Newsletters (208)

Children categories

Edition 767 - March 8, 2019

ANDY JORDAN'S SPRING SPECIAL!!

50% OFF

TRADERS NOTEBOOK

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

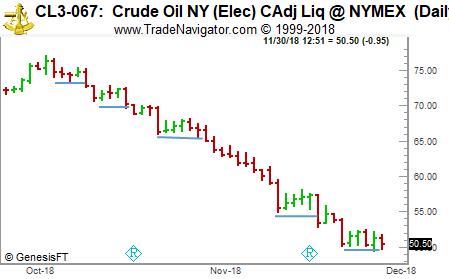

Chart Scan with Commentary: Stair-Stepping Markets

Hey Joe! In one of your online webinars (Trading All Markets), you mention stair-stepping markets. What exactly is a stair-stepping market?

Glad you asked. Take a look!

The stair-steps are the flat places leading to the next step down.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: A Flash of Light

It has often been said that trading is not rocket science. I believe that. You don't need to be as brilliant as a rocket scientist to trade the markets profitably. I know I’m not that bright. That said, there are moments when a trader has a brilliant insight and takes home huge profits because of it. (I don't know any rocket scientists, but I'll bet that a rocket scientist isn't brilliant every waking moment, and occasionally, must also rely on a moment of brilliance to get the job done.) All traders have their moments when they have a brilliant insight and profit from it.

When I talk to winning traders, I enjoy asking them to describe their biggest winning trades. Usually a combination of luck and brilliant insight results in the biggest wins. For example, in an often told story, a trader just happened to own stock in a company that was talked up by a media analyst. The price jumped on the news, and the trader sold into strength for a huge gain. In other stories, traders make a good guess that a product or service is bound to be in high demand in the future and that eventually the stock price is going to reflect the demand. For example, if you perceived early that all the kids on the block were going to successfully convince their parents to buy them an iPod, you would have made a killing buying Apple stock a few years ago. Other traders capitalize on unexpected world events, like droughts, floods, earthquakes, or hurricanes.

So what's the lesson? Sometimes you will have a brilliant insight and make a killing, but other times, you will not. Should you wait around for a brilliant insight and stand aside at other times? No. If you take no action, you will stagnate, and then, when a "once-in-a-lifetime" trade happens, you won't have the skills to execute the trade and capitalize on the opportunity. Instead, you should trade day after day, and always accept what the markets have to offer. Don't demand that the markets give you rare trading opportunities every day. There will be times when you will come across a rare market event, but the rest of the time, you have to settle for finding profitable run-of-the-mill trades. It is vital that you scour the markets for high probability setups and trade them, rather than only look for potentially big wins. The typical offerings may not allow you to achieve 50% of your earnings on a single trade, but they will allow you to make profits across a series of trades.

As much as you want to find that big trade that you can talk about for the rest of your life, realize that it may not be the big, thrilling trades that matter, but the smaller trades you make every day to become a winning trader.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

FEYE Trade

On 11th February 2019 we gave our Instant Income Guaranteed subscribers the following trade on FireEye Inc. (FEYE). Price insurance could be sold as follows:

- On 11th February 2019, we sold to open FEYE Mar 29 2019 13.5P @ 0.11, with 48 days until expiration with our short strike about 17% below price action.

- On 1st March 2019, we bought to close FEYE Mar 29 2019 13.5P @ 0.04, after 18 days in the trade.

With only 270$ margin requirement, this trade was suitable for very small accounts.

Profit: 7$ per option

Margin: 270$

Return on Margin annualized: 52.57%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ANDY JORDAN'S SPRING SPECIAL!!

50% OFF

TRADERS NOTEBOOK

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Striving for Perfection

You will never be a perfect trader. However, as traders we have a strong need to want complete control over the outcome of a trade. We want to…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

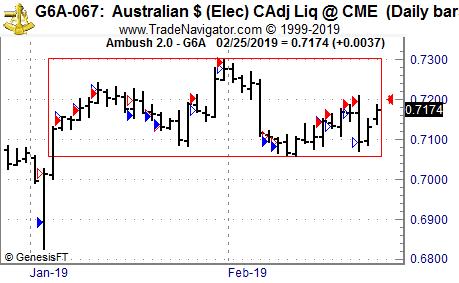

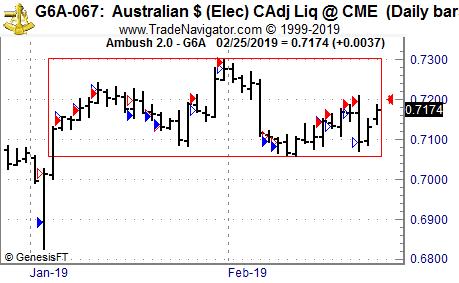

Ambush starts off with big profits into the year in the Australian Dollar!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Australian Dollar Future (6A) traded at the CME, where Ambush Traders are having an amazing time so far in 2019.

Ambush day trades on an end-of-day basis so there is no need to even check the markets during the day.

So let’s have a look at what happened in the Australian Dollar so far this year. Early January the market tried to break out to the downside and Ambush got in at a very low price level at around 0.6900, exiting above 0.7000. Since this false breakout as you can see not too much happened. The 6A just kept on moving in tight ranges and has been trading between about 0.71 and 0.73 for two months now.

Good news is that Ambush still was able to capture some nice profits, often getting in at the top/bottom of a day’s range!

Once you realize that this isn’t that uncommon but that it’s exactly what the markets do most of the time don’t you want a strategy that works well under such conditions?

Where is the Australian Dollar going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

