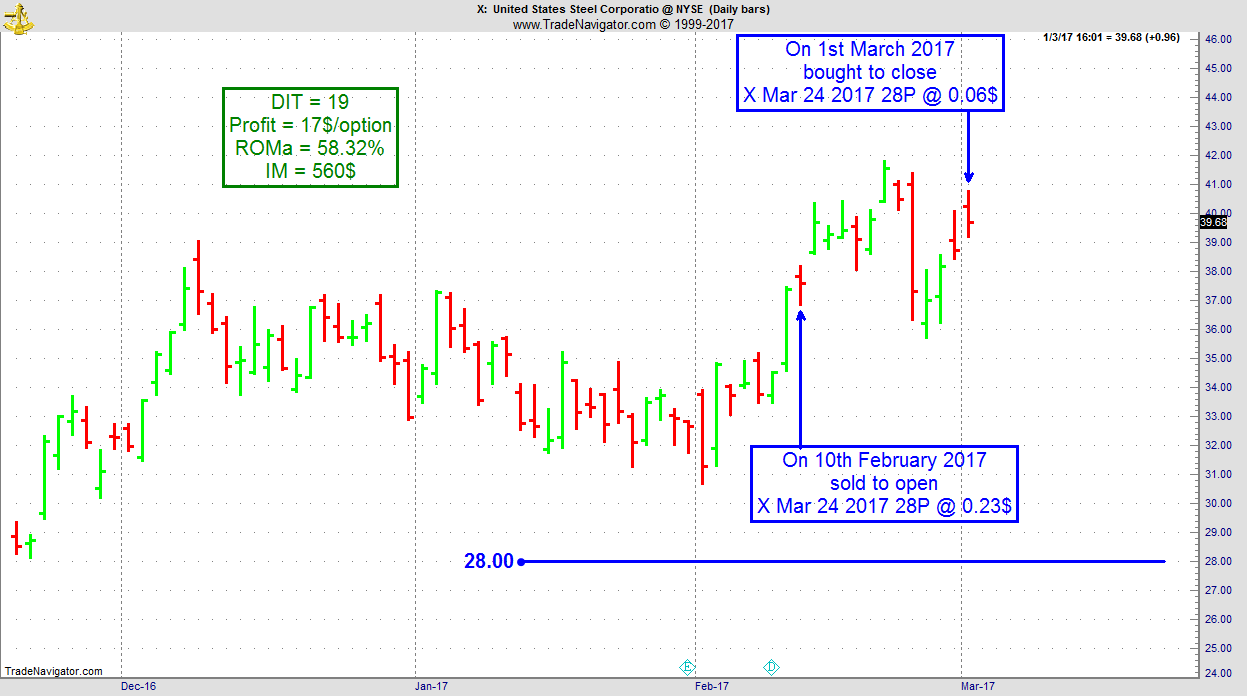

On 9th February 2017 we gave our IIG subscribers the following trade on X (US Steel). We decided to sell price insurance as follows:

- On 10th February 2017, we sold to open X Mar 24 2017 28P @ $0.23, i.e. $23 per option sold, with 44 days to expiration, and our short strike below a major support zone and 25% below price action.

- On 1st March 2017, we bought to close X Mar 24 2017 28P @ $0.06, after 19 days in the trade, for quick premium compounding

Profit: $17 per option

Margin: $560

Return on Margin Annualized: 58.32%

This trade was pretty safe in spite of overall very low implied volatility levels.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 669 - April 7, 2017

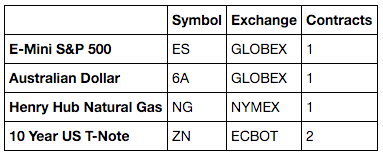

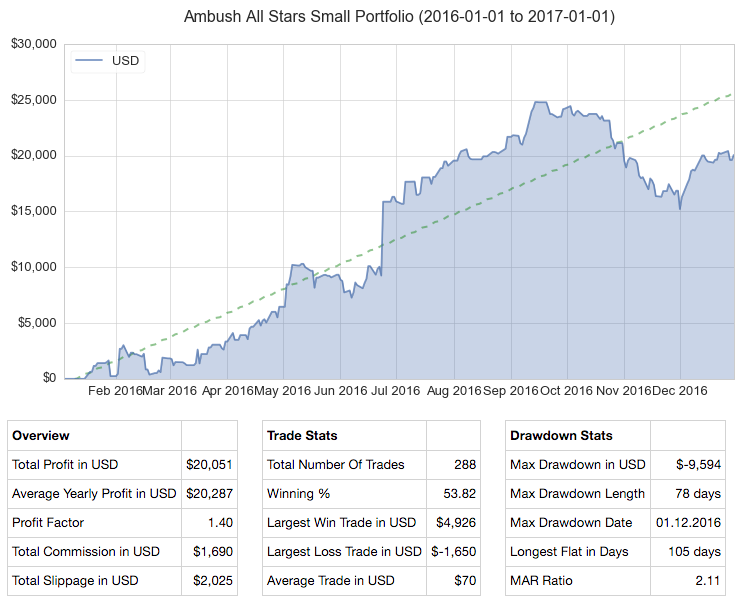

Ambush Signals

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Learn all you need to know about our new Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

