Joe Ross

Edition 730 - June 8, 2018

Edition 730 - June 8, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Markets Fall Faster…

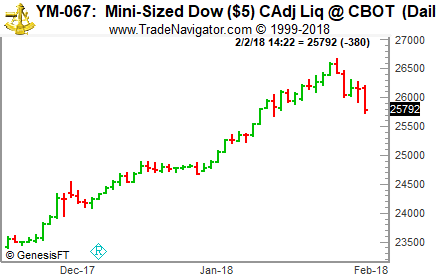

I believe that markets fall faster than they rise, except perhaps in currencies, where the rate of descent seems approximately the same as the rate of ascent, from one currency to another. A good part of these moves is due to market manipulation, but also when prices are falling there is a huge emotional component—fear and panic. We all know that what goes up, must come down (usually). It is also known that markets fall much faster than they rise. We have seen a lot of that lately, as well.

As I was looking through my charts, I couldn't help but notice a perfect illustration of prices falling much faster than they had risen with Wheaton Precious Metals.

Counting from the bar marked “1,” It took 13 bars to reach bar number 13. However, it took only 5 bars to wipe out any gains made since bar number 1.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Efficiency and Success

How much time do you spend preparing for the trading day? Do you spend hours scouring the markets for a winning trading opportunity? Do you watch hours of commentary or read all the major financial newspapers? You don't need to spend hours and hours reading about the markets if it doesn't directly lead to a profit. For example, most media coverage of the markets is for entertainment value, so spending hours reading or viewing it is a waste of valuable time. You need to work efficiently and make sure that the time you spend learning about trading and the markets does indeed pay off.

Consider how a seasoned hedge fund manager, prepares. "I look at about 300 charts every day. That gives me a good feel for what the markets are doing overall. I try to see whether a lot of different markets are signaling the same thing and breaking out at approximately at the same time. I wait for that to happen before I take a position. When it happens, it's fairly clear, and I really don't have any problem with courage at that point." The expert trader doesn't spend hours the night before preparing. Instead, the experienced, winning trader can prepare right before the trading day begins. Rather than wasting time on tasks that don't pay off, the winning trader works efficiently.

Veteran traders may work efficiently, but novice traders may need to spend a little extra time preparing. It's difficult to become a skilled and consistently profitable trader. Only an individual with rare talents can rise to the top 2% who make it as a top-notch trader. It does indeed take dedication and hard work. However, some make the mistake of thinking that trading is like a regular 40-hour a week job. The idea that an hour of work directly produces an hour of pay is not pertinent to trading. Trading is more about accomplishing a specific target, and making a profitable trade, rather than putting in a specific number of hours. For instance, if it takes only 15 minutes for a skilled trader to make enough profit to have a year's worth of living expenses, then so be it. Seasoned traders don't have to spend 40 hours a week to make a living, if they have the requisite skills (and novice traders may need to put in more time building up these requisite skills).

The point is that if you're a novice trader, you can't work under the belief that everything you do will have a payoff. You must also consider that there are a fixed number of hours in the day that you can work, so you must spend that time efficiently. Trading is a challenging profession, and you need to focus your psychological energy on what matters most. For example, don't be distracted by learning additional trading strategies that you will never use, or new indicators that are redundant with basic indicators of trend. And don't believe you must keep up with all the media hype. Focus, work efficiently, and in time you will build the skills you need to become a consistently profitable trader.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

M Trade

On 16th May 2018 we gave our Instant Income Guaranteed subscribers the following trade on Macy's Inc (M). Price insurance could be sold as follows:

- On 18th May 2018, , we sold to open M Jun 29 2018 28P @ 0.29, with 41 days until expiration and our short strike about 16% below price action

- On 24th May 2018, we bought to close M Jun 19 2018 28P @ 0.14, after only 6 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 560$

Return on Margin annualized: 162.95%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - Traders "Pro Active" and "Ray Active" – A Story!

Pro Active and Ray Active are both wannabe traders, but their approach to trading is quite different. Ray is consumed with trading for profits. He imagines himself achieving great wealth, and thinks that when he amasses the riches he is after, he'll finally get the respect and recognition he always wanted from his wife, family and friends. He thinks, "If I can only make it as a trader, I can show everyone that I deserve their respect."

Pro doesn't care about what other people think of him. He concentrates on building up his trading skills. He thinks it would be nice to make consistently regular profits, but he doesn't feel that he absolutely has to obtain great wealth. He enjoys trading. It's fun. It’s what he has discovered he always wants to do. He would trade for minimum wage if he needed to. He doesn't want to do anything else. He feels confident that if he applies himself, he will eventually become a profitable trader.

Pro has a strong sense of his own value as a person, and because he lets his own motives and values guide him, he is likely to reach his goal of become a winning trader. On the other hand, Ray is looking for his value through the eyes of others.

If you want to be a happy winning trader you cannot allow your “net worth” to define your “self-worth.” Any confidence you have has to be within yourself.

Winning traders develop or already have a sense of inner, rather than external, self-value. You are, what you think you are, and the only evaluation of yourself that counts is the one that comes from inside you. That is why anyone who wants to succeed at the business of trading must confront him/herself and discover and deal with who they really are.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders profit big time from novice traders who’re having a hard time trading the Canadian Dollar!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Canadian Dollar Future (6C) traded at the CME, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day. Now the Canadian Dollar has been doing what it’s doing most of the time, moving sideways in little boxes in a jerky way which is of course driving most traders nuts!

Luckily Ambush has no trouble in such markets and so Ambush Traders exploited and profited nicely from all the losing breakout traders lately! As you can see we had a lot of trades at the tops and bottoms of these trading ranges, whether they’re small or a bit more expanding.

Where’s the CAD going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

Here’s the result of these trades, trading one 6C contract, including $10 commissions per trade.

Is it always like that? Of course not, but if you’ve been on the other sides of these trades you maybe should think about switching sides!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Free Webinar with Trading Coach Adrienne

Trading Educators presents

An Evening With Adrienne

Tuesday - August 21, 2018 at 4:30 P.M., US ET

CLICK HERE TO REGISTER!

Adrienne Toghraie, Trader’s Success Coach

www.TradingOnTarget.com

In this one-hour workshop you will be given a choice of 70 typical questions that traders have frequently asked in workshops and seminars all over the world. You can either choose to ask these questions of Adrienne, ask questions in your own way or ask entirely different questions.

The benefits of this workshop are:

- You will have an opportunity to have a world renowned trader’s coach answer your questions about the psychology / discipline of trading.

- You will have an opportunity to hear other traders’ questions and issues that could trigger a breakthrough in understanding about some of your own issues.

ADRIENNE TOGHRAIE, a Trader’s Success Coach, is an internationally recognized authority in the field of human development for the financial community. Her 13 books on the psychology of trading including, The Winning Edge series 1-4 and Traders' Secrets, have been highly praised by financial magazines. Adrienne’s latest book published by Wiley, Trading on Target, is available at Amazon.com. Adrienne's public seminars and private coaching have achieved a wide level of recognition and popularity, as well as her television appearances and keynote addresses at major industry conferences.

919-851-8288

This email address is being protected from spambots. You need JavaScript enabled to view it.

Edition 729 - June 1, 2018

Edition 729 - June 1, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - New Zealand Dollar-Japanese Yen Spread

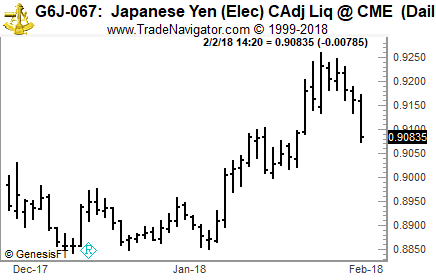

"Hey Joe! I’ve been watching the spread between the Japanese Yen and the New Zealand Dollar. I don’t have a Forex account, so I watch the spread as a differential spread long yen and short kiwi. Based on the chart below, do you think we are looking at a bottom for the yen? "

I think it’s much too soon to call for bottom in the yen. A one-day move is not sufficient for calling a bottom, in the yen or even a bottom in the spread.

The kiwi is still in an established uptrend.

And, all the yen has done is make a one-day spike upward in a trading range, which could be nothing more than stop running.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Greed

In the movie "Wall Street," Gordon Gekko argues, "Greed is good." Greed can motivate you to strive for perfection and keep you persisting in the face of adversity, but greed has its downside. It is often said that the markets are driven by fear and greed. The masses have a natural desire for wealth and all the advantages that money can buy. In their zeal, the masses invest in stocks and believe that their investments will allow them to achieve their financial goals. When the price starts going down, though, they fear losing their investment and they sell, often too prematurely and at a loss. The dynamics of greed drive the dynamics of the market.

In the movie "Wall Street," Gordon Gekko argues, "Greed is good." Greed can motivate you to strive for perfection and keep you persisting in the face of adversity, but greed has its downside. It is often said that the markets are driven by fear and greed. The masses have a natural desire for wealth and all the advantages that money can buy. In their zeal, the masses invest in stocks and believe that their investments will allow them to achieve their financial goals. When the price starts going down, though, they fear losing their investment and they sell, often too prematurely and at a loss. The dynamics of greed drive the dynamics of the market.

As an individual trader greed may drive you. Trading is a challenging profession. Not everyone makes it. You have to study the markets and learn how to take out profits from the market action. How to do this is not obvious. Finding profitable trading strategies is an unending search. You may find a strategy that works for a while, but market conditions change and the strategy no longer works. The challenge is to make profits in market after market. Why bother? If you aren't driven to achieve success, you won't make it. You won't persist. You won't try to overcome setback after setback. Greed is a powerful motivator. It is natural to seek out happiness. If you are similar to most people, you dream of eternal bliss. For centuries people have fantasized that if they had immense wealth, they could solve all their problems, but this fantasy is often unrealistic. The human mind is capable of fooling itself into falsely believing that unrealistic fantasies can come true.

Money is a powerful motivator, but many people know deep down that money can't solve all our problems. And those thoughts and feelings that lie deep down in our psyche can often influence us when we don't want them to. Since we know that money isn't going to solve our problems, we can lose hope when everything seems to be going against us. It's important that we acknowledge how greed can be a motivator but also a barrier. It can distract us from focusing on our trading plan. We can become so consumed with the pursuit of money that we fail to appreciate the inherent rewards of trading. Trading offers an intellectual challenge. You can build up your trading skills through practice and experience and feel good knowing that you have mastered a skill that few have developed. Don't focus all your energy on money and the accumulation of it. Instead, focus on developing your skills and enjoying the process of trading. In the long run, you'll find that you will enjoy trading a lot more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

MU Trade

On 15th May 2018 we gave our Instant Income Guaranteed subscribers the following trade on Micron Technology Inc. (MU). Price insurance could be sold as follows :

- On 17th and 18th May 2018, , we sold to open MU Jun 15 2018 44P @ 0.25 (average price), with 26 days until expiration and our short strike about 17% below price action

- On 22nd May 2018, we bought to close MU Jun 15 2018 44P @ 0.05, after only 5 days in the trade for quick premium compounding

Profit: 20$ per option

Margin: 880$

Return on Margin annualized: 165.91%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

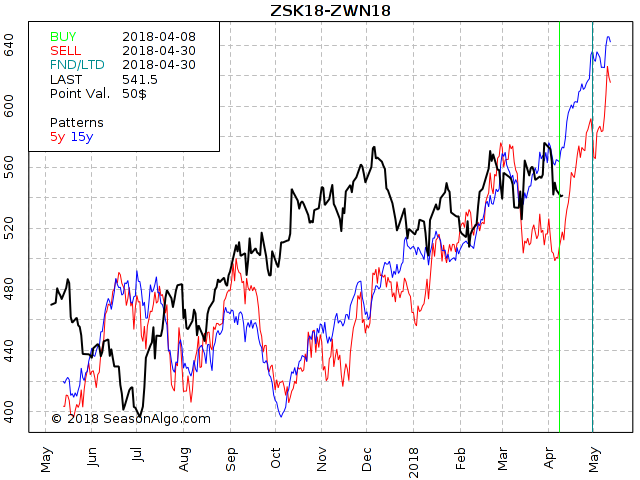

Trading Example - Inter-Market spread

This week, we're looking at 100*ZMZ18 – 600*ZLZ18: long December 2018 Soybean Meal and short December 2018 Soybean Oil (CBOT on Globex).

Today we consider an Inter-Market spread in the Soybean Complex: long December 2018 Soybean Meal and short December 2018 Soybean Oil. While the spread has been in a long term up-trend since the beginning of 2018, it has retraced from its May during the last few weeks. But the spread has found support at around $18,000 in April as well as in May. With an initial stop below the May low at approx. $17,700 and a potential target at $20,000 or even higher, the risk/reward ratio is in our favor. Please note: To alleviate the problem in spreads wherein tick values are not equal, one can convert the price of each contract into an equity value for each contract. Therefore, we multiply the Soybean Meal by 100 and the Soybean Oil by 600.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

AlgoStrats:FX Live Account hits new high for the year thanks to a 90 pip profit in AUD/USD

Trading the Forex markets can be tough and a lot of traders have been caught by the reversal in the USD related markets this week. The AUD/USD being one of the strongest markets, making back a week of losses within a single trading day.

Thanks to one of our mean reversion systems at AlgoStrats:FX we could catch almost the whole trading range of that day! As you can see on the chart below, we got in close to the low of the day and out close to the high, caching in a 90 pips profit.

At AlgoStrats:FX there is no "fantasy-trading" as with most signal services where you’re shown trades that actually never happened! All of the trades are real trades, traded in a live trading account. As a subscriber, you get access to all of the daily account statements of this account.

Overall we are up about 5% so far this year using very conservative risk management:

Learn More about AlgoStrats:FX

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 728 - May 25, 2018

Edition 728 - May 25, 2018

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders having a crazy winning streak in Natural Gas Futures

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Natural Gas Future (NG) traded at the NYMEX, where Ambush Traders are having an amazing run lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day. Now NG has been doing what it’s doing most of the time, moving sideways in a jerky way:

As you can see we had a lot of trades at the tops and bottoms of that trading range. With Ambush we’re in the trade when the reversal is actually happening and a new top/bottom is being put in place. Not when it’s over which is when other traders notice it after the fact and try to jump in way too late!

Here’s the result of these trades, trading one NG contract, including $10 commissions per trade. Yes, that’s a winning rate of over 90% with a profit factor of almost 30!

Is it always like that? Of course not, but it’s these periods Ambush traders love the most, literally dominating a market often for months at a time.

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Copper

In this issue of Chart Scan, we look at a very encouraging price breakout on the weekly chart of the price of copper.

The price of copper is one of the best gauges of global economic health. Copper is a key ingredient in transmission lines, plumbing, automobiles, appliances, and electronic equipment. The demand for copper rises and falls with manufacturing, infrastructure spending, and residential construction.

Copper had been suffering a huge decline, but as you can see on the chart below, it reached the critical price of $2.40 per pound. This price of $2.40 happened to be the lowest point copper had reached during its huge correction in 2007. From there prices had gone even lower, and so $2.40 became a point of resistance.

What is happening to cause copper and other industrial metals to move higher? Construction of the new Chinese Silk Road for one. Threats of war for another. Infrastructure spending in the US is contributing as well. Overall, the global economy looks good for copper prices to rise, although we don’t really know how rotten the global economy may actually be. But even if the global economy is not so good, wars and rumors of war are enough to keep copper in demand with steadily rising prices.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Maintaining Discipline

Winning traders are disciplined. Discipline means controlling impulses and fighting the urge to abandon your trading plan prematurely. Maintaining discipline is often easier said than done, especially when the market is moving in your favor. It's hard to avoid closing a trade out early in order to lock in profits. Some winning traders face more losers than winners, and when you hit upon a winner, it's tempting to take profits as soon as possible. But since winning traders are relatively rare, it's important to fight the impulse to sell prematurely and let the winning trade run for a while. In order to win big, it is necessary to delay gratification and patiently wait for the price to rise to your exit point according to your trading plan. Discipline is key, and it is vital to take whatever steps are necessary to maintain discipline.

Your mood can play a major role in determining your ability to stick with your trading plan. When you are in a bad mood, you may have trouble sticking with your trading plan. A 1991 study illustrates how feelings of emotional distress can influence your ability to maintain discipline. Participants engaged in a laboratory simulation in which waiting patiently resulted in greater profits. Specifically, participants were asked to pretend they were fishing in a lake, and that they would be given a monetary reward for each fish they caught. Taking too many fish out of the lake early in the game produced immediate profits, but when fish are taken out early, fewer fish are left in the lake to reproduce, and so, few fish can be taken out for a profit in the long run. Thus, waiting patiently to take out fish later is the most profitable strategy. Participants' moods influenced their ability to wait patiently and fight the urge to take profits too early.

You might see how this experiment has relevance for trading. When you are in an unpleasant mood, you may have a strong need to feel better. How can you feel better? Making money usually makes you feel better. You can either take profits out of a winning trade immediately or you can make an impulsive trade to get a quick thrill. Your mood can make all the difference. It is useful to make sure you are in a good mood while trading. When you are in a bad mood, you may act impulsively in order to make yourself feel better.

Of course, if you are a scalper, your plan may be to take quick profits whenever you can, as long as you are a high percentage winner.

Maintaining discipline is vital for trading success but it is difficult at times. The best ways to keep disciplined are to trade with a detailed trading plan, but this may not be enough. You must also make sure you are in a good mood. A good mood can mean the difference between trading impulsively and maintaining discipline.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

WDC Trade

On 10th May 2018 we gave our Instant Income Guaranteed subscribers the following trade on Western Digital Corporation (WDC). Price insurance could be sold as follows:

- On 11th May 2018, , we sold to open WDC Jun 22 2018 71P @ 0.79, with 41 days until expiration and our short strike about 10% below price action.

- On 16th May 2018, we bought to close WDC Jun 22 2018 71P @ 0.39, after only 5 days in the trade for quick premium compounding.

Profit: 40$ per option

Margin: 1420$

Return on Margin annualized: 205.63%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - The "Crush Spread"

The spread is defined as buying one futures contract, and selling a different, but related futures contract. Specifically, when trading the crush spread, you would buy soybeans and sell its respective products, the soybean meal and soybean oil. This is what is referred to as being crushed. If you buy the soybean meal or the soybean oil and sells soybeans, that is what is referred to as being reversed crushed. Soybeans alone have relatively little value. The value of soybeans is the fact that when crushed, the products have great value globally. Soybean meal is of value to the farms that raise chicken and hogs. Soybean meal is rich with protein and is fed to these animals to fatten them up. Soybean oil is of value across an array of industries. Primarily, soybean oil is used in food as one of many available edible oils. Soybean oil is also being used in a mixture to create an alternate source of energy to compete with crude oil. These uses and others of the products give soybeans their value.

There is more to you than your business. You are more than your trading. A proper fence informs you that the results of one trade are not to be confused with the results of all of your trading. Fences guide you as to the difference between the past, the present, and the future.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 727 - May 18, 2018

Edition 727 - May 18, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Hedging with Currency ETFs

At a time of crisis, it really helps to know what to do with your money. The strange thing is that you can protect your money by buying the money of others. There are two ways to go with this concept: 1. Use your shrinking dollars to buy foreign currencies when the dollar is falling and any one of a number of foreign currencies are rising. 2. When the dollar is rising, short any one of a number of foreign currencies that are falling. Either way, you protect your money while your next-door neighbor is probably losing his.

Recently, a friend of mine got into the Australian dollar based on his belief that the US dollar was going to fall. He entered a long position in an Australian Dollar ETF (FXA), which proved to be an adequate hedge.

Typically, moves in currencies last more than just a few days, and often last for many months, especially if the currency of a nation becomes out of favor with the currency of one or more other nations.

Below you can see that being long shares of FXA during December would have been a good way to protect against a falling US dollar.

Keep in mind that many ETFs pay interest on the money you have with them.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Trading Opportunities

Good trading times may be just ahead. Are you ready? It’s times like these when the right mental edge can make all the difference. If you want to take advantage of trading opportunities for the New Year, it’s vital that you approach trading with the proper mindset. Be ready to work hard and do whatever it takes to come out a winner.

Unfortunately, many traders aren’t up to the challenge. They don’t have the proper mindset. They don’t have rock solid confidence, and when they see a high probability setup, they flinch, make a trading error and end up with a losing trade. When market conditions are ideal, though, you must be ready to take advantage of them. Self-reproach is the biggest culprit. Many traders are ready to criticize their actions.

Some traders take setbacks in stride. Nothing seems to faze them. Why? They know how to put any setback into the proper perspective; they readily think, ‘It’s just business. It says nothing about me.’ After years of experience, they’ve seen it all, lived through it all, and have learned that the markets are ultimately in control, and so there’s no reason to get unnecessarily upset about the uncertainty of it all.

Other traders, however, secretly fear that the markets will expose their inadequacies. Deep down, they believe they will eventually fail. A little voice in the back of their mind tells them so. This little voice isn’t correct, helpful, or accurate, but it has a subtle impact on the trader’s every move. These thoughts usually happen just below our awareness. These thinking patterns can be seen as ‘automatic thoughts.’ An event happens, such as the market goes against you, and you automatically think, ‘The truth is out; I can’t keep trading profitably.’ The old saying, ‘I think, therefore I am,’ is appropriate here. If you think you can’t keep up your trading performance, you won’t be able to. You’ll start believing your little voice that tells you that you can’t trade. And you will find that even a minor trading error will upset you.

How do you defeat the little voice? Write down your automatic thoughts after they happen and analyze them. Break them down, refute them, and convince yourself that they just aren’t true. For example, if you face a trading setback and think, ‘This setback shows that I’m not a natural born trader; I might as well give up,’ you will actually feel like giving up. This automatic thought is inaccurate, however. When you look at it more closely, you can see that it is not true. First, setbacks happen to all traders. Setbacks should be expected. By thinking they are rare and significant you are exaggerating their importance. You are ‘magnifying’ the event into something bigger than it really is. A setback may reflect poor market conditions, and it may even reflect a lack of experience on your part to deal with a particular set of market conditions, but it is not so meaningful that it is a ‘sign’ that you are not a ‘natural born trader.’ Keep things in proper perspective.

No one really knows what the future will hold, but the start of the New Year looks promising. Don’t sabotage your efforts through self-doubt and unreasonable self-criticism. You can trade profitably if you put in the time and effort. Think optimistically, work hard, and take home the profits.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

KEY Trade

On 25th April 2018 we gave our Instant Income Guaranteed subscribers the following trade on KeyCorp (KEY). Price insurance could be sold as follows:

- On 3rd May 2018, on a GTC order, we sold to open KEY Jun 15 2018 18P @ 0.215 (average price), with 42 days until expiration and our short strike about 10% below price action

- On 10th May 2018, we bought to close KEY Jun 15 2018 18P @ 0.10, after only 7 days in the trade for quick premium compounding

Profit: 11.50$ per option

Margin: 360$

Return on Margin annualized: 166.57%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - How to separate your ego from trading?

One way to separate our egos from our trading is to build fences between ourselves and our trading.

Realize that it’s “okay” if you are not right about every trade. It is not important to be right. It is important to execute and carry out your trading plan with consistency and discipline. Give yourself permission to be wrong about a trade.

Realize that taking a loss has nothing to do with your self-esteem. Tell yourself that taking losses is a part of trading. Give yourself permission to lose from time to time. Your ego must remain intact regardless of what is happening in your trading.

Erecting appropriate fences between yourself and your trading maintains your ability to separate yourself from your trading business.

There is more to you than your business. You are more than your trading. A proper fence informs you that the results of one trade are not to be confused with the results of all of your trading. Fences guide you as to the difference between the past, the present, and the future.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article - Who's next in line?

"Buy low, sell high" is one of the most popular memes in the investment and trading world. And obviously, it does make sense, who wouldn't like to buy low and sell high all the time? I found this to be quite a helpful advice to invest in stocks for example. Wait for a crash, buy it and sell again when prices are back to old highs.

Of course, the problem often is to figure out what's actually a low price and what's a high price. You can also buy high and sell higher to make a profit, which is how trend following works.

So what's the real deal here? I think the actual question to ask is "who's going to buy after me?" or "who's next in line?". Will there be enough traders willing to buy after you did at a higher price? Or if you're short the other way around, will there be sellers standing in line to sell after you did or not?

Think about it. To make a profit that's exactly what needs to happen. If you buy at $100, the only way to make a profit is if there are buyers willing to buy at higher prices. If they don't bid it up after you and you find someone to sell to at a higher price, you won't make a profit. Simple fact most traders are not really aware of.

Obviously, there's always someone who's gonna be the last in line. Someone is going to buy the high of the day/week/month/year/all-time. In poker, there's the popular saying that if you don't know who the patsy is in the round after 30 minutes, it's probably you. That same idea applies to trading. If you don't know why other traders are probably willing to buy at a higher price after you during the day, you might be the last one in the order book to bid at such a high price for today.

Because of that, it's always helpful to ask yourself "Who's gonna buy/sell after me and why?". If you can't answer that question it might be best to skip the trade!

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 726 - May 11, 2018

Edition 726 - May 11, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Weekly Spread Charts

The chart below shows an inter-market spread between Crude Oil (CL) and Natural Gas, (NG) Both are very liquid markets and of course CL is one of the most consumed commodities on Earth. When NG first began to trade in the 1990s it was a wild and crazy market—extremely volatile. To tell the truth, I was afraid to trade it all by itself. However, trading it as part of a spread with CL took away a lot of the volatility and a lot of the risk.

At the time NG began to trade there was little in the way of seasonal information, and certainly nothing at all in the way of regression analysis to indicate that NG today is trading the same way it did in the early years. All I had to go on then was chart analysis, and I used the Law of Charts on both the weekly and daily spread charts to make my trading decisions.

A few months ago, there was a 1-2-3 low on the weekly spread chart long CL and short NG. Entry was taken just above the spread value at the last Ross Hook (Rh) at 101.40. As of the day I took the picture of the chart the spread had made 19 points (A full point in the spread is valued at $1,000. There was no real entry signal on the daily chart.

Despite the fact that today there is more seasonal and correlation information available, I still like to look at The Law of Charts, the way I have done it for years.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Why Stops

Would you ever think of jumping out of an airplane without a parachute? Of course not, but that's what some people do when they trade the markets. They are very willing to put their money on the line, but they don't have much to protect them from a major disaster. Placing a stop, for example, can prevent you from allowing a small loss to turn into a big one, but many traders avoid placing stops. Why do some traders take risks by not placing stops? It can be difficult to know where to place a stop. If you fail to account for volatility, you will get stopped out too soon. Other people are afraid to place stops. Placing a stop requires you to consider the worst-case scenario, and to many, it's difficult to consider failure. It's easier to deny the potential problem, and to pretend it will not possibly happen. Many experts, however, suggest placing stops. They know that nothing is certain when trading the markets. They view protective stops as a kind of insurance policy that prevents a catastrophic loss.

One seasoned trader I talked to, says "I never take a trade without knowing my stop. When I take a trade, I'm pretty convinced it's something worthwhile. I've already figured out my stop. I've accepted the (potential) loss before I ever clicked the button or made the call. So if it starts going against me, I don't feel a flood of emotions." For that trader, stops not only protect him from losses, but they help him control his emotions. Stops give him a feeling of security, and allow him to feel calm and relaxed.

Experienced traders may use stops all the time, but even the most experienced traders have difficulty following them. For example, one trader I know, admits, "I've blown stops and it's painful. The weird thing is that money does not seem to be driving it. Afterwards, I sit and try to analyze the incident. I certainly knew better. I believe trading is something of a self-journey. It involves learning about your character, your self-control, and your ego."

Still another trader also admits he blows his stops: "Sure. That happens all the time. There's nothing I can do about it. That's one of challenges that continue to engross me. Do you hold them or do you fold them? If you fold a long position and prices go up, you get angry because you made a mistake. If you hold a long position and prices go down, you become angry again. Nevertheless, you have to stay focused on what's going on and learn from the experience and try to apply it to the future. You're going to take your lumps in the market."

Even though stops are difficult to set and difficult to keep at times, they are an essential component of risk management. Losses are commonplace in trading. As hard as it is to focus on losses, they are impossible to avoid. Rather than avoid thinking of the worst-case scenario, face it head on. Figure out what could go wrong and where you can place a stop to protect you from a huge financial loss. In the long run, you'll find you will limit losses and trade more profitably.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

CAI Trade

On 30th April 2018 we gave our Instant Income Guaranteed subscribers the following trade on CAI International Inc. (CAI). Price insurance could be sold as follows :

- On 1st May 2018, we sold to open CAI Jun 15 2018 17.5P @ 0.20, with 44 days until expiration and our short strike about 22% below price action, making the trade very safe.

- On 4th May 2018, we bought to close CAI Jun 15 2018 17.5P @ 0.10, after only 3 days in the trade for quick premium compounding

Profit: 10$ per option

Margin: 350$

Return on Margin annualized: 347.62%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Idea - RBOB Gasoline

This week, we're looking at RBQ18 – RBZ18: long August 2018 and short December 2018 RBOB Gasoline (NYMEX at Globex).

Today we consider a RBOB Gasoline calendar spread: long August 2018 and short December 2018 RBOB Gasoline. The spread has found support around 0.21 several times and is now trading right in front of the seasonal time window. The seasonal window is very small with only 9 days but the move can be strong to the up-side with a reasonable risk/reward ratio.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Idea - AlgoStrats:FX Traders

A stress free-trade in AUD/USD and a good start into 2018 for AlgoStrats:FX Traders

Like all professional traders, we get a mixed bag of trades at AlgoStrats:FX. Some turn out as losers, others as big winning trades. And some of the trades are not spectacular in any way but nice stress-free bread and butter trades.

Here’s an example of a trade we did in AUD/USD. This is a 60-minute chart and as you can see our sell limit order to go short was filled at 0.75547. We got almost no drawdown on the trade and closed the trade at 0.75341 for a nice 20 pip profit.

At AlgoStrats:FX there’s no "fantasy-trading" as with most signal services where you’re usually shown trades that actually never happened! This means all of the trades are actually traded in a live trading account. As a subscriber, you get access to all of the daily account statements of this account. Here’s the discussed trade in detail, showing the trade statement of LMAX exchange:

Overall we’re up about 3.5% so far this year using very conservative risk management:

Learn More about AlgoStrats:FX

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 725 - May 4, 2018

Edition 725 - May 4, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Pork Bellies

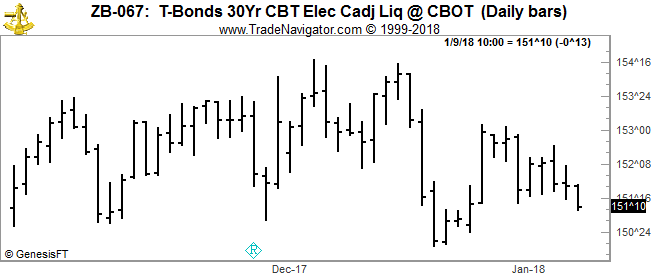

The pork bellies market is often characterized as thinly traded, loaded with stop running, containing many sudden and suspicious moves, full of unexpected twists and turns, and notorious for gaps. But the pork bellies I want to write about today are the Treasury Bond futures. "Bonds" have been called the pork bellies of the financial markets, and with good reason.

The bond market is definitely not an illiquid market. Even during the few years in which the 30-year T-Bond was no longer sold by the Treasury Department, the bond futures maintained a decent level of liquidity and traded much the same as when the Treasury Department was actively selling the bonds at auction.

So, why are the bonds considered to be the bellies of the financial markets? The picture becomes clear via the daily chart in the electronic bond futures market.

As you view the chart below, notice that overall prices are in a trading range. They are really going nowhere. However, this is exactly the kind of market insiders love.

They know where the ceiling is and they know where the floor is. They dip down and run the stops below them and lunge up and run the stops below them. Those short move up and down are there because the pigs who run rampant in the bond futures love to run stops.

Of course, they call it "filling orders." And that is true. If you had an order below the market, they made sure it got filled and vice-versa for orders above the market. That is part and parcel with the Law of Charts. Remember, TLOC reflects the actions and reactions of humans to the movement of prices. In the case of the bond futures, the humans happen to be particularly piggish, and they love to eat stops. So, in the name of providing you with an efficient market, they go out of their way to fill all orders, even those trailing orders from a few days back, in order to give you a fill — even when you don't really want one.

"Well," they say, "if you don't want us to run your stop, don't put one in the market," knowing that this flies in the face of the rule that says, "always have a stop loss in the market to protect yourself."

If this sounds bitter, please realize that I'm not bitter. I've lived with the truth of stop running all of my trading life. My intent is to be a bit sarcastic in order to drive home a truth, which is: you're damned if you do and you're damned if you don't, insofar as protective stops are concerned. But even though your stop is likely to be run by the bond pigs, it's better to always have one. Oh, and by the way, using a mental stop is not going to do you any good. The pigs have an incredible sense of smell. They can smell your stop no matter how carefully you hide it, or how deeply you bury it in your mind!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - If you doubt, you may be out

It's almost impossible to have rock solid confidence as a trader. Sure, some traders can't be thrown off track very easily, but it's natural to feel a little afraid occasionally. Let's look at some of the reasons that you might feel shaken. What the markets will do tomorrow or next week is far from certain, and you don't have a crystal ball. Your information is fallible. And without perfect information, you are bound to feel a little uneasy when your money is on the line. In addition, there's always a possibility that something may go wrong. A media analyst may hype a stock you are shorting. And what about trading strategies? You can perfect a trading strategy only to see it fail when market conditions change without warning. If you lose your confidence occasionally, it's understandable.

Even a seasoned hedge fund manager can lose confidence. Consider what one hedge fund manager told us when we asked him about what underlies his self-doubt. "Fear of losing money and fear about the lack of validity of my research. It's perfectly natural. Just like in sports, the difference between the physical abilities of the top pros is virtually nil. But the mental difference is huge. The guys at the top in tennis, for example, are mentally consistent throughout the whole match. It's the same thing in trading. The psychology of professional traders allows them to stick to their strategies. They don't stress out as much as rookie traders. I still make mistakes once in a while, but not as often as I used to. It's impossible to eliminate all doubt. I still fall victim to doubt and other psychological pitfalls. I still have major doubts, but now I know how to control them better."

How did this hedge fund manager conquer his feelings of doubt? Gaining a wealth of knowledge is key. "It requires a combination of research and experience. After a while, making or losing a lot just did not seem to bother me. It became second nature. The other thing is learning to handle profits and the losses. With experience, you don't get as excited over them. After a while, you expect to experience the natural ups and downs."

When you experience self-doubt, don't make matters worse by feeling bad about feeling bad. Everybody experiences doubt at times. It's natural when trading something as chaotic as the markets. If you are a novice trader, feel solace in the fact that your self-doubt will subside after you sharpen your trading skills and gain a wealth of experience. And if you are a seasoned trader, it may be useful to remind yourself that everyone gets in a slump occasionally. Don't worry. You'll regain your momentum if you keep trading. The key to success is to remember that self-doubt usually leads to stagnation. When in doubt, don't panic, calm down, and think rationally. You'll eventually work through your self-doubt and return to profitability.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

TRADE WITH NO LOSSES

Here's our latest example!

WGO Trade

On 5th April 2018 we gave our Instant Income Guaranteed subscribers the following trade on Winnebago Industries Inc. (WGO). Price insurance could be sold as follows:

- On 6th April 2018, we sold to open WGO May 18 2018 30P @ 0.35, with 42 days until expiration and our short strike about 22% below price action, making the trade very safe

- On 26th April 2018, we bought to close WGO May 18 2018 30P @ 0.15, after 20 days in the trade

WGO went sideways after our entry. Our exit was possible thanks to time decay and a drop in implied volatility.

Profit: 20$ per option

Margin: 600$

Return on Margin annualized: 60.83%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - Don't give in to the death wish

The death wish is resignation, fatalism, dejection, despair — in the face of "luck" repeatedly turning against us. The death wish is admitting defeat and shrugging our shoulders and throwing up our hands (generally after a string of losses) and not caring from then on whether we win or lose. The death wish is throwing money into the pot fatalistically, to punish ourselves. It is saying, “I might as well keep throwing my money away at this point, because it doesn't matter anymore.”

The problem with the death wish is that it removes the brain's analytical, decision-making function from the equation. It also tends to magnify disasters. It takes a bad situation and kicks it up to the next level. It also misses opportunities, because its attention is so focused on the great sadness of its plight.

It may even miss the turn-around point — when things start changing and going the other way and getting better — so intent is it on making an airtight case concerning the sadness of its plight.

Try not to give in to the death wish. If a disaster starts to unfold, try as much as possible to keep it under control, not exaggerate it further. Try to salvage something from the trade. Scale back your involvement, or simply get out of the trade. Go for a walk. Go watch something on TV. Go do anything that helps clear your mind.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article - (Good) Trading happens outside your comfort zone.

After writing about why good trading usually is quite boring last week, I’ll continue down that road today and write about another similar topic.

And again it’s more of a rant that many of you maybe don’t want to read about. But I believe it really can be an eye-opener to those of you who’re really serious about trading and these are the traders that I care for the most. Actually I wish I had read this myself years ago, I had to pay a lot of money to the markets to finally really get this. Read more!

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 724 - April 27, 2018

Edition 724 - April 27, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

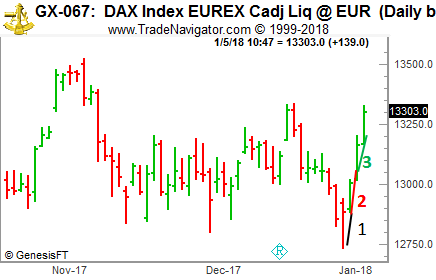

Chart Scan with Commentary - Trending or Not Trending?

Viewing the chart above, are prices trending or are they consolidating? This kind of question has come up a couple of times in the past few weeks. According to The Law of Charts, there is a defined trend showing on the chart. But which kind of trend? Is it an uptrend or a downtrend, and how can you tell which it is?

The Law of Charts states that trend supersedes any form of consolidation. That means if you find a trend within an area of consolidation, you must assume prices are trending. At Trading Educators, we call consolidations of 11 to 20 bars "congestion," and consolidations of 21 or more bars "trading ranges" However, in the chart above, if I count from the segment marked "1," to the segment marked "3" we have defined the beginning of a trend. Segment counting is explained in my book “Trading the Ross Hook.” Segment counting is part of the Law of Charts.

The Law of Charts states that if prices make 3 consecutive higher lows, the probabilities are for a trend to form, probably after a small retracement. It further states that if prices were to violate the high of the third segment bar, we would surely have a defined trend.

So based on Segment Counting, we are looking at the start of an uptrend.

What I like best is that in any language, a chart is a chart. For those who might not know, the DAX (GX) is traded at the Eurex Exchange.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Ready to Lose

Imagine what you would do in the following scenario. You have been looking at a position for a week. You had a clear and simple trading plan: Just wait for an announcement at the end of the week, watch prices jump, and then sell. As might be expected, things aren’t working as you had planned. First, no clear trend has emerged; prices are moving chaotically up and down. Second, it’s been two days since the announcement and the price has barely moved. You decide to wait for two days to see if your original plan will come to fruition, but a small voice inside you is telling you to sell. You’ve been stressed out and you’re tired. It’s been a tough week. Part of you wants to listen to the little voice, and just close out the position, but the logical part of your mind is telling you to wait patiently and see what happens. Although you know what you want to do, you have a powerful urge to sabotage your efforts, and just walk away. What can you do to combat this feeling?

Trading often comes down to maintaining a peak performance state at a few critical moments of trading. To take advantage of these key moments, you must be relaxed, full of energy, and ready to take decisive action. But your mind can grow weary, just like how a muscle can become weak and ready to fail at the slightest strain. When you go on a long run, for example, you soon run out of energy. You can't go any farther. Your muscles begin to ache and you need to take a rest and recuperate before you start moving again. It's the same when it comes to trying to maintain your mental edge. It's vital that you consider that the mind has limited energy, and that after putting in a hard and tedious effort, you must take a rest and rejuvenate, so you can face the market action with a renewed sense of vigor. If you have strained your mental "muscles," you'll have trouble maintaining control. Your mind will be elsewhere or you'll be too tired to act decisively. When you're tired, you may want to give up.

Don’t underestimate your need for psychological energy. When you are tired, you will have a strong urge to give up at a critical point during a trade when you should enthusiastically watch the market action and be ready to face a challenge with a peak mental state. The winning trader is always ready and willing to take action. To be a winning trader, you must be rested and ready, so get plenty of rest, make sure you are well nourished and physically up to the stresses and strains of trading. By taking these precautions, you’ll trade the markets with a winning mental edge and easily fight the urge to sabotage your efforts.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

TRADE WITH NO LOSSES

Here's our latest example!

ANDE Trade

On 27th March 2018 we gave our Instant Income Guaranteed subscribers the following trade on The Andersons Inc (ANDE). Price insurance could be sold as follows:

- On 4th April 2018, on a GTC order, we sold to open ANDE Apr 20 2018 30P @ 0.30, with 16 days until expiration and our short strike about 8% below price action,

- On 12th April 2018, we bought to close ANDE Apr 20 2018 30P @ 0.15, after only 8 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 114.06%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - How to Handle Fear

The best way to handle fear comes in two steps:

1. A detailed trading plan

2. Risk control

Let’s look at risk control first. You have no doubt, read it many times: "Trade with money you can afford to lose." Here’s another one: "Trade positions that are so small that you may think, "what's the point of even putting on the trade?"" One more: "Do not over-trade!"

All of the above carry essentially the same message: They minimize the personal significance of a trade. If the trade seems basically insignificant, you will be able to do a better job of controlling your emotions. Be sure to limit your risk as much as you can. You cannot afford to let yourself lose a lot on a single trade, it is demoralizing and it will take many more trades to regain your losses.

It's essential for survival as a trader to limit the amount of capital you risk on any one trade. It's also mandatory to learn to cut your losses short. Don't get stuck in a losing trade. Don't hope that it will turn around; just sell the loser quickly, get out fast. Controlling risk will not only make you feel safe and secure, it will ensure your longevity as well.

Now to the second part: Having a detailed trading plan. Before you execute a trade, specify how and when you will enter. Make sure you set out the signals that indicate the market may be going against your trade, and how and when you will exit. Most wannabe traders fail to carefully plan their trades. They first execute a trade and then once they are in the trade they try to develop a plan as they go along. What usually happens is that they easily become alarmed because they don't know what to do or when to do it. It's hard to think on your feet, especially when you are first learning to trade. What you need is the safety of a detailed trading plan: specific guideline to follow. Making a plan follows the wisdom of any job being 80% preparation and only 20% execution. The more clearly the plan is laid out, the easier it is to follow. And when the plan is easy to follow, it's likely that you'll stick with it. You'll be disciplined and in control of your emotions and thought processes.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

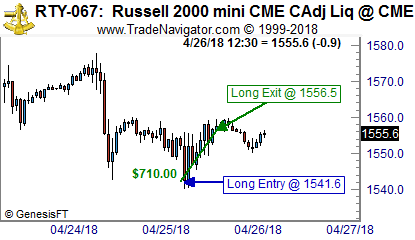

Trading Example - Buying the Low of the Day in the E-mini Russell 2000

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-mini Russell 2000 (RTY) traded at the CME, where Ambush Traders had a really nice trade this week.

Ambush trades on an end-of-day basis so there’s no need to even look at an intraday chart but to show you all the details of the trade, here’s a 60-minute chart of RTY.

As you can see we had an Ambush Signal to buy at 1541.6 which turned out to be almost the low of the day. A classic Ambush Trade where we ambushed the novice traders who sold below the previous days low. As these traders realized they were wrong buying panic kicked in and we could get out with a very nice profit of $710 per contract about 8 hours later!

Of course, a single trade doesn’t tell you too much about a trading method. If you want to learn more about Ambush and see long-term reports of all supported markets, check out the Ambush Signals Page.

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 723 - April 20, 2018

Edition 723 - April 20, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

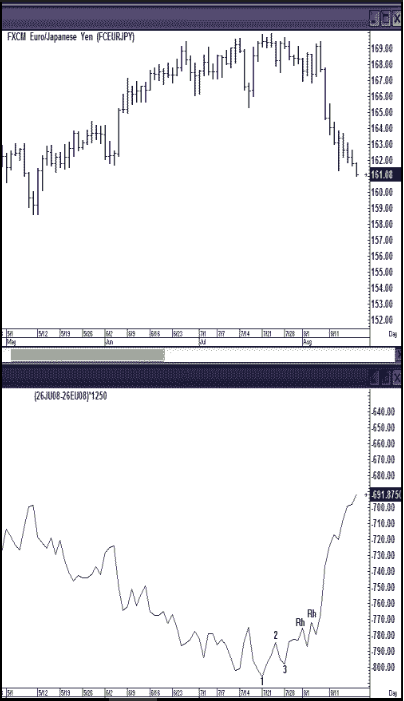

Chart Scan with Commentary - Ratio Spread vs. Differential Spreads

Is it possible for a differential spread to move more than a ratio spread? You might not think so when you look at a forex chart with open, high, low, close bars that look very much like moves in the outrights. However, differential spreads often move more than the ratio spreads, and in 2008 such a situation occurred in euro vs. the yen. Let's take a look.

All forex pairs are nothing more than ratio spreads. In the case of the EUR/JPY, we see the euro divided by the yen.

In the upper half of the chart above, we see a ratio spread between the euro and the yen. From the highest recent high (169.95) to the current low (161.08), there is a movement of $8.87 in the forex pair.

In the lower chart we see a differential spread displayed in dollars, and the move there is from the lowest low (-806.125) to the recent high (-691.875), a move of (114.25) Hopefully, you realize that for a differential spread to be making money, the spread line must rise. So although we are dealing with negative numbers, the spread has been moving to a less negative number. In other words, the yen has been gaining on the euro by $114.25. So what has really been happening, comparing the two spreads, is that the differential spread has moved 12.88 times more than the ratio spread.

If you're going to trade this pair, would it not have been more profitable to trade the differential between the euro and the yen than to trade the ratio between the euro and the yen?

If you are going to trade currencies in the majors, you should always consider whether to trade them in the futures or the Forex. Although I used a chart from 2008 because it was handy, the situation above happens frequently. Currencies are often better traded in the futures market than in the Forex market.

Interestingly, the differential spread chart also gave a much clearer signal vis-a-vis the Law of Charts.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Being Flexible

How flexible are you in your everyday life? When you are in a new city, do you worry about getting lost or do you just go your own way and assume that somehow and someway you'll eventually get back to your hotel? Do you get upset when you are told you are wrong, or do you welcome criticism or an opposing opinion? The ability to be open and flexible often makes the difference between winning and losing in the trading business.