Newsletters (208)

Children categories

Edition 795 - September 27, 2019

25% OFF

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

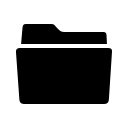

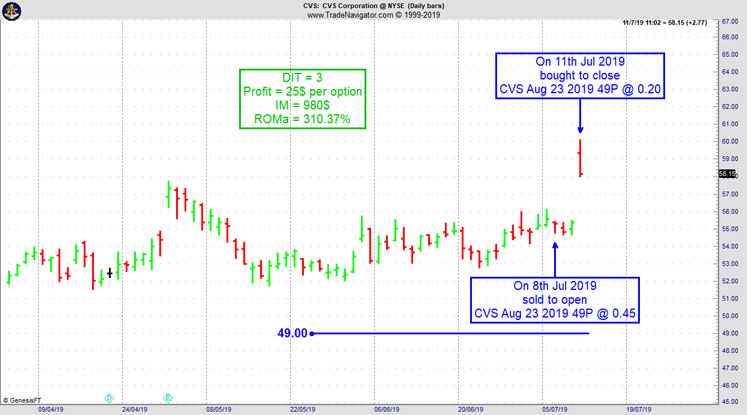

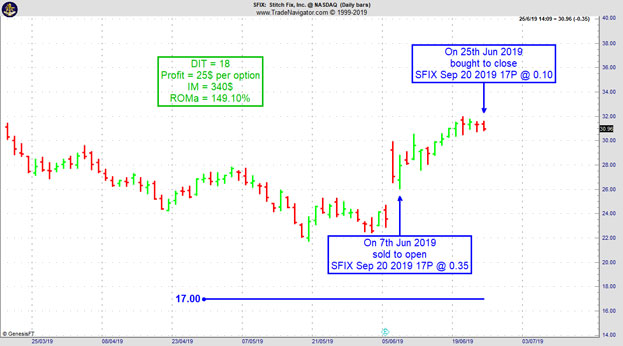

Chart Scan with Commentary: Options

Hey Joe! I don’t want to bother you with a whole bunch of questions about options, but could you please tell me if Option Open Interest is of any value, and if so, how would you use it?

Keeping in mind that I am strictly an option seller. I mainly sell put options.

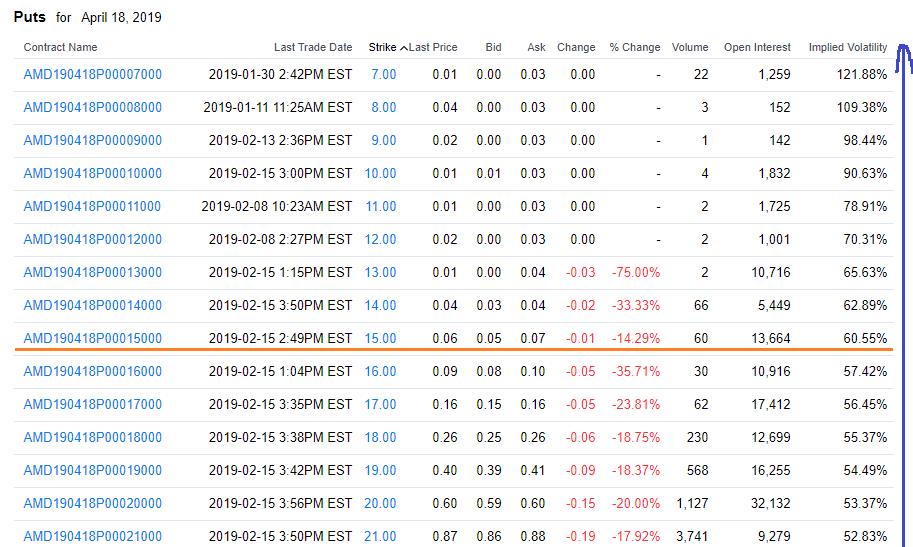

Open interest shows all open options contracts that are available for exercise that have not been closed out. (Arrows)

One way traders use open interest is to determine supply and demand levels for the underlying asset. For example, let's assume that I’m looking to sell put options for ABC stock that's priced at $50.00 per share and I believe that the stock is going to go up, or at least stay in a trading range.

When I look at the put options that expire 2 months from now, I find that the open interest on the $30.00 strike price put option is only 10 contracts, while the open interest on the 40 strike price put option is 500 contracts.