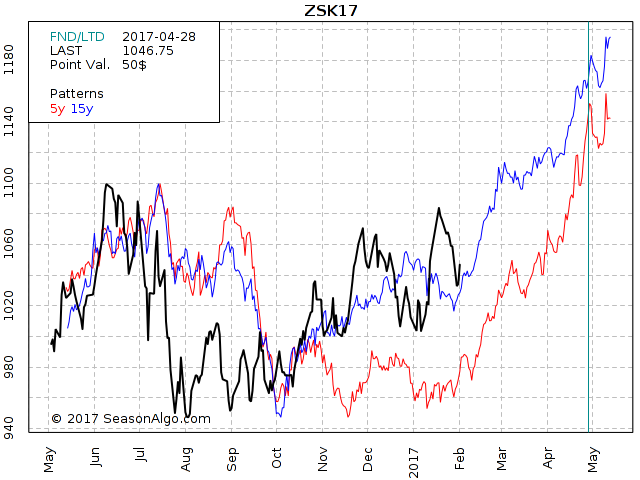

Trading Idea in Soybean Oil

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

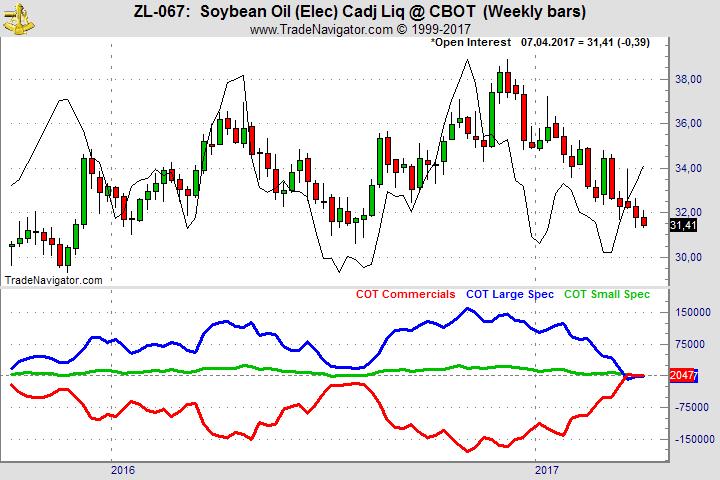

Today, I want to have a closer look at the Soybean Oil chart. As you can see from the chart below, Soybean Oil has been moving lower for several months and is coming close to the level around 30. This level is interesting to me because ZL bounced off of this level a few times in the past. Will it do the same this time? I have no idea, but we will see.

In addition, the commercials have turned to net long the first time for a long, long time. The last time commercials were net long was in June 2014.

Both, the long term chart and the COT chart, together with good Implied Volatility put Soybean Oil on my watch-list. I am now waiting to see what happens around 30 or 31 before I jump in to sell puts probably using the July contracts.

Learn from us by receiving daily detailed trading instructions on how to manage this trade and others! Click the below link for more information:

Traders Notebook Complete

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Latest Blog: Unlike many games and sports, trading has an additional factor: the market!

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Trading is more than just "a game". Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Trading options and futures combinations

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Option traders trade options, futures traders trade futures, "and never the twain shall meet." But why is it that way? Why are people who are trading options and futures combinations so rare?

Years ago, I set out to discover why we don’t see people trading both options and futures in order to get the best features of each. What I discovered is that option traders were scared of the underlying futures, and futures traders were afraid of the complexities of trading options. The result was that I couldn’t find a single person who was trading options and futures simultaneously.

What I have trouble understanding to this day is why traders don’t see that combining trading options and futures makes the trading of both much easier, and gives them the best of both worlds. What do I mean by that?

Let me give you an example that will show you why trading options and futures within a single strategy is a whole lot easier than trying to do the job using either options or futures separately.

Let’s say you want to create what is known in option trading as an "Option Box."

To create an Option Box, you must first create a synthetic long or short position. In this example let’s say you think prices will rise, so you want to be artificially long. You buy a call three strike prices distant from the current price of the futures, and you sell a put two strike prices distant from the current price of the futures. You do this only if you can achieve a satisfactory credit in your account for doing so.

Since we are talking here about trading options and futures, at the time we complete both transactions, we are synthetically long futures. (This same thing can be done with stock shares, CFDs, or Forex pairs.) Being synthetically long, we are now vulnerable. In the event that futures prices fall, we would be in trouble.

How would a straight options trader protect from the possibility of prices falling? Typically, the trader would buy an option at a strike price more distant than the one he just sold.

However, doing that would probably create two problems:

- Buying the more distant strike price for protection could or probably would eat up all or most of the premium credit earned by entering the position to begin with.

- The more distant strike price might involve more risk than could be had by protecting another way.

What is another way? The trader trading options and futures could simply place an open-order, good-till-canceled sell stop in the futures, anywhere in front of or behind the strike price of the option sold, thereby more closely tailoring the amount of risk he is willing to take. There are even more benefits to this strategy:

- The open order short futures has zero costs associated with it. It is a free hedge against the possibility of falling prices.

- There is no margin requirement for the short futures unless it is filled.

- There are no commissions to be paid until the short futures is filled.

- There are no Deltas to worry about because the futures position is always at full Delta and cannot decline from full Delta.

When trading options and futures with the objective being to create an Option Box, the trader now needs to close the box as quickly as possible. To accomplish that, he creates another synthetic futures position. This time he needs to sell a call and buy a put to become synthetically short futures. The trader needs to sell a call further distant from the call he bought, and buy a put closer in than the put he sold. And just as with the initial position, he should attempt, if possible, to accomplish the transaction with an additional credit to his account.

With the box closed, it is impossible to lose. By trading options and futures, the trader has opposing synthetic long and short futures, which now constitute a bear spread and a bull spread.

This strategy in combined trading has even further benefits:

- The closed position carries a guaranteed win. The trader owns the inside of the box and is short the outside — he has a covered call and a covered put. The original open-order short futures position is no longer needed and can be discarded.

- It eliminates the cost of having to buy one additional option that presumably would expire worthless or be sold for salvage value.

- The second synthetic futures position can be put on with a debit as long as it does not use up all of the credit originally earned from the combination of trading options and futures.

- An option model is not needed to trade this strategy (although a model could be helpful in extracting the most credit).

- As long as prices remain inside the box created by short options, the trade will expire and the trader gets to keep the premium earned.

- If prices break out of the box, in addition to the premium earned, the trader will enjoy a capital gain equal to the money earned between his long call and the more distant short call.

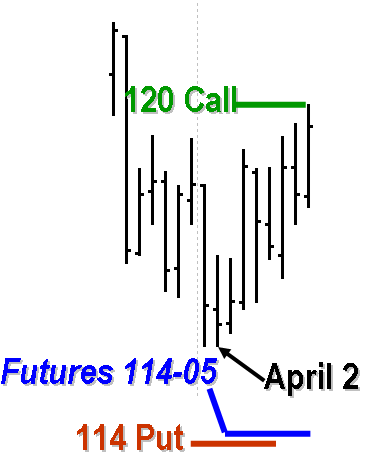

In trading options and futures combinations, an option box begins like this: Short a 114 Put, long a 120 Call, protected by an open-order sell stop in the futures.

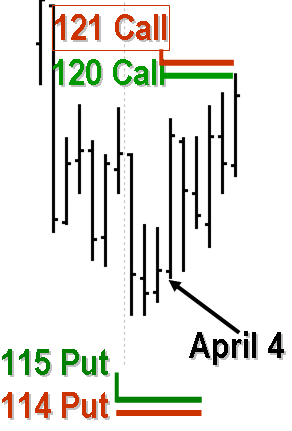

In trading this combination, an option box ends like this: Short a Call, long a Call; long a Put, short a put.

This is just one example of the innovative way traders can trade using combinations of options and futures. There are many more examples and explanations included in the book I wrote entitled Trading Optures and Futions, which is, of course, about various combinations of trading options and futures.

Follow the above link to find out how you can learn more about trading options and futures to realize the best of both worlds.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading Discipline

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading discipline exists in two distinct parts:

-

Before your order is filled.