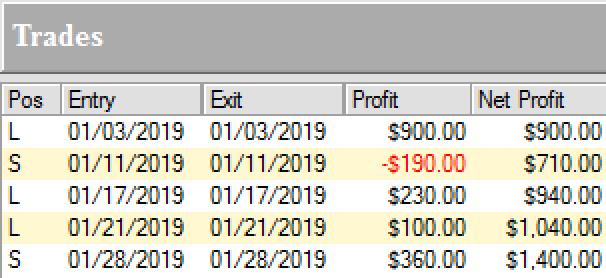

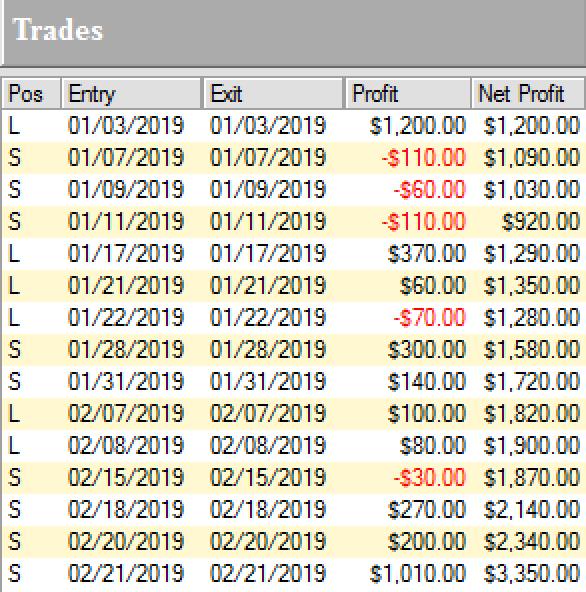

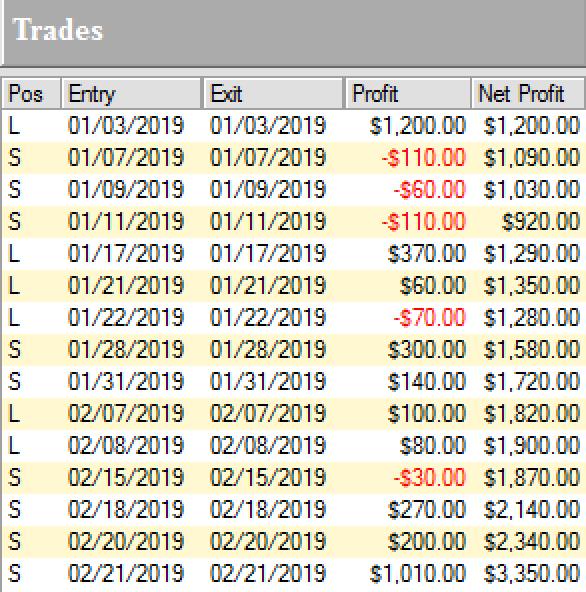

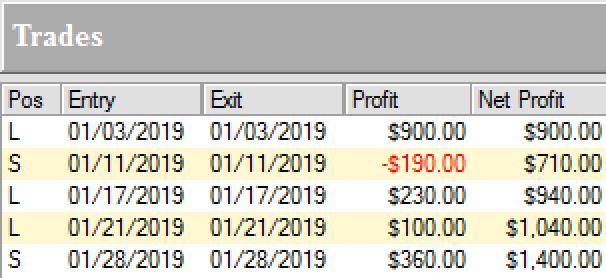

Here’s the result of all of these trades, trading one Australian Dollar Index (6A) contract, including $10 commissions/slippage per trade:

If you’ve been on the other sides of these trades trying to buy the breakouts, you really should consider switching sides!

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ANDY JORDAN'S SPRING SPECIAL!!

50% OFF

TRADERS NOTEBOOK

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 766 - March 1, 2019

TRADERS NOTEBOOK

"SPRING IS JUST AROUND THE CORNER"

SPECIAL!

50% OFF

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Classical Chart Projection

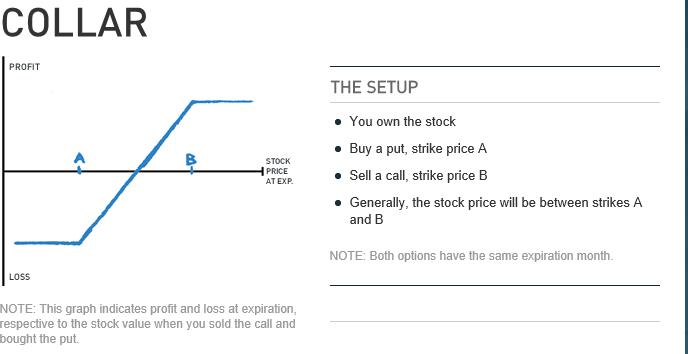

Hey Joe! I’ve asked everyone I know, but no one seems to know, “what is a ‘hedge wrapper.’”

A hedge wrapper is also known as a “Collar.” Based on the rest of what you wrote about complete protection against a drop in price, what you probably want is called a “Zero Cost Collar.”

A zero cost collar is a form of options collar strategy where the outlay of money on one half of the strategy offsets the cost incurred by the other half. It is a protective options strategy that is implemented after a long position in a stock that has experienced substantial gains. You buy a protective put and sell a covered call. Other names for this strategy include zero cost options, equity risk reversals, and hedge wrappers.

For example, if the underlying stock trades at $120 per share, the investor can buy a put option with a $115 strike price at $0.95 and sell a call with a $124 strike price for $0.95. In terms of dollars, the put will cost $0.95 x 100 shares per contract = $95.00. The call will create a credit of $0.95 x 100 shares per contract - the same $95.00. Therefore, the net cost of this trade is zero.

It is not always possible to execute this strategy as the premiums, or prices, of the puts and calls do not always match exactly. Therefore, investors can decide how close to a net cost of zero they want to get. Choosing puts and calls that are out of the money by different amounts can result in a net credit or net debit to the account. The further out of the money the option, the lower its premium. Therefore, to create a collar with only a minimal cost, the investor can choose a call option that is farther out of the money than the respective put option is. In the above example, that could be a strike price of $125.

To create a collar with a small credit to the account, investors do the opposite—choose a put option that is farther out of the money than the respective call. In the example, that could be a strike price of $114.

At the expiration of the options, the maximum loss would be the value of the stock at the lower strike price, even if the underlying stock price fell sharply. The maximum gain would be the value of the stock at the higher strike, even if the underlying stock moved up sharply. If the stock closed within the strike prices then there would be no effect on its value.

If the collar did result in a net cost, or debit, then the profit would be reduced by that outlay. If the collar resulted in a net credit then that amount is added to the total profit.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: What’s Next?

It is Tuesday, and you’ve been watching the markets closely for the past two weeks. It appears to be the fulfillment of your dreams: prices are making new market highs. You wonder, "What is the smart thing to do?" On the one hand, you can go long, but will this optimism last? Oil prices are still high, but they are lower and a little more stable compared to last summer. Everyone is hoping that companies will show strong earnings this quarter, but will they? Are the record highs just temporary? On Wednesday, the masses were worried about interest rates and the markets across the board closed down. Perhaps, cautious optimism may be warranted. Many traders and investors prefer a bullish market, but smart traders are cautiously optimistic these days. When trading the markets, you can't count on a sure thing. It can be up for several days and down the next. No one knows with 100% certainty what will happen next.

There is no replacement for doing your homework. The more you know about the markets and the companies you trade, the greater your odds of winning. Which companies will have earnings that match analysts' forecasts, and more important, will it matter? As any astute market observer knows, a stock may rise before an earnings announcement, if the masses are optimistic, but should the earnings report fail to match expectations, the price will decline even though the company may have done rather well. It's all a matter of the opinion of the buyers and sellers.

What will the masses do? That's the big question. Right now, there is international turmoil and a belief that we may not experience the economic growth to which we have been accustomed. And when that happens, the masses may turn to pessimism. What can you do to profit?