This tells me that the majority of speculators don't believe that the underlying stock is going to move up very much in the next two months and I may want to consider selling a lower strike price put option or reconsider the trade because the sentiment is against the stock moving up.

Another very simple way to use open interest is to determine whether the overall sentiment on the underlying assets that I’m analyzing is bullish or bearish. Let's say that I’m looking at XYZ stock and once again the stock is priced at $50.00 per share. When I look at the open interest column the 50 strike price put option has open interest of only 100, while the 50 strike price call option has open interest of 500.

This would tell me that the current market sentiment for this stock is bullish, since open interest is 5 times higher for the at the money call option compared to the at the money put option, this would tell me that the current sentiment favors XYZ stock moving higher.

If on the other hand the at the money put options have higher open interest than the at the money call options, then I would conclude that the sentiment is bearish.

If I find that open interest for the at the money call option and the at the money put option are similar to each other, then I would avoid using open interest as a directional sentiment indicator. I find that it works best when the open interest numbers favoring either the calls or the puts outweighs the other side by a very large margin.

Lastly, another very common way of utilizing open interest is to monitor for unusual options activity. For example, if ABC stock is trading at $50.00 and the $40 strike price call option that expires in 1 month has open interest of 10,000 contracts and within the next few trading sessions the open interest dramatically rises, this would imply that speculators are accumulating that option because they believe ABC stock is going to move lower within the next few weeks. Similarly, if the open interest drastically increased in a short period of time in an out of the money call option, the $60 strike price for example, it would imply that speculators believe that ABC stock is going to move higher.

Screening for unusual rise in open interest is so popular that several financial analysis firms specialize in screening for options with major changes in open interest in a short period of time.

I personally find that keeping an eye on stock index open interest levels, for different options strike price levels, offers an excellent analysis tool for short term price swings as well as support and resistance levels.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Be Aware

Beginning traders may make trade after trade and watch their account balance dwindle with each trade. They may feel unintelligent and thoughtless and think, "Why am I making so many losing trades?" At times they may wonder...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

WB Trade

On 18th August 2019 we gave our Instant Income Guaranteed subscribers the following trade on Weibo Corporation (WB), after a gap up on earnings. Price insurance could be sold as follows:

- On 20th August 2019, we sold to open WB Sep 27 2019 33.5P @ 0.35, with 37 days until expiration and our short strike about 22% below price action, making the trade very safe.

- On 3rd September 2019, we bought to close WB Sep 27 2019 33.5P @ 0.15, after 14 days in the trade.

Profit: 20$ per option

Margin: 670$

Return on Margin annualized: 77.83%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

25% OFF

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Accurate Records

As a trader, it's very important that you keep accurate records of all factors that may impact the outcome of your trades so that you can learn from your losses, improve your performance, and....read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 794 - September 20, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

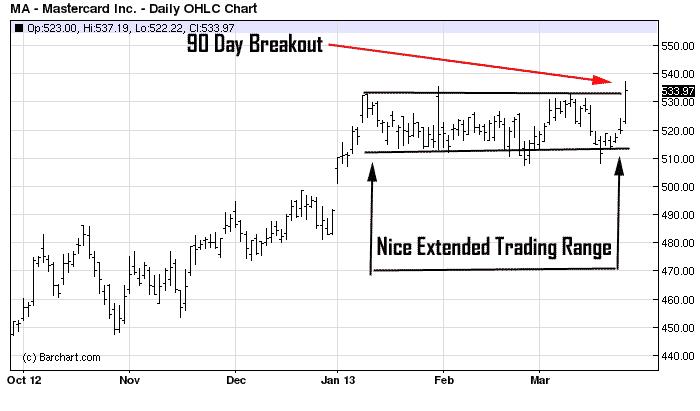

Chart Scan with Commentary: New Highs

Hey Joe! I’ve heard that a trader or investor should buy new highs. Couldn’t that be disastrous?

Yes, it could be disastrous. It’s not a good idea to simply buy new highs. There should be some qualifying parameters to go with new highs that increase the probabilities of making a good trade.