-

After your order is filled.

Let’s look at each of these categories, because both are tremendously important.

Trading Discipline Before Your Order Is Filled:

Here we are talking about all the things you do as a trader that require the consistency that comes from having good habits of preparation. Let’s look at good habits in terms of a series of questions:

- Do you research your trades?

- Do you study the markets?

- Do you regularly engage in chart analysis, technical analysis, fundamental analysis - even all three?

- Have you studied every kind of order available to you? Have you built strategies around the types of available orders, and have you come up with tactics -- ways to implement those strategies?

- Have you thoroughly mastered your trading software and the platform from which you trade?

All of these are part of trading discipline, and still there’s more:

- Have you practiced paper trading or trading on a simulator before launching a new strategy? This is especially necessary if you have never before traded.

- Do you have plans for what you will do if your computer goes down in the middle of a trade? What will you do if your data feed stops working? What will you do if you inadvertently place a wrong order — or your statement shows an order you didn’t place, or doesn’t show an order you did place?

Taking care of the seemingly little things are all part of trading discipline, and I’m sure I haven’t covered everything. My purpose is to get you thinking!

Trading Discipline After Your Order Is Filled (Also called Self-Control).

There is a saying in martial arts that goes something like this: "If you are suddenly and unexpectedly attacked, you have two seconds in which to make a rational response." This response must come automatically, as part and parcel of who you are, and the response is gained through disciplined practice and repetition. Another way of describing this kind of trading discipline is to call it self-control.

All the discipline practiced before your order has been filled, including the trading discipline derived from practice and repetition, finally comes into play as self-control in a battle situation. The moment you are filled you are in battle, and if you are not fully prepared you will begin to behave emotionally. Without the discipline gained through practiced repetition resulting in self-control, you will begin to act irrationally, emotionally. Fear, greed, pride, guilt, and other emotions will come into play, causing you to fail to carry out your strategy or to implement the tactics you need for fulfillment of your trading plan.

How Do You Gain Discipline and Self-Control?

Many, many years ago, I was in the same situation in which many of you find yourself today. You are asking yourself, "How can I acquire the discipline and self-control I need to become a successful trader?

When I asked myself the very same question, I eventually discovered the solution. I began to chart my life. After all, chart reading was a huge part of my trading life. Chart reading was what I did every day. My entire world concept revolved around reading charts. Charts were one of the main ways through which I perceived the world around me.

There was another aspect to trading discipline that intrigued me. I had always heard that if I wanted to be a winning trader, I had to keep my losses small and let my winners run. Wow! Great idea, isn’t it? But no one ever showed me how to do it!

I was now confronted by two mountains. The first was how to chart my life, and the other was how to keep my losses small and let my winners run.

The answer to both seemed to come at the same time. By charting my equity, it became crystal clear to me as to how to keep my losses small and let my winners run.

Charting my life was somewhat more difficult. I had to think hard about which factors of my life most affected my trading. I had a trading life, but how was I to break it down into chartable pieces? And what about my emotional life, how did that affect my trading? And there were still other life categories that affected my trading: my relational life was one; my financial life was another; and my spiritual life was yet another.

Eventually I came up with two tools: one I called the "Life Index;" the other I called the "Equity Evaluator." I laboriously maintained these tools manually until the computer age. Both of these tools have now been digitized, which makes it extremely easy to enter the data and quickly see the patterns of results. Now both tools are available to assist you with your trading discipline: learn more about the "Life Index for Traders” and the “Equity Evaluator."

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - SLW Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 22nd March 2017, we gave our IIG subscribers the following trade on SLW, right after earnings. We decided to sell price insurance as follows:

- On 23rd March 2017, we sold to open SLW Apr 28 2017 18.5P @ $0.20, i.e. $20 per option sold, with 35 days to expiration, and our short strike below a major support zone, about 14% below price action.

- On 31st March 2017, we bought to close SLW Apr 28 2017 18.5P @ $0.10, after 8 days in the trade, for quick premium compounding.

Profit: $10 per option

Margin: $370

Return on Margin Annualized: 123.31%

This trade was pretty safe in spite of overall very low implied volatility levels.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 668 - March 31, 2017

Trading Article - Having an edge in the markets

Trading Article - Having an edge in the markets

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

One of the most important concepts to understand in trading is what it actually means to have an Edge in the markets.

First of all, when we talk about an edge in trading, we mean a statistical edge. A good example of a statistical edge is the casino. If you play Roulette, the casino will have an edge, the "house advantage". This will make sure that the casino is going to make money in the long run. Everyone who plays there has a disadvantage but it doesn't mean you cannot win there once in a while. You might have luck sometimes, but that casino edge will always make sure the house makes money, and you lose it in the long run, due to the law of large numbers.

That same law of large numbers is of course also at work in trading which is why it's so important to understand this concept.

If you're trading without an edge (with a random entry for example), you'd expect to have about 50% winning and 50% losing trades in the long run. Which is exactly what's going to happen if you trade often enough to allow the law of large numbers to do its job.

The same way as you can be lucky in the casino, you can also be lucky in trading and you might actually make money in the short-term. You believe you have an edge, you start trading and you actually make money. You're up nicely after 6 months of trading and you think you finally got it. But then you give it all back again and you're exactly where you started wondering if your edge has stopped working. But the truth is you might never have had one in the first place, you might just have been lucky!

This happened multiple times during the first years of my trading career. I was trying to apply whatever method I just believed in (some chart/price action pattern for example), and after looking at a few samples on a price chart, I started trading it without having thoroughly backtested the method. This way I either made money once I started trading it, which of course reinforced my belief in the method and then lost it later on. Or I lost money right away and stopped trading the method shortly after. Which might have been a mistake, as I maybe didn't give the law of large numbers enough time to make money with the edge. In any case, shortly after I started looking for the next holy grail, and unfortunately, there's no lack of utterly useless trading methods on the internet/books/seminars and gurus who were willing to sell it to me.

In trading, there's no house advantage you have to overcome (unless you're trading against your broker), but there are trading costs, which means you actually start out with a disadvantage. The higher your trading costs, the larger this disadvantage will be. So you will lose money in the long run if you trade without an edge as you always will have to pay these trading costs. Truth is, to break even in trading, you already do need an edge to overcome trading costs.

The key point to take away from this is to understand that if you actually do have an edge in the markets, it's just that. You're now the casino, you have the advantage. You have the law of large numbers on your side. In the long run, you will win.