To a great extent, it depends on your personality. If you are a risk taker, you can capitalize on the times. You can trade on the likely probability that the masses will sell markets that fail to meet analyst expectations, feel seller's regret, and buy back what they sold out of impulsive fear. You can buy at the low point and sell it back to them when seller's regret sets in. One warning, however, it sounds easier than it is. But as a strategy, it works. Whether you try it depends on your personal psychology. If you don't mind the risk and uncertainty, it will work for you. If you are a cautious, however, then this may be a time to stand aside. Cautious stock and option traders stay away from trading right before earnings reports. You never know what will happen until it happens. The cautious trader may not want to risk money when analyst forecasts and earnings reports have the most power to dictate how the masses will behave. The masses react to news, reports, and speeches, and unless you have a crystal ball, you cannot know how the market will react. They can rise or fall on good news, and vice-versa on bad news.

In the end, even during times of optimism, it is wise to stick to the basics. Manage risk by risking only a small amount of capital on a single trade. Think in terms of the big picture and realize that what matters most is your performance across a series of trades. And work hard. Study the markets. Make an educated guess as to what the masses will do, and outline detailed trading plans. And most important, trade your plan. Sticking to the basics may not allow you to make huge profits on a few key winning positions, but on the other hand, it will keep you in the game should the markets turn against you. And in all likelihood, when you stick to the basics, you will end up taking home huge profits overall.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

LITE Trade

On 11th February 2019 we gave our Instant Income Guaranteed subscribers the following trade on Lumentum Holdings Inc. (LITE). Price insurance could be sold as follows:

- On 12th February 2019, we sold to open LITE Mar 22 2019 35P @ 0.35, with 40 days until expiration with our short strike about 21% below price action.

- On 20th February 2019, we bought to close LITE Mar 22 2019 35P @ 0.15, after 8 days for quick premium compounding.

Profit: 20$ per option

Margin: 700$

Return on Margin annualized: 130.36%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

TRADERS NOTEBOOK

"SPRING IS JUST AROUND THE CORNER"

SPECIAL!

50% OFF

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Why we use a 15-year seasonal pattern for trading spreads

Much seasonally based information conforms to random probability generated data. Avoid trading seasonally …read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush starts off with big profits into the year in the Australian Dollar!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Australian Dollar Future (6A) traded at the CME, where Ambush Traders are having an amazing time so far in 2019.

Ambush day trades on an end-of-day basis so there is no need to even check the markets during the day.

So let’s have a look at what happened in the Australian Dollar so far this year. Early January the market tried to break out to the downside and Ambush got in at a very low price level at around 0.6900, exiting above 0.7000. Since this false breakout as you can see not too much happened. The 6A just kept on moving in tight ranges and has been trading between about 0.71 and 0.73 for two months now.

Good news is that Ambush still was able to capture some nice profits, often getting in at the top/bottom of a day’s range!

Once you realize that this isn’t that uncommon but that it’s exactly what the markets do most of the time don’t you want a strategy that works well under such conditions?

Where is the Australian Dollar going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

Here’s the result of all of these trades, trading one Australian Dollar Index (6A) contract, including $10 commissions/slippage per trade:

If you’ve been on the other sides of these trades trying to buy the breakouts, you really should consider switching sides!

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

TRADERS NOTEBOOK

"SPRING IS JUST AROUND THE CORNER"

SPECIAL!

50% OFF

1-Year and 6-Month Subscriptions

Use coupon code: tn50

Offer expires on the First Day of Spring - March 20, 2019

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 765 - February 22, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

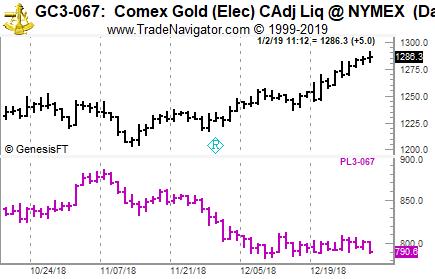

Chart Scan with Commentary: Spreads

Every time I produce a series of Chart Scans, I always like to provide at least one spread chart, because so many of our readers ignore spreads. I’m not saying that spreads are the only way to trade. However, if you are not watching spreads, you are missing out on a lot. They can be done with futures, ETFs, and stocks. Below is a spread chart long Gold, and short Platinum. Take a look. No magic is needed to trade spreads. All you have to do is be observant. This spread could easily have been entered by reading the news or watching something as idiotic as CNBC.

Here is the same spread seen as two bar charts. Obviously, gold is rising, while platinum is sideways. Back in November, gold was rising while platinum was falling.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Quick Thinking

Have you ever watched the last minute of a close football match and felt excited? When you are anticipating what will happen next, you often feel a little high, especially if you expect a desirable outcome. Humans like excitement. Whether it is a traffic accident on the way to work or the last scene of a murder mystery on television, we like suspense. Trading is naturally exciting, but if you are a winning trader, you do not put on trades for sheer excitement. Losing traders seek out thrills. Winning traders assess the market action rationally, make a sound trading plan, and calmly trade the plan. It may seem boring at times. But it doesn't always need to be. If you "think fast," you can spice things up.

Have you ever experienced racing thoughts, and felt a sense of eagerness, urgency, and wild exhilaration? Perhaps you were trying to meet a deadline, and felt at the top of your game, as if you were not only going to meet the deadline but also do a great job. You've probably also felt this sense of eagerness, urgency and exhilaration when you were about to close a big winning trade. When you are about to take home huge profits, feeling excited is understandable. If only we could bring this sense of excitement to the more mundane tasks of trading, such as when we are scouring charts for the next high probability setup. Increasing the speed of your thinking may offer a solution.

How can you think faster as a trader and sharpen your mental edge? Thinking fast is not the same thing as acting impulsively. Trading with the proper mental edge demands that you feel calm and rational, but rather than allow your mind to wander unenthusiastically, you want to push yourself to think with more attention. Rather than let your thoughts drift, focus on your trading. Try to block out distracting thoughts, and intensely focus on your immediate experience. Try to search for new setups more rapidly. Run through possible scenarios more rapidly. Plan more rapidly. If you can increase the speed of your thinking processes, you will feel more creative and optimistic and this state of mind can help you discover new insights. That said, it is essential to avoid trading impulsively. Think fast while you are planning the trade, but make sure you have a clear head before you execute the trade. Again, the idea is to "think fast" when you are in the planning stages of a trade.

Trading is a demanding profession. To make profits day after day, it is necessary to find new high probability setups. It can be a intimidating task, and if you are not careful, you can feel beaten down. But when you feel a little down, think fast. Your mood will pick up. You will see new possibilities, and trade at your best.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

SQ Trade

On 21st January 2019 we gave our Instant Income Guaranteed subscribers the following trade on Square Inc. (SQ) right after earnings. Price insurance could be sold as follows:

- On 29th January 2019, on a GTC order, we sold to open SQ Jun 21 2019 45P @ 1.50, with 142 days until expiration with our short strike about 35% below price action.