For example, the new high should be part of an overall strong uptrend. It should come as the result of a breakout from congestion. It might be a sideways congestion as pictured above or perhaps a flag or pennant formation. Other fundamental reasons should also be considered. Is there something in the news that would indicate higher prices to come. Is there a shortage of an underlying commodity that will increase demand? Does an underlying company have a new product, or innovation that is going to put its stock in demand? There are many more reasons that can cause prices to continue rising, that I’m sure you can think of. Consider doing a bit of research to find out why the underlying made a new high.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Graceful Trading

Whether you're a novice or seasoned trader, there are days when you face setback after setback: Adverse events go against you. You make a trading error. You misread the markets. The possible setbacks can be endless, and it hurts a little to watch your account balance take a hit when one of them catches you off guard. But whatever roadblocks get in your way, you have to take...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

KN Trade

- On 7th August 2019, we sold to open KN Sep 20 2019 12.5P @ 0.15, with 43 days until expiration and our short strike about 36% below price action, making the trade very safe,

- On 23rd August 2019, we bought to close KN Sep 20 2019 12.5P @ 0.05, after 16 days in the trade.

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Your Role in the Market

Our past experience is a factor coloring the way we see things. We get an electric shock, and we decide....read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 793 - September 13, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

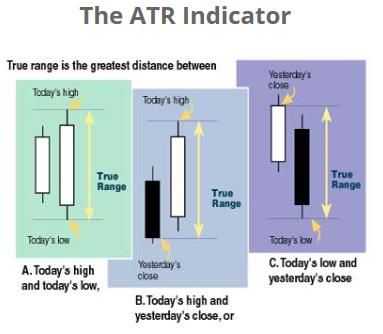

Chart Scan with Commentary: ATR

Hey Joe! I’ve been trying to figure out the correct way to program the Average True Range (ATR). Various charting programs seem to come up with different answers. Which one is the right one?

The Charting Software that I use, Genesis Trade Navigator, has two different ways to do it. I’m not sure which is which, but one of them is based on Welles Wilder’s original formula and the other way is based on their own in-house formula. It seems to me that the last two ways pictured above are the most correct. As you see above in the graphic that you sent, the first way if fine for a single day, but what would you do if prices gapped open either up or down? The first way above fails to take into consideration any gap that might occur. Going from the close to the next day’s high, or from the close to the next day’s low, at least takes into consideration any gap that might occur. However, there is yet another way not pictured above. It would be to measure from yesterday’s low to today’s high for a move up, or to measure from yesterday’s high to today’s low, to envision the correct amount of volatility in the price movement. Of course, why use only the close? Why not substitute from the Open to the low or high? I don’t know which is the correct way, and I don’t think anyone else knows it either. It seems to be a matter of opinion. The main thing for ATR is to be consistent in the way it is calculated.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Setbacks

Are you experiencing an emotional roller coaster, euphorically celebrating wins, but facing despair when losses mount? If you are, you may be taking things a little too personally. If you want to trade like a winner, you need to take responsibility for your actions, taking every precaution possible to neutralize...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

JD Trade

- On 14th August 2019, we sold to open JD Sep 27 2019 25P @ 0.35, with 43 days until expiration and our short strike about 18% below price action,

- On 19th August 2019, we bought to close JD Sep 27 2019 25P @ 0.15, after 5 days in the trade, for quick premium compounding

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: The Ideal Parameters for Successful Trading

- Your trading goals and objectives must be possible to complete. They cannot be too abstract or too high. It is best to just execute a trade rather than being overly concerned with profits or achieving unrealistic performance standards.

- You must be able to intensely concentrate on....read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 792 - September 6, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