Does this mean you'll be able to predict the outcome of the very next trade you'll take? Will you know it's going to be a winner? No, the same way the casino doesn't know if it will make money in the very next round. Does it guarantee you that you'll make money within the next 10 trades? No, the same way the casino doesn't know it will make money on this table tonight. Could it happen that you get 5 losing trades in a row? Absolutely, the same way someone might double his money 5 times in a row playing roulette in your house.

If you manage to really understand and acknowledge this, your trading will become a lot easier. You'll stop trying to predict what a market will do, knowing that it's simply impossible to know and that the outcome of a single trade is a random event. This way you'll pay much less attention to individual trades and be more focused on the long run.

And that's the only way to succeed in this business. Have an edge, focus on the long run and ignore the noise in between. I hope this article helps you to do just that.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Latest Blog - Anticipation Regarding Losses

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Most traders don't want to hear the REAL truth about trading, but we know you do...read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

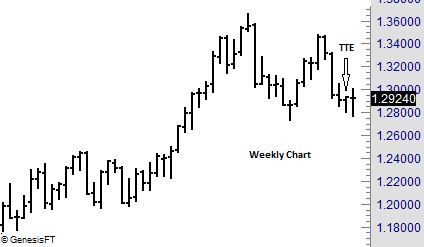

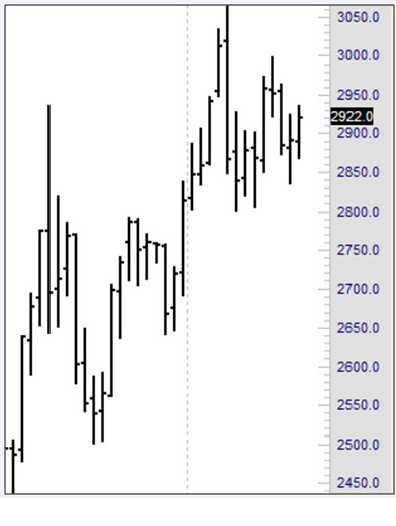

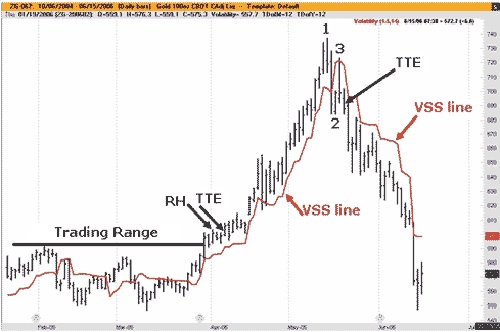

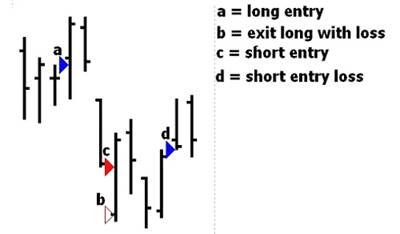

Chart Scan with Commentary - The Traders Trick Entry

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Of all the setups available, the Traders Trick Entry is the only one that gets better with more people using it. That may sound strange, but it is true.

Most setups are effective only when limited to a few traders, but the Traders Trick Entry is quite different. The reason is the Traders Trick is designed to take advantage of the momentum of others—the more “others” the more effective the trick becomes.

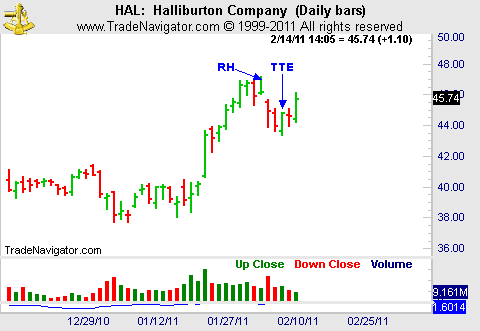

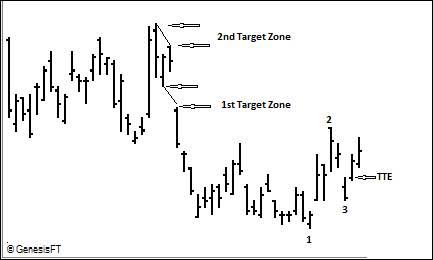

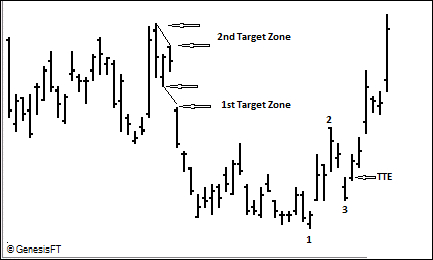

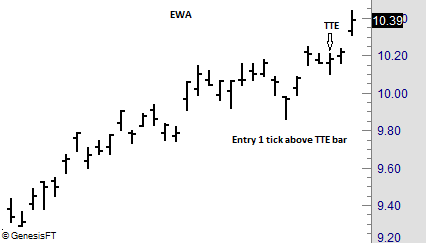

The Traders Trick Entry has now been in use for over 30 years, and with use, it gets better and better. It is a setup that is so consistent, that many professional traders use it exclusively for their trade entries. The Traders Trick Entry (TTE) takes advantage of retracement turnarounds, and pre-breakout momentum.

TTE works in all markets and in all time frames. The primary consideration for the TTE to work is that there be enough room between the point of entry and the targeted breakout point to be able to earn a profit.

Through 20 years of global experience, by thousands of traders, TTE has been refined to a point that it possible to earn a living using only that single setup.

The Traders Trick Entry is not a mechanical system—in fact it is not even a discretionary method. It is a setup, pure and simple. As a setup, it is one way to implement two of the three primary formations of the Law of Charts. Those formations are 1-2-3 highs and lows, and Ross Hooks.

One of our associates here at Trading Educators, uses the TTE exclusively for trading stock options. A gentleman in South Africa uses it to trade futures on point and figure charts. We have a student who uses TTE exclusively to trade the financial markets. TTE is used by many to trade Forex. Another of our associates uses it to trade spreads on futures.

TTE can be, and is used, by traders who prefer candlestick charts, point and figure charts, range charts, tick charts and regular bar charts. It is completely independent of market or time frame because of the fact that it is the implementation of a physical law.

Just as the physical laws underlying the fact of electricity can be used to generate heat, light, and turn a motor, the physical laws underlying the Law of Charts can be used to produce profits.

The chart above is a weekly chart. It could be the weekly of anything that is chartable. The only way you know that this is a weekly chart is because I told you it is, and I have left off the identifying information on the chart.

Prices have dropped to a low noted by the number 1 point on the chart. From there prices rose to point number 2 and subsequently retraced to point number 3. The Traders Trick Entry Calls for a trade to be entered one tick, pip, bip, or X cents above the high of the bar labeled 3.

