Joe Ross

Edition 692 - September 15, 2017

Edition 692 - September 15, 2017

AMBUSH TRADING METHOD - ALL TIME EQUITY HIGHS!

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

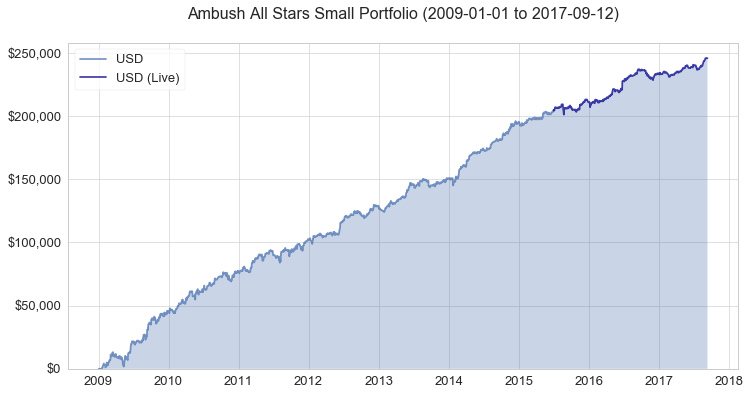

Ambush made new all time equity highs having its best month EVER!

You may remember earlier this year in my previous report when I announced that Ambush had made new all time equity highs. Well, guess what? It didn’t stop there and it literally exploded much higher while having its best trading month ever!

Looking at the whole futures systematic trading industry, 2017 has been an exceptionally difficult year. Of all the systems that I’m following, Ambush is literally the only one that kept performing as usual this year.

Ambush has been around for almost 10 years now but as markets tend to change, I do review Ambush once a year to see if any changes are necessary to adapt to changing market conditions. The last time any significant changes have been required was in July 2015. As you can see on the following chart Ambush kept on performing as expected in live trading.

Funny enough it just beat its pre-live backtest and as of August has been its best trading month EVER! This really says something about a trading method if it beats its historical backtest performance in live-trading doesn’t it?

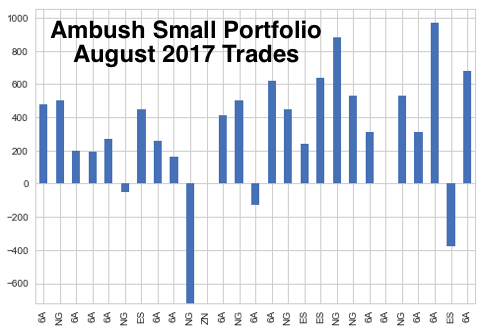

Let’s look at the Ambush All Stars Portfolio for Small Accounts (you can find out more about the sample portfolios on the Performance Page) in August.

Looking at all the August trades in detail, we can see that the profits have been nicely distributed across the different markets.

In total the portfolio gained more than $8,000 in August, with 85% winning trades while having made over 1.4 times more profits on winning trades than on losing trades. Yes, really and yes this is crazy!

Now obviously "crazy" happens and it’s fun to talk about it but of course you want to see more than just a chart showing you what happened last month right? How did the Australian Dollar perform over the years? What are the different portfolios made of? How’s your favorite market doing with Ambush?

To find out about all of the above, simply go to the Performance Page where you’ll find all the stats you need.

Join us and become an Ambush Trader!

The easiest way to follow Ambush is, of course, Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close!

If you following any System it can be tough in the beginning. It simply needs time to build the confidence needed to make it through drawdowns. What if you’re unlucky and don’t catch Ambush’s best trading month ever when you start trading?

I want you to succeed trading Ambush, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a profitable Ambush trader.

I offer you 6 months of Ambush Signals for just $499. That’s a saving of $215, giving you almost two months of Ambush Signals for free. As we usually only offer monthly or 3-months subscriptions, this is a one-time offer!

These 6 months will allow you to get to know Ambush Signals without too much stress or pressure and to follow it for a long enough time period that it simply won’t that much if you’re lucky and start on Ambush’s best trading month ever or not.

Don’t miss out on this and get your 6 months of Ambush Signals for $499 today, click here!

Ambush eBook

Now if you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, we also have a special offer for the Ambush eBook:

Coupon Code:

- Ambush eBook: use "ambush300" to get the Ambush eBook $300 off, for $999 instead of $1299.

Now if you’re thinking that getting a trading method that’s been doing so well for such a nice price is too good to be true, then you’re right. As you might remember we’ve already significantly raised the price of eBook last year. I can’t tell you much more at this point but this might be your last chance to get into Ambush Signals or to buy the Ambush eBook at such a low price.

All Coupon codes are valid only until Wednesday, September 20th. Hurry up and don’t miss out on this rare opportunity!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Drawdowns

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

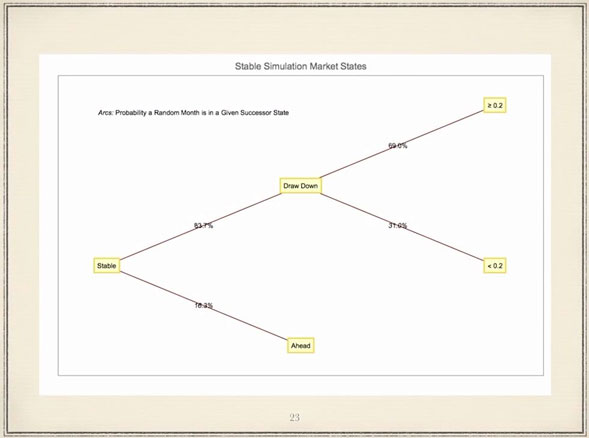

Today I want to show you something that most educators will not talk about: Drawdowns

Most of the time as a trader, you will find yourself in periods of draw downs. This means, most of the time after reaching a new equity high you will be under water. That is something most newbies underestimate and one of the main reasons traders fail because they get the idea they will be up most of the time. Inexperienced traders don’t come up with this idea by themselves, of course. It is mainly the trading education industries that tells everyone how easy and how much fun trading is.

The calculation shown below comes from Robert Frey, a math guy, and as you can see, traders might be a significant time in draw down periods.

“Robert FREY - 180 years of Market Drawdowns” has a video on YouTube that is worth checking out.

Happy trading,

Andy

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Weekly Chart Trading

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Are you missing out?

Sometimes we are so busy looking at the forest that we miss seeing the trees. If you are a day trader it could be you are no longer seeing the trees that are on the weekly chart. This past week I've been looking at weekly charts. What prompted me was that a friend of mine, who has been trading strictly from the weekly charts, wrote to tell me his account is up five-fold. Is yours?

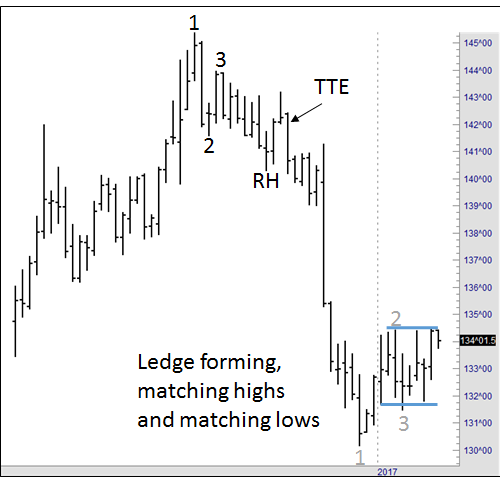

T-Note futures have always been difficult for me to trade as a day trader. So I decided to look at "trees" in the T-Note futures first. I was astonished at what I saw. There were 1-2-3s, Ross Hooks and Traders Tricks.

Yeah! But who wants to trade the weekly chart? What I should have been asking is why haven't I been trading the weekly charts? Trading the weekly charts doesn't mean that you have to sit and watch the market all week long hoping for a trade. With today's automatic trading platforms, there's not a lot of watching to do. Besides, if you are willing to take some money off the table quickly, trades from the weekly chart can be ideal. The moves on a weekly chart, even when small, are typically much greater than you'll get from the same move on a daily or intra-day chart.

Take a look!

The arrow points to a Traders Trick Entry. I would have made a nice bundle on that one. But where was I? Burning up my eyeballs looking for an intraday trade in four other markets.

Several weeks later, prices bottomed out and formed a 1-2-3 low, which has turned into a possible ledge trade. Please notice that when notes move a full point, it is worth $1,000. That means if I had entered at 142^00 and exited at 132^00, I would have made $10,000. As Fagin said the movie “Oliver,” I think I’d better think it out again.

Are you getting my message?

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Hey Joe! Any suggestions for the kind of information a new trader should collect and maintain?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

New traders must keep a diary of trades with the following information:

- Why trades were initiated

- How stops were managed

- Where and why they were moved

- Why the trade was exited

Personal observations. This trade check analysis will spot any breakdowns in discipline or methodology, and focus the trader on why actions are being taken. What is the purpose of this diary? To help you find your true self. To be a successful trader, you need to find out who you really are.

Traders should also keep a chart of their equity. This can be set up in a spread sheet and graphed. Every win should be added and every loss subtracted. After 20 trades, begin to maintain a moving average of the equity. If your trading equity falls below the moving average, stop trading. Paper trade until the equity curve rises above the moving average, at which point you may trade again using real money.

This little exercise will assist you in keeping your losses small and optimizing your wins. You will trade away your bad periods on paper, or a simulator, while your winning periods will be traded with real money.

We have developed a wonderful tool to help you. It’s called “The Life Index for Traders” and it comes with the “Equity Evaluator.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - TRN Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 14th Aug 2017 we gave our IIG subscribers the following trade on Trinity Industries (TRN). We sold price insurance as follows on a GTC order as we could not get filled initially at our minimum price:

- On 18th August 2017, we sold to open TRN Sep 29, 2017 24P @ $0.15, with 41 days until expiration.

- On 1st September 2017, we bought to close TRN Sep 29 2017 24P @ $0.05, after 14 days in the trade for quick premium compounding.

Profit: $10 per option

Margin: $480

Return on Margin Annualized: 54.32%

By patiently waiting for a retracement to get our minimum fill price, we could exit the trade fairly quickly.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 691 - September 8, 2017

Edition 691 - September 8, 2017

Trading Article - Is there a correct way to trade the markets?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

There isn't one “correct” way to trade the markets. While it may be tempting to emulate your favorite “Market Marvel”, in the end it’s really crucial to match your trading style with your personality. Some traders are methodical and almost compulsive in their tactics, carefully backtesting their strategies, scrutinizing all possibilities and taking sound precautions to ensure success. Other traders are more laid back, taking risk and uncertainty in stride, confident enough to formulate trading plans as they go along, finding opportunity as it happens. Again, there is no best approach. The approach you use to trade the markets depends on your unique personality and what you are comfortable with.

Above all, to trade successfully, the critical requirement is self-confidence. Developing a sense of confidence requires the accumulation of real life experience – becoming acquainted with various market conditions and discovering how you react to them. Once you have rock solid confidence based on copious experience, the way you approach trading is a matter of preference.

It is vital to your performance to be yourself, and not try to be someone you aren’t just because you think there’s ultimately a “right” way to trade. You must discover what works best for you, and what you need to do to trade profitably. The only standards that matter are your own.

Happy trading,

Andy

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - From Ledge to Ross Hook

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

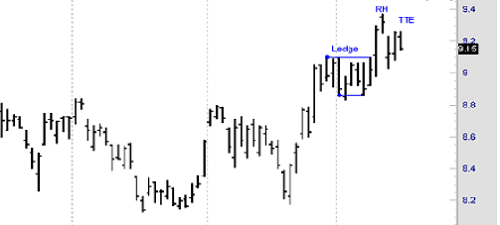

Prices for a stock I was trading broke out of an extended trading range on September 27, 2015. Almost immediately prices began to form a nine bar ledge with matching highs at 9.10 and matching lows at 8.87 and 8.86. The Law of Charts states that a ledge formation must contain at least four price bars, but no more than ten price bars. Prices broke out to the upside of the ledge on the tenth bar (October 11, 2015), and were followed the next day with the recent high. The Law of Charts states that the first failure of prices to continue in the direction they were going subsequent to the breakout of a ledge constitutes a Ross hook. There was a potential double high Traders Trick entry to go long showing on the chart. A breakout one tick above the double high at 9.26 offered a consideration to buy at 9.27. However, as we show in our online seminar Traders Trick, Advanced Concepts there are refinements that can make the probabilities for a winning trade approach the 90th percentile.

Notice also that entry on the breakout from a ledge is taken only in the direction of the previous trend or swing.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Achieving Self-Esteem

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

The single most important component of the personality related to personal achievement is self-esteem. Self-esteem is simply how much an individual likes himself and correlates to high achievement on a one-to-one basis. The more an individual likes himself the higher levels of performance he can achieve in any area of his life. Traders should always have at least one physical or mental activity every week that helps them feel good about themselves, like chess or golf. After a trader takes a loss or makes a mistake, he should consider going to a mirror looking himself in the eye and repeating the phrase, “I like myself,” with intensity, at least five times. This should boost the trader's self-esteem despite his losses, assuming he committed no trading discipline violations.

To reach high performance and personal achievement, understanding the three components of the self-concept is beneficial. The Ideal Self is a mental picture of the trader a person would like to become, a composite of the all positive qualities admired in other traders. Schwager's “Market Wizards” is filled with these admirable characters with their winning personalities. The Self Image is the inner mirror of the person a trader thinks he really is, and relates how he interacts with others on a day-today basis. A person seldom reaches levels of achievement beyond his self-image limitations. The Self-Esteem is how much a person likes himself. The more a person likes himself the higher levels of achievement are possible. These three components of the personality are always changing every moment. The self-aware trader shapes these personality components to compliment his goal achieving efforts to profitably trade the markets.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - RIO Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 22nd June 2016, we gave our subscribers a new type of trade for RIO (Rio Tinto), on a pullback within an uptrend on the weekly chart.

We entered a spread position for a net credit (still working with OPM, i.e. other people's money, as usual), but with unlimited upside potential.

- On 12th June 2016, we entered the trade for a credit of 2.00$(or $200 per position).

- We took partial exits for a profit on 9th November 2016 and 24th January 2017.

- On 31st August 2017, we completely closed the trade, after 455 days in the trade.

Profit: $850 per spread

Margin: $561 per spread

Return on Margin Annualized: 136.79%

These are low maintenance, low stress trades with lots of upside potential.

We presently have 25 of these trades opened. We took partial profits on some of them.

This technique is allowing us to take advantage of sector rotations (metals, gold and silver miners, etc.).

If you are interested in learning this new technique, come and join us!

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Ambush Signals

Trading Video - Ambush Signals

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Ambush made new all time equity highs! Be on the lookout for Special Pricing in next week's newsletter with Marco Mayer's Ambush ebook and Ambush Signals.

Learn all you need to know about our Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 690- September 1, 2017

Edition 690 - September 1, 2017

Chart Scan with Commentary - Spreads

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

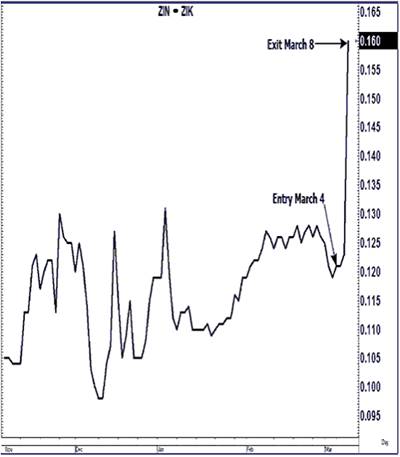

I know I often write about spreads, and it is because there are some important lessons to be learned about spread trading. One of my favorites is learning to spread when I need more time for a market to decide which way it wants to go.

One day, I got myself tangled up short in a May silver futures trade. Due to circumstances beyond my control, I ended the day still in the market with May silver going nowhere. It was struggling to find direction, but it didn't seem to be going anywhere.

I found myself down a bit by the end of the day and, because sometimes I am persistent in trying to turn a trade into a winner if I can find a way, I decided to spread off by going long the July contract. I was down only a few ticks, and prices were not yet close to my stop loss when I entered the spread long July and short May. The chart shows what happened. I got out with a win, and now I'm standing aside until things begin to rock and roll once again. Sometimes you get lucky!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - One market or several?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Why do traders bail out of some markets to go to other contracts? Wouldn’t it be better to learn one market and stick with it?

The main reason traders bail out of a market is that they are not making any money. This has happened in various ways. In the currencies in the 1990s, for instance, lot sizes became too big for the market movers to fade (take the opposite side). The big players did not want to fade the trades of the smaller locals in the pit. In some instances, the smaller locals were standing around with their hands in their pockets for lack of something to do. Some locals were forced into conglomerates that took away their freedom to trade as they pleased. If they wanted to stay in the pit, they had to team up with other traders and together, as a group, they would fade the large orders that were/are coming into the pit. This meant that the biggest of the small traders would fade let's say a 500-lot order. He would then parcel out all the contracts he didn't want to the smaller traders: “Okay, you take 50, and you take 20, and you take 10, and you take 30,” etc.

If you didn't take what was parceled out to you, you would never again trade in the pit. It was either take it, or get out of the pit. No one would trade with you if you refused even one segment that was parceled out to you. That’s not exactly a free market type of situation. If you lost, then the "boss" trader would try to make it up to you, but this was seldom possible. In other words, your own trades depended entirely on someone else's judgment and ability to trade. The end result was the beginning of Forex as a major venue for currency traders. What happened then is that many currency traders moved to other markets.

What are the pit traders doing now that the best markets have moved to electronic trading? Just as with anything else, if you can't make money where you are, you move on. Some are moving on to other careers. Others are trying for success through trading from a screen. But here's a startling statistic: "Ninety percent of pit traders fail at trading from a screen."

So why does anyone leave one market for another? You leave when you can no longer make money. In 2003 I stopped trading the e-mini S&P 500. I was unable to make money there. That is not to say that others can't make money there, but for the way I like to trade, I had to move to other markets, and I found plenty of other markets in which to trade. To some extent, I had to change my trading style in order to succeed, but the changes were minor. I went from trading only the S&P 500 in open outcry to trading several markets other markets electronically. Being eclectic, I go where I am able to succeed.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - AEM Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 30th July 2017 we gave our IIG subscribers the following trade on Agnico-Eagle Mines Ltd (AEM). We sold price insurance as follows:

- On 31st July 2017, we sold to open AEM Sep 15 2017 42P @ $0.435 (average price), with 45 days until expiration, with our short strike about 11% below price action.

- On 4th August 2017, we sold to open AEM Sep 15 2017 42P @ $0.65 on a GTC order for the second half of our position.

- On 16th August 2017, we bought to close AEM Sep 15 2017 42P @ $0.25, after 16 days in the trade for quick premium compounding.

Profit: $29.30 per option

Margin: $840

Return on Margin Annualized: 79.57%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - The right mindset to deal with drawdowns

Trading Article - The right mindset to deal with drawdowns

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Drawdowns are an unavoidable fact in trading that's tough to deal with. But you probably already noticed that and might have encountered some of the serious issues this can lead to during your trading career. Maybe you tend to stop trading a system or switch systems always at the wrong time. Or worse. But as I've written about these issues before, here's a mindset that has helped me a lot to deal with drawdowns in the long run.

Things got a lot easier for me once I started to treat trading a system or just following a specific trading plan or strategy like an investment. Let me explain.

Let's say you believe in the success and growth of a certain company, Apple for example. Therefore you decide to invest a certain amount of money in it and buy the stock. You get in at $100. Right after you bought the price of the stock goes down to $95. You're down 5% and probably a little bit disappointed about your bad timing. If you're sane that's where you stop worrying. You won't start questioning your investment because the price of the stock dropped $5. You still believe in the company, nothing fundamental changed so you just keep your stocks. A year later Apple trades at $140 and you're quite happy but it might have been a volatile journey up to $135 during the year. Again though that's no big issue as you expect this. Stock prices can be volatile and you don't expect them to move higher in a straight line!

Why not apply the same mindset to trading a system? Take a certain amount of money and invest it into the strategy. As long as you believe in the strategy and the drawdown is within what you expect, why worry? Just keep on trading it, stop worrying about the daily ups and down and questioning it on every little drawdown. Of course, if something fundamental changes or you hit unexpected drawdowns you act. But otherwise, it really helps to treat it like an investment, leave it alone and let it do its thing.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea - Lean Hogs Butterfly Spread

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

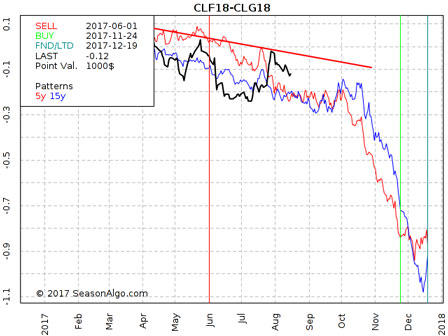

Editor of Traders Notebook Complete and Traders Notebook Outrights

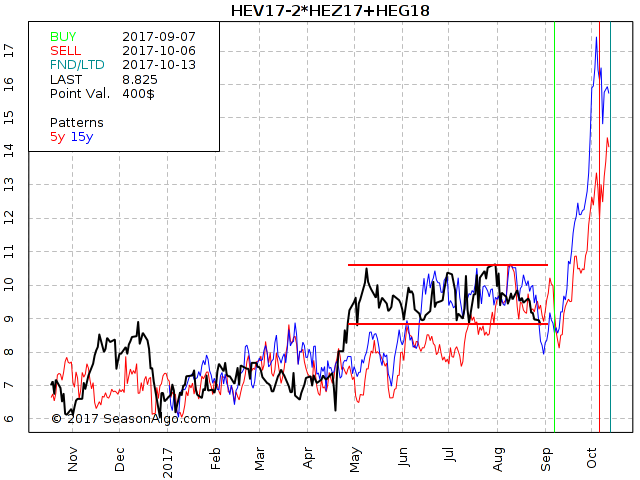

This week, we're looking at the HEV17 – 2*HEZ17 + HEG18 Butterfly Spread: long 1 October 2017, short 2 December 2017, and long 1 February 2018 Lean Hogs (CME on Globex).

Today we consider a Lean Hogs Butterfly Spread: long 1 October 2017, short 2 December 2017, and long 1 February 2018 Lean Hogs (elec. symbols: HEV17 – 2*HEZ17 + HEG18 or HEL1V17 on CQG). The Butterfly Spread has been in a range since May as you easily notice on the chart above. For the next few weeks, the spread usually moves to the up-side as shown by the blue (15 year seasonal) and red (5 year seasonal) line on the chart. Will this also happen this year? Of course, we never know for sure but the spread closed higher on 10/06 compared to 09/07 during the last 20 years. Statistically speaking, there is a high chance we will see higher prices of the spread during the next few weeks.

Happy trading,

Andy

Do you want to see how we manage this trade and how to get detailed trading instructions every day?

Traders Notebook Complete

Please visit the following link:

Yes, I would like additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 689- August 25, 2017

Edition 689 - August 25, 2017

Chart Scan with Commentary - Spread

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

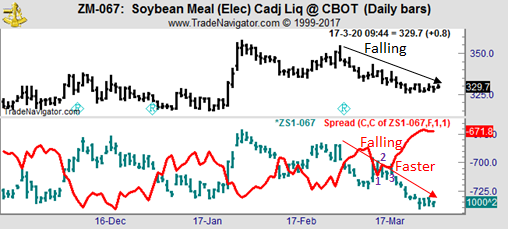

A spread can be profitably entered even though prices on both legs of the spread are moving down. As you can see both soybean meal and soybeans were moving down, only prices for soybeans (lower chart) were moving down more steeply and faster than prices for soybean meal. This is a situation for creating a spread between the two.

You can see the spread line begin to rise in late February. The spread formed a 1-2-3 low and then broke out above the #2 point.

At this point in time it is of no importance whether this spread is seasonal or not. The fact is that it can be entered simply my mere observation. Prices falling on one hand and prices falling faster on the other. The beauty of spread is that they are based on reality, rather than price manipulation. There is a fundamental reason why soybean prices are falling faster than soymeal prices. We don’t have to know the reason why this is happening. We have only to look and see the truth.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Computerized Trading

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Someone wrote in: “Will trading eventually be done by programmed computers and not by people? Are we really headed that way?”

The answer is that it is already true. I read that at times 90% of daily trading in the stock market is computerized trading.

The computer age is bringing about unprecedented change in the markets. Even now it is altering the manner in which we conduct business, interpret events, gather information, and keep ourselves entertained.

While computers can expand our intellectual horizons, they can also limit creative interpretation. There is a tendency these days to let computers do the work of designing and discovering rather than relying upon intuition and imagination. All too often this is taking place even when it flies in the face of reality.

In a business context, computers reduce problems to statistical probabilities without necessarily considering the broad effects of events and relationships. No computer can keep you safe from those events which come unexpectedly, and which cause markets to go berserk. Wars, sudden shifts in political power and alliances, and natural disasters, can cause markets to become suddenly and extremely volatile. Even when statistics take such extremes into account, how do you defend yourself if you are long and a market suddenly crashes? Prices can leap right over your protective stops. A severe crash can shut the market down, and when it reopens you could be staring at a huge loss.

I’m not saying that computers shouldn’t be used to prove or disprove theories. But keep in mind that the intuition of the human mind has not yet been duplicated by electronic circuitry. Our educated insights are the critical tools with which we learn and comprehend how markets work.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - HST Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 27th July 2017 we gave our IIG subscribers the following trade on Host Marriott Financial Trust (HST). We sold price insurance as follows on a GTC order as we could not get filled initially at our minimum price:

- On 9th August 2017, we sold to open HST Sep 15 2017 17P @ $0.20, with 36 days until expiration.

- On 17th August 2017, we bought to close HST Sep 15 2017 17P @ $0.10, after 8 days in the trade for quick premium compounding.

Profit: $10 per option

Margin: $340

Return on Margin Annualized: 134.19%

By patiently waiting for a retracement to get our minimum fill price, we could exit the trade very quickly.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Don’t get married to a market!

Trading Article - Don’t get married to a market!

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

There are so many different instruments to trade like stocks, bonds, futures, spot forex, options and so on. And even when you decide to get into futures, there are tons of futures out there! So where to even start? I was as confused as anyone else about this when I started trading.

That’s why it probably feels good to focus on just one market in the beginning. "I just trade the EUR/USD" or "I only trade the ES" or "I'm a Gold trader" are common statements out there. And that’s not a bad thing. It’s almost impossible to start otherwise, you have to over simplify things in the beginning. Otherwise, you’d never get started trading at all.

But at some point, you should move on and expand your trading world. There are times when it’s almost impossible to make a profit in the EUR/USD or when it’s better to stay away from the ES. During these times maybe Gold or Crude Oil or AUD/USD are providing really good trading opportunities.