- On 13th February 2019, we bought to close SQ Jun 21 2019 45P @ 0.75, after 15 days in the trade for quick premium compounding even if our option had 142 days to go until expiration initially.

Profit: 75$ per option

Margin: 900$

Return on Margin annualized: 202.78%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Stop Management

Richard Wyckoff wrote: “My stop was moved down so there couldn't be a loss, and soon a slight rally and another break gave me a new stop, which insured a profit, come what might…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

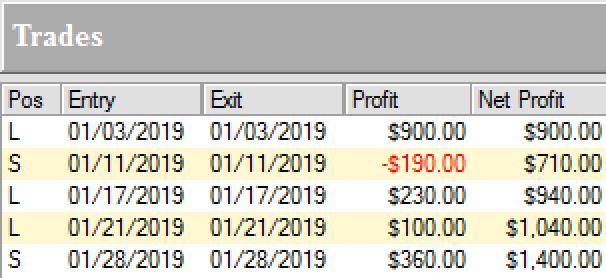

Ambush Traders start the year with a big bang in the currency markets!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including many currency markets like the Dollar Index Future (DX), the Australian Dollar Future (6A) and the New Zealand Dollar Future (6N), where Ambush Traders had an amazing start into 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

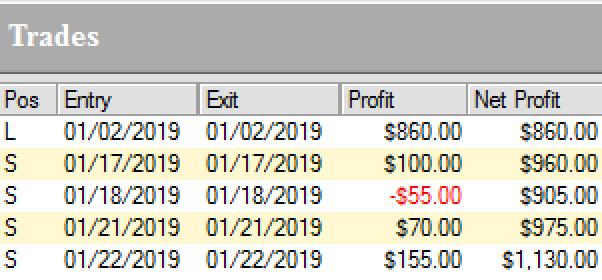

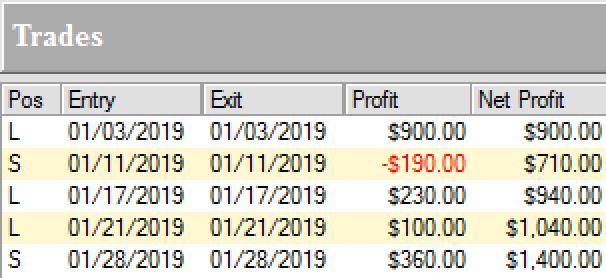

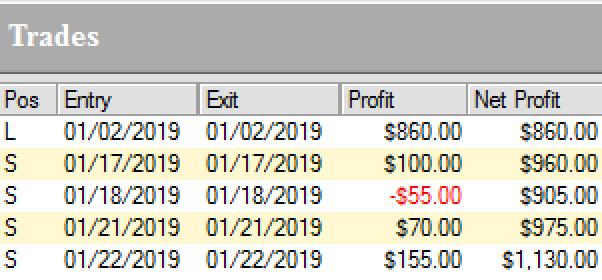

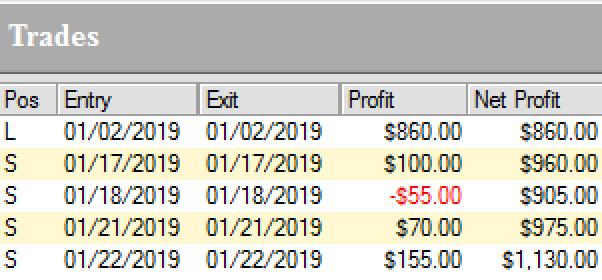

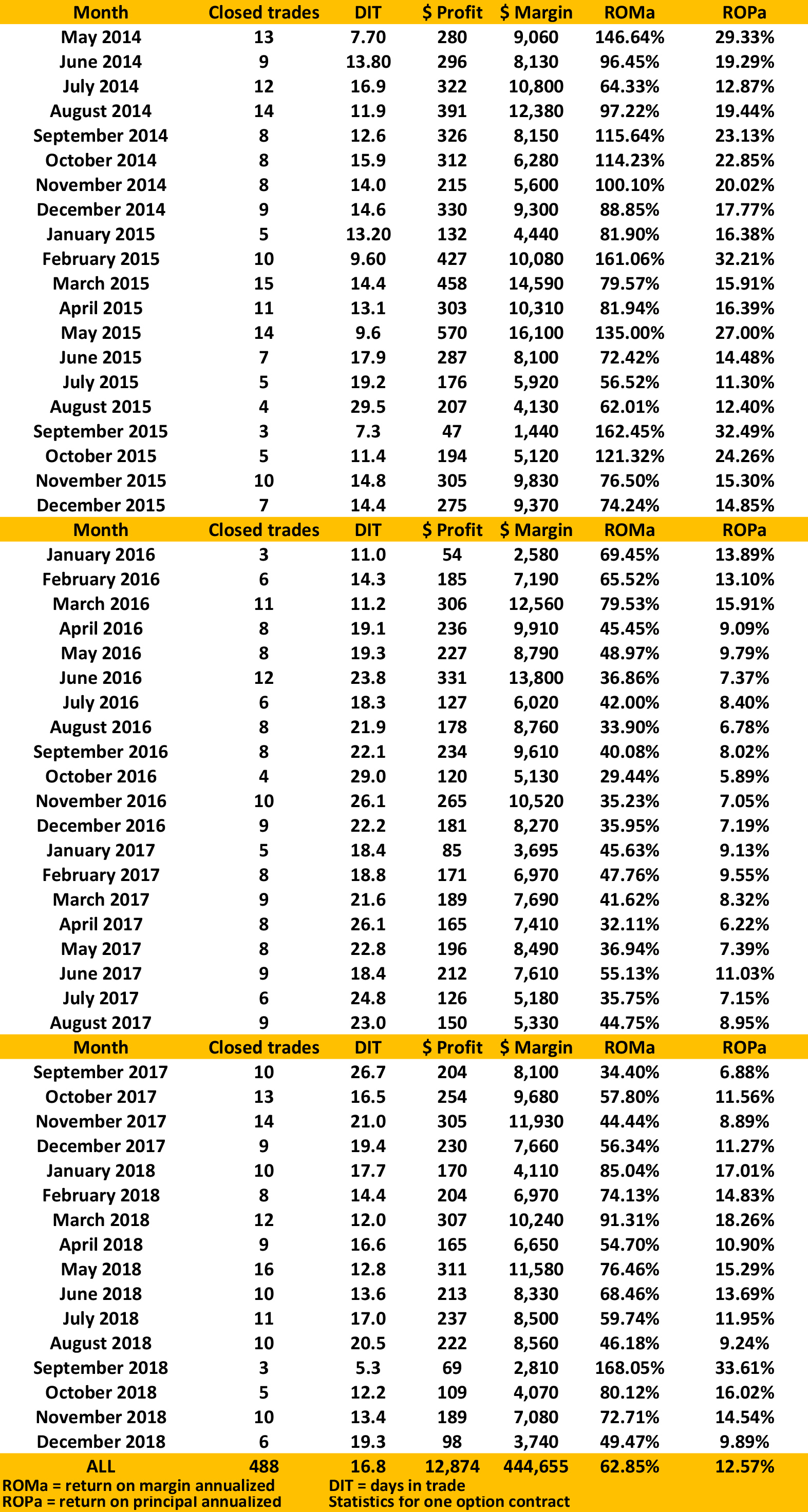

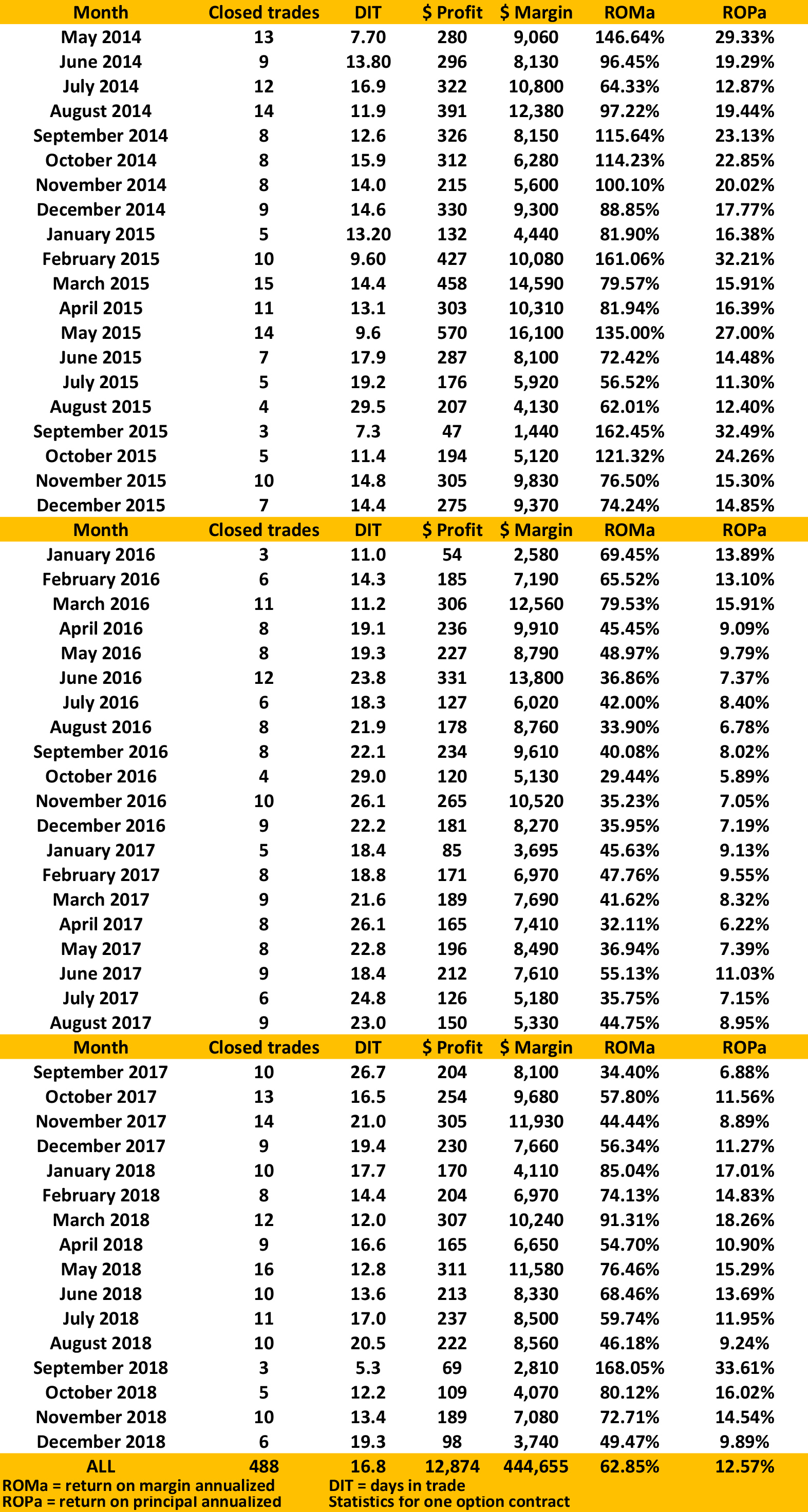

Here’s the result of all of these trades, trading one contract, including $10 commissions/slippage per trade:

New Zealand Dollar Future (6N):

Australian Dollar Future (6A):

Dollar Index (DX):

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 764 - February 15, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Trend from Congestion

In mid-April, share prices of the McDonald's Corp broke from an area of congestion to form once again another area of congestion. Although not rocket science, the Law of Charts calls for prices to break out from a trading range a high percentage of the time on the 21st to 29th bar of congestion. The low of the 20th