Of course, there is more to it than the simple explanation above. There are refinements that can be used to make the trick extremely effective. It is also important to know the market dynamics behind the trick, so that you have a complete understanding of how and why it works.

The free eBook you received when signing up igningAt our website, we have an elementary explanation of the Traders Trick Entry. For a more complete explanation, and to see it in action you can purchase our webinar "Traders Trick Advanced Concepts," or sign up for private one-on-one tutoring with Joe Ross. You can trade for a living with the simple setup Traders Trick Entry. Traders all over the world are using it. Don’t be left out.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Maintaining Discipline: When Past Choices Influence Future Decisions

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Traders and investors have difficulty "letting their profits run." When you see your investment increase in value, it's hard to avoid selling early to lock in profits. But not every trade goes your way, so when you come upon a trade that does produce a profit, it's vital for your long-term success to optimize the profits for that particular trade. You must make more profits on your winning trades than you lose on your losing trades, but this is difficult to do if you consistently sell prematurely. Waiting for your price objective takes self-control. You must fight the urge to sell early. A thinking strategy that may help you increase your ability to maintain self-control when you need to suggest viewing economic decisions as "linked" in that the decisions you make on earlier economic choices influence the decisions you make on later economic choices.

How do you approach discipline when you trade? Do you think, "I'll sell early on this trade, but on future trades, I'll let my profits run." Is there harm in thinking that way? It may set a bad precedent. What you do early on may influence what you do later: If you sell early on some trades, you may tend to sell early on other trades. In an experiment with a simple thinking strategy, participants were told to think of a series of decisions as linked together. They were told that initial choices were good predictors of future choices. The choices they made concerned deciding on a smaller reward up front, or waiting for a larger reward later. For example, a participant might decide between one piece of pizza now and two pieces of pizza in a week. It's quite similar to taking a smaller profit early rather than patiently waiting to take a larger profit later. Some participants were asked to consider the advantage of putting off taking a smaller reward up front.

Results of the study showed that this simple thinking strategy worked. When people were reminded of the recurring nature of choices, and that they should show self-control early on, they were able to actually show more discipline and self-control when asked to make later economic decisions. These findings suggest that if you want to trade with discipline, it is essential that you maintain discipline at all times. Don't sell early, and think, "I'll hold on next time." The mind doesn't seem to work that way. You must show self-control early and on all decisions. So when you are about to sell early, stop! Remind yourself that the long term consequence of taking profits prematurely is that it will set a bad precedent. You won't be able to show self-control and restraint when you really need to. And in the long run, it will severely cut into your overall profits.

However, there is another way to handle trades—one that can give you the best of both worlds. The way we do it at Trading Educators is to take a small but quick profit as soon as possible, move to breakeven, and then allow the market to take you as far as it is willing.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - X Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 9th June 2016, we gave our subscribers a new type of trade on US Steel (X), which was showing accumulation on a pullback on the weekly chart.

We entered a "complex position", entered for a net credit (still working with OPM, i.e. other people's money, as usual), but with unlimited upside potential.

- On 10th June 2016, we entered the trade for a credit of $1.70 (or $170 per position).

- On 9th November 2016, we took partial profits on our long position.

- On 7th December 2016, we took new partial profits on our long position and closed our short position.

- On 13th March 2017, we took our profit on our last long position on a weekly trailing stop.

DIT = 277 days

Profit: $906.70 per unit

Average short strike = $15.68

Margin: $314

Return on Margin annualized: 380.96%

These are low maintenance, low stress trades with lots of upside potential. Our total profit was about 3 times our average margin requirement on this trade.

We presently have 22 of these trades opened, some of them with no margin requirements left.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 667 - March 24, 2017

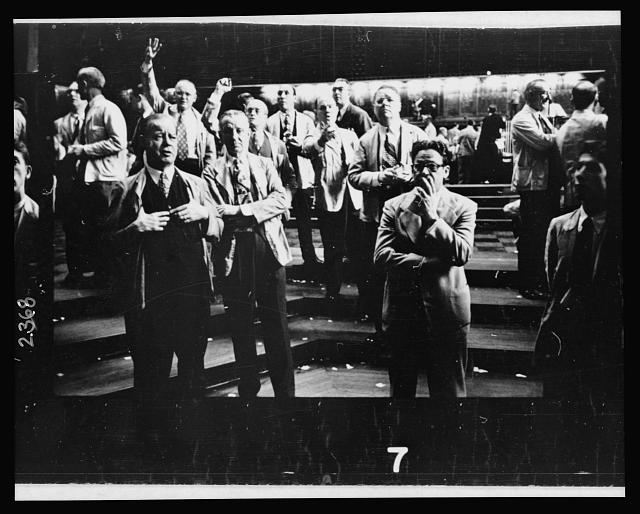

Men working the floor at the Chicago Board of Trade. Photograped by Stanley Kubrick for Look Magazine in 1949.

Image is in Public Domain and available through Library of Congress

Latest Blog - How to Approach Trading - Part 7

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

It is critical to develop a well thought out and organized trading plan. It is then important to have...read more.

Begin reading from Andy's first blog in his series!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Ambush Signals

Ambush Signals

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Learn all you need to know about our Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System? What's the idea behind it? Ambush Signals trades in a variety of markets:

- Futures: Stock Index, Commodity, Currency, and Interest Rates

- Spot Forex Markets

- ETFs

- CFDs on any of the supported markets (results may vary, depending on your broker's quotes)

Time-Proven System

Easy to Follow

Stress Free Day Trading

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Can you have it both ways?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Many traders are highly concerned with reducing their risk, and/or getting out when their positions turn against them. The normal method for doing this is to use a stop order. In his books, William O’Neal advocates getting out after an 8-10% loss. Many other authors of trading books also suggest this approach.

This is an adequate approach, except for two details never mentioned in most books: the first is that you don’t know when the 8-10% is going to happen; the second is that the price can gap over your 8-10% stop, causing you to exit with a greater loss than planned.

However, there is a way to know exactly when to exit, and how much of a loss you are willing to accept. More importantly, the stock can gap as much as it wants, but you would lose only the predetermined amount you decided upon when you entered the position.

The Protective Put or Call is a synthetic options strategy that allows you to have predetermined risk and unlimited growth potential. A Protective Put is used for a bullish position, and a Protective Call is used for a bearish position. The following example shows Protective Puts. A good Protective Put position is usually one that limits your risk to about 6%. This strategy positions you at least 2 – 4% better than would using the conventional wisdom of an 8 – 10% stop.

Additionally, there is a method for entering a Protective Put with very little, and sometimes negative, risk. You enter it using the Trader’s Trick Entry (TTE), using the principles of the Law of Charts. In the following example, our entry uses a Ross Hook (RH) chart formation with the TTE.