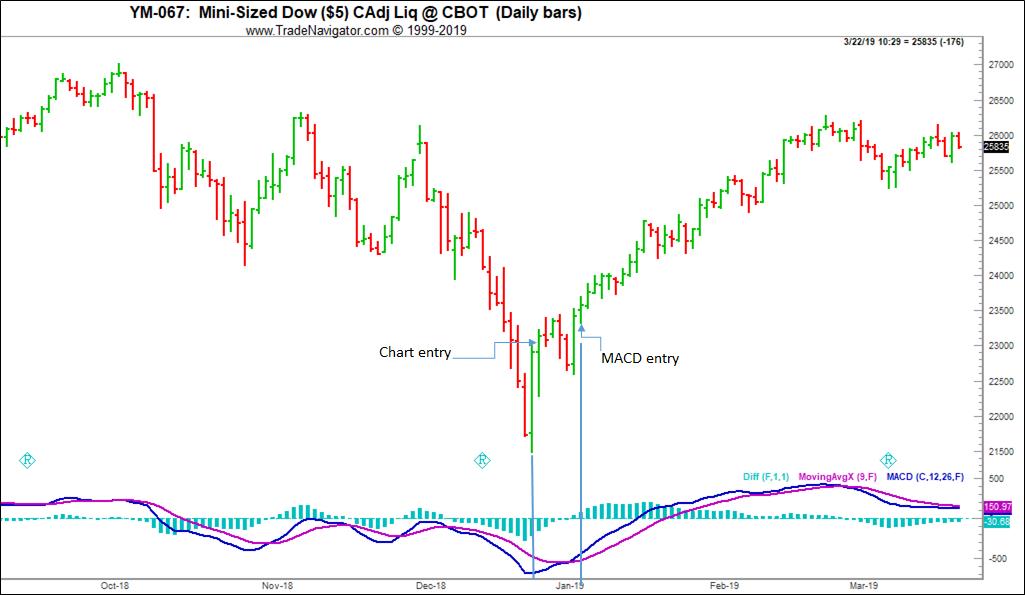

Chart Scan with Commentary: Chart Reading

Early in my trading career, apart from moving averages, there were no indicators worthy of much mention. The computations needed for creating indicators were much too time-consuming for anyone to do without having a large main-frame computer, or at the very least a mini computer (cost $400,000). I learned to trade by reading a chart. In my opinion, chart reading still has the advantage over trading with indicators, especially if an indicator become the prime reason for entry into a trade. Indicators are okay as confirming entities to what a trader can see with the naked eye, but in my opinion that’s all they are good for. Of course, this kind of thinking is contrary to the vast majority of opinion among those who trade the markets.

The greatest weakness of an indicator is the fact that it requires historical data. Indicators are generally detrended plots of moving averages of whatever is the underlying. Because they depend on historical data, they are always behind the actual price action. The following is an example of what I mean.

For the Chart entry all that was needed was single reversal bar. Buy on the following bar at the price of the high of the reversal bar. Take a scalp trade and a second trade was possible at the MACD entry. The reversal bar gave its signal 7 bars before the MACD entry signal. The MACD entry was possible on the 8th bar of the series.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Be Flexible

As traders in the markets, it's informative to study everyday examples of mass psychology. Although humans are highly intelligent, they can act like cattle blindly following the leader of the pack to the slaughterhouse. For example, have you ever...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Getting in Step with the Market

Early in the trading day, as part of your daily preparation (you do have a daily preparation, don’t you?) it's helpful to practice a little to get a "feel" for what you might do and how you might trade. One way to do it is to make....read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 791 - August 30, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

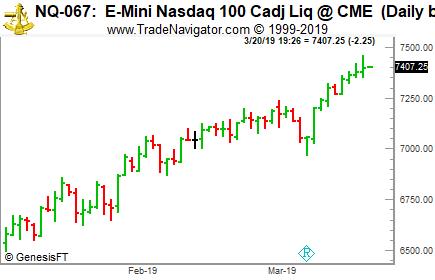

Chart Scan with Commentary: A Tale of Two Charts

Take a look at the following two charts. Something should become immediately apparent. Do you see it? It’s a way for you to be able to make a low risk, high probability trade, with much of the volatility removed.

The E-mini Nasdaq 100 (NQ) futures are dramatically outperforming the Mini-Sized Dow (YM) futures. The result is an easily observable spread opportunity to go long NQ and short YM. To see it more clearly look at the sideways movement of both markets from about the middle February to the latest bar shown. NQ has broken out of a consolidation area, while YM is still in the middle of a sideways consolidation. Now do you see it?

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Emotions

Winning traders are extremely disciplined. They wisely study the markets, devise a trading plan, and follow it. They control their impulse to abandon their plans prematurely, and they don't allow emotions, such as fear and greed, to influence their trading decisions. In the trading profession,...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

CSIQ Trade

On 29th July 2019 we gave our Instant Income Guaranteed subscribers the following trade on Canadian Solar Inc. (CSIQ). Price insurance could be sold as follows:

- On 2nd August 2019, on a GTC order, we sold to open CSIQ Oct 18 2019 15P @ 0.30, with 78 days until expiration and our short strike about 28% below price action.

- On 19th August 2019, we bought to close CSIQ Oct 18 2019 15P @ 0.15, after 17 days in the trade.