Especially as a day trader, you got to go where the action is. I’ve seen many traders going under because they kept on trying to milk a dead cow. That’s why recognizing when it’s time to look elsewhere is one of the most important skills to survive in the long term.

Don’t get marries to a single market, don’t keep on throwing good money after bad just to prove to your ego that you can get the money back from that market. Be flexible, go where the easy buck is.

There’s almost always a low hanging fruit…and usually, you know where it is. You’re just too stubborn to take it.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading is not a Black-and-White Game

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Many traders seem to have trouble understanding this concept. They cannot get their mind around it. Some are able to attain a composed calm and harmony when they are winning, but go berserk when losing. Others become defeatist when things turn bad. Still, others become resigned or go on tilt in various ways.

They try to abolish losing completely from their trading, and do everything in their power to avoid it. The solution they choose is to tighten up their trading to the nth degree. But unfortunately, swings in fortune are part of the game and need to be included. They must be worked with and controlled, not eliminated.

This attempt to turn trading into a black-and-white game goes like this: “I’ll trade absolutely safely. I will stay only in perfect trades, and if they are not perfect, then I’ll drop out.” On paper, this seems foolproof. The problem with this strategy is that you get trapped whenever you are in the gray areas (which is often). Trading is dynamic and constantly changing, with many rough edges. Trying to be too perfect is like trying to keep your clothing and life vest perfectly arranged during a river-rafting trip. You must roll with the water as it is moving along, not try to confine and control it!

Finally, there is also the frustration aspect that occurs if you try to banish all losses from trading. Stress occurs whenever a loss happens – anger, despair, indignation, outrage. Every trade becomes a life-and-death matter. This is the result of telling yourself that you must never fail. By including losses in the system, however, we anticipate them and thereby remove all the power from them. We are cool and composed; calmly factor them in, and move on.

"He who fears being conquered is sure of defeat".

- Napoléon Bonaparte

Happy trading,

Andy

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 688- August 18, 2017

Edition 688 - August 18, 2017

Trading Idea

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

This week, we're looking at short CLF18 – CLG18: short January and long February 2018 Crude Oil (NYMEX at Globex).

Today we consider a Crude Oil calender spread: short January and long February 2018 Crude Oil (elec. symbols: CLF18 – CLG18 or CLES1F8 on CQG). The spread has been in a down trend since the beginning of 2017 trading now close to the upper side of its down-trend channel. Because there is only one month of difference between the two legs, the risk is at a manageable level of about $300 per spread contract. The spread should gain stronger momentum regarding seasonality to the down-side in later months (October and later) but a trader might already now scale into the trade.

Do you want to see how we manage this trade and how to get detailed trading instructions every day?

Traders Notebook Complete

Please visit the following link:

Yes, I would like additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - A Gold Trader

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

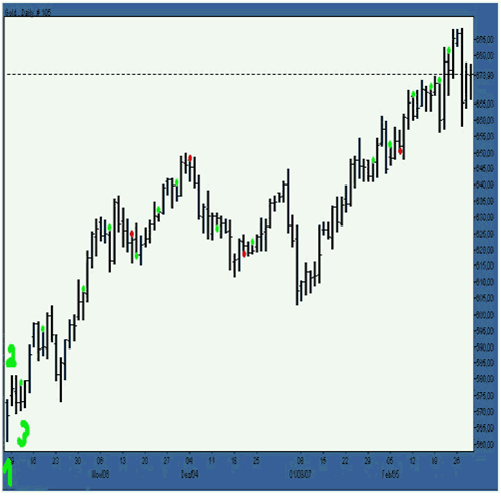

This week I lifted the chart I want to show you from one of our students, and it shows you how he trades gold using only Traders Trick Entries. You’ll have to look closely to see the green and red dots

"I traded lots of gold lately and thought I should share this chart as an example of how nice TTEs [Traders Trick Entries] can work.

"It's a daily-chart of gold. It starts with a 1-2-3, where I luckily bought and I'm still in with 1/3 of my initial position using natural supports to trail my stop.

"The green dots shows TTEs that 'worked,' the red dots are TTEs that 'failed.' For me they worked when they reached the point of the RH where I usually take profits, and move my stop to break even, or did a large enough move to take some profit, and did not go below the last day's low where I trail my stop when getting into a position.

"Of course I wouldn't have traded all of those TTEs; some of them are much too near the RH so that they don't allow to take enough profit at the RH. Some don't look 'good', and some come too close together. But just if you had taken them blindly, you still would have won big using the right money-position-management."

Notice that he says, "Of course I wouldn't have traded all of those TTEs.” Over the years from our own experience and feedback from our students there have been a number of refinements made to the way we select and trade the TTE. You can discover the filters we use to achieve close to 90% accuracy when selecting which TTE to trade. The material is covered in an online webinar “The Traders Trick, Advanced Concepts.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - The Lottery Mindset

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Do you ever dream about winning the lottery? There are actually people who have such good luck that they repeatedly enter contests and win. They win so often that if they wanted, they could count on winning, even though they are essentially trying to capitalize on chance. They develop a "lottery mindset" in that they approach life by counting on rare chance events. The rest of us aren't so lucky, and we don't live our lives counting on a fluke like winning the lottery. We work hard, master a profession, and work steadily to make a living. In many ways, top-notch traders approach their profession in the same diligent way. They don't view trading as recreational gambling, and count on a fluke to make a profit.

Many people do experience key life-changing events. We have all heard of people who needed a lucky break and got it. You often hear of actors who with their last 50 bucks went on an audition and landed a job and ended up as a star of a hit sit-com. You probably know of friends who were desperately searching for a job for months, and needed a job fast! With only a week's worth of resources left, they found a job. It can also happen in sports. Olympic athletes may practice their entire life for "one moment in time" when they can perform at their best. But there is some luck involved. A family member may pass away or they may become ill, and it may throw them off their game. Sure, they have rare talents, but the Gold Medal winners are also lucky enough to have everything go their way. There are times when life can come down to a few key moments. It's a little like playing Lotto and hoping that you'll win.

Even though profitable traders don't approach trading as if they are playing the lottery, they all have at least one big winning trade in their careers. Do people make huge profits capitalizing on a once in a lifetime trade? Sure they do, but the question you need to ask yourself is, "Do I want to trade hoping to make all my profits on a fluke?" Do you want to approach trading with a lottery mindset? If you do, you'll always be on edge and you will have difficulty trading with discipline. You'll tend to take big chances, and you may end up losing big. It's better to trade more prudently. That doesn't mean never taking a risk or pushing yourself to invest a little more capital when you hit upon a winning streak. What it does mean, though, is controlling over-confidence. Don't seek out those one or two trades a year that will make up for all you've lost. There's an advantage to using a more methodical approach: Continue to search for solid, high probability trade setups, outline detailed trading plans, and trade prudently with unwavering discipline.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - NTNX Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 16th July 2017 we gave our IIG subscribers the following trade on Nutanix Inc (NTNX). We sold price insurance as follows:

- On 17th July 2017, we sold to open NTNX Aug 18 2017 17.5P @ $0.175 (average price), with 31 days until expiration and our short strike 21% below price action.

- On 7th August 2017, we bought to close NTNX Aug 18 2017 17.5P @ $0.05, after 21 days in the trade.

Profit: $12.50 per option

Margin: $350

Return on Margin Annualized: 62.07%

When the trade was given, $VIX had closed at 9.82, a particularly low level historically. But by widening our choice of underlying stocks (a recently introduced stock in September 2016 in that case), we can still find safe trades with quite decent levels of premium.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Q&A Episode 1: BID/ASK-Spread/Discipline in Trading

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

This first episode, Marco Mayer answers trading related questions sent in from viewers like you!

Feel free to This email address is being protected from spambots. You need JavaScript enabled to view it. your questions or whatever is on your mind about trading.

>

Happy Trading,

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Trading Strategies with Ambush and Stealth Combined

Save 20% instantly with the Ambush & Stealth Trading Methods Combined!

Enjoy the flexibility of trading during any market condition by combining the trading education of the Ambush and Stealth Trading Methods! These products follow completely different trading approaches:

Ambush Trading Method™ is a counter-trend method and Stealth Trader™ is a trend-trading method.

- Ambush Trading Method™ is fading the trend and stays in the market for only one day

- Stealth Trader™ catches the trend and holds on to the trade as long as possible.

- Both trading methods support many different trade markets, including commodity trading, so you'll be diversified in markets and methods!

You no longer have to decide in what market conditions you are trading. Trade both methods at the same time, and let the trading methods do their job.

The Ambush and Stealth Combo Includes:

- Ambush Trading Method™ eBook by Marco Mayer

- Stealth Trader™ eBook by Andy Jordan

- 20% Instant Savings for purchasing the combo

- Personal email support provided by both traders

Orders filled via email within 24 hours and all sales of digital products are final.

$2,196.80 (20% Instant Savings!)

IMPORTANT: Your order will be fulfilled within 24-hours during our regular business hours. If you have not received instructions via email by that time, please contact us, so we can resend it to you. Be sure to check your junk/spam folder before you contact us. All sales are final.