Trading is never without risk, but the length of time for which you accept that risk is under your control. When you are able to control events, the probability of your making a profit increases dramatically. The question is, how do you use the Law of Charts to create negative risk more quickly, without any additional risk when entering the position? Assume the following:

Stock/ETF price = $50

Put strike price is $60 and 6 months' out

The $60 Put premium is $13.80, creating a 6% ($3.80) risk on capital 1

7-Day Average Trading Range (ATR) is 1.50

Examining our situation using 100 shares, we have:

Traditional 8 – 10% stop loss

| Cost of Stock/ETF | $ 5,000 |

| Stop Risk (10%) | $ 500 |

| Downside Gap Open Risk | ??? |

| Total Risk | Unknown |

| Protective Put | |

| Cost of Stock/ETF | $ 5,000 |

| Cost of Put | $ 1,380 |

| Total Cost | $ 6,380 |

| Put Sell Rights | $ 6,000 |

| Total Risk | $ 380 |

| Downside Gap Open Risk | $ 0 |

| Total Risk Guaranteed | $ 380 |

From the initial entry, the Protective Put limits our risk without any potential for more.

How do you reduce the risk even more? With the above parameters you would have to make up $3.80 upon entering the position, without risking more than 6%. That would be the same risk as if you had entered the Protective Put directly. To make up the $3.80, you will use a combination of Options and Stock to reduce your risk to near zero or less.

First, you need to determine the Law of Charts' formation with which to enter. The preference would be to enter a position with momentum. Therefore, look for a Ross Hook in a trend, and select your entry point according to the Law of Charts.

1 Rounded to the nearest option premium.

As mentioned above, there is no such thing as risk-free trading. However, the amount of time for which you accept that risk is your decision. The total time to execute this entry strategy will be 1 day. During that day, you employ the traditional stop methodology for your positions. However, since you will enter the positions after the market opens, there is no chance of your experiencing a gap down on the open.

The second step is to divide the risk amount of $3.80 into a portion for the stock and a portion for the options you will use. You will then employ a technique like the double or triple ETF to gain an advantage. For a double advantage, buy a long Call for each 100 shares of stock purchased. For a triple advantage, buy 2 long Call contracts. Buying long Calls requires less margin than does selling short puts. Our allocation for the triple advantage will be:

Stock/ETF risk = $1.80

Long Call Risk = $1.00 x 2 = $2.00

Total Allocated Risk = 3.80

These are the stops you will use for the stock and 2 option contracts when you enter them according to the Law of Charts and TTE methodology. In this manner, you are risking the same amount as if you entered the Protective Put directly. Do not get greedy, you just want to reduce your risk.

The third step is to place contingent orders to enter the stock and 2 option contracts with stops of $1.80 and $1.00 respectively. Be sure to select an option with a delta of 75 or greater. It will not take much movement to get close to a negative risk Protective Put with this set up, as it is very likely to occur within one day.

The 7-Day ATR (Average True Range) is 1.50; its significance is how much you can expect the stock/ETF to move in one day. Do not expect to get 100% of the movement: 70% is good, and 80% is very good. This is what you should be looking for as your decision point to exit the Long Call options and enter the Protective Put.

| Stock Increase of approximately | $ 1.20 |

| Option increase of approximately $0.75 x 2 | $ 1.50 |

| Decrease in $60 Put of approximately | $ .40 |

| Total Advantage | $ 3.10 |

Protective Put Risk

| Cost of Stock/ETF | $ 5,000 |

| Cost of Put | $ 1,380 |

| Total Cost | $ 6,380 |

| Put Sell Rights | $ 6,000 |

| Total Risk | $ 380 |

| Downside Gap Open Risk | $ 0 |

| Total risk guaranteed | $ 380 |

| TTE Strategy | $ -310 |

| Total Risk | $ 70 |

| % Risk | 1.1% |

Can and does this work? Yes, it does, but you have to have your plan in place before you jump into the market. You must have your plan in place BEFORE you enter the trade

There is one more step to this trade, and that is how to set yourself up for unlimited upside potential. This is a bullish strategy, and the two simplest methods are to do nothing and just let the stock appreciate, or to sell a Call at or above the strike price of the Put.

These are very effective and profitable strategies. However, selling a Call will remove you from any profits above the strike price of the Call. Doing nothing requires the stock to rise $10.70 before you have any profit. There is a third and more effective trade: sell a Bear Call Spread at or above the Protective Put strike price.

| Total Current Risk | $ .70 |

| Sell Bear Call for at least | $ .70 |

| Total Position Risk | $ 0 |

| % Total Risk | 0% |

The advantage of using a Bear Call Spread instead of the Covered Call is that you participate in the appreciation of the stock when it rises beyond the $75 strike price of the short Call. The worst you can do is 0% return, and the best is unlimited. However, as the expiry date approaches you will have to make a decision to sell the long Call to take your profits.

Other methodologies for adding profits include selling Puts when the stock/ETF is rising, taking small profits. When the stock is falling, selling the stock and buying it back at a lower price provides the same return as short selling, but without the risk.

In the above example we used a stock. You can use this strategy equally well with futures contracts with one precaution. Whereas a stock will not expire, a futures contract will expire, so you must carefully structure the trade with the understanding that the expiration date for a futures contract must be taken into consideration.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading for a living

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Trading for a living involves more than getting in and out of the market at the right time, and more than thinking about moving averages and indicators. Trading is a business, not just a job, and every business in the world has to be managed. Every business involves the managerial functions of organizing, planning, delegating, directing, and controlling. If you, the trader, are to perform these functions well, you must learn to practice self-discipline and self-control.

It is actually painful to see traders who are highly successful in their present occupations, yet who come into the business of trading for a living using few, if any, of the managerial skills that make them winners in their own area of specialization. They have entered into a high-stakes venture, but are acting as if there were no way to lose. By omitting the functions of management, they often lose a considerable amount of money. They blindly throw themselves, their time, and their capital resources at the markets.

There is much more to the business of trading for a living than just trade, trade, trade, with no regard for the managerial aspects of trading. Traders are generally defeated by their own bad habits.

If you have any bad habits, expect the market to discover them and destroy you with them. In the business of trading, you have to take every step possible to save yourself the pain of having the markets discover your weaknesses. You need to find those weaknesses yourself, before you are hurt, and learn how to deal with them. Do you stay in too long? Do you expect too much from a trade? Are you greedy? Do you find yourself ending up "the greater fool?" Are you overtrading? Are you selfish? Are you fearful? If you have any of those bad habits, they are problems; and for problems, there are solutions.

If you think trading for a living is the same as investing, you are way off base. You need to realize there is a vast difference between the business of investing and the business of trading. You need a wake-up call if you are trading from desperation or the opinion of others — even your own opinion is worthless! You cannot change the market with your opinion. The only thing you can do if you want to win is to get in step with the market.

If you are looking for the holy grail of trading, or if you are trading because you’re bored, then you need to stop, think, and take a good look at yourself.

Until you establish your trading as a business, you will find that you don’t know what it means to let your profits run — you won’t have any consistent profits! Until you discover your real personal risk tolerance, you won’t really understand the meaning of risk. True risk management involves matching your risk tolerance with the risk in the marketplace.

If you are losing money, it’s because you don’t actually understand losing! Believe it or not, there’s an art to losing in the market. You have to learn how to control your losses; when you do, the wins will take care of themselves!

Are you a trader who tries to reinvent the wheel? Are you a trader who shoots his mouth off? Do you lie to yourself? Do you change your trading plan in mid-stream? You need to fix these bad habits.

Are you getting out of a trade too soon? Are you afraid to be wrong? What are your character faults? Do you see them?

Do you suffer from lack of humility? Are you throwing good money after bad? Just what is your sad but true story?

If you’re a losing trader, you need to be taken apart at the seams, put back together, and placed on the path to success.

The business of trading for a living involves making and taking profits. In addition to finding the solutions to your problems, you have to learn the chart patterns for success, as well as how to manage trades and manage yourself.

Over fifty-six years ago, I (Joe Ross) went through the very same problems you face today. I had to deal with those problems, and believe me, I had many of the bad habits discussed in this article.

Partly to help myself, and partly to help others, I wrote down the problems and solutions in what has become a classic manual for traders. It’s called Trading Is a Business, and it’s about making money in the markets. The book deals with solving the problems most traders have. Since I wrote the book, I have discovered that there are numerous traders who are successfully trading for a living through using what they learned in Trading Is a Business.

Trading Is a Business caused one trader to write, "I have been trading for six years with limited success. Joe’s techniques have really brought my trading into focus. Joe’s trade and money management techniques in particular, have helped me to become more consistent in my trading. Learning to take some profits early on has made a huge difference." Simon H.

I knew I had succeeded at getting my message across when I received this email: "Learning that trading is a serious business has changed my life. I was about to give up, when I began to fully realize just how serious this business really is. However, now that I finally woke up, I am a winning trader making money for myself and my clients." Mark C.

My book has helped thousands of traders. You, too, might consider studying your own copy of Trading Is a Business.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - MOMO Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 7th March 2017, we gave our IIG subscribers the following trade on MOMO, right after earnings. We decided to sell price insurance as follows:

- On 8th March 2017, we sold to open MOMO Apr 21 2017 22.5P @ $0.20, i.e. $20 per option sold, with 43 days to expiration, and our short strike below a major support zone, about 25% below price action.

- On 20th March 2017, we bought to close MOMO Apr 21 2017 22.5P @ $0.05, after 12 days in the trade, for quick premium compounding.

Profit: $15 per option

Margin: $450

Return on Margin annualized: 101.39%

This trade was pretty safe in spite of overall very low implied volatility levels.

We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade (see recent EWZ example in Newsletter Edition 649 found in our "member only" area under the archives tab).

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 666 - March 17, 2017

Chart Scan with Commentary - Setting Objectives

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Prices formed a base at the end of a down swing, and then formed a 1-2-3 low. Prices thrust above the #3 point, and I was filled on a Traders Trick Entry. My first objective was for prices to reach to, or close near the #2 point, but what if prices continue higher? How should I set objectives for the remainder of my position?

If prices break beyond #2 there were two immediate target zones. The first one was the gap that formed when prices moved down to squeeze out the last of the bulls (1st Target Zone). Traders become confused by gaps, and tend to move protective orders to the top and bottom of the gap. The second one is that of previous consolidation high (2nd Target Zone). Prices had held steady while in the area of the previous consolidation, but after a breakout to #1, a move back into the consolidation area will generally see a test of the highs.

The chart below shows what happened with this trade:

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Commitment

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Recently, someone sent me the following question: "Just how committed does a trader need to be?"

I don’t know that I can put a number to that. For instance, on a scale of 1-10 how committed should a trader be. But if I had to evaluate it on that basis, I would say he must be a "10."

What is the value of commitment? How do you measure such a thing?

Most people have an "interest" in becoming consistently profitable traders. However, few possess the essential ingredient of "total commitment." Total commitment is what is demanded for a high level of success from any endeavor. A trader with commitment will take the money from 100 traders who have only an "interest."

Commitment is seen as Cortez burning his ships upon landing in Mexico. With less than 100 men, Cortez rode into Mexico City against 100,000 Aztec warriors and placed Montezuma, leader of the Aztecs, in chains. Few people have ever accomplished any goals without commitment to success. For some traders, commitment to success is not optional but mandatory.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

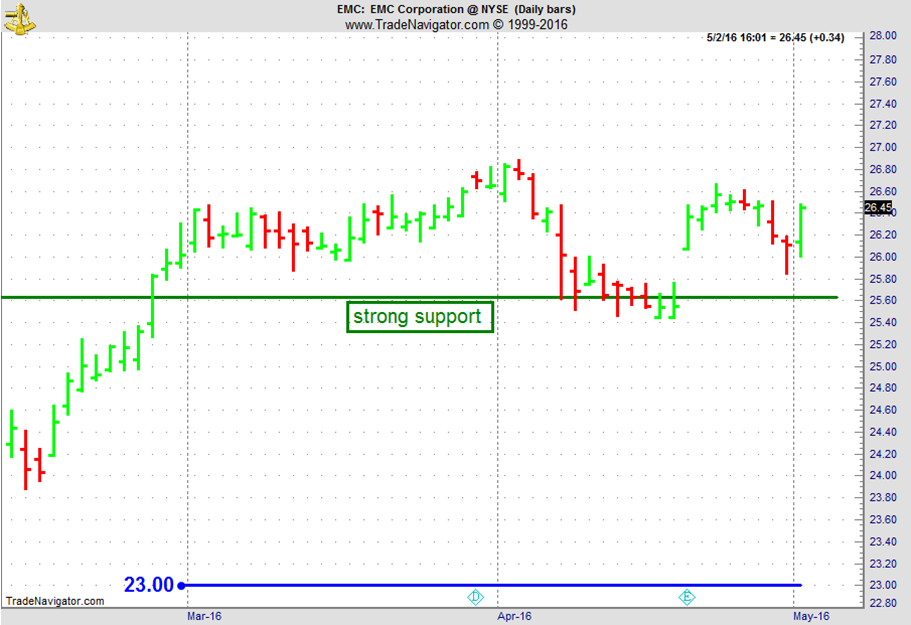

Instant Income Guaranteed - EMC Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 2nd May 2016 we gave our IIG subscribers the following trade on EMC, on a TTE on a RH on the daily chart. We decided to sell price insurance as follows:

- On 3rd May 2016, we sold to open EMC Jun 17 2016 23P @ $0.38, i.e. $38 per option sold, with 44 days to expiration, and our short strike below a major support zone, about 13% below price action.