Profit: 15$ per option

Margin: 300$

Return on Margin annualized: 107.35%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

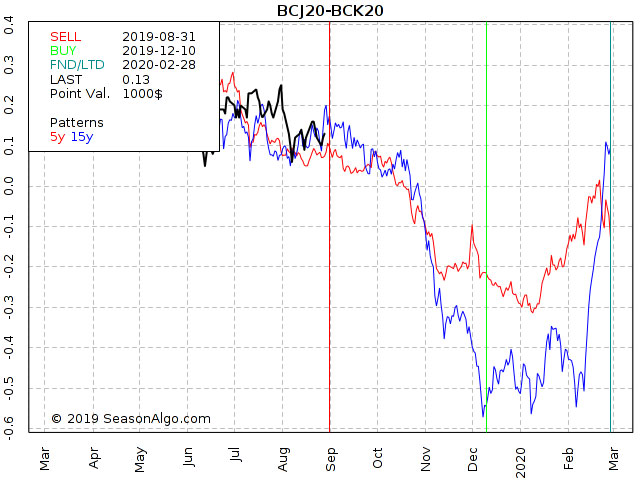

Trading Idea

This week, we're looking at short BCJ20 – BCK20: short April 2020 and long May 2020 Brent Crude (NYMEX on Globex).

Today we consider a Brent Crude calendar spread: short April 2020 and long May 2020 Brent Crude (NYMEX on Globex). The spread was trading in a tight range between 0.160 and 0.260 in July, broke to the down-side at the beginning of August and has been trading in a range since then. It seems the former support level around 0.160 became resistance. Is this a good level for an entry or should we better wait for a break out to the down-side?

Do you want to see how we manage this trade and do you want to get detailed trading instructions every day? Click here for additional information!

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 790 - August 23, 2019

HURRY!

Offer Expires August 24th

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

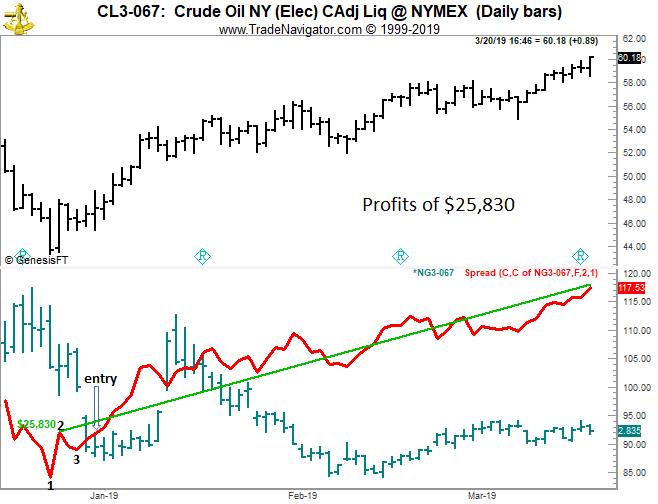

Chart Scan with Commentary: Oil vs. Natural Gas

Crude Oil has been outpacing Natural Gas since the beginning of 2019. A spread long CL and short NG continues to earn steady profits. It’s not unusual for a spread to trend much longer than the underlying commodities, which tend to swing wildly as you see with the lower NG graph on the chart below.

Spreads take a lot of the volatility out of trading the markets. The CL-NG spread began with nice 1-2-3 low on the chart. From the point of breakout to the day this chart was recorded the spread has earned $25,830. If you’re missing these trades in favor of getting your butt kicked on a 5 minute e-Mini S&P chart, you need to think things through….again!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Regrets

Fear and greed drive market action. We enthusiastically put on trades when we think a huge profit is assured, but when we see the market shift dramatically, we get out as quickly as possible. We fear being trampled by the masses as they all rush to sell. Fear and greed are powerful emotions that underlie the actions of the masses, but behavioral economists argue...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

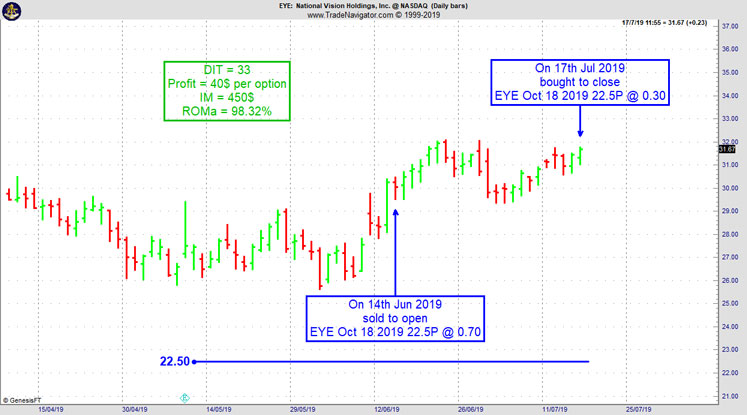

EYE Trade

On 13th June 2019 we gave our Instant Income Guaranteed subscribers the following trade on National Vision Holdings Inc. (EYE). Price insurance could be sold as follows:

- On 14th June 2019, we sold to open EYE Oct 18 2019 22.5P @ 0.70, with 124 days until expiration and our short strike about 26% below price action.

- On 17th July 2019, we bought to close EYE Oct 18 2019 22.5P @ 0.30, after 33 days in the trade.

Profit: 40$ per option

Margin: 450$

Return on Margin annualized: 98.32%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Successful Trading

Because we don't know what "successful" means to every individual, we should divide traders into different groups. I think most traders can be found in one of the following groups: Group One - these are mainly traders new in the...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

HURRY!

Offer Expires August 24th

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 789 - August 16, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

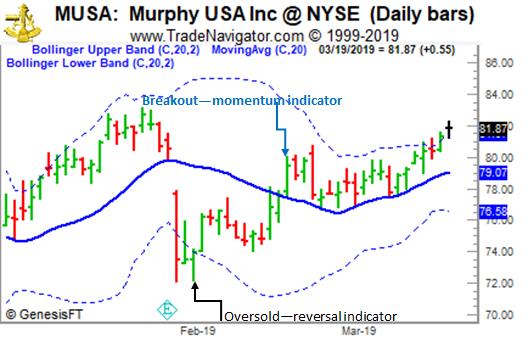

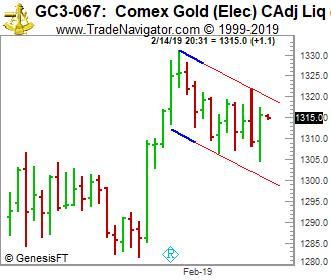

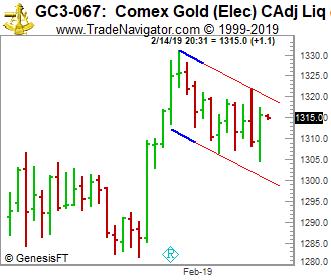

Chart Scan with Commentary: BBs as a Momentum Indicator

One of my earliest uses of an indicator came about in the 1980s, when John Bollinger invented his Bollinger Bands (BBs). To tell the truth, it was superior to almost every other method of creating a price envelope because instead of the trader guessing where to place the envelope outer bands, BBs allow the bands to be set at least partially by actual price volatility. The trader has only to decide how many bars are to be used for the moving average, and the trader decides at what level to set the Standard Deviation (STD).

I began to use the BBs as an overbought, oversold indicator, typically together with a reversal bar, which I called a Gimmee Bar. When I saw a reversal bar with prices at one of the outer bands, I knew it was just a matter of time until prices reverted to the moving average line. Statistics show that sooner or later prices will revert to the Mean. I’m not a statistician, nor am I much of a mathematician, but my experience was that Gimmee Bars worked around 80% of the time.

However, I always wondered if there might be another way to use the BBs. Could BBs tell me when to make a momentum trade? What would such a setup look like?

The chart above gives you a very good picture of how to use BBs as a momentum indicator.

First, in February, we see prices exceed the lower outer band which I set at 2 STD distant from a moving average of 20 bars. Any time frame can be used—in this case we have a daily chart.

We see that at the lower band there was a reversal bar (Gimmee Bar).

In about mid-February, after having reversed direction, we see prices break and close above the moving average. That was the momentum indicator. Entry is at the high of the momentum bar, and the stop is trailed below the moving average. You tighten the stop when prices hit the upper band in anticipation of an imminent reversal to the downside. Success rate for this kind of trade is around 80%.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Stress Errors

Have you ever been so excited about a trade that you couldn't sleep at night? Or perhaps you are trying to dig yourself out of a hole and worry has taken a toll. Studies of disasters, ranging from major environmental catastrophes to minor laboratory accidents, happen when people are under ...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

MOMO Trade

On 30th April 2019 we gave our Instant Income Guaranteed subscribers the following trade on Momo Inc. (MOMO). Price insurance could be sold as follows:

- On 30th April 2019, and on 10th May 2019 on a GTC order, we sold to open MOMO Oct 18 2019 21.9P @ 1.025 (average price), with 167 days until expiration and our short strike about 38% below price action initially.