bar took out the bottom of the congestion area, but Closed above that area. The 21st bar firmly violated the congestion area both Closing and making a new low below the area of congestion. The very next price bar was an inside bar, thus creating a Ross hook. Prices corrected for two days and then gapped lower once again. The violation of a Ross hook establishes a trend, so we were now looking at an established trend. The second bar labeled Rh became a Ross hook when prices once again failed to move lower. The resulting two bars of correction away from Rh #2 presented traders with a Traders Trick entry. A very nice sell short trade resulted when prices violated the low of the Traders Trick. Prices moved down once again, and as we see the chart at last look, we have a third Ross hook, and a Traders Trick entry to sell short on a violation of the low of the correcting bar.

Does it matter what caused prices to move lower? Only if you are interested in the fundamentals, knowledge of which came too late to take advantage of the long bar move down seen as the next-to-last price bar. In this case, news about terrorist bombs being planted entered the picture, causing a severe sell-off. But using the Law of Charts and the Traders Trick would have automatically seen you with a sell stop just below the low of the second from last price bar.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

IR Trade

On 30th January 2019 we gave our Instant Income Guaranteed subscribers the following trade on Ingersoll-Rand plc (IR) right after earnings. Price insurance could be sold as follows:

- On 31st January 2019, we sold to open IR Mar 15 2019 87.5P @ 0.50, with 45 days until expiration and our short strike about 13% below price action.

- On 11th February 2019, we bought to close IR Mar 15 2019 87.5P @ 0.15, after 11 days in the trade as IR went on upwards after our entry.