- On 11th May 2016, we bought to close EMC Jun 17 2016 23P @ $0.19, after 8 days in the trade, for quick premium compounding.

Profit: $19 per option

Margin: $460

Return on Margin annualized: 188.45%

N.B. We have also added new types of trades for our IIG daily guidance, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Latest Blog - How to Approach Trading - Part 6

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

If you missed the first blog in his series, be sure to check it out! Any fool can get into the market, but it takes a consistent successful trader to...read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

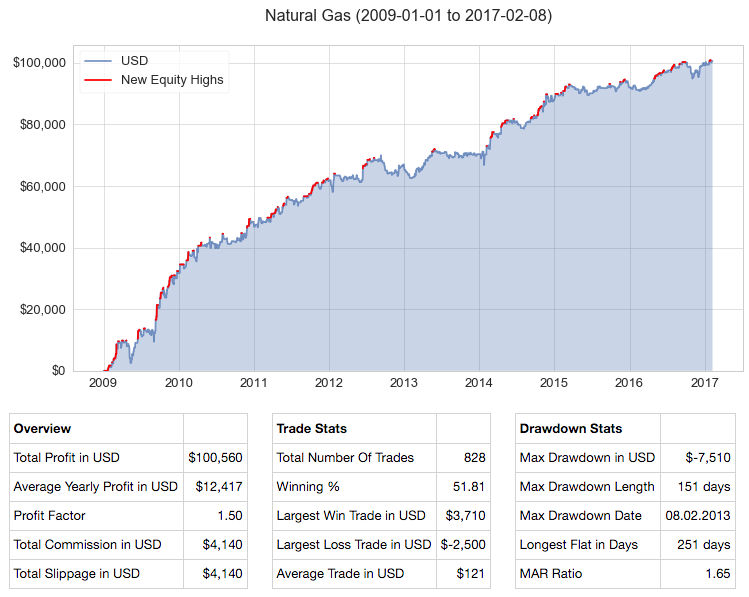

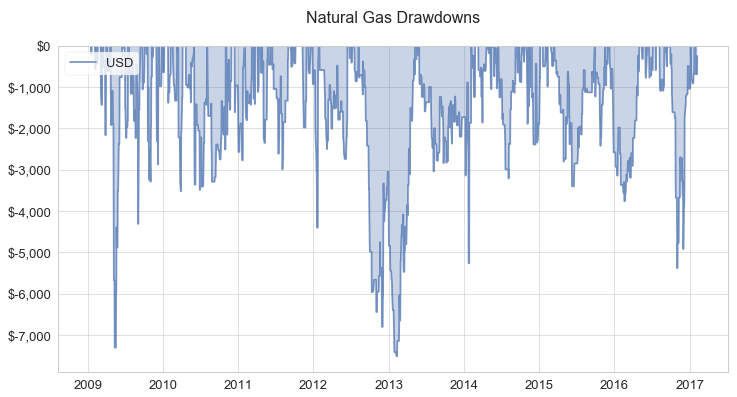

AlgoStrats.com

AlgoStrats.com

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Click here to learn more about Professional Trader Marco Mayer - AlgoStrats.com!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 665 - March 10, 2017

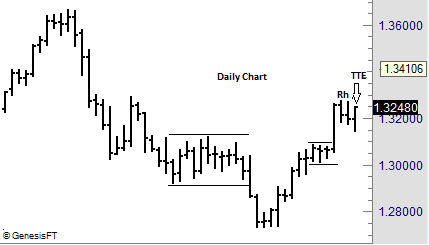

Chart Scan with Commentary - Trade Management

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Prices have formed doji on the weekly chart. That doji bar, although it was an outside bar, also filled a Traders Trick Entry from the previous week. The question was “Would that entry also be fulfilled on the daily chart during the following week. By dropping down to the daily chart, would we see a chance for entry with a Traders Trick™ on the daily chart. Implementation of The Law of Charts™ teaches that entry signals from a larger time frame can often be entered and managed on a lesser time frame. So let's look at the daily chart and then see how we might have entered a trade based on a weekly signal on the daily time frame.

The Law of Charts states that a Ross hook is the first failure of prices to move higher following a breakout from congestion. The Law also states that a good way to enter such a trade is from a Traders Trick entry. In this case entry would be at 1.3253.

Now let’s go to a lesser time frame for actual entry and management with a daily chart.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Keeping Your Focus Right

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Some time ago I spent 4 days in a Forex trading office, teaching and working with the traders there. It was interesting to see how these traders speak with one another, and to listen to what they say. I couldn’t help making some observations which I will now share with you.

If you are a part- or full-time trader, you may have enjoyed the attention this wild and wooly occupation brings at social gatherings and events. Many are interested in trading, and find you interesting as a successful trader. At first, the attention may be enjoyable; but a need to maintain this reputation may impact your trading attitude and mindset, and therefore, your bottom line.

The best strategy you can use to avoid letting your reputation influence your performance—especially when enduring a drawdown period—is to keep your conversation low-key about your trading career. Why? The more you present yourself socially as a "successful trader," the more psychological effort you will spend defending this reputation. Several research studies have documented that one of the biggest obstacles to sound decision-making is the need to save face in social situations. People are so reluctant to face the adverse social consequences of having made a poor decision that they stay on a losing course of action, rather than admit they were wrong. For example, some traders are reluctant to sell off losers in order to avoid the possible social criticism that acknowledging a failure may bring.

Suppose you have told your friends about a large position, and within minutes, hours, or days, it tanked, hard and fast. Most folks can’t wait for the next opportunity to ask you (even though they probably know the answer) how your “hot trade” is doing. If you got rid of it, at least you have the solace of managing the trade properly—even though you must tolerate a volley of smug “you-thought-it-would-go up and such, but-it crashed-instead” comments. On the occasions when you ignored your protective stop, however, and held onto the bad trade, the “Boy, you-really-ARE-dumb” looks (and perhaps comments) can exacerbate the psychological devastation you've by now, surely, inflicted on yourself. And we all know the negative impact a negative attitude can have on our trading.