Denise Ross

Edition 678 - June 9, 2017

Edition 678 - June 9, 2017

Chart Scan with Commentary - Classic Another Chart Revelation

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

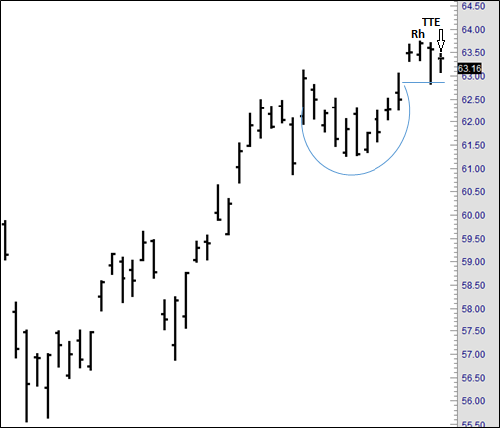

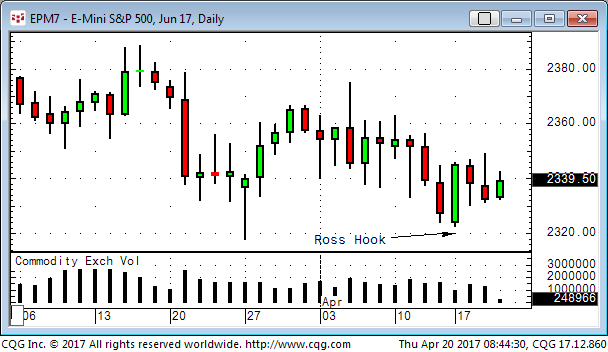

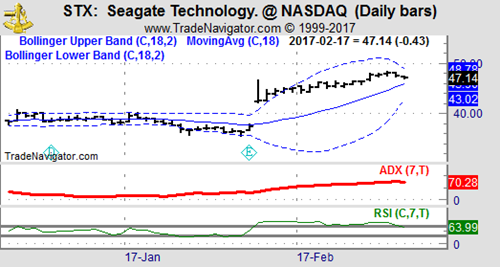

In one of my books I discuss the formation called "Cup with Handle." It is a formation that has been known about for a long time, and was first mentioned by that name by the publisher of "Investor's Business Daily." Actually the cup with handle is often nothing more than a head with a right shoulder. Lots of times the left shoulder is missing or, as in the case of the daily chart below, the left shoulder is there but very small and shallow. Notice this is an upside down head with a right shoulder to go long.

If you look closely you will see that the high of the cup "handle" is also a Ross Hook. Two days after the Ross Hook there was a Traders Trick Entry to go long at 63.40.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Protecting Profits

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Over the years, I've had the most profitable results by always making an attempt to receive pay for the risk I am taking. I want to be paid to trade. Being "paid to trade" has become a slogan at Trading Educators. The moment you can realize some profit from a trade, the sooner the pressure is off. You sleep well during nights where you have taken some money out of the trade during the day. You make fewer mistakes. Your growth in your confidence and faith in what you are doing, and seeing that what you are doing is succeeding, do wonders for your feeling of well-being.

If a trade gives you $1000 from a risk you have assumed in the market, never give them back more than $500. If someone gives you $2000, keep $1200; $3000, keep $2100; $4000, keep $3200; $5000, keep $4500. Remember the Point of Diminishing Returns as applied to trading. Never allow a $1000 per contract open equity profit to become a loss. As the market moves further beyond the Point of Diminishing Returns, the probability of a short-term trend reversal increases exponentially. The best market moves make the majority of their initial profits in 2 to 6 days. Therefore, a higher percentage of profits needs to be protected as the market moves higher and you approach at least a temporary end to the current move. Traders feel good about themselves to the degree they control trade profits and losses. This is the psychological Law of Control applied to the trade decision-making process.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - MDLZ Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 21st May 2017 we gave our IIG subscribers the following trade on Mondelez International (MDLZ). We decided to sell price insurance as follows:

- On 22d May 2017, we sold to open MDLZ Jun 30 2017 41.5P @ $0.24, with 38 days until expiration and our short strike 9% below price action.

- On 2nd June 2017, we bought to close MDLZ Jun 30, 2017 41.5P @ $0.07, after 11 days in the trade, for quick premium compounding..

Profit: $17 per option

Margin: $830

Return on Margin Annualized: 67.96%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

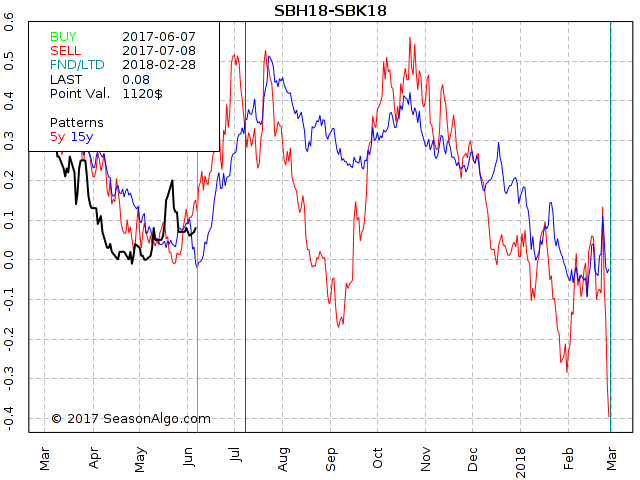

Trading Idea - Sugar spread long March and short May 2018

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Sugar is one of the markets I use mainly for spreads. In general, the Soft markets are not easy to trade and, because of exchange data fee costs of about $110, expensive. The calendar spread catches my interest because we are right at the beginning of the seasonal time window (06/07-07/08), the statistic regarding seasonality looks promising with very small draw-downs in the past and also the chart looks like the spread might turn to the up-side soon.

Do you want to know how we trade this spread in Traders Notebook?

Did you know Traders Notebook Complete had its most profitable year in 2016?

Learn how to manage this trade by getting daily detailed trading instructions, learn more!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - 5 Tips to Improve your Day Trading

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Day trading has always been a tough game, requiring a very strong psyche, discipline and a high level of trading skills to succeed in.

Nowadays though it's even harder due to the stronger competition, not only by humans but especially by computers trading at a speed a human trader simply can not match up to. High-Frequency Trading is happening in literally all of the popular markets out there and like Chess, scalping has become a game where humans cannot win against the AIs anymore. Add to that the speed/location advantage of the HFT shops and the odds of success decrease even more.

My advice is to forget about scalping. Even without the trading bots, odds of success to make money scalping are very low as the trading costs involved are incredibly hard to overcome. To not get completely killed by trading costs you need to trade in very liquid markets. But that's exactly where the robots are.

But not everything is lost, maybe all you have to do is to slightly adapt as a day trader. Here are some of the things you can do:

- The longer your trades last, the higher your profits (and losses) will be on average. It's a simple fact, if your trades last 4 hours on average, you'll be much more likely to catch a big move than if you average trade lasts 5 minutes. This way the HFTs can't hurt you as much anymore and also trading costs will have much less of an impact.

- You don't have to do 20 trades per day to be a successful day trader, quite the opposite! The more you trade, the higher your trading costs and believe me these trading costs will kill you in the long run.

- Don't get married to a specific market, instead, diversify your day trading over different, uncorrelated markets. This will strongly increase your chances of success as you'll stop seeing opportunities in a market where there aren't any.

- Day trade only markets that provide a good bang for the buck. I do this by looking at the average daily range of a market in relation to the average trading costs.

- Trade the news. I know you often hear the opposite advice but if you learn how to do this right, trading the news is one of the best ways to day trade. Just look at the markets, especially currencies. Isn't it true that most big moves happen right when some economic report is coming out? Sure, volatility explodes and liquidity often isn't that great. But hey, isn't high volatility exactly what you're looking for as a day trader? Now first you need to do your homework of course and have a plan ready on how to trade each of the specific news events.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 677 - June 2, 2017

Edition 677 - June 2, 2017

Chart Scan with Commentary - Decisions, Decisions

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

The day the arrow is pointing to was a Friday and it created a very nice Traders Trick Entry to go long on Monday, one tick above Friday’s high. During the Sunday/Monday night prices traded as you see them above. Should you leave the TTE in place, or should you get out? I opted to leave my order in place at 1252.90. My reasons: 1) I anticipated a follow-through of the momentum begun on Friday. 2) The TTE in this instance offers a very low risk trade. I use a tight protective stop in the event I’m wrong.

The chart below shows what happened on Monday. Prices reached 1255.90, or $300 per contract, more than enough for a profitable scalp trade. Since I was scalping, I was all in and all out at 1255.90. Will gold prices move higher? Should I have stayed in the trade to see? Not if I was scalping. When I’m scalping I take what I can get and leave the rest for someone else. There are plenty of trades to be had, you simply have to look for them.

30% Off Webinars

Use Coupon Code During Checkout: summer30

Offer Ends June 6, 2017

The Law of Charts In-Depth

Trading All Markets

Traders Trick Advanced Concepts

Traders with More Special Set-Ups

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - More About Losses

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

How should you feel about losses? I once read somewhere that you are supposed to love losses. Does that make sense to you? It doesn't to me.

The worst aspect of losing is that it tends to create pessimism. Traders should feel bad when they lose money only if they fought the market trend, or violated their own trading strategies. The best traders have a healthy "so what, big deal!" attitude that maintains a sense of humor about losses. There is no reason to feel bad about losses if the trading discipline was correctly used. On the other hand, there is no reason to learn to love them either.

Analyze losses, learn from them, and then let them go; move on, that's the best thing to do.

Understanding man's relationship to time is one of life's most important challenges. When man becomes free of time's constraints, he lives life to the fullest and achieves goals on his own terms. Pessimism traps traders in the past, destroys their present, and robs them of the future. Imagine a world without time where the thought of death is not a finality of existence. If money were not the reason for your work-related behavior, then who are you? Where are you and what are you doing? Who shares this existence with you? In the philosophical sense, man creates himself and his existence when he takes responsibility for his actions and his time. Think how any individuals create order, structure, and discipline in their lives. How will you allow a trading loss today affect your life five years from today?

Thinking the wrong way can become self-fulfilling. The trouble with self-fulfillment is that many people have a self-destructive streak. Accident-prone drivers keep destroying their cars, and self-destructive traders keep destroying their accounts. Markets offer unlimited opportunities for self-sabotage, as well as for self-fulfillment. Acting out your internal conflicts in the marketplace is a very expensive proposition.

Traders who are not at peace with themselves often try to fulfill their contradictory wishes in the market. If you do not know where you are going, you will wind up somewhere you never wanted to be.

Every business has losses. I cannot think of any that don't. Shoplifting, embezzlement, internal pilferage, lawsuits, bad debts, spoilage, etc., I'm sure you can think of even more. You name it and businesses have one or more of the many ways to experience losses. Most businesses expect and accept such losses as part of doing business. Why, then, is it such a big deal when you have a loss in trading? If you know the answer to that, please let me know.

The way I handle a loss is this: I examine it, make every attempt to learn from it, and ascertain whether I had the loss by straying from my trading plan. If I have strayed, I reinforce my resolve to stick with my plan. If I have not strayed, then I learn from it what I can, and shrug it off as a cost of business. It is not an expense, it is a cost, and if you don't know the difference you need to take a course or read a book on the basics of accounting.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

30% Off Books and eBooks

Use Coupon Code During Checkout: summer30

Offer Ends June 6, 2017

Instant Income Guaranteed - GRMN Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 8th May 2017, we gave our IIG subscribers the following trade on Garmin Ltd (GRMN). We decided to sell price insurance as follows:

- On 9th May 2017, we tried to sell to open GRMN Jun 16 2017 47.5P @ $0.24-$0.26; some subscribers were filled but I decided not to accept less than $0.26 and was not filled on that day.

- On 18th May 2017, I sold to open GRMN Jun 16, 2017 47.5P @ $0.32 or $32 per option sold on a Good Till Cancelled order.

- On 26th May 2017, we bought to close GRMN Jun 16, 2017 47.5P @ $0.07, after 8 days in the trade (or longer for those who entered on 18th May 2017), for quick premium compounding.

Profit: $25 per option

Margin: $950

Return on Margin Annualized: 120.07%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade..

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Receive 30% Off

Instant Income Guaranteed

Use Coupon Code During Checkout:

summer30

Offer Ends June 6, 2017

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - Emotions with Winning and Losing

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

What kinds of emotions go with winning and losing? Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

30% Off Stealth Trader and Combo

Use Coupon Code During Checkout: summer30

Offer Ends June 6, 2017

Stealth Trader

Stealth/Ambush Combo

Trading Error: Averaging into a Losing Position

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco talks about one of the most common, and also one of the most deadly mistakes traders can make, and that's averaging into a losing position. He also gives you some insights as to why this is so tempting, and shows you why you should avoid it at all costs.

If you should you have any questions, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

30% Off Books

Use Coupon Code During Checkout: summer30

Offer Ends June 6, 2017

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 676 - May 26, 2017

Edition 676 - May 26, 2017

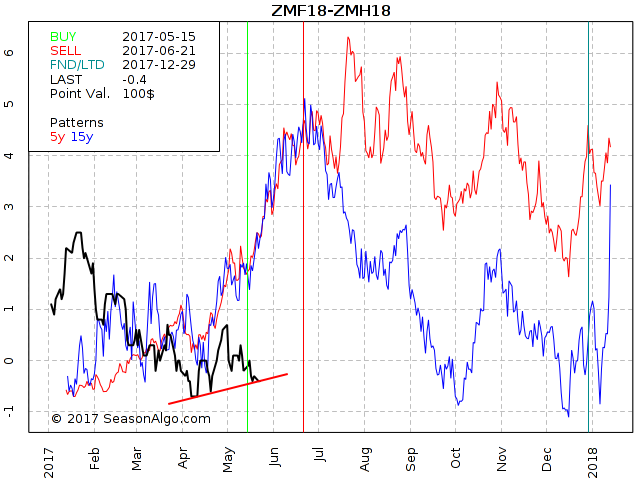

Spread Trading Idea: ZMF18-ZMH18

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Chart Scan Trading Idea: ZMF18-ZMH18, long January and short March 2018 Soybean Meal

Today I want to have a closer look at a Soybean Meal spread using 2018 contracts. While the spread doesn’t show much volume, you can easily trade 10 or 20 contracts without any problem and bid/ask with only 1-tick away (nevertheless, I recommend the use of limit orders).

So far, the spread has not made its strong seasonal move to the up-side but at least it is showing higher lows for the last few weeks. We are in an up-trend since April as shown by the red line even if the up-trend is not very strong. Personally, I would wait what happens next before entering the trade but keep in mind the seasonal time window will already close in about 4 weeks and this doesn’t give the spread much time to develop. The spread seems promising with 15 winning years out of 15 (seasonally speaking) and because volatility is low, it may also work for the once with small trading accounts.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - Money Management

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Don't confuse money management with trade management. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Error: Trading Your P&L

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In this video, Marco talks about another very common trading mistake, and that's trading your P&L instead of the actual market. If you're struggling to become a winning trader, this might be an eye-opener, especially if you're a breakeven trader right now.

If you should you have any questions, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Second Look

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Taking a second look at potential trades at times results in “why didn’t I see this before?”

For instance, what if you are looking at a market as it approaches a support area? Isn’t it reasonable to ask yourself, “If this market breaks through and I am long, what will I do?” Ask yourself how such an event would change the picture. If you have a position, will you still want to hold it? If you have no position, will this cause you to take a position opposite what was the trend? If it will, then why not place an order entry just the other side of that support area? Very often, when prices approach support from what has been a trading range, they are already in a counter trend within the confines of the trading range. That means a breakout of the trading range would be a continuation of a newly formed minor trend.

After a second look, I will put my work aside before looking at my charts again. Then I make a plan for the orders I want to place.

I make sure my trading platform is working. To do this, I issue an order I know will come back as “unable.” I also check to see if my phone line is working by making a call to my cell phone. In the event of an emergency, I want to be able to call my broker.

Another thing I do is to quickly check the news to see if there is anything that has come out or is reported to come out that might affect my trades. I want to know if any reports are due or any speeches scheduled that might affect the market in which I intend to trade.

I do all this before I enter a trade. But do you know what most traders do? They do their analysis after the trade is made. Too often, they do it when the trade is already going against them.

How many times have you entered a trade, and then said to yourself, “Oh no, why didn’t I see that before?” How could you have seen it if you hadn’t looked, and looked again, and thought about it, and then perhaps looked one more time?

Also, many traders do their analysis after entering the trade in search of a justification for having entered. “Now I’m in the trade, let’s see if I can find out a couple of good reasons as to why!”

If you want to be a successful trader, you have to be hard: Hard on yourself. I don’t mean that you have to be browbeat yourself, or tell yourself you are a loser and can’t win. I don’t mean you have to blame yourself for everything that happens to you when you are trading. Some problems and situations are unavoidable. You just have to be firm with yourself in all that you do. You can’t afford to be a mouse about the way you do things. You need strong self-discipline and self-control. This is a business; you must be businesslike in conducting your affairs.

As a business person, you must manage your business. One of the main functions of management is planning. You have to plan your trades. Other things to look for as you go through your charts are: Tradable formations and setups. Look for reversal bars that indicate a move may be ending. Look for a drop in volume that may indicate illiquidity, or perhaps a coming change of direction. Watch all the things that you can that reveal to you the kinds of information that are needed for the way you trade. These should all be part of your plan.

Some people give more thought to choosing which flavor ice cream to eat than to which market to enter and how and when to do it.

By not taking the time for preparation, you end up not having enough time to weigh the pros and cons or really familiarize yourself with what you are getting into.

You don’t have time to realize that prices have supported two ticks away from your entry about forty times in the past. You don’t have time to see that you are trading right into overhead selling. You don’t have time to notice that if prices break out of a consolidation area just ahead of yesterday’s high or low, they will also probably violate yesterday’s high or low. You don’t have time to see where prices are in relation to the trend line. You don’t have time to really grasp the overall trend, or the correction that is going counter trend. You don’t have time to really consider where you will place your stop. You don’t have time to read the market and to see what it might be telling you.

All of these things can be done ahead of time. If you do not do your homework, you will end up chasing markets in a desperate attempt to get into “the big move.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - KSU Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 25th April 2017 we gave our IIG subscribers the following trade on Kansas City Southern (KSU). We decided to sell price insurance as follows:

- On 26th April 2017, we sold to open KSU Jun 16 2017 80P @ $0.75, i.e. $75 per option sold, with 50 days to expiration, and our short strike below a major support zone about 11% below price action, making the trade pretty safe in spite of a low implied volatility environment.

- On 15th May 2017, we bought to close KSU Jun 16, 2017 80P @ $0.30, after 19 days in the trade, for quick premium compounding.

Profit: $45 per option

Margin: $1,600

Return on Margin Annualized: 54.03%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 675 - May 19, 2017

Edition 675 - May 19, 2017

Ambush Traders are Celebrating!

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

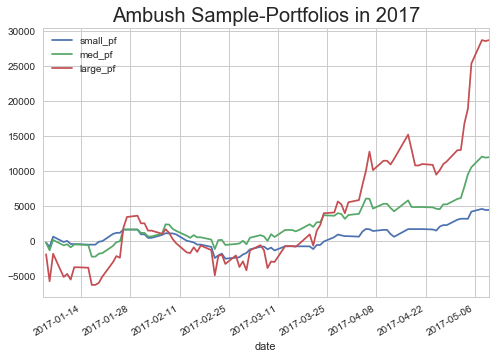

Ambush just made new all time equity highs all over the place for the first time in 2017!

As you might know, there are three sample Portfolios I came up with a couple of years ago to show the power of diversified trading with Ambush. It simply doesn't make sense to trade just one market and to hope that one is going to be the big winner of the year. That's why trading multiple markets is so important and one of the key principles to successful trading in the long-term.

You can learn more about the details of these portfolios and see the updated long-term performance here.

Now all of the Futures portfolios just hit new all-time equity highs! As you can see all of them had a slow start in 2017, going more or less nowhere for two months. But then the fun started and during the last month they really took off!

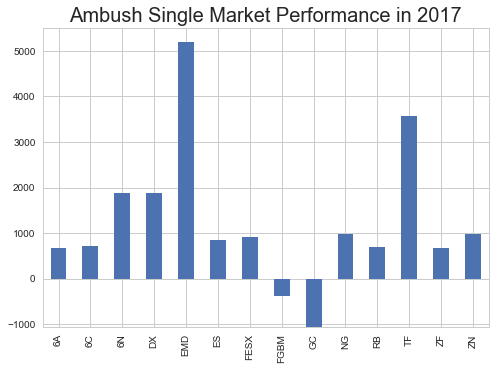

Here's an overview of how Ambush performed in each of the Futures markets (trading one contract) so far in 2017. And as you can see the performance is widely spread across the markets. The only two markets that didn't come out ahead yet are GC (Gold) and FGBM (Euro Bobl).

Join the Ambush success story and become an Ambush Trader!

The easiest way to follow Ambush is, of course, Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 18:30 NY Time (yes, it's ready much earlier now than before) the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the markets close! Remember that all Ambush trades are day trades, can you imagine a more comfortable way to day trade?

I look forward to welcoming you as an Ambush Trader! Here's something for you to celebrate with us right from the beginning:

Sign up now and on the check-out (credit card payment only) use one of these:

Coupon Code:

- Monthly Subscription: use "ambsigmonth20" to get $20 off the first month

- 3 Month Subscription: use "ambsigthree50" to get $50 off the first 3 months

If you’d prefer to generate the signals on your own and want to know the exact trading rules of Ambush, we also have a special offer for the Ambush eBook:

Coupon Code:

- Ambush eBook: use "ambush200" to get $200 off the Ambush eBook

This is the first Ambush Signals Promo ever and all Coupon codes are valid only until Sunday. Hurry up and don’t miss out on this rare opportunity!

If you should you have any questions, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - How do you go about making trading decisions?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

In time, your trading decisions will become better and better. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Trade Selection

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I often receive the question: "Hey Joe! How do I choose a good trade?" Traders write, "How can I tell if the trade will be a good one?" My answer is that I don't know how you can tell, but there is a way I can tell, and I'll share it with you.

I look for both probability and momentum. When dealing with futures, I look for a trend in any market and in one or more time frames that is producing sufficient movement for me to make some money. When dealing with stocks, it is much easier to find momentum. There are numerous sources of data telling you about stocks making new highs or stocks having the most movement.

It seem obvious that a stock moving to new highs, or one being among the most active, is experiencing something in its fundamentals to cause it to move. So my first filter, that of momentum, is already screened for me.

Next, I want to look at probability. What I want to know is: "What kind of a pattern follows the making of a new high?" Does the stock correct on profit taking and, if so, how much does it correct? Does it correct as far as the previous support area? If so, how often does it do that?

Last week I was looking at a stock. Did I know anything about that company? No, I didn't, and I didn't care to know. The stock was making a new 52 week high. That's all I needed to know.

If you look at the chart below you can see that following the making of a new high, it never, as far as we can see on the chart, corrected below a previous support area (arrows). So the probabilities are in my favor if I buy that stock. Also, I know where to place my stop - below the last support!

Okay, so when should I consider buying this stock? Well, it usually corrects for 3-4 days, and I want to grab it when it begins to move toward the new high. So I will place a buy order just above each bar of the correction (Traders Trick). When filled, I will hold that stock until it reaches my objective, which, by the way, is never very great. I will definitely sell part of my position as soon as possible so that I am paid to trade and am no longer under pressure or stress. From there I will trail a stop until I'm stopped out. I let the market show me where to put my stop. It is always under the most recent support unless I see something that shows me clearly that the move is over.

Are there any other filters I use? Yes! I use volume as a filter. I want to see at least 500,000 shares trading every day. I also use price as a filter. I recommend that you stay with stocks that fit within your capitalization. You simply can't afford to over trade your capital. If you do, it's gambling, not trading. As your account grows, realize this: higher priced stocks move more than lower priced stocks. It is much easier to get a $1 move on a $60 stock than it is on a $20 stock.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Creativity in your Trading-the Spiritual Factor

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

I was asked the following question: “Joe, is it important to be creative in your trading?”

I’m not sure I can describe it in terms of importance. The creative process is somewhat of a mystery, even to scientists who study it, but that is only because scientists do not recognize the spiritual factors of our lives and consequently in our trading.

The Bible says: “There is a spirit in man.” Man is made up of body, soul, and spirit. In a moment we will look at how the spirit in man affects the soul of man and ultimately the body, but first we must understand what constitutes the soul!

The soul consists of three components: 1. the mind; 2. the heart, and 3. the will.

There are a few common characteristics that all creative persons possess, but for the most part, exactly how the creative mind makes earthshaking discoveries is through the impulse of the spirit. Those impulses come as “inspiration.”

A few prerequisites are necessary. The mind should be focused. New ideas need to flow freely through the mind, and there needs to be a wide range of ideas, so that they can be combined and re-combined in new ways.

New and creative trading ideas are important for a trader to be able to stay ahead of the crowd, so doing whatever you can to prepare your mind to consider new ideas will help to develop creative trading strategies that are essential to profitable trading.

Many great discoveries were made by what may appear to have been lucky observations. However, there is nothing having to do with luck about such discoveries. Those great discoveries are inspired; inspired is what we call the impulse that comes from the spiritual component of man. The word inspired itself means in-breathed. That breath derives from the spirit in man. Without a trained eye the observation might have been missed, but because the mind of the discoverer was continuously mulling over ideas, he or she saw something new in what might be termed an ordinary event. The discovery derives from inspiration, and inspiration comes from the spirit.

Discovering new trading ideas is the end result of creativity. You must get your creative impulses flowing in order to see a new idea. To get your creative impulses flowing you prepare your thinking processes, getting your mind ready to make a creative observation. But it is from your spirit that you get the impulse, i.e., the impetus that stirs your mind to creativity.

The spirit in man is what gives man intellect. It is the spirit in man that makes him vastly different from every other species on earth. No other creature reasons as man does; no other creature philosophizes. No other creature creates music, art, or literature. Man is the only earthly creature who can truly invent, plan, and organize anything he can imagine to do.

Animals operate on instinct. All spiders of a kind weave the same web. All bears of a kind hibernate. All animals mate by instinct, but man reproduces willfully and with pleasure. I could go on and on about the differences between man and the other creatures that inhabit this planet, but surely by now you can see that the difference is vast.

In some ways, your mind is like a water pump. You prime a pump to get the water flowing, and once it's started, it flows continuously. You must similarly prime your mind to get ideas flowing. It is your spirit that primes the pump of your mind. Various ideas in your mind are stored in a hierarchical structure. Information is stored together in various sectors of your mind, depending on its meaning. When you aren't thinking of a particular topic, it's hard to bring information about that topic into consciousness; it lies there dormant and hidden. However, when you make a definite effort to think carefully about a specific topic, or a closely related topic, and start running through the possibilities, new possibilities become apparent. Your mind scans various concepts and ideas, almost unconsciously. Suddenly this wealth of information combines and you see something new. For example, suppose you develop a trading idea about how you might make profitable trades by taking the breakout of reversal price bars. Once you get the basic idea in your mind, you unconsciously use your spirit to prime your mind to get your creativity flowing. For example, you begin looking at reversal bars in various markets and in different time frames to find support for your idea. As you look through the charts, the information you see will prime other related information. Other ideas will then come together, and you'll make an unplanned discovery that can serve as a basis for yet another trading strategy.

The main point is that you must set your thinking processes in motion to come up with a creative new idea. The more your mind is active, the more likely you'll make creative new discoveries. Knowing about the creative process and how your spirit sets it in motion gives you power. Some people feel dejected because they can't seem to think creatively. But with understanding of the spirit and with effort they can think creatively. They just need to know how to do it. Here are the steps:

- Be physically relaxed and get into a meditative mood.

- Be free of anxiety; allow your mind to wander, but do not empty your mind.

- Allow the thought processes to flow, that way you can allow your spirit to prime your mind in order to start the process. If you’re looking at a chart, ask yourself: “What do I really see here? What is this chart telling me?”

It takes a bit of practice, but soon you will see that the spiritual component of who you are will begin to inspire ideas into your mind. As your mind grasps the potential of the ideas, your emotions (your heart) will reflect those ideas. You will become excited and your body will find the energy and your mind will find the will to pursue your new discovery. You may even find yourself saying: “Why didn’t I see this before?”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - HAS Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

On 24th April 2017, we gave our IIG subscribers the following trade on Hasbro Inc (HAS). We decided to sell price insurance as follows:

- On 25th April 2017, we sold to open HAS Jun 16 2017 90P @ $0.45, i.e. $45 per option sold, with 51 days to expiration, and our short strike below a major support zone and 12% below price action.

- On 10th May 2017, we bought to close HAS Jun 16 2017 90P @ $0.10, after 15 days in the trade, for quick premium compounding.

Profit: $35 per option

Margin: $1,800

Return on Margin Annualized: 47.31%

This trade was safe and had a decent return in a pretty low volatility environment ($VIX around 10).

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 674 - May 12, 2017

Edition 674 - May 12, 2017

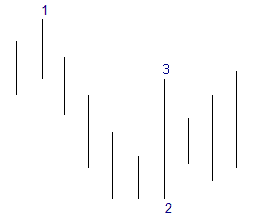

Chart Scan with Commentary - 1-2 on Same Bar

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

A couple of times this past week, people have asked me to explain how two points can possibly be on one bar using the Law of Charts. Since this question invariably comes up from time to time, I decided to show you how it can happen. First we will look at a chart sent to me by one of our students in Brazil. The chart shows a #1 and a #2 point existing on a single bar. Next you will see a hand drawn chart I made to answer a question, in which you will see a #2 and #3 point existing on the same bar.

The Law of Charts dictates that the #1 point of a 1-2-3 high formation must be equal to or in itself be the highest high. Following the bar labeled 1-2, we see first a higher low followed by a higher high, thus creating the 1-2 on the same bar.

In the chart below, we note that the Law of Charts dictates that the #2 point must be equal to or in itself be the lowest low following the #1 point. Following the bar labeled 2-3, we have first a higher low followed by a higher high, thus creating the 2-3 on the same bar.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - BG Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

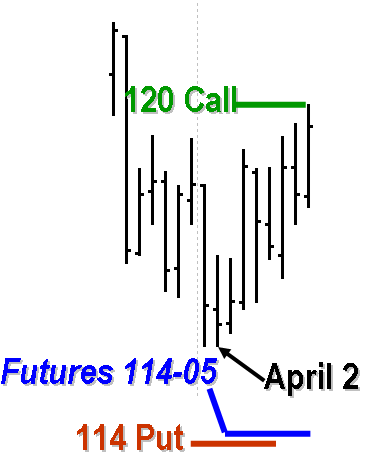

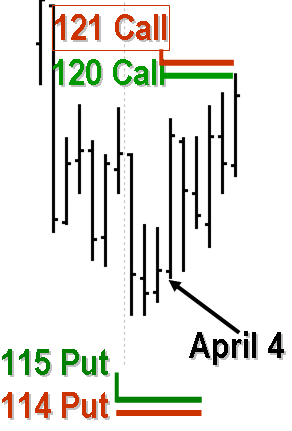

On 11th July 2016, we gave our subscribers a new type of trade on Bunge Limited (BG), to play the recovery of the agricultural sector.

We entered a "complex position" for a net credit (still working with OPM, i.e. other people's money, as usual), but with unlimited upside potential.

- On 12th July 2016, we entered the trade for a credit of $3.25 (or $325 per position).

- On 1st December 2016, we took partial profits on our long position.

- On 28th December 2016, we took new partial profits on our long position.

- On 20th April 2017, we closed our short position (no more margin requirement for the trade).

- On 3rd May 2017 we closed our last long position.

Profit: $908

Margin: $1,721

Return on Margin Annualized: 65.29%

These are low maintenance, low stress trades with lots of upside potential.

We presently have 24 of these trades opened and we closed 5 already.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post - Is it really possible to be consistently profitable?

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Find out the consequences to negative thinking. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

8 Tips on How to be an Open-Minded Trader

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

In my last article, I wrote about why it is so important to stay as open-minded as possible as a trader.

But that is easier said than done, so here are 8 tips you can actively follow on how to be more open-minded:

- Question everything and never stop doing so. There’s only one way to continue improving and that’s to constantly question your beliefs about trading and yourself. If you think you figured something out forever, you’re probably in trouble! That strategy that has been working for years might have stopped doing so. Maybe a market you’re trading in has changed in a significant way and you need to adopt.

- Doing so you have to be completely honest with yourself and your trading and scrutinize everything to make sure your trading and your beliefs about the markets are as close to reality as possible. You do want to know when you’re wrong or have made a mistake right away. Even if that truth might hurt. If you’ve been working on a trading strategy for weeks you want it to work, you want that edge to be true. But the fact is that if it’s not, you do want to know that, otherwise the markets will take it apart for you!

- Never stop learning. The markets, it’s participants and the trading technology evolves quickly. To stay ahead of the game you have to know what’s going on. Read new books that come out, watch videos, read articles and blog posts. There might even be some interesting posts on Twitter, Facebook, and other social media sites.

- But while doing so never believe any "truth" you hear or read about the markets before you have verified it for yourself. Doesn’t matter if it’s on TV, a trading book, a forum or from Paul Tudor Jones himself. In my experience, most of the information you can get for free or for significant amounts of money is absolutely worthless in terms of potential real trading profits. That’s why you need to scrutinize all of it.

- Workout, meditate or do whatever helps you to reset your brain on a daily basis. Find some method that works for you and make it into a routine. This will create the space in your head that’s required to come up with unique ideas.

- Try to get completely away from the markets for longer periods at least twice a year. After trying to crack the markets for months we all tend to get stuck and stop seeing the simple solutions. This is when you need a break so you can start from scratch again. You’ll find that very often you’ll solve the problem you’ve been working on right away after the break. Go on vacation, visit your parents, travel! Whatever helps you to free your thoughts from the markets for a while. For me, hiking does the job.

- Relax. This might be the best and the hardest to follow advice. Of course, it’s necessary to think through everything in a logical way when it comes to trading. And this works fine, but the best trading ideas/ideas for a new system usually come by themselves and as a surprise. You can not force these and thinking hard will take you only to a certain point. At some point, you have to relax and trust in your subconscious (or whatever you want to call it) to work this out for you. That’s when the magic can happen and an idea/solution you never thought about before is suddenly there. Eureka!

- Get in touch with other traders. Talking to someone else about trading who understands what you’re talking about can be very helpful. You can exchange ideas, get completely new perspectives and if you’re talking with someone honest get your ideas and views challenged. This can be very helpful as it forces you to clarify your trading thoughts that can be quite vague. Just having someone ask you "why?" and "how?" a couple of times might save you from wasting weeks of time. And of course, it’s fun to meet other traders!

As always, should you have any questions or feedback, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 673 - May 5, 2017

Edition 673 - May 5, 2017

AlgoStrats:FX Free Trial & April Report

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

Another month passed by and as there have been some exciting changes happening at AlgoStrats:FX I wanted to give you a quick update.

First of all, we are offering you a Free Trial starting now until May 10th. Go ahead and join us for free! If you already have an account, you can simply login with your existing account. If you don’t have one yet, register here. And if you forgot your password, you can go here to reset it.

I've been quite excited about the month of April as I have been working on some major changes to AlgoStrats:FX during the last couple of months which have finally all been implemented in March.

To learn more about what changed in AlgoStrats:FX 2.0 and how it actually performed in April, check out this video:

That's it! As always, should you have any questions or feedback, don't hesitate to send me an email, This email address is being protected from spambots. You need JavaScript enabled to view it..

Happy Trading!

Marco

Join the AlgoStrats:FX Free Trial

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

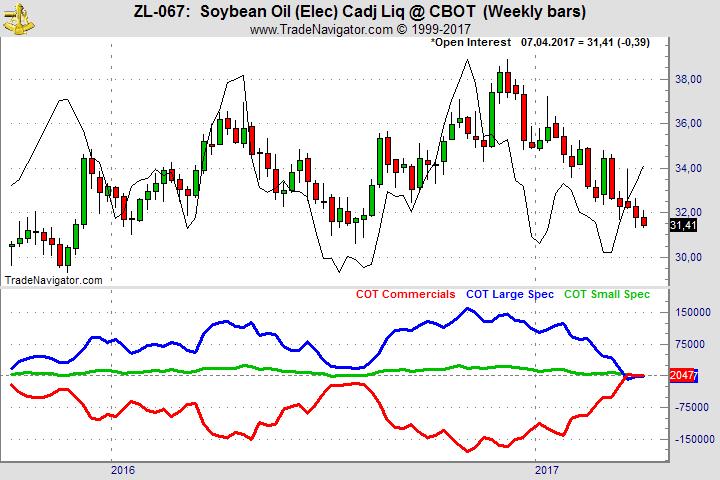

Trading Idea - Selling Soybean Oil Puts

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

It took a while until the July Soybean Oil broke out of the range, but with the break and close above 32.30 Soybean Oil might move higher. Also the Implied Volatility is high in Soybean Oil compared to other markets. I would not want to touch Currencies or Financial markets until the French Presidential Election on May 5, but I don’t see any high risk for the Soybean Oil market.

In Traders Notebook we have started to sell July puts with a strike price at 30.00.

Do you want to see how we manage this trade and do you want to get detailed trading instructions every day?

Please visit our website for additional information:

Traders Notebook

Blog Post - Kramer (from the Seinfeld show) on the Swiss Franc

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

“Hello, Kramer? You got a minute? Take a look at the Swiss Franc chart what do you think?” Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - Gaps

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

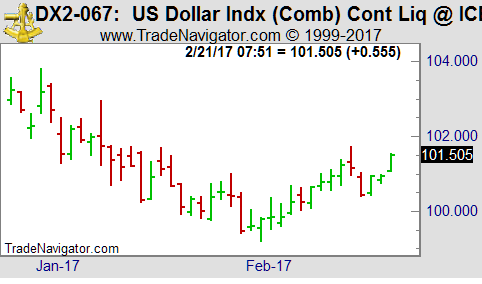

I don't know where the term "stop-gap" originated, but I do know that it certainly applies to the markets. It seems that when traders see a gap, they are not sure of where to place their protective stop, so many of them place it at one end or in the middle of the gap. Remember, if you will, that it is the job of the market to fill orders; prices almost surely will move to fill the gap. I once read somewhere that gaps are always filled. The use of the word "always" usually gives me the chills. Virtually nothing in the markets is "always."

I'm looking at a March 2017 Dollar Index chart on February 21, 2017, and I see prices having just made a gap. Will that gap be filled? I really don't know. There is nothing in my notes that states that "gaps must be filled!" However, to state that gaps are usually filled would be true, and that is what I see as possibly happening.

Gaps on daily charts are less frequent now that more and more markets are becoming fully electronic and trading pretty much around the clock. This means that when you do see a gap, it has more significance than in the past. The question we receive most often is, "What should I do about gap openings?" "Should I trade the back-fill?" In the past, it was true that trading the back-filling of a gap was right 50% of the time and wrong 50% of the time.

However, you always have to pay the commission, so it did not pay to trade on the back-fill unless you could prove by testing that it paid you to do so in any one individual market.

Now that gaps occur less frequently, it is crucial to test what happens in a particular market when a gap occurs, especially as trading continues to increasingly trade 24-hours.

One question you will want to ask, market-by-market, is "Does this market usually move in the direction of the gap following the back-fill, or does it move in the opposite direction from the gap following the back-fill?"

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Time stops in intraday trading

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

For the most part, trader’s stops are based on money, ticks, pips or some percentage of their trading account. All of these are money management stops. In this respect, the level selected for the stop should take into consideration your risk tolerance.

However, very few traders use time stops in addition to money management stops. Time stops are trade management stops.

Using a time stop is quite simple. You apply a stop to your intraday positions which has nothing whatsoever to do with price. With a time stop, you decide how much time since entry is enough for your position to have moved in the direction you anticipated.

When you are trading there are two ways to be wrong:

- You can be wrong about direction

- You can be wrong in your timing.

Think about how many times you have entered a position, then saw your money management protective stop get hit for a loss, only to see the market turn around, and go in your desired direction; a most discouraging situation. You were right about the direction it was your timing that was wrong!

The idea behind the use of a time stop is that it has been proven that the longer an intraday trade remains suspended between a profit and a loss the more likely it is that the position will produce a loss.

The use of a time stop goes hand-in-hand with having a defined trading plan. You should have a well-defined setup or entry signal, a definite profit objective, and a money management stop loss. The stop loss can be fixed or trailing, as you prefer.

The question almost always comes up: “How long should I give the trade to materialize before I simply exit?”

The answer is that you make that determination through study and testing of your chosen market and time frame. If you trade in more than one market, then you make the determination for each market and time frame in which you actually trade.

Experience has shown that the best time to get out—win or lose—is when trading slows down while you are still in the position.

What we want to gain by using a time stop is a reason to exit those trades which are hanging around break even, but have are not really going anywhere—doing nothing to encourage us to stay in the trade. Profits are made when there is momentum in the direction of our profit objective. If momentum decreases, simply get out. You will find that some of the time you will exit with a profit and other times with a loss. Either one will be small and inconsequential in the long run.

When a market becomes volatile a time stop may be as little as 1 minute. If volatility is low, you may choose 5 or 10 minutes for the trade to go your way.

Even when using a time frame as long as 60 minutes in a less volatile environment, your time stop is not likely to be more than 30 minutes.

The major objection to the use of time stops is that they can involve a lot of in-and-out trading. It is true that positions are exited even when they are not actually losing money, simply because they have run out of time to materialize. I have no argument against that point, it is valid.

However, experience dictates that sitting in front of a screen hoping that a position reaches your profit objective, more often turns into a loss than into a profit. You certainly don’t want to be holding a position when liquidity dries up, the market suddenly becomes volatile, or you see an entry signal for a trade in the direction adverse, to your current position.

You should become aware of those times when liquidity dries up. Typically, it will be around the lunch hours of the major trading centers. Also be aware of when reports or news releases are scheduled to come out. Ten to fifteen minutes before a report or news release is due to come out, liquidity will dry up as traders wait to see what is in the report.

Keep in mind that although electronic markets are open for extended hours, traders are not willing to trade during all those hours, so liquidity tends to dry up during the hours when a lot of traders are simply asleep. Traders are creatures of habit. They still tend to trade the most during the hours they traded during the years prior to electronic trading.

The use of time stops adds a dimension to your trading that few traders ever employ. If you use them wisely they can definitely improve your trading. Time stops quickly dispatch non-performing positions and reduce the burden carrying a position that is going nowhere.

Instant Income Guaranteed - TSO Trade

Philippe Gautier: Administration and New Developments

Developer: Joe Ross

Underlying stocks don't always go straight up or sideways after our entry. So it is of utmost importance to choose our short put strikes carefully.

On 19th March 2017, we gave our IIG subscribers the following trade on Tesoro Petroleum Corporation (TSO). We decided to sell price insurance as follows:

- On 20th March 2017, we sold to open TSO Apr 28 2017 75P @ $0.40, i.e. $40 per option sold, with 38 days to expiration, and our short strike below a major support zone and 12% below price action.

- On 24th April 2017, we bought to close TSO Apr 28 2017 75P @ $0.10, after 35 days in the trade.

Our short strike was never violated during the life of the trade (lowest daily low 11 ticks above $75 put strike).

Profit: $30 per option

Margin: $1,500

Return on Margin Annualized: 20.86%

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 672 - April 28, 2017

Edition 672 - April 28, 2017

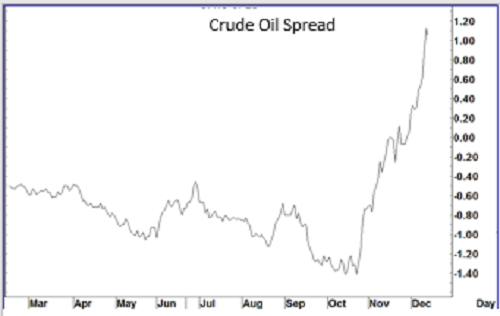

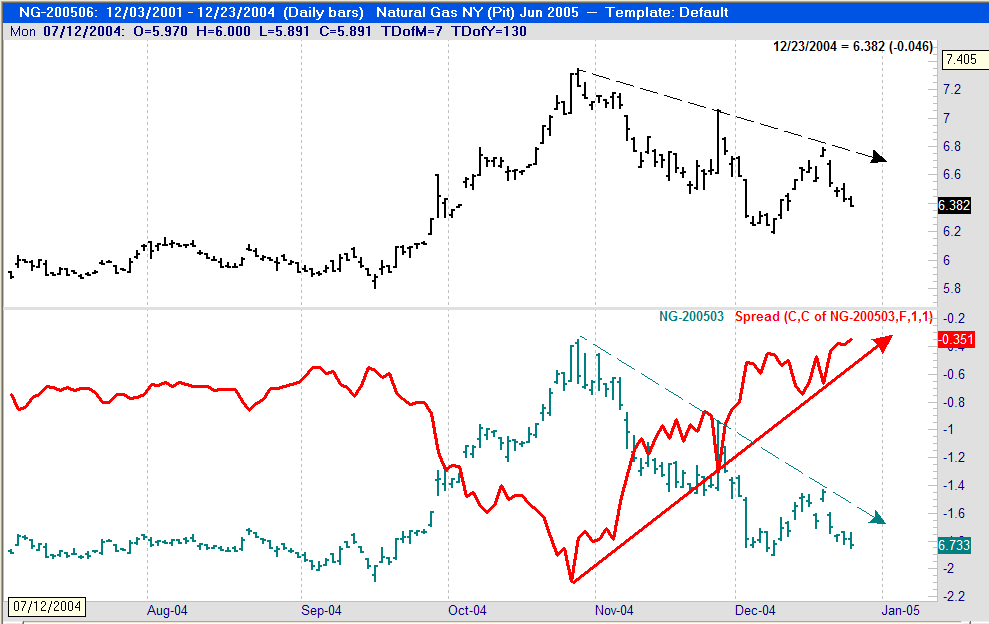

Chart Scan with Commentary - The Secret of Reduced Margin Spreads

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

One of the best kept secrets in trading is that of reduced margin spreads. You cannot name many ways to trade that provides more safety or a greater return on margin than does a reduced margin spread, while also being one of the least time- consuming ways to trade. Have you ever asked yourself why it is that many of the largest, most powerful traders trade spreads? I’m going to show you why!

WHAT IS A REDUCED MARGIN SPREAD?

Because of perceived lower volatility, exchanges grant reduced margins on certain types of spreads. Spreads consist of being long in one or more contracts of one market and short in one or more contracts of the same market but in different months—an Intramarket spread; or being long in one or more contracts of one market and short one or more contracts of a different market, and in the same or different months—an Intermarket spread.

DISTORTIONS ABOUT SPREADS

There are some distortions about spread trading that need to be dispelled. If we get them out of the way, I can show you the tremendous advantages spread trading has over any other form of trading.

It is said that spreads do not move as much as outright futures. I agree 100% with that statement. However, I believe that spreads trend much more often than outright futures, they trend much more dramatically than outright futures, and they trend for longer periods of time than do the outright futures. For these reasons you can make much more money with spreads than with the outrights.

The second distortion about spread trading goes like this: “You have to pay double commissions when you trade spreads.” Yes! You have to pay two commissions for every spread you enter in the market. So what? You are trading two contracts instead of one. You pay two commissions because you are trading two separate contracts, one in one place and the other in an entirely different place. Paying two commissions for two separate trades is hardly unfair. Let me tell you what is unfair—paying a round turn commission for an option that expires worthless. Why don’t you hear people complaining about that? You pay for a round turn, and you receive only half a turn. Doesn’t make a lot of sense, does it?

ADVANTAGES OF SPREAD TRADING

There are so many advantages to trading reduced margin spreads that I hope I don’t run out of room here before I can tell you all of them. Let’s begin with return on margin, i.e., yield.

Yield: As I write this, the margin to trade an outright futures position in crude oil is $4,725, whereas a spread trade in crude oil requires only $540, only 11.4% as much. If crude oil futures move one full point, that move is worth $1,000. If a crude oil spread moves one full point, that move is worth $1,000. That means either a 1-point favorable move in crude oil futures or a 1-point favorable move in a crude oil spread earns the trader $1,000. However, the difference in return on margin is extraordinary: In the futures the return is $1,000/$4,725=21%. For the spread, the return is $1000/540=185%. Think about that!

Leverage: This leads us to the next benefit of spread trading—with the same amount of margin, you could have traded 4 soybean spreads instead of one soybean futures. How’s that for leverage? Instead of making $250 on a five-point move, you could have made $1,000. Reduced margin spreads offer a much more efficient use of your margin money.

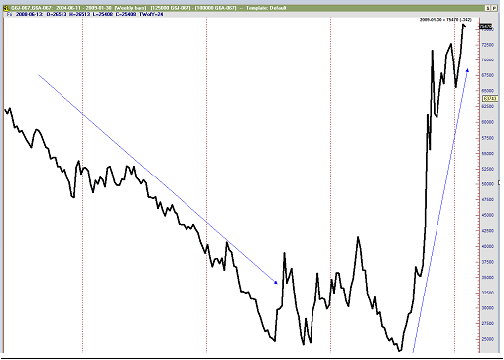

Trend: Earlier I said that spreads tend to trend much more dramatically than outright futures contracts. Not only that, but they trend more often than do outright futures. I don’t have room here to show you the dozens of sharply trending spreads that can regularly be found in the markets, so we’ll have to settle for a recent one. You’ll have to take my word for it that this sort of trending happens frequently when trading spreads.

Opportunities: Because spreads tend to trend more often and more dramatically than do outright futures contracts, they offer more opportunities for earning money, and they do so without the interference and noise caused by computerized trading, scalpers, and market movers. Spreads avoid the “noise” in the markets. There are numerous reduced margin spread opportunities, enough to keep almost any trader busy. And it is the lack of interference by market makers and shakers that leads us to one of the most important advantage of trading spreads, whether they be reduced margin or full margin.

Invisibility: One of the primary problems with any kind of trading in the outrights, whether it be in futures or stocks, is that of stop running. The insiders love it when they can see your order. Even when your entry or exit is held mentally, they know where it is. They are keenly aware of where people place their orders. That is why they love Fibonacci and Gann traders. They know precisely where those people will place their orders. The same is true for anyone who uses one of the more commonly known indicators. The insiders fade moving average crossovers, and so-called overbought and oversold—regardless of which indicator is used to show either of those conditions. They know when prices have reached the outer limits of the Bollinger Bands, and they know the location of supposed support and resistance, etc. But with spreads, they have no idea of the location of your orders. You are long in one market and short in another. Your position is invisible to the insiders. They can’t run your stop, because you don’t have one. You cannot place a stop order in the market when trading spreads! Your exit point is entirely mental; it exists exclusively in your head. In that respect, spread trading is a purer form of trading. It is the closest thing in trading to having a level playing field. Could that be the reason you hardly ever hear about spread trading?

Liquidity: Attempting to trade in “thin” illiquid markets is one of the surest ways to encounter serious stop running and bizarre price movements. However, other than occasional problems with getting filled, spread trading does not suffer from a lack of liquidity—which in itself creates more trading opportunities. I would never consider taking an outright position in feeder cattle. Feeders are a thin, illiquid market normally best left to professional interests. But a reduced margin (feeder cattle)-(live cattle) spread is something I look for all the time. Some of the moves in this particular spread are incredible. They are worth hundreds and even thousands of dollars per spread, several times a year. They are highly seasonal in nature due to the birth and growth cycles of cattle. The same thing is true of spreading both live and feeder cattle against lean hogs. These spreads are seasonal, which brings us to the next great advantage to spread trading - seasonality.

Seasonality: Whereas seasonality doesn’t always take place as planned, i.e., seasonality can come early, late, or not at all, but when it is happening, you can see it. It is obvious when a seasonal trade is working as expected. Seasonality is not subject to the whims of man. Seasonality is one of the strongest reasons for trading spreads. Crops are planted within a given period of time. Calves and piglets are born according to their birth cycle and they grow according to their growth cycle. Even futures based on financial instruments are seasonal, and many of them offer reduced margin spreads.

Inversion: Along with seasonality comes the huge profits that can be made when an underlying market become inverted (goes into backwardation). This is true for any agricultural commodity as well as any financial instrument. I don’t have space here to explain inversion, but when it occurs, which is commonplace, the spread between front and back months can widen tremendously, thereby offering marvelous profit-making opportunities to the spread trader. As if that weren’t enough, the same opportunity becomes available when the period of backwardation ends and the relationship between front and back months returns to normal.

Probabilities: If we eliminate those trades in the outrights in which you get yourself whipsawed in a sideways market and maybe win or lose a little, the actual odds of winning on any trade is 50%. If you are long and prices move down, you lose. Conversely, if you are short and prices move up, you lose. It doesn’t matter how accurate is your trade selection, the bottom line is that your chances of being right once you enter a trade are one in two. However, when you enter a spread you are not primarily concerned with the direction of prices. Your primary concern is with the direction of the spread.

With a spread you can make money when both legs of the spread are moving up, both legs are moving down, when both legs are moving sideways but one more so than the other, or best of all, when the leg you are long is moving up and the leg you are short is moving down! As long as the leg you are long is moving better than the leg you are short, you will have a winning trade. There is only one situation in which you can lose with a spread, and that is to be dead wrong about both legs. So with a spread you can win even if you were wrong about the direction of price movement, as long as you’re not too wrong. The chart gives you an idea of what I’m talking about. Both months of this natural gas trade were moving down, but the spread was widening and moving up.

(Source Genesis Financial Data Systems)

There are additional opportunities in spread trading, including spreads that require full margin. You can trade spreads with stock indexes, sector funds, and single stock futures. Did you know you can daytrade stock index spreads? These are topics for another day and another time.

Unfortunately, either by accident or design, much of the truth of spread trading has been lost over the years. There are many more aspects to it than I have touched on here. Furthermore, there are some wonderful and inexpensive tools available that make spread trading a delight. Spread trading is one of the most relaxed ways to trade. It rarely takes more than 1-2 hours of your time each day, and more often than not, we are talking about only minutes per day to seek out and trade the wonderful opportunities that are available in reduced margin spreads.

Now that I’ve told you about spreads, my secret is no longer a secret.

To learn more about Spreads, click here!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - HST Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

On 16th November 2016 we gave our IIG subscribers the following trade on Host Marriott Financial Trust (HST). We decided to sell price insurance as follows:

- On 17th November 2016, we sold to open HST Jan 20 2017 14P @ $0.15, i.e. $15 per option sold, with 63 days to expiration, and our short strike below a major support zone and 18% below price action, making the trade very safe.

- On 7th December 2016, we bought to close HST Jan 20 2017 14P @ $0.05, after 20 days in the trade, for quick premium compounding.

Profit: $10 per option

Margin: $280

Return on Margin Annualized: 65.18%

This trade was suitable for small accounts.

We have also added new types of trades for our IIG daily guidance since 2016, "no loss" propositions with unlimited upside potential, still using other people's money to trade.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

One of the lessons I learned the hard way in trading is that to become and to stay successful as a trader, you have to be very open-minded. Unfortunately, this is easier said than done and many traders fail to stay open-minded in the long run.

This is a very common trap for traders you're having success early in their trading career. Maybe you started trading back in the early 90s when the stock markets moved from one high to the next. You learned a very simple long-only strategy to trade stocks and of course, you were very successful doing that. But in the year 2000 everything changed and that super bull markets turned into an ugly bear market. A completely new environment to trade in and guess what your long-only trading strategy stops working. But as you've been making nice money with it for almost 10 years it's very hard to stop trading it. On every little profit you make, you start hoping it might work again. But as the stock markets continue to collapse, so does your equity.

That trader can hardly be blamed for not being open-minded enough to see that and stop trading the strategy before it's too late. It's a very difficult thing to do. And that's why most traders who've had a very good start usually give it all back to the markets later on.

But there are also traders who've been around for a while that should know better by now. Still, they believe that only one way of trading is right and try to stick to it forever, happily ignoring all the facts telling them the opposite. Often, they're the ones who love hanging out in trading forums to tell everyone the truth about trading. Whenever someone wants to tell you "the truth about the markets", run as fast as you can!

If there is a truth in trading and the markets, it can be summarized in "it changes all the time". Whenever you think you've seen it all, something new happens. Truths like "bonds and stock market are highly correlated" simply become untrue. Whole markets become illiquid or disappear. Trading costs is another factor that can make markets untradeable (or tradable) for a specific strategy. And of course, market participants change all the time.

Because of that, trading strategies that worked for years can simply stop working. It will be very interesting to see what happens to many traders/strategies/hedge funds that are currently relying on some kind of long-only stock market strategies when things become ugly again.

So that's one of the reasons you have to stay flexible and open-minded in this business. Markets change. If you don't adapt, you won't survive.

But you also need an open mind to be successful in developing trading strategies and looking for market edges. Very often you'll find that the very opposite of what you believe or read in a trading book is actually true. But you won't find that out if you're not ready to challenge what you believe to the true right now. Is a certain chart pattern that is categorized as "bullish" all over the internet actually "bullish"? Or might the truth be that chances of success are much higher fading that signal? Go ahead and find out!