- On 15th July 2019, we bought to close MOMO Oct 18 2019 21.9P @ 0.30, after 71 days in the trade on average

Profit: 72.50$ per option

Margin: 438$

Return on Margin annualized: 85.09%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Staying on the “Sideline”

Don't get irritated or angered because you haven't put on a new trade in a long time. Whenever there is nothing to trade, don't trade. Accept it and stay on the "sideline." There will be …read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 788 - August 9, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

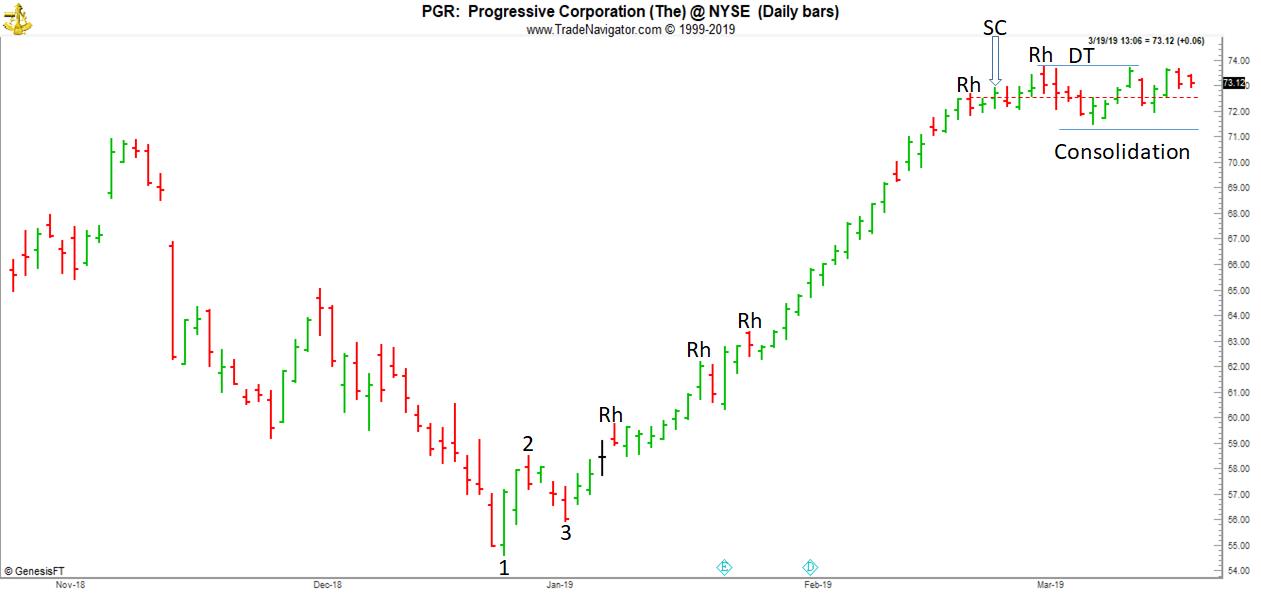

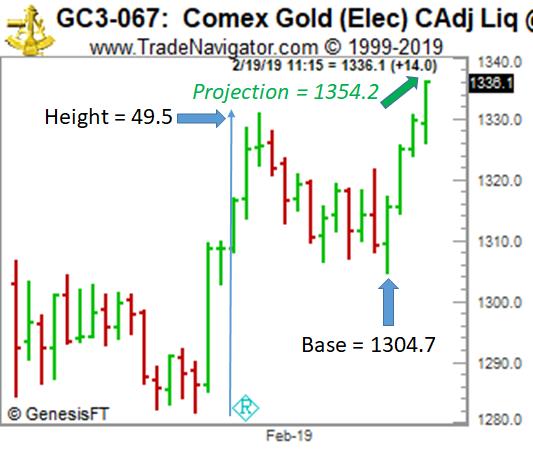

Chart Scan with Commentary: Classic Pattern

Joe! Does classical chart analysis still work in today’s crazy markets? I wonder how it could be when you consider the volatility in the markets, the insane political situation, and the amount of not-knowing what the Fed will do next!

Human behavior remains quite consistent even in seemingly crazy markets. Markets are driven by human emotion. That’s why trading is an art form and not really scientific or mathematical.

Take a look at the following chart. It is current as of March of 2019. As you will see, it is as classical as it could possibly be.

Classic 1-2-3 low, followed by Ross Hooks, formed a double top (DT), while in consolidation (SC). The hollow arrow shows where consolidation started. It is the furthest bar back that most typifies prices during the consolidation. Prices have been in consolidation for 17 bars. The red dotted line is half-way between the low and the high of consolidation, which is the vertical center of the consolidation. The DT could very well be the beginning of a turn in trend. However, it is not clear yet which way prices will break out.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Creative Idea

The winning trader stays ahead of the crowd. In ever-changing market conditions, you have to think of new, innovative trading ideas. But it isn't always easy. There are times when you feel mentally stuck and unable to think creatively. When you are feeling....read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

FNKO Trade

On 15th May 2019 we gave our Instant Income Guaranteed subscribers the following trade on Funko Inc. (FNKO). Price insurance could be sold as follows:

- On 20th May 2019, on a GTC order, we sold to open FNKO Aug 16 2019 12.5P @ 0.25, with 86 days until expiration and our short strike about 42% below price action, making the trade very safe.

- On 2nd June 2019, we bought to close FNKO Aug 16 2019 12.5P @ 0.10, after 43 days in the trade.

Profit: 15$ per option

Margin: 250$

Return on Margin annualized: 50.93%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: I just can’t seem to accept uncertainty and risk. What can I do?

I’ll try to give you a few things to think about, but unless you can overcome your inability to accept risk, you don’t have much of a chance to make it as a trader.

Trading and risk are virtually one and the same. Shorter-term trading isn't about …read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The Russell 2000 is simply too easy to trade right now!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 787 - August 2, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: What’s This?

Hey Joe! I brought up an old chart the other day, and it had a pattern on it that I’ve seen many times before. I’m never sure quite what it means, but surely it is telling us something. Would you please comment? Thanks.

Sure! What you are looking at is an inside breakout pattern. It looks like a mini-triangle. It is made up of successive inside bars. The probabilities are that the breakout will result in a continuation of the previous trend.

This pattern frequently occurs after a strong trend comes to a temporary pause for a few bars. What I like about this pattern is that it provides a low risk entry opportunity because the volatility and the length of the trading bars is greatly reduced from the normal bar to bar volatility of the underlying.

This provides a good low risk entry area without having to incur excessive risk due to extended volatility which causes extended trading range and more risk to the position. You can see in the example you sent. MDCO was still in a strong uptrend and was consolidating temporarily. The stock looked like it will continue moving to the upside in the near future.

Okay! So, did it do what the chart pattern predicted? I took the liberty of looking back to find that stock, and below is the result.

I guess there is nothing that always works in trading!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Three Traders

The expectations you hold about where your trading career is going can have a powerful impact on what you do and how you do it. Consider three traders, Jake, Steve, and Paul. Each has a different outlook, and this outlook dictates how they approach the markets.

Jake is a pessimist. He wants to become a profitable trader, but his attitude....read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

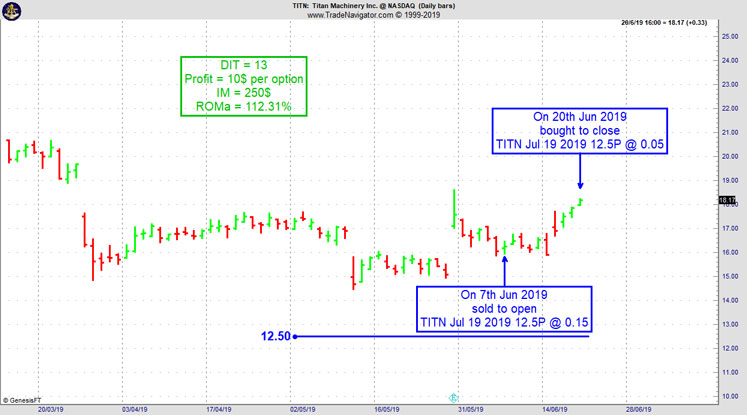

TITN Trade

On 6th June 2019 we gave our Instant Income Guaranteed subscribers the following trade on Titan Machinery Inc. (TITN). Price insurance could be sold as follows:

- On 7th June 2019, we sold to open TITN Jul 19 2019 12.5P @ 0.15, with 42 days until expiration and our short strike about 42% below price action, making the trade very safe.

- On 20th June 2019, we bought to close TITN Jul 19 2019 12.5P @ 0.05, after 13 days in the trade

Profit: 10$ per option

Margin: 250$

Return on Margin annualized: 112.31%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Should I reverse when I am having a loss?

Professional day traders reverse their positions about 60% of the time when they take losses? Why do they do this? The market should not have…read more.