Joe Ross

Edition 712 - February 2, 2018

Edition 712 - February 2, 2018

Exciting News - Forex Best Awards 2018

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Marco has been nominated at FxStreet for the "Forex Best Awards 2018" in the category "Best Educational Article" for his article "5 Tips to improve your day trading" (link to http://www.tradingeducators.com/blog-page/5-tips-to-improve-your-day-trading). If you also liked the article which of course was published on Chart Scan first and have a minute, help Marco win the Award by voting for his article at https://goo.gl/forms/Z3K8LIjtr6RYz0z62. You'll find Marco's article in the category "Best Educational Article" and can simply select "Don't know" on all of the other categories.

Kind regards

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Blog - What should I do after closing out a trade?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

You must be disciplined in following the plan of your trade religiously. Once you have closed your position, you should...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Trading Sugar off the COT Report

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

If you want to see how to make a contrarian long-term trade, you might consider looking at the positions on the COT report.

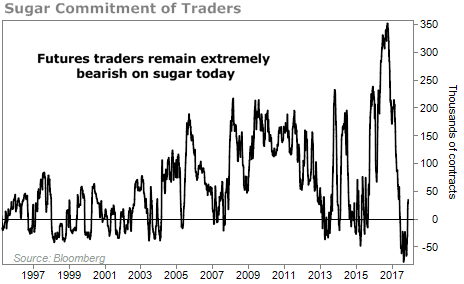

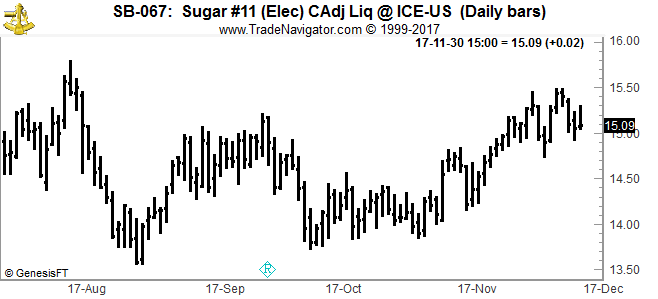

As of November 2017, sugar was really down, and way oversold, but had begun to rally. Sugar prices were down nearly 60% from 2010 and 29% from the previous year. The Commitment of Traders (COT) report revealed that traders were more negative on sugar than ever before.

COT details the real-money bets of futures traders. It tells us whether traders are excited about or disinterested in a commodity market.

That means it's a useful contrarian tool... When traders all agree on an outcome, it's a good idea to bet against them.

And futures traders have become extremely bearish on sugar in recent months. Take a look...

The COT report hit its most negative level ever in August, -77,495. It has rebounded slightly to 34,270 since then.

The negativity is a good thing for traders looking for big opportunity, based on history.

You want to be in sugar when the COT is this negative. Historically, sugar prices have soared when the COT fell below and then rose back above -35,000. Being in sugar when it is this negative has led to dramatically high returns. As I write this, sugar prices have rebounded recently. There are a number of ways you can trade this, here are a few suggestions.

Via the stock market:

- Long the iPath Sugar Subindex Total Return ETN (SGG)

- Buy a CALL LEAP option (long-dated option)

- Buy SGG and sell a CALL LEAP option

- Sell a PUT LEAP option to gain a lot of premium

Via the futures market:

- Go long July, or October 2018 futures

- Buy a CALL LEAP option

- Sell a PUT LEAP option to gain a lot of premium

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Seeing what you want to See

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Some people live in a world of delusion and fantasy. They see what they want to see and ignore what they don't want to see. Traders are especially prone to this ailment. When your money is on the line, you are consumed with avoiding loss. Trading is a competitive business where few make it in the long term. This fact always lurks in the back of your mind, putting added pressure on you. In the back of your mind, you wonder, "How am I going to make it?" Sure, you know that you must make it and that allowing pessimism to take hold will do nothing more than throw you off track, but the possibility of failure is always there, working behind the scenes to thwart your efforts. With all this psychological pressure it's hard to stay objective. There's a powerful need to see what you want to see.

staying objective is difficult It's important to distinguish between the data and your interpretations of the data. View as neutral both the events and your inclination to impose your interpretations on them. Enter the market without expectations, surrendering to it rather than struggling with it for personal gain.

How can you stay objective? The first thing you must do is trade with money you can afford to lose and manage your risk. If your entire financial future is on the line on a single trade, you will be consumed with anxiety, self-doubt, and frustration. But if you risk relatively little on a single trade, you'll know deep down that you can live with the negative consequences should the trade be a loser. It's useful to follow the old trading adage, "Risk so little capital on a trade that you ask yourself, 'Why am I even bothering to put on this trade?”

The second thing you must do to stay objective is to take your ego out of the trade. You cannot control the markets, so why put your ego on the line with your money? Don't make winning or losing a personal issue? Why put your ego on the line with each trade? Why gloat when you are lucky enough to have the odds work in your favor and sulk when the odds go against you? It's not personal in the end. There's little you can do but stay calm, try your best, and accept where the markets take you. Ironically, if you can identify and control what you can (such as risk management and a sound trading strategy), and accept what you cannot (the outcome of a trade), you will feel calm and be able to trade in a peak performance mindset. And the calmer you feel, the more open you will be to seeing the markets as they are, rather than what you want them to be.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Example: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

TRADE WITH NO LOSSES

Here's our latest example!

GDX Trade

On 9th January 2018 we gave our Instant Income Guaranteed subscribers the following trade on Market Vectors Gold Miners ETF (GDX). Price insurance could be sold as follows:

- On 10th January 2018, we sold to open GDX Mar 16 2018 21.5P @ 0.265$ (average price), with 66 days until expiration and our short strike about 7% below price action.

- On 16th January 2018, we bought to close GDX Mar 16 2018 21.5P @ 0.12$, after 6 days in the trade for quick premium compounding.

Profit: 14.50$ per option

Margin: 430$

Return on Margin annualized: 205.14%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 711 - January 26, 2018

Edition 711 - January 26, 2018

Chart Scan with Commentary - The Law of Charts

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

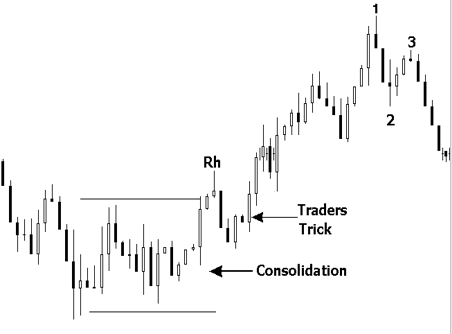

I am often challenged with regard to the Law of Charts. "How do you know it's a law?" The answer is that TLOC can be seen on any chart that has a range of values.