Profit: 35$ per option

Margin: 1750$

Return on Margin annualized: 66.36%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Disappointment and Regret

Every trader makes bad trades and faces regret, it is inevitable. And we all have the human tendency to be overtaken by emotions. When we screw up we have a feeling of...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders start the year with a big bang in the currency markets!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including many currency markets like the Dollar Index Future (DX), the Australian Dollar Future (6A) and the New Zealand Dollar Future (6N), where Ambush Traders had an amazing start into 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Here’s the result of all of these trades, trading one contract, including $10 commissions/slippage per trade:

New Zealand Dollar Future (6N):

Australian Dollar Future (6A):

Dollar Index (DX):

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 763 - February 8, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Comparison of the traits of winning traders vs. losing trader

|

TRAITS OF CONSISTENT WINNERS |

TRAITS OF CONSISTENT LOSERS |

|

Tell virtually no one their activities in the marketplace. |

Tell anyone who will listen the details of their market activities, to the point of campaigning for their particular point of view. |

|

View other’s opinions about the markets as other’s opinions. |

Very disturbed by someone else’s contrary opinions. Such opinions make them worry they themselves will be wrong. |

|

Approach speculation for what it is, a form of educated guessing. There are no sure things and they realize that. A commitment will be maintained only if it continues to act profitably. If a loss is taken, it is not taken as a personal failure, simply a bet that did not work. |

Cannot face the possibility of being wrong. This is taken as a personal failure. Their self-inflicted emotional punishment seems far worse than the monetary loss involved. For these reasons, closing out a position that has not worked out is seen as a great sign of failure. A losing position originally entered as a short-term trade is extended and rationalized as a long-term position (assuming such a position can be adequately financed.) Often the position is sold out only because of a failure to meet margin calls; i.e., it is an involuntary rather than a voluntary liquidation. |

|

Tend to make no pinpoint forecasts. Obviously, if all their own research points to higher prices, this is in a sense a forecast, but since no one can consistently predict how high a price will be realized, the forecast merely consists of an upward bias. Even this is only adhered to as long as the price movement confirms the research bias. They realize they must be eternally vigilant for a sign of change. |

Tend to work with very detailed forecasts of price behavior. Any fundamental research worked with is usually not original and is believed rather blindly. While such forecasts may be verbalized repeatedly, they are not truly believed in only because so many past forecasts have not worked out. Their own forecasts are for unusually large price movements. Such phrases as “This one’s the retirement trade,” are often used. |

|

Have an attitude that one attempts to capitalize on a portion of a particular price movement rather than on the entire move. Do not attempt to either pick bottoms or tops ahead of actual evidence of a change in direction. They do not allow greed to tempt them back into a market they have exited if their research says they are late in the movement or that the market has become overextended. |

Tend to either take many small profits, because they are so seldom experienced, or overstay a commitment because they dream of much larger profits. Often their dreams of all things the profits will buy prevent them from selling at a lower price than already achieved in the current trend. Once the trend does reverse, higher prices are waited for in the hope their dreams can still come true. |

|

Tends to handle capital very carefully. Initial commitments to a position are taken in small increments and are added to only if these early commitments become profitable. They have a plan which is closely followed. They tend to make money over months only because they seldom realized success in short-term operations. Capital is gradually withdrawn even from a successful trade, mainly because there is a strong aversion to having capital at risk. Good money management is seen as the key to mental equilibrium and therefore, good decision making. Mental equilibrium is seen as very fragile, and is guarded very carefully. |

Tends to plunge into the market with most or all of his trading capital. If the early stages of the trade are successful, any available margin produced through paper profits is immediately committed to making the position larger. No capital is withdrawn from the market due to success. Instead, the losing trader dreams not only of the money that will be made, he begins daydreaming of all the fantastic things the paper profits will buy. The Mercedes, a yacht with own crew, an apartment in London, ad infinitum. The trade, if it lasts this far, has become a mental trip. The loser has lost touch with reality. The paper profits are purely numbers, no longer currency. The trader has now become very emotional about the whole situation. He will overstay the position until the price trend truly turns against him. First, the paper profits are given up, then the actual trading capital, and then come the margin calls. At this point, it is purely a miracle if the loser escapes without owing the broker money after he has been forced by his broker to finally close out all positions. Emotional depression now sets in. And the next trade made is even a larger disaster. |

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

CDAY Trade

On 26th November 2018 we gave our Instant Income Guaranteed subscribers the following trade on Ceridian HCM Holding Inc. (CDAY). Price insurance could be sold as follows:

- On 6th December 2018, on a GTC order, we sold to open CDAY Dec 21 2018 30P @ 0.25, with 15 days until expiration with our short strike about 22% below price action.

- On 28th January 2019, we bought to close CDAY Dec 21 2018 30P @ 0.10, after 12 days in the trade (we could have let the option expire worthless for a greater annualized return, but we played safe and bought it back a few days before expiration as we usually do in these cases).

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 76.04%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: The Best Trader in the World

If you had to describe the best trader in the world, who would that person be? What qualities would he have? Take a moment ...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

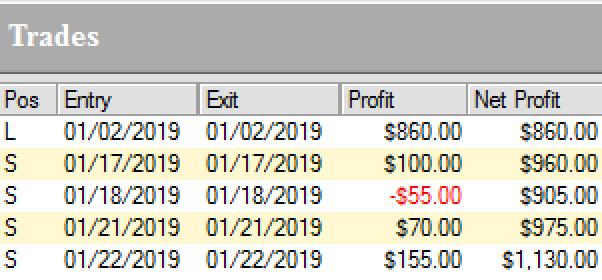

Ambush Traders start the year with a big bang in the currency markets!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including many currency markets like the Dollar Index Future (DX), the Australian Dollar Future (6A) and the New Zealand Dollar Future (6N), where Ambush Traders had an amazing start into 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Here’s the result of all of these trades, trading one contract, including $10 commissions/slippage per trade:

New Zealand Dollar Future (6N):

Australian Dollar Future (6A):

Dollar Index (DX):

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 762 - February 1, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Managing your Trading Business

Keeping Losses Small

I cannot say this enough times, so I’m saying it again, you must learn to keep your losses small. It is the single greatest concept that I can show you that will help you make profits in the market.

This principle is of such magnitude that it dwarfs all other principles for trade, money, and risk management.

Did you know that if you keep your losses small, you can flip a coin for go long/ go short, and you will make money in the markets? Yes, without even the benefit of trade selection you will make profitable trades if you learn to control your losses.

That means getting out as soon as you see that the trade is not doing what it should.

I know that losing is contrary to human nature. I know how much you hate to take those losses. I know how much you detest admitting you are wrong, especially when you’ve put a lot of work and planning into a trade. But consider this: If the trade doesn’t almost immediately go your way, then you have made a mistake! Either your planning was wrong or your timing was bad. The good trades almost always, quickly go your way.

I can usually spot which of my students will become good traders. How can I tell? They are the ones who are concerned with getting out fast and not losing money. They keep tight stops. They are anxious to protect profits—even small profits. They don’t give a trade “room” until they have locked in some profits. They are the ones who realize that many trades will result in little or no profits, but they realize that the market is going to hand them a sizable profit from time to time. Therefore, they conserve their capital waiting for the big windfall to be handed to them.

They are the ones who exert patience in waiting for such an event to happen. They know that they have to score big only a few times a year to get rich in the markets. In effect, they do not overtrade.

I can tell from what you say at my seminars, in your emails, and what you say when you phone me, that most of you trade far too often. You think that you have to trade every day. If you are daytrading you think you have to make numerous trades during the day. You think you have to watch the markets all day long. You are so greedy to take every opportunity that comes along, that you end up making lots of bad trades.

Trades must be planned ahead of time. They must meet every criterion for a good trade. They must be easily seen, and clear cut. There can be no guess work.

If you flipped a coin whether to go long or short, presumably, over time, you would go long half the time and short the other half. My guess is that half the time you would be correct giving you 1/2 of 1/2 correct trades. It has been statistically shown that a 25% trader can make money in the markets with proper risk management. So for some of you, those unwilling to do the proper planning that results in good trade selection, you would be better off flipping a coin, taking small losses on 75% of your trades, and then milking the 25% winners for all they are worth, while making sure that your winners do not turn into losers. THINK ABOUT IT! Maybe you should do some serious self-examination, spend some time working on what is wrong with YOU that causes you to lose consistently.

Staying with Winners

I’ve been taking you apart for overtrading. Now I’d better put you back together again by explaining how to trade correctly.

As traders, each day we face situations that demand buy or sell decision making. If we are daytrading we may be faced with more trading decisions than position traders, but not necessarily so. It depends upon how many markets we are following.

It’s as though we never run out of decision making opportunities. When we decide correctly, we should make money. When we decide incorrectly, we usually lose money.

If we constantly make decisions in order to satisfy some inner need, or because we get some kind of “rush” from decision making, then we are our own worst enemy. Trading for the “attack” or “flight” adrenaline high is almost a sure way to consistently lose.

As traders, unless we are hedgers, we are speculators. It has been my experience that constant decision making does not result in success as a trader. To be successful, we need to avoid overtrading (constant decision making) for making decisions with decreasing frequency. The more we engage in decision making, the more we expose our equity capital to chance of loss.

Our chances of entering a trade correctly on the flip of a coin is small. We use trade selection and planning to increase the chances of entering a trade correctly. Still, because we may not time the trade exactly right, our chances of entering the trade correctly are small. How many times have you entered a trade, had it go against you, gotten out with a loss, and then see it do exactly what you had planned on its doing? What was wrong? Your timing was wrong! That is why you have to get out right away, take your hit and get out NOW! You can always get back in when you see the trade begin to go according to plan.

Once in a trade, the chances of exiting it correctly are even less than they were for entering the trade correctly.

The chances of being right on both entry and exit are the smallest of all. Therefore, the fewer decisions you have to make about trading, the better off you will be.

This fact is the best reason I know for placement of resting stops for both entry and exit. Resting stops allow the market to come to you. Resting stops on entry allow the market to sweep you in when the market is moving your way: If it keeps on moving then you will make money. If the market doesn’t keep on moving, then something is wrong and you must get out quickly. On exit, resting stops take away the need for a decision in the heat of battle, when you are most apt to make the wrong decision.

How often do you get to buy at the bottom or sell at the top? Occasionally, by pure chance, it happens. Usually, you are forced to go with the trend. You must be a buyer in bull markets and a seller in bear markets. You must let the market tell you what to do. If you don’t, then you have some kind of ego problem that makes you think you can control the markets. You want to be God!

The only sound basis besides simple chart reading that I’ve ever found for exiting a trade is the trailing stop. Granted it keeps you from getting out at the market extreme. When you are too busy to constantly track every trade all day long, the trailing stop makes more sense than anything else.

Almost any logical scheme for trailing it is good. You can draw a trend line and keep moving your stop just outside the trend line. You can curve fit a moving average to the trend and keep your stop just outside the moving average. It doesn’t much matter whether the moving average is simple or exponential, or whether it is offset or not offset.

You can trail your stop just beyond the extreme of the last market correction. The main idea here is that once a position is in the money, you don’t give back more than 1/2, or 1/3, or 1/x of what you’ve already seen in unrealized paper profits, and besides protecting that 1/x of what you’ve seen, you DO NOT CROWD the trade. Give it room, but never move your stop further away once you have determined where it should be. If you are using a 3/3 offset moving average and it shows good containment of the trend, then at the point at which there are ample profits, you may even switch over to say a 7/5 offset moving average containment, to give the trade plenty of room to continue its trend.

Another way to help you to stay in winning trades longer is to view corrections as opportunities not to unload your position, but rather to add to your position. A good way to do this is to consider selling out part of your position at corrections, thereby taking some profits, with the idea that as soon as the trend is underway again, you will put on additional positions. Remember, when you add a new position you are adding new risk and you must trade add-on positions in the same way that you would trade any new position, carefully and with tight initial stops.

If you would like to know the best method I have ever found for setting stops consider a small investment in my eBook “Stopped Out.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

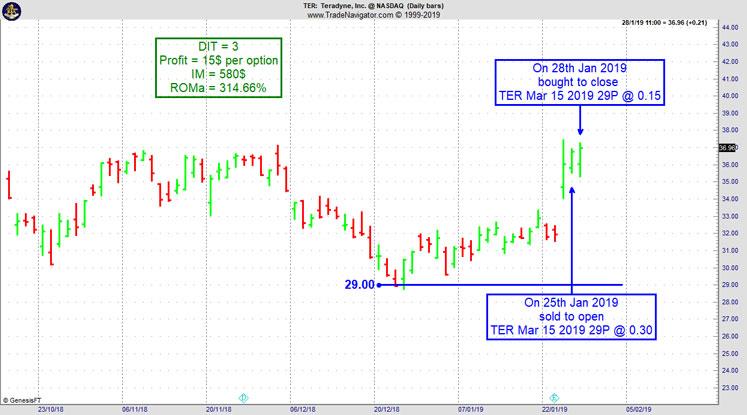

TER Trade

On 24th January 2019 we gave our Instant Income Guaranteed subscribers the following trade on Teradyne Inc. (TER). Price insurance could be sold as follows:

- On 25th January 2019, we sold to open TER Mar 15 2019 29P @ 0.30, with 50 days until expiration with our short strike about 20% below price action, and well below the earnings gap.

- On 28th January 2019, we bought to close TER Mar 15 2019 29P @ 0.15, after only 3 days in the trade for quick premium compounding.

Profit: 15$ per option

Margin: 580$

Return on Margin annualized: 314.66%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Emotions

Letting your emotions influence your trading decisions is virtually a guarantee that you will lose as a trader. If you are...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

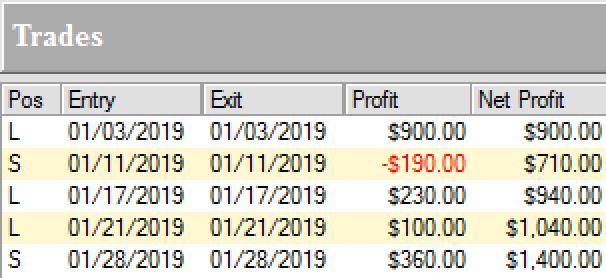

Ambush Traders start the year with a big bang in the currency markets!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including many currency markets like the Dollar Index Future (DX), the Australian Dollar Future (6A) and the New Zealand Dollar Future (6N), where Ambush Traders had an amazing start into 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Here’s the result of all of these trades, trading one contract, including $10 commissions/slippage per trade:

New Zealand Dollar Future (6N):

Australian Dollar Future (6A):

Dollar Index (DX):

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 761 - January 25, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Brazilian Stocks

One of my most respected stock trading friends uses only weekly charts to trade stocks. This year his account is up considerably. Naturally, I wanted to know what he was doing. Riding above my mustache is a nose, and sometimes it is "nosy."

My friend informed me that he has been making a ton of money selling short Brazilian stocks that trade in the U.S. He said that a significant part of the gains made when he was long, were because of the rise of Brazilian stocks.

I asked him about his current position. He keys his trades from the Brazil Bovespa Index (IBV) for a clearer outlook for Brazilian stocks. He watches 20 Brazilian stocks in all, and he trades them using The Law of Charts, taking Traders Tricks ahead of 1-2-3s and Ross Hooks.

Below is a chart of the weekly Bovespa. As you can see, Brazilian stocks have been in an overall uptrend since January of 2016.

There is one caution with these stocks. Be aware that you must take into consideration the value of the Brazilian Real compared with the US dollar. You could be making money with the stocks, but losing money on the exchange rate.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Chart vs. Technical Analysis

Is there a difference between chart analysis and technical analysis?

In my opinion there is. I am surprised at how many traders lump charting together with technical indicators into a category they call “Technical Analysis.” I am often accused of being a technical analyst because I am not a fundamental analyst. In the past, I’ve often carelessly, and without much thought, allowed myself to accept the general view that if you are not a fundamentals trader, you must be a technical trader.

If it hasn’t already been done by others, I want to create a category called “Chart Analyst.” I am a chart analyst (“Chartist,” if you prefer). I am not a market technician, I am not a fundamentals analyst, and I most certainly am not a technical analyst. I use technical indicators to about the same degree I use fundamental information for operating my trading business and making my trading decisions: very little.

My reading of charts does not preclude my use of fundamental information, nor does it preclude my use of a technical indicator when I deem such use to be appropriate to the operation of my trading business.

I refuse to be placed in a box of someone else’s making. If I have to be placed in a box, and apparently for many traders I do, then place me in the box of being a chart analyst. Why am I a chart analyst? Because it is the best way to see what’s going on that I’ve been able to discover.

I am not going to negate the value of fundamental information when such information can render a better result from my trading. I am not going to negate the use of a technical indicator when such an indicator can benefit my trading. But I am going to do the bulk of my trading from what I can plainly see on a bar chart showing me the open, high, low, and close.

Trading solely from fundamentals has too often gotten me in deep trouble. The same is true of trading exclusively from indicators. I want whatever gives me the best picture of reality.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

SQ Trade

On 2nd January 2019 we gave our Instant Income Guaranteed subscribers the following trade on Square Inc. (SQ). Price insurance could be sold as follows:

- On 3rd January 2019, we sold to open SQ Feb 15 2019 30P @ 0.25, with 42 days until expiration and our short strike about 48% below price action, making the trade extremely safe.

- On 8th January 2019, we bought to close SQ Feb 15 2019 30P @ 0.10, after only 5 days in the trade

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 182.50%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Welcome the Idea of Breaking Even

No one enters a trade with the idea of breaking even as a goal. Rather, we set out with high hopes...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 760 - January 18, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: ETF Trading

At times in the past I got so wrapped up in day trading that I no longer could see the forest for the trees. I convinced myself that I needed to day trade because I don't have much time for trading. So I limited my day trading to 1-1.5 hours per day. Then along came a student, and I realized for about the thousandth time that if I really didn't have a lot of time for trading, I ought to be trading the weekly charts.

My friend John and were going over some strategies, and I was telling him about someone I know who trades only the weekly charts and who is making a lot of money.

I said to John, "All he does is trade Exchange Traded Funds (ETFs) from the weekly chart. The rest of the time he spends on the beach. He follows the sun, and for him it is springtime and mild summer wherever he goes."

Is that not an enviable lifestyle that many, if not most, traders dream about? I will show you just one of the many ETFs available for trading. By trading them from the weekly charts, you avoid all the confusion and noise of daily and intraday charts.

On the chart above, the green arrow indicates the first clearing of the consolidation. Its low was 20.08. The high of the consolidation was 20.07. The red arrow points to a Traders Trick Entry to trade short. The black arrows all point to unfiltered Traders Trick Entries to go long. Each Traders Trick is preceded by a Ross Hook. Although there may be fewer trades per ETF, an even better way to trade any market is with “filtered” Traders Trick Entries. The percentage of winning trades is exceptional. Here is a link to Traders Trick Advanced Concepts.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Covalency

Someone asked, “What in the world is 'covalent bonding of futures pairs?’”

Covalent bonding of futures pairs is said to create the best trading system portfolio structure. After the most stable individual futures parameters have been selected, the optimal portfolio should be created. Atoms share electrons to form molecules of a substance. This same covalent bonding process finds the trading system's most profitable futures, then tests all futures to find the best futures pair, and then the best possible futures for the optimal portfolio. Often the best futures, most profits divided by lowest draw-down, will not be part of the best futures pair. Covalent bonds share the daily equity runs so when one futures or pair loses money, another futures or pair should gain equity. Adding the euro to T- Bonds, or Japanese yen to the British pound, may lower the combined maximum equity draw-down to a figure lower than the maximum equity draw-down of either individual futures. This is the function of covalent bonding applied to optimal portfolio construction.

The optimal portfolio structure is completed when the percentage of individual futures equity gain increases less than percentage of maximum equity draw-down. Portfolio A makes $500,000 with a maximum equity draw-down of $25,000. Adding a new futures increases the profits by 10% to $550,000, buts also increases the equity draw-down from $25,000 to $30,000. While a $5,000 draw-down increase is small in comparison to a $50,000 profit increase, the futures should not be added, since it increases maximum equity draw-down by 20%. Adding more contracts of a futures already within the optimal portfolio with less risk may be safer than a risk increase of 20% for a gain of 10%. It is a little known, or understood, fact that some futures, within a system portfolio, may add up to four contracts and successively lower the maximum equity draw-down while profits are increased with each addition.

Having said all that, I have no idea what it means. Do you. All I did was answer the question. : )

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed