Newsletters (208)

Children categories

Edition 781 - June 21, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: 2nd Time Through

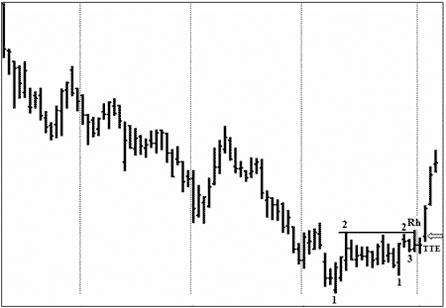

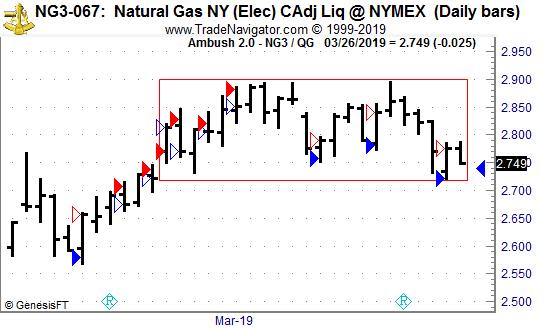

The chart below presents a couple of interesting concepts. Prices have obviously been in consolidation. Prices formed an initial 1-2 low, but never completed the #3 point.

When prices are in consolidation, there are often full or partial 1-2-3 formations in both directions — 1-2-3 highs and 1-2-3 lows. These formations are part of the Law of Charts.

At one point, prices dipped down and violated the low of a very tight cluster of prices forming a second #1 point, which can be justified as a #1 point only by the fact that it was followed by a #2 and a #3 point.

Why do I use the term "cluster?" It's because either the Open or Close, or both, of every bar following the first #2 point fell within the price range of that #2 point. That long bar labeled "2" is called a Measuring Bar.

Ultimately, the second #2 point was violated, thus forming a Ross Hook.

At our seminars, in private tutoring, and in our online courses, we teach that when prices are in consolidation, it usually requires both a 1-2-3 formation, followed by a Ross Hook (tie breaker) to convince us that at last prices are ready to break out of consolidation.

Since trend takes precedence over consolidation, and because a 1-2-3 formation followed by a Ross Hook confirms a trend, we are then correct in attempting a Traders Trick Entry (TTE).

That Ross Hook was the not only the first time through the original #2 point, it was also the tie breaker that indicated prices may very well break out.

There were then two possible entries: enter early, using the TTE, or wait for the second time through the original #2 point. Either way resulted in a very nice trade.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Wisdom

It would be wonderful if there were a foolproof and valid instruction manual for how to trade the markets profitably, a cookbook of sorts where you merely follow the steps and you are successful. For decades, traders have ...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

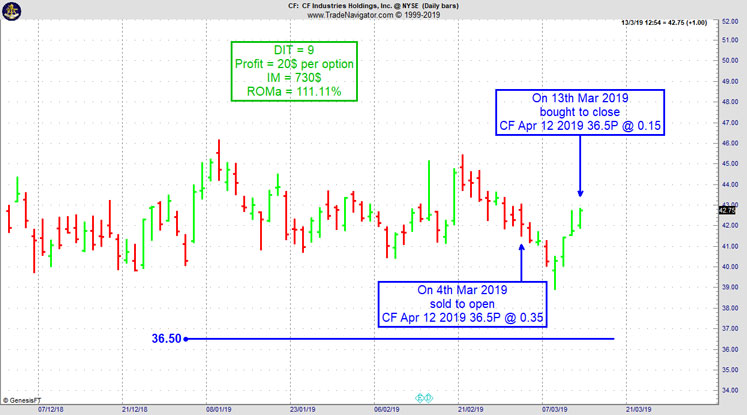

Trading Idea: Instant Income Guaranteed

JD Trade

On 4th June 2019 we gave our Instant Income Guaranteed subscribers the following trade on JD.com Inc. (JD). Price insurance could be sold as follows:

- On 5th June 2019, we sold to open JD Jul 19 2019 22P @ 0.30, with 44 days until expiration and our short strike about 18% below price action.

- On 10th June 2019, we bought to close JD Jul 19 2019 22P @ 0.15, after 5 days in the trade, for quick premium compounding.

Profit: 15$ per option

Margin: 440$

Return on Margin annualized: 248.86%

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Stay Relaxed

Experience and trading from a plan can help you to make trades in a carefree, relaxed, and…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

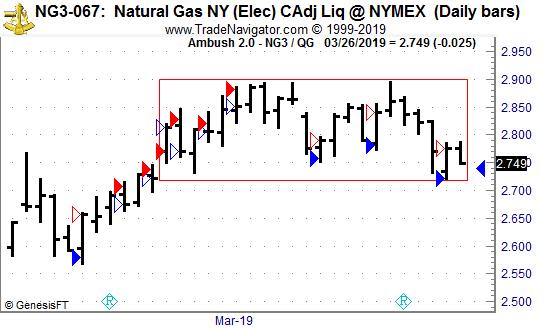

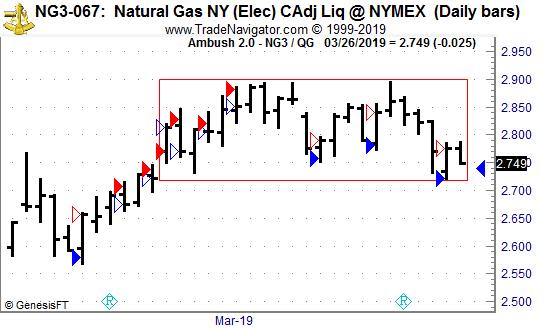

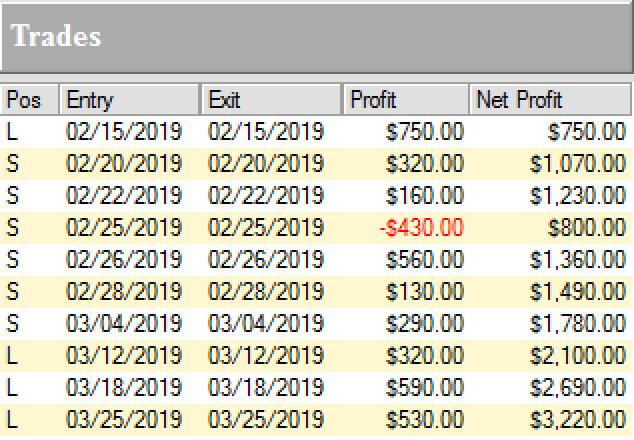

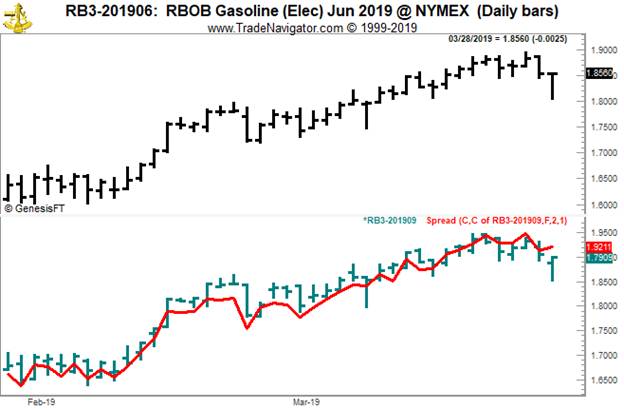

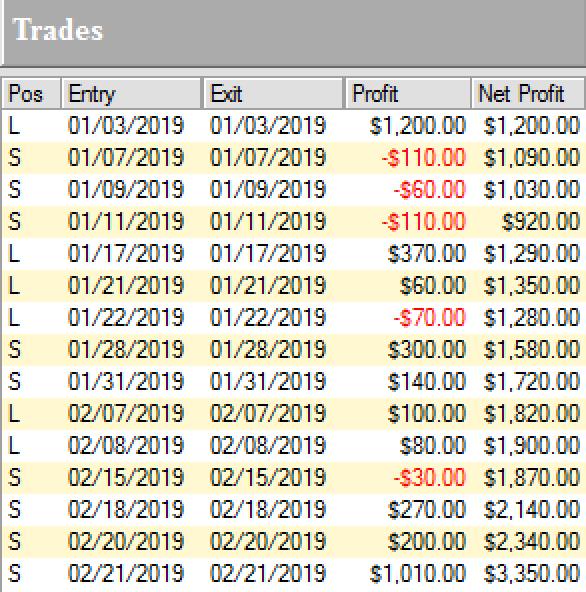

The Russell 2000 is simply too easy to trade right now!

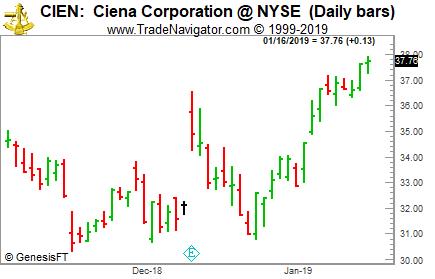

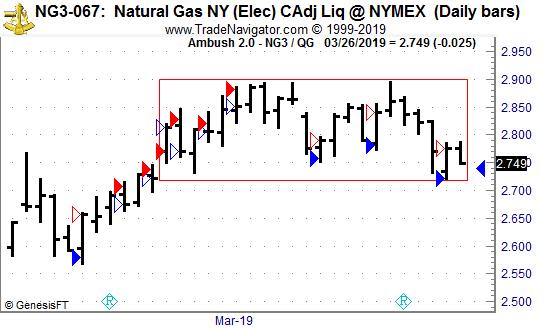

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 Mini Future (RTY/M2K) traded at the CME, where Ambush Traders keep on cashing in big time again over the last couple of months!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

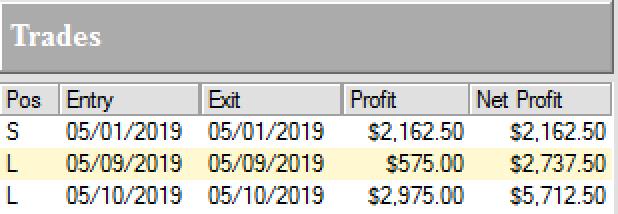

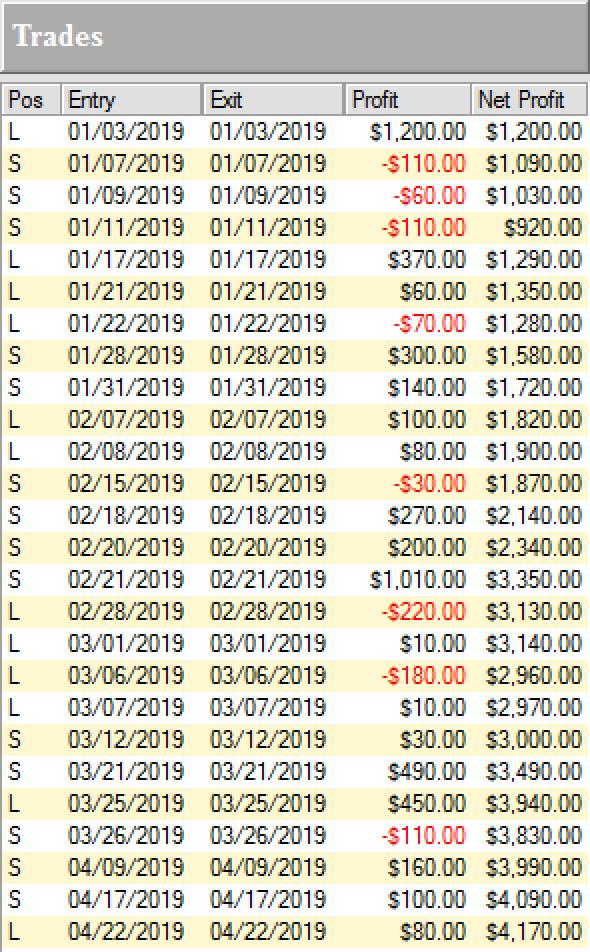

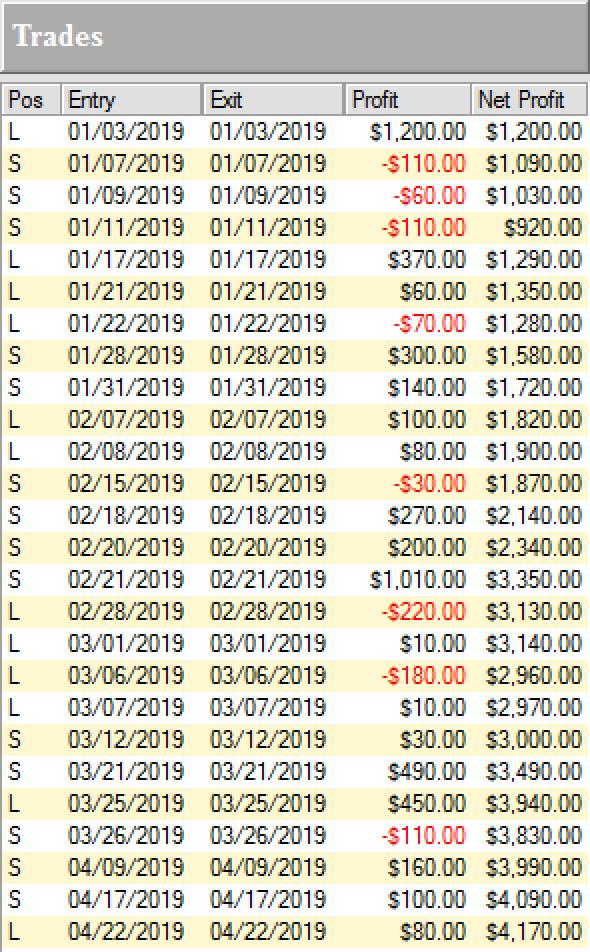

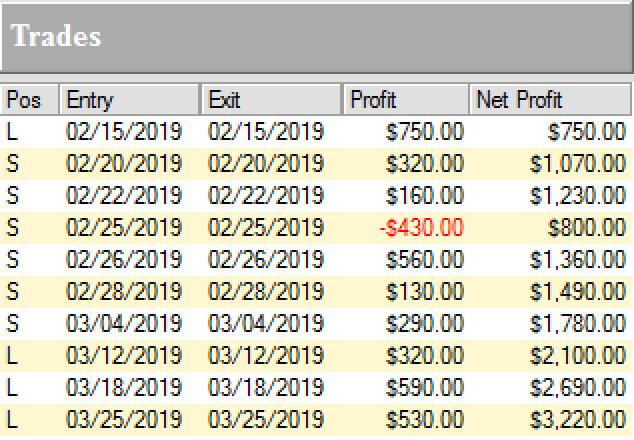

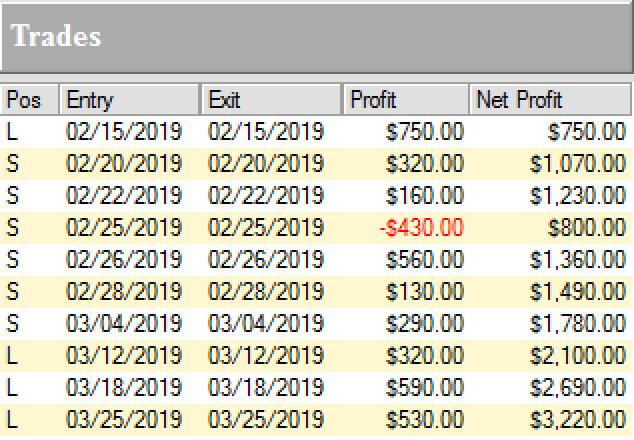

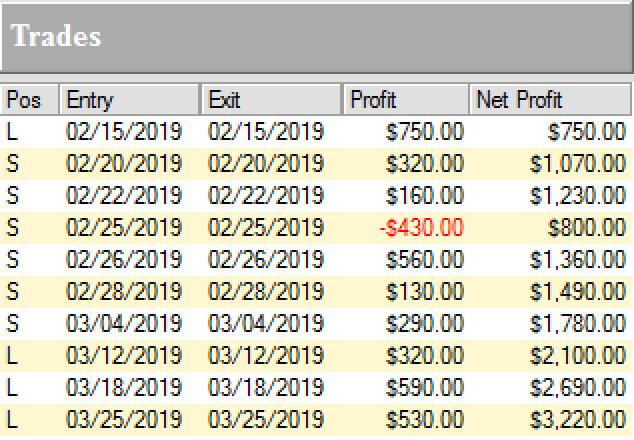

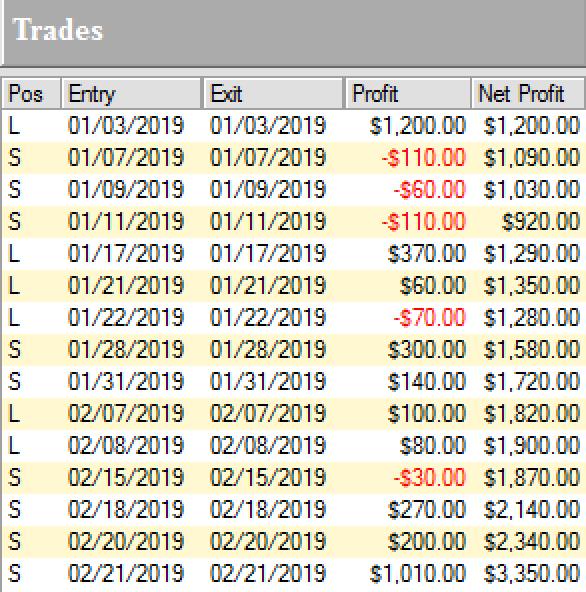

The Russell 2000 a very popular market out there among traders. It has two of the most important things private traders are looking for liquidity and volatility. I won’t even include a daily chart here as it does look quite boring. To keep it brief, the Russell is trading in a wide range for a long time now. Perfect conditions for Ambush and so this has paid out big time, here are all the recent trades:

Yes, that’s over $6000 within just three month and not even 20 trades! Which means Ambush traders made over $300 on average per trade doing nothing more than placing one entry order per day. I guess most active day traders made a lot less…but their brokers rich!

Now those are huge amounts if you have a small account and you might not want to make or lose hundreds or dollars per trade. Thanks to the new Micro Russell 2000 Mini Contracts (M2K) this is not an issue anymore. You can trade these with a small account now. Here are the results trading one M2K contract:

If that is not enough bang for the buck simply size it up and trade two contracts or three. It’s so great now you can position size as you like exactly matching your risk preferences!

In either case you have to ask yourself if you really can afford to miss out on these trades!

So whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 780 - June 14, 2019

If you have trouble opening your eBook(s), please send us an email:

This email address is being protected from spambots. You need JavaScript enabled to view it.

THANK YOU FOR YOUR PATIENCE AND WE APPRECIATE YOUR BUSINESS!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Gold vs Euro

Hey Giuseppe,

Does it make sense for me to convert some of my euros into gold? Can I do it by somehow trading a spread in the futures markets?

Yes, I think I would be worthwhile. Hopefully it’s not too late in the game, but my guess is that with all the problems in Europe, the uptrend we are seeing will last considerably longer.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: You Need Control

The need for control is the biggest psychological impediment to profitable trading. Traders strive to control the markets, but in the end, they find that they must accept their...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

UA Trade

On 21st May 2019 we gave our Instant Income Guaranteed subscribers the following trade on Under Armour Inc. (UA). Price insurance could be sold as follows:

- On 23rd May 2019, we sold to open UA Jul 19 2019 17.5P @ 0.20, with 49 days until expiration and our short strike about 17% below price action.

- On 5th June 2019, we bought to close UA Jul 19 2019 17.5P @ 0.10, after 13 days in the trade.

Profit: 10$ per option

Margin: 350$

Return on Margin annualized: 80.22%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Distraction

Trading is a profession where dare not give up in the face of adversity. You must go into the trading day …read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

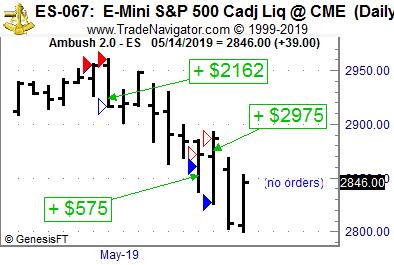

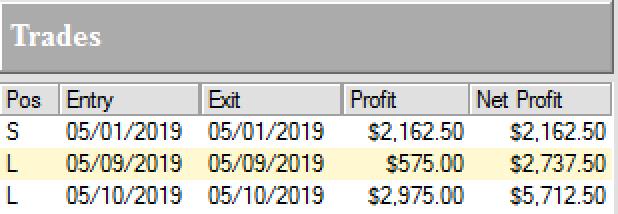

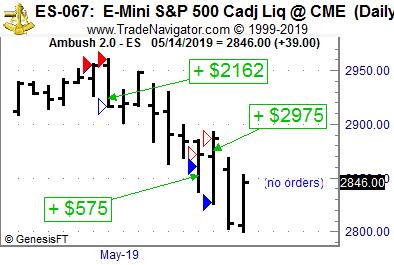

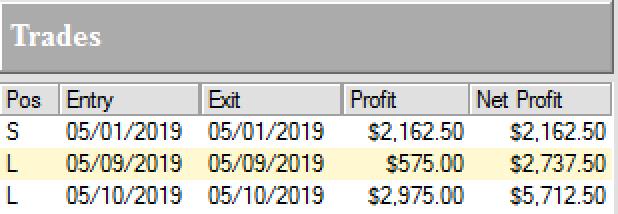

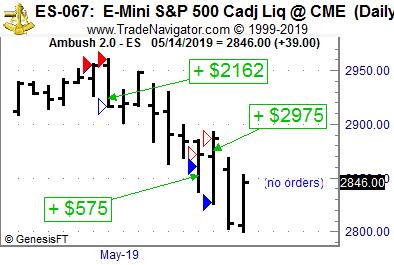

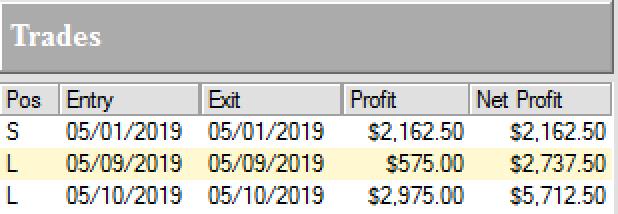

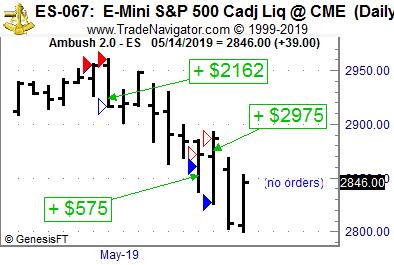

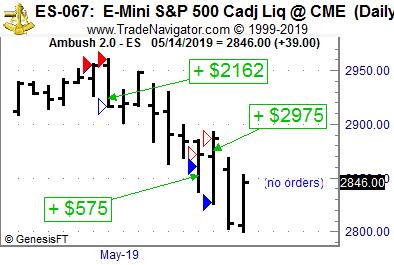

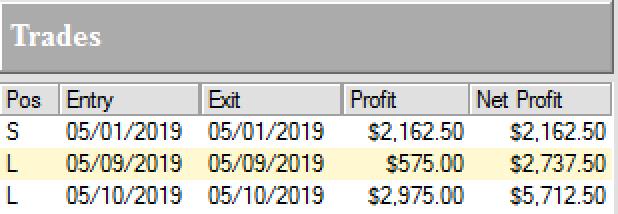

Ambush Traders lock in $5700 of profits in the E-Mini S&P 500!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-Mini S&P 500 Future (ES) traded at the CME, where Ambush Traders cashed in big time again over the last couple of days!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The E-Mini S&P 500 is the most popular market out there. Everyone follows it and most of you guys probably trade it or at least own some ETFs based on the S&P 500 index. Ambush has always been doing well in this market and so it’s no surprise it has actually just made new all time equity highs.

But this month so far has been really crazy. While a lot of traders lost their shirts on the huge reversal we’ve seen related to the news around the trade war with china, Ambush took the other side of these trades and made over $5700 within a couple of days!

Yes, looking at that chart you’re right, Ambush went short pretty much exactly at the all time high of the S&P 500...

You have to ask yourself if you really can afford to miss out on these trades or at least be aware of the signals.

Now with the new Micro E-mini S&P 500 Index Futures (MES) that just started trading at the CME you can also follow these Ambush trades now with a small account:

Yes it’s just 1/10 the size of the regular E-Mini and this allows you to nicely position size into these trades. This is great news as the E-Mini S&P 500 hasn’t been that “mini” any more lately trading at such high prices.

Whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 779 - June 7, 2019

If you have trouble opening your eBook(s), please send us an email:

This email address is being protected from spambots. You need JavaScript enabled to view it.

THANK YOU FOR YOUR PATIENCE AND WE APPRECIATE YOUR BUSINESS!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: MACD

Hey Joe! Is there any way I could have used MACD to get in on the huge drop prices made to new lows? See above chart.

Not the way I learned to trade MACD.

I use MACD only when there are swings high and swings low. Typically, I will look for a reversal bar of the price, followed by confirmation of MACD via a cross over. The cross over must take place no later than 3 bars from the swing-high/low reversal bar. I never use MACD to lead a trade. If the cross over happens before prices swing high or low, I ignore the trade. In the situation you presented, there was no real swing high, no real reversal bar, and the drop came due to a bad earnings report. There is no telling what might have happened had there been a good earnings report. Would prices have spiked higher? Who knows?

I do like to use weekly charts with MACD, which you showed above. Below I will mark the places where I would have used MACD to confirm the price action.

Reversal bars must be the highest high or the lowest low at the end of a swing, and the crossover must come within 3 bars of the highest high, or lowest low.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Trouble Winning?

There has been great interest in the markets lately, so there's no reason that you shouldn't take home huge profits, right? Although many traders...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

After Philippe's Instant Income Guaranteed (IIG) trading example, you must check out his daily guidance trade! Our IIG subscribers are in multiple trades and our program will walk you through each trade. This type of expertise is worth the investment, so become a trader today by using Instant Income Guaranteed!

Trading Idea: Instant Income Guaranteed

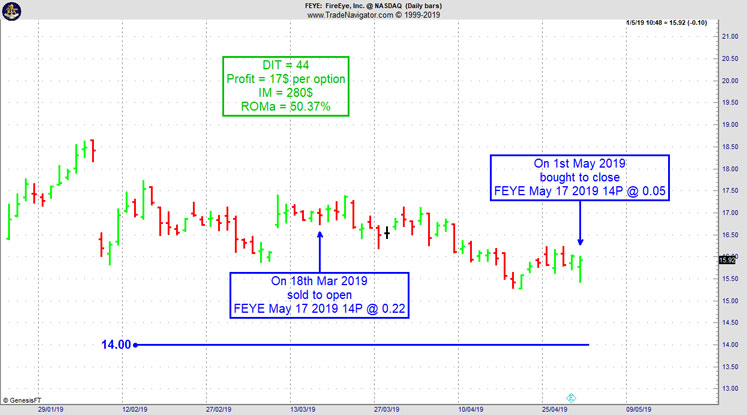

FEYE Trade

- On 18th March 2019, we sold to open FEYE May 17 2019 14P @ 0.22, with 49 days until expiration with our short strike about 18% below price action.

- On 1st May 2019, we bought to close FEYE May 17 2019 14P @ 0.05, after 44 days in the trade.

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

IN CASE YOU MISSED IT...

Here is a recent example of the daily guidance you will receive from Phillipe Gautier using Instant Income Guaranteed. It's worth the investment, subscribe today:

NOTE: THE FOLLOWING IS A DAILY GUIDANCE EMAIL THAT OUR SUBSCRIBERS RECEIVE WHEN SIGNED UP FOR INSTANT INCOME GUARANTEED. WE RESEARCH THE TRADES FOR YOU AND EARN WHILE YOU LEARN TO TRADE. SIGN UP TODAY!

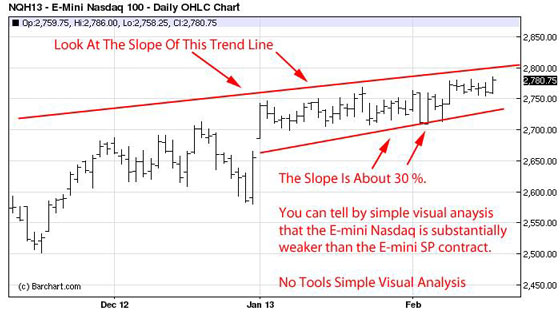

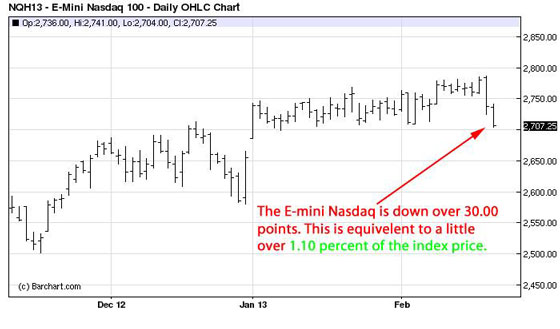

Today all US indices dropped sharply, exceeding mid May lows, even if they recovered part of their intraday losses by the close when buying activity came in: ES -0.86% (close @2780.75), NQ -1.11%, RTY -1.10%, DJT -0.76%, DJX -0.88%. The 2800$ support did not hold for ES.

VIX closed at 17.90, below the 20 “fear level”, but VIX is in a daily uptrend right now (consistent with seasonality).

152 industry groups were down for the day, and only 23 were up.

With the P/C volume ratio reaching 1.26, a bounce could happen.

WDAY’s earnings weighed on software stocks today. Wild move on earnings for GOOSE and ANF, both down more than 25%.

Grains (especially corn, see attached text file) are on potential major cyclical lows. Trade war apart, this should help ADM (-0.10% today), ANDE (+0.70%), BG (+2.35%).

FEYE recovered 4.00% to 14.81 around daily resistance level , nice performance on a down day.

Some of our laggards posted decent gains: HCLP +5.83%, HL +4.76%, HMY +2.55%.

FNKO and BJ retested their daily support levels today.

MOMO jumped 3.44% to daily resistance level.

UA dropped 3.05%, but that was not sufficient to give us a fill for our second entry at 0.35 (fills at 0.30).

ETSY also dropped 4.52% but no entry fill yet (fills at 0.35, 5 cents below our entry price).

SSYS had a wild day but managed to close near its intraday high (-0.41% for the day, close at 22.02, 48 cts below our long call strike). There were fills today at 0.50 for our spread. The mid price of the spread at the close is 0.625, right at 50% of our buying price. We now need a quick recovery, to our long call strike at least, or we will have to take a loss to avoid the maximum loss (which is guaranteed if SSYS stays below our long call strike by expiration).

Kind Regards,

Philippe Gautier

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Persistence is Needed in Trading

Trading is a profession where dare not give up in the face of adversity. You must go into the trading day …read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders lock in $5700 of profits in the E-Mini S&P 500!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-Mini S&P 500 Future (ES) traded at the CME, where Ambush Traders cashed in big time again over the last couple of days!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The E-Mini S&P 500 is the most popular market out there. Everyone follows it and most of you guys probably trade it or at least own some ETFs based on the S&P 500 index. Ambush has always been doing well in this market and so it’s no surprise it has actually just made new all time equity highs.

But this month so far has been really crazy. While a lot of traders lost their shirts on the huge reversal we’ve seen related to the news around the trade war with china, Ambush took the other side of these trades and made over $5700 within a couple of days!

Yes, looking at that chart you’re right, Ambush went short pretty much exactly at the all time high of the S&P 500...

You have to ask yourself if you really can afford to miss out on these trades or at least be aware of the signals.

Now with the new Micro E-mini S&P 500 Index Futures (MES) that just started trading at the CME you can also follow these Ambush trades now with a small account:

Yes it’s just 1/10 the size of the regular E-Mini and this allows you to nicely position size into these trades. This is great news as the E-Mini S&P 500 hasn’t been that “mini” any more lately trading at such high prices.

Whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 778 - May 31, 2019

If you have trouble opening your eBook(s), please send us an email:

This email address is being protected from spambots. You need JavaScript enabled to view it.

THANK YOU FOR YOUR PATIENCE AND WE APPRECIATE YOUR BUSINESS!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

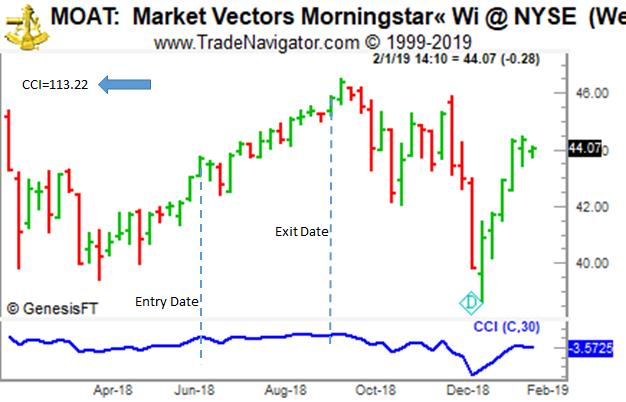

Chart Scan with Commentary: CCI

Hey Joe! What can a trader do with the CCI (Commodity Channel Index)?

Interesting question! Here are couple of things you might want to know about CCI. Believe it or not, it is very similar in concept to Bollinger Bands, which we discussed last week.

Bollinger Bands are showing you how today’s closing price compares with the closing prices of the last X number of days. You see it displayed as a simple moving average, with outer band lines at a distance of 2 standard deviations from the moving average of the closing prices of the last X days. BBs are plotted in the same window pane as are the prices.

CCI, however, is plotted as a single line in a separate pane. You see it as an oscillator with no limit on values within the pane. The CCI line can go up in value theoretically forever, or down in value, theoretically forever. CCI compares today’s typical price to a moving average of typical prices for X number of days’ and its value represents the mean deviation of today’s typical price from the moving average. Typical price can be the high + the low + the open + the close: divided by 4, or as simple as open + close: divided by 2, or any other combination of prices. CCI is typically plotted as an oscillator with the possibility of infinite values, however, once the value of CCI exceeds +100 or -100 it indicates that prices are beginning to trend. All values between +100 and -100 are essentially meaningless for purposes of trend identification. +100 indicates prices are moving up. -100 indicates that prices are trending down.

So, what can you do with it?

I use it to tell me when it seems safe to sell a naked put option. However, I can use it to go long the underlying stock or futures; buy a call option and sell a put option—creating a synthetic long position, or simply to buy a call.

For all the years I’ve used CCI, I set the moving average at 30 bars, which seems to work best for me.

Below is an example of selling a naked put with the help of CCI. Bear in mind that there are a number of other things I look at, which are taught in our course on Instant Income. I don’t just trade because CCI is above +100 or below -100.

On June 15, 2018 CCI moved above +100 to a value of 113.22. I then sold a naked $40 September put. As you can see, by the September option expiration prices were still climbing.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Worry-Free and Profitable

Even though there is great interest in the markets these days, and more opportunities than usual, it's vital to approach...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

After Philippe's Instant Income Guaranteed (IIG) trading example, you must check out his daily guidance trade! Our IIG subscribers are in multiple trades and our program will walk you through each trade. This type of expertise is worth the investment, so become a trader today by using Instant Income Guaranteed!

Trading Idea: Instant Income Guaranteed

KTOS Trade

-

On 22nd March 2019, we sold to open KTOS Aug 16 2019 12.5P @ 0.375 (average price), with 143 days until expiration with our short strike about 20% below price action.

-

On 10th May 2019, we bought to close KTOS Aug 16 2019 12.5P @ 0.10, after 49 days in the trade.

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Here is a recent example of the daily guidance you will receive from Phillipe Gautier using Instant Income Guaranteed. It's worth the investment, subscribe today:

NOTE: THE FOLLOWING IS A DAILY GUIDANCE EMAIL THAT OUR SUBSCRIBERS RECEIVE WHEN SIGNED UP FOR INSTANT INCOME GUARANTEED. WE RESEARCH THE TRADES FOR YOU AND EARN WHILE YOU LEARN TO TRADE. SIGN UP TODAY!

Today all US indices dropped sharply, exceeding mid May lows, even if they recovered part of their intraday losses by the close when buying activity came in: ES -0.86% (close @2780.75), NQ -1.11%, RTY -1.10%, DJT -0.76%, DJX -0.88%. The 2800$ support did not hold for ES.

VIX closed at 17.90, below the 20 “fear level”, but VIX is in a daily uptrend right now (consistent with seasonality).

152 industry groups were down for the day, and only 23 were up.

With the P/C volume ratio reaching 1.26, a bounce could happen.

WDAY’s earnings weighed on software stocks today. Wild move on earnings for GOOSE and ANF, both down more than 25%.

Grains (especially corn, see attached text file) are on potential major cyclical lows. Trade war apart, this should help ADM (-0.10% today), ANDE (+0.70%), BG (+2.35%).

FEYE recovered 4.00% to 14.81 around daily resistance level , nice performance on a down day.

Some of our laggards posted decent gains: HCLP +5.83%, HL +4.76%, HMY +2.55%.

FNKO and BJ retested their daily support levels today.

MOMO jumped 3.44% to daily resistance level.

UA dropped 3.05%, but that was not sufficient to give us a fill for our second entry at 0.35 (fills at 0.30).

ETSY also dropped 4.52% but no entry fill yet (fills at 0.35, 5 cents below our entry price).

SSYS had a wild day but managed to close near its intraday high (-0.41% for the day, close at 22.02, 48 cts below our long call strike). There were fills today at 0.50 for our spread. The mid price of the spread at the close is 0.625, right at 50% of our buying price. We now need a quick recovery, to our long call strike at least, or we will have to take a loss to avoid the maximum loss (which is guaranteed if SSYS stays below our long call strike by expiration).

Kind Regards,

Philippe Gautier

BECOME A PART OF OUR TRADING TEAM

JOIN TODAY

INSTANT INCOME GUARANTEED

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Pivot Points

I have never been a pivot point trader per se. Pivot Points are those price levels that are most likely to act as levels of…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders lock in $5700 of profits in the E-Mini S&P 500!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-Mini S&P 500 Future (ES) traded at the CME, where Ambush Traders cashed in big time again over the last couple of days!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The E-Mini S&P 500 is the most popular market out there. Everyone follows it and most of you guys probably trade it or at least own some ETFs based on the S&P 500 index. Ambush has always been doing well in this market and so it’s no surprise it has actually just made new all time equity highs.

But this month so far has been really crazy. While a lot of traders lost their shirts on the huge reversal we’ve seen related to the news around the trade war with china, Ambush took the other side of these trades and made over $5700 within a couple of days!

Yes, looking at that chart you’re right, Ambush went short pretty much exactly at the all time high of the S&P 500...

You have to ask yourself if you really can afford to miss out on these trades or at least be aware of the signals.

Now with the new Micro E-mini S&P 500 Index Futures (MES) that just started trading at the CME you can also follow these Ambush trades now with a small account:

Yes it’s just 1/10 the size of the regular E-Mini and this allows you to nicely position size into these trades. This is great news as the E-Mini S&P 500 hasn’t been that “mini” any more lately trading at such high prices.

Whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 777 - May 24, 2019

It seems a recent update has affected any customer that purchased an eBook(s), we are sorry for any inconveniences. Please email us at This email address is being protected from spambots. You need JavaScript enabled to view it. if there are other concerns to address.

THANK YOU FOR YOUR PATIENCE WHILE ACTIVELY WORK ON THIS MATTER

WE APPRECIATE YOUR BUSINESS!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Bollinger Bands

Hey Joe! I know you have used Bollinger Bands with options when there is a reversal bar at one of the outer bands. Are there other ways to us it?

First, realize that most people use it as an indicator to locate overbought and oversold market conditions.

Yes! BBs can be used as a short-term trading indicator to determine market conditions and market direction. The idea is to sell when the price reaches above the upper band and to purchase when the market gets below the lower Bollinger Band.

The BBs also work very well for fading trends when the market is range bound and choppy. However, when markets are trending strongly, using the Bollinger Bands for picking tops and bottoms is highly discouraged. Traders who make this mistake can end up paying a huge price.

I’ve found it useful to use BBs to determine if the market is in fact range bound or trending. This helps me when trading options. However, I do change the settings from the standard 20 bar moving average of the close, along with two standard deviations for the outer bands, to a 15 day moving average along with two standard deviations.

To determine a strong up trend you want to see the upper band sloping upwards, with price bars touching or penetrating the upper band.

Notice how the upper band rises and prices are either coming very close, touching or penetrating the upper band.

Below you can see an example of how the BBs catch a strong downtrend. Notice the slope of the lower band and how the prices are moving and collecting at that band. This is a good sign that markets are headed sharply down, you can also see at one point the band is flattening out and market is becoming range bound and flat as well. This is what makes the Bollinger band one of the best short term trading indicators, the ability to analyze market conditions in volatile and flat markets.

Notice that in the beginning part of the GLD chart, and the latter part of the AA char prices are flat and sideways. There you see that the bands are flat and most of the price action is contained inside the bands. The Bollinger Bands do a very good job of identifying market conditions.

There are several ways your trading can benefit from using BBs to determine market direction. If you are trading a breakout or a trend following strategy, you can use this method as a filter to confirm that market is in fact trending strongly either upwards or downwards. If you are trading a flat market strategy or a reversal strategy you can use this method as filter to confirm that the market is in fact flat.

By using the Bollinger Band as a filter to determine market conditions and market direction you will avoid trading trend following strategies during dull flat market conditions and avoid picking tops and bottoms during strong trending market conditions.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Where the Public Go Next?

Even during a strong bull market, you have to do your homework. Many stocks will go up while the public is interested in trading the markets, but not all stocks are equal. Some will...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

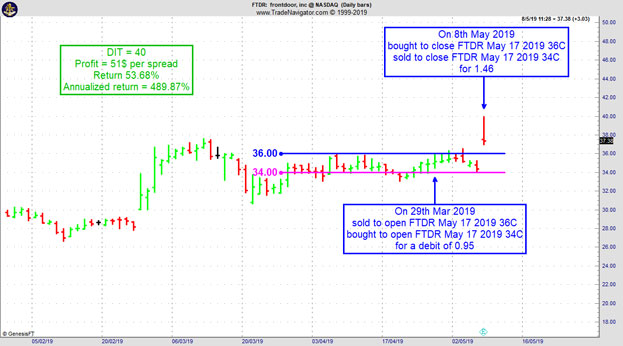

FTDR Trade

- On 29th March 2019, we sold to open FTDR May 17 2019 36C and bought to open FTDR May 17 2019 34C for a debit of 0.95.

- On 8th May 2019, we bought to close FTDR May 17 2019 36C and sold to close FTDR May 17 2019 34C for 1.46.

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Believe in Trading

Is there anything we can believe when it comes to trading? Is it all lies and fakery?

Trading is a challenge. Tens of thousands are…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders lock in $5700 of profits in the E-Mini S&P 500!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-Mini S&P 500 Future (ES) traded at the CME, where Ambush Traders cashed in big time again over the last couple of days!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The E-Mini S&P 500 is the most popular market out there. Everyone follows it and most of you guys probably trade it or at least own some ETFs based on the S&P 500 index. Ambush has always been doing well in this market and so it’s no surprise it has actually just made new all time equity highs.

But this month so far has been really crazy. While a lot of traders lost their shirts on the huge reversal we’ve seen related to the news around the trade war with china, Ambush took the other side of these trades and made over $5700 within a couple of days!

Yes, looking at that chart you’re right, Ambush went short pretty much exactly at the all time high of the S&P 500...

You have to ask yourself if you really can afford to miss out on these trades or at least be aware of the signals.

Now with the new Micro E-mini S&P 500 Index Futures (MES) that just started trading at the CME you can also follow these Ambush trades now with a small account:

Yes it’s just 1/10 the size of the regular E-Mini and this allows you to nicely position size into these trades. This is great news as the E-Mini S&P 500 hasn’t been that “mini” any more lately trading at such high prices.

Whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 776 - May 17, 2019

It seems a recent update has affected any customer that purchased an eBook(s), we are sorry for any inconveniences. Please email us at This email address is being protected from spambots. You need JavaScript enabled to view it. if there are other concerns to address.

THANK YOU FOR YOUR PATIENCE WHILE ACTIVELY WORK ON THIS MATTER

WE APPRECIATE YOUR BUSINESS!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Should I Buy Gold?

Chart Scan is not an advisory. I intend it to be a teaching letter. However, in this issue of Chart Scan I want to answer the question above. It’s a question I hear on a regular basis. Following are some things you should consider when thinking about buying gold.

“Monster Gold-Mining Deals Pile Pressure on Those Left Behind.”

The January 14 Bloomberg headline above might not seem like much, but it is really something to think about. Here’s why.

When an industry consolidates, investors can make a lot of money. Consolidation means buyouts—which usually come at a premium… And premiums boost stock prices higher. But that’s not the only reason the above is worthy of your attention. Mergers among mining companies are signaling a shift in the gold market, as well.

Those who know me know that I recommend holding a small percentage (5–10%) of chaos hedges like gold in of your portfolio. These assets provide insurance in times of crisis. But under the right conditions, they can also boost your wealth.

In today’s article, I’ll tell you why 2019 is shaping up to be a year in which holding gold will start to pay off.

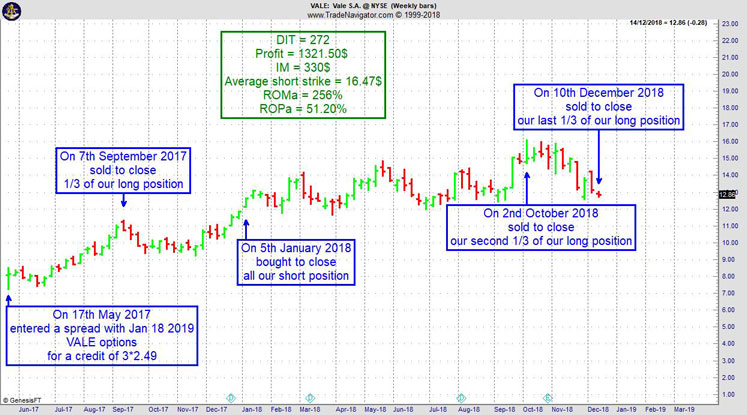

Over the past six months, the gold mining industry has seen two megamergers.

In September 2018, A major gold miner bought a competitor for $6 billion. The merger made the major miner the largest gold mining company in the world… But that title won’t last long.

Recently, another major miner announced it would buy a rival miner for $10 billion. If the deal goes through, this latter miner will unseat the former as the world’s biggest gold miner. This wave of consolidation will probably continue.

The two major miners still represent only six or seven percent of global mine supply, so it’s still a very fragmented industry and I think investors are rightfully demanding that there’s a bit more consolidation.

And miners aren’t just merging because the industry is fragmented. They’re merging because it’s also necessary for their survival. That’s why the pressure is on for them to join forces.

I’ve heard the following dozens of times, “Gold Supply is Drying Up!” I decided to look more deeply into that statement to see if this time it might be believable. Here’s what I found:

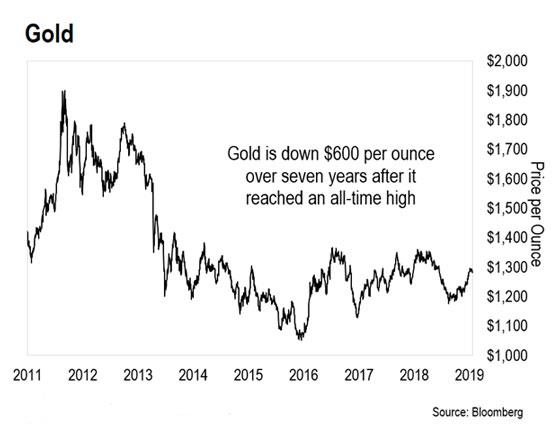

Over the past seven years, we’ve seen a massive bear market in gold. As you can see in the chart below, gold is down $600 from its peak in September 2011…

Due to lower prices, miners have had to tighten their budgets. And in tough times, one of the first budget items to go is exploration. After all, if gold isn’t profitable, why look for it?

It hasn’t just been gold miners cutting back, either. Metals miners across the board have done so as well.

Capital spending is projected to be less than half of what it was at its peak in 2012. And smaller exploration budgets mean miners are finding fewer new deposits. On top of that, the new deposits aren’t as good as old ones.

In a recent private correspondence, I was told, “Mine grades and life are dwindling.” Since the source of this statement is from a company that does the drilling for exploration teams, I have a strong reason to believe it.

Adding to the supply crunch are production costs. Over the past 15 years, they’ve skyrocketed about 300% for major gold companies.

For example, one of the major miners had an average production cost of $300 per ounce in 2004. Ten years later, it rose to $800. Another major miner’s production costs jumped from $278 per ounce in 2004 to $922 last year.

Lower gold prices combined with higher productions costs mean one thing: dwindling supply. That’s good for gold prices—and gold investors…

An old saying goes like this: “The Cure for Low Prices Is Low Prices.” It’s a common saying amongst commodity investors.

When prices are low, miners aren’t making money. So they stop exploring new mines. The lack of supply creates scarcity. But scarcity eventually pushes prices back up.

That’s why miners are merging. They’re desperate for profits and hoping they can make up for lower profitability by increasing scale. But that’s a short-term solution.

Still, the long-term outlook for gold is positive. As gold becomes scarcer, prices will eventually rebound.

Now, it could take a couple years for this trend to play out. But when it finally does, we’ll see gold rise over 50% and reach new all-time highs.

The key thing, if you are going to use gold as a hedge to protect your assets is to get positioned now, before the move higher.

So, should you buy gold? I can tell you only that it’s what I have done.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Is it Really All About Image?

Preconceived images have a powerful influence on our decisions. If we believe that a company has a hot new product, we can't help but think its stock price is bound to go up. Trading the...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

NTR Trade

- On 9th May 2019, on a GTC order, we sold to open NTR Jun 21 2019 45P @ 0.45, right ahead of earnings, as NTR retested the March swing low in the 50.50$ area as anticipated.

- On 10th May 2019, we bought to close NTR Jun 21 2019 45P @ 0.20 on earnings day, after only one day in the trade, for quick premium compounding

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

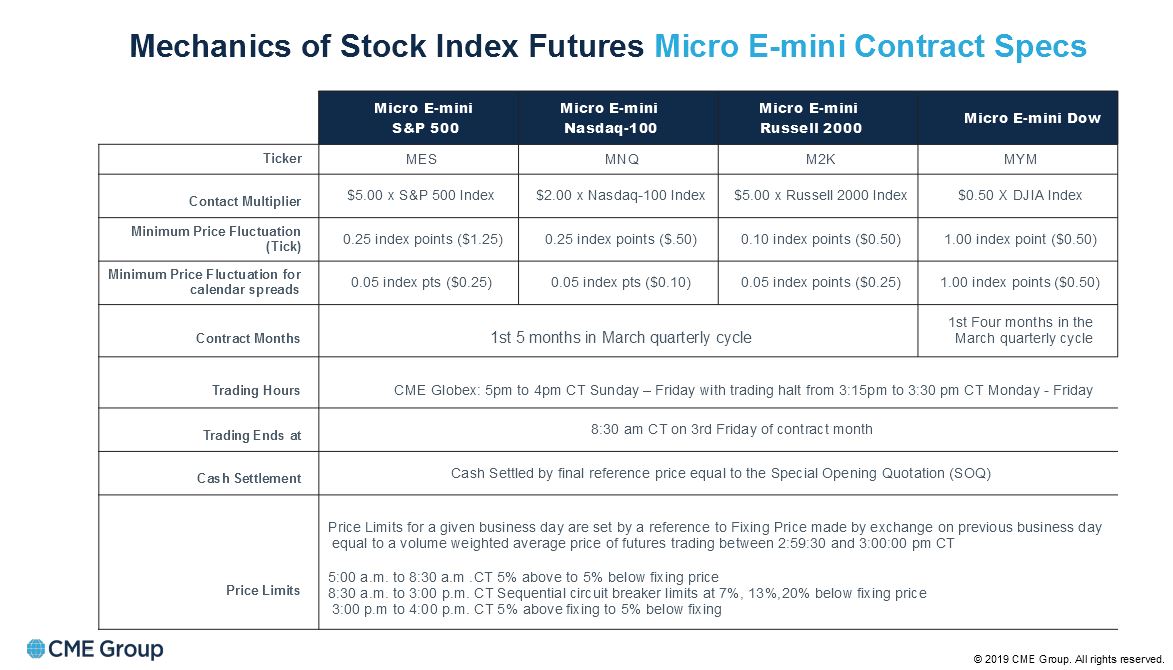

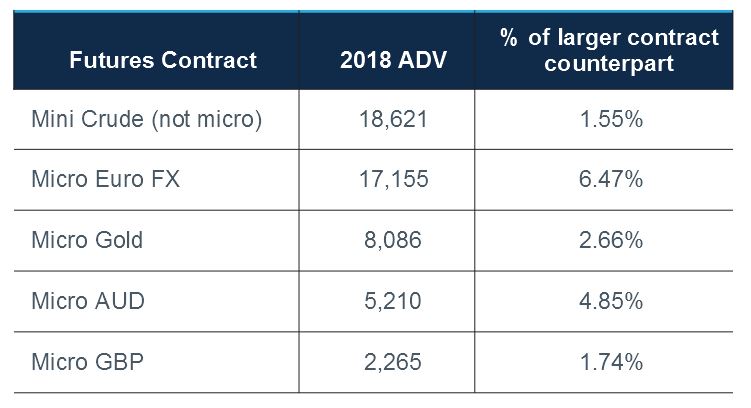

The next big thing in equities trading is here!

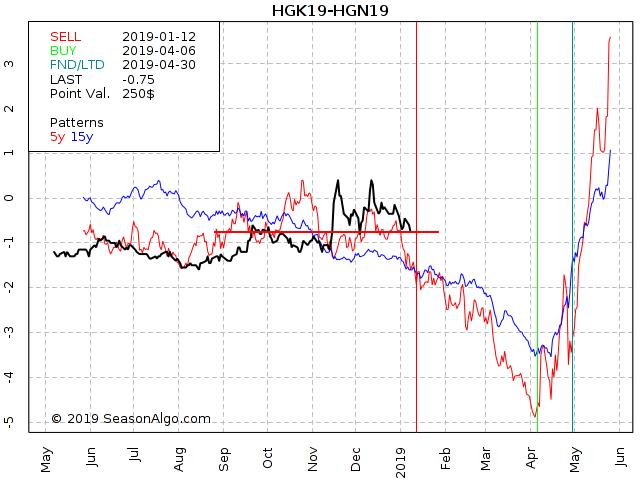

This is what the CME says about their new product the Micro E-mini futures for the 4 major US indexes. The S&P 500, the Dow, the Nasdaq and the Russell 2000.

https://www.cmegroup.com/cme-group-futures-exchange/micro-futures.html

From what I can tell, this new products are really great especially with all the high volatility we see right now in the US indexes.

While it was easy to trade in the indexes with a small account and little risk, it got almost impossible during the last few years. The average amount on a 15 minute bar in the Nasdaq is about $400 to $500 these days which makes it almost impossible to trade these markets with small accounts.

That’s where I see a lot of potential with the Micros which are only 1/10 of the E-minis and a commission of about ½ of what we pay on the E-minis.

Finally you can open a futures account with only $2k and trade the indexes and you do not have to move into the stock market. No! You can trade real futures now with very little money.

By the way, there are not only micros or minis in the indexes now, you can also find them in the Currencies or Gold or trade Mini-Sized products in Crude or even Wheat, Corn or Soybeans.

In my opinion all the Micros and Mini-Sized products in the futures market are a big step forward for the retail trader, especially at the beginning of his or her trading career.

Good trading,

Andy Jordan

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders lock in $5700 of profits in the E-Mini S&P 500!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-Mini S&P 500 Future (ES) traded at the CME, where Ambush Traders cashed in big time again over the last couple of days!

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The E-Mini S&P 500 is the most popular market out there. Everyone follows it and most of you guys probably trade it or at least own some ETFs based on the S&P 500 index. Ambush has always been doing well in this market and so it’s no surprise it has actually just made new all time equity highs.

But this month so far has been really crazy. While a lot of traders lost their shirts on the huge reversal we’ve seen related to the news around the trade war with china, Ambush took the other side of these trades and made over $5700 within a couple of days!

Yes, looking at that chart you’re right, Ambush went short pretty much exactly at the all time high of the S&P 500...

You have to ask yourself if you really can afford to miss out on these trades or at least be aware of the signals.

Now with the new Micro E-mini S&P 500 Index Futures (MES) that just started trading at the CME you can also follow these Ambush trades now with a small account:

Yes it’s just 1/10 the size of the regular E-Mini and this allows you to nicely position size into these trades. This is great news as the E-Mini S&P 500 hasn’t been that “mini” any more lately trading at such high prices.

Whether you’re trading a $10k account or a $100k account, Ambush has the right markets for you to start following the signals.

Again, ask yourself if you really can afford to miss out on these trades or at least be aware of the signals? Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides?

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 775 - May 10, 2019

Thank you for your patience and understanding with our recent technical difficulties.

We hope to be 100% online as soon as possible.

Please let us know if you experienced any other issues during this time:

This email address is being protected from spambots. You need JavaScript enabled to view it.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

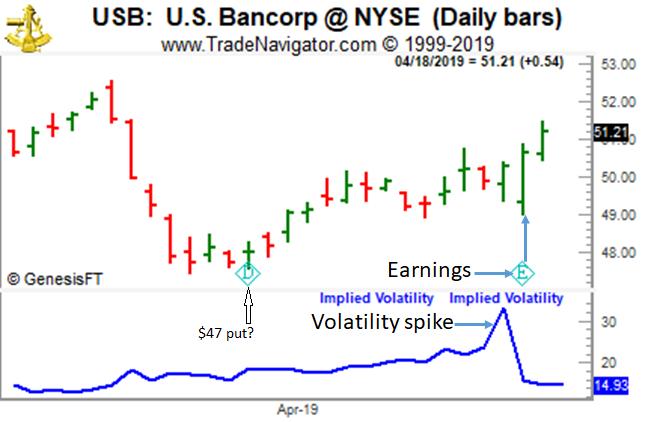

Chart Scan with Commentary: My Favorite Way to Trade Earnings Dates

Earnings reports enable me to be an occasional trader, in no way tied to a trading screen. In my semi-retirement, I trade only around earnings reports, which means I trade for a few days once each quarter when earnings are reported. That leaves me a lot of time for other activities.

I found that whenever the price of shares shoots up after earnings, I am able to get a second trade the day after prices react to the earnings report. The way I do it is through the strategies we use in out Instant Income Guaranteed program (IIG). Using Implied Volatility as described in the most recent issues of Chart Scan, and following with IIG the following day may be the perfect way to trade around earnings dates.

If share prices shoot up the day after the earnings report hits the market, why not sell some put options. Take a look at the following chart of U.S. Bancorp:

We see the volatility spike the day before earnings. We see that prices initially dropped but made a strong recovery by the end of the day. The next day prices continued the upward momentum from earnings day. Why not consider selling a $47 put if the premium is satisfactory?

Let’s look at a recent IIG trade. We make these kinds of trades over and over again. They are not at all unusual.

PETQ trade

On 26th March 2019 we gave our Instant Income Guaranteed subscribers the following trade on PetIQ Inc. (PETQ). Price insurance (put) could be sold as follows:

- On 27th March 2019, we sold to open PETQ May 17 2019 21P @ 0.25, with 50 days until expiration with our short strike about 31% below price action, making the trade pretty safe..

- On 10th April 2019, we bought to close PETQ May 17 2019 21P @ 0.10, after 14 days in the trade.

Profit: 15$ per option

Margin: 420$

Return on Margin annualized: 93.11%

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Impulsive Trading

Why do so many traders abandon their trading plan? Is it their personality, an inherent pitfall of the trading profession, or temporary insanity? A host of factors may contribute to a lack of...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

QTNA Trade

- On 6th February 2019, we sold to open QTNA Apr 18 2019 12.5P @ 0.20, with 72 days until expiration and our short strike about 22% below price action.

- On 18th April 2019, QTNA Apr 18 2019 12.5P expired worthless

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! WEALTH BUILDING FOR YOUR FUTURE ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

EXTRA! EXTRA! READ ALL ABOUT IT...

CME Group is aiming to make equity index futures trading more accessible to active traders through the launch of Micro E-mini futures on the S&P 500, Nasdaq-100, Russell 2000 and Dow Jones Industrial Average indexes.

"Futures trading has been growing in popularity for active traders all over the world," says Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products. "The smaller contract size of Micro E-mini equity index futures will make it easier to more nimbly execute a variety of equity trading strategies, while benefiting from the deep liquidity that CME Group markets offer around the clock."

For more information, CLICK HERE!

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Is Trading all Lies and Fakery?

Trading is a challenge. Tens of thousands are drawn to trading, but few last more than a few months.

Trading is presented…read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Traders Notebook Complete

Learn how to manage this trade by getting daily detailed trading instructions, click here!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

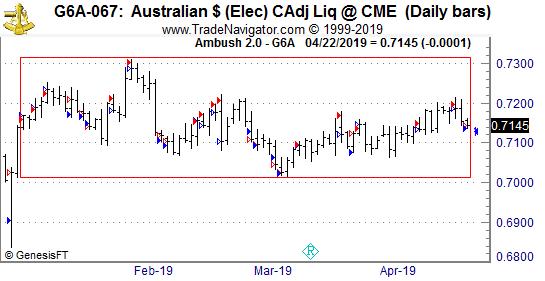

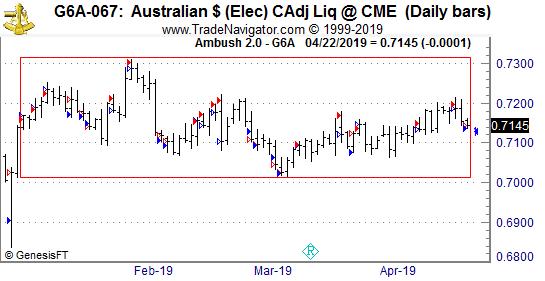

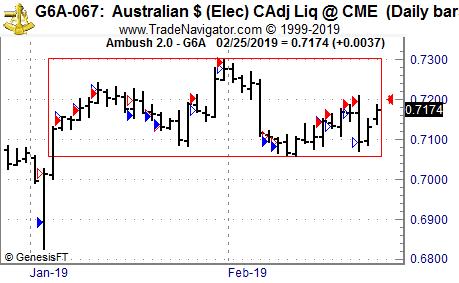

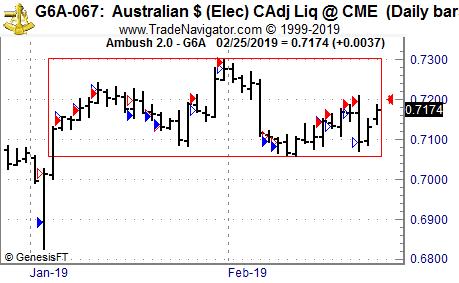

Ambush extends its crazy rally in the Australian Dollar!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including the Australian Dollar Future (6A) traded at the CME, where Ambush Traders are having an amazing time so far in 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Some of you might remember the last time we had a look at the Aussie Dollar in February. Till then Ambush showed an amazing performance trading that currency in 2019. But how did things go on from there? Was it worth buying the Ambush eBook or signing up to Ambush Signals to take the following trades?

The answer is a clear YES. The 6A just kept on moving in tight ranges and has been trading between about 0.71 and 0.73 for the whole year now. Just perfect conditions for Ambush allowing the Australian Dollar to make new equity highs in its Ambush performance.

That method still was able to capture some nice profits, often getting in at the top/bottom of a day’s range!

Once you realise that this isn’t that uncommon but that it’s exactly what the markets do most of the time don’t you want a strategy that works well under such conditions?

Where is the Australian Dollar going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

Here’s the result of all of these trades, trading one Australian Dollar Index (6A) contract, including $10 commissions/slippage per trade. We’re up over $4000 in the Aussie Dollar now, and that’s just one of many markets Ambush covers!

Now if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

TWO WAYS TO JOIN US

AND BECOME AN AMBUSH TRADER!

1) AMBUSH SIGNALS

OR

2) AMBUSH EBOOK

READ ON....

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush eBook and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2019 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 774 - May 3, 2019

Due to technical difficulties, last week's newsletter was postponed until today!

Thank you for your patience and understanding. Enjoy!

We will extend our 20% OFF discount on all eBooks until May 8, 2019

Use coupon code during checkout: ebooks20

Please let us know if you experienced any other issues during this time:

This email address is being protected from spambots. You need JavaScript enabled to view it.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Quick Reversals

One of the better money-making trading patterns is something you might call a “quick reversal.”

These are not the easily identified major reversal bars you see at the end of a swing or trend. The one I will be describing in this issue of Chart Scan requires fast action on your part. The reversal pattern is especially good for scalping in the context of day trading.

A quick reversal is a short 1-day reversal opposite the main trend.

When the pattern is forming it looks like the market is suddenly breaking out in the opposite direction from the trend. However, as the day continues the market quickly changes direction and closes back in line with the main trend.

In the example below, you can see how prices gap down against the trend, and at first appear to be heading down.

However, as the day progresses buyers come into the market who feel that this is a good buying opportunity, and momentum going in the direction of the trend begins again.

This is a short term trade that's designed to take advantage of prices being temporarily out of balance.

Make sure the breakaway day closes in the upper 20 percent of the trading day.

You want to make sure momentum is coming into the market the day before your entry.

Let’s look at this on a daily chart GLD, aka, Spider Gold Trust.

You need 1-day gap away from the main trend and a close near the high of the day as the best setup for the trade.

The next day is the entry day, and this is the most important time because this strategy moves fast, and you want to make sure you don't miss the momentum coming into the market.

The entry point is above the high that was made on the signal bar which is the gap down bar.

The best trades get filled at or near the opening bell so you probably want to place a buy stop order just above the gap-day high price.