As I have often stated, the impetus for TLOC is the human action and reaction to the movement of prices. However, it is possible to see TLOC in action due to a variety of causes. The chart below shows what I mean.

This chart was produced by a random number generator using MS Excel. It really would have been nice for trading. In the future I want to show you another chart that proves TLOC is real. However, for now, please realize that TLOC is not a method or a system; it is a law. As with any law or precept, it is up to you as the trader to come up with a way to make money from the fact that TLOC will make patterns of consolidation, 1-2-3s, and Ross hooks.

Joe Ross knows trading!

Click on the links below to learn about his trading method!

Trading the Ross Hook

The Law of Charts

Traders Trick Entry

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Stress and Vulnerability

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Many traders underestimate the influence of stress. Stress is not only a psychological reaction, but a biological response as well. When you are stressed, your body reacts instinctively. You are agitated, on edge, and ready to lash out. Your attention is restricted. Your mind is closed and inflexible. The stress response has a specific biological, adaptive function: Your energy is channeled into making the simple response of fighting an opponent or running away. Not only is your energy channeled, but your perceptions are limited. Trading requires a more complicated skill set, though, and when you feel stressed out, you are bound to make a trading error.

It's surprising how stress can impact your ability to trade effectively. What's there to impact? Trading isn't that complicated, is it? Actually, there's a great deal that can happen. You can have a very complete trading plan, where every aspect is spelled out clearly, and you may have a wealth of experience executing such plans, but when you are stressed out, even the simplest task can be difficult to complete. You may not see an obvious signal to take action. And even when you see the signal, you can make a small mistake when you're stressed. Again, you are agitated and your psychological perceptions and intuition are restricted and closed off. You miss little things and have a tendency to respond quickly without thinking. While trading, we often do things automatically, without thinking, but stress can cause us to act so quickly that we miss something. We may forget to place an order according to plan or we may misread a signal and close out a position too early. These little errors can add up to disaster.

How can you beat stress? The most effective stress control strategies prevent stress before it happens. It is useful to minimize potential stressors. Getting into an argument with your spouse, for example, can put you in a bad mood that can escalate into an intense, distracting mood later in the day. Minor hassles can build up. For example, you may get cut off on the way to work, or the police may wrongly give you a traffic ticket. It can all add up, and set the stage for an incapacitating stress response. It’s important to acknowledge the power of these stressors, and when you feel agitated by them, you may want to stand aside until you feel better. Your trading environment can also impact your ability to handle stress. In many ways, trading is an art. You wouldn't try to create art in a noisy, chaotic environment, and you may not want to trade in such an environment either.

Trading requires an optimal mindset. When you are upset, tired, and emotionally distracted, you will have trouble following your trading plan. You must return to a calm, focused mindset, a mindset where you are attentive and alert, and can trade like a winner.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Performance Track Record: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

TRADE WITH NO LOSSES

HERE'S THE PROOF!

Check out our Performance Track Record page!

Check out our Performance Track Record page!

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea - Short Euro FX (or long on a strong break above 1.2500)

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

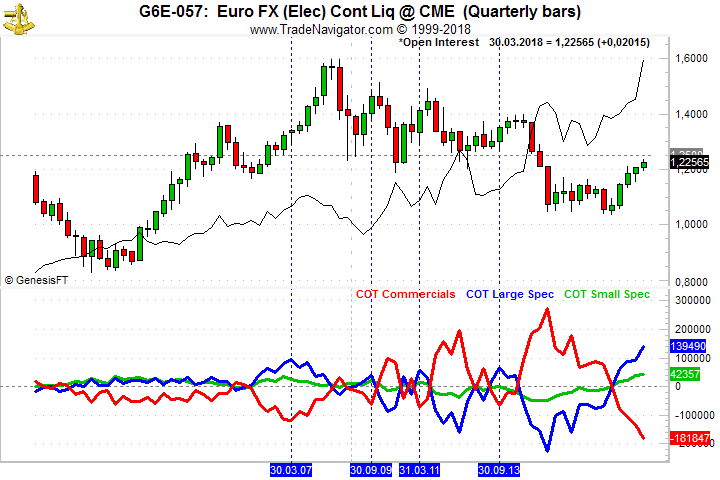

Today, I want to have a closer look at the Euro FX, especially at the all time net short position of the Commercials. While the COT report can give a trader some kind of “road map”, it is not meant to be a timing tool, as you can see on the chart below. The market did NOT turn around at the low levels of the COT Commercials chart (red line on the chart below), it took the market more time until it finally turned to the down-side. But not only the COT chart with the extreme levels look interesting, also the 1.2500 level is an interesting level because very often old support levels turn into resistance and vise versa. As I said before, I would not time my trades using COT (or seasonal) charts, but with possible resistance at 1.2500 we might see a lower Euro FX soon. On the other hand, if we move strongly above 1.2500 and the Commercials get caught on the wrong foot, we might easily see 1.4000.

Receive daily guidance from Andy Jordan! Traders Notebook Complete shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook Complete

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trading Bitcoin and other Cryptocurrencies

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

After I mentioned that I’ve been doing trading the crypto currencies last year there’s been quite some feedback from you with questions about these new markets.

So I thought I’d share my thoughts about the crypto markets, my experiences regarding trading these and hopefully give you some useful tips on how to get started.

First of all, these crypto currency markets are still quite in the early stages of development. Volatility is often crazy, exchanges and brokers are still not fully established in terms of stability and features and every now and then there’s still something crazy happening like bitcoins getting stolen, exchanges going bust and so forth. It kind of reminds of the early days of retail forex trading even though the actual markets are completely different of course.

There’s Bitcoin Futures trading at the CME now but the liquidity isn’t really there yet. After having tried different crypto exchanges, I’m now using gdax.com which is quite well regulated and so far I’m having no issues at all trading there. Liquidity usually is very good and even when the markets go a bit crazy the platform works just fine. Another one that I didn’t try personally as it’s for US citizens only but that I’ve heard is good too is gemini.com.

Personally I still avoid having large sums of money at any of the crypto exchanges. To invest in a coin I do the trade at the exchange and then sent the actual coins to my electronic wallet instead of leaving them at the exchange. If I want to get out I sent the coins to the exchange, do the trade and withdraw the money back to my bank account. This way the risk of losing money when an exchange goes under is minimized.

New markets also have many advantages though, especially for us private traders. The biggest is that there’s less competition as the professionals aren’t in there yet. Even though there’s bitcoin futures trading at the CME now, hardly any of the very tough competitors you have in the currency or stock future markets are there yet.

This makes is quite easy to trade these markets if you’re used to trading much more difficult markets. They’re mostly driven by private investors and many well known strategies that stopped working in most markets long ago work very well in the crypto currency markets. One example are simple breakout and momentum strategies. When these markets start moving, they often do so in a very nice and "clean" way.

Happy Crypto-Trading!

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 710 - January 19, 2018

Edition 710 - January 19, 2018

Blog Post - Keeping a Trading Journal

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

I keep one of sorts, it is part of my monthly homework. The journal is very basic and includes...read more.

Receive daily guidance from Andy Jordan! Traders Notebook Complete shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook Complete

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

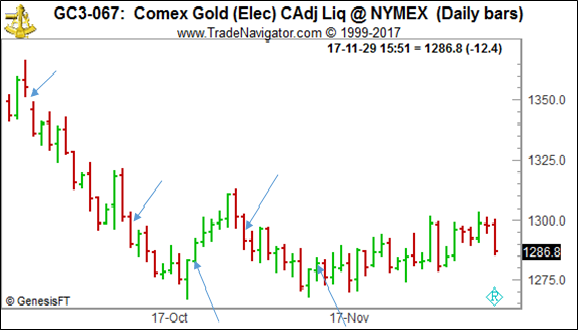

Chart Scan with Commentary - Enter a Position in Gold or Silver

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

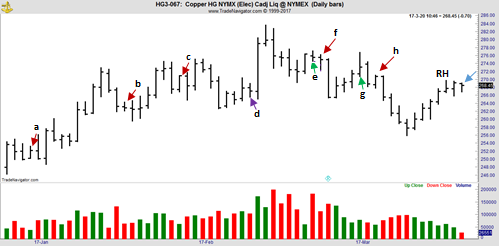

When economic times become volatile times, investors run to hard assets. Gold is a favorite hard asset in which to run, but keep in mind that gold loves to swing, even when it is trending. Recently, we've seen perfect setups for attempting to enter positions in gold based on the setups we teach at Trading Educators. The chart below shows exactly what I mean. The Law of Charts made it clear. I have shown where there were entry opportunities in gold. Three were short setups and two were long setups for short-term scalps. Trading gold, or silver should be obvious in times where people are looking for safe havens.

There are essentially two ways to "play" gold. One: Trade the swings in gold. Two: Buy and hold. Gold is most likely on its way to at least $5,000, and if we get the much anticipated “global currency reset,” we could easily see $10,000.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Mastering Yourself

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

If we had a crystal ball, trading would just be a matter of buying at a bottom, holding the stock as the price continued to rise, and selling near a top, right before the public sells in a state of panic. But we don't have a crystal ball, and there is no foolproof way to forecast the markets. Sure, if you have enough capital, are willing to wait long enough for a stock price to increase, and will be satisfied with a small profit, you can identify a few key stocks that will pay off handsomely with a buy-and-hold strategy. But that isn't what you're looking for. If you are like most traders, you are trying to capitalize on short-term moves to make big gains over and over again, and in the long run, mount a series of impressive wins. To accomplish this goal, you need to control your impulses and emotions. You need to cultivate enough energy to study the markets and search for profitable setups. But the work doesn't end there. You also need to execute your trading plan with smoothness and agility.

A cursory review of history reveals a host of people who have fallen victim to self-sabotage. They range from presidents Ulysses S. Grant to Bill Clinton, from Charles M. Schwab of U.S. Steel to Dennis Kozlowski of Tyco International. These individuals rose from humble beginnings to accumulate wealth, fame, and power. Yet in the end, they took extreme risks and paid a steep price. Upon hearing their stories, it's tempting to think they had a motive for self-sabotage, a hidden demon ready to undermine all that they had accomplished.

Most of the articles in Chart Scan are about gaining a mental edge, and when you trade with a mental edge, you increase your odds of winning. This sentiment is expressed by the many trading experts. By understanding your motives and setting goals, as well as consciously controlling your state of mind, you can manage anxieties, focus concentration, and enhance our confidence as traders. In addition, by using specific psychological skills you can greatly improve your performance. These skills will increase your level of personal enjoyment and fulfillment.

At Trading Educators, we try to bring you knowledge from our own journey through life as a trader. We would like this opportunity to thank you for reading, and allowing us to help you master the markets and be the best trader that you can be. If you set realistic goals, work hard to gain market experience, and manage your mental state, you will be one of the few who become a winning trader.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Example: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

SSYS TRADE

On 10th January 2018 we gave our Instant Income Guaranteed subscribers the following trade on Stratasys Inc (SSYS). Price insurance could be sold as follows:

- On 11th January 2018, we sold to open SSYS Feb 23 2018 18.5P @ 0.30$, with 42 days until expiration and our short strike about 14% below price action.

- On 12th January 2018, we bought to close SSYS Feb 23 2018 18.5P @ 0.15$, after 1 day in the trade for very quick premium compounding.

Profit: 15$ per option

Margin: 370$

Return on Margin annualized: 1479.73%

Philippe

Receive daily trade recommendations - we do the research for you.

TRADE WITH NO LOSSES!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Why having a view on a market isn't enough.

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco Mayer talks about why having a view on the direction of a market isn't enough. The reason is that just having a directional view doesn't make a trade...find out why!

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 709 - January 12, 2018

Edition 709 - January 12, 2018

~ Use Coupon Code During Checkout ~

newyear

Trading is a Business

Trading the Ross Hook

Life Index

Recorded Webinars:

The Law of Charts In-Depth

Traders Trick - Advanced Concepts

Blog Post - The "Now Trap"

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

There is a great attraction in all aspects of the modern age to immediacy. Likewise, most of the trouble in trading occurs through...read more.

Receive daily guidance from Andy Jordan! Traders Notebook Complete shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here - Traders Notebook Complete

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

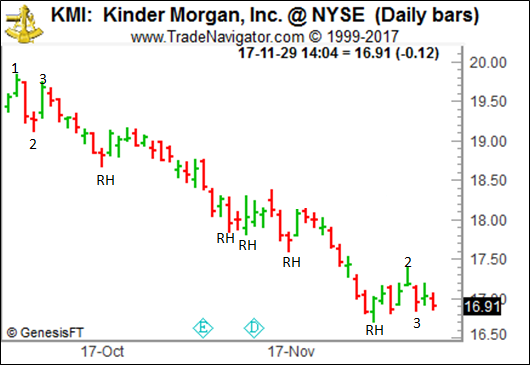

Chart Scan with Commentary - Trading the Obvious

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I can't recall how many times I have said or written, "Trade what you see, not what you think." In fact, those very words have become my motto. In this week's Chart Scan, let's look at the obvious — an easy trade that requires nothing more than the willingness to take a look. So many traders have their noses buried in indicators that it is a wonder they don't suffocate. If you look at the daily chart shown below, you will see that once prices violate a #2 point and then violate a Ross Hook, you can expect at least one more hook violation and often two. However, be careful about expectations once prices have violated a third Ross Hook. The violation of a third hook is generally very near the end of a move. From there prices make a 1-2-3 formation at least temporarily ending the trend, or simply consolidate for a while. In the case below, prices made the 1-2-3 after a violation of the fourth hook.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Are You Sabotaging Yourself?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

People come from humble beginnings to achieve wealth, status, or fame. But to get ahead, successful people often had to break conventional rules. This readiness to break the rules is often associated with an affinity toward risk. Although they may achieve success, they may also have a shaky self-image. Sure they achieved a lot, but a voice deep inside their psyche still questions their self-worth or competence. They don't have the birthright and the psychological security that matches their current status in life. They beat the odds and they know it, but they never quite feel secure. Their demons lurk in the back of their mind, ready to take over.

Everyone has his or her talents. Some people are intelligent. Other people are natural born athletes while others have physical attractiveness that turns heads. The identity you form early in life can give you an ego boost when you need it, but may throw you off when you are under pressure. Bill Clinton, for example, described himself as an unattractive dork in his autobiography, "My Life." His early self-image didn't match his later success, and his hidden demon lurked below the surface. His need to validate his attractiveness and desirability led to his downfall.

Many people have insecurities and demons that can come out when they least expect them. If you question your intellectual ability, for example, you may be prone to question your trading decisions while under stress. A voice in the back of your mind may say, "Who do you think you are? You're not smart enough to completely trust your decisions." Your ability to combat these self-statements depends on your life experiences. Some people conquer their demons while other people try to ignore them. If you pretend they are not there, however, they can catch you off guard.

How do demons exert their power? Many demons have a common core. People with hidden insecurities feel that you don't belong and that they’re identify can collapse at any minute. In contrast, people who have conquered their demons may feel "natural" in whatever they do. Nothing is a big deal. For example, a person raised in the trading environment is more likely to see trading events as commonplace. Trading is natural. It's no big deal. Trading events are not imbued with emotional significance.

Other people have demons that may impact their trading. What are some popular ones? Consider the imposter demon. Imposters feel they don't belong in the trading profession. They feel that they are just faking it. They assume that they are going to get caught at any minute, so they might as well not take anything seriously. Then there is the gambler demon. Gamblers believe that they are just having fun. They like the risk. They like the rush. It's all about living in the moment and getting high. Some demons aren't as deep seated. Consider the slacker demon. Slackers spent most of their early life blowing off responsibility. They didn't do well in school and ended up a success later in life. Because they spent their early life avoiding structure and discipline, they easily entertain the idea of breaking the rules. They are likely to throw out their trading plan while under stress.

How do you fight your demons? First, gain awareness. Demons only impact you when you are not conscious of them. When you are aware of your secret demons, you can neutralize their power. Second, change your self-talk. When you feel unworthy or uncertain, remind yourself that you are worthy. Remind yourself that your effort will pay off eventually and that you should protect yourself and keep working hard. Don't let your demons sabotage your efforts. Gain awareness of them and fight them. You'll stay profitable in the long run if you do.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

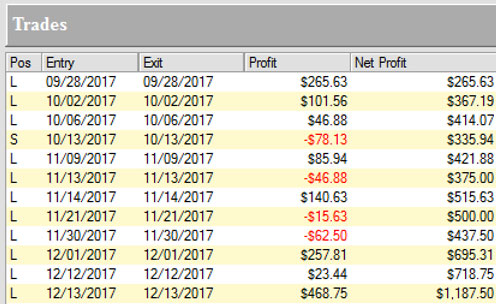

2017 Activity Summary: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

In 2017, conditions were particularly hostile for premium selling, with especially low implied volatility levels. We still managed to reach our objectives.

- Safety

- With implied volatility particularly low during the whole year, we had to widen our choice of candidates again, to keep maximum safety. We managed to maintain, on all our trades, a safe distance between price action and our short strikes (see AA and BPOP examples below).

We only had to roll 3 times in 2017 (and all these newly rolled trades are now closed for a profit), as a result of our safety policy. The way we roll now takes a lot of research and is better avoided. This releases more time for back testing, improving Instant Income Guaranteed, etc.

- We banked profits on many of our new long term spread trades with unlimited upside potential, always using other people’s money. We recently closed a trade on BHP for instance, which lasted 556 days in total, giving us annualized returns on margin of 179.73% and on principal of 35.95%. This is a very low stress way of yielding 35.95%/year on your cash, maximizing your profits along the way. The only “risk” in this trade was to acquire BHP for a net price of 16.50$ (BHP was quoting 48.84$ on 9th Jan 2018).

As of the 9th January 2018, we have completely closed 8 of these trades and we have 25 of them still opened (out of these 25 trades, 12 have no more margin requirements as we bought to close for a profit the short legs).

- In the last few months of the year, I put my efforts on 2 main topics:

- Enter our trades closer to the beginning of a daily uptrend, which allowed us to get higher capital efficiencies and returns, in spite of a particularly low implied volatility (see TIF and CSX examples below):

Refining a new promising spread trade type, much shorter term than the initial one, with excellent annualized returns; after back testing, we entered our first live trade of this type the last trading day of the year.

Wishing you all a great trading year,

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Outside Bars in the Russell 2000 Mini Future

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Marco Mayer explains the "Outside Bars" pattern as an entry signal. He shows you how if it works as an entry signal in the Russell 2000 Mini Future and how to evaluate entry signals in general by using a systematic approach.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

~ Use Coupon Code During Checkout ~

newyear

Trading is a Business

Trading the Ross Hook

Life Index

Recorded Webinars:

The Law of Charts In-Depth

Traders Trick - Advanced Concepts

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 708 - January 5, 2018

Edition 708 - January 5, 2018

Chart Scan with Commentary - Wedges

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Once in a while I have a longing for the old “geometrical” ways of trading, which for some are still the best ways for trading. What I will show you incorporates the Law of Charts, but it does so while answering a question I received: “What is a bullish descending wedge pattern?” While I’m at it, I’ll show you a bearish ascending wedge.

As you can see in the first chart below, the wedge has grown increasingly narrow. Of course, where to begin drawing the wedge is somewhat in the eye of the beholder. I could have drawn the lower line from the May low (dotted line), and I could have gone way back to the high that occurred in November (not shown). I think you get the idea. The interesting thing is that as the wedge has narrowed, we see the beginning of what may turn out to be a 1-2-3 low. If I had room (I don’t’) I could also show you that from a technical point of view there is a rising trend line on MACD, indicating divergence.

The next chart below shows a narrowing rising wedge. Amazingly, prices have been trading at 300 times earnings! It stubbornly resisted the forces of gravity until just this week, when it formed a 1-2-3 high. Could we see more selling ahead? Could the descent be severe? It will be interesting to find out. But at least now you know what the old-timers called ascending and descending wedges. To make money out of these still requires good management. It is always challenging to see some traders make money from a trade while some traders lose money from the very same trade.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - It’s not the Money, It's the Challenge

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Why do you trade? Most people would think it's obvious. It's for the money, right? What many winning traders know, however, is that money is a poor motivator in the end. It's much more satisfying to pursue trading for the pure joy of mastering the markets, regardless of how much money you make. Winning traders are motivated more by the process of trading than by the profits they are making. It's common to hear traders say, "I love trading so much that I would do it for free if I had to." Indeed, when one looks into the backgrounds of top traders, the story seems to be the same: They all tried to get a job in the trading industry as soon as possible, any job as long as it involved trading in some way. The markets fascinated them. The money was either secondary or not an issue at all. Successful traders love the challenges the market offers and view their work as meaningful.

Consider what Ben, a successful trader, said about money to our TE staff, "Money doesn't make a person happy. Trading is what I do and I enjoy doing it. The money aspect of it is obviously cool and everybody wants that, but I don't know how to do anything else." Staying detached and apathetic towards money can help put you in the proper mindset. Curt, a successful winning trader wrote in to say, "One of the reasons I was successful was because money wasn't the reason I wanted to trade. Because the allure of money wasn't the reason I was trading, it was a lot easier for me to withstand the ups and downs of the market, and to execute without that affecting the way I was executing." When you aren't worried about the money, you can take a more carefree approach to trading. You feel that you don't have to win, and knowing you can make a mistake here and there allows you to relax and trade more creatively.

In modern society, we are pushed to make money. We think we need money, and see trading as a way to make a lot of it. Ironically, if you are focused only on the money, you will become disappointed and eventually fail. Pursuing trading as a passion is a more satisfying way to trade. It's more useful to focus on pursuing goals that are intrinsically interesting and personally meaningful. One should pursue trading because he or she enjoys the intellectual challenge. Market action is intrinsically interesting. It is a rewarding intellectual challenge to devise innovative new trading strategies and to see how well your ideas pan out, just for the fun of it. Viewing trading from this perspective can powerfully motivate you.

Whether it's art, sports, or business, the folks at the top are not primarily motivated by fame, glory, respect, or status. They are driven by the pure love of the game. Winning traders, similarly, have strong interests in the markets, and this passion is the driving force that puts them at the top, year after year. Those who find trading intrinsically satisfying, enjoyable, and meaningful will put in the necessary hard work and achieve high performance levels. So don't focus on the money and status that successful trading may bring. Enjoy the process of trading. Seek out challenges and the satisfaction of meeting them. You'll end up more profitable by doing so.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea: Instant Income Guaranteed

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Trade with No Losses

WDC Trade

On 12th December 2017 we gave our Instant Income Guaranteed subscribers the following trade on Western Digital Corporation (WDC). Price insurance could be sold a few days later on temporary weakness:

-

On 15th December 2017, we sold to open WDC Jan 19 2018 72.5P @ 0.65$ (average price), with 34 days until expiration and our short strike about 11% below price action.

-

On 18th December 2017, we bought to close WDC Jan 19 2018 72.5P @ 0.25$, after 3 days in the trade for quick premium compounding.

Profit: 40$ per option

Margin: 1450$

Return on Margin annualized: 335.63%

Kind regards,

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

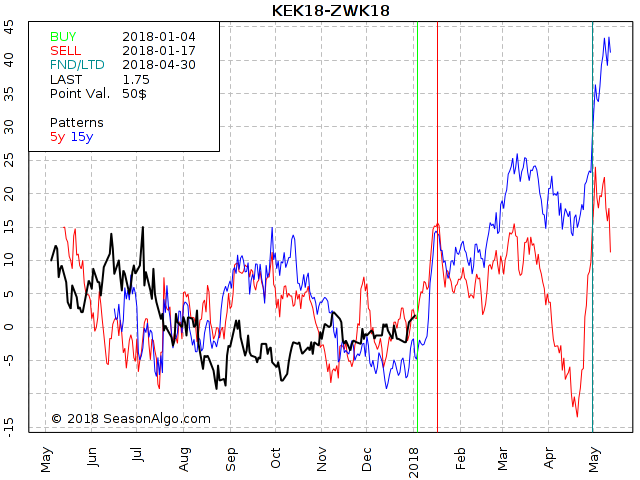

Trading Example: KEK18 – ZWK18

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

This week, we're looking at KEK18 – ZWK18: long May 2018 Kansas Wheat and short May 2018 Chicago Wheat (KCBT on Globex).

Today we consider a Wheat Inter-Market spread: long May 2018 Kansas Wheat and short May 2018 Chicago Wheat. This trade is simply based on the seasonal statistic. With 22 winning trades in a row it looks promising. This trade should work out immediately because the seasonal time window (01/04 – 01/17) is really small.

Learn how we manage this trade and how to get detailed trading instructions every day by subscribing to Traders Notebook!

Click Here!

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video - Trading Error: Averaging into a Losing Position

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco talks about one of the most common, and also one of the most deadly mistakes traders can make, and that's averaging into a losing position. He also gives you some insights as to why this is so tempting, and shows you why you should avoid it at all costs.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 707 - December 29, 2017

Edition 707 - December 29, 2017

HAPPY NEW YEAR!

2018

Happy New Year Traders

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

With 2018 upon us, it's time to make plans for having a fruitful and productive new year. We have only a few days left before a new year of trading starts. It is a time to rejuvenate and re-energize, and one of the best ways to do that is to clean out all the old stuff you have littering your workstation. Organizing your workspace can make you feel in control, as if you are ready to tackle new challenges.

Clutter, full email inboxes and stacks of old paperwork can be distracting. Saved online articles and piles of newspapers you'll never read can make you feel as if the clutter is closing in on you, cramping your style and stressing you out a little. Removing some of the clutter often symbolically gives you increased psychological space and renewed creative vigor. You'll literally have more room to breathe. Some traders may prefer a messy workspace or unorganized files on their computer, but most people associate untidiness with confusion, chaos, and ultimately, stress. An organized workspace, in contrast, is less distracting. When you are trading, it's essential to focus on your screens. Clutter and disarray can grab your attention and shift it away from monitoring the trade of the moment. A clean, sparse and organized workspace is often refreshing.

It may take a little time and effort, but organizing your workspace pays off. And if you do it systematically, you'll get the job done in no time. The first step in organization is to delete old and throw out worthless information. This is the hardest part. We collect saved documents, books and papers because we think we will need them. Yet many times we accumulate so much stuff that its actual contribution is minimal. We'll never find the time to read all of it, and it will just take up valuable workspace. But it's hard to delete it or throw it away. It took time and energy to assemble these items, and throwing them out subtly suggests that you wasted your time collecting the stuff. But most of it can be tossed out. Make tough decisions and commit yourself to throwing out and deleting anything you don't really need.

For those who still have a love for paper copies, developing an informal filing system can be helpful. It doesn't have to be formal with folders for each topic and precise categories labeling each folder. Sometimes you can merely place documents for a particular task or project in a large attractive looking box. You can then pile the boxes in a corner of your office, or if it is still a distraction, you can stack the boxes in the garage. But it's important to get them off your desk and prevent them from encroaching on your workspace, and more importantly, on your mind.

Get a fresh start on 2018. The first trading day of the New Year is on Tuesday. Spend the rest of the week cleaning things out. You'll feel refreshed and invigorated, and ready to tackle the challenges of the New Year.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

End of the Year with No Losses

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Another year of price insurance selling is coming to an end. Another year of trading without losses. This is the time for us to stop trading in this low liquidity environment during the last trading week of the year and spend more time with our families and friends. But time decay is still working for us on our existing positions, rewarding us for doing nothing.

We wish you a Happy New Year 2018.

Kind regards,

Philippe

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Start the New Year Healthy

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

2017 was for sure a very interesting year. Because of the missing volatility and direction it was very tough for me to swing trade on the daily chart. Selling options was difficult as well because the Implied Volatility stayed at the lower side of the range in most markets throughout the entire year. Not only trading was tough, I had to fight health issues as well at the last quarter of 2017. But we learn only during tough times and this year I learn a lot. What have I learned? I learned not to take things like money, work, or in general all material things so important and to concentrate much more on health than on anything else. And on family of course. At the end, that’s all that matters!

Regarding trading, I want to concentrate more on spreads again. 2018 will be the 15th year I am recommending spread trades in Traders Notebook and during all these years spreads have been an important part. In 2018, I want to push spread trading even more especially under these trading conditions we are in right now. Hopefully you will join the Traders Notebook Family in 2018!

I wish you and your loved ones a happy and healthy 2018!

Andy Jordan

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

New Year Outlook

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Dear Traders,

I'd like to thank all of you for a great year 2017! Like every year I feel like I’m the one who learned from you or by looking into topics that interested you about trading. It’s amazing how there’s always a new level of depth when it comes to trading that you couldn’t imagine before.

When it comes to actually trading, 2017 surely was a mixed year for me. While Ambush took off to new highs throughout the year in many markets, AlgoStrats:FX drifted into quite a drawdown that surely isn’t what I had expected starting into the year. This lead me to day trade more actively again which happily helped a lot.

I also did my first trades in the crypto currency markets this year and luckily that worked out quite well. Being long the equity markets wasn’t hurting either. But hey, you hardly could fail with that in 2017!

I'll spend the next week over Christmas with my family and friends, far away from the markets. That's what I strongly suggest to do during these days of low liquidity. Just do what everyone else does and relax. After the holidays I’ll go and travel for almost a month and decided to pull the plug completely this time and simply don’t trade at all. This is the first time I’m doing this for many years so I’m really looking forward to this.

So I'd like to wish all of you a Merry Christmas and a Happy New Year! Enjoy the holidays with your family and friends, and I'm looking forward to a great trading year 2018 with you.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Happy New Year from “Behind the Scenes”

While we don’t write articles for the Chart Scan, many of you may recognize us from e-mails and phone calls over the past year as we have had the pleasure of working with students with orders, general questions and guidance. We wish everyone a very successful 2018 and beyond.

Denise Ross and Martha Ross-Edmunds

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 706 - December 22, 2017

Edition 706 - December 22, 2017

Chart Scan with Commentary - The Importance of the Big Picture

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

When prices on a daily chart remain contained, traders can become complacent, and vulnerable to emotional breakouts.

When prices trade in a range for an extended time, the market begins to depend on those prices. Traders make assumptions and plans about such markets, and tend to trade accordingly. Sometimes those plans can extend well into the future, in turn generating other plans contingent on a certain level of continuing price containment.

But what if prices break out of that range? Complacency gives way first to surprise, then to denial, sometimes to desperation. The latter can eventually induce panicky behavior, driving prices even further.

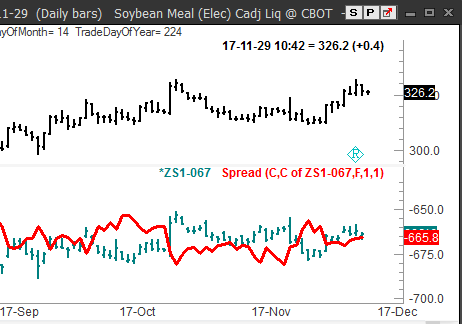

The chart below shows a currency spread (line chart overlay) long Soymeal (upper bar chart) and short Soy beans (lower bar chart). As you can see, each of the two markets is in a trading range, and so is the spread.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - It Can Look Good in Hindsight

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

The human mind is capable of extreme optimism. We have a strong need to win. This need can be so strong that everything looks rosy. For example, you may look backward at old charts and think, “It’s easy to see winning patterns.” Behavioral economists call this optimism, ‘hindsight bias.’ When we know how a stock price moved in the past, we think it all seemed inevitable when we look backward. For example, if you looked at a rise in stock price over the past few years, you may think in hindsight that it was inevitable. People have been positive about stocks.

Profits have been good, and of course, stock prices went up. You may have also seen the decline at times as being inevitable as well. If too many investors buy, prices were bound to go down a little eventually. The patterns all make sense in hindsight. The problem, however, is that people have difficulty seeing these patterns in foresight.

People are, indeed, too optimistic. Our thinking can be biased and self-serving. We can falsely believe that good quality setups are easy to spot, and we can convince ourselves that success is assured. But our expectations don’t always match reality.

The mind is prone to bias and unrealistic optimism. That’s why it is crucial to cultivate a healthy sense of skepticism. Skepticism isn’t the same thing as pessimism. A pessimist falsely distorts reality to the point that he or she believes that even a reasonable plan is doomed. A skeptic is optimistic yet is also realistic. No trading plan is foolproof. You may look back at old charts and see a foolproof way to make money. But history only repeats itself when it does (and sometimes it does not), and the mind can make it all look so obvious in hindsight. The markets don’t always cooperate with you. The winning trader is the person who questions a trading plan before executing it. He or she tries to anticipate what could go wrong, and thinks of ways to work around these potential setbacks. Being a healthy skeptic can be difficult at times, but the cautious optimist usually ends up making the most profits in the end.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - SLCA Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 19th November 2017 we gave our IIG subscribers the following trade on U.S. Silica Holdings Inc (SLCA). We sold price insurance as follows:

- On 20th November 2017, we sold to open SCLA Jan 19 2018 27P @ 0.425$ (average price), with 59 days until expiration and our short strike about 21% below price action.

- On 12th December 2017, we bought to close SLCA Jan 19 2018 27P @ 0.20$, after 22 days in the trade

Profit: 22.50$ per option

Margin: 540$

Return on Margin annualized: 69.13%

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post: I just wiped out for the second time.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

This week, Andy asks if he's some kind of trading freak. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Video: Presenting Ambush Signals

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Learn all you need to know about our new Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier!

Happy Trading!

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 705 - December 15, 2017

Edition 705 - December 15, 2017

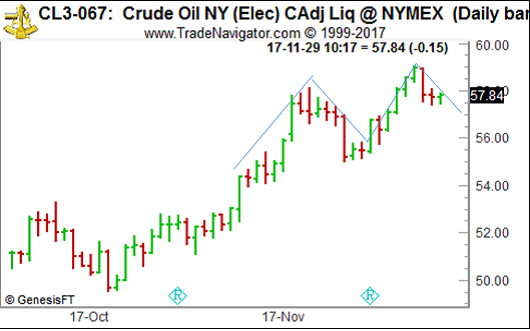

Chart Scan with Commentary - Is Crude Oil Putting in a Top?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

This is a question I am being asked quite often these days. The answer is that I honestly don't know. But from a purely technical analysis point of view, it is. On the daily chart, crude seems to be forming an m-shaped top. Some old-timers would even label it as a left shoulder and a head that could end up with a heads and shoulders top. The neckline seems to be right around 57.00. Of course, all of this is in the eye of the beholder.

What do we see on a daily chart basis via The Law of Charts? Prices are definitely still trending, making higher highs and higher lows. I've marked the /\/\ such as it is, so you can see it as well. So, from the point of view of chart analysis, we appear to have the probability of a top in crude oil, but in actuality prices are still trending.

Will the top form as a sideways price action known as distribution? Again, who knows? I don't even pretend to know. There are too many other factors involved. Crude oil is now a political football, as well as an economic enigma.

As far as the weekly chart is concerned, crude is still in an uptrend, having not broken any uptrend lines.

Can crude oil go much higher? Absolutely! Especially with the uneducated move the U.S. Congress is likely to make if they decide to regulate trading in crude oil.

I do not believe that this is a time to make any kind of definitive decision to short crude oil, but if you can't stand the suspense, maybe you could buy an at-the-money option straddle. Then if/when crude makes up its mind, you simply drop the losing side.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Living With Reality

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

If you're like most traders, you expect to win. You put your time and energy into finding high probability setups, and after all the studying, searching, and theorizing, when you think you have come upon a good idea, you want it to work. Unfortunately, the markets don't always cooperate. You have to go where the markets take you. In the end the markets are always right. How do you react when things don't go your way? Do you feel upset? Are you angry? Do you want to get even?

When things don't go your way, it's very human and understandable to feel frustrated and angry. People experience anger when they feel that they have been unfairly wronged. It's easy to get angry while trading the markets. You expect to win. You were counting on winning. And when the markets don't cooperate, you feel a little hurt. Your ego is dinged and you are angry with someone: fate, yourself, imaginary institutional traders who are out to get you. The possibilities are endless. If you want to find someone to be angry with, you can find it, but it isn't very productive.

Anger can be a dangerous emotion when trading the markets. When you feel angry, you are ready to put up a fight. You have a powerful inclination to focus all of your energy and resources on fighting, seeking revenge, and looking for any sign of provocation. It's hard to think clearly when you are angry. Sound decision-making requires you to remain calm, focused, and flexible. There's no reason to be angry at the markets. Here's how you can be less angry at the markets.

First, don't personify the markets. Anger is an interpersonal emotion. We are usually angry with someone because we believe that he or she has purposely tried to harm us. The markets may consist of people making trades, but it doesn't make sense to make up imaginary relationships with the markets. There is nothing that is personal going on. You are merely making it personal, and taking setbacks personally, as if someone were out to wrong you. The people participating in the markets may engage in actions that thwart your goals, but their actions are not directed toward you personally. It is best to look at the markets as an abstract impersonal entity. Pretend you are playing a videogame. The more impersonal you can make trading, the better you will feel, and the more profits you'll realize.

Second, don't expect anything to go your way. Practice radical acceptance. Whatever happens, happens, and there is little you could have done to change things. (All you can do is limit your risk.) Anger is felt when our expectations have been shattered. One expects to profit from a trade, and when the profits are not realized, he or she may become angry, seek revenge, and want to get even. However, it isn't useful to have high expectations in the markets. Don't depend on the markets to fulfill your goals or meet your expectations. Assume that anything can happen. Indeed, in dealing with the markets, it's almost a given that you will lose money, so it is not useful to expect to make money on every trade. Just accept what you can get. Using this thinking strategy will make you feel calm.

The more you can stay calm while trading the markets, the more profitably you will be. Don't get frustrated, angry or upset. Take all setbacks in stride and enjoy the process of trading. You'll find you'll be calmer, focused, and more profitable.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - CSX Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 26th November 2017 we gave our IIG subscribers the following trade on CSX Corporation (CSX). We sold price insurance as follows:

- On 27th November 2017, we sold to open CSX Jan 05 2018 46P @ 0.46$, with 38 days until expiration and our short strike about 8% below price action.

- On 29th November 2017, we bought to close CSX Jan 05 2018 46P @ 0.20$, after 2 days in the trade for quick premium compounding.

Profit: 26$ per option

Margin: 920$

Return on Margin annualized: 515.76%

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea: 1000*CLN18 – 420*HON18

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

This week, we're looking at 1000*CLN18 – 420*HON18: long July 2018 Crude Oil and short July 2018 Heating Oil (NYMEX on Globex).

Today we consider a Cotton calender spread: long July 2018 Crude Oil and short July 2018 Heating Oil (NYMEX on Globex). After being in a long down-trend, it looks like the spread might want to turn around to the up-side following its seasonal pattern. While the 15 year seasonal pattern shows an up-trend between October and January, the 5 year seasonal pattern shows the start of the seasonal up-move at the beginning of December. Energy spreads using two different markets (so called inter-market spreads) are usually very volatile and therefore need a wide stop. A risk of at least $1,500/spread seems to be appropriate for this spread. Please Note: because Crude Oil and Heating Oil have a different value per price tick we need to multiply the buy side by 1,000 and the sell side by 420 to plot the correct equity chart. The spread is 1:1.

Learn how we manage this trade and how to get detailed trading instructions every day!

Please visit the following link:

Yes, I want additional information!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

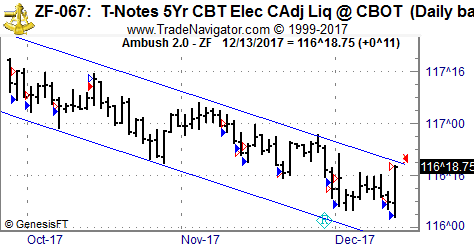

Trading Article: 5-Year T-Notes keep on trending in perfect Ambush Rhythm!

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

One of the best performing Ambush markets this year has been the 5-Year T-Notes Future (ZF). Actually its performance just hit new all-time-highs!

The interesting part here is that this market actually has been trending most of the time. While it’s been in an uptrend during the first part of the year, it’s now been trending lower in an almost perfect channel:

Now as you probably know, Ambush is a mean-reversion method so how is this possible? The answer is that Ambush is hitting that sweet spot of getting into trades usually towards the end of an up- or downswing in the markets and stays in only for a single day.

At the same time this market has been trending lower rather slowly. This creates a very nice environment for Ambush to trade in. Meaning ZF and Ambush are in perfect sync and having a really nice dance!

Here’s the trade details of all trades visible on the chart and as you can see ZF is quite a small contract you can trade nicely even with a small account:

Become an Ambush Trader today!

Simply sign up to Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 PM NY Time (yes, it's ready much earlier now than before) the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the markets close! Can you imagine a more comfortable way to day trade?

Ambush eBook

Now if you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want to get the Ambush eBook. Here’s a hint: we’ve already significantly raised the price of eBook last year and probably we’ll do the same soon in 2018. So if you’re interested in buying the eBook, go for it now.

Happy Trading!

Marco

Feel free to email Marco Mayer with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 704 - December 8, 2017

Edition 704 - December 8, 2017

Chart Scan with Commentary - Spread Trade

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I think many traders should take the time to learn a lot about spread trading. Sometimes I wonder why more people are not trading spreads. There are incredible advantages available for trading them: no stop running, low margins, most efficient use of your capital, more and steeper trends, seasonality, mathematical correlation — the list goes on and on.

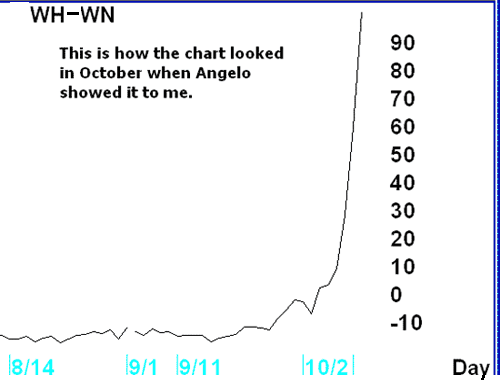

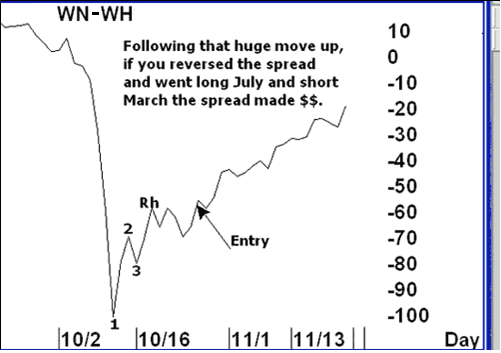

I love the spread shown to me by my friend Angelo when we were together in October. Take a look!

Spread trading is quietly kept secret. Why? Because spread trading completely eliminates stop running. Do you think the insiders want you to know that? What would they do if they didn't have your stops to run?. Follow this link to find out more!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Trends

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

IS IT TRUE THAT MARKETS TREND ONLY 15% OF THE TIME?

The statement that charts trend only 15% of the time is true only in the most general sense. There is almost always something trending somewhere, in some time frame. Trending means the market is moving from a definable top to a definable bottom, or from a bottom to a top. If traders cannot define the trend on one chart, they should look at another time period chart for the same stock or commodity, where the trend is more evident. You might even consider using tick charts, where each bar represents a certain number of ticks (or pips forex). There are many instances where a tick chart can be set to a number of ticks (pips) that will present a trending market in a market that presents as sideways using time charts. However, be aware that with tick charts you never know when you are going to get a new bar, and that the bars can suddenly change shape.

Believing markets trend only 15% of the time, popularly espoused by market technicians, is in one sense foolish. Long accumulation phases on daily charts, experienced by markets like sugar and silver, may not readily expose their trends until weekly and monthly charts are examined. Once the accumulation phase is identified, traders must wait for valid breakouts to occur before entry. The Latin roots to the word accumulate means to "add to the pile." A cumulus cloud is a pile of water vapor. There are three common congestion phases, and accumulation at the market bottom is one of them. The up move and down move have congestion phases as the market digests previous gains and losses, then usually continues the trend prior to the congestion. Congestion occurrence in the distribution phase, at a market top, is opposite the low range accumulation congestion phase. Congestion phases usually have low volatility and well defined five- to ten-day high and low price ranges, the opposite of the volatile distribution phase at market tops.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - TIF Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 29th November 2017 we gave our Instant Income Guaranteed subscribers the following trade on Tiffany & Co (TIF). We sold price insurance as follows:

- On 30th November 2017, we sold to open TIF Jan 19 2018 82.5P @ 0.85$, with 49 days until expiration and our short strike about 11% below price action.

- On 1st December 2017, we bought to close TIF Jan 19 2018 82.5P @ 0.42$, after 1 day in the trade for quick premium compounding.

Profit: 43$ per option

Margin: 1650$

Return on Margin annualized: 951.21%

Philippe

Receive daily trade recommendations - we do the research for you!

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article: Is Seasonality the same in all Markets?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights