Denise Ross

Edition 626 - June 10, 2016

Edition 626 - June 10, 2016

Joe Ross sent out a letter earlier this week. In case you missed it, you can read it on his blog and have an opportunity to sign up for his "Money Master Plus" webinar on June 25th (take advantage of the early bird special).

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

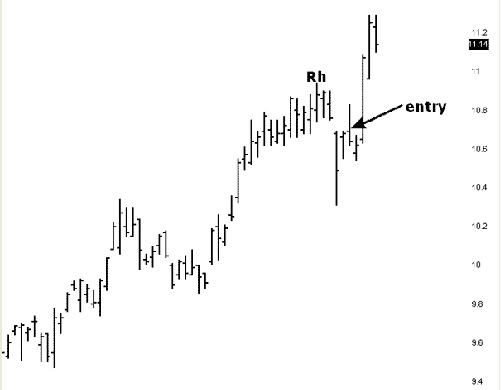

Sugar Trade

This week we look at a daily sugar chart. We need to learn something here about the Traders Trick Entry (TTE). March Sugar prices reached a high of 10.94 and then retraced for two days. Those two days made identical highs [at 10.90]. Prices then dropped again, and again we had two identical highs [at 10.69]. The TTE rules say that after 4-bars of correction you are no longer to enter a trade based on the TTE. However, the rules also state that when expecting a continuation towards the upside, equal highs count as only one bar of correction (retracement). So, although we have 4-bars in the correction, because of the equal highs we count this as only two bars of correction. Now you can see why we made an entry 1-tick above 10.69. What happened afterwards is of no consequence to the rule I am showing you here. In accordance with your money and trade management, you made a little, or took a loss, or made a lot on this trade. I will tell you only that we made a little. ;-)

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Seeking Out Protection

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Making a profit in the trading world is hardly a sure thing. How you deal with this fact of trading, though, depends on your personality. Some people take risks in stride, while others obsess over them. Which type of person are you - a natural born risk taker, or an obsessive, fearful seeker of safety?

Life is a matter of taking risks, but some people embrace it while others superstitiously try to avoid it. For example, have you ever seen an extremely ineffective car theft device called "The Club?" You are fooled into believing that by putting a massive metal bar on your car's steering wheel, you are protected. It seems it would work, until you realize it takes merely a few minutes to cut the steering wheel with a hacksaw to pull it off. Similarly, why do car stereos have removable faceplates? Do you think thieves are actually unaware that there isn't an expensive stereo beneath a removed faceplate?

These kinds of "protective" devices make us feel better, at least until we realize that they don't work. At that point, we think, "How could I have been so stupid?" That said, feeling protected helps take the edge off. Even if it is just superstitious behavior, like wearing your lucky shirt on the day of a big trade, you feel better when you do it. There's a psychological benefit to it.

We can alleviate some of the uneasiness of taking risks through risk control. By risking a small percentage of your trading capital on a single trade, and looking at the big picture, you will feel more at ease. From a psychological viewpoint, it is to your advantage to make a potential trading loss so insignificant that you may start thinking "Why am I even bothering making this trade?" There is no universal rule for how to limit risk. Some experts suggest risking merely 2% of your capital, while others suggest 5%, and still others suggest using past market action to determine the amount of loss you can afford to take (for example, if the market is bullish with many opportunities for profit, then you can take a little more risk.)

The best way to control risk is to set a protective stop, but whether or not you set a stop loss or how you do it depends on your personality and attitude toward risk. If you are a natural born risk taker, you may not set a formal stop loss at all. You may keep an informal stop loss point in mind, and close your position when the stock price reaches that point. At the other extreme, the obsessive-compulsive worrier trader may set the stop loss too close to the entry price, and end up getting stopped out too early. The middle ground seems to be reasonable for most traders. Again, it depends on your personality, but if you are afraid to take a loss, a stop loss can help. If you don't have a stop loss and hate taking a loss, you may not close out a position when the price falls hard. You may be prone to hope against hope that the trade will turn around, and watch your losses mount as you fail to take action. The stop loss order, however, guarantees that you will be out of the trade should prices move against you.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

This week, Andy is looking into a Natural Gas calendar spread going long the April and short the March 2017 Natural Gas.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy's Blog Post - The Best Trader in the World

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

If you had to describe the best trader in the world, who would that person be? What qualities would he have? Take a moment to envision him. This is important because this is the person you want to be, so you need to have an exact picture of him and what his qualities are. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Forex vs. Futures

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com.

In his new video, Marco talks about the major differences between trading Futures and Forex from his point of view. Find out what the advantages and disadvantages of both trading instruments are! If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum.

Marco's new site is now live!

AlgoStrats.com

(Be sure to also follow Marco on Facebook and Twitter)

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 625 - June 3, 2016

Edition 625 - June 3, 2016

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Tradable Markets

Regardless of what you trade, or where you live, the price of crude oil is going to affect your life. We are receiving many emails asking us about crude oil prices. Will they go higher? Will they go lower? Will the release of export restrictions bring down the price of crude oil and thus the price of gasoline?

My friends, I do not have the answers. When they passed out crystal balls, they somehow overlooked me. However, I think this might be a good opportunity to see what the daily chart was telling us some years ago. While we discuss the daily chart, please realize that as I wrote this the weekly and monthly charts show crude still in an uptrend, with the monthly chart indicating that the rise may have been be a bit too steep. On my charts oil prices had become increasingly parabolic.

Now to the daily October crude oil futures chart, on which I will show only prices since June in order to conserve space.

Clearly, the dotted uptrend line had been broken. I drew a solid horizontal line at the base of what was officially a trading range in accordance with The Law of Charts. The arrow points to a price bar which typifies the vertical midpoint of the trading range. Inclusive of that bar, prices had been consolidating for 21 days. The Law of Charts states a probability of a breakout of the trading range is most likely to occur on days 21-29.

We can also see the left shoulder and head of what might have become a classical "Head and Shoulders" formation.

What does all this mean? I can tell you only what it meant to me - you are, of course, entitled to your own opinion. Keeping in mind that I have trained myself to trade only what I see and not what I think, I extracted myself from anything to do with short-term crude oil futures, and was standing aside at the time. Short-term conclusion was: get out of any short-term long crude oil positions. Prepare for the eventuality that a right shoulder may form. Prepare for further consolidation. Wait to see what develops.

What did I think? I thought crude oil had a very good chance of going much higher - perhaps even hitting the $100/bbl mark, which it eventually did. But obviously, not just yet. So for long-term stock holdings, I was willing to run my trend line along the weekly chart, but quite frankly, the monthly chart seemed to be a bit overdone. Long-term conclusion? Crude oil price will consolidate here for awhile, perhaps go a bit lower. This was a good opportunity for getting long and holding on for higher prices.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Passion for Trading

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

After months of trading in a slump, Jake tells his best friend, "I think I want to quit the trading business. Why am I doing it? There must be a better way to make a living."

Have you ever felt like Jake? Trading is stressful and demanding. It's understandable to feel like “throwing in the towel” at times. If you are ready to find a new job, or if you just don't seem to have the same passion for trading that you used to, there is a lot you can do to reignite your desire to trade the markets.

Trading is a tough business. If you lose your passion for trading, all it means is that you are human. Here's an obvious cure. Why not take the rest of the month off? Maybe you're just stressed out. A little rest will help put things back in perspective. Once you are rested, relaxed, and re-energized, you'll be ready to tackle the markets with zeal.

Here's another strategy. Remind yourself of how great trading really is. You work for yourself (unless you are an institutional trader). You can work at your own pace, and feel that you have freedom. Remember what it was like to work a 9-to-5 job?

"Absence makes the heart grow fonder." Maybe you could arrange to visit a friend for a day at a regular 9-to-5 job. Or, when it is the holiday season, you could take time off from trading and find a part-time holiday job. It's not forever. It's just a way to rebuild your passion. Sometimes we forget why we trade. It’s like having a thrilling sports car, we start to see the “thrilling” job of trading as mundane. Drive a compact car for a week and you'll see how great your sports car drives. Work at a regular 9-to-5 job for a few weeks, and you will quickly rediscover your passion for trading. It may sound extreme, but it works. Maybe even after the first day, you'll think, "Oh, now I remember why I became a trader."

It's hard to trade successfully day in and day out. Some traders never lose their passion, but many forget just how exciting the markets can be. If you lose your passion, don't sit around sulking about how boring life can be. Go out to see how the other-half lives. You'll remember why trading is a great profession. And you will trade with renewed passion.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Plan Series - Part 3

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

In part 3 of our Trading Plan Series, we talk about how important it is to know yourself and to know your purpose.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Plan Series - Part 4

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

In part 4 of our Trading Plan Series, Andy explains how to set the right trading goals.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy's Blog Post - Controlling Emotions

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Winning traders cannot afford to be influenced by their emotions. The nature of trading demands an objective, logical approach. If you experience extreme excitement after a win and extreme disappointment after a loss, you will be living on an emotional roller coaster: up and down, up and down. Read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Error: Trading Your P&L

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method and AlgoStrats.com.

In this week's video, Marco talks about another very common trading mistake: trading your P&L instead of the actual market action. If you're struggling to become a winning trader, this might be an eye-opener, especially if you're a breakeven trader right now. If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., or post it in our Blog or Forum.

(AlgoStrats.com - Coming Soon!)

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Instant Income Guaranteed by Joe Ross

Start on the right path to Wealth Building!

Instant Income Guaranteed - A new way to look at trading

Hit and Run Trading

“Hit and run?” Sounds like maybe I did something wrong? But don’t think for one second that I’m admitting to some kind of wrongdoing, because everything I did was 100% within the law.

And on this web page I'm going to show how easily I picked up and got away with $67,500... from some of the most fearful, and often greediest, speculators and investors who participate in the stock market.

Now I know it sounds suspicious. But as you'll soon see, it’s not.

What I did has been legally possible for more than 39 years. And for ordinary people like you and me, it's the easiest way to pocket a few hundred, or even a few thousand dollars, without working very hard.

In fact, I've shown this to other people, and they have joined me in this extremely unusual activity.

Like research chemist S. Ruof, who grabbed $2,100 and told me, "This was my first time, and it was very easy!"

Or retired dentist Norma C., who says, "I had no problems learning it. I have made over $10,000."

One of the folks who joined us made over $50,000 since finding out about this. He said, "I have been using this for almost a year, and now I’m living on it."

These are everyday people like you and me, who have come from all walks of life. None of them have any specialized skills or training in this field. Yet each has learned how to do this simple action to supplement, or even replace, their monthly income.

In only 5 months, I picked up over $67,500 this way. Whenever I do this, it takes me only 2 to 3 minutes. I do it from my laptop, sitting comfortably in my home office. I have the use of the money right away. It’s mine to use any way I choose: to pay my bills - to take vacations - or buy a new car.

My name is Joe Ross. I’ve been trading in the markets for almost 6 decades. And I'm going to show you exactly how I pull off what I like to call "Hit and Run Trading."

My name is Joe Ross. I’ve been trading in the markets for almost 6 decades. And I'm going to show you exactly how I pull off what I like to call "Hit and Run Trading."

Now I understand that you may have moral reservations about doing this yourself. So let me put your mind at ease and show you exactly what it is - why it's been lawful for more than 35 years - and how you can use it to grab cash month after month in just a few minutes of your time. How you can use it to pay your bills... buy gifts, travel... supplement your income... or whatever you wish.

Then you can decide if it's something you could feel comfortable doing. And if so, you'll see how easily you, too, could pocket a bunch of money almost immediately after reading what I have to say...

Hit and Run Trading exploits people’s fear of losing money

The first thing you should know about this way to pocket money is that it's lawfully being done by huge investment banks and hedge funds every day.

Of course, the fact that they do it doesn't make it legal. But what they do was passed into law by Congress, signed by the President, and endorsed by the SEC and the U.S. Federal government - most likely at the urging of Wall Street's large hedge funds and investment banks, who make billions of dollars with it every year.

Now I'm not talking about any kind of regular investing, day trading, or anything like that. And when I say "pocketing money," I'm not describing any form of stealing or robbery.

As you probably know, Wall Street has many ways of making money which have nothing to do with buying or selling stocks. In fact, what I will show you if you join me is how to not buy stocks, unless for some reason you want to own them.

The actions of the big money traders make money for them in seconds, time and time again. In most cases with little risk, because they create situations in which they almost always make money.

Perhaps you've heard of some of them, like high-frequency trading or arbitrage, a tactic that lets Wall Street pros buy up investments at one exchange at a lower price, and immediately sell them at another exchange at a profit.

They can do this over and over again, with little chance of losing money. With high-frequency trading, they can do a thousand trades in a second or two.

Tactics like these are not available to people like us. But they generate piles of cash for the professionals who use them.

Maybe you've heard of the specialized investments Wall Street creates, which let the pros exploit existing market situations at huge profits, but with little or no risk.

These Wall Street insiders use strange-sounding names like “credit default swaps,” and “collateralized debt obligations” to snatch billions of dollars from the markets.

These tactics may be lawful, but in my opinion they are unethical.

Yes, there are many tactics used on Wall Street which, in reality, add up to legalized theft - unfair tactics that allow them get away with a fortune, but aren't available to individuals like you and me.

I don't agree with these tactics, no matter how lucrative they are, because I don't believe in making money by hurting or exploiting someone else financially. I have always made my money by performing a service or producing a product. It’s no different with Hit and Run Trading, I want to create new value.

Yes, there is one type of “clever” trading which is both ethical and within the law. I use that kind of trading all the time, and have no reservations in using it (and neither should you) because by using it I perform a service that others want.

A similar service is heavily used on Wall Street by their taking advantage of their mountains of cash. But in the case of what I do, it isn't complicated and doesn't require large sums of money. It’s a form of price insurance - and it's available to regular folks like you and me.

I've adapted the service for my own use, making it possible to use with almost anyone’s limited resources.

In fact, what I do often lets me jump ahead of the big Wall Street firms and get away with a cut of their profits before they even know what happened. And that's why I call it Hit and Run Trading.

It's easy to do, and you don't need any specialized training or skill to do it.

But it wasn't always like this...

Computer technology gives us access to this Wall Street secret

Years ago, when this way of trading was made lawful, it wasn't available to ordinary investors. Only Wall Street professionals could take advantage of it.

But all that changed in the 1990's when the combination of the personal computer and the Internet made the markets accessible to all. That's when regular folks like you and me gained access to the markets through online discount brokers. And for the first time, we were able to directly get at the same pools of money as the pros. And for the first time also, we could use Hit and Run Trading to pull in money just as the pros do.

"I was able to pay off my car almost 2 years early!" says Lori B. in Austin, TX, after grabbing $13,250.

“I’m taking my family on a long hoped-for vacation, says Michael Ems of Cape Town, South Africa.

These folks are grabbing the easiest and safest income possible.

As John Vacani, an investment analyst said; "It's really doing a service for those who need to protect the value of their investments. It’s truly a win-win situation for those who provide the service and those who need it."

And once you try it for yourself, you'll see exactly why. Because with Hit and Run Trading, you can pocket money every day the markets are open, while at the same time providing a real service to those who need it.

So how do you do it?

It works through your online brokerage account by accessing money lying around in the financial markets.

Now I realize you may not think the markets have money lying around for you to simply grab.

But that is how Wall Street does it. Let me show you...

Providing insurance against fear

Many stock market investors, as well as many stock market advisers, live in fear of falling stock prices. Investors, especially, fear losing money on their stock investments through a stock market crash or falling prices in what they call “a bear market.”

Stock market psychology erroneously equates rising prices with being “good” and falling prices with being “bad.” Therefore the markets are heavily biased towards rising prices. But nothing, not even stock prices, goes up forever, so stock prices are said to “climb a wall of worry.”

Most investors can withstand the normal ups and downs of the stock market, but they are terrified of suddenly falling (crash) or steadily falling (bear market) stock prices. To protect against falling prices, investors are advised to purchase a form of price insurance. That insurance protects them against falling prices.

Said another way, an investor can purchase insurance against falling stock prices by purchasing an insurance contract that will grow in value at the same time the value of shares of stock is lost due to falling prices.

Insurance is no doubt one of, if not the best, business in the world. Insurers receive money up front for perceived risks that may never take place. That upfront money is what they call “the float,” and they use it to invest for profits. But unlike other businesses that have to pay interest on money they borrow, insurers get their investment capital for free via the premiums people pay for insurance. What a racket, huh?

When you purchase accident insurance, you immediately cough up the money to protect against an accident, but hope you never have one. The insurer has the exact same hope. Your protection is from month to month, quarter to quarter, semi-annually, or year to year, depending on how you pay for it.

When you buy health insurance, you come up with the money, “the premium”, to pay for an insurance you hope you will never have to use. Again, you pay for it each month, each quarter, semi-annually, or perhaps on a yearly basis.

If a person buys a one-year term life insurance policy, the insurance expires at the end of one year, and has to be renewed for another year, usually at a higher price. If not renewed at the end of one year, the insurance policy expires worthless. Strange! The only way to collect on that kind of insurance is to die. Still, it serves an economic purpose for those who survive the person insured.

Buyers of price insurance are insuring against something they hope they will never have to use. Sellers of price insurance share the same hope. Price insurance against falling prices is sold for one week, one month, one quarter, several months, or even one year and beyond. The longer the insurance period covered, the higher the price for protection, since the insurer will be at risk for a long period of time.

The buyer of price insurance wants the insurer to take the risk of falling stock prices by agreeing to buy the insured’s stock when prices have fallen to the point of loss. For that insurance, the buyer pays a premium.

The seller of price insurance receives immediate income in the form of the premium paid by the insured. The seller agrees to buy devalued shares of stock from the buyer of the price insurance, and statistics show that at the end of the insurance period 8 out of 10 insurance contracts have no value whatsoever. They expire worthless, without the insured’s collecting anything. Price insurance is the cost paid for protection against a fall in the price of the underlying shares of stock.

The seller of price insurance pockets the contract premium and gets to keep it on average 80% of the time, but what about the other 20% of the time? Does the insurer, the person selling the insurance, have to pay up? Does the seller of price insurance actually have to pay up, and purchase the devalued shares of stock as set out in the insurance contract? Not with Hit and Run Trading.

With Hit and Run Trading, you will find out how to pocket guaranteed option premium, i.e., guaranteed income, without ever having to buy a single share of stock. A Hit and Run trader never has to fear falling stock prices, because a Hit and Run trader will never have to own shares of any stock. If you never own shares, you will never fear a falling stock market, and never lose money by owning shares.

Just click "submit" and access unlimited cash

The most money made by the professionals in the stock market is not made by buying and selling stocks. The real money, the big money, is made by dealing in derivatives. Price insurance is a derivative. And derivatives comprise the largest financial market in the world.

The word derivative means that the financial instrument, (in this case the price insurance contract) is derived from an intangible — the intangible in this case is fear of losing money on the price of shares of stock. Every derivative must have an underlying asset. In the case of price insurance, the underlying assets are the shares of stock.

Derivatives have many different names such as:

Forward rate agreements...

Money market instruments...

Stock options...

Swap options...

Interest rate caps...

Property index notes...

Futures...

and many additional names, most of which we’ve never even heard.

Their names might sound confusing, but basically these are all just various types of bets. Insurance, too, is a bet.

Derivatives are bets on anything to do with money. Like bets on what interest rates will be next month - bets on fuel prices – or, as in the case of price insurance for stocks, bets on share prices. If you buy insurance of any kind, you are placing a bet.

If you buy life insurance, you bet the company that you might die tomorrow, and the insurance company says, “Yes! You will die, but not yet.” When you buy health insurance, you bet you will get sick, but the insurance company says, “We don’t think so.” With accident insurance, you bet you will have an accident, but the insurance company says, “We don’t think you will.”

Hit and Run Trading has nothing to do with your making any of these bets. With Hit and Run Trading, you take the insurance company’s side of the argument. You don’t make a bet, you take a bet, but it’s a bet you cannot lose if you are careful in underwriting the risk.

I got the Hit and Run Trading idea by finding out how Wall Street makes its money, which led me to the secret I want to share. I learned how to underwrite risk, so that I never have to buy the devalued shares of stock. Wall Street makes money by unfairly collecting the money being lost on bets. I learned to make money by performing a much-wanted service.

Let me show you what I mean...

Investors lose money betting that prices will fall

The money they lose is yours for the taking. Many of the bets placed in the stock market are highly speculative. For instance, I recently saw bets being made that Microsoft's stock price would drop. People who simply don’t understand Microsoft’s business, were buying price insurance to hedge against expected falling prices. Wow! Were they ever wrong! Within a week, Microsoft’s prices soared 2 ½% in a single day.

In other words, some people were using the stock market to bet that Microsoft's stock price would collapse in the next few weeks. To me, that's just ridiculous. But what's even crazier is that these people had put up $2,320 betting this would happen.

To show you how unlikely this bet is, just consider that Microsoft has been around for decades and is the world's number 1 software company. They make multiple billions a year from their software business. Microsoft actually has 16 businesses that make over a billion dollars a year each. And their money from this has been going up every year without any signs of stopping. Even during the last financial crisis, Microsoft's stock didn't drop by as much as these people were betting on.

So short of an unprecedented global disaster, I don't see how its share price could possibly drop an anticipated 60% in a few weeks.

But for whatever reason, there were some people out there who've placed bets on this happening.

Who are these people?

They are speculators, and fear-driven investors. In fact, they may be some of the insiders... or Wall Street's wealthy clients. Often they are people with perhaps more money than common sense.

To them, the stock market is just a huge casino where they can place bets in the off chance of hitting a large jackpot. These people just love taking risks, and would feel equally at home in a casino. Losing on speculative bets like this is normal in their pursuit of that one lucky bet that may pay off. It comes with the territory, similar to losing your bet on a spin of the roulette wheel.

Lots of people gamble in the stock market. They do it for the adrenaline rush, and the euphoria that comes with it. Others, who are fearful investors, are often just plain ignorant of the realities of the markets.

And that's why they're placing bets on things like Microsoft's stock dropping so far in such a short time. It's trying to attain the thrill of getting rich quick, or to protect against unlikely losses.

Of course, Microsoft's stock price will go up and down over the next few weeks as it always does. But it's virtually impossible for it to drop as much as those speculators were betting on. Too bad for them, because they'll lose the $2,320 per contract they've put on this wager. And in most cases, some Wall Street firm will pick up this money like a casino collecting bets from its gambling table.

And this is where the Hit and Run Trading comes in. Because with Hit and Run Trading, you can grab this money before Wall Street does.

"I couldn't believe how easy it was. Last year I made $78,000," says Denise H. in Albany, NY.

And Bahamas retiree, Don W., is collecting $1,300 EACH WEEK.

Let me show you how you could do it...

How to "steal" from Wall Street's income

What Hit and Run Trading enables you to do is spot these ridiculous bets, and collect the money being lost by those impulsive speculators and fearful investors.

As I mentioned, I don't believe in taking money from people without their consent. And I certainly don't believe in hurting someone else financially while my own wealth is growing.

When you use this tactic, you are simply collecting the money lost by impulsive (and often wealthy) gamblers who make wildly speculative bets in the derivatives market. They are willing to pay for price insurance, which will result in limiting their losses. They are placing a bet, and I’m willing to take that bet knowing I will win.

That's what the Hit and Run Trading allows you to do. It helps you to run ahead of Wall Street and pick up the money being lost before they do, while at the same time performing a needed service.

That's why I call it a "hit and run". Because when you do this, you're "snatching" some of Wall Street's profit.

And as I said, I'm completely comfortable with a legal strategy that earns me money while I perform a service others are willing to pay for.

To give you an idea of how easily you can pick up this kind of money, just look at the vast number of bets and the money in the market right now...

Millions of bets losing money means millions of dollars for the taking

Today, as I write this, TransCanada Pipeline Company is selling for $45.52. In the last 4 days the price has risen $0.85, and rose more than $2 in the past 3 weeks. Yet there are 1,402 crazies and fear-driven holders of TransCanada who are willing to bet that prices will fall back 87% in the next 6 weeks.

Johnson & Johnson, a global dominating blue chip company, just hit $98.23 per share, up from $85.47 per share in less than 2 months. There are 2,824 owners of Johnson & Johnson who are willing to pay someone to take their shares off their hands if prices fall back to $85 in the next 19 days!

Earlier I showed you some of the ridiculous bets people have placed on Microsoft’s stock. Now, I’ve shown you two more insane bets. But the truth is, it's like that with nearly every large stock on the New York, AMEX, and NASDAQ stock exchanges - on everything from stock symbols AAPL to ZZZ.

Your online brokerage account holds the key to collecting money in less than 5 minutes

Doing these "hit and run trades" is very easy. In fact, it involves steps that are not unlike placing a regular order to buy or sell shares of stock, except that in this case you don't use the stock order section of your account.

Instead, you access another account feature of which most people simply aren't aware. It gives you direct access to the money you'll be extracting with the Hit and Run Trading.

If you deal with any of the large online brokerages like Fidelity... E*Trade... Charles Schwab... TD Ameritrade... or Scottrade, you most likely have this feature in your account. Personally, I use Interactive Brokers to do the job.

The key to access the money is easier to find on some brokerage websites than others. And some accounts have the feature locked out or disabled by default. But don't worry. With a few clicks or a phone call, you can usually unlock this feature in your existing brokerage account. I'll show you exactly how.

Once you've enabled this account feature, you simply enter a specific code into the account. I'll show you how to generate the code. This code is used to place the "transfer request" that extracts a given amount of money out of the market.

And then, you just click "submit" to watch the money get transferred into your account.

How much you collect varies each time. But most people I've shown this to can withdraw a few hundred to a few thousand dollars at a time.

So where do you get these "transfer request" codes?

That's easy - I'll teach you how they are constructed. Putting them together is child’s play. I’ll also give you simple step-by-step instructions on how to use them. All you have to do is follow the directions I give you in my online seminar, workshop, and two months of daily guidance.

Start profiting by joining my next group of insurers...

During the period of daily guidance I’ll give you details on how much you can expect to grab, and how to go about collecting the money.

If you're interested, I'll add you to the list for my next course immediately.

You see, I've been a trader for almost six decades, and an educator for more than half that time. I love to show people how they can make money. In the early 1990s I formed Trading Educators. Trading Educators has grown to have representation in numerous countries around the world. We have students on every continent.

I’ll show you how to find the bets most likely to lose, so you can then collect them.

And once you've taken my online seminar and workshop, I'll not leave your side for two full months — and beyond that if you wish. I'll guide you every day with all the information you could possibly need.

I am so confident that you will not lose money selling price insurance that I guarantee to give back your seminar and guidance fee if you incur even one loss during the two-month guidance period. What I will show you is not for novices who are happy with mediocre gains...

Collecting a steady income this way is not for everyone. And I find that the people who benefit most from my program usually meet two specific qualifications:

First, I recommend you have at least $2,000 in investing capital set aside. $2,000 will severely limit what you can do, but it will enable you to learn the technique and rather quickly build your capital so that you can snatch more and more money away from Wall Street, and help those who need your service.

Of course, whether or not you choose to follow my advice, and how much money you commit to any single bet, is entirely up to you. But it's a good idea to have at least this much capital at your disposal so you get the maximum benefit of the techniques I'll be showing you.

And second, you must be open to embracing a new way of seeing things. I will be showing you a highly profitable way to make money.

In my experience as a trader and educator, I’ve seen that most people are afraid to try anything that looks in any way "unusual." Especially when it comes to the financial markets.

If that sounds like you, I regret wasting your time.

I have no interest in showing you a conventional way of making money. If all you want to do is buy stocks and collect a few dividends, there’s no point in continuing because my technique relies completely on money to be made from the highly lucrative derivatives market.

In other words, you'll be using tactics that might be entirely new to you, unlike anything you imagined would be legal or even possible. Let’s be honest. Have you really ever heard of price insurance? Where would you go to buy such a service?

As a result, you must be willing to use the investments found in the derivatives market, including stock options. They are the best way to collect the money being lost in this market.

That's why with Hit and Run Trading, we'll be using stock options to collect other people's wild bets. Those stock options are the financial vehicle the government provided to the market insiders over 35 years ago.

To reiterate, we're NOT making any bets ourselves. We're only going after the money being lost on those crazy gambles and fear-driven hedges.

So, if you're comfortable with mutual fund gains or a typical buy-and-hold approach, Hit and Run Trading most likely isn't suited for you.

On the other hand, if you're still interested and ready to collect a safe, consistent guaranteed income, then I think you'll love Hit and Run Trading.

And don't worry, you don't need any special skill or prior experience. Just a willingness to try something you may have never done before.

If you're excited by the idea of making an extra $1,000 or more each and every month, I think you're going to love this!

California insurer, Jose M., says, "I am averaging about $4,000 per month."

And listen to this one: Lukas Z. was so excited with his results, he sent me an email saying, “I'm buying a new BMW since everything else is paid off.”

So how much does it cost to join me on my Wall Street "raids?" How much is it worth to know you have guaranteed income for life, with a money-back guarantee that you will not lose any money if you do as I say?

Would $100,000 be too high? What about $50,000? Would you give a year’s pay to know you are set for life?

Well, I don’t charge anywhere near that kind of money. I will reserve a seat for you at my online seminar. Before the seminar you will receive a PDF copy of the seminar content so that you can look it over and prepare yourself for what I will show you.

I will also reserve a seat for you at the online workshop. You will receive a PDF copy of the workshop material as well. Two-days later, you will be ready to start hauling in the money. From that point on, I will hold your hand and guide you for 2 months, during which time I guarantee you will have had no losses. Two months of guidance is more than enough for most to completely master my strategy and technique. The price for all that is $2,900, no ups, no extras, no discounts. It’s more than a fair price for knowledge that can make you financially independent.

Here's how you can start collecting income now:

How to get started...The money from your 1st "insurance premium" could cover your cost

The fact is, you could easily collect 2 to 3 times that amount in the next few days if you have sufficient starting capital.

The bottom-line is that I believe that what I show you will change your life for the better as soon as you start using it. And it could easily help you make a retirement fortune, as it is already doing for so many other people who are selling price insurance.

IMPORTANT: If you intend to sell price insurance from an IRA or other controlled pension plan, you may need to obtain permission from the broker to do so.

You can sign up right here. This will take you to a secure order page, where you'll be able to review everything before submitting your order.

Wishing you all the best,

Joe Ross

DISCLAIMER: Trading Educators, Inc. is a publisher of Educational material, and NOT a securities broker/dealer or an investment advisor. You are responsible for your own investment decisions. All information contained in our publications or on our web site(s) should be independently verified with the companies mentioned, and readers should always conduct their own research and due diligence and consider obtaining professional advice before making any investment decision. As a condition to accessing Trading Educator’s materials and websites, you agree to our Terms and Conditions of Use, including without limitation all disclaimers of warranties and limitations on liability contained therein. Owners, employees, and writers may hold positions in the securities that are discussed in our newsletters or on our website.

These have to be changed -àDisclaimer | Privacy Policy

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Please read below for access information

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 623 - May 20, 2016

Edition 623 - May 20, 2016

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

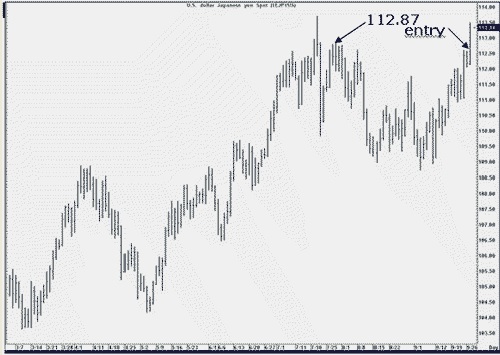

Forex Trade

We’re referencing an older dollar-yen forex pair at a time that the Yen was making strong moves. There is a lesson to be learned from this older chart.

The move began with a 1-2-3 low formation. The number 2 point was violated, and then followed by three Ross hooks - two of them being the double-high kind. The Law of Charts states that following the breakout of the #2 point of a 1-2-3 low, every failure by prices to move higher constitutes a Ross hook.

On Monday, the 26th of September, prices failed to move higher, thereby giving us a Ross hook. The question then was: should we take a Traders Trick Entry with only a 2-tick difference between the highs of Friday the 23rd and Monday the 26th? I can only tell you what my own decision was, and why I decided to take the Traders Trick with only 2-tick’s clearance between Friday's high and Monday's high.

As I looked to the left of the chart, I saw that traders probably have stops just above 112.87. Contrary to the popular belief that there is no stop-running in forex, the truth is exactly the opposite: there is plenty of stop-running - but that's a story for another day. I figured if they took out Monday's high of 112.59, there was a good chance they would take a shot at 112.87, giving me enough pips on a day trade to take in the money I wanted to achieve from the trade. As you can see, they more than met my expectations, taking prices all the way to 113.51. I have often said that every trader needs to have rules, but there are times when common sense tells you to break those rules. That's what I did on Tuesday, September 27.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Can exchanges change the rules any time they want to?

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Yes, they certainly can, and do. In 2015-16 NASDAQ eliminated all types of orders other than limit orders. Following shortly after, NYSE did the same thing. The thought of not being able to place a stop-loss order in the market was mentally devastating to many traders. The same was true for eliminating “Good 'til Canceled” orders (GTC). This action by the exchanges threatened to seriously reduce trading volume, and to force traders into becoming day traders, having to sit in front of a screen all day long simply to monitor their positions. The only other choice would have been to trade stocks only through mutual funds and exchange-traded funds.

Fortunately, most, if not all, stock brokers changed their software to handle these, and even more kinds of orders than the exchanges had ever allowed.

In 1980, few who were trading at the COMEX at the time the Hunt brothers tried to corner the silver market, will ever forget that the exchange forbid the Hunt's from buying silver futures.

Federal commodities regulators introduced special rules to prevent any more long-position contracts from being written or sold for silver futures. This stopped the Hunts from increasing their positions by temporarily suspending the fundamental rules of the commodities markets.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

This week Andy is looking at a Crude Oil calendar spread going long the December and short the July Crude Oil.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Error: Stop Trading At the Worst Time

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

Marco talks about one of the most common mistakes traders do: stopping following their strategy just at the worst time possible. He also gives you some insights on why that is, and why methods have drawdowns at all. With this understanding you can learn to better deal with drawdowns which are simply part of the trading business. If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

( Stay tuned while Mayer Marco puts on the finishing touches to: AlgoStrats.com. )

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Don't miss out! Sale ends this Sunday for Andy Jordan's Traders Notebook. Click Here for more details, and watch Andy's video that gives you a sneak peek to the Traders Notebook Campus.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 622 - May 13, 2016

Edition 622 - May 13, 2016

Stay tuned while Mayer Marco puts on the finishing touches to: AlgoStrats.com.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

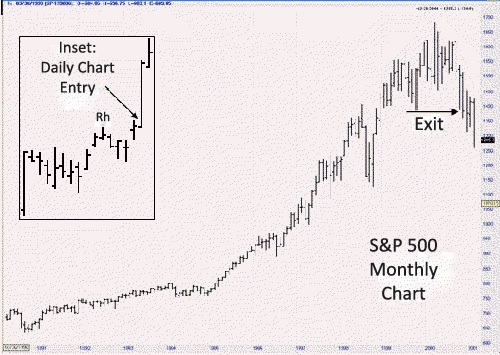

Trading Concept

One of the concepts we teach at Trading Educators is that at times, it is worth taking entry signals from the larger time frame chart and then, once in the trade, managing from a lesser time frame. For example: taking an entry signal from a 60-minute chart, then managing on a 30-minute chart once you get a fill. Or taking entry from a weekly chart, and managing on the daily chart. The reason for doing this is to enable you to micro-manage the trade.

However, in the case of the greatest trade I have ever personally seen, the management was done in just the opposite manner. It was done by a long-term trader, and the trade lasted from 1991 to 2000.

The trader entered the S&P 500 in early December, 1991, and exited in 2000, by first entering from a daily chart, using a trailing stop for protection. When he felt he had accumulated sufficient profits, he began trailing his stop on the weekly chart, and then finally on the monthly chart, where he kept his stop two support levels (below two retracements) back. The trade ended up making $16 million.

Going from "micro" managing to "macro" managing is a perfectly logical way in which to stay longer in a trade. There was a Ross hook on the daily chart following a breakout from congestion. However, because of the gap opening on the bar prior to the one where I showed the entry, he chose to enter the following day. This is not exactly how I would have preferred to enter, but who am I to argue with $16 million?

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Lottery Mindset

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Do you ever dream about winning the lottery? There are actually people who have such good luck that they repeatedly enter contests and win. They win so often that if they wanted, they could count on winning, even though they are essentially trying to capitalize on chance. They develop a "lottery mindset" in that they approach life by counting on rare chance events. The rest of us aren't so lucky, and we don't live our lives counting on a fluke like winning the lottery. We work hard, master a profession, and work steadily to make a living. In many ways, top-notch traders approach their profession in the same diligent way. They don't view trading as recreational gambling, counting on a fluke to make a profit.

That said, many people do experience key life-changing events. We have all heard of people who needed a lucky break and got it. You often hear of actors who, with their last 50 bucks went for an audition, landed a job, and ended up as a star of a hit sit-com.

You probably know of friends who were desperately searching for a job for months, and needed a job fast! With only a week's worth of resources left, they found a job. It can also happen in sports. Olympic athletes may practice their entire life for "one moment in time" when they can perform at their best. But there is some luck involved. A family member may pass away, or they may become ill, and it may throw them off their game. Sure, they have rare talents, but the Gold Medal winners are also lucky enough to have everything go their way. There are times when life can come down to a few key moments. It's a little like playing Lotto, and hoping that you'll win.

Even though profitable traders don't approach trading as if they were playing the lottery, they almost all have at least one big winning trade in their careers. In a series of exclusive interviews, we asked traders to describe their biggest winning trades. Jesse described how he invested in Juno Online: "I bought about 3000 shares, and the stock went up 20 points in two days. It went up fast, and there was really no reason for it. I had a feeling it was just hype and euphoria, so I sold out and made $60,000." Andy described how he used to trade currencies: "One day I was trading Yen, and made around $18,000 in just that day." Don's biggest trade was in the heyday of the dot-com boom. "A European auction company was upgraded one morning. It was touted as the next eBay. CNBC was playing it up. The stock had just split, and they got the price target a little bit wrong. They quoted an ungodly high amount. This was merely a single digit stock. That morning it had traded up over 100. I shorted it as it fell.”

Do people make huge profits capitalizing on a once-in-a-lifetime trade? Sure they do, but the question you need to ask yourself is, "Do I want to trade hoping to make all my profits on a fluke?" Do you want to approach trading with a lottery mindset? If you do, you'll always be on edge, and you will have difficulty trading with discipline. You'll tend to take big chances, and you may end up losing big. It's better to trade more prudently. That doesn't mean never taking a risk or pushing yourself to invest a little more capital when you hit upon a winning streak. What it does mean, though, is controlling over-confidence. Don't seek out those one or two trades a year that will make up for all you've lost. There's an advantage to using a more methodical approach: continue to search for solid, high probability trade setups, outline detailed trading plans, and trade prudently with unwavering discipline.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog - Thoughts about being an option buyer

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Read Andy's blog about why we sell options instead of buying them in Traders Notebook along with a TN special offer.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Position Sizing Part II

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In the first part of the Position Sizing series, Marco explains the basic indicators that are useful for position sizing. In Part II, Marco gives you a simple approach to determine your position size based on market volatility.

If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 621 - May 5, 2016

Edition 621 - May 5, 2016

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

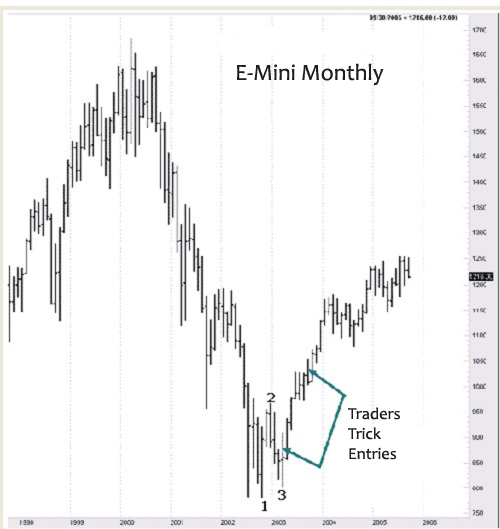

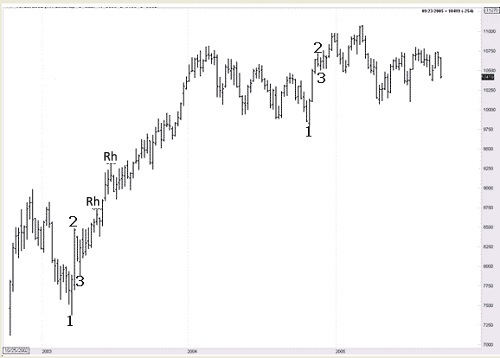

Long Term Trading

Some years ago I was tutoring a trader who would be trading a $1 billion managed money account, moving up from trading a $15 million account. He had been trading in a single market, but found that the amount of money being managed was simply too big for a single market, which he traded in his own country. The need to diversify brought him to the U.S. to learn about the U.S. markets.

With a trading account of that size, he feels there is no way to engage in short-term day trading, and I agree. It's pretty hard to diversify when your entire focus is on a 5-minute E-mini chart. So this week, I want to show you something about the long-lost art of position trading long-term charts using monthly and weekly charts in markets with which most of you are already familiar - the E-mini S&P 500 and the Mini Dow.

It seems that these days few traders are interested in trading long-term. The monthly and weekly charts remain relatively unnoticed. Traders are so busy looking at anything and everything from 60 minutes down to 1 minute, that they let beautiful trades slip right by them in the very markets where they are trying so desperately to make a buck. Since monthly and weekly charts of the E-mini S&P and Mini DJ show only a few bars, I am going to have to use a continuous chart to show you what I mean. The prices may not be correct historically, but the relationship between bars will be exactly as they happened, so don't despair about the fact of continuity. Please keep in mind that the moves you will be seeing are huge on the monthly and weekly charts; and if they last for only a few bars, that is many times better than the moves you are getting on intraday charts.

The weekly chart of the Mini Dow below is loaded with Ross Hooks (Rh), too many for me to mark them all. Each one has a Traders Trick. Please examine these charts on your own, and remember the moves are big. A Ross hook is the first and subsequent failures of prices to continue in the direction they were moving after the breakout of a 1-2-3 formation, a ledge, or any form of consolidation. If you need more help, please study "The Law of Charts" which was a free EBook sent to you via email. If you need another copy, please This email address is being protected from spambots. You need JavaScript enabled to view it. to request it.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Maintaining Discipline

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Traders and investors have difficulty "letting their profits run." When you see your position increase in value, it's hard to avoid selling early to lock in profits. But not every trade goes your way, so when you come upon a trade that does produce a profit, it's vital for your long-term success to maximize the profits for that particular trade. You must make more profits on your winning trades than you lose on your losing trades, but this is difficult to do if you consistently sell prematurely. Waiting for your price objective takes self-control. You must fight the urge to sell early if it fits in with your testing and trading experience.

A thinking strategy that may help you increase your ability to maintain self-control when you need to consists of viewing trading decisions as "linked" in that the decisions you make on earlier trading choices influence the decisions you make on later trading choices.

How do you approach discipline when you trade? Do you think, "I'll sell early on this trade, but on future trades, I'll let my profits run. What's the harm?" It may set a bad precedent. What you do early on may influence what you do later: If you sell early on some trades, you may tend to sell early on other trades. The truth is that initial choices are good predictors of future choices. The choices you make deciding on a smaller reward upfront, or waiting for a larger reward later, are important. For example, a person might decide between one piece of pizza now and two pieces of pizza in a week. It's quite similar to taking a smaller profit early rather than patiently waiting to take a larger profit later. Nevertheless, you must make such decisions based on experience and testing. If you are more comfortable taking smaller profits at both ends of the trade, then doing so becomes your trading style. If that is how you trade profitably, then stick with it.

If you want to trade with discipline, it is essential that you maintain discipline at all times. Don't sell early, and think, "I'll hold on next time." The mind doesn't seem to work that way. You must show self-control early, and on all decisions. So when you are about to sell early, stop! Remind yourself that the long term consequence of taking profits prematurely is that it might set a bad precedent. You won't be able to show self-control and restraint when you really need to. And in the long run, it will severely cut into your overall profits.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Idea

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Today I'm looking into Silver and will explain a trading idea using options.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Method

I'll explain how to read the equity chart of a trading method or system to better understand the characteristic of a trading method.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In my new Q&A Episode, I'll answer questions about the usefulness of demo-trading, trading 123 formations, and why I developed my own python-based backtesting platform.. If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 620 - April 29, 2016

Edition 620 - April 29, 2016

As we spring into May, for many of you, this time of the year is when you start to make plans for the summer, declutter areas in your house, and enjoy the recent plush growth and blooms from your garden. For traders, this is also a great time to re-evaluate your trading plan, straighten up your office, and add one healthy habit to your trading routine. You are encouraged to use the upcoming month for reflection and to make positive improvements to your trading.

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

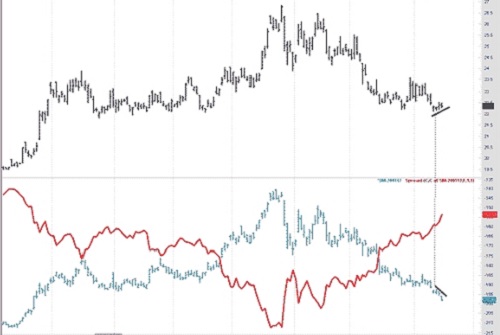

Spread Trading

I can't help but show you one of the easiest trades I ever made. I was browsing through my charts using Genesis Trade Navigator, and what I call an "observation trade" leaped off the screen.

Sometimes when you are looking at charts, something hits you as a "can't lose" trade. Such was the long Bean Oil, and short Soy Meal trade shown in this article. Bean Oil had virtually no direction, and Soy Meal, along with Soybeans, were heading down. This is a natural trade. There is no need for seasonality, correlation, backwardation, or chart pattern. Simple observation is all that is needed for this kind of easy money. Let’s look - Upper Graph (Bean Oil) and Lower Graph (Soy Meal):

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Right Timing

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Over the three-day weekend, trader Bill received a call from his friend Jack. "Hi Bill, did you take a look at the market last week?" Bill replied, "It was a rough week for my short positions. I didn't anticipate the buying surge and it hurt me a little. No, I didn't look closely at the market. I was caught up trading my own positions." Excitedly, Jack says, "Well, on Monday I bought at 345 and sold at 370 on Friday. I made almost $4,000 on that one trade alone."

Have you ever received a call from a friend in the trading business bragging about a great trade that he or she made? If you aren't doing as well, and cannot also bask in the glory of success, it's hard to avoid feeling a little resentful, envious, and somewhat disappointed in yourself. You may think, "It's just a matter of being at the right place at the right time, and unfortunately, I was at the wrong place at the wrong time."

Trading can indeed be a matter of luck. When events aren't going your way, you can get thrown off and become overly consumed with how poorly you are doing to the point that you can't think clearly. Trading the markets skillfully requires a clear, focused mindset. You can't get thrown off. But when your money is on the line, it's hard to think clearly.

There's a powerful human need to trade with perfection. You want to be at the right place at the right time, and make a huge win. One of the worst fears of many traders is missing out on a significant trading opportunity. It's natural to want to search for a once-in-a-lifetime trade, and make a year's worth of profits in a day. But constantly searching for such trades can be distracting. You spend the majority of your time searching for the ultimate trade setup, and when you do that, you start placing demands on yourself that you just can't reach. You think illogically. You lose focus, and you can no longer think clearly and wisely.

Ironically, if you become overly consumed with being at the right place at the right time, you will probably be at the wrong place at the wrong time. You won't think freely and creatively, and you will miss the potentially profitable opportunities right in front of you. From a bird's eye view, they may not be the absolute best opportunities out there, but they may be good enough to profit from. If you devote all your effort to trading them, you will make profits. Remind yourself that you don't have to be perfect. You don't have to trade the best opportunities at all times. You just need to trade the best way you know how with the resources and opportunities you have available to you. You need to trade freely, rather than stagnating under the pressure of trading to perfection.

Trading can be a matter of probabilities. Sometimes you'll be at the right place at the right time; at other times you won't. That's all right. If you are consumed with perfection and finding the ultimate trading opportunity, you will often miss the trades that are right in front of your nose.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Blog Post

by Master Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and Editor of Traders Notebook

Read Andy's latest blog post which addresses a tough question, "Can I really make it as a trader?"

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Andy's Trading Plan Series - Part 2

This is the second part of the Trading Plan series that provides answers for the following questions: "Who needs a trading plan?" and "What will a trading plan do for you?"

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Q&A Series

by Master Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and Creator of Ambush Trading Method

In this Trading Basics video, Marco shares his knowledge to get into position sizing. Topics include the Range, Avg. Range, True Range, and Average True Range (ATR) indicator, as well as the concept of Initial Risk (R). If you have any questions, feel free to This email address is being protected from spambots. You need JavaScript enabled to view it., post it in our Blog or Forum.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

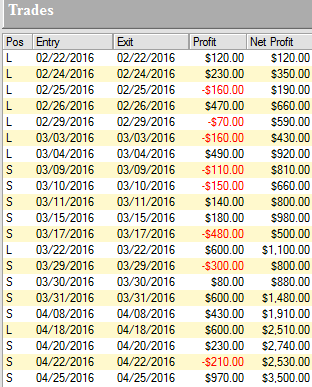

Ambush Method Trade and Performance Report

by Master Trader Marco Mayer

Specialist in Forex, Futures, Systematic Trading, and Creator of Ambush Trading Method

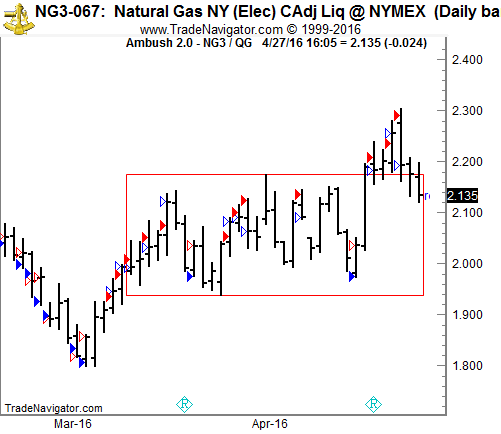

Ambush had a really good run during the last couple of months! This week is an excellent example with the Henry Hub Natural Gas Futures (NG) traded at the NYMEX.

The market has been moving in a small range between 1.95 and 2.20 (red box) for weeks and finally last week, it broke out of the range and managed to move up to 2.30. As you can see on the chart below, that’s where Ambush traders sold NG and ambushed all the breakout-traders who still wanted to get in after the break out. Today it’s moving within the range again, and I wouldn’t be surprised to see NG moving back down towards 2.00.

On the chart above are four different kinds of arrows:

Let's examine the results of those trades (including $10 for commissions and slippage round-turn) trading one Henry Hub Natural Gas Futures (NG) contract:

As you can see, Ambush managed to make a total of $3,500.00 profit (including $10 for commissions and slippage round-turn) trading just one contract without keeping any positions overnight!

Click on the link below to see the long-term performance of the Henry Hub Natural Gas Futures (NG) and all other markets supported by Ambush:

View The Reports Now

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2016 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.

Edition 619 - April 22, 2016

Edition 619 - April 22, 2016

Sometimes you just need a little extra encouragement, a gentle push in the right direction, or someone to hit you upside the head and tell you to, "snap out of it!" Trading Educators has the trading experience to provide you with the type of support needed, don't hesitate. Email us today!

The Law of Charts with Commentary

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

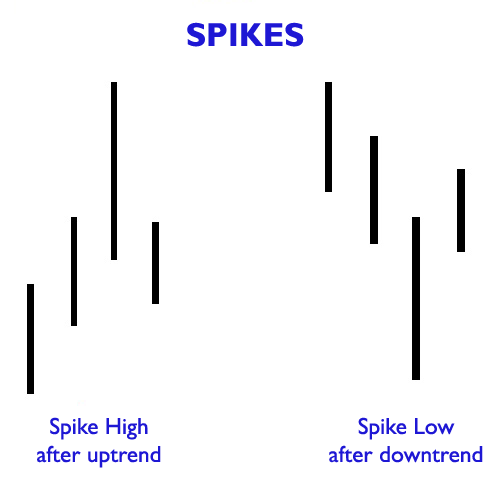

Thrust Reversals

Last week we looked at a "Spike Reversal." This week we are going to look at a different kind of reversal, which I call a "Thrust Reversal."

Quite often "Thrust" is the first step in what turns out to be at the very least a short-term move. By that, I mean you can usually count on some sort of follow-through in the short-term.

The stock chart I'm going to show you is one that has been previously shown, Watts Water Technologies (WWT). But what you see occurs in all markets and in all time frames. I had expressed that the chart showing was a sudden and rapid "melt-down" of prices that was nothing more than stop running, and that you see such stop running quite often in the stock market. My point then was that what we were seeing was not a downtrend. It was simply a collapse brought about by one or more market movers powerful enough to put the squeeze on investors who were long the shares of the company. Such moves often accompany disappointing financial reports by a company, but not always. Sometimes a melt-down is initiated by news affecting an entire industry, or even by news affecting the whole economy.

In the case of the up-thrust bar in the share price of WWT, I feel certain that what we are seeing is directly related to the recent hurricane that hit the gulf coast of the U.S.A. Is this the beginning of an uptrend? That is possible, yes. But more likely it is the beginning of a short-term move that could quite possibly last only a day or two. When I see a thrust reversal, I get ready for some quick short-term profits. In essence, this is a scalping situation. Take some money and run. Possibly move any remaining portion of your position to breakeven, and count your blessings if the thrust bar results in a real move.

It looks as follows:

The up-thrust bar we are seeing with this chart is defined in the Law of Charts as a breakout from congestion.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Low Probability Setups

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

How many times do you tell yourself “I'll worry about it later”?